Académique Documents

Professionnel Documents

Culture Documents

National Stock Exchange of India Limited: Back Office Operations Module

Transféré par

Carla TateTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

National Stock Exchange of India Limited: Back Office Operations Module

Transféré par

Carla TateDroits d'auteur :

Formats disponibles

NATIONAL STOCK EXCHANGE OF INDIA LIMITED

DEPARTMENT : SBU - EDUCATION NCFM COURSE OUTLINE

BACK OFFICE OPERATIONS MODULE

A. B. C. D. E. F.

Know Your Client, Anti-Money Laundering & Combating Financing of Terrorism Principles Client Due Diligence Customer Policy Clients of Acceptance Special Category (CSC) Client Identification Procedure (CIP) Client Registration 1. Proof of Identity (POI) 2. Proof of Address (POA) 3. PAN Card 4. Additional Requirements for non-individuals 5. Unique Client Code 6. Power of Attorney (POA) 7. Nomination

G.

Changes in Client Information 1. Change of Address 2. Change in Bank Details 3. Change in Signatory 4. Minor becoming major

H. I. J. K.

KYC Registration Agencies (KRA) Suspicious Transactions Reporting (STR) Designated Individuals & Entities Record Keeping

A.

Primary Market Types of Issues 1. Public Issue - IPO

Regd. Office : Exchange Plaza, BandraKurlaComplex, Bandra (E), Mumbai 400 051

Page 1 of 5

2. Public Issue Follow-on Offering 3. Public Issue Offer for Sale 4. Rights Issue 5. Bonus Issue 6. Private Placement 7. GDR / ADR Issues 8. Sponsored GDR / ADR Issues 9. Foreign Currency Convertible Bond (FCCB) Issues 10. India Depository Receipts B. C. D. E. F. Public Issue Process Time-line for Public Issue Common Bid-cum-Application Form ASBA Buy Back of Securities

A. B. C. D. E. F. G. H.

Secondary Market (Trading in Shares) National Stock Exchange Trading Members & Clearing Members Authorised Persons & Sub-brokers Trading Members Responsibilities for Trades Uniform Documentation for Opening Trading Account Screen-based Trading System (SBTS) Trade Management Market Types 1. Normal Market 2. Auction Market 3. Odd Lot Market 4. Retail Debt Market

I. J. K.

Margin Trading Exchange Margins Settlement 1. Clearing House 2. Other Agencies Involved in Settlement 3. Clearing Mechanism 4. Clearing Process 5. Settlement Process 6. Transaction Cycle

Regd. Office : Exchange Plaza, BandraKurlaComplex, Bandra (E), Mumbai 400 051

Page 2 of 5

7. T+2 Rolling Settlement Calendar 8. Delivery Versus Payment (DVP) / Hand Delivery 9. Auction Settlement 10. F&O Settlement 11. Books of Accounts 12. Straight Through Processing (STP) Depository Operations Depository and Issuer Depository Participant Transactions 1. Account Opening 2. De-materialisation 3. Re-materialisation 4. Secondary Market Purchases 5. Secondary Market Sales 6. Standing Instructions 7. Power of Attorney (PoA) 8. Transposition 9. Transmission of Securities 10. Dividends 11. Pledging Securities 12. Freezing of Accounts 13. SMS Alerts

A. B. C.

A. B. C. D.

Registrar & Transfer Agent Role & Responsibilities Voting Rights in Companies Dividend Payments in Companies Physical Shares 1. Transfer Deed 2. Delays in Transfer of Shares by Companies 3. Good and Bad Delivery Norms Mutual Fund: AMC Operations Legal Structure Net Asset Value (NAV)

A. B.

Regd. Office : Exchange Plaza, BandraKurlaComplex, Bandra (E), Mumbai 400 051

Page 3 of 5

C. D. E. F.

Expenses Load Offer Documents Investor Transactions (Normal Physical Mode) 1. Acquisition of Units by Investor from the Scheme 2. Sale of Units by Investor to Scheme 3. Secondary Market Transactions in Units by Investor 4. Redemption of Units on closure of scheme 5. Additional Purchase by Investor 6. Switch by Investor 7. Systematic Investment Plan 8. Systematic Withdrawal Plan 9. Systematic Transfer Plan

G. H. I.

Investor Transactions (Through the Internet) Investor Transactions (NSE MFSS Channel) Dividend Options 1. Dividend Payout Option 2. Growth Option 3. Dividend Re-investment Option

J. K. L. M.

Dividend Mechanics Income Distribution Tax Securities Transaction Tax (STT) Cut-off Time Regulations 1. Liquid Schemes & Plans - Subscriptions 2. Liquid Schemes & Plans Re-Purchases 3. Other than Liquid Schemes & Plans - Subscriptions 4. Other than Liquid Schemes & Plans Re-purchases

N. O. P. Q. R. S.

Official Points of Acceptance (PoA) Time Stamping RTA Role Distributors Commission Bank Accounts Other Back Office Activities

A. B.

Mutual Fund Transactions through NSE Listed Schemes Exchange Traded Funds (ETFs)

Regd. Office : Exchange Plaza, BandraKurlaComplex, Bandra (E), Mumbai 400 051

Page 4 of 5

C.

Mutual Fund Service System (MFSS) 1. Subscription (Physical mode) 2. Subscription (Demat mode) 3. Redemption (Physical mode) 4. Redemption (Demat mode) Qualified Foreign Investors Equity Shares Background Permitted Transactions Investment Restrictions Administration of Investment Limit Other Conditions Transaction Flow Qualified Foreign Investors Mutual Funds Background Investment Limit Transaction Flow 1. Direct Route (Demat) 2. Indirect Route (Unit Confirmation Receipts UCR)

A. B. C. D. E. F.

A. B. C.

D.

Other Conditions

Regd. Office : Exchange Plaza, BandraKurlaComplex, Bandra (E), Mumbai 400 051

Page 5 of 5

Vous aimerez peut-être aussi

- Course Out BoomDocument8 pagesCourse Out BoomrahulkatareyPas encore d'évaluation

- Back Office Operations Module: Know Your Client, Anti-Money Laundering & Combating FinancingDocument8 pagesBack Office Operations Module: Know Your Client, Anti-Money Laundering & Combating FinancingrahulkatareyPas encore d'évaluation

- Overview of Indian Capital Markets and Financial InstrumentsDocument4 pagesOverview of Indian Capital Markets and Financial InstrumentsIshant SoniPas encore d'évaluation

- Indian Banking Sector SyllabusDocument98 pagesIndian Banking Sector SyllabusNikhil JainPas encore d'évaluation

- CMDocument84 pagesCMMuhammad NiazPas encore d'évaluation

- Curr 04Document2 pagesCurr 04bharatPas encore d'évaluation

- Unit 1Document39 pagesUnit 1neeshPas encore d'évaluation

- Mergers and Acquisitions ModuleDocument6 pagesMergers and Acquisitions ModuleSankalp SinghPas encore d'évaluation

- 429428ICAI CA Campus - JDs For Freshers - IndusInd BankDocument4 pages429428ICAI CA Campus - JDs For Freshers - IndusInd BankAbhishek GuptaPas encore d'évaluation

- RFP For Consultancy On CBSDocument45 pagesRFP For Consultancy On CBSPremPas encore d'évaluation

- Treasury Management OverviewDocument47 pagesTreasury Management Overviewlakshika madushaniPas encore d'évaluation

- NISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketDocument6 pagesNISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketSanket MohapatraPas encore d'évaluation

- Curriculum - Nsdl-Depository Operations Module: Overview of The Capital MarketDocument3 pagesCurriculum - Nsdl-Depository Operations Module: Overview of The Capital MarketSubrat TripathiPas encore d'évaluation

- Program: MBA Class Of: 2010-2011 Semester: IV Course Title: Treasury Management Credits: 3Document3 pagesProgram: MBA Class Of: 2010-2011 Semester: IV Course Title: Treasury Management Credits: 3Ann DeePas encore d'évaluation

- Depository - A Brief Highlight: Securities and Exchange Board of IndiaDocument12 pagesDepository - A Brief Highlight: Securities and Exchange Board of IndiaMohammed BilalPas encore d'évaluation

- KYC and account opening process at SMC Global SecuritiesDocument12 pagesKYC and account opening process at SMC Global Securitiesanam kazi100% (2)

- 209 - F - IndiabullsDocument75 pages209 - F - IndiabullsPeacock Live ProjectsPas encore d'évaluation

- AssignmentMF0008 Set 2Document5 pagesAssignmentMF0008 Set 2AmbrishPas encore d'évaluation

- Treasury & Capital Markets GuideDocument5 pagesTreasury & Capital Markets Guidemaniraj sharmaPas encore d'évaluation

- Financial Markets OverviewDocument86 pagesFinancial Markets OverviewAnuska JayswalPas encore d'évaluation

- MMS III Finance SyllabusDocument30 pagesMMS III Finance SyllabusHardik ThakkarPas encore d'évaluation

- SECURITY ANALYSIS & PORTFOLIO MANAGEMENTDocument17 pagesSECURITY ANALYSIS & PORTFOLIO MANAGEMENTarun kumarPas encore d'évaluation

- Project Details - Indira IIBM & DMTIMS - Finance PDFDocument5 pagesProject Details - Indira IIBM & DMTIMS - Finance PDFDr. Vishal GhagPas encore d'évaluation

- Statement of Cash FlowsDocument13 pagesStatement of Cash FlowsDenise RoquePas encore d'évaluation

- Himanshu1 Project Report On BonanzaDocument91 pagesHimanshu1 Project Report On Bonanzahimanshusharma007Pas encore d'évaluation

- Course Out Mam26Document5 pagesCourse Out Mam26Sushil MundelPas encore d'évaluation

- Depository System in India Needs and ProgressDocument17 pagesDepository System in India Needs and ProgressGaurav PandeyPas encore d'évaluation

- Elective Courses SyllabusDocument37 pagesElective Courses SyllabusAsif WarsiPas encore d'évaluation

- Annexure II - Test ObjectivesDocument4 pagesAnnexure II - Test ObjectivesShashank ShekharPas encore d'évaluation

- Sebi Investor Awareness Programme - : Secondary MarketDocument15 pagesSebi Investor Awareness Programme - : Secondary MarketGagan PreetPas encore d'évaluation

- Sebi Investor Awareness Programme - : Secondary MarketDocument15 pagesSebi Investor Awareness Programme - : Secondary MarketRahul ShakyaPas encore d'évaluation

- MBA Finance Assignment on Universal Banking and Money Market PlayersDocument10 pagesMBA Finance Assignment on Universal Banking and Money Market PlayersKetakiPas encore d'évaluation

- Sriram Business School: "Investment Behavior With Respect To Share Market & Sales Promotion of Globe Capital"Document77 pagesSriram Business School: "Investment Behavior With Respect To Share Market & Sales Promotion of Globe Capital"satyarthsinghPas encore d'évaluation

- Citizens Charter 2021 - 031221Document1 102 pagesCitizens Charter 2021 - 031221Ramil LaysonPas encore d'évaluation

- Treasury and Fund Management in Bank123Document29 pagesTreasury and Fund Management in Bank123Ravi SuchakPas encore d'évaluation

- Stock Market in IndiaDocument31 pagesStock Market in IndiaUtkarsh JaiswalPas encore d'évaluation

- Off - Balance Sheet Activities (OBSA) inDocument10 pagesOff - Balance Sheet Activities (OBSA) injahanPas encore d'évaluation

- Neo Checklist For Credit InvestigatorDocument2 pagesNeo Checklist For Credit Investigatorjandy salazarPas encore d'évaluation

- Neo Checklist For Credit InvestigatorDocument2 pagesNeo Checklist For Credit Investigatorjandy salazarPas encore d'évaluation

- Pradeep ProjectDocument66 pagesPradeep Project9908107924Pas encore d'évaluation

- Pradeep ProjectDocument66 pagesPradeep Project9908107924Pas encore d'évaluation

- Indian Financial SystemDocument33 pagesIndian Financial SystemVanshika RajPas encore d'évaluation

- Depository - A Brief Highlight: Securities and Exchange Board of IndiaDocument11 pagesDepository - A Brief Highlight: Securities and Exchange Board of IndiaRahul SinghPas encore d'évaluation

- 134 Fundamentals of Accounting SHDocument6 pages134 Fundamentals of Accounting SHSadia khanPas encore d'évaluation

- What Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.Document15 pagesWhat Is NCFM Exam? What Is Nism Exam? NCFM, Nism Mock Test at WWW - Modelexam.in.SRINIVASAN100% (4)

- Sudhir Kochhar: Foreign LC Advising and LC Transfer Cases Handling Outward RemmitancesDocument4 pagesSudhir Kochhar: Foreign LC Advising and LC Transfer Cases Handling Outward Remmitancessudhir.kochhar3530Pas encore d'évaluation

- Tax Evasion Through SharesDocument5 pagesTax Evasion Through SharesPrashant Thakur100% (1)

- AccountAble Handbook FCRA 2010 - Select PagesDocument88 pagesAccountAble Handbook FCRA 2010 - Select PagesmahamayaviPas encore d'évaluation

- Course Outline CSRM Module8Document2 pagesCourse Outline CSRM Module8Sushil Mundel100% (1)

- Indian Financial System 1Document10 pagesIndian Financial System 1fananjelinaPas encore d'évaluation

- 8th Semester SyllabusDocument7 pages8th Semester SyllabusFizza KamranPas encore d'évaluation

- Course OutlineDocument4 pagesCourse OutlineAPas encore d'évaluation

- Sa - Securities MarketsDocument39 pagesSa - Securities Marketsapi-3757629Pas encore d'évaluation

- A Study of Online Trading and Stock Broking"Document48 pagesA Study of Online Trading and Stock Broking"Prabha100% (1)

- Greater Noida: Management Submitted By: Ankit Kumar Sangal Post Graduate Diploma in Management (PGDM) 2009-11Document27 pagesGreater Noida: Management Submitted By: Ankit Kumar Sangal Post Graduate Diploma in Management (PGDM) 2009-11Ankit SangalPas encore d'évaluation

- Currency DerivativesDocument25 pagesCurrency DerivativesDarshitSejparaPas encore d'évaluation

- Financial MarketsDocument54 pagesFinancial Marketsdurga_319Pas encore d'évaluation

- Investment Banking Immersion Program SyllabusDocument4 pagesInvestment Banking Immersion Program SyllabussPas encore d'évaluation

- Account Payable and Receivable Configuration GuideDocument2 pagesAccount Payable and Receivable Configuration GuideRam RamPas encore d'évaluation

- The Investment Industry for IT Practitioners: An Introductory GuideD'EverandThe Investment Industry for IT Practitioners: An Introductory GuidePas encore d'évaluation

- Seductress Women Who Ravished The World and Their Lost Art of LoveDocument3 pagesSeductress Women Who Ravished The World and Their Lost Art of LoveCarla TatePas encore d'évaluation

- Link Your Aadhaar With Mobile Number To Stay Active!Document3 pagesLink Your Aadhaar With Mobile Number To Stay Active!Carla TatePas encore d'évaluation

- First Advantage Offshore Services - Associate - Senior Associate, MumbaiDocument1 pageFirst Advantage Offshore Services - Associate - Senior Associate, MumbaiCarla TatePas encore d'évaluation

- Kotak Research Report Buy Sell StocksDocument6 pagesKotak Research Report Buy Sell StocksCarla TatePas encore d'évaluation

- To Build Their World-Class CompaniesDocument4 pagesTo Build Their World-Class CompaniesCarla TatePas encore d'évaluation

- Job - Trainee Executive - Mumbai, Bengaluru - Bangalore, Hyderabad - Secunderabad - Rhizome Hospitality Solutions - 0-To-1 Years of Experience - Jobs IndiaDocument2 pagesJob - Trainee Executive - Mumbai, Bengaluru - Bangalore, Hyderabad - Secunderabad - Rhizome Hospitality Solutions - 0-To-1 Years of Experience - Jobs IndiaCarla TatePas encore d'évaluation

- Sabbatical - Wikipedia, The Free EncyclopediaDocument2 pagesSabbatical - Wikipedia, The Free EncyclopediaCarla TatePas encore d'évaluation

- Harbour Line: Mumbai CST To ChemburDocument34 pagesHarbour Line: Mumbai CST To ChemburCarla TatePas encore d'évaluation

- Epfo - Contact OfficeDocument2 pagesEpfo - Contact OfficeCarla TatePas encore d'évaluation

- Serco BPO careers UK bankingDocument2 pagesSerco BPO careers UK bankingCarla TatePas encore d'évaluation

- Dunning Kruger PDFDocument5 pagesDunning Kruger PDFhubik38Pas encore d'évaluation

- 101 Tactical TipsDocument34 pages101 Tactical TipsBallu BaluPas encore d'évaluation

- Altisource QuestionsDocument2 pagesAltisource QuestionsCarla TatePas encore d'évaluation

- Regd. Office: Exchange Plaza, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051 Page 1 of 1Document1 pageRegd. Office: Exchange Plaza, Bandra Kurla Complex, Bandra (E), Mumbai - 400 051 Page 1 of 1valvinderPas encore d'évaluation

- Other NewsDocument1 pageOther NewsCarla TatePas encore d'évaluation

- User Manual: S19C350NW S22C350B S22C350H S23C340H S23C350B S23C350H S24C340HL S24C350BL S24C350HL S24C350H S27C350HDocument156 pagesUser Manual: S19C350NW S22C350B S22C350H S23C340H S23C350B S23C350H S24C340HL S24C350BL S24C350HL S24C350H S27C350HCarla TatePas encore d'évaluation

- Technicals - Nifty Support & ResistanceDocument1 pageTechnicals - Nifty Support & ResistanceCarla TatePas encore d'évaluation

- Stop Procrastinating!: AssessmentDocument7 pagesStop Procrastinating!: AssessmentCarla TatePas encore d'évaluation

- 5Document8 pages5Carla TatePas encore d'évaluation

- International Mathematics Olympiad: Sample PaperDocument5 pagesInternational Mathematics Olympiad: Sample PaperCarla Tate100% (1)

- Helping You Spot Opportunities: Investment Update - October, 2012Document56 pagesHelping You Spot Opportunities: Investment Update - October, 2012Carla TatePas encore d'évaluation

- Aptitude Ablity Part IIIDocument4 pagesAptitude Ablity Part IIIShridhar BassapurPas encore d'évaluation

- Ind CNX SmallcapDocument3 pagesInd CNX SmallcapCarla TatePas encore d'évaluation

- Nuggets of WisdomDocument2 pagesNuggets of WisdomCarla TatePas encore d'évaluation

- Mr. Kedar MurdeshwarDocument1 pageMr. Kedar MurdeshwarCarla TatePas encore d'évaluation

- Technicals - Nifty Support & ResistanceDocument1 pageTechnicals - Nifty Support & ResistanceCarla TatePas encore d'évaluation

- LyricsDocument1 pageLyricsCarla TatePas encore d'évaluation

- What Is Trigger Price or Stop Loss OrderDocument1 pageWhat Is Trigger Price or Stop Loss OrderCarla TatePas encore d'évaluation

- Movies ListDocument3 pagesMovies ListCarla TatePas encore d'évaluation

- 35 Smart Dating Rules Explained: Marius PanzarellaDocument17 pages35 Smart Dating Rules Explained: Marius PanzarellaIgor Alperovich100% (1)

- INS 21 Flash CardsDocument34 pagesINS 21 Flash CardsSheetal Rout100% (2)

- HIND TERMINAL PVT LTD Public Tariff for ICD KilaraipurDocument3 pagesHIND TERMINAL PVT LTD Public Tariff for ICD KilaraipurFasteners GargPas encore d'évaluation

- Aadhaar E-KYC-User Manual For Kiosk Ver 1.0Document13 pagesAadhaar E-KYC-User Manual For Kiosk Ver 1.0Arjun NandaPas encore d'évaluation

- DigitalDocument25 pagesDigitalPrithvi ChadhaPas encore d'évaluation

- Hotel Booking Ref-0109230128557Document5 pagesHotel Booking Ref-0109230128557Sourabh BhardwajPas encore d'évaluation

- 6 Dec - 5 JanDocument8 pages6 Dec - 5 JanEXE03 BilmedPas encore d'évaluation

- Company Profile Set Final 1Document2 pagesCompany Profile Set Final 1jolo_hynson17Pas encore d'évaluation

- Walmart Presentation - Group 3Document20 pagesWalmart Presentation - Group 3Mya CPas encore d'évaluation

- PWC Top Health Industry Issues of 2014Document17 pagesPWC Top Health Industry Issues of 2014daveawoodsPas encore d'évaluation

- Rating 101Document2 pagesRating 101AmitPas encore d'évaluation

- # CH-1 - Transaction - AnalysisDocument3 pages# CH-1 - Transaction - AnalysisGetaneh ZewuduPas encore d'évaluation

- QuizDocument3 pagesQuizmuhammad_sajid98Pas encore d'évaluation

- International Banking and Future of Banking and FinancialDocument12 pagesInternational Banking and Future of Banking and FinancialAmit Mishra0% (1)

- Instructions PDFDocument14 pagesInstructions PDFsaihejPas encore d'évaluation

- Statement of Financial Position or Balance SheetDocument3 pagesStatement of Financial Position or Balance SheetLouisePas encore d'évaluation

- Mobile Recharge Tax InvoiceDocument2 pagesMobile Recharge Tax InvoiceJegan jiPas encore d'évaluation

- 2007 Private Target Deal Points Study (v.1)Document82 pages2007 Private Target Deal Points Study (v.1)Emil BovaPas encore d'évaluation

- Wireshark 802.11 Display Filter Field Reference GuideDocument2 pagesWireshark 802.11 Display Filter Field Reference Guideregister NamePas encore d'évaluation

- 1502-NIFT Store Design and Presentation - Surender - HandoutDocument90 pages1502-NIFT Store Design and Presentation - Surender - HandoutRahulKumbharePas encore d'évaluation

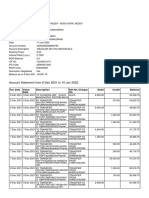

- Account Statement From 1 Jan 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Jan 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceManishDikshitPas encore d'évaluation

- Empirical Statistics Related To Trade Flow: Submitted To: Rashmi Ma'am Submitted By: Salil TimsinaDocument25 pagesEmpirical Statistics Related To Trade Flow: Submitted To: Rashmi Ma'am Submitted By: Salil TimsinaSalil TimsinaPas encore d'évaluation

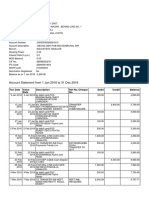

- Account Statement From 1 Jan 2019 To 29 Jan 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Jan 2019 To 29 Jan 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balanceajaykumar soddalaPas encore d'évaluation

- ELEM-District: - Particular Amount: Actual MOOE Expenses 2015 For The Month ofDocument1 pageELEM-District: - Particular Amount: Actual MOOE Expenses 2015 For The Month ofCHANIELOU MARTINEZPas encore d'évaluation

- Retail Multichannel Unit 2Document26 pagesRetail Multichannel Unit 2Nikita ShekhawatPas encore d'évaluation

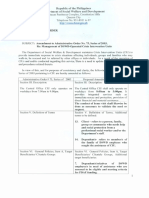

- Republic o F The Philippines Department o F Social Welfare and DevelopmentDocument6 pagesRepublic o F The Philippines Department o F Social Welfare and DevelopmentJasmin Mingo CalaPas encore d'évaluation

- Company Profile ING VysyaDocument10 pagesCompany Profile ING VysyaPrince Satish ReddyPas encore d'évaluation

- Products and Services in MFBDocument24 pagesProducts and Services in MFBMichael TochukwuPas encore d'évaluation

- Name Link Contact #: Divisoria/Trendy ItemsDocument3 pagesName Link Contact #: Divisoria/Trendy ItemsMark Marcaida ErandioPas encore d'évaluation

- Indemnity To Be Shared by Customer With PPBLDocument1 pageIndemnity To Be Shared by Customer With PPBLAnkit Patel70% (10)

- Broadband Network Management: ATM NetworksDocument40 pagesBroadband Network Management: ATM NetworksAnuvrat ChaturvediPas encore d'évaluation