Académique Documents

Professionnel Documents

Culture Documents

Fbe432 Usc

Transféré par

socalsurfyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fbe432 Usc

Transféré par

socalsurfyDroits d'auteur :

Formats disponibles

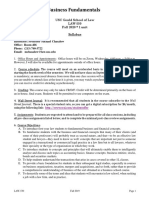

UNIVERSITY OF SOUTHERN CALIFORNIA

MARSHALL SCHOOL OF BUSINESS

CORPORATE FINANCIAL STRATEGY (FBE 432)

SYLLABUS, FALL 2012 Prof. Oguzhan Ozbas

Course objective: The objective of this course is for you to learn the financial tools needed to make good business decisions. The emphasis will be on linking finance to other aspects of corporate strategy. Teaching methods: The course will build on corporate finance theory with applications to real business decisions. Each session will involve class discussion. In some instances, discussion will be centered on lectures; in others, it will be centered on a business case. As opportunities arise, we will discuss current events in the world of corporate finance. Your participation is critical to the success of the course. You are expected to study all cases and readings, come to class, and participate in class discussion. Prerequisites: Business Finance (BUAD 306). Some background in financial statement analysis can be useful. Course packet: There is a course packet that contains the case studies, the corresponding study questions, and some readings for the course at the USC Bookstore. Lecture Notes: Lecture notes and all other additional course material will be posted on Blackboard, which can be accessed at http://blackboard.usc.edu. You will need to download them before each class. Readings/Books: Ross, Westerfield and Jordan, Fundamentals of Corporate Finance, 10th ed., Irwin, McGraw-Hill (from BUAD 306) Articles as noted in the schedule Requirements/Grading: Class Participation: 20 % Case Write-ups: 40 % Final: 40 % (open-book) Case Write-ups: You should form groups of 3-4 students, and hand-in a single write-up per team. Except for two cases of your choice, teams are required to hand in all write-ups. If more write-ups are handed in, only the best ones will count.

Your write-ups, which summarize your analysis and recommendations, must not exceed two pages of reasonably sized text (at least 11 points, and preferably double-spaced). Supporting appendices should be concise and clear. Office Hours: Open office hours will be Wednesdays at 9am in HOH 514, and additional office hours will be announced preceding the final exam. In addition, I am generally available at other times, and I am always happy to discuss any issues with you either after class or in my office. I will also attempt to answer questions via e-mail on a timely basis. Contact Information: email ozbas@usc.edu office (213) 740-0781 Institute Policy regarding Academic Integrity: The use of unauthorized material, communication with fellow students during an examination, attempting to benefit from the work of another student, and similar behavior that defeats the intent of an examination or other class work is unacceptable to the University. It is often difficult to distinguish between a culpable act and inadvertent behavior resulting from the nervous tensions accompanying examinations. Where a clear violation occurs, however, the instructor may disqualify the students work as unacceptable and assign a failing mark on the paper. Institute Policy regarding Disabilities: Any student requesting academic accommodations based on a disability is required to register with Disability Services and Programs (DSP) each semester. A letter of verification for approved accommodations can be obtained from DSP. Please be sure that the letter is delivered to me as early in the semester as possible. DSP is located in STU 301 and is open 8:30am-5:00pm, Monday through Friday. The telephone number for DSP is (213) 740-0776.

SCHEDULE Part I: Financing Objective: The aim of this part of the course is to develop a framework to think about how firms finance their operations and how this interacts with overall corporate strategy. Session #1 Monday, August 27 Introduction For background, you may want to read again: o RWJ, Chapter 2: Financial Statements, Taxes, and Cash Flow o RWJ, Chapter 3: Working with Financial Statements Session #2 Wednesday, August 29 Case Study: Butler Lumber Company (Session I) Reading: RWJ, Chapter 4: Long-Term Financial Planning and Growth Monday, September 3 Labor Day, university holiday, no class Wednesday, September 5 Group work on Butler Lumber Company, no class Session #3 Monday, September 10 Case Study: Butler Lumber Company (Session II) Session #4 Wednesday, September 12 Lecture: Capital Structure Session #5 Monday, September 17 Lecture: Capital Structure (continued) Session #6 Wednesday, September 19 Case Study: UST Inc. Session #7 Monday, September 24 Case Study: UAL, 2004: Pulling Out of Bankruptcy Session #8 Wednesday, September 26 Lecture: Capital Structure: Informational and Dynamic Considerations Session #9 Monday, October 1 Case Study: MCI Communications Corp., 1983 Session #10 Wednesday, October 3 Lecture: Dividend Policy

Session #11 Monday, October 8 Case Study: Intel Corporation, 1992 Session #12 Wednesday, October 10 Lecture: Risk Management Reading: Froot, Scharfstein and Stein, A Framework for Risk Management, Harvard Business Review, 1994 Session #13 Monday, October 15 Case Study: American Barrick Resources Corporation

PART II: Valuation and Investment Objective: The aim of this part of the course is to develop tools to evaluate real investment opportunities, such as building a new plant or acquiring another company. Session #14 Wednesday, October 17 Lecture: Free Cash Flows Session #15 Monday, October 22 Case Study: Sky Television versus British Satellite Broadcasting Session #16 Wednesday, October 24 Lecture: WACC Session #17 Monday, October 29 Lecture: APV Reading: Luehrman, Using APV: A Better Tool for Valuing Operations, Harvard Business Review, 1997 Session #18 Wednesday, October 31 Case Study: Dixon Corporation: The Collinsville Plant (Session I) Session #19 Monday, November 5 Case Study: Dixon Corporation: The Collinsville Plant (Session II) Session #20 Wednesday, November 7 Lecture: Real Options Reading: Luehrman, Investment Opportunities as Real Options, Harvard Business Review, 1998 Session #21 Monday, November 12 Case Study: MW Petroleum Corporation (A)

Session #22 Wednesday, November 14 Lecture: Valuing a Company Monday, November 19 No class Wednesday, November 21 Thanksgiving, university holiday, no class Session #23 Monday, November 26 Case Study: The Southland Corporation (A) Session #24 Wednesday, November 28 Lecture: Mergers and Acquisitions Session #27 Monday, December 3 Case Study: Radio One, Inc. Session #28 Wednesday, December 5 Sample Final Exam

FINAL EXAM: University scheduled day and time MW 10:00-11:50am Monday, December 17, 8:00-10:00am MW 2:00-3:50pm Friday, December 14 , 2:00pm-4:00pm

Vous aimerez peut-être aussi

- Multifactor Model CaseDocument4 pagesMultifactor Model CaseJosh Brodsky100% (1)

- UGBA 131 Syllabus Spring 2016Document6 pagesUGBA 131 Syllabus Spring 2016Rushil SurapaneniPas encore d'évaluation

- Analysis of Business StrategiesDocument12 pagesAnalysis of Business StrategiesFawad Ahmed ArainPas encore d'évaluation

- Syllabus FIN408 2020Document5 pagesSyllabus FIN408 2020seanPas encore d'évaluation

- Financial Management (251.301.007) Spring 2014, SNU-CBA UndergraduateDocument5 pagesFinancial Management (251.301.007) Spring 2014, SNU-CBA UndergraduateTack Wei HoPas encore d'évaluation

- The Art and Science of Decision MakingDocument13 pagesThe Art and Science of Decision MakingsocalsurfyPas encore d'évaluation

- Mor 479Document13 pagesMor 479socalsurfyPas encore d'évaluation

- Mor 560Document13 pagesMor 560socalsurfyPas encore d'évaluation

- Iom 581 TTH Syllabus: Sosic@Marshall - Usc.EduDocument11 pagesIom 581 TTH Syllabus: Sosic@Marshall - Usc.Edusocalsurfy0% (1)

- 20 Golden Rules For TradersDocument7 pages20 Golden Rules For Traderspongpong13Pas encore d'évaluation

- Sabp A 043 PDFDocument44 pagesSabp A 043 PDFWalid MegahedPas encore d'évaluation

- Interviewing and Counseling: Spring 2012Document42 pagesInterviewing and Counseling: Spring 2012Greg BealPas encore d'évaluation

- Corporate FinanceDocument6 pagesCorporate FinanceCristina Nicolescu0% (1)

- Advanced Corporate Finance: (Preliminary & Subject To Change. Updated On January 12, 2015)Document5 pagesAdvanced Corporate Finance: (Preliminary & Subject To Change. Updated On January 12, 2015)Abhishek KamdarPas encore d'évaluation

- Course Outline - University of Washington Foster School of BusinessDocument10 pagesCourse Outline - University of Washington Foster School of BusinessFirdausPas encore d'évaluation

- Course Outline - Fm-IIDocument6 pagesCourse Outline - Fm-IIDebarghya BagchiPas encore d'évaluation

- Advanced Principles Corporate FinanceDocument6 pagesAdvanced Principles Corporate Financeveda20Pas encore d'évaluation

- SYLLABUSDocument16 pagesSYLLABUSvix130Pas encore d'évaluation

- MOR 465 SyllabusDocument8 pagesMOR 465 SyllabussocalsurfyPas encore d'évaluation

- Course Outline Comm 394 Lindsey Fall 2014Document8 pagesCourse Outline Comm 394 Lindsey Fall 2014favor8hellPas encore d'évaluation

- CI7600 Module Guide 15-16 v3Document6 pagesCI7600 Module Guide 15-16 v3Param MalkanPas encore d'évaluation

- Texts:: Financial Statements, Second EditionDocument6 pagesTexts:: Financial Statements, Second EditionKempostPas encore d'évaluation

- BUS 331 01 Syllabus Wynter Spring 2023Document6 pagesBUS 331 01 Syllabus Wynter Spring 2023Javan OdephPas encore d'évaluation

- EMBA Financial Statement Analysis and Valuation (Katz) FA2016Document5 pagesEMBA Financial Statement Analysis and Valuation (Katz) FA2016darwin12Pas encore d'évaluation

- MBA505.03 Huang Fall2014 Syllabus RevDocument6 pagesMBA505.03 Huang Fall2014 Syllabus Revnit737Pas encore d'évaluation

- Engineering Entrepreneurship General SummaryDocument6 pagesEngineering Entrepreneurship General SummaryawaisjinnahPas encore d'évaluation

- ADMS 1000 - Session 1 SlidesDocument46 pagesADMS 1000 - Session 1 Slidespeggysun1023Pas encore d'évaluation

- Seattle Pacific University School of Business and Economics: Moss AdamsDocument22 pagesSeattle Pacific University School of Business and Economics: Moss AdamsAlphaPas encore d'évaluation

- BUSMHR 4490 3485 Syllabus FinalDocument10 pagesBUSMHR 4490 3485 Syllabus FinalPhuong TranPas encore d'évaluation

- Syllabus 534B 2015 SpringDocument7 pagesSyllabus 534B 2015 SpringSahit Chowdary GarapatiPas encore d'évaluation

- Acct 587Document6 pagesAcct 587socalsurfyPas encore d'évaluation

- Jcater@uttyler - Edu: UT Tyler BookstoreDocument8 pagesJcater@uttyler - Edu: UT Tyler BookstoreMichel NayrePas encore d'évaluation

- CAFO Syllabus Spring12 S04Document17 pagesCAFO Syllabus Spring12 S04ammanairsofterPas encore d'évaluation

- Coursework Receipting MmuDocument6 pagesCoursework Receipting Mmuafayememn100% (2)

- Statistics and Operations Management IDocument5 pagesStatistics and Operations Management IMike PeñaPas encore d'évaluation

- Sokol Law and Entrepreneurship S19Document10 pagesSokol Law and Entrepreneurship S19DeepikaPas encore d'évaluation

- FRL440 Fall 2015Document9 pagesFRL440 Fall 2015nobuyukiPas encore d'évaluation

- Mgmt218 Patrick LohDocument6 pagesMgmt218 Patrick LohSimon HoPas encore d'évaluation

- ENTP SyllabusDocument16 pagesENTP Syllabusakashmehta10Pas encore d'évaluation

- Course Outline - Econ 5100b - Fall 2011 - FLDocument6 pagesCourse Outline - Econ 5100b - Fall 2011 - FLRafik DawoodPas encore d'évaluation

- Fina-4332 001Document7 pagesFina-4332 001Kiều Thảo AnhPas encore d'évaluation

- Smeal ENTR500 Syllabus 2012Document5 pagesSmeal ENTR500 Syllabus 2012patPas encore d'évaluation

- Sample: Crj557: Fraud InvestigationDocument9 pagesSample: Crj557: Fraud InvestigationFilibert Patrick Tad-awanPas encore d'évaluation

- Creditv Risk AnalysisDocument5 pagesCreditv Risk Analysisveda20Pas encore d'évaluation

- MBA - Entrepreneurship - Larry Louie - Mod E 2015-2016Document14 pagesMBA - Entrepreneurship - Larry Louie - Mod E 2015-2016Bhagath GottipatiPas encore d'évaluation

- 2:00-3:50pm, JKP 110: Kdietrich@marshall - Usc.eduDocument5 pages2:00-3:50pm, JKP 110: Kdietrich@marshall - Usc.edusocalsurfyPas encore d'évaluation

- Business FundamentalsDocument7 pagesBusiness FundamentalsjfasldjflakdjqdfPas encore d'évaluation

- ECON 451 SyllabusDocument4 pagesECON 451 SyllabusjbyuriPas encore d'évaluation

- Syllabus Fall 2014Document8 pagesSyllabus Fall 2014Steven ScottPas encore d'évaluation

- Hello World :DDocument7 pagesHello World :DJames KimPas encore d'évaluation

- CHEM-214 Chemical EntrepreneurshipDocument9 pagesCHEM-214 Chemical EntrepreneurshipSyedMaazAliPas encore d'évaluation

- MGMT 2020 Fall 11fDocument7 pagesMGMT 2020 Fall 11fYunasis AesongPas encore d'évaluation

- Pre Cource Term 11 IntroDocument14 pagesPre Cource Term 11 Introsunil kumarPas encore d'évaluation

- Syllabus 410 Caro 2011 SummerDocument11 pagesSyllabus 410 Caro 2011 SummerMindaou_Gu_3146100% (1)

- Sup 125Document14 pagesSup 125lennoxus8114Pas encore d'évaluation

- Fin 551 Aut21Document12 pagesFin 551 Aut21Badri Narayan MishraPas encore d'évaluation

- UT Dallas Syllabus For Ba3341.004.08f Taught by Michael Keefe (Mok051000)Document7 pagesUT Dallas Syllabus For Ba3341.004.08f Taught by Michael Keefe (Mok051000)UT Dallas Provost's Technology GroupPas encore d'évaluation

- Strategic Cost Analysis For Decision Making Acc 3416Document7 pagesStrategic Cost Analysis For Decision Making Acc 3416Paul SchulmanPas encore d'évaluation

- Syl 3010Document3 pagesSyl 3010Tim LingPas encore d'évaluation

- Principles of Accounting - Module Information PackDocument6 pagesPrinciples of Accounting - Module Information PackHaider QureshiPas encore d'évaluation

- Syllabus BUS 313: The Economic and Financial Environment of Global Business Spring, 2016Document5 pagesSyllabus BUS 313: The Economic and Financial Environment of Global Business Spring, 2016lizPas encore d'évaluation

- Uwe Coursework Cover SheetDocument6 pagesUwe Coursework Cover Sheetafayepezt100% (2)

- ENGL 203 (CRN 64885) : Professional Writing ResearchDocument3 pagesENGL 203 (CRN 64885) : Professional Writing ResearchCody ReimerPas encore d'évaluation

- BAC:AF5AC6O3:Corporate Law, Audit and Regulation: Lecture 1: Introductory LectureDocument13 pagesBAC:AF5AC6O3:Corporate Law, Audit and Regulation: Lecture 1: Introductory LectureBK BlakPas encore d'évaluation

- Operations Management: Course Syllabus OPMG-UB.0001.03Document16 pagesOperations Management: Course Syllabus OPMG-UB.0001.03maheritaniPas encore d'évaluation

- INTRODUCTORY ECONOMICS: Passbooks Study GuideD'EverandINTRODUCTORY ECONOMICS: Passbooks Study GuidePas encore d'évaluation

- Mor 567Document12 pagesMor 567socalsurfyPas encore d'évaluation

- Mor 569Document1 pageMor 569socalsurfyPas encore d'évaluation

- Mor 570Document13 pagesMor 570socalsurfyPas encore d'évaluation

- Mor 569Document13 pagesMor 569socalsurfyPas encore d'évaluation

- Mor 571Document27 pagesMor 571socalsurfyPas encore d'évaluation

- Mor 555Document22 pagesMor 555socalsurfyPas encore d'évaluation

- Mor 566Document24 pagesMor 566socalsurfyPas encore d'évaluation

- Mor 548Document12 pagesMor 548socalsurfyPas encore d'évaluation

- Mor 551Document13 pagesMor 551socalsurfyPas encore d'évaluation

- MKT 499 EthicsDocument9 pagesMKT 499 EthicssocalsurfyPas encore d'évaluation

- MOR 499 SustainabilityDocument25 pagesMOR 499 SustainabilitysocalsurfyPas encore d'évaluation

- MKT 556Document5 pagesMKT 556socalsurfyPas encore d'évaluation

- Mor 472Document12 pagesMor 472socalsurfyPas encore d'évaluation

- Mor 473Document9 pagesMor 473socalsurfyPas encore d'évaluation

- Mor 463Document8 pagesMor 463socalsurfyPas encore d'évaluation

- Syllabus MOR 462 USCDocument19 pagesSyllabus MOR 462 USCsocalsurfyPas encore d'évaluation

- Mor 465Document8 pagesMor 465socalsurfyPas encore d'évaluation

- Overview of MKT 543: Market Demand and Sales Forecasting Instructor: Professor S. Siddarth Reasons To Take This CourseDocument1 pageOverview of MKT 543: Market Demand and Sales Forecasting Instructor: Professor S. Siddarth Reasons To Take This CoursesocalsurfyPas encore d'évaluation

- MKT 430Document23 pagesMKT 430socalsurfyPas encore d'évaluation

- MKT 512Document12 pagesMKT 512socalsurfyPas encore d'évaluation

- Mor 469Document14 pagesMor 469socalsurfyPas encore d'évaluation

- Mor 462Document11 pagesMor 462socalsurfyPas encore d'évaluation

- MKT 445Document7 pagesMKT 445socalsurfyPas encore d'évaluation

- MKT 450Document11 pagesMKT 450socalsurfyPas encore d'évaluation

- IOM 435 - Business Database SystemsDocument6 pagesIOM 435 - Business Database SystemssocalsurfyPas encore d'évaluation

- MKT 430Document23 pagesMKT 430socalsurfyPas encore d'évaluation

- Financial Risk Management Quiz 1Document4 pagesFinancial Risk Management Quiz 1Hawar HAPas encore d'évaluation

- Tche 303 - Money and Banking Tutorial Assignment 3Document5 pagesTche 303 - Money and Banking Tutorial Assignment 3Yên GiangPas encore d'évaluation

- Burlington PDFDocument5 pagesBurlington PDFAlivia HasnandaPas encore d'évaluation

- Ahmad Hassan Textile MillsDocument52 pagesAhmad Hassan Textile Millsmakymakymaky007100% (4)

- Pej PPT Notes 3Document29 pagesPej PPT Notes 3phalguni bPas encore d'évaluation

- Indian Capital MarketDocument35 pagesIndian Capital MarketVivek Rai100% (1)

- PNL PresentationDocument31 pagesPNL PresentationKishore Babu SiramPas encore d'évaluation

- Balance Sheet of Grasim Industries LimitedDocument5 pagesBalance Sheet of Grasim Industries LimitedDaniel Mathew VibyPas encore d'évaluation

- Credit Operations QuestionDocument2 pagesCredit Operations QuestionSumon AhmedPas encore d'évaluation

- Assignment: Strategic Financial ManagementDocument7 pagesAssignment: Strategic Financial ManagementVinod BhaskarPas encore d'évaluation

- CA Inter Accounts Suggested Answer Nov 2022Document29 pagesCA Inter Accounts Suggested Answer Nov 2022adityatiwari122006Pas encore d'évaluation

- Danaher Annual Report 2019Document160 pagesDanaher Annual Report 2019xacaPas encore d'évaluation

- PRESIDENTIAL DECREE No. 129 February 15, 1973Document6 pagesPRESIDENTIAL DECREE No. 129 February 15, 1973chitru_chichruPas encore d'évaluation

- (Routledge Advances in Risk Management) Kin Keung Lai, Jerome Yen, Shifei Zhou, Hao Wang - Volatility Surface and Term Structure - High-Profit Options Trading Strategies-Routledge (2013)Document98 pages(Routledge Advances in Risk Management) Kin Keung Lai, Jerome Yen, Shifei Zhou, Hao Wang - Volatility Surface and Term Structure - High-Profit Options Trading Strategies-Routledge (2013)Yuming MaPas encore d'évaluation

- Investment FunctionDocument18 pagesInvestment FunctionSana ZahidPas encore d'évaluation

- India Tech Monthly Funding ReportDocument29 pagesIndia Tech Monthly Funding ReportShreyaPas encore d'évaluation

- NCUA NGN 2010-R1 - Final Prelim Offering MemorandumDocument72 pagesNCUA NGN 2010-R1 - Final Prelim Offering Memorandumthe_akinitiPas encore d'évaluation

- Agriculture and Investment PropertyDocument15 pagesAgriculture and Investment PropertyHesil Jane DAGONDONPas encore d'évaluation

- Chartered Financial AnalystDocument9 pagesChartered Financial AnalystBhavesh SharmaPas encore d'évaluation

- Passive Income IdeasDocument10 pagesPassive Income Ideasjavayd6215Pas encore d'évaluation

- Accounting For Business Combinations Part 2 - Course AssessmentDocument8 pagesAccounting For Business Combinations Part 2 - Course AssessmentArn KylaPas encore d'évaluation

- Fund Flow and Cash Flow StatementDocument10 pagesFund Flow and Cash Flow StatementAjayPas encore d'évaluation

- Morning Star Report 20190726102355Document1 pageMorning Star Report 20190726102355YumyumPas encore d'évaluation

- Comparative Liquidity Analysis of NepalDocument57 pagesComparative Liquidity Analysis of NepalMd ReyajuddinPas encore d'évaluation

- Bhumika Project ReprtDocument24 pagesBhumika Project Reprtshweta shuklaPas encore d'évaluation

- Real Estate FinanceDocument33 pagesReal Estate FinanceAVICK BISWASPas encore d'évaluation

- Cabot Corporation As3586Document6 pagesCabot Corporation As3586Abhijeet SinghPas encore d'évaluation