Académique Documents

Professionnel Documents

Culture Documents

Birds Eye

Transféré par

Ayesha KhalidDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Birds Eye

Transféré par

Ayesha KhalidDroits d'auteur :

Formats disponibles

Birds Eye and UK Frozen Food Industry

12121002

Introduction This case is based on Birds Eye, a UK based company which started its operations in 1930s and operations continued to 1980s till now. Birds eye were the pioneers in frozen food industry and they started as vertically integrated producers and gained big market share that is 62 % in 1966 which continuously dropped and reached to 20 % in 1982 (shown in exhibit 2). This case is a good example of how competitive advantage (Vertical Integration and vast network) can sometimes become a hurdle in company growth and share later on. Issues Main issue in this case is that Birds Eye which were having the biggest market share and were the pioneers in this field could not maintain their position as before and their share started decreasing as shown in figure1. Their condition became even worse when there were certain changes in the industry, which allowed other companies to enter at different stages of production and distribution chains instead of covering the vast networks. When the industry was getting matured the competition become intense there were fall in the prices of the frozen foods. This lead to decrease in their profitability and Birds eye did not respond in a timely manner when consumer needs were changing. Analysis Birds Eye pioneered the frozen foods industry as vertically integrated producers. They wanted to create barriers for the new potential entrants which can be a threat to them. They created these barriers by investing at various levels of the supply chain thus becoming their own producers, retail distributors and marketers and thus making their operations complex and diversified.. This high cost of investment was a barrier for the new firms entering the market. They were the leaders so they were enjoying more market share and prices while few other firms like Ross and Findus were the imitators so they have to act according and cant increase their prices. In 1970s when the own label firms started entering the market their own competitive advantage become hurdle in their further growth due to the fact that they were involved at various levels of the entire supply chain they have to bear high costs while other firms were devoted their marketing efforts to one of the levels of the chain and focused on particular brands thus offering better quality products at prices less than the Birds eye. The ROI of the Birds eye was also in a declining trend as can be seen from 1972 to 1979 as shown in exhibit 2. This exhibit is showing that they were investing more and getting fewer

1

Birds Eye and UK Frozen Food Industry

12121002

profits due to which the return is less. Their greater cost was attributed to greater cost of raw materials, production and control of vast national distribution network. Their competitive advantage was not sustainable due to the above reasons. Exhibit 5 is showing that there is an increase in the number of self service stores and the number of counter service stores is decreasing. This means these super markets have extra freezing space and increase in demand of frozen foods shown in exhibit 1a. It means that someone has to fill that extra space, so there is potential for the firms to enter in the market and utilize that space. This also increased the power retailers and super markets have. After the new firms entered the market Birds eye cannot gain its share with high prices and it cannot even lower the prices because its costs are high due to complex operations and diversification. There is competition based on price wars and differentiation now there is no advantage of having extensive national network across the value chain. Other companies were then putting efforts to marketing and production while outsource of raw materials and retail network control were not I their operations making their operations and transaction costs less due to which own label companies gained much of the market share from Birds Eye. Their operations were also more efficient and smooth due to less diversification. The suppliers gave them raw materials at cheaper rates than the Birds Eye were able to give. The company was no more able to regain its market share and that share was taken by own label companies which put their efforts in marketing. Those companies were also not able to increase share which imitated Birds eye. Company has to divest its assets so that it can take control over its operation and transaction costs associated with the supply chain. They have to do this as their market share and profits are both declining. They can use the saving to extend their product lines further by adding innovations and promoting them in a right way. This would give them differentiation advantage if they introduce new lines catering to different consumer needs and consumers would be ready to pay even high prices. Consumer pay for the desired quality no matter prices are high or not so they should focus on making their quality better rather than getting control over the entire chain because that would no longer work here. Hence it is analyzed here that the demand for frozen foods industry was increasing. This increased competition and worsen the condition of birds eye. It allowed more space in stores

2

Birds Eye and UK Frozen Food Industry

12121002

when there was shift from counter stores to self service stores. It allowed new entrants and they grabbed the share because of lower transaction costs and smooth and efficient operations. Recommendations: They can use retrenchment strategy in which those operations or business Units are divested which are not profitable. When considering on whom to sell the assets one has to choose only those firms which are specialist in that particular business stage of supply chain so that they can perform meet the quality standards. Divestiture of acquired business would decrease the transaction costs and in this way cash flows generated would be more due to more savings and less costs. These cash flows can be reinvested to marketing its brand like other own label brands are getting advantages out of it. They can get more benefit because they can now focus on quality of its brands and can focus on one activity rather than the entire supply chain. Consumers are already aware of their brand but they must add new innovation and variations in their products because consumer preferences are changing. If they are successful in their marketing efforts they can charge higher prices if they gain some differentiation advantage and in this way profitability will increase. Birds Eye can sell to own labels because those were the only players which gained market share over time at a rapid rate from 6% to 21% in 8 years. They would help in marketing of the brand and Birds eye may focus on production.

Birds Eye and UK Frozen Food Industry

12121002

Figure 1 ( Market Share)

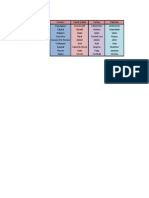

Exhibit 2 Year Profit 1972 1223 1973 1465 42947 1974 1468 48993 1975 1925 52199 1976 249 90383 1977 -679 100004 ROI 0.036084 0.034112 0.029963 0.036878 0.002755 0.00679 0.008941 0.061332 1978 1094 122352 1979 8145 132801

Investment 33893

Figure 2 (Birds Eye ROI)

Vous aimerez peut-être aussi

- Brand Audit of DHLDocument33 pagesBrand Audit of DHLAyesha Khalid100% (1)

- Transfer Courier: Brand Exploratory Brand RecallDocument12 pagesTransfer Courier: Brand Exploratory Brand RecallAyesha KhalidPas encore d'évaluation

- Transfer Courier: Brand Exploratory Brand RecallDocument12 pagesTransfer Courier: Brand Exploratory Brand RecallAyesha KhalidPas encore d'évaluation

- BRM FinalDocument15 pagesBRM FinalAyesha KhalidPas encore d'évaluation

- Quantitative QuestionnaireDocument14 pagesQuantitative QuestionnaireAyesha KhalidPas encore d'évaluation

- Quantitative QuestionnaireDocument14 pagesQuantitative QuestionnaireAyesha KhalidPas encore d'évaluation

- BRM FinalDocument15 pagesBRM FinalAyesha KhalidPas encore d'évaluation

- Birds EyeDocument2 pagesBirds EyeAyesha KhalidPas encore d'évaluation

- Tata Motors DCVCDocument3 pagesTata Motors DCVCAyesha Khalid100% (1)

- Case 1Document5 pagesCase 1Ayesha KhalidPas encore d'évaluation

- Sports IndustryDocument5 pagesSports IndustryAyesha KhalidPas encore d'évaluation

- Consumer Ethics While Buying Counterfeit ProductsDocument3 pagesConsumer Ethics While Buying Counterfeit ProductsAyesha KhalidPas encore d'évaluation

- Assess Hutchison WhampoaDocument4 pagesAssess Hutchison WhampoaAyesha KhalidPas encore d'évaluation

- Countries DataDocument2 pagesCountries DataAyesha KhalidPas encore d'évaluation

- Introduction of The CompanyDocument32 pagesIntroduction of The CompanyAyesha KhalidPas encore d'évaluation

- Dairy Farm Project Feasibility ReportDocument47 pagesDairy Farm Project Feasibility ReportHamza Irfan100% (1)

- 43911Document51 pages43911Ayesha KhalidPas encore d'évaluation

- Chemical Sector 1Document28 pagesChemical Sector 1Ayesha KhalidPas encore d'évaluation

- Consumer Ethics While Buying Counterfeit ProductsDocument5 pagesConsumer Ethics While Buying Counterfeit ProductsAyesha KhalidPas encore d'évaluation

- Enhancing The Largest Set Rule For Assembly Line Balancing Through The Concept of Bi-Directional Work RelatednessDocument2 pagesEnhancing The Largest Set Rule For Assembly Line Balancing Through The Concept of Bi-Directional Work RelatednessAyesha KhalidPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Trader'S Code: Abhishek NinaniyaDocument74 pagesThe Trader'S Code: Abhishek Ninaniyaトゥーテェッパィ0% (2)

- P5 Syl2012 Set2Document22 pagesP5 Syl2012 Set2JOLLYPas encore d'évaluation

- A Young Engineer Applied For A Position That Was To Last Six MonthsDocument6 pagesA Young Engineer Applied For A Position That Was To Last Six MonthsNeco Carlo PalPas encore d'évaluation

- Project On TATA CORUS WITH SPECIAL EMPHASIS TO PRICING OF CORUSDocument61 pagesProject On TATA CORUS WITH SPECIAL EMPHASIS TO PRICING OF CORUSchikuu000% (1)

- Module 2 Concept of IncomeDocument3 pagesModule 2 Concept of IncomeNormel DecalaoPas encore d'évaluation

- Treasury Stock ENtriesDocument3 pagesTreasury Stock ENtrieseuphoria2Pas encore d'évaluation

- Merger - Ashish Sharma - 0101151295 PDFDocument34 pagesMerger - Ashish Sharma - 0101151295 PDFAshish SharmaPas encore d'évaluation

- Drivers of Liquidity in Corp BondsDocument38 pagesDrivers of Liquidity in Corp BondssoumensahilPas encore d'évaluation

- Illovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022Document1 pageIllovo Sugar (Malawi) PLC - Final Results - 31 Aug 2022Mallak AlhabsiPas encore d'évaluation

- Service Tax Refund - RansaDocument1 pageService Tax Refund - RansaservervcnewPas encore d'évaluation

- Tally Notes PDFDocument115 pagesTally Notes PDFLokesh Yadav100% (6)

- Problem 8-31Document4 pagesProblem 8-31Majde QasemPas encore d'évaluation

- Ch08TB PDFDocument15 pagesCh08TB PDFMico Duñas CruzPas encore d'évaluation

- Restatement of TrustDocument19 pagesRestatement of TrustAlex CastroPas encore d'évaluation

- Process and Home OpisDocument15 pagesProcess and Home OpisAngelica ManaoisPas encore d'évaluation

- Cement - Elara Securities - 8 April 2020 PDFDocument5 pagesCement - Elara Securities - 8 April 2020 PDFshahavPas encore d'évaluation

- Fabm 1-PTDocument12 pagesFabm 1-PTMaxene YbañezPas encore d'évaluation

- Partnership DeedDocument6 pagesPartnership DeedMD Khalik100% (1)

- Mas 9407 Decision MakingDocument18 pagesMas 9407 Decision MakingmozoljayPas encore d'évaluation

- Account Number Account Name Header Balance 10000 ASSET 11000 Current AssetDocument4 pagesAccount Number Account Name Header Balance 10000 ASSET 11000 Current AssetMuhammad Aziz FikriPas encore d'évaluation

- Maryam - 37 - 3726 - 1 - Assignment Based FT Template SUMMER 2021Document3 pagesMaryam - 37 - 3726 - 1 - Assignment Based FT Template SUMMER 2021Hasnain BhuttoPas encore d'évaluation

- Axtel IndustriesDocument37 pagesAxtel IndustriesBandaru NarendrababuPas encore d'évaluation

- Business Plan Little Munchkins Child CareDocument24 pagesBusiness Plan Little Munchkins Child Careapi-355593468100% (8)

- 9.2 Investment in AssociateDocument6 pages9.2 Investment in AssociateJorufel PapasinPas encore d'évaluation

- The TRAIN Law and The Poor Antonio P. Contreras: BY ON JANUARY 30, 201Document7 pagesThe TRAIN Law and The Poor Antonio P. Contreras: BY ON JANUARY 30, 201Jellah Lorezo AbreganaPas encore d'évaluation

- The Cpa Licensure Examination Syllabus Financial Accounting and ReportingDocument6 pagesThe Cpa Licensure Examination Syllabus Financial Accounting and ReportingNicole Anne CornejaPas encore d'évaluation

- Customer Satisfaction in LICDocument69 pagesCustomer Satisfaction in LICGauri Soni100% (2)

- November 13, 2020 Strathmore TimesDocument16 pagesNovember 13, 2020 Strathmore TimesStrathmore TimesPas encore d'évaluation

- List of Requirements BIR - Transfer of Shares of StockDocument1 pageList of Requirements BIR - Transfer of Shares of Stockiris_irisPas encore d'évaluation

- E-Con 266 Transcript PDFDocument19 pagesE-Con 266 Transcript PDFSanjeed SharmaPas encore d'évaluation