Académique Documents

Professionnel Documents

Culture Documents

Lecture6 DurationTermStructure

Transféré par

Jeremy PageTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lecture6 DurationTermStructure

Transféré par

Jeremy PageDroits d'auteur :

Formats disponibles

Fall 2011

Duration and Term Structure

Prof. Page

BUSM 411: Derivatives and Fixed Income 6.

6.1.

Duration and Convexity

Interest rate sensitivity

Bond prices and yields are inversely related: as yields increase, bond prices fall and vice versa An increase in a bonds yield to maturity results in a smaller price change than a equal decrease in yield (convexity) Prices of long-term bonds tend to be more sensitive to interest rate changes than prices of short-term bonds The sensitivity of bond prices to changes in yields increases at a decreasing rate as maturity increases Interest rate risk is inversely related to the bonds coupon rate: high-coupon bonds are less sensitive to changes in interest rates than low-coupon bonds The sensitivity of a bonds price to yield changes is inversely related to the yield at which the bond currently sells

Fall 2011

Duration and Term Structure

Prof. Page

6.2.

Duration

Maturity is the key determinant of a bonds interest rate risk Even the relation between coupon rates and interest rate sensitivity really boils down to maturity: Bonds with higher coupons have more of their cash ows occurring at shorter horizons relative to low or zero coupon bonds Hence, high coupon bonds have a lower eective maturity Duration is a measure of the eective maturity of a bond or portfolio of bonds Duration combines the eects of coupon rates and actual maturity into a summary measure of interest rate risk Macaulay duration is simply a weighted average of the horizons of each of the bonds cash ows, weighted by their present value:

T

D=

t=1

CFt /(1 + y )t Bond price

where CFt is the cash ow in period t. Duration tells us how much a bonds price changes for a given change in (gross) yields: (1 + y ) B = D B (1 + y ) Practitioners often express this in a simpler, more intuitive form by dening modied duration, D = D/(1 + y ), so that B = D y B

Fall 2011

Duration and Term Structure

Prof. Page

6.3.

Properties of duration

The duration of a zero coupon bond equals its time to maturity Holding maturity constant,a bonds duration is lower when the coupon rate is higher Holding coupon rate constant, duration increases with maturity Holding other factors constant, duration of a coupon bond is higher when yield to maturity is lower Duration of perpetual bond is

1+y y

Fall 2011

Duration and Term Structure

Prof. Page

6.4.

Duration and convexity

Duration is only a local, linear approximation of the relationship between yield changes and bond price changes

We can improve our approximation of this relationship by accounting for convexity The formula for the convexity of a bond with maturity of T years and annual coupon payments is T 1 CFt (t2 + t) Convexity = 2 P (1 + y ) t=1 (1 + y )t We can then incorporate convexity into our expression for price changes as a function of yield changes: P 1 = D y + Convexity (y )2 P 2

Fall 2011

Duration and Term Structure

Prof. Page

Example: 30-year bond with 8% coupon, selling at initial yield to maturity of 8% Macaulay duration:

3

D= Modied duration:

0t=1 t

CFt /(1 + y )t $1000

= 12.16

D = D/(1 + .08) = 11.26 Convexity: 1 Convexity = $1000(1.08)2

30

t=1

CFt 2 (t + t) = 212.4 (1.08)t

Suppose the yield increases from 8% to 10%: Price = a decline of 18.85% The linear duration rules predicts a price change of P = D y = 11.26 .02 = .2252 or 22.52% P Accounting for convexity gives P 1 1 = D y +( )Convexity (y )2 = 11.26.02+( )212.4(.02)2 = .1827 or 18.27% P 2 2 a much more accurate prediction. $80 1 $1000 1 + = $811.46 3 .10 (1.10) 0 (1.10)3 0

Fall 2011

Duration and Term Structure

Prof. Page

6.5. 6.5.1

The Term-Structure of Interest Rates The yield curve

Interest rates can and often do dier for cash ows of dierent maturities. The relationship between yield and maturity is known as the term-structure of interest rates, and the graphical representation of this relationship is called the yield curve. Examples:

Figure 1: Treasury yield curves

Yield curves are typically constructed from the yields on Treasury securities, in order to isolate the relationship between yield and maturity (no default risk)

Fall 2011

Duration and Term Structure

Prof. Page

6.5.2

The yield curve and future interest rates

Where does the shape of the yield come from? Interest rate certainty (we know what the future path of interest rates will be): Suppose the yield curve is upward sloping as in the example above: the 1-year yield is 5% and the 2-year yield is 6%. Consider two strategies: (i) buy a 2-year zero-coupon bond, or (ii) buy a 1-year zero coupon bond and roll it over next year into another 1-year bond. If we invest the same initial amount (say $100) in both strategies, they must oer the same return (or else wed have an arbitrage opportunity, since neither strategy involves any risk): Buy & hold 2-year zero = Roll over 1-year bonds $100 (1.06)2 = $100 (1.05) (1 + r2 )

Solve for r2 : r2 =

(1.06)2 1 = .0701 or 7.01% > 5% (1.05)

Upward sloping yield curve means interest rates will rise! Spot rate: the current yield on a zero coupon bond of a given maturity. In the example above, the 1-year spot rate is 5% and the 2-year spot rate is 6%. Short rate: the yield for a given time interval (say a year) at dierent points in time. In the example above, todays short rate is 5% and next years short rate is 7.01%. More generally, we can nd the short rate for n periods ahead using the formula: (1 + rn ) = (1 + yn )n (1 + yn1 )n1

In reality, we dont know future interest rates with certainty, so we refer to the interest rate backed out in this manner the forward rate. The forward rate need not equal the actual future short rate or even the expected future short rate if investors require some sort of liquidity premium. Forward rates and interest rate risk: 7

Fall 2011

Duration and Term Structure

Prof. Page

Investors with short horizons prefer to lock in an interest rate by investing in short-term bonds, rather than long-term bonds to be sold for an uncertain price in the future. Short-term investors would require a liquidity premium to invest longer-term bonds forward rate is higher than expected future short rate Long-term investors would prefer to lock in long-term interest rates, rather than subjecting themselves to interest rate risk by rolling over Forward rate is lower than expected short rate!

Fall 2011

Duration and Term Structure

Prof. Page

6.5.3

Theories of the term structure

Expectations hypothesis Slope of the yield curve is due to expectations of changes in short-term interest rates Under this hypothesis, forward rate equals the market consensus expectation of future short rate This can lead to either upward or downward sloping yield curves depending on what the expectations of future short rates are Liquidity preference People prefer liquidity (matching maturity to investment horizons) Short-term investors dominate the market, so long-term bonds must oer a liquidity premium in order to get individuals to invest in them. The liquidity premium on longer-term bonds leads to an upward sloping yield curve (which is what we usually observe) The two theories arent mutually exclusive. Expectations of future short rates interact with required liquidity premia to produce various shapes of the yield curve:

Fall 2011

Duration and Term Structure

Prof. Page

10

Fall 2011

Duration and Term Structure

Prof. Page

11

Fall 2011

Duration and Term Structure

Prof. Page

6.5.4

Interpreting the term structure

If term structure reects market expectations of future interest rates, we can use the term structure to infer the markets expectations This expectation can serve as a benchmark for our own analysis and help guide our investment decisions Problem: we cannot tell how much an upward sloping yield curve is due to expectations of interest rate increases and how much is dues to a liquidity premium fn = E [rn ] + Liquidity premium Still, very steep yield curves are typically taken as an indicator of interest rate increases We can more safely interpret a downward sloping yield curve as evidence that interest rates are expected to decline

12

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Note5 DeterminingForwardPricesDocument10 pagesNote5 DeterminingForwardPricesJeremy PagePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Bank Regulation SlidesDocument18 pagesBank Regulation SlidesJeremy PagePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Note5b DeterminingForwardPricesI Pt2Document10 pagesNote5b DeterminingForwardPricesI Pt2Jeremy PagePas encore d'évaluation

- 3 Equation Carlin SokiceDocument37 pages3 Equation Carlin SokiceGonzalo PlazaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The of Olympic Weightlifting and How To Avoid Them: 7 Deadly SinsDocument29 pagesThe of Olympic Weightlifting and How To Avoid Them: 7 Deadly Sinswxman6877Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Color Slant Number Sluggo Color Slant Number SluggoDocument1 pageColor Slant Number Sluggo Color Slant Number SluggoJeremy PagePas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

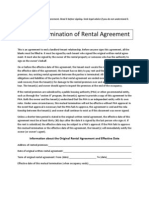

- Mutual Termination of Rental AgreementDocument2 pagesMutual Termination of Rental AgreementJeremy PagePas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Gambling and ComovementDocument50 pagesGambling and ComovementJeremy PagePas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Jim Wendler's Frequency ProjectDocument5 pagesJim Wendler's Frequency Projectantonio_aranzamendez100% (3)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Domestic Violence Lease TerminationDocument2 pagesDomestic Violence Lease TerminationJeremy PagePas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- LockoutDocument2 pagesLockoutJeremy PagePas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Route TreeDocument1 pageRoute TreeJeremy PagePas encore d'évaluation

- Trading and Return ComovementDocument47 pagesTrading and Return ComovementJeremy PagePas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Chocolate Silk PieDocument1 pageChocolate Silk PieJeremy PagePas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- FIN 411: Derivatives and Fixed Income Review of Math Concepts 1. Algebra 1.1. VariablesDocument24 pagesFIN 411: Derivatives and Fixed Income Review of Math Concepts 1. Algebra 1.1. VariablesJeremy PagePas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Note PricingFISecuritiesDocument6 pagesNote PricingFISecuritiesJeremy PagePas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- FIN 411: Derivatives and Fixed Income Review of Math Concepts 1. Algebra 1.1. VariablesDocument24 pagesFIN 411: Derivatives and Fixed Income Review of Math Concepts 1. Algebra 1.1. VariablesJeremy PagePas encore d'évaluation

- Introduction To Fixed Income MarketsDocument12 pagesIntroduction To Fixed Income MarketsJeremy PagePas encore d'évaluation

- Chapter 6 Fixed Income With AnswersDocument27 pagesChapter 6 Fixed Income With AnswersbettyPas encore d'évaluation

- JMP Securities - ORCC - Initiation - 2Q20 Preliminary Balance Sheet - 6 PagesDocument6 pagesJMP Securities - ORCC - Initiation - 2Q20 Preliminary Balance Sheet - 6 PagesSagar PatelPas encore d'évaluation

- Sie Study Manual P 121Document313 pagesSie Study Manual P 121Nredfneei riefh100% (5)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- 2018 FRM Practice Exam Part IDocument136 pages2018 FRM Practice Exam Part Ideepti100% (2)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Chapter 4 Credit Risk PDFDocument53 pagesChapter 4 Credit Risk PDFSyai GenjPas encore d'évaluation

- Financial Statement Analysis 11th Edition Test Bank K R SubramanyamDocument46 pagesFinancial Statement Analysis 11th Edition Test Bank K R Subramanyamcynthiafieldssozagiwjcb100% (38)

- Interest Rates, Exchange Rates and Inflation: A PrimerDocument26 pagesInterest Rates, Exchange Rates and Inflation: A PrimerBhavya ShahPas encore d'évaluation

- Financial Management - Practice WorkbookDocument39 pagesFinancial Management - Practice WorkbookFAIQ KHALIDPas encore d'évaluation

- Alibaba's Bonds Dilemma: Location, Timing, and Pricing AssignmentDocument5 pagesAlibaba's Bonds Dilemma: Location, Timing, and Pricing AssignmentJoel Christian MascariñaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Lums Cases Bibliography FinalDocument171 pagesLums Cases Bibliography FinalAli ShehrwaniPas encore d'évaluation

- Discovering Finance PDFDocument258 pagesDiscovering Finance PDFShahriar Azad100% (1)

- 21 Problems For CB NewDocument31 pages21 Problems For CB NewNguyễn Thảo MyPas encore d'évaluation

- Chapter 1 - Overview - 2022 - SDocument100 pagesChapter 1 - Overview - 2022 - SĐức Nam TrầnPas encore d'évaluation

- 2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013Document9 pages2.BMMF5103 FINAL EXAM Formated-Moderated 1-2013theatresonicPas encore d'évaluation

- FMI7e ch06Document44 pagesFMI7e ch06lehoangthuchien100% (1)

- Interest Rate Markets - Siddhartha JhaDocument6 pagesInterest Rate Markets - Siddhartha JhaNipun DuaPas encore d'évaluation

- Examination: Subject CT1 Financial Mathematics Core TechnicalDocument211 pagesExamination: Subject CT1 Financial Mathematics Core TechnicalMfundo MshenguPas encore d'évaluation

- Financial Planning Association of MalaysiaDocument36 pagesFinancial Planning Association of MalaysiaMie ChipsmiePas encore d'évaluation

- CF - 04Document54 pagesCF - 04Нндн Н'Pas encore d'évaluation

- ACI Dealing Certificate New Version Syllabus 27 Jul 2020Document15 pagesACI Dealing Certificate New Version Syllabus 27 Jul 2020Oluwatobiloba OlayinkaPas encore d'évaluation

- ch14 The Test Bank For Intermediate AccountingDocument45 pagesch14 The Test Bank For Intermediate AccountingCleofe Mae Piñero AseñasPas encore d'évaluation

- Environgrad Corporation: A Case StudyDocument25 pagesEnvirongrad Corporation: A Case StudyAbhi Krishna ShresthaPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Wealth ManagementDocument4 pagesWealth ManagementvimmakPas encore d'évaluation

- General Mathematics - Q2 - Week 5-8Document32 pagesGeneral Mathematics - Q2 - Week 5-8Rayezeus Jaiden Del Rosario0% (1)

- Factor Investing in The Corporate Bond Market - Patrick Houweling and Jeroen Van ZundertDocument16 pagesFactor Investing in The Corporate Bond Market - Patrick Houweling and Jeroen Van ZundertJuan Manuel VeronPas encore d'évaluation

- Investment PDFDocument15 pagesInvestment PDFLenrey Cobacha100% (1)

- Debt Analysis and ManagementDocument47 pagesDebt Analysis and ManagementRahul AtodariaPas encore d'évaluation

- 5) Exam Is Due Back Before Midnight (EST) On Nov 5: WWW - Federalreserve.govDocument3 pages5) Exam Is Due Back Before Midnight (EST) On Nov 5: WWW - Federalreserve.govTrevor TwardzikPas encore d'évaluation

- Bond Valuation PresentationDocument16 pagesBond Valuation PresentationJACOB GAMUPas encore d'évaluation

- Sample ProblemsDocument5 pagesSample ProblemsfenPas encore d'évaluation

- STEM Labs for Physical Science, Grades 6 - 8D'EverandSTEM Labs for Physical Science, Grades 6 - 8Évaluation : 3.5 sur 5 étoiles3.5/5 (6)