Académique Documents

Professionnel Documents

Culture Documents

Counter Trade I2

Transféré par

Catherine JohnsonTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Counter Trade I2

Transféré par

Catherine JohnsonDroits d'auteur :

Formats disponibles

Counter trade is a trade related entry mode.

Definition : Definition LCR explains "Countertrade is inherently an ad hoc activity practice varies according to local regulations and requirements, the nature of the goods to be exported and the current priorities of the parties involved. Also, the terms used to describe the main modes of trading vary, often interchangeably causing confusion. " - which is a fancy way of saying countertrade can be a lot of things depending on who is involved Need of Countertrade : Need of Countertrade Shortage of convertible currency Liquidity problems Develop new markets Stimulation of jobs and Industry To balance overseas trade Ensure future selling contracts (Counterpurchase) To gain a competitive edge over other suppliers. It has become popular as a means of financing international trade to reduce risks or overcome problems associated with various national currencies. Types of Countertrade : Types of Countertrade Barter Counterpurchase Offset Buyback Switch Trading Tolling Barter : Barter Goods or services are exchanged for goods or services In principle, no cash involvement Exchange maybe delayed Only one contract involved Examples : Indo Iraq Wheat and Rice for Oil deal Example of Barter Trade : Example of Barter Trade Country A Country B Cigars Mining Equipment This means if Country A sells mining equipment to Country B in return for cigars - they will probably hold some of the mining equipment back until they have made some good profit from the cigars. . Indo-Iraq Barter Deal : Indo-Iraq Barter Deal In 2000, India and Iraq agreed on an "oil for wheat and rice" barter deal, subject to UN approval under Article 50 of the UN Gulf War sanctions, that would facilitate 300,000 barrels of oil delivered daily to India at a price of $6.85 a barrel while Iraq oil sales into Asia were valued at

about $22 a barrel. In 2001, India agreed to swap 1.5 million tonnes of Iraqi crude under the oil-for-food program. Counterpurchase : Counterpurchase Counter purchase is a reciprocal buying agreement. It occurs when a firm agrees to purchase a certain amount of materials in future back from a country to which a sale is made. Volume of trade does not have to be equal (may be covered by cash) Covered by two separate contracts. More flexible than barter Under one of the contracts, the sale of goods between an exporter and importer is negotiated and paid for in a specified currency. The second contract obligates the exporter to purchase goods from the importer at a specified value over a period of time. Unlike buybacks, counterpurchases involve hard currency. Offset: Offset A party agrees to purchase goods and services with a specified percentage of its proceeds from its original sale Generally used in case of Military Equipment. Direct Related Products Indirect Unrelated Products Example: Example DIRECT - E.g. Shanghai Aircraft manufacturing corp china may buy jets from boeing using its proceeds from manufacturing the tail sections of the jets from Boeing. INDIRECT suppose Japan supplies a Chinese company with capital inputs and asks China to promote its other services like tourism and trade etc. Buyback : Buyback Occurs when a firm provides a local company with inputs for manufacturing products (mostly capital equipment) and agrees to buy a part of the produce in return for the payment. It may also include technology transfer Two separate contracts involved : Sales and purchase contract Example of Buyback : Example of Buyback Chinatex, a Shanghai based clothing manufacturer and Japans Fukusuke Corp., arranged a buyback whereby the latter sold 10 knitting machines and raw materials in return for 1 Million pairs of underwear to be produced on the knitting machines Chinatex benefitted from Fukusukes instructions on how to use the equipment and its excellent after sales service In Turkey, Coca-Cola set up a joint venture to produce

tomato paste for the American market and other markets, providing management and technology for the plant. Switch Trading : Switch Trading It involves atleast three parties. This means a country may barter goods from another country which may be of no use to itself so it sells the goods to other country for hard cash Expands Exports Enables party to achieve satisfactory outcome May be difficult in brokering. Example- Switch Trading : Example- Switch Trading Brazil exported corn to East germany (before Unification) and received products in return. Germany did not use corn , so it sold the corn to other countries for hard cash. Tolling : Tolling Manufacturers, in regions such as the Former Soviet Union, may sometimes be unable to service customers because they lack the foreign exchange to buy raw materials. In a tolling deal, a supplier himself provides the raw material (steel ingots, say) and hires capacity of the factory to turn it into finished goods (e.g. steel tubes). These are then bought by a final customer who pays the supplier in cash - throughout the process the supplier retains ownership of the material as it is processed by the factory." - this is similar to Contract Manufacturing where the Contractor provides much of the materials.

Vous aimerez peut-être aussi

- Summary of Carley Garner's A Trader's First Book On CommoditiesD'EverandSummary of Carley Garner's A Trader's First Book On CommoditiesPas encore d'évaluation

- Counter Trade: Chapter 3 and Chapter 8Document23 pagesCounter Trade: Chapter 3 and Chapter 8kirthi nairPas encore d'évaluation

- Counter TradeDocument5 pagesCounter TradeJitendra SingodiyaPas encore d'évaluation

- Types of Counter TradeDocument8 pagesTypes of Counter Tradeutkarsh275Pas encore d'évaluation

- Counter TradeDocument4 pagesCounter TradeManvinder Kaur100% (1)

- THE BOOMING BUSINESS OF COUNTERTRADEDocument12 pagesTHE BOOMING BUSINESS OF COUNTERTRADERAHULPas encore d'évaluation

- Ibo-2 McomDocument5 pagesIbo-2 McomAbhishek SahaPas encore d'évaluation

- Counter TradeDocument38 pagesCounter TradethomasPas encore d'évaluation

- The Growth and Development of Counter Trade (IBA Term Paper)Document12 pagesThe Growth and Development of Counter Trade (IBA Term Paper)Imad AliPas encore d'évaluation

- Lec 8 - International TradeDocument13 pagesLec 8 - International TradeNEERAJA UNNIPas encore d'évaluation

- Countertrade Continuation: Unit 3 SectionDocument7 pagesCountertrade Continuation: Unit 3 SectionBabamu Kalmoni JaatoPas encore d'évaluation

- International Contract For Sale of Goods PDFDocument28 pagesInternational Contract For Sale of Goods PDFtienma19890% (1)

- CHP 4 HnsDocument4 pagesCHP 4 HnshnsPas encore d'évaluation

- Countertrade: An Overview of Forms, Mechanisms and CriticismsDocument25 pagesCountertrade: An Overview of Forms, Mechanisms and CriticismsRishiPas encore d'évaluation

- CountertradeDocument4 pagesCountertradechandresh_lifePas encore d'évaluation

- Counter TradeDocument7 pagesCounter TradeGudiya UpadhyayPas encore d'évaluation

- Question 1 - Discuss The Goals of International Financial Management Answer - 1Document8 pagesQuestion 1 - Discuss The Goals of International Financial Management Answer - 1Raghavendra SoniPas encore d'évaluation

- Assignment MK0018Document9 pagesAssignment MK0018dinesh jobanputraPas encore d'évaluation

- 7Document7 pages7namnqn23Pas encore d'évaluation

- Importing, Exporting and Global Sourcing: An IntroductionDocument16 pagesImporting, Exporting and Global Sourcing: An IntroductionKimberly Ann SurdellaPas encore d'évaluation

- The Economics and Politics of Countertrade: Gary BanksDocument24 pagesThe Economics and Politics of Countertrade: Gary BanksSusan LaskoPas encore d'évaluation

- Countertrade: Unit 3 SectionDocument4 pagesCountertrade: Unit 3 SectionBabamu Kalmoni JaatoPas encore d'évaluation

- Trade NoteDocument5 pagesTrade Noteevelynna andrewPas encore d'évaluation

- Understanding International TradeDocument8 pagesUnderstanding International TradeSanskriti SamadhiyaPas encore d'évaluation

- Xternal Rade: Module-5 MarketingDocument24 pagesXternal Rade: Module-5 MarketingRamona IonPas encore d'évaluation

- International Sale Agreement SampleDocument11 pagesInternational Sale Agreement SampleGlobal NegotiatorPas encore d'évaluation

- International TradeDocument3 pagesInternational TradeArun KarathPas encore d'évaluation

- Tie-In Arrangements: Section 3Document77 pagesTie-In Arrangements: Section 3gauravPas encore d'évaluation

- L3-1 Forward and Futures I - StructureDocument5 pagesL3-1 Forward and Futures I - StructureOmar 11Pas encore d'évaluation

- Trade Expose Final PDFDocument19 pagesTrade Expose Final PDFGhizwaPas encore d'évaluation

- Derivatives DocumentationDocument89 pagesDerivatives DocumentationJonathan Ching100% (1)

- How International Trade WorksDocument4 pagesHow International Trade WorksfePas encore d'évaluation

- Best Answer - Chosen by Asker: Money NewageDocument7 pagesBest Answer - Chosen by Asker: Money NewagenomanashrafPas encore d'évaluation

- Chapter 20Document7 pagesChapter 20Sowparnika BalasubramaniamPas encore d'évaluation

- Chapter 5 (LMS)Document48 pagesChapter 5 (LMS)HanhPas encore d'évaluation

- Why Countries TradeDocument2 pagesWhy Countries TradeAndrewPas encore d'évaluation

- Chapter 11 - Questions Pool PDFDocument31 pagesChapter 11 - Questions Pool PDFPT Thanh TrúcPas encore d'évaluation

- Importance of External Trade & ProceduresDocument3 pagesImportance of External Trade & ProceduresAkashPas encore d'évaluation

- Chapter 12: Global Pricing : Milly (Zhangli) 18-3005-292Document30 pagesChapter 12: Global Pricing : Milly (Zhangli) 18-3005-292li zhangPas encore d'évaluation

- A) Measuring Exchange Rate MovementsDocument9 pagesA) Measuring Exchange Rate MovementsjobinPas encore d'évaluation

- Unit 2 - Claasical& Non Classical TheoryDocument35 pagesUnit 2 - Claasical& Non Classical TheoryGlendsss RjndlrPas encore d'évaluation

- Unit 2 - Claasical& Non Classical TheoryDocument35 pagesUnit 2 - Claasical& Non Classical TheoryGlendsss RjndlrPas encore d'évaluation

- Internationl MarketingDocument17 pagesInternationl Marketingarchana yadavPas encore d'évaluation

- Partial 2 - DGRL - Reading PDFDocument4 pagesPartial 2 - DGRL - Reading PDFGabyy xPas encore d'évaluation

- INTERNATIONAL TRADE EDITED NEWDocument16 pagesINTERNATIONAL TRADE EDITED NEWNaomi NyambasoPas encore d'évaluation

- Unit 3 Export Sales: ContractDocument10 pagesUnit 3 Export Sales: Contractfer nandoPas encore d'évaluation

- International Contracts ModelsDocument40 pagesInternational Contracts ModelsGlobal Negotiator67% (3)

- What Is International TradeDocument19 pagesWhat Is International TradeImran AzizPas encore d'évaluation

- INCOTERMSDocument5 pagesINCOTERMSborbonchrestinealcazarenPas encore d'évaluation

- How International Trade Benefits Consumers Through Lower Prices and Access to New GoodsDocument2 pagesHow International Trade Benefits Consumers Through Lower Prices and Access to New Goodsashley greyPas encore d'évaluation

- International TradeDocument43 pagesInternational TradeAshwani SinghPas encore d'évaluation

- CommoditiesDocument6 pagesCommoditiesSmart Academic solutionsPas encore d'évaluation

- International Economic Law Test NotesDocument21 pagesInternational Economic Law Test NotesMagano ShinenePas encore d'évaluation

- International Sales ContractDocument39 pagesInternational Sales ContractNhật HạPas encore d'évaluation

- A Report of Grand Project On Study On Derivatives in Indian MarketDocument58 pagesA Report of Grand Project On Study On Derivatives in Indian Marketmehul_218Pas encore d'évaluation

- Sale of Goods Act 1930Document17 pagesSale of Goods Act 1930Foyshel RahmanPas encore d'évaluation

- Commodity MarketDocument8 pagesCommodity MarketRushabh ShahPas encore d'évaluation

- National College of Business Administration & Economics: Reading 1Document4 pagesNational College of Business Administration & Economics: Reading 1Hamza HusnainPas encore d'évaluation

- Up To Date Business Including Lessons in Banking, Exchange, Business Geography, Finance, Transportation and Commercial Law Home Study Circle Library Series (Volume II.)D'EverandUp To Date Business Including Lessons in Banking, Exchange, Business Geography, Finance, Transportation and Commercial Law Home Study Circle Library Series (Volume II.)Pas encore d'évaluation

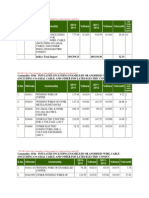

- Itc HS (85400Document20 pagesItc HS (85400Catherine JohnsonPas encore d'évaluation

- Free Trade ZoneDocument3 pagesFree Trade ZoneCatherine JohnsonPas encore d'évaluation

- Mergers & Acquisitions: 10 Solid Reasons To Support An Acquisition StrategyDocument2 pagesMergers & Acquisitions: 10 Solid Reasons To Support An Acquisition StrategyCatherine JohnsonPas encore d'évaluation

- Mergers and AcquisitionsDocument12 pagesMergers and AcquisitionsCatherine JohnsonPas encore d'évaluation

- Present Position in International SubcontractingDocument3 pagesPresent Position in International SubcontractingCatherine JohnsonPas encore d'évaluation

- International StrategyDocument26 pagesInternational StrategyCatherine JohnsonPas encore d'évaluation

- Multinational CorporationDocument6 pagesMultinational CorporationCatherine JohnsonPas encore d'évaluation

- International SubcontractingDocument2 pagesInternational SubcontractingCatherine JohnsonPas encore d'évaluation

- International Control SystemDocument5 pagesInternational Control SystemCatherine JohnsonPas encore d'évaluation

- Export of Project & ConsultancyDocument65 pagesExport of Project & ConsultancyCatherine Johnson100% (1)

- Cross Border Business Reorganisation The Indian PerspectiveDocument39 pagesCross Border Business Reorganisation The Indian PerspectiveCatherine JohnsonPas encore d'évaluation

- Overseas Project ConsultancyDocument23 pagesOverseas Project ConsultancyCatherine JohnsonPas encore d'évaluation

- Multinational CorporationDocument8 pagesMultinational CorporationDhananjana JoshiPas encore d'évaluation

- 1 292583745 Bill For Current Month 1Document2 pages1 292583745 Bill For Current Month 1Shrotriya AnamikaPas encore d'évaluation

- Solution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFDocument24 pagesSolution Manual For Fundamentals of Modern Manufacturing 6Th Edition by Groover Isbn 1119128692 9781119128694 Full Chapter PDFsusan.lemke155100% (11)

- Group 1 - MM - Vanca Digital StrategyDocument10 pagesGroup 1 - MM - Vanca Digital StrategyAashna Duggal100% (1)

- AACCSA Journal of Trade and Business V.1 No. 1Document90 pagesAACCSA Journal of Trade and Business V.1 No. 1Peter MuigaiPas encore d'évaluation

- PMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationDocument6 pagesPMT Machines LTD Inspection and Test Plan For Bogie Frame FabricationAMIT SHAHPas encore d'évaluation

- The Basketball Diaries by Jim CarollDocument22 pagesThe Basketball Diaries by Jim CarollEricvv64% (25)

- Year 2019 Current Affairs - English - January To December 2019 MCQ by Sarkari Job News PDFDocument232 pagesYear 2019 Current Affairs - English - January To December 2019 MCQ by Sarkari Job News PDFAnujPas encore d'évaluation

- Interview - Duga, Rennabelle PDocument4 pagesInterview - Duga, Rennabelle PDuga Rennabelle84% (19)

- Configuration Rationale Document - Personnel StructureDocument11 pagesConfiguration Rationale Document - Personnel Structurepkank09100% (1)

- How a Dwarf Archers' Cunning Saved the KingdomDocument3 pagesHow a Dwarf Archers' Cunning Saved the KingdomKamlakar DhulekarPas encore d'évaluation

- Understanding the Causes and Misconceptions of PrejudiceDocument22 pagesUnderstanding the Causes and Misconceptions of PrejudiceმარიამიPas encore d'évaluation

- LTD NotesDocument2 pagesLTD NotesDenis Andrew T. FloresPas encore d'évaluation

- Investment Decision RulesDocument113 pagesInvestment Decision RulesHuy PanhaPas encore d'évaluation

- Vedic MythologyDocument4 pagesVedic MythologyDaniel MonteiroPas encore d'évaluation

- Tax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsDocument12 pagesTax Ii: Syllabus - Value-Added Tax Atty. Ma. Victoria A. Villaluz I. Nature of The VAT and Underlying LawsChaPas encore d'évaluation

- Property Accountant Manager in Kelowna BC Resume Frank OhlinDocument3 pagesProperty Accountant Manager in Kelowna BC Resume Frank OhlinFrankOhlinPas encore d'évaluation

- Drought in Somalia: A Migration Crisis: Mehdi Achour, Nina LacanDocument16 pagesDrought in Somalia: A Migration Crisis: Mehdi Achour, Nina LacanLiban SwedenPas encore d'évaluation

- Detailed Project Report Bread Making Unit Under Pmfme SchemeDocument26 pagesDetailed Project Report Bread Making Unit Under Pmfme SchemeMohammed hassenPas encore d'évaluation

- RA MEWP 0003 Dec 2011Document3 pagesRA MEWP 0003 Dec 2011Anup George Thomas100% (1)

- Su Xiaomi's spring arrives in unexpected formDocument4 pagesSu Xiaomi's spring arrives in unexpected formDonald BuchwalterPas encore d'évaluation

- Summary of Kamban's RamayanaDocument4 pagesSummary of Kamban's RamayanaRaj VenugopalPas encore d'évaluation

- Ngulchu Thogme Zangpo - The Thirty-Seven Bodhisattva PracticesDocument184 pagesNgulchu Thogme Zangpo - The Thirty-Seven Bodhisattva PracticesMario Galle MPas encore d'évaluation

- CIR vs. CA YMCA G.R. No. 124043 October 14 1998Document1 pageCIR vs. CA YMCA G.R. No. 124043 October 14 1998Anonymous MikI28PkJc100% (1)

- CounterclaimDocument53 pagesCounterclaimTorrentFreak_Pas encore d'évaluation

- The Meaning of Life Without Parole - Rough Draft 1Document4 pagesThe Meaning of Life Without Parole - Rough Draft 1api-504422093Pas encore d'évaluation

- Aclc College of Tacloban Tacloban CityDocument3 pagesAclc College of Tacloban Tacloban Cityjumel delunaPas encore d'évaluation

- ICAO EDTO Course - Basic Concepts ModuleDocument63 pagesICAO EDTO Course - Basic Concepts ModuleLbrito01100% (1)

- Trivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFDocument12 pagesTrivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFABINPas encore d'évaluation

- Ombudsman Complaint - TolentinoDocument5 pagesOmbudsman Complaint - TolentinoReginaldo BucuPas encore d'évaluation

- Environmental PolicyLegislationRules & RegulationsDocument14 pagesEnvironmental PolicyLegislationRules & RegulationsNikin KannolliPas encore d'évaluation