Académique Documents

Professionnel Documents

Culture Documents

Board of Liquidators v. Kalaw

Transféré par

Maiti LagosCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Board of Liquidators v. Kalaw

Transféré par

Maiti LagosDroits d'auteur :

Formats disponibles

Board of Liquidators v.

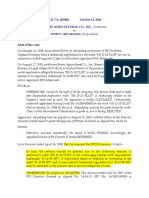

Kalaw Emergency Recit: NACOCO was a non-profit governmental organization avowed in the development of the coconut industry. It was granted the express power to buy, sell, barter, export, or in any manner, deal in coconut, copra and other by-products. NACOCO embarked on copra trading activities, and Kalaw served as its general manager and board chairman. As general manager, Kalaw, entered into several contracts for delivery of copra, without prior approval from the Board of Directors of NACOCO. But the contracts were later on ratified by the Board of Directors. An unexpected chain of events transpired which deterred NACOCO from fulfilling its obligations in the contracts entered into by Kalaw. Devastating typhoons damaged coconut trees throughout the country, which resulted in the decrease in copra production. NACOCO then failed to deliver the amount of orders covering the aforementioned contracts. There was only partial fulfilment of the contracts, which resulted to a suit filed by one of the buyers, Louis Dreyfus & Co. (Overseas) Ltd. The case was thereafter settled but when Kalaw management was already out of the picture. The settlements sum up to about P1.3M. Thereafter, a suit was filed by NACOCO Board of Liquidators, seeking to recover the amount of settlement from Kalaw and other past directors of NACOCO. It charges Kalaw with negligence under Art. 2176 of the Civil Code. The directors, including Kalaw, was charged with bad faith and/or breach of trust for having approved of the contracts. The lower court dismissed the case and absolved Kalaw and other directors of any liability. The Board of Liquidators then appealed to the Supreme Court, which is the instant case. The Supreme Court affirmed the lower courts decision absolving the defendants of any liability. It ruled that the case is one of damnum absque injuria (damage without injury). Conjunction of damage and wrong was absent in this case. There cannot be an actionable wrong if either one or

the other is wanting. The Court held that there was absence of bad faith on the part of Kalaw, because he was led to believe that he was empowered to enter into such contracts even without the prior approval of the Board of Directors (even though the by-laws of the corporation requires such approval) since such was the practice and record showed that the Board was knowledgeable of the transactions he entered into without objecting thereto. Moreover, the Court took note of the nature of the position of a general manager, who has control of the business and has implied authority to make any contract or do any act necessary to the conduct of ordinary business of the corporation. Since copra trading is one of the ordinary business of the corporation, entering into contracts for delivery of copra was deemed to be within the powers of Kalaw as general manager. Indeed, the Board has ratified such acts by Kalaw. The Court further pronounced that settled jurisprudence has it that where similar acts have been approved by the directors as a matter of general practice, custom, and policy, the general manager may bind the company without formal authorization of the board of directors. In the case at bar, the practice of the corporation has been to allow its general manager to negotiate and execute contracts in its copra trading activities for and in NACOCOs behalf without prior board approval. The contracts therefore were valid contracts. It was found that the cause of the losses of NACOCO was not negligence or bad faith on the part of Kalaw and other directors, but the typhoon and other force majeure which prevented NACOCO from fulfilling its contractual obligations. Further, no assertion was made and no proof was presented which would link Kalaws acts, ratified by the Board, to defraudation of the government. *There were issues on the legal personality and prescription which the Court resolved in favour of Board of Liquidators, having legal personality and continuous existence despite the lapse of 3-year period to liquidate.

FACTS: NACOCO was chartered as a non-profit governmental organization by Commonwealth Act 518 avowedly for the protection, preservation and development of the coconut industry in the Philippines. NACOCO's charter was amended [Republic Act 5] to grant the corporation the express power "to buy, sell, barter, export, and in any other manner deal in, coconut, copra, and dessicated coconut, as well as their by-products, and to act as agent, broker or commission merchant of the producers, dealers or merchants" thereof. The charter amendment was enacted to stabilize copra prices, to serve coconut producers by securing advantageous prices for them, to cut down to a minimum, if not altogether eliminate, the margin of middlemen, mostly aliens. Kalaw was general manager and chairman of the board. NACOCO, after the passage of Republic Act 5, embarked on copra trading activities. Kalaw, as general manager, entered into contracts for delivery of copra, without prior approval of the Board of Directors. These contracts were the subject of the suit later on filed against Kalaw. An unhappy chain of events conspired to deter NACOCO from fulfilling these contracts. Nature supervened. Four devastating typhoons visited the Philippines. Coconut trees throughout the country suffered extensive damage. Copra production decreased. Prices spiralled. Warehouses were destroyed. Cash requirements doubled. Deprivation of export facilities increased the time necessary to accumulate shiploads of copra. Quick turnovers became impossible, financing a problem. When it became clear that the contracts would be unprofitable, Kalaw submitted them to the board for approval. The buyers threatened damage suits. Some of the claims were settled, with the exception of one buyer, Louis Dreyfus & Go. -

(Overseas) Ltd., who in fact sue NACOCO. The case was later on settled, the settlement claims summed up to around P1.3M. Thereafter, the Board of Liquidators of NACOCO filed a suit against Kalaw and other directors seeking for the recovery of the amount of settlements paid by NACOCO. The case charges Kalaw with negligence under Article 1902 of the old Civil Code (now Article 2176, new Civil Code); and defendant board members, including Kalaw, with bad faith and/or breach of trust for having approved the contracts. The lower court dismissed the case, which prompted the Board of Liquidators to file an appeal with the Supreme Court, now the instant case.

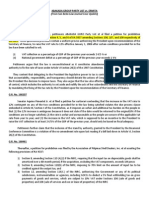

ISSUES: 1. 2. 3. WON plaintiff Board of Liquidators has lost its legal personality to continue with this suit? NO WON action is enforceable against the heirs of Kalaw? YES WON Kalaw is negligent and in bad faith, thus, liable for entering into contract without prior approval of the Board of Directors? NO

HELD: Kalaw and other directors are not liable. The decision of the lower court is affirmed. RATIO: 1. The Board of Liquidators has personality to sue and may continue to prosecute claims in favour of NACOCO. while the boards of directors of the various corporations were abolished, their powers and functions and duties under existing laws were to be assumed and exercised by the Board of Liquidators. The President thought it best to do away with the

boards of directors of the defunct corporations; at the same time, however, the President had chosen to see to it that the Board of Liquidators step into the vacuum. And nowhere in the executive order was there any mention of the lifespan of the Board of Liquidators. By Executive Order 372, the government, the sole stockholder, abolished NACOCO, and placed its assets in the hands of the Board of Liquidators. The Board of Liquidators thus became the trustee on behalf of the government. It was an express trust. The legal interest became vested in the trustee the Board of Liquidators. The beneficial interest remained with the sole stockholder the government. At no time had the government withdrawn the property, or the authority to continue the present suit, from the Board of Liquidators. If for this reason alone, we cannot stay the hand of the Board of Liquidators from prosecuting this case to its final conclusion. 2. A claim based on tort or delict survives the death of the offender. Thus, the claim by NACOCO, if proven, is not barred by the death of Kalaw, and can thus be enforced against his heirs. The suit here revolves around the alleged negligent acts of Kalaw for having entered into the questioned contracts without prior approval of the board of directors, to the damage and prejudice of plaintiff; and is against Kalaw and the other directors for having subsequently approved the said contracts in bad faith and/or breach of trust." Clearly then, the present case is not a mere action for the recovery of money nor a claim for money arising from contract. The suit involves alleged tortious acts. And the action is embraced in suits filed "to recover damages for an injury to person or property, real or personal", which survive.

3.

Kalaw and the other directors were not guilty of bad faith and negligence, respectively. Ordinary in this enterprise are copra sales for future delivery. The movement of the market requires that sales agreements be entered into, even though the goods are not yet in the hands of the seller. Known in business parlance as forward sales, it is concededly the practice of the trade. A certain amount of speculation is inherent in the undertaking. NACOCO was much more conservative than the exporters with big capital. This shortselling was inevitable at the time in the light of other factors such as availability of vessels, the quantity required before being accepted for loading, the labor needed to prepare and sack the copra for market. To NACOCO, forward sales were a necessity. Copra could not stay long in its hands; it would lose weight, its value decrease. Above all, NACOCO's limited funds necessitated a quick turnover. Copra contracts then had to be executed on short notice at times within twenty-four hours. To be appreciated then is the difficulty of calling a formal meeting of the board. xxx contract it should be stressed, were signed by Kalaw without prior authority from the board. Said contracts were known all along to the board members. Nothing was said by them. The aforesaid contracts stand to prove one thing: Obviously, NACOCO board met the difficulties attendant to forward sales by leaving the adoption of means to end, to the sound discretion of NACOCO's general manager Maximo M. Kalaw. Settled jurisprudence has it that where similar acts have been approved by the directors as a matter of general practice, custom, and policy, the general manager may bind the company without formal authorization of the board of directors. In varying language, existence of such authority is established, by proof of the course of business, the usage and practices of the company

and by the knowledge which the board of directors has, or must be presumed to have, of acts and doings of its subordinates in and about the affairs of the corporation. As we have earlier expressed, Kalaw had authority to execute the contracts without need of prior approval. Everybody, including Kalaw himself, thought so, and for a long time. Doubts were first thrown on the way only when the contracts turned out to be unprofitable for NACOCO. The damage suffered was due to the typhoons and not attributable to Kalaws decisions. The typhoons were known to plaintiff. In fact, NACOCO resisted the suits filed by Louis Dreyfus & Co. by pleading in its answers force majeure as an affirmative defense and there vehemently asserted that "as a result of the said typhoons, extensive damage was caused to the coconut trees in the copra producing regions of the Philippines and according to estimates of competent authorities, it will take about one year until the coconut producing regions will be able to produce their normal coconut yield and it will take some time until the price of copra will reach normal levels;" and that "it had never been the intention of the contracting parties in entering into the contract in question that, in the event of a sharp rise in the price of copra in the Philippine market produce by force majeureor by caused beyond defendant's control, the defendant should buy the copra contracted for at exorbitant prices far beyond the buying price of the plaintiff under the contract. As the trial court correctly observed, this is a case of damnum absque injuria. Conjunction of damage and wrong is here absent. There cannot be an actionable wrong if either one or the other is wanting.

On top of all these, is that no assertion is made and no proof is presented which would link Kalaw's acts ratified by the board to a matrix for defraudation of the government. Kalaw is clear of the stigma of bad faith. Kalaw's acts were not the result of haphazard decisions either. Kalaw invariably consulted with NACOCO's Chief Buyer, Sisenando Barretto, or the Assistant General Manager. The dailies and quotations from abroad were guideposts to him. Of course, Kalaw could not have been an insurer of profits. He could not be expected to predict the coming of unpredictable typhoons. And even as typhoons supervened Kalaw was not remissed in his duty. He exerted efforts to stave off losses. He asked the Philippine National Bank to implement its commitment to extend a P400,000.00 loan. The bank did not release the loan, not even the sum of P200,000.00, which, in October, 1947, was approved by the bank's board of directors. In frustration, on December 12, 1947, Kalaw turned to the President, complained about the bank's short-sighted policy. In the end, nothing came out of the negotiations with the bank. NACOCO eventually faltered in its contractual obligations. That Kalaw cannot be tagged with crassa negligentia or as much as simple negligence, would seem to be supported by the fact that even as the contracts were being questioned in Congress and in the NACOCO board itself, President Roxas defended the actuations of Kalaw. On December 27, 1947, President Roxas expressed his desire "that the Board of Directors should reelect Hon. Maximo M. Kalaw as General Manager of the National Coconut Corporation."

Vous aimerez peut-être aussi

- Board of Liquidators Vs Kalaw-DigestDocument2 pagesBoard of Liquidators Vs Kalaw-DigestRfs SingsonPas encore d'évaluation

- 17 Lanuza Vs BF CorpDocument30 pages17 Lanuza Vs BF CorpJanine RegaladoPas encore d'évaluation

- 02 JRS Business V Imperial Insurance - AlbanoDocument2 pages02 JRS Business V Imperial Insurance - AlbanorbPas encore d'évaluation

- Marvex Commercial Co. Inc. vs. Petra Hawpia & Co.Document4 pagesMarvex Commercial Co. Inc. vs. Petra Hawpia & Co.AJ AslaronaPas encore d'évaluation

- 03 Ching Vs QC Sports ClubDocument3 pages03 Ching Vs QC Sports ClubBeata CarolinoPas encore d'évaluation

- J. Bersamin TaxDocument14 pagesJ. Bersamin TaxJessica JungPas encore d'évaluation

- Pagcor vs. BirDocument4 pagesPagcor vs. BirBea Vanessa AbellaPas encore d'évaluation

- COMMISSIONER OF INTERNAL REVENUE Versus PASCOR REALTY AND DEVELOPMENT CORPORATION, ROGELIO A. DIO and VIRGINIA S. DIODocument1 pageCOMMISSIONER OF INTERNAL REVENUE Versus PASCOR REALTY AND DEVELOPMENT CORPORATION, ROGELIO A. DIO and VIRGINIA S. DIOCharles Roger RayaPas encore d'évaluation

- Pantranco v. BaesaDocument3 pagesPantranco v. BaesaD De LeonPas encore d'évaluation

- In The Matter of Guardianship of Carmen Vda. de Bengson v. Philippine National Bank G.R. No. L 17066 December 28 1961Document2 pagesIn The Matter of Guardianship of Carmen Vda. de Bengson v. Philippine National Bank G.R. No. L 17066 December 28 1961JaylordPataotaoPas encore d'évaluation

- Succession 7 CasesDocument8 pagesSuccession 7 CasesNullus cumunisPas encore d'évaluation

- University of The Philippines College of Law: DoctrineDocument3 pagesUniversity of The Philippines College of Law: DoctrineLilu BalgosPas encore d'évaluation

- 190Document2 pages190RhenfacelManlegroPas encore d'évaluation

- 364 Lorenzo V GSISDocument2 pages364 Lorenzo V GSISNN DDLPas encore d'évaluation

- 041 - Lu Do v. Binamira, 101 Phil 120 (1957)Document1 page041 - Lu Do v. Binamira, 101 Phil 120 (1957)Law StudentPas encore d'évaluation

- CD - 39. PLDT Company Inc. vs. Court of Appeals G.R No. 57079 Sept. 29,1989Document2 pagesCD - 39. PLDT Company Inc. vs. Court of Appeals G.R No. 57079 Sept. 29,1989MykaPas encore d'évaluation

- Belizar Vs BrazosDocument2 pagesBelizar Vs BrazosMaribel Nicole LopezPas encore d'évaluation

- AMAY BISAYA and Gabeto Vs AranetaDocument3 pagesAMAY BISAYA and Gabeto Vs AranetaJSPas encore d'évaluation

- NDF Vs CA 164 Scra 593Document6 pagesNDF Vs CA 164 Scra 593CiroPas encore d'évaluation

- Cangco V Manila Railroad DigestDocument2 pagesCangco V Manila Railroad DigestMikhail Ambrose AggabaoPas encore d'évaluation

- B5D Samson v. Court of Appeals, GR 139983Document2 pagesB5D Samson v. Court of Appeals, GR 139983KISSINGER REYESPas encore d'évaluation

- 8) Cantre V Go - Mangaser (d2017)Document1 page8) Cantre V Go - Mangaser (d2017)Grace Robes HicbanPas encore d'évaluation

- Lanuzo Vs PingDocument4 pagesLanuzo Vs Pingangelsu04Pas encore d'évaluation

- Case Digest Berris Agricultural v. Abyadang (G.R. 183404Document3 pagesCase Digest Berris Agricultural v. Abyadang (G.R. 183404Charity RomagaPas encore d'évaluation

- 120 Hoit vs. Detig (Dayos)Document2 pages120 Hoit vs. Detig (Dayos)ASGarcia24Pas encore d'évaluation

- Rosales vs. New ANJH EnterprisesDocument18 pagesRosales vs. New ANJH EnterprisesAira Mae P. LayloPas encore d'évaluation

- Insurance Cases DigestDocument24 pagesInsurance Cases DigestAbigail WrightPas encore d'évaluation

- Motion For Execution - Mrc-JaboneteDocument2 pagesMotion For Execution - Mrc-JaboneteGalgs BorgePas encore d'évaluation

- Rosit V DR Gestuvo DigestDocument3 pagesRosit V DR Gestuvo DigestAnonymous 0AiN3tPas encore d'évaluation

- PSTMSDWO v. PNCCDocument2 pagesPSTMSDWO v. PNCCmaite fernandezPas encore d'évaluation

- State Street Bank Trust Co vs. Signature Financial GroupDocument2 pagesState Street Bank Trust Co vs. Signature Financial GroupIñigo Mathay RojasPas encore d'évaluation

- Martin v. GuerreroDocument3 pagesMartin v. Guerrerolouis jansenPas encore d'évaluation

- 140.national Investment and Development Corp. vs. AquinoDocument18 pages140.national Investment and Development Corp. vs. Aquinovince005Pas encore d'évaluation

- Case.13.Alaska Vs PonceDocument9 pagesCase.13.Alaska Vs PonceHaroldDeLeonPas encore d'évaluation

- Vargas V ChuaDocument1 pageVargas V ChuaAliw del Rosario0% (1)

- Arbitration Law PDFDocument53 pagesArbitration Law PDFPulkit AgarwalPas encore d'évaluation

- La Campana Coffee V Kaisahan Full 1962Document4 pagesLa Campana Coffee V Kaisahan Full 1962Rejane MarasiganPas encore d'évaluation

- 24 de Gala V de GalaDocument2 pages24 de Gala V de GalaCristina OlaritaPas encore d'évaluation

- 011 Villa Rey Transit v. CADocument2 pages011 Villa Rey Transit v. CAKikoy IlaganPas encore d'évaluation

- Transpo LawDocument8 pagesTranspo LawCarlo John C. RuelanPas encore d'évaluation

- AbakadaDocument7 pagesAbakadaJayzell Mae FloresPas encore d'évaluation

- CIR v. Pilipinas Shell 2014 CaseDocument1 pageCIR v. Pilipinas Shell 2014 CaseLeo NekkoPas encore d'évaluation

- Case Digest 1-4Document10 pagesCase Digest 1-4Patricia Ann Sarabia ArevaloPas encore d'évaluation

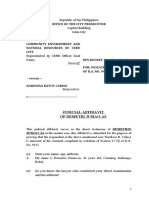

- Plaintiff,: Judicial Affidavit of Demetri Jumao-AsDocument6 pagesPlaintiff,: Judicial Affidavit of Demetri Jumao-AsAthena SalasPas encore d'évaluation

- CIV REV 2 Uribe SyllabusDocument22 pagesCIV REV 2 Uribe SyllabusicyPas encore d'évaluation

- 2.) Prince Transport v. GarciaDocument1 page2.) Prince Transport v. GarciaKris MercadoPas encore d'évaluation

- Endorsement LetterDocument2 pagesEndorsement LetterMPK08Pas encore d'évaluation

- CD SEPC PRO Alaban Vs CaDocument9 pagesCD SEPC PRO Alaban Vs CaSunny TeaPas encore d'évaluation

- Ramirez V Mar Fishing DigestDocument3 pagesRamirez V Mar Fishing DigestpurplebasketPas encore d'évaluation

- Gokongwei vs. SecDocument22 pagesGokongwei vs. SecLenPalatanPas encore d'évaluation

- Labrel ReportDocument14 pagesLabrel ReportJeniePas encore d'évaluation

- Cariaga Vs LTB CoDocument2 pagesCariaga Vs LTB CohappymabeePas encore d'évaluation

- PCIB V CA Digest ProvremDocument3 pagesPCIB V CA Digest ProvremErlinda G SolamilloPas encore d'évaluation

- Merida vs. PeopleDocument2 pagesMerida vs. PeopleGabby ElardoPas encore d'évaluation

- Ferdinand R. Marcos II, Petitioner, vs. Court of Appeals, The Commissioner of The Bureau of Internal Revenue and Herminia D. de Guzman, Respondents.Document5 pagesFerdinand R. Marcos II, Petitioner, vs. Court of Appeals, The Commissioner of The Bureau of Internal Revenue and Herminia D. de Guzman, Respondents.Jennilyn Gulfan YasePas encore d'évaluation

- Case Digest On SantamariaDocument1 pageCase Digest On Santamariaiceiceice023Pas encore d'évaluation

- Rule 102 (Habeas Corpus) CasesDocument4 pagesRule 102 (Habeas Corpus) CasesRachel AndreleePas encore d'évaluation

- 075 Board of Liquidators v. Heirs of Maximo M. Kalaw (1967)Document3 pages075 Board of Liquidators v. Heirs of Maximo M. Kalaw (1967)May RMPas encore d'évaluation

- Board of Liquidators v. Kalaw, 20 SCRA 987Document3 pagesBoard of Liquidators v. Kalaw, 20 SCRA 987Alexander Genesis DungcaPas encore d'évaluation

- Mabutas Vs PerelloDocument6 pagesMabutas Vs PerelloMaiti LagosPas encore d'évaluation

- RMO NO. 4-2016 - DigestDocument2 pagesRMO NO. 4-2016 - DigestMaiti LagosPas encore d'évaluation

- Toshiba Vs CIRDocument5 pagesToshiba Vs CIRMaiti LagosPas encore d'évaluation

- Sanchez Vs CADocument1 pageSanchez Vs CAMaiti LagosPas encore d'évaluation

- Matling Industrial and Commercial CorporationDocument5 pagesMatling Industrial and Commercial CorporationMaiti LagosPas encore d'évaluation

- Bacarro Vs CastanoDocument2 pagesBacarro Vs CastanoMaiti LagosPas encore d'évaluation

- Ortanez V CA - Make DigestDocument4 pagesOrtanez V CA - Make DigestMaiti LagosPas encore d'évaluation

- Negligence. It Further Decided That The Incident Was A Fortuitous EventDocument3 pagesNegligence. It Further Decided That The Incident Was A Fortuitous EventMaiti LagosPas encore d'évaluation

- Berciles Vs GSISDocument3 pagesBerciles Vs GSISMaiti Lagos100% (1)

- Cir Vs AichiDocument3 pagesCir Vs AichiMaiti LagosPas encore d'évaluation

- CivPro DigestDocument4 pagesCivPro DigestMaiti LagosPas encore d'évaluation

- Daywalt v. Corporacion RecoletosDocument5 pagesDaywalt v. Corporacion RecoletosMaiti Lagos100% (1)

- Turnell v. CentiMark Corp. (7th Circuit)Document18 pagesTurnell v. CentiMark Corp. (7th Circuit)Ken VankoPas encore d'évaluation

- Jimenez Vs SoronganDocument2 pagesJimenez Vs SoronganEAPas encore d'évaluation

- AttyDeVera Syllabus 2019Document6 pagesAttyDeVera Syllabus 2019Raffy MarianoPas encore d'évaluation

- City of San Antonio Lawsuit Over Paso Hondo HomeDocument9 pagesCity of San Antonio Lawsuit Over Paso Hondo HomeKENS 5Pas encore d'évaluation

- HONNETH, A. Moral Consciousness and Class DominationDocument12 pagesHONNETH, A. Moral Consciousness and Class DominationStefanie MacedoPas encore d'évaluation

- Prostitution in Indian Society: Issues, Trends and RehabilitationDocument16 pagesProstitution in Indian Society: Issues, Trends and RehabilitationVipin VermaPas encore d'évaluation

- Institutional Correction Easy - QuestionsDocument16 pagesInstitutional Correction Easy - QuestionsKhael Bureros88% (8)

- 1077 157401443 Fab's Verified Response To Dft's Claim of ExemptionDocument11 pages1077 157401443 Fab's Verified Response To Dft's Claim of Exemptionlarry-612445Pas encore d'évaluation

- 118 Cebu Stevedoring Vs Regional DirectorDocument2 pages118 Cebu Stevedoring Vs Regional DirectorKym HernandezPas encore d'évaluation

- Ethics: The Foundation For Relationships in Selling: Making Ethical DecisionsDocument5 pagesEthics: The Foundation For Relationships in Selling: Making Ethical DecisionsPB VeroPas encore d'évaluation

- Heng Tong Textiles Co., Inc. v. CIR (1968) Case DigestDocument2 pagesHeng Tong Textiles Co., Inc. v. CIR (1968) Case DigestShandrei GuevarraPas encore d'évaluation

- Najera V NajeraDocument3 pagesNajera V NajeraMaya TolentinoPas encore d'évaluation

- Chapter 1 - Nature and Scope of NGASDocument26 pagesChapter 1 - Nature and Scope of NGASJapsPas encore d'évaluation

- SPS Pascual V First Conslidated Rural BankDocument45 pagesSPS Pascual V First Conslidated Rural BankGlenn BaysaPas encore d'évaluation

- R.A. #6397-P.D. 181Document5 pagesR.A. #6397-P.D. 181Ronald C. Romero100% (1)

- Foundations of Evidence Law. Alex Stein. © Oxford University Press 2005. Published 2005 by Oxford University PressDocument34 pagesFoundations of Evidence Law. Alex Stein. © Oxford University Press 2005. Published 2005 by Oxford University PressMiguel Angel MuñozPas encore d'évaluation

- Tani G. Cantil-Sakauye Conflict of Interest Misconduct: Improper Summary Dismissal of Supreme Court Petition for Review by Disabled, Indigent Pro Per Litigant - Commission on Judicial Performance Director Victoria B. Henley CJP Chief Counsel San Francisco - California Supreme Court Justice Marvin Baxter, Justice Joyce Kennard, Justice Leondra R. Kruger, Justice Mariano-Florentino Cuellar, Justice Goodwin H. Liu, Justice Carol A. Corrigan, Justice Ming W. Chin, Justice Kathryn M. Werdegar, Justice Tani G. Cantil-Sakauye Supreme Court of CaliforniaDocument73 pagesTani G. Cantil-Sakauye Conflict of Interest Misconduct: Improper Summary Dismissal of Supreme Court Petition for Review by Disabled, Indigent Pro Per Litigant - Commission on Judicial Performance Director Victoria B. Henley CJP Chief Counsel San Francisco - California Supreme Court Justice Marvin Baxter, Justice Joyce Kennard, Justice Leondra R. Kruger, Justice Mariano-Florentino Cuellar, Justice Goodwin H. Liu, Justice Carol A. Corrigan, Justice Ming W. Chin, Justice Kathryn M. Werdegar, Justice Tani G. Cantil-Sakauye Supreme Court of CaliforniaCalifornia Judicial Branch News Service - Investigative Reporting Source Material & Story IdeasPas encore d'évaluation

- Cep2020 Chapter03d SocialwelfareDocument15 pagesCep2020 Chapter03d SocialwelfareV KiersPas encore d'évaluation

- Ra 11362Document2 pagesRa 11362Madeh EhlatPas encore d'évaluation

- Paschim Gujarat Vij Co. LTD: InvitesDocument5 pagesPaschim Gujarat Vij Co. LTD: Invitesgaurav.shukla360Pas encore d'évaluation

- Case Note On The Chorzow FactoryDocument5 pagesCase Note On The Chorzow FactoryKaryl Ann Aquino-CaluyaPas encore d'évaluation

- Dulay Vs PeopleDocument10 pagesDulay Vs PeopleEgo sum pulcherPas encore d'évaluation

- Berciler vs. GSIS - Conjugal Partnership of Gains (What Is Excluded)Document2 pagesBerciler vs. GSIS - Conjugal Partnership of Gains (What Is Excluded)Ace Diamond100% (2)

- Filed: Patrick FisherDocument6 pagesFiled: Patrick FisherScribd Government DocsPas encore d'évaluation

- Demand Notice Construction Contract Zechariah Wakili MsomiDocument2 pagesDemand Notice Construction Contract Zechariah Wakili MsomiRANDAN SADIQPas encore d'évaluation

- Lecture Notes On Law On Contracts Revised 09Document17 pagesLecture Notes On Law On Contracts Revised 09JanetGraceDalisayFabrero100% (3)

- Steven I. Kotzen and National Patient Aids, Inc. v. Sam J. Levine and Marian P. Levine, 678 F.2d 140, 11th Cir. (1982)Document3 pagesSteven I. Kotzen and National Patient Aids, Inc. v. Sam J. Levine and Marian P. Levine, 678 F.2d 140, 11th Cir. (1982)Scribd Government DocsPas encore d'évaluation

- Village of Briarcliff ManorDocument1 pageVillage of Briarcliff ManorMrSanDiegoPas encore d'évaluation

- C.P. - 816 - 2009 SC Pak Decision Rate of IntererestDocument14 pagesC.P. - 816 - 2009 SC Pak Decision Rate of IntererestOsmanRafaeePas encore d'évaluation

- 2020-10-22 Gov. McMaster's Petition For Rehearing (With Ex. A) - Adams v. McMasterDocument33 pages2020-10-22 Gov. McMaster's Petition For Rehearing (With Ex. A) - Adams v. McMasterWIS Digital News StaffPas encore d'évaluation