Académique Documents

Professionnel Documents

Culture Documents

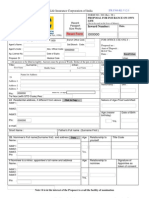

New Simplified Proposal Form 2013

Transféré par

Rakeshor NingthoujamCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

New Simplified Proposal Form 2013

Transféré par

Rakeshor NingthoujamDroits d'auteur :

Formats disponibles

Shriram Life Insurance Company Limited

(A joint venture with Sanlam Life Insurance Limited, South Africa)

PROPOSAL FORM

Affix Latest

Regd. & Admn Office: 3-6-478, lll Floor, Anand Estate, Liberty Road, Himayat Nagar Hyderabad-500029 Ph: 23434466 72

(For Office use only) Proposal No : Customer ID : Dep. Receipt No : Rural Urban Agent/Sales Officer Name: Code: & Policy No : Inward Date : & Date : UIN: Photograph of Proposer if annual premium is more than Rs.10.000/-

GUIDELINES FOR FILLING UP THE PROPOSAL FORM: I. Insurance is a contract of utmost good faith which requires the proposal and the life to be assured to disclose all material facts in response to the questions in the proposal form. Before filling up the form, please read the product brochure so that you fully understand the benefits of the product, as well as the terms and conditions. II. Please fill in BLOCK LETTERS.

1.Details of Life to be assured : Name : Gender Male Female Nationality Indian NRI Educational Qualification :

Fathers Name : Age Proof Submitted (Specify): b. Occupation: Name of present employer : C. Annual Income (in Rs) : PAN Card No : 2. Name of the proposer if other than Life to be Assured 3. Address of the Proposer & Source : Aadhaar No : Relationship with Life to be assured: a. Date of Birth: Nature of Duties : Age :

(as on last birthday)

Funds Opted Name of the Fund Percentage (%)

D No:/St Area Landmark City / District State Contact No Email ID PIN Code :

4. Plan Details - Plan Name : Policy term Premium paying term Mode of premium payment Single / Quarterly / Half-Yearly / Yearly / Monthly ULIP Auto Transfer Option Yes No If Yes 6 Months 12 Months Sum proposed Installment premium Cash/DD/Cheque no: Particulars of Amount Deposited Date: Bank Name:

Name of Rider

Sum Proposed

Rider Term

5. Are you existing customer in Shriram? if yes, give details Loan / Ticket / Certificate No. 6. Nominee Details - Name of the Nominee : Age : Relationship with the Life to be Assured :

Appointee details (If the Nominee is a minor):- Name of the Appointee : Address for communication : Acceptance Signature of the Appointee: 7. Has your application for revival of your lapsed life insurance policy been rejected? If yes, give reasons 8. Please give details of your existing life insurance policies with any life insurance company? Name of Company Sum Insured Year in which policy was taken

8. Family History: Please give details of the family members of the Life to be assured. Family Member Father Mother Brothers Sisters If alive, age If dead, age at death

9. Personal Medical History of the life to be assured *. Answer the following in YES / NO- Tick

A. Height (in cms): C. Are you at present in good health? D. If answer to any of the below question is yes, please Give details of illness & enclose relevant reports 1.Are you physically handicapped or having any other deformity? 2.When were you in a hospital last? For how many days? For what illness? 3.Have you ever suffered from any of the following diseases? (i) Heart dysfunction (ii) Kidney dysfunction (iii) High blood pressure (iv) Diabetes (v) Cancer (vi) Liver dysfunction (vii) Blood abnormality (viii) Any other health ailment

Declaration by the Proposer / Life to be Assured: I hereby declare and agree that the statements and this declaration made under this proposal will be the basis of the contract of assurance between me and Shriram Life Insurance co. Ltd, and that if any Statement is untrue or inaccurate, or if any matter that might influence the terms of this Proposal is not disclosed, the contract shall be absolutely null and void and all premiums so for paid in respect of this contract shall stand forfeited to the company.I further agree that I will inform the company, if, between the date of this proposal and the date of acceptance of the proposal (issue of the first premium receipt),*There is any change in my general health, occupation, or financial position or,*Any other proposal or application to any other Insurance Company on my life is declined or accepted other than on standard terms so that the Company may reconsider the terms of acceptance. I also understand that if I fail to do so, the company may treat the contract as void and all premiums paid will be forfeited to the company.*I authorize and direct any doctor, hospital or employer to disclose to Shriram Life Insurance Co. Ltd. any information relating to health or employment now or at any time in the future, as and when required.*The contents of this proposal form have been fully explained to me & I have full understood the significance of the proposed contract. If an age proof extra, health extra or occupation extra has to be imposed, I hereby give my consent for imposing the same by reducing the sum proposed by me / by deducting from the allocated units.

the relevant Box

& (Please note that Strokes / Dots / Dashes are NOT accepted)

B. Weight (in kgs):

Yes No

Details

Name Address Date Place

: : : :

Signature of Witness

Signature/thumb impression of the Proposer

Signature/thumb impression of the Life to be assured Note: (Signature of a Minor life assured is not required) Date: Place:

Declaration for signing in vernacular or for illiterate cases:(The company requires that this proposal is completed by the proposer himself. However, if this not possible as the proposer does not read, write or speak English, then this proposal form can be completed by another person who can read, speak and write English and who is not connected to the company either as an agent/employee or Insurance Intermediary)I have explained the contents of this proposal to the proposer and done my best to ensure that the contents have been fully understood by the proposer. I have accurately recorded the proposers responses to the information sought by the proposal form and I have read the responses back to the proposer and he/she has confirmed that they are correct.

Place Date

: : Name : Signature of the declarant in English

Section 41 of the insurance Act, 1938 : No person shall allow or offer to allow, either directly or indirectly, as an inducement to any person to take out, renew, or continue an insurance contract in respect of any kind of risk relating to lives or property in India, any rebate of the whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person taking out or renewing or continuing a policy accept any rebate, except such rebates as may be allowed in accordance with the published prospectus or tables of the insurer. Any person making default in complying with the provisions of this section shall be punishable with fine, which may extend to five hundred rupees. Section 45 of the insurance Act, 1938: No policy of life insurance effected before the commencement of this Act shall, after the expiry of two years from the date of commencement of this Act, and no policy of life insurance effected after the coming into force of this Act shall, after the expiry of two years from the date on which it was effected, be called in question by an insurer on the ground that a statement made in the proposal for insurance or in any report of a medical officer, or referee, or friend of the insured, or in any other document leading to the issue of policy, was in accurate or false, unless the insurer shows that such statement was on a material matter or suppressed fact which it was material to disclose and that it was fraudulently made by the policyholder and that the policyholder knew at the time of making it that the statement was false or that it suppressed facts which it was material to disclose.

AGENTS RECOMMENDATION

I have verified the information given in the proposal by discreet enquiries and find the information true to the best of my knowledge and belief. I am of the opinion that the Life proposed for insurance is insurable. I recommend the proposal for acceptance.

Signature of the Agent in English

Signature of an Authorised Official (equivalent to B.M)

Date: Place:

Note : If the policy is being taken by the agent on his/her own life, then the immediate superior/reporting officer equivalent to the designation of a Manager, should duly sign the proposal form recommending the Insurer to consider the proposal for a life insurance.

Vous aimerez peut-être aussi

- Life, Accident and Health Insurance in the United StatesD'EverandLife, Accident and Health Insurance in the United StatesÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanD'EverandHow to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanPas encore d'évaluation

- Abhay KumarDocument5 pagesAbhay KumarSunil SahPas encore d'évaluation

- Axa Credit Life Insurance Confirmation FormDocument1 pageAxa Credit Life Insurance Confirmation FormJoevelyn CubianPas encore d'évaluation

- Sample: Ab Health HameshaDocument4 pagesSample: Ab Health HameshaVikas MehtaPas encore d'évaluation

- Instructions For Filling The FormDocument2 pagesInstructions For Filling The Formyash kavitaPas encore d'évaluation

- Travel Guard Overseas TravelDocument2 pagesTravel Guard Overseas Travelchitrodasagar07Pas encore d'évaluation

- Ti Claim FormDocument8 pagesTi Claim FormHihiPas encore d'évaluation

- Form 300Document8 pagesForm 300Sachin SharmaPas encore d'évaluation

- PM OthersDocument35 pagesPM OthersHihiPas encore d'évaluation

- Ab Arogyadaan Proposal FormDocument2 pagesAb Arogyadaan Proposal FormMurthy0% (1)

- DoctorPI Proposal Form UIICDocument2 pagesDoctorPI Proposal Form UIICfardoctorPas encore d'évaluation

- Future Vector Care-Proposal Form (Single Member)Document2 pagesFuture Vector Care-Proposal Form (Single Member)Arup GhoshPas encore d'évaluation

- Star Health and Allied Insurance Company Limited: Proposal FormDocument2 pagesStar Health and Allied Insurance Company Limited: Proposal FormBhaktha SinghPas encore d'évaluation

- Ipr F300 Re V12.0Document6 pagesIpr F300 Re V12.0gtmlpatelPas encore d'évaluation

- Horse Insurance Proposal FormDocument3 pagesHorse Insurance Proposal FormpullareddybPas encore d'évaluation

- Cigna TTK Lifestyle Protection Group Policy - Health InsuranceDocument4 pagesCigna TTK Lifestyle Protection Group Policy - Health InsuranceChrissy CattonPas encore d'évaluation

- Customer Mandate Cum Declaration Form For New Business: Shriram Life Insurance Company LimitedDocument1 pageCustomer Mandate Cum Declaration Form For New Business: Shriram Life Insurance Company LimitedShashank DixitPas encore d'évaluation

- Saral Suraksha Bima, Plan - Preposal Form - v1Document3 pagesSaral Suraksha Bima, Plan - Preposal Form - v1rajeshPas encore d'évaluation

- Iob Health Care Plus Policy Proposal FormDocument2 pagesIob Health Care Plus Policy Proposal FormPritamjit RoutPas encore d'évaluation

- CC Stroke NewDocument12 pagesCC Stroke NewHihiPas encore d'évaluation

- CDF New PDFDocument2 pagesCDF New PDFSachin KapoorPas encore d'évaluation

- LIC S Jeevan Akshay VII - Pol Doc With LOGODocument22 pagesLIC S Jeevan Akshay VII - Pol Doc With LOGOSrivatsan DevarajanPas encore d'évaluation

- Master Proposal Form - Grameen Super Suraksha - 28022020 PDFDocument3 pagesMaster Proposal Form - Grameen Super Suraksha - 28022020 PDFmahboob aliPas encore d'évaluation

- Crisis Care Accelerator ClaimDocument9 pagesCrisis Care Accelerator ClaimHihiPas encore d'évaluation

- Portability Form - RevisedDocument2 pagesPortability Form - Revisedshirishkanhegaonkar2Pas encore d'évaluation

- Member Enrollment Form - SMQDocument2 pagesMember Enrollment Form - SMQHussain bashaPas encore d'évaluation

- Good Health Declaration PDFDocument2 pagesGood Health Declaration PDFkckrishnenPas encore d'évaluation

- Application and Consent To Become A Member Under Group Life Insurance Policy For Personal Loan CustomersDocument2 pagesApplication and Consent To Become A Member Under Group Life Insurance Policy For Personal Loan Customersprem kumarPas encore d'évaluation

- LIC Form 300Document7 pagesLIC Form 300PJEYAKANNANPas encore d'évaluation

- Claimant Statement Form Death Claim 2Document3 pagesClaimant Statement Form Death Claim 2Anitha AnuPas encore d'évaluation

- Good Health DeclarationDocument2 pagesGood Health DeclarationPraharshit GorripatyPas encore d'évaluation

- Life Insurance Corporation of India IPR-F300-V1.0Document6 pagesLife Insurance Corporation of India IPR-F300-V1.0Austin GibbsPas encore d'évaluation

- Bajaj Allianz General Insurance Company LimitedDocument4 pagesBajaj Allianz General Insurance Company Limitedbrg robertPas encore d'évaluation

- Enrolment Form - Group Credit Secure Plus: 1. Proposer'S InformationDocument2 pagesEnrolment Form - Group Credit Secure Plus: 1. Proposer'S Informationirfan shamaPas encore d'évaluation

- CP+GTI JL Regulated DOGH Member Enrollment FormDocument2 pagesCP+GTI JL Regulated DOGH Member Enrollment Formsubodhsingh88266Pas encore d'évaluation

- Following Questions To Be Answered by The ProposerDocument4 pagesFollowing Questions To Be Answered by The Proposeranurag655Pas encore d'évaluation

- Proposal - SmartCare PrimeDocument6 pagesProposal - SmartCare PrimeBasman LiauPas encore d'évaluation

- Presented By: Kapil Dev Sharma Kunal Dhawan Naved Sami Pooja Babber Vishal SharmaDocument23 pagesPresented By: Kapil Dev Sharma Kunal Dhawan Naved Sami Pooja Babber Vishal SharmaYe PhonePas encore d'évaluation

- Policy Document LIC S Jeevan ShantiDocument15 pagesPolicy Document LIC S Jeevan ShantitapanPas encore d'évaluation

- Proposal Form: Single Life Traditional Plans Full UnderwritingDocument14 pagesProposal Form: Single Life Traditional Plans Full Underwritingankitag612Pas encore d'évaluation

- Student Application FormDocument6 pagesStudent Application FormelletjiesPas encore d'évaluation

- MediRaksha Proposal FormDocument4 pagesMediRaksha Proposal FormNarayana MugalurPas encore d'évaluation

- Termsandcondition HealthDocument2 pagesTermsandcondition Healthghff gytttPas encore d'évaluation

- Max Life Group Credit Life Secure Policy Document v1Document19 pagesMax Life Group Credit Life Secure Policy Document v1Amit VermaPas encore d'évaluation

- GEMI Application Form - Two Wheeler LoansDocument5 pagesGEMI Application Form - Two Wheeler LoansLuckyPas encore d'évaluation

- MRI - Application For Group Loan Redemption Insurance Plan - Suntrust FinalDocument1 pageMRI - Application For Group Loan Redemption Insurance Plan - Suntrust FinalJoni Rose MagkalasPas encore d'évaluation

- Proposal Form For New India Premier MediclaimDocument6 pagesProposal Form For New India Premier MediclaimAnonymous 95dlTK1McPas encore d'évaluation

- Employee Joining Form: Personal InformationDocument20 pagesEmployee Joining Form: Personal InformationAditya LPas encore d'évaluation

- LVGI Policy ProposalDocument2 pagesLVGI Policy Proposals KollaPas encore d'évaluation

- Muthoot Finance Business Loan XH Enrolment Form v1Document2 pagesMuthoot Finance Business Loan XH Enrolment Form v1Subramanyam JonnaPas encore d'évaluation

- IOB Suraksha Proposal FormDocument1 pageIOB Suraksha Proposal FormgurujmPas encore d'évaluation

- FB Pregnancy-ComplicationDocument19 pagesFB Pregnancy-ComplicationHihiPas encore d'évaluation

- My Peace Plan FormDocument2 pagesMy Peace Plan FormStephen PhiriPas encore d'évaluation

- 5star Family Protection Plan: Term Life Insurance To Age 100 ApplicationDocument2 pages5star Family Protection Plan: Term Life Insurance To Age 100 Applicationimi_swimPas encore d'évaluation

- Presented By: Shalvi MahajanDocument23 pagesPresented By: Shalvi MahajanEnna GuptaPas encore d'évaluation

- Branch / Divisional OfficeDocument7 pagesBranch / Divisional Officervlnth_prabhuPas encore d'évaluation

- GP Mediclaim-Claim NewwerDocument3 pagesGP Mediclaim-Claim Newwervatsalshah24Pas encore d'évaluation

- Claim Form: (For Reimbursement of Expenses)Document4 pagesClaim Form: (For Reimbursement of Expenses)Shankar NathPas encore d'évaluation

- St. John'S National Academy of Health Sciences, Bangalore-560 034Document1 pageSt. John'S National Academy of Health Sciences, Bangalore-560 034Rakeshor NingthoujamPas encore d'évaluation

- Assignment-International Marketing-2012 Batch Dear Students, Submit The Following Assignment, On Line As Per Instructions Given at The EndDocument1 pageAssignment-International Marketing-2012 Batch Dear Students, Submit The Following Assignment, On Line As Per Instructions Given at The EndRakeshor NingthoujamPas encore d'évaluation

- Ijaiem 2013 12 20 050Document11 pagesIjaiem 2013 12 20 050Rakeshor NingthoujamPas encore d'évaluation

- FY 2006 at A Glance: Total Financing Working CapitalDocument2 pagesFY 2006 at A Glance: Total Financing Working CapitalRakeshor NingthoujamPas encore d'évaluation

- Era Business School: Preference FormDocument1 pageEra Business School: Preference FormRakeshor NingthoujamPas encore d'évaluation

- Irabot and Capitalism by IRCC and CPDM - 2013Document11 pagesIrabot and Capitalism by IRCC and CPDM - 2013Rakeshor NingthoujamPas encore d'évaluation

- Conference Paper 4 2013Document27 pagesConference Paper 4 2013Rakeshor NingthoujamPas encore d'évaluation

- Quarterly Retail E-Commerce Sales 1 QUARTER 2013Document3 pagesQuarterly Retail E-Commerce Sales 1 QUARTER 2013Rakeshor NingthoujamPas encore d'évaluation

- New Simplified Proposal Form - 1Document2 pagesNew Simplified Proposal Form - 1Rakeshor NingthoujamPas encore d'évaluation

- Mit College of Management, (Mitcom) : PuneDocument2 pagesMit College of Management, (Mitcom) : PuneRakeshor NingthoujamPas encore d'évaluation

- 1612 Mathematical 2013Document2 pages1612 Mathematical 2013Rakeshor NingthoujamPas encore d'évaluation

- Cds1 Ota11 Eng - 2013Document9 pagesCds1 Ota11 Eng - 2013Rakeshor NingthoujamPas encore d'évaluation