Académique Documents

Professionnel Documents

Culture Documents

(How To - 205 Conduct Effective R... ) PDF

Transféré par

Anthony MichailTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

(How To - 205 Conduct Effective R... ) PDF

Transféré par

Anthony MichailDroits d'auteur :

Formats disponibles

How to conduct effective research - The Marketer magazine

http://www.themarketer.co.uk/articles/how-to/how-to-conduct-effective...

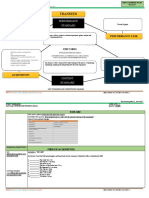

How to...

conduct effective research

Market research is only valuable if you ask the right people the right questions. So how do you get the most from surveys, focus groups and mystery shoppers? Marketers are on an eternal quest to understand what motivates their customers. And that desire to get inside customers heads is what drives market research. So although it might seem blindingly obvious, the very first thing to ask about market research is whether this is what you need. Rather than rushing to put numbers and ticks in boxes, marketers need to stop and think about exactly what it is they want to find out, and assess whether market research can do that. Anthony Tagal, head of insight at POV Marketing and Research says: Theres a knee-jerk response. Clients feel they should do research when theres nothing better to do. Business and marketing are about creating new ideas and insights for the product, brand idea or creative route. So its about finding meaning. Research is one way of finding meaning but we can get lazy with what we ask and assume that research will give us everything we need. Lets start at the very beginning How you start a research project is crucial if you want to avoid wasting time and money. Robin Birn, client services director at Research International, suggests beginning by writing down what you do know and what you dont. This will form the basis of a brief. Juliet Strachan, senior partner at HPI Research, adds: All things stem from the brief. The most important things to include are what the business problem is, how the research is to be used and how the outcome will answer that business issue. Its easy to fall into the trap of using research to validate something youve already decided to do, cautions Andy Moore, director of customer insight, Vodafone Global Marketing. Dont decide to do it and then think, Ill check it out with the customer. A much better route to gaining genuine insight is first arming yourself with an understanding of the core consumer drivers and then making sure thats shaping your thinking. Great marketers will listen to what the consumer is actually saying. When to outsource Once a good brief has been drawn up, other decisions flow from that. One of the first will be whether the research can be done in-house or whether it should be outsourced. The majority of marketers simply do not have the manpower or resources to run research projects themselves. Even companies with large departments dedicated to insight and research will usually outsource the legwork and use internal intelligence for analysis. Besides the cost, there are risks to doing research in-house. Among these is the possibility that responses will be influenced by respondents awareness of who is asking the questions an organisation conducting its own research must make that fact clear. Equally, if your research base is flawed, those flaws could be perpetuated throughout the results. Carrying out research in-house, you run the risk that the hypothesis in the organisation drives the design and outcome of the research, so you dont get a fresh perspective, says Strachan. Another problem with in-house projects is that they slip down managers priority lists and are in danger of being dropped as more pressing matters arise. But Related Articles

How to... Track Customer Behaviour New Year, New Insight How to... Measure your Success Time to get back to Basics

Related Links

British Market Research Bureau GfK NOP Social Research

"Nationwide developed its TV adverts after research showed that people felt financial service companies treated them unfairly"

15/7/2009 1:17

1 of 4

How to conduct effective research - The Marketer magazine

http://www.themarketer.co.uk/articles/how-to/how-to-conduct-effective...

before you rush headlong into a research project and get into detailed methodology, ask yourself whether you can solve your problems using existing information does new information really need to be collected? Sometimes the question or problem requires some digging closer to home. If, for example, you dont know who your core customers are then theres no point in looking for new ones. So doing your homework in-house may be the first stage to address. Of course, existing information, be that articles, directories or reports, wont give you everything you need and, if what youre after is specific to a product or company, you will probably need primary information. Quant or qual? As with most things in business, you get what you pay for. So the methodology will vary according to the scope of the research as well as what youre trying to find out. The two main options to consider are of course qualitative and quantitative research, depending on whether youre looking for more detail and depth on a topic, or hard figures on recall or use, for example. With quantitative research people need to be questioned for their response; methods range from telephone to internet, face-to-face to printed questionnaires. Jean Sutton, a course director for The Institute and founder and managing director of market research agency Actionline Research and Training Sales, says the most efficient and cost-effective route is likely to be via telephone. This has the advantages of face to face be it for qualitative or quantitative work in that you get more depth and detail. But the internet is becoming an increasingly popular route, especially as broadband and PC penetration increase. When the internet first came along it was a very cheap way to conduct research. But internet research is no longer the compromise it was. Now its an extraordinarily powerful research tool because youre talking one-to-one, says Strachan. Whether your questionnaire reaches its audience on- or offline, there are a number of points to consider. Should your questions be structured or closed yes or no or should you go for a semi-structured questionnaire with open questions as well? The latter provides more qualitative responses while the former lends itself to quantitative findings. It comes back to what information you need and what you want to do with it. You wouldnt use a closed questionnaire for an audience of CEOs. Semi-structured allows for a two-way conversation, says Sutton. Crucial to remember is that average response rates to self-completed questionnaires range between 3 per cent and 5 per cent. So to get 50 responses, you need to send out 1,000 questionnaires. And you have little control over who chooses to complete often only those who are very happy, or very unhappy, with a product or service, or those who have time on their hands, will fill them in. The only way of limiting this effect is to ensure high response rates to reduce the bias. Offering an incentive is a common solution. But keeping the questions short and simple and making the sponsors identity clear will also improve the response rate. Time to focus The classic market research tool for gaining depth of understanding is the focus group. Many are quick to sneer at the image of a cosy room of housewives, chatting over tea and biscuits about their favourite fragrance for toilet cleaners, all keenly observed by researchers behind a two-way mirror. But this method of

Dos and donts

Do be clear on what decision is to be made as a result of your research. Do think about what budget is available research requires time and money and you

2 of 4

15/7/2009 1:17

How to conduct effective research - The Marketer magazine

http://www.themarketer.co.uk/articles/how-to/how-to-conduct-effective...

cant buy in a project for much less than 10,000. Do understand how Amrita Sood, associate director at GfK NOP Social Research, runs many focus much emotional and groups for clients. She says clients are often surprised at how specific the unconscious factors agency can be in recruiting the right sort of people to a group. Weve done affect the market and to projects with people whove committed benefit fraud or crimes or with a specific what extent research will range of ethnic groups. The target sample is a really important aspect of uncover those. research. Do respect the time and contribution of the Focus groups are unusual environments for most people so its important to respondents dont compensate participants for their time, says Sood, and to be as transparent as overstretch their possible about the research. While focus groups are useful for highlighting patience. attitudes and behaviours, they should not be used for quantifying behaviour. Dont decide on the If you end up with 100 people in your focus groups and 80 say they love the research methodology new product, it doesnt mean you can say 80 per cent love the product, cautions before being clear about Sutton. Focus groups are hand-picked and so you cant extrapolate from that. what information youre hoping to gather. In the pursuit of ever more effective ways to understand the customer, market Dont just do the same research is spreading its wings and techniques span ethnography, semiotics, thing as has always been longitudinal studies and even mystery shopping. done and avoid doing the same research as Ethnographic techniques are good for immersing and gaining insight, says the competition. Sood. We may go to their home and spend time with them, observe their daily routines, look around their house, see how they use technology and media. research is still used to great effect and can provide a forum for a target group to interact and open up in a relaxed environment. With more time and depth these research tools can be useful for context and bringing to light things that the consumer doesnt realise are important. Birn says FMCG clients in particular are adopting these techniques where they might go into shoppers homes to see how they stack tins in their cupboards or what selection of cereals they choose. Continual and ad hoc For many big companies, research will involve a wide range of continuous measures from brand tracking to customer satisfaction surveys, as well as ad hoc research. At Vodafone, for instance, Moore says about 40 per cent of research is continual tracking, while the rest is ad hoc. Royal Mail Group uses ongoing programmes to act as a health check and to identify business challenges. It then instigates ad hoc research to delve into those challenges as necessary, says Crispin Beale, director of insight, intelligence and analysis at the organisation. The company also uses mystery shopping. One shopper survey, called Effect, is about improvement in Post Office branches. Its carried out in partnership with employees, consulting them about what they think is important for the customer. Theres a danger that research can go wrong when companies get obsessed with measuring the wrong thing or measuring too frequently. Ive seen customer satisfaction measured on a weekly basis, which is too often as things move with a margin of error. Ive been in companies where the measures were changing faster than the programme could keep up with it, says Beale. The most valuable research results are those where a performance improvement in a product can be proven to add directly to the bottom line, he adds. Research can and should produce real insight that can have a fundamental effect on the business. At Nationwide, TV advertising was developed following research revealing that people dont think financial companies treat them as fairly as they should. Paul Hibbs, advertising controller at Nationwide, says the theme for its advertising came from posing the question what can we do to treat our customers fairly? On mortgages we dont do new customer only deals and we also dont charge

3 of 4

15/7/2009 1:17

How to conduct effective research - The Marketer magazine

http://www.themarketer.co.uk/articles/how-to/how-to-conduct-effective...

to use cards abroad. Most of that was driven by research into what frustrates customers, says Hibbs. Market research can be a detailed and complicated science but Beale boils it down to some pertinent advice for marketers: Research should be seen as the radar of your organisation it give you the early warning sign and then you respond to it. Research only makes a difference if you actually use it, he says. Its is all about making money or saving money for the organisation, it shouldnt happen otherwise. It should drive the business forward how do we get ROI on this and increase income?"

Case study: Artful research

Appealing to a wider audience is crucial for the arts industry, so the British Market Research Bureau helped the Arts Council find out whats putting off potential punters Taking Part is a large-scale population survey that has been running continuously since 2005, commissioned by the Department for Culture, Media and Sport in partnership with the Arts Council England. The survey looks at who attends and participates in the arts. Conducting the fieldwork is the British Market Research Bureau (BMRB) Social Research, which interviews around 29,000 English adults per year, face-to-face in their homes. But the Arts Council wanted a more detailed segmentation of the population to better understand arts consumers, with specific profiles on each segment. The objective was to improve engagement with consumers and understand the barriers to participation. One of the key constraints for BMRB was the limited budget but ambitious scope of the segmentation project, as well as the Arts Councils desire for a very robust statistical approach. As a result, BMRB decided to delve into the existing Taking Part data rather than conduct new ad hoc research. Anni Oskala, research officer at the Arts Council England, says: First we segmented people into different types of arts consumers through cluster analysis of the Taking Part data. Then that data was fused with BMRB Target Group Index data, which allowed the creation of rich profiles of each segment, not only in terms of their arts engagement but also their broader lifestyles and attitudes. The segmentation and fusing stages took about six months and also involved the work of Henley Centre HeadlightVision to help deliver clear recommendations. It allowed the council to understand what made people tick and their hidden motivation or barriers to attending arts-related activities. The research has provided a strong tool for strategic planning by giving us a much better picture of how and why people engage with the arts today. TGIs information on media use and attitudes could be used to feed directly into communications and potential campaigns, says Oskala.

Jane Bainbridge is a freelance journalist who writes on marketing and PR for titles including Media Week

4 of 4

15/7/2009 1:17

Vous aimerez peut-être aussi

- Intro To BacchaeDocument15 pagesIntro To BacchaeAnthony MichailPas encore d'évaluation

- BandB T&CsDocument17 pagesBandB T&CsAnthony MichailPas encore d'évaluation

- Advantage April 2013Document60 pagesAdvantage April 2013Anthony MichailPas encore d'évaluation

- SMIP Specimen June 07Document31 pagesSMIP Specimen June 07Anthony MichailPas encore d'évaluation

- Celebrity Athletes and Sports Imagery inDocument56 pagesCelebrity Athletes and Sports Imagery inAnthony MichailPas encore d'évaluation

- SMIP Specimen June 08Document51 pagesSMIP Specimen June 08Anthony MichailPas encore d'évaluation

- Dup Strategy Not Technology Drives Digital TransformationDocument30 pagesDup Strategy Not Technology Drives Digital TransformationAnthony MichailPas encore d'évaluation

- Sappi Code of Ethics Brochure English UK ExternalDocument24 pagesSappi Code of Ethics Brochure English UK ExternalAnthony MichailPas encore d'évaluation

- Celebrity Athletes & Sports Imagery in NFL Game AdsDocument39 pagesCelebrity Athletes & Sports Imagery in NFL Game AdsAnthony MichailPas encore d'évaluation

- Advantage February 2013Document60 pagesAdvantage February 2013Anthony MichailPas encore d'évaluation

- SMIP Specimen June 06Document41 pagesSMIP Specimen June 06Anthony MichailPas encore d'évaluation

- 2012.10 Medical Equipment in AngolaDocument7 pages2012.10 Medical Equipment in AngolaAnthony MichailPas encore d'évaluation

- The 20 Minute Course in Project Management PDFDocument4 pagesThe 20 Minute Course in Project Management PDFAnthony MichailPas encore d'évaluation

- The 20 Minute Course in Teamworking...Document4 pagesThe 20 Minute Course in Teamworking...Anthony MichailPas encore d'évaluation

- The 20 Minute Course in Coaching...Document4 pagesThe 20 Minute Course in Coaching...Anthony MichailPas encore d'évaluation

- 20 Minute Data Protection CourseDocument4 pages20 Minute Data Protection CourseAnthony MichailPas encore d'évaluation

- The 20 Minute Course in Leadership...Document4 pagesThe 20 Minute Course in Leadership...Anthony MichailPas encore d'évaluation

- The 20 Minute Course in Leadership...Document4 pagesThe 20 Minute Course in Leadership...Anthony MichailPas encore d'évaluation

- How To... Tackle Foreign MaDocument4 pagesHow To... Tackle Foreign MaAnthony MichailPas encore d'évaluation

- How To... Get More From AgeDocument4 pagesHow To... Get More From AgeAnthony MichailPas encore d'évaluation

- How To - 205 Score A Hit at Trad...Document4 pagesHow To - 205 Score A Hit at Trad...Anthony MichailPas encore d'évaluation

- How To... Exploit Digital MDocument4 pagesHow To... Exploit Digital MAnthony MichailPas encore d'évaluation

- How To - 205 Market To The Over-...Document4 pagesHow To - 205 Market To The Over-...Anthony MichailPas encore d'évaluation

- How To... Communicate WithDocument5 pagesHow To... Communicate WithAnthony MichailPas encore d'évaluation

- How To - 205 Push The Brain - 222s Bu...Document4 pagesHow To - 205 Push The Brain - 222s Bu...Anthony MichailPas encore d'évaluation

- How To - 205 Pamper Your Custome...Document4 pagesHow To - 205 Pamper Your Custome...Anthony MichailPas encore d'évaluation

- How To - 205 Wow With Direct Mai...Document4 pagesHow To - 205 Wow With Direct Mai...Anthony MichailPas encore d'évaluation

- Highlight Good Deeds to Attract CustomersDocument4 pagesHighlight Good Deeds to Attract CustomersAnthony MichailPas encore d'évaluation

- Get creative with agenciesDocument4 pagesGet creative with agenciesAnthony MichailPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Omore ReportDocument38 pagesOmore ReportSameer Ur RahmanPas encore d'évaluation

- Chapter 9 HRM NotesDocument5 pagesChapter 9 HRM NotesAREEJ KAYANIPas encore d'évaluation

- Cape Pure Maths Unit 2 2016 Paper 2Document32 pagesCape Pure Maths Unit 2 2016 Paper 2Shemar Williams100% (2)

- The Impact of Social Media Influencers On Purchase Intention Towards Cosmetic Products in ChinaDocument18 pagesThe Impact of Social Media Influencers On Purchase Intention Towards Cosmetic Products in ChinaHương MaiPas encore d'évaluation

- COPARDocument12 pagesCOPARGlenn Asuncion PagaduanPas encore d'évaluation

- Multiple Choice - 25 QuestionsDocument4 pagesMultiple Choice - 25 Questionssmith_sherileePas encore d'évaluation

- Weka Book QuestionsDocument2 pagesWeka Book QuestionsSravan Kumar0% (1)

- Healthcare Statistic in MalaysiaDocument13 pagesHealthcare Statistic in MalaysiaMOZAIDPas encore d'évaluation

- What Is Continuous Quality Improvement?Document2 pagesWhat Is Continuous Quality Improvement?Mudiasti AdeliaPas encore d'évaluation

- Eastern Mediterranean University Department of Industrial EngineeringDocument3 pagesEastern Mediterranean University Department of Industrial EngineeringAngela NatashaPas encore d'évaluation

- Effects of Billboards on Student Network PreferencesDocument22 pagesEffects of Billboards on Student Network PreferencesRose Ann Manalaysay100% (5)

- Kiran - Synopsis - 1Document4 pagesKiran - Synopsis - 1umeshrathorePas encore d'évaluation

- The T-Value For A One-Tailed Test With 1% Significance Level and 18 Degrees of Freedom Is 2.878. According To The T Value TableDocument3 pagesThe T-Value For A One-Tailed Test With 1% Significance Level and 18 Degrees of Freedom Is 2.878. According To The T Value TableRichmond BaculinaoPas encore d'évaluation

- TIMMS Technical ManualDocument265 pagesTIMMS Technical Manualunicorn1979Pas encore d'évaluation

- Economic and Management Sciences - Business Plan Rubric - Grade 9Document2 pagesEconomic and Management Sciences - Business Plan Rubric - Grade 9tshilidziPas encore d'évaluation

- Variance and Standard DeviationDocument16 pagesVariance and Standard Deviationmehtab sanaPas encore d'évaluation

- General Assesment: Learning ObjectivesDocument7 pagesGeneral Assesment: Learning ObjectivesDwiPas encore d'évaluation

- Estudio de MuestreoDocument42 pagesEstudio de MuestreoMiriam JaraPas encore d'évaluation

- Module No. 9 Title: Testing The Difference Between The Population Means (Large Independent Samples) and (Small Independent Samples)Document13 pagesModule No. 9 Title: Testing The Difference Between The Population Means (Large Independent Samples) and (Small Independent Samples)Janine LerumPas encore d'évaluation

- Risk Based ApproachDocument4 pagesRisk Based ApproachMigoy DAPas encore d'évaluation

- Learning CompetencyDocument38 pagesLearning CompetencyJean S. FraserPas encore d'évaluation

- English 10 Quarter 4 Module 4Document18 pagesEnglish 10 Quarter 4 Module 4Marife Magsino83% (64)

- Green Belt TrainingDocument9 pagesGreen Belt Trainingsharad226869Pas encore d'évaluation

- Feasibility of Long Lasting Fragrance SoapDocument64 pagesFeasibility of Long Lasting Fragrance SoapPrincess Gletcher LumangtadPas encore d'évaluation

- Auditor Independence Challenges Faced by External Auditors When Auditing Large Firms in ZimbabweDocument7 pagesAuditor Independence Challenges Faced by External Auditors When Auditing Large Firms in ZimbabweInternational Journal of Business Marketing and ManagementPas encore d'évaluation

- Visual Merchandising Impact On Impulse Buying Behaviour: SciencedirectDocument6 pagesVisual Merchandising Impact On Impulse Buying Behaviour: SciencedirectAmit DixitPas encore d'évaluation

- Building Surveying Dissertation ExamplesDocument6 pagesBuilding Surveying Dissertation ExamplesWriteMyPaperCanadaCanada100% (1)

- Research LP (3RD Quarter)Document7 pagesResearch LP (3RD Quarter)Jaidee BiluganPas encore d'évaluation

- STA111 REPORT FinalDocument28 pagesSTA111 REPORT FinalADAM SUFFIAN BIN HAMZAH MoePas encore d'évaluation

- Statistics For BCADocument6 pagesStatistics For BCAsebastian cyriac100% (1)