Académique Documents

Professionnel Documents

Culture Documents

HWL Should Issue Eurobonds to Fulfill Future Capital Commitments

Transféré par

Ayesha KhalidDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

HWL Should Issue Eurobonds to Fulfill Future Capital Commitments

Transféré par

Ayesha KhalidDroits d'auteur :

Formats disponibles

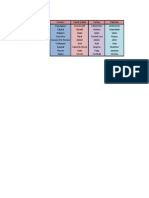

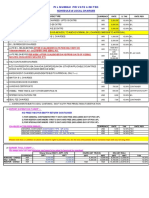

Employment of Capital Share Capital Reserves Shareholders Funds Minority Interest Loan Stock Long term Liability Deferred

Item

90458 904 57935 58839 5333 26174 112 31619 90458 Debt

Capital Employed

Long term Liabilities Total Liabilities Bank Loan Beyond 5 years Other Loan Beyond 5 years Convertible Debt due in more than 5years % Liabilities payable more than 5years is

26174 31503 5110 8106 13216 50%

By maintain current capital structure.. Based on current level of debt, no sufficient portion of long term debt remaining to investment next capital commitments. Because.. 50% of debt is payable within period of 5years and remaining long term debt isn't wholly payable within period of 5 years.. but HWL needs financing for atleast 10 years or beyond.. so it is not possible to fulfill the capital commitments with reallocation of current debt. HWL needs to change current debt structure and needs new financing for longer period.

Total Assets

Capital Commitments Already Contracted for Authorized for Total Capital Commitments Authorized for Operating Cashflows for 1995

Equity

Debt Total Equity and Liabilities Two types of debt: 1.Payable in 5years 2.Not wholly payable in 5years Current Capital Structure Equity Debt 65% 35%

Year1 Year2 Year3

Sources to fulfill the future need of capital: 1. Internal Generated Cash by Cashflows by Reallocation of Debt

Internal Generated Cash 1 Not enough cashflow to investment in up coming capital comm 2 Current years operating cashflows are 8552 million not in posi

nt portion of ext capital

1 2 3 4 5

Bank Loans Other constraints to obtain Bank Loan Not feasible because company needs the finance for more 10 y And syndication of local and foreign banks are offering loans fo And also syndicated loans are at floating rate of interest, not fa Another problem to get bank loan is.. Limited loan to one grou And Hutchison needs atleast 5 Billion US$ in next 5 years to ma

able within

ger period.

l Commitments 6468.9 23736.2 30205.1 HK$ Million 23736 HK$ Million 8552 HK$ Million + 23736 15184 6632 -1920

US$ HK$

1 7.73485 3905.07 US$ Million

8552 8552 8552

Based on current cashflows it is impossible to maintain the present growth and to fulfill the next years capital commitments and investments.

HWL relied heavily on internally generated funds to fuel growth. This method of funding and capital structure perfect and sufficient when capital commitments invesment.. no longer duration, such as HWL needs funds for more than 10 years. HWL needs fully guaranteed funds for long-term projects, and its current capital structure cannot support this growth.

the future need of capital: Not sufficient Not possible

to investment in up coming capital commitment ng cashflows are 8552 million not in position to fulfill the capital commitments

cant take due to restriction of current capital structure btain Bank Loan ompany needs the finance for more 10 years at fix rate of interest al and foreign banks are offering loans for 5 years to max. 7 years ans are at floating rate of interest, not favorable for company et bank loan is.. Limited loan to one group or related subsidiary companies atleast 5 Billion US$ in next 5 years to maintain current growth rate

1 2 3 4 5 6 7 8

HWL should issue Eurobonds to obtain Debt Maturity varies from 3 years to 15 years or more Less statutory issues and regulations required in issuance of eurobonds No need to report the financial statements according to GAAP Investors need diversification of investment and eurobond fulfill this need Investors and banks can use these bonds for swap which means investors hold and invest in these eurobonds othe Eurobonds can be traded in all capital markets around the world More tax benefits for the investors More Demand

HWL needs very effective and appropriate capital structure to funding the next financial investments. HWL shou issuing bonds but also by considering the credit rating and has to maintain the acceptable credit rating. If HWL lo more interest in form of risk premium to the investors due to increase in risk.

And HWL also needs to raise some portion capital from debt.. because by issuing bonds due to the impact of tax decreases which increases the shareholder wealth and corporate value.. and also wants to reduce the threat of

HWL make sure to keep BBB credit rating because.. to fulfill to future need of funds and current peformance are credit rating better than BBB.. because companies profits and cashflow ratios are falling in the BBB rating overal

If HWL is can approve its rating from BBB to A.. it can saves only 0.4% Nd lose the opportunity using more debt.. So HWL must issue the bonds (to take debt) up to maximium level by maintaining the BBB rating

After issuing the bonds.. some portion of future financing fulfilled and so remaining portion of financing should r in market.. by this company can maintain its credit rating up to standard and also by issuing bonds the threat of issue less share than absence of debt.

nd invest in these eurobonds other than yield purposes.. Result is various sort investors can invest in this product

t financial investments. HWL should raise some portion of future fund needed by acceptable credit rating. If HWL loses the credit rating.. company has to pay

ng bonds due to the impact of tax shield.. HWL cost of capital WACC also lso wants to reduce the threat of diluting ownership

funds and current peformance aren't supporting the company to maintain the are falling in the BBB rating overall..

the opportunity using more debt.. tax shield and lose returns

ing the BBB rating

aining portion of financing should raise via equity financing by issuing new shares lso by issuing bonds the threat of diluting control minimize and company has to

Vous aimerez peut-être aussi

- Case Study-Finance AssignmentDocument12 pagesCase Study-Finance AssignmentMakshud ManikPas encore d'évaluation

- Lecture - Sources of FinanceDocument27 pagesLecture - Sources of FinanceNelson MapaloPas encore d'évaluation

- Finance & Cash FlowDocument10 pagesFinance & Cash FlowAngelica MarinPas encore d'évaluation

- Fin Ca2 FinalDocument6 pagesFin Ca2 FinalVaishali SonarePas encore d'évaluation

- Corporate Finance Assignment 2Document7 pagesCorporate Finance Assignment 2manishapatil25Pas encore d'évaluation

- Name: Mohammed Nayeem Roll No-EMBA201917Document7 pagesName: Mohammed Nayeem Roll No-EMBA201917Md NayeemPas encore d'évaluation

- Business Finance M3Document6 pagesBusiness Finance M3Katrina LuzungPas encore d'évaluation

- Capital Structure Analysis of IOCLDocument31 pagesCapital Structure Analysis of IOCLAmit SardanaPas encore d'évaluation

- Comparative Analysis of Indian Banks With Respect To Fixed Deposit VariantsDocument8 pagesComparative Analysis of Indian Banks With Respect To Fixed Deposit VariantsPriya RajPas encore d'évaluation

- ExplainDocument2 pagesExplainUSD 654Pas encore d'évaluation

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingD'EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingPas encore d'évaluation

- Bus.-Finance LAS 5-6 QTR 2Document18 pagesBus.-Finance LAS 5-6 QTR 2lun zagaPas encore d'évaluation

- Long Term Source of Finance 222222Document12 pagesLong Term Source of Finance 222222mandeep singhPas encore d'évaluation

- What Is A Foreign Currency Convertible Bond (FCCB) ? A ForeignDocument9 pagesWhat Is A Foreign Currency Convertible Bond (FCCB) ? A ForeignParas R AsharaPas encore d'évaluation

- Hutchison Whampoa Case ReportDocument6 pagesHutchison Whampoa Case ReporttsjakabPas encore d'évaluation

- Raising Funds Through EquityDocument20 pagesRaising Funds Through Equityapi-3705920Pas encore d'évaluation

- Debt StrategyDocument10 pagesDebt StrategysnehaaggarwalPas encore d'évaluation

- What Every CEO Needs To Know About Financing An ESOPDocument6 pagesWhat Every CEO Needs To Know About Financing An ESOPheenaieibsPas encore d'évaluation

- LBO Definition: Buyout: The Purchase of A Company or ADocument36 pagesLBO Definition: Buyout: The Purchase of A Company or APRAO6005100% (1)

- Xavier University Financial Analysis of Limketkai Sons, IncDocument11 pagesXavier University Financial Analysis of Limketkai Sons, Incmichean mabaoPas encore d'évaluation

- CLO Investing: With an Emphasis on CLO Equity & BB NotesD'EverandCLO Investing: With an Emphasis on CLO Equity & BB NotesPas encore d'évaluation

- Debt RestructuringDocument5 pagesDebt RestructuringVinay TripathiPas encore d'évaluation

- Term Loans Case StudyDocument8 pagesTerm Loans Case StudyneemPas encore d'évaluation

- Ublic Deposit Scheme: Application FormDocument2 pagesUblic Deposit Scheme: Application Formsarvesh.bhartiPas encore d'évaluation

- FM Cia 3Document6 pagesFM Cia 3Priyanshu ChhabariaPas encore d'évaluation

- CH - 15 Financial Management: Core ConceptsDocument35 pagesCH - 15 Financial Management: Core ConceptsLolaPas encore d'évaluation

- FMPPTDocument8 pagesFMPPTnishii29Pas encore d'évaluation

- Working Capital Management: BhushanDocument42 pagesWorking Capital Management: BhushanDrisya NpPas encore d'évaluation

- Financing Options for Small BusinessesDocument5 pagesFinancing Options for Small BusinessesRenz Abad50% (2)

- Forecast of Balance Sheet 2.1 Assets Cash and Cash EquivalentDocument4 pagesForecast of Balance Sheet 2.1 Assets Cash and Cash EquivalentQuyên HoàngPas encore d'évaluation

- Sources of Short Term and Long Term FinanceDocument6 pagesSources of Short Term and Long Term FinanceSharath KannanPas encore d'évaluation

- Finance Law ExamsDocument23 pagesFinance Law ExamsJohn Paul ChuaPas encore d'évaluation

- Project Final AltafDocument60 pagesProject Final AltafVirendra BhavsarPas encore d'évaluation

- Managemnt of Capital in BanksDocument8 pagesManagemnt of Capital in Banksnrawat12345Pas encore d'évaluation

- Basis For Loan ClassificationDocument9 pagesBasis For Loan ClassificationFarhan IslamPas encore d'évaluation

- Assignment 3Document4 pagesAssignment 3arina7Pas encore d'évaluation

- SBA Loan ChartDocument2 pagesSBA Loan ChartsbdcwtPas encore d'évaluation

- Funds Presentation in AccountingDocument17 pagesFunds Presentation in Accountingवैभव शिरोडेPas encore d'évaluation

- Corporate Bond Market in IndiaDocument19 pagesCorporate Bond Market in IndiashagoonsaritaPas encore d'évaluation

- 2 Stock ValuationDocument9 pages2 Stock Valuationmichaelbarbosa0265Pas encore d'évaluation

- Budget Impact Debt Mutual FundDocument2 pagesBudget Impact Debt Mutual FundnnsriniPas encore d'évaluation

- Factors Affecting Capital StructureDocument9 pagesFactors Affecting Capital StructureRai Saif SiddiqPas encore d'évaluation

- Interest RateDocument21 pagesInterest RateSagara AbeykoonPas encore d'évaluation

- Long-Term Finance Sources: Shares, Debentures and Term LoansDocument34 pagesLong-Term Finance Sources: Shares, Debentures and Term LoansBharat KumarPas encore d'évaluation

- SHORT-TERM FUNDS SOURCESDocument9 pagesSHORT-TERM FUNDS SOURCESJack Herer100% (1)

- Chap. 5 Debt Service FundDocument9 pagesChap. 5 Debt Service Fundhenok AbebePas encore d'évaluation

- Estimating Funds Requirements Butler Lumber CompanyDocument18 pagesEstimating Funds Requirements Butler Lumber CompanyNabab Shirajuddoula71% (7)

- Finance Module 05 - Week 5Document8 pagesFinance Module 05 - Week 5Christian ZebuaPas encore d'évaluation

- Ratio Analysis of Dutch-Bangla Bank LTD (Based On FY 2009-13)Document22 pagesRatio Analysis of Dutch-Bangla Bank LTD (Based On FY 2009-13)Yeasir MalikPas encore d'évaluation

- Fixed Income Investment Options for Low Risk PortfoliosDocument7 pagesFixed Income Investment Options for Low Risk PortfoliosbhoopendrasinghPas encore d'évaluation

- Unit 7 Capital StructureDocument12 pagesUnit 7 Capital StructurepnkgoudPas encore d'évaluation

- Chapter 10a - Long Term Finance - BondsDocument6 pagesChapter 10a - Long Term Finance - BondsTAN YUN YUNPas encore d'évaluation

- Case Presentation-McKenzie Corporations Capital BudgetingDocument17 pagesCase Presentation-McKenzie Corporations Capital Budgetingpragati bora67% (3)

- Cash Flow Interpretation of Hero Moto Corp ForDocument15 pagesCash Flow Interpretation of Hero Moto Corp ForNikita KhandujaPas encore d'évaluation

- Factors Determining Capital Structure of Chetinad Cement CorporationDocument5 pagesFactors Determining Capital Structure of Chetinad Cement CorporationKarthik RamPas encore d'évaluation

- NBFIDocument47 pagesNBFIAakanksha SanctisPas encore d'évaluation

- According To Time-PeriodDocument9 pagesAccording To Time-PeriodMin JeePas encore d'évaluation

- BRM FinalDocument15 pagesBRM FinalAyesha KhalidPas encore d'évaluation

- Birds EyeDocument4 pagesBirds EyeAyesha KhalidPas encore d'évaluation

- Brand Audit of DHLDocument33 pagesBrand Audit of DHLAyesha Khalid100% (1)

- Transfer Courier: Brand Exploratory Brand RecallDocument12 pagesTransfer Courier: Brand Exploratory Brand RecallAyesha KhalidPas encore d'évaluation

- Assess Hutchison WhampoaDocument4 pagesAssess Hutchison WhampoaAyesha KhalidPas encore d'évaluation

- Tata Motors DCVCDocument3 pagesTata Motors DCVCAyesha Khalid100% (1)

- Quantitative QuestionnaireDocument14 pagesQuantitative QuestionnaireAyesha KhalidPas encore d'évaluation

- Transfer Courier: Brand Exploratory Brand RecallDocument12 pagesTransfer Courier: Brand Exploratory Brand RecallAyesha KhalidPas encore d'évaluation

- Quantitative QuestionnaireDocument14 pagesQuantitative QuestionnaireAyesha KhalidPas encore d'évaluation

- Sports IndustryDocument5 pagesSports IndustryAyesha KhalidPas encore d'évaluation

- BRM FinalDocument15 pagesBRM FinalAyesha KhalidPas encore d'évaluation

- Sampling Methods Explained: Probability vs Non-ProbabilityDocument51 pagesSampling Methods Explained: Probability vs Non-ProbabilityAyesha KhalidPas encore d'évaluation

- Birds EyeDocument2 pagesBirds EyeAyesha KhalidPas encore d'évaluation

- Consumer Ethics While Buying Counterfeit ProductsDocument3 pagesConsumer Ethics While Buying Counterfeit ProductsAyesha KhalidPas encore d'évaluation

- Countries DataDocument2 pagesCountries DataAyesha KhalidPas encore d'évaluation

- Introduction of The CompanyDocument32 pagesIntroduction of The CompanyAyesha KhalidPas encore d'évaluation

- Dairy Farm Project Feasibility ReportDocument47 pagesDairy Farm Project Feasibility ReportHamza Irfan100% (1)

- ETHICS OF BUYING COUNTERFEIT PRODUCTSDocument5 pagesETHICS OF BUYING COUNTERFEIT PRODUCTSAyesha KhalidPas encore d'évaluation

- Enhancing The Largest Set Rule For Assembly Line Balancing Through The Concept of Bi-Directional Work RelatednessDocument2 pagesEnhancing The Largest Set Rule For Assembly Line Balancing Through The Concept of Bi-Directional Work RelatednessAyesha KhalidPas encore d'évaluation

- Chemical Sector 1Document28 pagesChemical Sector 1Ayesha KhalidPas encore d'évaluation

- Maf603 Topic 2 Portfolio Management N Asset Pricing TheoryDocument75 pagesMaf603 Topic 2 Portfolio Management N Asset Pricing Theory2022920039Pas encore d'évaluation

- Pil Mumbai Private Limited: Schedule of Local ChargesDocument1 pagePil Mumbai Private Limited: Schedule of Local ChargesANMOL SUKHDEVEPas encore d'évaluation

- Learning MaterialsDocument38 pagesLearning MaterialsBrithney ButalidPas encore d'évaluation

- Since 1977PFRS 9 Financial AssetsDocument11 pagesSince 1977PFRS 9 Financial AssetsNah HamzaPas encore d'évaluation

- Project On Credit Management 222Document82 pagesProject On Credit Management 222Karthik Kartu J71% (7)

- Statement Summary: Statement Period Account NumberDocument5 pagesStatement Summary: Statement Period Account NumberSharon JonesPas encore d'évaluation

- Understanding Derivatives Chapter 2 Central Counterparty Clearing PDFDocument15 pagesUnderstanding Derivatives Chapter 2 Central Counterparty Clearing PDFOsas ImianvanPas encore d'évaluation

- Capital Market CMDocument1 pageCapital Market CMFranzing LebsPas encore d'évaluation

- Libby7ce PPT Ch09Document47 pagesLibby7ce PPT Ch09Moussa ElsayedPas encore d'évaluation

- Multiplier Effect ExplanationDocument5 pagesMultiplier Effect Explanationfreaky mintyPas encore d'évaluation

- 2024 ItsbaDocument7 pages2024 ItsbaNyesha GrahamPas encore d'évaluation

- SWIFT and BAI2 transaction codes guideDocument40 pagesSWIFT and BAI2 transaction codes guideAdéla DoležalováPas encore d'évaluation

- Interest Rate Risk and Bond PricesDocument61 pagesInterest Rate Risk and Bond PricesMarwa HassanPas encore d'évaluation

- Financial Markets and Institutions Test Bank (021 030)Document10 pagesFinancial Markets and Institutions Test Bank (021 030)Thị Ba PhạmPas encore d'évaluation

- SESSION14Document10 pagesSESSION14RADHIKA RASTOGIPas encore d'évaluation

- National Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramDocument17 pagesNational Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramManu BhikshamPas encore d'évaluation

- Sap Tan - CodesDocument2 pagesSap Tan - CodeskocherlakotapavanPas encore d'évaluation

- Interface of Pandapos CounterDocument63 pagesInterface of Pandapos CountersnadminPas encore d'évaluation

- Card ConfirmationDocument1 pageCard Confirmationkilo6954Pas encore d'évaluation

- Investment Appraisal Camb AL New (1) RIKZY EESADocument14 pagesInvestment Appraisal Camb AL New (1) RIKZY EESAAyesha ZainabPas encore d'évaluation

- CASH APP HACK Get A Chance To Win 750$ Cash App MoneyDocument6 pagesCASH APP HACK Get A Chance To Win 750$ Cash App Moneyالرجل الخفي مر من هناPas encore d'évaluation

- Chap 4 BMADocument38 pagesChap 4 BMAGaurav SainiPas encore d'évaluation

- Intoduction To BankingDocument41 pagesIntoduction To BankingAbhilash ShahPas encore d'évaluation

- Study On Saving & Investment Pattern of SalariedpersonDocument109 pagesStudy On Saving & Investment Pattern of SalariedpersonTasmay Enterprises100% (3)

- Accounting Books - Ledgers and JournalsDocument30 pagesAccounting Books - Ledgers and JournalsAbegail BoquePas encore d'évaluation

- IFRS 2 - Share Based Payment1Document7 pagesIFRS 2 - Share Based Payment1EmmaPas encore d'évaluation

- (Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDocument4 pages(Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalakurilPas encore d'évaluation

- Cash Flow Statement 2019 HL Question Worked SolutionDocument5 pagesCash Flow Statement 2019 HL Question Worked SolutionConor MurphyPas encore d'évaluation

- Finance for Managers: Financial Markets GuideDocument5 pagesFinance for Managers: Financial Markets GuidehonathapyarPas encore d'évaluation

- Solman NRDocument13 pagesSolman NRMeeka CalimagPas encore d'évaluation