Académique Documents

Professionnel Documents

Culture Documents

LCC Formula

Transféré par

somapala88Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

LCC Formula

Transféré par

somapala88Droits d'auteur :

Formats disponibles

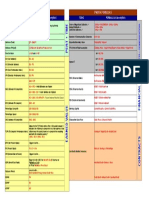

WLC decision rules

Net Present Value (NPV) The most obvious decision approach is to base the choice on whole life costs as represented by the NPV of various competing alternatives. The NPV is defined as the sum of money that needs to be invested today to meet all future financial requirements as they arise throughout the life of the project. Obviously, the best alternative is the one with minimum NPV. As the WLC focuses on cost rather than income, it is usual practice to treat costs as positive and income as negative Equivalent Annual Cost (AEC) Rather than being expressed as a one-time net present value, this method converts all costs of an alternative to a uniform equivalent annual cost (EAC). The EAC is related to the NPV by the YP. In this way, alternatives with different lives can be compared without the need to attribute residual values. However, it should be noted that the EAC is an average number and does not indicate the actual cost that will be incurred during each year of the life cycle. The ranking criterion in this case is that the preferred alternative has the minimum EAC. AEC = NPV/YP

Discounting and Interest formula used in life cycle costing

1. Compound interest: This formula shows the future accumulated value of an initial capital. Compound interest = P x (1+ i) n Where P = principal or present value (e.g. initial capital); i= interest rate (as a decimal); n= time period (usually number of years) 2. Present Value: This formula shows the present value of a future accumulated amount. Present value of Rs.1 = A x 1 (1+ i) n Where A = accumulated amount; i= interest rate (as a decimal); n= time period (usually number of years) 1

3. Years purchase or Present value of Rs.1 payable at regular intervals: This formula shows the present value of an annual expenditure to take place over n number of years, Present value of Rs.1 per annum = R[ 1- (1+ i) -n ]

i

Where R = payments due at the end of each period (usually year); i= interest rate (as a decimal); n= time period (usually number of years) 4. Annuity purchased by Rs.1(Loan Repayment) = i(1+ i) n (1+ i) n -1 P=principal or present value (i.e. size of loan); i= interest rate (as a decimal); n= time period (usually number of years) 5. Sinking Fund: This formula shows the amount of money to be put aside each year to cover a future known expenditure. Sinking Fund = A x i

(1+ i) n - 1

6. Inflation Formula = (1+t) - 1 (1+f) This formula shows the discount rate to be applied which takes account of inflation, where t= actual discount rate (usually bank base rate), f=inflation rate. Note: to obtain a percentage the result from the formula has to be multiplied by 100 Life cycle costing can be used in value engineering to provide a meaningful comparison of the total cost of different design options. Anticipated future costs are converted to a common base by discounting future cash flows in order to identify the net present value (NPV) of each option. Example: Calculate the comparative Whole life costs of the following heating systems installations for a house. Basic Data System A System B 1,750 50 p.a 450(10th Yr) 750 15Yrs 250 7% 2

Initial purchase cost 1,500 Annual maintenance cost 50p.a th Pump replacement cost 400(8 Yr) Annual fuel cost 800 Time period of investment 15Yrs Expected residual value of investment 250 Interest rate 7%

Vous aimerez peut-être aussi

- Performance Evaluation of Construction PDocument10 pagesPerformance Evaluation of Construction PMarioPas encore d'évaluation

- LR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004Document36 pagesLR5 Cap 9 Cost Estimating - Scott Amos - Skills Knowledge of Cost Engineering - AACEI - 2004apzambonPas encore d'évaluation

- TVM Formulas Guide Business Math ProblemsDocument7 pagesTVM Formulas Guide Business Math ProblemsAftab HossainPas encore d'évaluation

- ArgumentsDocument21 pagesArgumentsSaddam MullaPas encore d'évaluation

- Analysis of Transaction CostDocument383 pagesAnalysis of Transaction CosthjsdPas encore d'évaluation

- Primavera P6: Project Monitoring DepartmentDocument76 pagesPrimavera P6: Project Monitoring DepartmentMariam SaeedPas encore d'évaluation

- Compare ASME and material specsDocument2 pagesCompare ASME and material specsg_sanchetiPas encore d'évaluation

- Project WorkflowDocument1 pageProject WorkflowAnnaPas encore d'évaluation

- Investigating The Value of An MBA Education Using NPV Decision ModelDocument72 pagesInvestigating The Value of An MBA Education Using NPV Decision ModelnabilquadriPas encore d'évaluation

- Excel Skills and Functions for Business Problem SolvingDocument119 pagesExcel Skills and Functions for Business Problem SolvingRishabh JainPas encore d'évaluation

- Material-Handling EquipmentDocument7 pagesMaterial-Handling EquipmentNickiPas encore d'évaluation

- Excel Project Timesheet FullDocument4 pagesExcel Project Timesheet Fullprateekchopra1Pas encore d'évaluation

- Ch2-General Design Considerations Week2Document61 pagesCh2-General Design Considerations Week2ميثة الغيثيةPas encore d'évaluation

- Pipe & Pipe FittingsDocument10 pagesPipe & Pipe FittingsSalim BakhshPas encore d'évaluation

- Piping Codes & Standards ListDocument10 pagesPiping Codes & Standards ListbratishkaityPas encore d'évaluation

- Cost Accounting Chapter 2 IntroductionDocument13 pagesCost Accounting Chapter 2 IntroductionAbigail Faye Roxas100% (1)

- Core Chapter 04 Excel Master 4th Edition StudentDocument150 pagesCore Chapter 04 Excel Master 4th Edition StudentDarryl WallacePas encore d'évaluation

- FRM Index (Revised)Document28 pagesFRM Index (Revised)api-3717306Pas encore d'évaluation

- Metals, Test Methods and Analytical ProceduresDocument1 pageMetals, Test Methods and Analytical ProceduresSARATH KRISHNAKUMARPas encore d'évaluation

- Cost Estimation Manual Manual Number SM014Document0 pageCost Estimation Manual Manual Number SM014pankajmayPas encore d'évaluation

- RETScreen Help-Sensitivity and Risk AnalysisDocument17 pagesRETScreen Help-Sensitivity and Risk AnalysisAbolfazl PezeshkzadehPas encore d'évaluation

- Best Practices Engineering GuideFINALDocument4 pagesBest Practices Engineering GuideFINALAnbalagan PrabhuPas encore d'évaluation

- Glossary PM TerminologyDocument14 pagesGlossary PM TerminologyLawal Idris AdesholaPas encore d'évaluation

- Rate of ReturnDocument38 pagesRate of ReturnPraz AarashPas encore d'évaluation

- Tong Hop Ham ExcelDocument244 pagesTong Hop Ham ExcelImpossible MinosPas encore d'évaluation

- Analysis and design of multi-story building using STAAD ProDocument6 pagesAnalysis and design of multi-story building using STAAD ProarjunPas encore d'évaluation

- Build a Production Schedule with ExcelDocument58 pagesBuild a Production Schedule with ExcelSafety Inspector Daop 7Pas encore d'évaluation

- SEEP FRAME Tool, Version 2.02Document159 pagesSEEP FRAME Tool, Version 2.02anish-kc-8151Pas encore d'évaluation

- Pmbok Formulas Pmbok Formulas: Topic FORMULA (Or Description) Topic FORMULA (Or Description)Document1 pagePmbok Formulas Pmbok Formulas: Topic FORMULA (Or Description) Topic FORMULA (Or Description)jpcdellPas encore d'évaluation

- Tender Process GuideDocument45 pagesTender Process GuideHany FathyPas encore d'évaluation

- Ce 1402 Estimation and Quantity SurveyingDocument26 pagesCe 1402 Estimation and Quantity SurveyingNagaraja Prasanna RassPas encore d'évaluation

- XyzDocument1 pageXyzUsman TahirPas encore d'évaluation

- Employee Timecard1Document34 pagesEmployee Timecard1Ebiyele Olusegun OwoturoPas encore d'évaluation

- Answers - Capital Budgeting TechniquesDocument44 pagesAnswers - Capital Budgeting Techniquesjacks ocPas encore d'évaluation

- CONTRACT Performance of Reciprocal PromiseDocument13 pagesCONTRACT Performance of Reciprocal PromiseRachit JaiswalPas encore d'évaluation

- Timesheet: January, February, MarchDocument4 pagesTimesheet: January, February, MarchkhuonggiaPas encore d'évaluation

- 3.NPER Function Excel Template 1Document9 pages3.NPER Function Excel Template 1w_fibPas encore d'évaluation

- Tutorial 1Document4 pagesTutorial 1摩羯座Pas encore d'évaluation

- The Inner Workings of P6™ Part 1: P6 Durations and Dates: by Ron Winter, PSPDocument48 pagesThe Inner Workings of P6™ Part 1: P6 Durations and Dates: by Ron Winter, PSPsaadali90Pas encore d'évaluation

- Risk and Return - Section 11.2Document99 pagesRisk and Return - Section 11.2Dane JonesPas encore d'évaluation

- Delay Analysis 1Document8 pagesDelay Analysis 1Eslam AshourPas encore d'évaluation

- Compress A Schedule Using Duration Types in Primavera P6Document7 pagesCompress A Schedule Using Duration Types in Primavera P6senrrPas encore d'évaluation

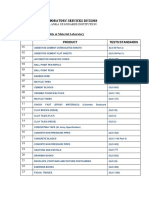

- Sri Lanka Standards Institution Laboratory Testing FacilitiesDocument4 pagesSri Lanka Standards Institution Laboratory Testing FacilitiesAbcPas encore d'évaluation

- Yearly Summary 32375 35436 35436: 0 How To Fill in This?Document41 pagesYearly Summary 32375 35436 35436: 0 How To Fill in This?ajit_dixit_6Pas encore d'évaluation

- Equations (Continued) : ElectricityDocument1 pageEquations (Continued) : Electricitykrishna_pipingPas encore d'évaluation

- Piping MaterialsDocument1 pagePiping Materialslibid_rajPas encore d'évaluation

- Excels For Solution ManualDocument116 pagesExcels For Solution ManualDimple PandeyPas encore d'évaluation

- Construction Baseline Book Development Time FrameDocument4 pagesConstruction Baseline Book Development Time Framesohail2006Pas encore d'évaluation

- Linear Programming On Excel: Problems and SolutionsDocument5 pagesLinear Programming On Excel: Problems and Solutionsacetinkaya92Pas encore d'évaluation

- 01 - Corporate Piping-Mechanical ProceduresDocument2 pages01 - Corporate Piping-Mechanical Proceduresmostafa aliPas encore d'évaluation

- Project Costing - TermsDocument4 pagesProject Costing - TermsK M SendhilPas encore d'évaluation

- Lecture 6fDocument30 pagesLecture 6fhiteshPas encore d'évaluation

- Critical Path Analysis ExplainedDocument2 pagesCritical Path Analysis ExplainedJayna Crichlow100% (1)

- WORKSHOPS Primavera P6 V4 To 7 PDFDocument54 pagesWORKSHOPS Primavera P6 V4 To 7 PDFIsmail XabiPas encore d'évaluation

- Cash Flow Forecast TemplateDocument1 pageCash Flow Forecast TemplateMohamed Ahmed100% (1)

- Planning and Scheduling Construction Projects Using Primavera Software A Case StudyDocument11 pagesPlanning and Scheduling Construction Projects Using Primavera Software A Case StudyEditor IJTSRDPas encore d'évaluation

- CE 3220 Lecture 7-2 Earthwork PDFDocument17 pagesCE 3220 Lecture 7-2 Earthwork PDFMohamedRaahimPas encore d'évaluation

- Man Hour EstimationDocument2 pagesMan Hour EstimationSergio SmithPas encore d'évaluation

- WELCOME To Cost & Evaluation Workbook by Peters, Timmerhaus and West. Accompanying Plant Design and Economics For Chemical Engineers, 5th EditionDocument15 pagesWELCOME To Cost & Evaluation Workbook by Peters, Timmerhaus and West. Accompanying Plant Design and Economics For Chemical Engineers, 5th Editionxhche7Pas encore d'évaluation

- Focus Areas of The Class: Evaluation MethodsDocument45 pagesFocus Areas of The Class: Evaluation MethodsBikila M. KejelaPas encore d'évaluation

- 1-Std Form - 1st Edit - QS Cover PageDocument1 page1-Std Form - 1st Edit - QS Cover Pagesomapala88Pas encore d'évaluation

- Limitations of Liability in Construction ContractsDocument3 pagesLimitations of Liability in Construction ContractsAhmed Mohamed BahgatPas encore d'évaluation

- Besl 4 (1) 3Document10 pagesBesl 4 (1) 3Sanka SeneviratnePas encore d'évaluation

- T 300312 6 PDFDocument4 pagesT 300312 6 PDFsomapala88Pas encore d'évaluation

- Role of urban planning laws and development practices in containing infectious diseases in Sri LankaDocument7 pagesRole of urban planning laws and development practices in containing infectious diseases in Sri Lankasomapala88Pas encore d'évaluation

- The Top 10 Things You Need To Know About FIDIC PDFDocument6 pagesThe Top 10 Things You Need To Know About FIDIC PDFsomapala88Pas encore d'évaluation

- 485) 2057-05 - E CIDA Gazette PDFDocument24 pages485) 2057-05 - E CIDA Gazette PDFAmy FitzpatrickPas encore d'évaluation

- KPMG Covid 19 Economic ImpactDocument30 pagesKPMG Covid 19 Economic Impactsomapala88Pas encore d'évaluation

- KPMG Covid 19 Economic ImpactDocument30 pagesKPMG Covid 19 Economic Impactsomapala88Pas encore d'évaluation

- Cost Estimation ShareDocument2 pagesCost Estimation ShareCahyo PriyatnoPas encore d'évaluation

- Dispute Causation in Construction Projects: Manvendra Sinha, Dr. A. S. WayalDocument5 pagesDispute Causation in Construction Projects: Manvendra Sinha, Dr. A. S. Wayalsomapala88Pas encore d'évaluation

- Besl 4 (1) 3Document10 pagesBesl 4 (1) 3Sanka SeneviratnePas encore d'évaluation

- Can contractors claim lost profits from omitted worksDocument2 pagesCan contractors claim lost profits from omitted worksMdms Payoe100% (1)

- The Top 10 Things You Need To Know About FIDICDocument6 pagesThe Top 10 Things You Need To Know About FIDICsomapala88Pas encore d'évaluation

- Act No. 20 (E)Document10 pagesAct No. 20 (E)somapala88Pas encore d'évaluation

- Eligibility Requirements Compulsory Core Modules For M.Sc. / Post Graduate Diploma in CPMDocument2 pagesEligibility Requirements Compulsory Core Modules For M.Sc. / Post Graduate Diploma in CPMsomapala88Pas encore d'évaluation

- ConstructionIndustry TenderingProcedures&AwardofTenderDocument10 pagesConstructionIndustry TenderingProcedures&AwardofTenderhopalica100% (1)

- Moratuwa University Postgraduate Degrees in Construction Project ManagementDocument2 pagesMoratuwa University Postgraduate Degrees in Construction Project Managementsomapala88Pas encore d'évaluation

- Bid Eval ProceduresDocument12 pagesBid Eval ProceduresvictorsunnyPas encore d'évaluation

- ConstructionDocument9 pagesConstructionsomapala88Pas encore d'évaluation

- 1 Variations Handout Part IDocument6 pages1 Variations Handout Part ISampath BandaraPas encore d'évaluation

- Workshop Practice Series - BooksDocument8 pagesWorkshop Practice Series - Bookscatapix100% (5)

- Introduction To NC and CNC Machines CNC Controls and RS274 ProgrammingDocument32 pagesIntroduction To NC and CNC Machines CNC Controls and RS274 ProgrammingRamanujam O SPas encore d'évaluation

- Bored PileDocument74 pagesBored PileGan Wei HuangPas encore d'évaluation

- Builders, Subcontractors and Employers' LiabilitiesDocument52 pagesBuilders, Subcontractors and Employers' LiabilitiesDiana Alexandra ComaromiPas encore d'évaluation

- Tap Drill Chart for 75% Thread Depth up to 2Document1 pageTap Drill Chart for 75% Thread Depth up to 2somapala88Pas encore d'évaluation

- 3 Concurrent Delay Handout Part IIDocument1 page3 Concurrent Delay Handout Part IIsomapala88Pas encore d'évaluation

- Cpd-Nominated Sub ContractDocument10 pagesCpd-Nominated Sub Contractsomapala88Pas encore d'évaluation

- Cold Metal Processes: Mr. Patterson Construction Tech 1Document19 pagesCold Metal Processes: Mr. Patterson Construction Tech 1somapala88Pas encore d'évaluation

- Tapping and ThreadingDocument15 pagesTapping and Threadingsomapala88100% (2)

- Barringer E3 PPT 13Document26 pagesBarringer E3 PPT 13Aamir BalochPas encore d'évaluation

- Engineering EconomyDocument159 pagesEngineering EconomyAlbert Aguilor88% (8)

- COL Retail Sample ExamDocument31 pagesCOL Retail Sample ExamFernanda Raquel0% (1)

- This Study Resource Was: PAS 2 InventoriesDocument3 pagesThis Study Resource Was: PAS 2 Inventorieshsjhs100% (1)

- Costing in Educational Planning: Presented by Joannp - Maiquez Catrinaa - TenorioDocument27 pagesCosting in Educational Planning: Presented by Joannp - Maiquez Catrinaa - TenorioLorna Manalo Siman100% (1)

- 7096 w13 Ms 22Document8 pages7096 w13 Ms 22mstudy123456Pas encore d'évaluation

- Manage Inventory Costs with EOQ ModelsDocument30 pagesManage Inventory Costs with EOQ ModelsGopi SPas encore d'évaluation

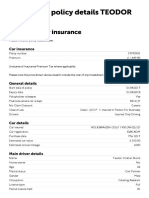

- Policy Details PageDocument2 pagesPolicy Details PageLuci PoroPas encore d'évaluation

- Marketing Process: Analysis of The Opportunities in The MarketDocument7 pagesMarketing Process: Analysis of The Opportunities in The Marketlekz rePas encore d'évaluation

- CH 1 Cost Volume Profit Analysis Absorption CostingDocument21 pagesCH 1 Cost Volume Profit Analysis Absorption CostingNigussie BerhanuPas encore d'évaluation

- 05march 2019 - India - Daily PDFDocument39 pages05march 2019 - India - Daily PDFCoupant CapitalPas encore d'évaluation

- Cost Analysis of Shahabad Co-Op Sugar Mills LTDDocument78 pagesCost Analysis of Shahabad Co-Op Sugar Mills LTDVinay ManchandaPas encore d'évaluation

- Jordan B. Peterson - Template For Writing EssaysDocument24 pagesJordan B. Peterson - Template For Writing EssaysvojarufosiPas encore d'évaluation

- Why Is It Important To Consider Uncertainty When Evaluating Supply Chain DesignDocument3 pagesWhy Is It Important To Consider Uncertainty When Evaluating Supply Chain DesignAkshay_Raja_94150% (2)

- Trial Balance December 2016Document1 pageTrial Balance December 2016Faie RifaiPas encore d'évaluation

- Equipment Cost Estimating - Otuonye - 2000Document42 pagesEquipment Cost Estimating - Otuonye - 2000Rotax_Kid0% (1)

- Economics Higher Level Paper 3: Instructions To CandidatesDocument6 pagesEconomics Higher Level Paper 3: Instructions To CandidatesAndres Krauss100% (1)

- Cross-Country Determinants of Capital Structure Choice A Survey of European FirmsDocument31 pagesCross-Country Determinants of Capital Structure Choice A Survey of European FirmséricPas encore d'évaluation

- EOLA's Equity Distribution - v4Document18 pagesEOLA's Equity Distribution - v4AR-Lion ResearchingPas encore d'évaluation

- Tax Motivated Film Financing at Rexford StudiosDocument13 pagesTax Motivated Film Financing at Rexford StudiosNiketPaithankarPas encore d'évaluation

- Bus 504Document13 pagesBus 504RaselAhmed082Pas encore d'évaluation

- Question Paper Code:: Reg. No.Document6 pagesQuestion Paper Code:: Reg. No.Vijay RamanathanPas encore d'évaluation

- SOLTEK SOLAR POWER Specification and PriceDocument4 pagesSOLTEK SOLAR POWER Specification and PriceAlexis MalicdemPas encore d'évaluation

- A Comprehensive Sales Plan Intended For Lipton Herbal Tea UnileverDocument13 pagesA Comprehensive Sales Plan Intended For Lipton Herbal Tea UnileverRakib ChowdhuryPas encore d'évaluation

- G.R. No. 152411 September 29, 2004 University of The Philippines, Petitioner, PHILAB INDUSTRIES, INC., RespondentDocument4 pagesG.R. No. 152411 September 29, 2004 University of The Philippines, Petitioner, PHILAB INDUSTRIES, INC., RespondentDiana HernandezPas encore d'évaluation

- 2018 July 20 CME Advanced Gap TechniquesDocument19 pages2018 July 20 CME Advanced Gap TechniquesVinicius FreitasPas encore d'évaluation

- Chapter 6 - Accounting For SalesDocument4 pagesChapter 6 - Accounting For SalesArmanPas encore d'évaluation

- Mikro EkonomiDocument3 pagesMikro EkonomiririanPas encore d'évaluation

- EOQDocument53 pagesEOQFredericfrancisPas encore d'évaluation

- Assignment On ABCDocument5 pagesAssignment On ABCRaghav MehraPas encore d'évaluation

- A Place of My Own: The Architecture of DaydreamsD'EverandA Place of My Own: The Architecture of DaydreamsÉvaluation : 4 sur 5 étoiles4/5 (241)

- An Architect's Guide to Construction: Tales from the Trenches Book 1D'EverandAn Architect's Guide to Construction: Tales from the Trenches Book 1Pas encore d'évaluation

- Building Construction Technology: A Useful Guide - Part 1D'EverandBuilding Construction Technology: A Useful Guide - Part 1Évaluation : 4 sur 5 étoiles4/5 (3)

- Building Construction Technology: A Useful Guide - Part 2D'EverandBuilding Construction Technology: A Useful Guide - Part 2Évaluation : 5 sur 5 étoiles5/5 (1)

- Practical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsD'EverandPractical Guides to Testing and Commissioning of Mechanical, Electrical and Plumbing (Mep) InstallationsÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedD'EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedÉvaluation : 5 sur 5 étoiles5/5 (1)

- Piping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationD'EverandPiping and Pipeline Calculations Manual: Construction, Design Fabrication and ExaminationÉvaluation : 4 sur 5 étoiles4/5 (18)

- Civil Engineer's Handbook of Professional PracticeD'EverandCivil Engineer's Handbook of Professional PracticeÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- The Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsD'EverandThe Complete Guide to Alternative Home Building Materials & Methods: Including Sod, Compressed Earth, Plaster, Straw, Beer Cans, Bottles, Cordwood, and Many Other Low Cost MaterialsÉvaluation : 4.5 sur 5 étoiles4.5/5 (6)

- The Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialD'EverandThe Complete HVAC BIBLE for Beginners: The Most Practical & Updated Guide to Heating, Ventilation, and Air Conditioning Systems | Installation, Troubleshooting and Repair | Residential & CommercialPas encore d'évaluation

- Nuclear Energy in the 21st Century: World Nuclear University PressD'EverandNuclear Energy in the 21st Century: World Nuclear University PressÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- The Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseD'EverandThe Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseÉvaluation : 5 sur 5 étoiles5/5 (3)

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionD'EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- Engineering Critical Assessment (ECA) for Offshore Pipeline SystemsD'EverandEngineering Critical Assessment (ECA) for Offshore Pipeline SystemsPas encore d'évaluation

- Field Guide for Construction Management: Management by Walking AroundD'EverandField Guide for Construction Management: Management by Walking AroundÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- How to Write Construction Programmes & SchedulesD'EverandHow to Write Construction Programmes & SchedulesÉvaluation : 4 sur 5 étoiles4/5 (9)

- Woodworking: 25 Unique Woodworking Projects For Making Your Own Wood Furniture and Modern Kitchen CabinetsD'EverandWoodworking: 25 Unique Woodworking Projects For Making Your Own Wood Furniture and Modern Kitchen CabinetsÉvaluation : 1 sur 5 étoiles1/5 (4)

- 1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideD'Everand1,001 Questions & Answers for the CWI Exam: Welding Metallurgy and Visual Inspection Study GuideÉvaluation : 3.5 sur 5 étoiles3.5/5 (7)

- Estimating With Microsoft ExcelD'EverandEstimating With Microsoft ExcelÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Markup & Profit: A Contractor's Guide, RevisitedD'EverandMarkup & Profit: A Contractor's Guide, RevisitedÉvaluation : 5 sur 5 étoiles5/5 (11)

- The E-Myth Contractor: Why Most Contractors' Businesses Don't Work and What to Do About ItD'EverandThe E-Myth Contractor: Why Most Contractors' Businesses Don't Work and What to Do About ItÉvaluation : 4 sur 5 étoiles4/5 (16)

- Estimator's General Construction Manhour ManualD'EverandEstimator's General Construction Manhour ManualÉvaluation : 4.5 sur 5 étoiles4.5/5 (20)