Académique Documents

Professionnel Documents

Culture Documents

Public Relations For Improving Public Perception of The Marketing Executives in The Banking Industry in Nigeria

Transféré par

Alexander DeckerTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Public Relations For Improving Public Perception of The Marketing Executives in The Banking Industry in Nigeria

Transféré par

Alexander DeckerDroits d'auteur :

Formats disponibles

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.4, No.

8, 2013

www.iiste.org

Public Relations for Improving Public Perception of the Marketing Executives in the Banking Industry in Nigeria

Joseph I. Uduji Department of Marketing, Faculty of Business Administration, University of Nigeria, Enugu Campus e-mail: joseph.uduji@yahoo.com, Tel: +2348037937393 Abstract This study was undertaken to examine how public relations enhances mutual lines of communication, understanding, acceptance and cooperation between an organization and its publics to improve the overall public perception of the marketing executives in the banking industry in Nigeria. The open systems model of public relations guided study analysis. The marketing executives of the consolidated banks in the commercial city of Lagos, Nigeria formed the population of the study. A sample of 180 marketing executives was determined using a percentage formula. The Friedman non-parametric test statistics was used for the hypothesis testing. A calculated Friedman Chi-square result of 246.410 was obtained from the tested hypothesis. This value is greater than the critical Chi-square value of 5.991, which is significant as P-value of 0.000<0.05. This indicates that effective public relations can project the image of an organization to improve the overall public perception of the marketing executives in the banking industry in Nigeria. Keywords:Public Relations, Public Perception, Marketing Executives, Banking Industry in Nigeria, Public Opinion, Media Relations, Open Systems Model of Public Relation. Introduction The purpose of public relations practice is to establish two-way communication seeking common ground or areas of mutual interest, and to establish understanding based on truth, knowledge and full information. The scale of activity to promote good public relations may vary considerably according to the size and nature of the interested parties, but the philosophy, the strategy and the methods will be very similar whether the public relation program is designed to influence international understanding or to improve relations between a bank and its customers. Public relations in the banking industry is a function of management. It can contribute to the successful operation of a bank in proportion to the extent to which it is allowed to play its part. This fact has been accepted by most large companies, but many banks in Nigeria have been slow to realize the advantages of organized public relations (Nwude and Uduji, 2013). There could be two main objectives of public relations in a banking industry. The first could be to establish contact with three important sections of the public: its customers, its shareholders, and its employees; securing the mutual understanding and cooperation of these three groups is essential to success. The second objective could be to promote the banks services and products in highly competitive world. It is necessary to draw a distinction between a public relations attitude and public relation practice. Both are required in the banking industry. The current attitude toward public opinion should be present from top to bottom in a bank; the practice should be the responsibility of professionals trained in the art of communication. Public relations in a bank requires a list of priorities in order that available money and manpower are deployed to maximum advantage. It is easy to be tempted into pursuing projects that might yield fruitful results; but there may be more important problems which should be tackled first. The order of priority will not necessarily remain constant, and will require periodic reassessment. Some very effective public relations can be carried out in the banking industryboth by banks with their own internal public relations departments and by using consultants- but the general level of attainment has been uneven. For example, one bank is well organized for press relations and employee relations, but neglects other aspects. Another bank devotes all its attention to community relations. The best result can only come from a properly coordinated plan that is based on a carefully chosen list of priorities (Nwosu and Uduji, 2009). The importance of public relations to management decision making in banks was recently emphasized through the observation of the operation and function of a public relations department in some other industries in Nigeria. The role of the public is having on decisions made by top management in the banks was readily evident in more than a dozen areas. Technical advancement in the communications field, creating an accessibility to information not available to previous generations, is one of the reasons for an increasing national awareness and interest on

76

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.4, No.8, 2013

www.iiste.org

the part of the public in Nigeria. An exploding national population straining water, land, forest, and mineral resources, however, is probably the main reason for the public interest in banking industry decisions. Management in banks is also finding that it must know much more about the public and the various defined or specialized interest groups within the public which can have an impact on the banks concerned. Public influence can be exerted through the development of government regulation; legal system decision; lobbying efforts of special interest groups; press coverage, editorial comment, and published letters to the editor; through the withdrawal of bank product support; and by public demonstration (Uduji, 2012). Bank Management in Nigeria is rapidly learning that it is less costly to know the probable reaction of its public to decision so that courses of action can be planned in advance to educate and promote understanding. It is also learning to avoid decisions causing public reaction that will lead to increased legislation or regulation. Banks are learning that by ignoring or improperly evaluating public reaction, management decisions can be made which in the long range may be detrimental to the welfare of the banks. An example of the area in which public opinion and concerned are directly affecting management decisions in the banking industry in Nigeria, is in the protection of investors. Extensive steps are taken to keep investors and potential investors, through investment analysis, informed about management decisions and the banks financial condition. This specialized sector of public relations has developed rapidly during the last few years in Nigeria. It is perhaps more correctly described as Investor Relation. In this field, the public relations consultancy, or in-house department, will usually also be responsible for the financial advertising which can become very important in bid, takeover or right issue situations. It is essential to be familiar with the increasing number of disclosure regulations and insider restrictions applicable to all deals affecting the stock exchange. Different rules may apply to stock exchanges in other countries (Uduji, 2007; Nwude and Uduji 2013). Previously, in the banking industry in Nigeria, the sending out of the annual accounts and balance sheets was often the only contact between a bank and its shareholders. This annual report, a legal requirement, was often little more than a mass of figures and statistics. It is now becoming common for public relations advice to be sought in the preparation of the report, in order that it may give as much information as possible to shareholders. The design and typography of annual reports can be improved beyond all recognition in the next few years. In addition to financial public relations in the banks, customer relations need urgent attention. Relations with customers depend very much on quality, price, and delivery service, but also very directly on the reputation of the bank in Nigeria. Public relations can play a vital part in safeguarding a reputation or in building a new image. It can also help to improve methods of communication with existing and potential customers of the bank. Hence, this study was undertaken to examine how public relations enhances mutual line of communication, understanding, acceptance and cooperation between an organization and its publics to improve the overall public perception of the marketing executives in the banking industry in Nigeria. Theoretical Framework This study is based on the Open Systems Model of Public Relations. Acknowledging the importance of publics and their actions, Cutlip, Centre and Broom (2000) have proposed an open systems theory of public relations. Open systems are systems that take their environment into account and change their business activities accordingly. Closed Systems do not adapt to external conditions. Cutlip and his colleagues suggest that public relations should view itself as part of an open system. It should help the organization to monitor relevant environmental influences and adapt its activities accordingly, as well as encouraging changes in the external environment that will help the organization. In this model, two-way symmetric communications and strategic monitoring of the environment are fundamental to good public relations practice. According to Tech and Yeomans (2006), this approach has distinct advantages for practitioners: It positions them as strategic advisors to the organization and therefore gives them access to senior managers and more power to influence organizational activities. It limits the potential for crises, since environmental scanning allows the practitioner to anticipate difficulties and take early corrective action. It also ensures that public relations make a significant contribution to organizational effectiveness. .

77

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.4, No.8, 2013

www.iiste.org

Feedback Information about relationship with publics: desires versus observed Structure, plans and programme of organizations Output Internal: maintenance or redefinition of desired Output External: actions and communications directed to publics Knowledge, Predisposition and behavior of publics relationships Input Actions taken by or information about publics Desired Relationship with publics

Figure 1: Open System Model of Public Relations Source: Cutlip, S.M; Centre, A.H; and Broom, G.M (2000) Effective Public Relations, Upper Saddle River, N.J: Pearson Education Inc. Figure 1 shows the model of open systems public relations According to Grunig and Grunig (2000), a public relations planning is located with the activist framework and maps across very well to the systems view of organization as shown in systems theory. The open system view of an organization is an important concept for public relations planning, because an open system assumes that the organization is an organism of living entity with boundaries, inputs, outputs, through - puts and enough feedback from both the internal and external environments so that it can make appropriate adjustments in time to keep on living. Cutlip, Center and Broom (2000) present an open systems model of public relations that clearly identifies how all these systems characteristics map on to the planning process, as shown in figure 1. So, for example, input refers to actions taken by, or information about, publics. These inputs in turn are transformed into goals (aims) and objectives that underpin the desired relationships with publics. By contrast, a closed system approach publics and thus the planner might formulate aims and objectives in isolation. According to Hutton (2001), an emerging perspective in the systems family of approaches puts the actual relationship of an organization with its publics at the center of public relations is the objective of public relations. This means that strategies and tactics should always be assessed in terms of their effect on the relationship between an organization and its publics, rather than, for example, the benefits they provide for the organization. Black (1989) remarked that the focus on relationships broadens the perspectives used to formulate public relations strategies and tactics, but also by definitions requires greater involvement from organizations. This is not as simple as it sounds involvement means genuine dialogue, which in itself can be challenging. For example, L Etang (1999) points out that dialogue in practice frequently fails to meet the expectations of those taking part. The outcomes of diagloue may not be what was desired, and dialogue itself requires disclosure of information vulnerable. Practitioners pressing for greater interaction with publics must recognize, explain and manage these potential risks for organizations as well as for the publics they interact with (Dowling, 2001; Conelissen, 2004). Drawing on the literature around public relations and relationship management, Ledingham (2003) draws fourteen conclusions about the organization public relationship: Organization public relationships are transactional. For example, the relationship between a bank and its customer is based on the fact that they buy and sell their products it is an example. The relationships are dynamic: they change over time. They are goal oriented. Organization public relationships have antecedents and consequences and can be analyzed in terms of relationship quality, maintenance strategies, relationship type and actors in the relationship.

78

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.4, No.8, 2013

www.iiste.org

They are driven by the perceived needs and wants of interacting organizations and publics. The continuation of organization public relationships is dependent on the degree to which expectations are met. Those expectations are expressed in interactions between organizations and publics. Such relationships involve communication, but communication is not the sole instrument of relationship building. These relationships are impacted by relational history, the nature of the transaction, the frequency of exchange, and reciprocity. Organization public relationships can be described by type (personal, professional, community symbolic and behavioural) independent of the perceptions of those relationships. The proper focus of the domain of public relations is relationships, not communication. Communication alone cannot sustain long-term relationships in the absence of supportive organizational behaviour. Effective management of organization public relations supports mutual understanding and benefit. The relationship perspective is applicable throughout the public relation process and with regard to all public relations techniques. Practitioners role have been a major focus for theory development within the systemic perspective. Broom and Smith (1979) proposed five practitioner role model: problem solving process facilitators; expert prescribers, communication process facilitators; technical services providers and acceptant legitimisers. These were later simplified by Broom and Dozier (1986), who defined two basic roles for the public relations practitioner: The communication technician, who focuses on tactical matters such as writing, event management and media management. The communication manager, who has a more strategic communication perspective and will normally create overall strategy, take and analyze client briefings and deal with issues and crises. Research Methodology The study covered the marketing executives of the following selected eight consolidated banks in Lagos, commercial hub of Nigeria: Access Bank Diamond Bank Eco bank First City Monument Bank Fidelity Bank First Bank Zenith Bank United Bank of Africa Since the study was concerned with specific predictions, narrations of facts and characteristics, a descriptive/diagnostic design was adopted. The research design ensured enough provision for protection against bias and maximized reliability, with due concern for the economical completion of the work. Both secondary and primary sources were used to gather information for the study. Questionnaire was the principal source of the primary data, while interview served as complementary. The sample size of 180 marketing executives was determined using a percentage formula: Z2(Pq) n= e2 where: n= the sample size z= standard error associated with the chosen level of confidence P= estimated variability in the population q= (100-p) e= acceptable error The choice of this formula was based on the fact that the study was focused on some nominally scaled question in the survey. Data collected for the study were analyzed using descriptive and inferential approaches. For hypothesis testing, Friedman Non Parametric tests descriptive statistics was used to judge the significance of the result obtained.

79

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.4, No.8, 2013

www.iiste.org

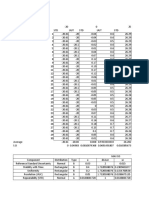

Data Presentation Analysis and Interpretation Scale: Definitely Disagree (DD)1 Generally Disagree (GD) 2 Somewhat Disagree (SA) 3 Generally Agree (GA) 4 Definitely Agree (DA) 5 Table 1: Public Relations as a Tool to improve Public Perception of the Marketing Executives in the Banking Industry in Nigeria n = 180 Questions DD GD SA GA DA Mean Std. (%) (%) (%) (%) (%) Dev. Corporate PR, such as annual reports, 0 0 (0.0) 0 (0.0) 84 96 4.53 0.50 conferences, ethical statements, visual identity, (0.0) (46.7) (53.3) and images can improve the overall public perception of the marketing executives in the Banking Industry in Nigeria Media relations, such as press releases, photo 0 0 (0.0) 21 66 93 4.40 0.69 calls, video news release, off-the-record (0.0) (11.7) (36.7) (51.7) briefings, and press events can improve the overall public perception of the marketing executives in the Banking Industry in Nigeria Community relations/corporate social 0 0 (0.0) 18 74 88 4.39 0.66 responsibility, such as Exhibitions, (0.0) (10.0) (41.1) (48.9) presentations, letters, meetings, sport activities and other sponsorships can improve the overall public perception of the marketing executives in the Banking Industry in Nigeria Source: Field Survey, 2013 While trying to establish whether using Public Relations can improve public perception of the marketing executive in the banking industry in Nigeria, certain responses were elicited from the study respondents. In particular, as presented in table 1, 84 respondents (46.7%) generally agree and 96 respondents (53.3%) definitely agree that corporate PR, such as annual reports, conferences, ethical statements, visual identity, and images can improve the overall public perception of the marketing executives in the Banking Industry in Nigeria. With a mean response score of 4.53, the respondents definitely agree to this. With a mean response score of 4.40 and the responses of 21 respondents (11.7%) who somewhat agreed, 66 respondents (36.7%) who generally agreed and 93 respondents (51.7%) who definitely agreed, the sampled respondents generally agree that media relations, such as press releases, photo calls, video news release, off-the-record briefings, and press events can improve the overall public perception of the marketing executives in the Banking Industry in Nigeria. As indicated by the responses of 18 respondents (10%) who somewhat agreed, 74 respondents (41.1%) who generally agreed and 88 respondents (48.9%) who definitely agreed and a mean response score of 4.39, the respondents generally agree that community relations/corporate social responsibility, such as Exhibitions, presentations, letters, meetings, sport activities and other sponsorships can improve the overall public perception of the marketing executives in the Banking Industry in Nigeria. Test of Hypothesis Effective Public Relations do not project the image of an organisation to improve the overall public perception of the marketing executives in the Banking Industry in Nigeria. To test this hypothesis, the respondents responses to the three questions presented in table 1 were tested using the Friedman Test statistics. Table 2: Friedman Non-Parametric Tests Descriptive Statistics N q1 q2 q3 180 180 180 Mean 4.5333 4.4000 4.3889 Std. Deviation .50028 .68991 .66340 Minimum 4.00 3.00 3.00 Maximum 5.00 5.00 5.00

Source: Field Survey, 2013

80

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.4, No.8, 2013

www.iiste.org

Table 3: Friedman Test Ranks Mean Rank q1 q2 q3 2.13 1.95 1.92

Source: Field Survey, 2013 Table 4: Friedman Test Statistics N Chi-Square df Asymp. Sig. 180 24.844 2 .000

a. Friedman Test Table 3 in ranking the mean responses to the three questions presents responses to question 1 with the highest mean rank (2.13) followed by question 2 (with a mean rank of 1.95) and question 1 (with a mean rank of 1.92). Upon testing this hypothesis, a calculated Friedman Chi-square result of 24.844 was obtained. This value is greater than the critical Chi-Square value of 5.991. This result is significant as p-value of 0.000 < 0.05. Hence, the null hypothesis is rejected. Therefore effective Public Relations projects the image of an organisation to improve the overall public perception of the marketing executives in the Banking Industry in Nigeria. Discussion of Research Findings The Friedman Chi Square result of 24.844 which is greater than the critical Chi Square value of 5.991, shows significant as p value of 0.000 < 0.05 suggests that effective public relations do project the image of an organization to improve the overall public perception of the marketing executives in the banking industry in Nigeria. This result indicates that output of a steady stream of press release and other traditional reactive public relations is suggestive of closed systems thinking operating in Nigeria banks. This all two common approach to the function is apparently based on two assumptions: (1) that the purpose of public relations in Nigerian banks is limited to effecting changes in the environment, and more mistakenly, (2) that banks have the power to change their environments, thereby eliminating the need to change themselves. On the other hand, the guided model of this study, an open systems approach casts public relations in the role of bringing about changes in both environments and organizations as a result of environmental inputs. Nwude and Uduji (2003) refer to the first approach to public relations as functionary and the second as functional. In their view, the functionary role is similar to a closed systems approach. In this approach to public relations, the emphasis suggests on maintaining the status quo within the banks while effecting change in the banks public. Therefore, to the functionary approach, the goal of building and maintaining relations between the banks and its publics is to bring the publics into line with the banks plans. In contrast, the finding of this study as shown in table 1, 2, 3, and 4 indicates a functional view of public relations which calls for an open systems approach by changing both the bank and the environment. Therefore, relations between the banks in Nigeria and its publics should be maintained or changed on the basis of reciprocal output feedback adjustment in order to improve the overall public perception of the marketing executives in the banking industry in Nigeria. The functionary approach would cast public relations practice in the banks in the technician role. And in this limited role, they monitor the environment (if at all) to make communication output more effective, not to make changes within the banks. But in the banks where public relations operate in the functional mode, on the other hand, practitioners can become part of the top management. In effect, public relations practiced in the closed system (functionary) model attempts to maintain the status quo within the banks while directing change efforts at the environment. When public relations is part of the banks strategic attempt to adjust and adapt to their dynamic environments, the practice reflects the open systems (functional) model. The open systems can radically change the practice from how it is widely practice in the banking industry in Nigeria. Whereas the more common functionary version attempts to exercise control over environmental forces, the open systems model suggests adjustment and appropriate responses for improving public perception of marketing executives among Nigerian banks. Most definitions of organizational environment suggest that it includes factors outside organizational boundaries and often outside organizations control. Therefore, a banks specific environment includes those constituencies that can positively or negatively influence the banks effectiveness. It is unique to each bank in Nigeria, and can change with conditions.

81

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.4, No.8, 2013

www.iiste.org

The open systems model uses two way symmetric approaches, meaning that communication is two way and that information exchange causes changes on both sides of the bank public relationships. The difference between one-way and two-way communication led the Grunigs to propose yet another way to describe closed and open system of public relations (Grunig and Grunig, 2000). Both approaches emphasized the primary role of communication in social systems. Applying the open systems approach to public relations in the banking industry in Nigeria, first and foremost calls for purposeful sensing of the environment to anticipate and detect changes that affect the banks relationships with its publics. But following an open systems approach, to improve public perception of the marketing executives in Nigerian banks, public relations must be selectively sensitive to specifically define publics that are mutually affected or involved by bank polices, procedures, and actions. The Open Systems Model of public relations calls for research skills to monitor publics and other environmental forces, as well as forces within the banks. Open Systems Public relations also has the capacity to initiate corrective actions within banks in Nigeria and direct programs to affect knowledge, predisposition, and behavior of both internal and external publics. The outcomes sought are maintenance or achievement of goals that reflect the mutual interests of the banks and their publics. Those found in conflict with mutual interests are changed or eliminated, before they become issues or problems. Proactive corrective action may be the major and most useful aspect of the open systems model of public relations. Steps taken in advance can reduce both the amount of effort required and the trauma associated with crisis-oriented reactive public relations. Thus, banks employing open systems public relations can maintain their relationships and improve public perception of the marketing executives, by adjusting and adapting themselves and their publics to ever changing social, political, and economic environment. Conclusion and Recommendations Effective public relations project the image banks to improve the overall public perception of marketing executives in the banking industry in Nigeria. Public relations in banks must be cost-effective and part of the formula for successful competition. Thus, the competitive nature and the profit imperative of business in the banking industry in Nigeria, make public relations work extremely demanding. Add to this, the increasingly global nature of bank business and its potential clash of cultures, as well as the possibility of a corporate takeover, merger, or acquisition. The public relations function in banks is subject to continuing evaluation- as are marketing, finance, and manufacturing- with the ultimate yardstick being progress toward goals and objectives set by management. In times of stress, economic downturn, or increased competition, management often increases its concern for the survival of the business and demands greater commitment to the bank goals. The public relations practitioner must be alert to these conditions, must understand that internal dissent and criticism of communication policies may be regarded as disloyal, but must continue to act professionally in the role of improving public perception of the bank in general, and marketing executives in particular. For public relation to survive in the banking industry in Nigeria, it must do more than build and maintain relationships with employees and neighbours. Public relations must help banks create an environment in which owners or investors are satisfied with the return on their invested capital. This motivation usually means that much of what is called open system models of public relations should be designed to help the marketing function attract new customers and keep customers satisfied with the banks product or services. Simply put, public relations must contribute to achieving the profit goal of the banks in the competitive environment of the banking industry in Nigeria. The competitive and private nature of the banks in Nigeria and the demands placed on each function make for variety in the role and stature of public relations. Its place in the banks should be determined by top managements concept of the function; hence the ongoing education process some practitioners find necessary in making the function part of the management team and professionalizing the practice. In some banks in Nigeria, public relations report to marketing, personnel, human resources, or even the legal department. In others, it reports directly to the CEO. Each bank tailors its public relations function to reflect the character and personality of its management, its corporate culture, and its tradition. But it is recommended in this study that public relations in the banking industry in Nigeria should be in the centre stage in helping to formulate policy and programs for carrying out the banks social responsibility in order to improve the public perception of the marketing executives for its profit imperativeness. References Black, S. (1989) introduction To Public Relations, London: Modino Press Limited. Broom, G.M and Dozier, D. M. (1986) Advancement For Public Relations Role Models Public Relations Review, 12(1): 37-56. Broom, G.M and Smith, G.D. (1979) Testing the Practitioners Impact on Clients Public Relations Review, 5(3): 47-59. Cornelissen, J. (2004) Corporate Communications: Theory and Practice, London, Thousand Oaks, CA, and New

82

Journal of Economics and Sustainable Development ISSN 2222-1700 (Paper) ISSN 2222-2855 (Online) Vol.4, No.8, 2013

www.iiste.org

Delhi: Sage. Cutlip, S.M; Center, A.H; and Broom, G.M. (2000) Effective Public Relations, Singapore: Pearson Education LTD. Dowling, G. (2001) Creating Corporate Reputation, Oxford: Oxford University Press. Grunig, J.E. and Grunig, L.A (2000) Public Relations in Strategic Management and Strategic Management of Public Relations: Theory and Evidence from the IABC Excellence Project Journalism Studies 1(2):303-321. Hutton, J.G. (2001) Designing the Relationship Between Public Relations and Marketing in Handbook of Public Relations, Health, R.L. (ed.), Thousand Oaks, CA: Sage. Ledingham, J.A. (2003) Explicating Relationship management as a General Theory of Public Relations Journal of Public Relations Research, 15(2):181 198. LEtang, J. (1999) Public Relations Education in Britain: An Historical Review in the Context of Professionalization Public Relation Review, 25(3):261-289. Nwosu I.E. and Uduji J.I (2009) Effective Performance Evaluation as a Strategy for Improving Workers Performance in Nigeria: A Study of Salespeople with Lessons for Public Relations and Other Officers Public Relations Journal, 6(1&2):79-94. Nwude E.C and Uduji J.I (2013) Implementing a Customer Relationship Management: The Proactive Steps For Sales Managers to Prevent A Sub-Optimized Sales force Performance European Journal of Business and Management, 5(2): 253-264. Nwude E.C and Uduji J.I (2013) Customer Relationship Management; A Strategic Imperative in the Pharmaceutical Industry in Nigeria Developing Country Studies, 3(1): 144-153. Tench, R. and Yeomans, L. (2006) Exploring Public Relations, Harlow: Pearson Education Ltd. Uduji J.I (2007) Public Relations and Corporate Image / Reputation Building and Management Public Relations Journals, 3(2): 165-179. Uduji J.I (2012) Public Relations Management, Enugu: His Glory Publications. About the Author Dr. Joseph Ikechukwu Uduji holds Ph.D (marketing), Ph.D (Public Administration), M.Sc (marketing), M.Sc (Public Relations), MBA (Management) and MPA (Public Administration) from the University of Nigeria. He is a full member of National Institute of marketing of Nigeria (NIMN); Nigeria Institute of Management (NIM); Nigeria Institute of Public Relations (NIPR). He lectures Sales Management, Public Relations, Marketing Management, Advertising and Marketing Communications in the University of Nigeria. He has published many books and journal articles in the filed of marketing, management and Public Relations. He is a regular preferred conference speaker for professional bodies in Nigeria and Sub-Sahara African. Dr. Joseph Ikechukwu Uduji has worked as a Regional Manager with Companies such as Wiggins Teap Plc. He is also a full ordained Zonal Pastor in the Redeemed Christian Church of God, Enugu and the Regional coordinator (South East of Nigeria) of the Redeemed Christian Bible College. He is a Board Member and Trustee of the Biblical-Africa. He is happily married with four children. He is domicile in Enugu, Nigeria West Africa.

83

Vous aimerez peut-être aussi

- Frustration Behaviors in Domestic DogsDocument18 pagesFrustration Behaviors in Domestic DogsLuis Antonio Buitron RamirezPas encore d'évaluation

- A Qualitative Study On The Perception of FatherhoodDocument18 pagesA Qualitative Study On The Perception of FatherhoodFariza NavaraPas encore d'évaluation

- The Impact of Teacher Immediacy On Student Participation: An Objective Cross-Disciplinary ExaminationDocument9 pagesThe Impact of Teacher Immediacy On Student Participation: An Objective Cross-Disciplinary ExaminationSergio RodriguezPas encore d'évaluation

- ID Hubungan Antara Self Esteem Dengan PenyeDocument36 pagesID Hubungan Antara Self Esteem Dengan PenyeDaniellePas encore d'évaluation

- Cheema 2017Document24 pagesCheema 2017Shah Nam DokhtarPas encore d'évaluation

- Job Satisfaction and EmployeeDocument14 pagesJob Satisfaction and EmployeeAinulPas encore d'évaluation

- Consilium: Analisis Tingkat Kecemasan Karir SiswaDocument10 pagesConsilium: Analisis Tingkat Kecemasan Karir SiswaRIFQIPas encore d'évaluation

- Kruskal WallisDocument13 pagesKruskal Wallisgkmishra2001 at gmail.comPas encore d'évaluation

- The Relationship Between Emotional Intelligence and SelfEfficacy Within The Higher Education PopulationDocument15 pagesThe Relationship Between Emotional Intelligence and SelfEfficacy Within The Higher Education PopulationAJHSSR JournalPas encore d'évaluation

- Jurnal Tesis: Analisis Pengaruh Motivasi, Disiplin Kerja Dan Kemampuan Kerja Terhadap Kinerja Pegawai Negeri SipilDocument56 pagesJurnal Tesis: Analisis Pengaruh Motivasi, Disiplin Kerja Dan Kemampuan Kerja Terhadap Kinerja Pegawai Negeri SipilBryan GintingPas encore d'évaluation

- Childhood Trauma and Current Psychological Functioning in Adults With Social Anxiety DisorderDocument7 pagesChildhood Trauma and Current Psychological Functioning in Adults With Social Anxiety DisorderAnda SlicPas encore d'évaluation

- Future Anxiety: Concept, Measurement, AND Preliminary ResearchDocument10 pagesFuture Anxiety: Concept, Measurement, AND Preliminary ResearchnerazziPas encore d'évaluation

- Savickas Et Al 2009 - A Paradigm For Career Constructing in The 21st CenturyDocument12 pagesSavickas Et Al 2009 - A Paradigm For Career Constructing in The 21st CenturyPaulo Fonseca100% (2)

- Understanding Behavioral Intention To ParticipateDocument8 pagesUnderstanding Behavioral Intention To ParticipateLuiz Fernando Silva PintoPas encore d'évaluation

- Contoh ProposalDocument16 pagesContoh ProposalEylah FadilahPas encore d'évaluation

- The Homesickness and Contentment Scale Developing A Culturally Sensitive Measure of Adjustment For AsianDocument17 pagesThe Homesickness and Contentment Scale Developing A Culturally Sensitive Measure of Adjustment For AsianLourdes García CurielPas encore d'évaluation

- Indri-The Theory of Reasoned Action Applied To Brand LoyaltyDocument11 pagesIndri-The Theory of Reasoned Action Applied To Brand LoyaltyakfaditadikapariraPas encore d'évaluation

- TITLE:-Investigating The Relationship Between Smartphone Addiction With Social Anxiety, Self Esteem, Sleep Quality, General Health and GenderDocument33 pagesTITLE:-Investigating The Relationship Between Smartphone Addiction With Social Anxiety, Self Esteem, Sleep Quality, General Health and GenderRanapartap SinghPas encore d'évaluation

- Theory of Reasoned ActionDocument8 pagesTheory of Reasoned ActionraulrajsharmaPas encore d'évaluation

- Parenting Styles in Relation To Self-Esteem and SCDocument37 pagesParenting Styles in Relation To Self-Esteem and SCKaiser04Pas encore d'évaluation

- McQuail, Dennis (1984) - Reflections On Uses and Gratifications StudiesDocument18 pagesMcQuail, Dennis (1984) - Reflections On Uses and Gratifications Studieslucaslsantana100% (1)

- Elijah Akintunde ReviewtheoriesandconceptsDocument15 pagesElijah Akintunde ReviewtheoriesandconceptsTyron De Lemon100% (1)

- Jurnal PsikologiDocument10 pagesJurnal PsikologiPungkyPas encore d'évaluation

- Constructivist and Narrative Approaches To Career DevelopmentDocument13 pagesConstructivist and Narrative Approaches To Career Developmentemanuel morales100% (1)

- Analisis Kebutuhan Pelatihan PerawatDocument10 pagesAnalisis Kebutuhan Pelatihan PerawatLIPTAPas encore d'évaluation

- 20160927220923B03 Values Attitude Job Satisfaction Nilai Sikap Dan Kepuasan KerjaDocument31 pages20160927220923B03 Values Attitude Job Satisfaction Nilai Sikap Dan Kepuasan KerjaSivaganesh SubramanyanPas encore d'évaluation

- The Determinants of Muslim Travellers ' Intention To Visit Non-Islamic Countries: A Halal Tourism ImplicationDocument24 pagesThe Determinants of Muslim Travellers ' Intention To Visit Non-Islamic Countries: A Halal Tourism ImplicationDio CalediPas encore d'évaluation

- Parenting StylesDocument9 pagesParenting StylesNuzhat TabassumPas encore d'évaluation

- 09 - Chapter 1 PDFDocument39 pages09 - Chapter 1 PDFThe AlchemistPas encore d'évaluation

- Sustainable Food ConsumptionDocument106 pagesSustainable Food ConsumptionFhamida IslamPas encore d'évaluation

- 2015 Idmp Employee Intentions Final PDFDocument19 pages2015 Idmp Employee Intentions Final PDFAstridPas encore d'évaluation

- Elsina Aponno, Juni 2017Document17 pagesElsina Aponno, Juni 2017Elsina Huberta AponnoPas encore d'évaluation

- Non Parametric TestingDocument42 pagesNon Parametric TestingdrnareshchauhanPas encore d'évaluation

- NURS - FPX 4060 - Romona Heywood - Assessment - 4-1Document8 pagesNURS - FPX 4060 - Romona Heywood - Assessment - 4-1SohaibPas encore d'évaluation

- Module 14. Albert Bandura's Social Learning TheoryDocument27 pagesModule 14. Albert Bandura's Social Learning TheoryTricia LicosPas encore d'évaluation

- Jurnal KepemimpinanDocument14 pagesJurnal KepemimpinanArfa YustianPas encore d'évaluation

- Ajzen TPB Obhdp1991 PDFDocument34 pagesAjzen TPB Obhdp1991 PDFHusna Hafiza Bt. R.AzamiPas encore d'évaluation

- Engaruh Attachment Terhadap Self-Disclosure PaDocument15 pagesEngaruh Attachment Terhadap Self-Disclosure Paxxx uuuPas encore d'évaluation

- Framework JournalDocument19 pagesFramework JournalFatin KhiruddinPas encore d'évaluation

- Consumer BehaviourDocument1 pageConsumer BehaviourMimi MyshaPas encore d'évaluation

- Armitage Efficacy of The Theory of Planned BehaviorDocument29 pagesArmitage Efficacy of The Theory of Planned BehaviorDristorXela100% (1)

- Research Paper On Social MediaDocument17 pagesResearch Paper On Social MediaMoiz SiddiquiPas encore d'évaluation

- Comparing Problem Based Learning With Case Based.10Document9 pagesComparing Problem Based Learning With Case Based.10sayacitraPas encore d'évaluation

- Use of Children in AdDocument63 pagesUse of Children in AdSanal NairPas encore d'évaluation

- Productattachments Files W o Work-Motivation-Scale-Administrators-Guide PDFDocument16 pagesProductattachments Files W o Work-Motivation-Scale-Administrators-Guide PDFRoxana-Teodora Achimescu100% (1)

- Effect of Emotional Quotient, Servant Leadership, Complexity of Task, Cultural Organization of Work Motivation and Performance of Civil State Apparatus (ASN) in Wajo South Sulawesi ProvinceDocument18 pagesEffect of Emotional Quotient, Servant Leadership, Complexity of Task, Cultural Organization of Work Motivation and Performance of Civil State Apparatus (ASN) in Wajo South Sulawesi ProvinceinventionjournalsPas encore d'évaluation

- Barnards Model of Decision MakingDocument15 pagesBarnards Model of Decision MakingNichol R. Broso100% (1)

- 2 Questioning and Wait Time - Ying DaiDocument4 pages2 Questioning and Wait Time - Ying Daiapi-310292407Pas encore d'évaluation

- Kecemasan Akademik1Document12 pagesKecemasan Akademik1Liza FizlinaPas encore d'évaluation

- Annotated BibliographyDocument3 pagesAnnotated Bibliographyapi-240834444Pas encore d'évaluation

- Awareness On Plagiarism Among Research Scholars of Sri Venkateswara University: A StudyDocument5 pagesAwareness On Plagiarism Among Research Scholars of Sri Venkateswara University: A StudyInternational Organization of Scientific Research (IOSR)Pas encore d'évaluation

- Cory Magdalena - Pengaruh Kepemimpinan Transformasional Dan Kepemimpinan Transaksional THDP KinerjaDocument20 pagesCory Magdalena - Pengaruh Kepemimpinan Transformasional Dan Kepemimpinan Transaksional THDP KinerjaandraaaaapmPas encore d'évaluation

- Role of Shs Heads and MotivationDocument234 pagesRole of Shs Heads and MotivationPapakofigyamfi RichiePas encore d'évaluation

- A Study On Investor Behavior in Choosing StockDocument11 pagesA Study On Investor Behavior in Choosing StockSemargarengpetrukbagPas encore d'évaluation

- Emotional Intelligence and Cross-Cultural Comm CompDocument7 pagesEmotional Intelligence and Cross-Cultural Comm CompRosolimou EviPas encore d'évaluation

- Teori-Teori Dalam Konseling PsikologiDocument195 pagesTeori-Teori Dalam Konseling Psikologihpp lptsemarangPas encore d'évaluation

- Participant Observation: History and DevelopmentDocument6 pagesParticipant Observation: History and DevelopmentAmadaLibertadPas encore d'évaluation

- Advertising Strategy of LG ElectronicsDocument71 pagesAdvertising Strategy of LG ElectronicsTushar Sethi74% (23)

- Majala Manza ProposalDocument19 pagesMajala Manza ProposalBarnababas BeyenePas encore d'évaluation

- Advertising Strategies OF LG Electronics: A Minor Project ReportDocument70 pagesAdvertising Strategies OF LG Electronics: A Minor Project ReportManju KengannarPas encore d'évaluation

- Assessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaDocument10 pagesAssessment of Knowledge, Attitude and Practices Concerning Food Safety Among Restaurant Workers in Putrajaya, MalaysiaAlexander DeckerPas encore d'évaluation

- Assessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaDocument10 pagesAssessing The Effect of Liquidity On Profitability of Commercial Banks in KenyaAlexander DeckerPas encore d'évaluation

- Assessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaDocument11 pagesAssessment For The Improvement of Teaching and Learning of Christian Religious Knowledge in Secondary Schools in Awgu Education Zone, Enugu State, NigeriaAlexander DeckerPas encore d'évaluation

- Analysis of Teachers Motivation On The Overall Performance ofDocument16 pagesAnalysis of Teachers Motivation On The Overall Performance ofAlexander DeckerPas encore d'évaluation

- An Overview On Co-Operative Societies in BangladeshDocument11 pagesAn Overview On Co-Operative Societies in BangladeshAlexander DeckerPas encore d'évaluation

- Analysis of Blast Loading Effect On High Rise BuildingsDocument7 pagesAnalysis of Blast Loading Effect On High Rise BuildingsAlexander DeckerPas encore d'évaluation

- An Experiment To Determine The Prospect of Using Cocoa Pod Husk Ash As Stabilizer For Weak Lateritic SoilsDocument8 pagesAn Experiment To Determine The Prospect of Using Cocoa Pod Husk Ash As Stabilizer For Weak Lateritic SoilsAlexander DeckerPas encore d'évaluation

- Agronomic Evaluation of Eight Genotypes of Hot Pepper (Capsicum SPP L.) in A Coastal Savanna Zone of GhanaDocument15 pagesAgronomic Evaluation of Eight Genotypes of Hot Pepper (Capsicum SPP L.) in A Coastal Savanna Zone of GhanaAlexander DeckerPas encore d'évaluation

- GRA 5917: Input Politics and Public Opinion: Panel Data Regression in Political EconomyDocument24 pagesGRA 5917: Input Politics and Public Opinion: Panel Data Regression in Political Economysathish_inboxPas encore d'évaluation

- T Test: Table of Critical T ValuesDocument7 pagesT Test: Table of Critical T ValuesMursalin Allin'kPas encore d'évaluation

- Comparative Analysis of Machine Learning Algorithms Using Diabetes DatasetDocument35 pagesComparative Analysis of Machine Learning Algorithms Using Diabetes DatasetHimangshu Shekhar Baruah100% (1)

- Literature SurveyDocument2 pagesLiterature Surveydevils devilPas encore d'évaluation

- Psychological Statistics AssignmentDocument4 pagesPsychological Statistics AssignmentyashitaPas encore d'évaluation

- Temp CalculationsDocument10 pagesTemp CalculationsRosalinda Giron PrincipePas encore d'évaluation

- Probabilistic Similarity MeasuresDocument20 pagesProbabilistic Similarity MeasuresPintu DasPas encore d'évaluation

- MethodologyDocument58 pagesMethodologyrogianeolinda122Pas encore d'évaluation

- OE & HS Subjects For 2020-21 - Ready To PrintDocument122 pagesOE & HS Subjects For 2020-21 - Ready To Printbharath hsPas encore d'évaluation

- Jerry Banks - CH 10Document12 pagesJerry Banks - CH 10Arief Rahman AlfithraPas encore d'évaluation

- Security ThesisDocument17 pagesSecurity ThesisRalph Celeste93% (15)

- IASSC Reference Document V1.4.2Document29 pagesIASSC Reference Document V1.4.2Eric DesportesPas encore d'évaluation

- Anova Random Examples and ExplanationDocument3 pagesAnova Random Examples and ExplanationipsaPas encore d'évaluation

- Jurnal Keperawatan Muhammadiyah: Pelangi Jiwa Aobama, Dedy PurwitoDocument11 pagesJurnal Keperawatan Muhammadiyah: Pelangi Jiwa Aobama, Dedy PurwitoVania Petrina CalistaPas encore d'évaluation

- 1 - Economie Industrielle - Plan Du CoursDocument9 pages1 - Economie Industrielle - Plan Du CoursHurbain GbaméléPas encore d'évaluation

- NTU AlgoProgrammeDocument3 pagesNTU AlgoProgrammerajibmishral7125Pas encore d'évaluation

- Analisa Data Menggunakan SpssDocument42 pagesAnalisa Data Menggunakan SpssTuan HaikalPas encore d'évaluation

- Heart Disease Prediction Using Machine LearningDocument7 pagesHeart Disease Prediction Using Machine LearningIJRASETPublicationsPas encore d'évaluation

- Cia 2Document14 pagesCia 2Shivangi GuptaPas encore d'évaluation

- Todini 1988Document12 pagesTodini 1988Andria AnriaPas encore d'évaluation

- BRM Article 2Document9 pagesBRM Article 2Henok AsemahugnPas encore d'évaluation

- The Moderating Effect of Kaizen Culture On The Relationship Between Innovation and Operational PerformanceDocument7 pagesThe Moderating Effect of Kaizen Culture On The Relationship Between Innovation and Operational Performanceahmad azmiPas encore d'évaluation

- Internasional JurnalDocument12 pagesInternasional JurnalSilvia SyuhaPas encore d'évaluation

- Evaluation Theory, Models, & Applications by Daniel LDocument3 pagesEvaluation Theory, Models, & Applications by Daniel LRocío de la CruzPas encore d'évaluation

- Buying Behaviour and Perceptions Regarding Branded Vs UnbrandedDocument10 pagesBuying Behaviour and Perceptions Regarding Branded Vs UnbrandedRoshni BishtPas encore d'évaluation

- Answer Report (Preditive Modelling)Document29 pagesAnswer Report (Preditive Modelling)Shweta Lakhera100% (1)

- Output Uji Reabilitas (LAMP 2)Document3 pagesOutput Uji Reabilitas (LAMP 2)rizka nur amaliaPas encore d'évaluation

- Code-Switching Attitudes and Practices and The Student'S Academic Achievement in English Research MethodologyDocument10 pagesCode-Switching Attitudes and Practices and The Student'S Academic Achievement in English Research Methodologygerlie maePas encore d'évaluation

- Project Report NavneetDocument63 pagesProject Report NavneetNavneet PalPas encore d'évaluation

- SHS Final Exam (Statistics)Document3 pagesSHS Final Exam (Statistics)Aljun PadiosPas encore d'évaluation

- Summary of Noah Kagan's Million Dollar WeekendD'EverandSummary of Noah Kagan's Million Dollar WeekendÉvaluation : 5 sur 5 étoiles5/5 (2)

- The 7 Habits of Highly Effective PeopleD'EverandThe 7 Habits of Highly Effective PeopleÉvaluation : 4 sur 5 étoiles4/5 (2567)

- The Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverD'EverandThe Coaching Habit: Say Less, Ask More & Change the Way You Lead ForeverÉvaluation : 4.5 sur 5 étoiles4.5/5 (186)

- Billion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsD'EverandBillion Dollar Lessons: What You Can Learn from the Most Inexcusable Business Failures of the Last Twenty-five YearsÉvaluation : 4.5 sur 5 étoiles4.5/5 (52)

- The First Minute: How to start conversations that get resultsD'EverandThe First Minute: How to start conversations that get resultsÉvaluation : 4.5 sur 5 étoiles4.5/5 (57)

- Spark: How to Lead Yourself and Others to Greater SuccessD'EverandSpark: How to Lead Yourself and Others to Greater SuccessÉvaluation : 4.5 sur 5 étoiles4.5/5 (132)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)

- High Road Leadership: Bringing People Together in a World That DividesD'EverandHigh Road Leadership: Bringing People Together in a World That DividesPas encore d'évaluation

- Scaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0D'EverandScaling Up: How a Few Companies Make It...and Why the Rest Don't, Rockefeller Habits 2.0Évaluation : 5 sur 5 étoiles5/5 (2)

- How to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobD'EverandHow to Talk to Anyone at Work: 72 Little Tricks for Big Success Communicating on the JobÉvaluation : 4.5 sur 5 étoiles4.5/5 (37)

- Sun Tzu: The Art of War for Managers; 50 Strategic RulesD'EverandSun Tzu: The Art of War for Managers; 50 Strategic RulesÉvaluation : 5 sur 5 étoiles5/5 (5)

- The Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceD'EverandThe Power of People Skills: How to Eliminate 90% of Your HR Problems and Dramatically Increase Team and Company Morale and PerformanceÉvaluation : 5 sur 5 étoiles5/5 (22)

- How to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersD'EverandHow to Lead: Wisdom from the World's Greatest CEOs, Founders, and Game ChangersÉvaluation : 4.5 sur 5 étoiles4.5/5 (95)

- Unlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsD'EverandUnlocking Potential: 7 Coaching Skills That Transform Individuals, Teams, & OrganizationsÉvaluation : 4.5 sur 5 étoiles4.5/5 (28)

- Transformed: Moving to the Product Operating ModelD'EverandTransformed: Moving to the Product Operating ModelÉvaluation : 4 sur 5 étoiles4/5 (1)

- The Introverted Leader: Building on Your Quiet StrengthD'EverandThe Introverted Leader: Building on Your Quiet StrengthÉvaluation : 4.5 sur 5 étoiles4.5/5 (35)

- The 7 Habits of Highly Effective People: 30th Anniversary EditionD'EverandThe 7 Habits of Highly Effective People: 30th Anniversary EditionÉvaluation : 5 sur 5 étoiles5/5 (337)

- Good to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tD'EverandGood to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tÉvaluation : 4.5 sur 5 étoiles4.5/5 (64)

- Leadership Skills that Inspire Incredible ResultsD'EverandLeadership Skills that Inspire Incredible ResultsÉvaluation : 4.5 sur 5 étoiles4.5/5 (11)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderD'EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderÉvaluation : 4.5 sur 5 étoiles4.5/5 (60)

- The Little Big Things: 163 Ways to Pursue ExcellenceD'EverandThe Little Big Things: 163 Ways to Pursue ExcellencePas encore d'évaluation

- Management Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowD'EverandManagement Mess to Leadership Success: 30 Challenges to Become the Leader You Would FollowÉvaluation : 4.5 sur 5 étoiles4.5/5 (27)

- 300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionD'Everand300+ PMP Practice Questions Aligned with PMBOK 7, Agile Methods, and Key Process Groups - 2024: First EditionÉvaluation : 5 sur 5 étoiles5/5 (1)

- Superminds: The Surprising Power of People and Computers Thinking TogetherD'EverandSuperminds: The Surprising Power of People and Computers Thinking TogetherÉvaluation : 3.5 sur 5 étoiles3.5/5 (7)

- The Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderD'EverandThe Friction Project: How Smart Leaders Make the Right Things Easier and the Wrong Things HarderPas encore d'évaluation

- The Effective Executive: The Definitive Guide to Getting the Right Things DoneD'EverandThe Effective Executive: The Definitive Guide to Getting the Right Things DoneÉvaluation : 4.5 sur 5 étoiles4.5/5 (469)

- 7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthD'Everand7 Principles of Transformational Leadership: Create a Mindset of Passion, Innovation, and GrowthÉvaluation : 5 sur 5 étoiles5/5 (52)