Académique Documents

Professionnel Documents

Culture Documents

Investors Often Overlook The

Transféré par

Soumava PaulCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Investors Often Overlook The

Transféré par

Soumava PaulDroits d'auteur :

Formats disponibles

Investors often overlook the balance sheet. Assets and liabilities aren't nearly as sexy as revenue andearnings.

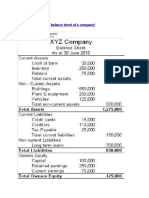

While earnings are important, they don't tell the whole story. The balance sheet highlights the financial condition of a company and is an integral part of the financial statements. (To read more on financial statement basics, see What You Need To Know About Financial Statements and Advanced Financial Statement Analysis.) The Snapshot of Health The balance sheet, also known as the statement of financial condition, offers a snapshot of a company's health. It tells you how much a company owns (its assets), and how much it owes (its liabilities). The difference between what it owns and what it owes is its equity, also commonly called "net assets" or "shareholders equity". The balance sheet tells investors a lot about a company's fundamentals: how much debt the company has, how much it needs to collect from customers (and how fast it does so), how much cash and equivalents it possesses and what kinds of funds the company has generated over time. The Balance Sheet's Main Three Assets, liability and equity are the three main components of the balance sheet. Carefully analyzed, they can tell investors a lot about a company's fundamentals. Assets There are two main types of assets: current assets and noncurrent assets. Current assets are likely to be used up or converted into cash within one business cycle - usually treated as twelve months. Three very important current asset items found on the balance sheet are: cash, inventories andaccounts receivables. Investors normally are attracted to companies with plenty of cash on their balance sheets. After all, cash offers protection against tough times, and it also gives companies more options for futuregrowth. Growing cash reserves often signal strong

company performance. Indeed, it shows that cash is accumulating so quickly that management doesn't have time to figure out how to make use of it. A dwindling cash pile could be a sign of trouble. That said, if loads of cash are more or less a permanent feature of the company's balance sheet, investors need to ask why the money is not being put to use. Cash could be there because management has run out of investment opportunities or is too short-sighted to know what to do with the money. Inventories are finished products that haven't yet sold. As an investor, you want to know if a company has too much money tied up in its inventory. Companies have limited funds available to invest in inventory. To generate the cash to pay bills and return a profit, they must sell the merchandise they have purchased from suppliers. Inventory turnover (cost of goods sold divided by average inventory) measures how quickly the company is moving merchandise through the warehouse to customers. If inventory grows faster than sales, it is almost always a sign of deteriorating fundamentals. Receivables are outstanding (uncollected bills). Analyzing the speed at which a company collects what it's owed can tell you a lot about its financial efficiency. If a company's collection period is growing longer, it could mean problems ahead. The company may be letting customers stretch their credit in order to recognize greater top-line sales and that can spell trouble later on, especially if customers face a cash crunch. Getting money right away is preferable to waiting for it - since some of what is owed may never get paid. The quicker a company gets its customers to make payments, the sooner it has cash to pay for salaries, merchandise, equipment, loans, and best of all, dividends and growth opportunities. Non-current assets are defined as anything not classified as a current asset. This includes items that are fixed assets, such as property, plant and equipment (PP&E). Unless the company is in financial distress and is liquidating assets, investors need not pay too much attention to fixed assets. Since companies are often unable to sell their fixed assets within any reasonable amount of time they are carried on the balance sheet at cost

regardless of their actual value. As a result, it's is possible for companies to grossly inflate this number, leaving investors with questionable and hard-to-compare asset figures. Liabilities There are current liabilities and non-current liabilities. Current liabilities are obligations the firm must pay within a year, such as payments owing to suppliers. Non-current liabilities, meanwhile, represent what the company owes in a year or more time. Typically, non-current liabilities represent bank and bondholder debt. You usually want to see a manageable amount of debt. When debt levels are falling, that's a good sign. Generally speaking, if a company has more assets than liabilities, then it is in decent condition. By contrast, a company with a large amount of liabilities relative to assets ought to be examined with more diligence. Having too much debt relative to cash flows required to pay for interest and debt repayments is one way a company can go bankrupt. Look at the quick ratio. Subtract inventory from current assets and then divide by current liabilities. If the ratio is 1 or higher, it says that the company has enough cash and liquid assets to cover its short-term debt obligations. Current Assets - Inventories Quick Ratio = Current Liabilities Equity Equity represents what shareholders own, so it is often called shareholder's equity. As described above, equity is equal to total assets minus total liabilities. Equity = Total Assets Total Liabilities The two important equity items are paid-in capital and retained earnings. Paid-in capital is the amount of money shareholders

paid for their shares when the stock was first offered to the public. It basically represents how much money the firm received when it sold its shares. In other words, retained earnings are a tally of the money the company has chosen to reinvest in the business rather than pay to shareholders. Investors should look closely at how a company puts retained capital to use and how a company generates a return on it.

Most of the information about debt can be found on the balance sheet - but some assets and debt obligations are not disclosed there. For starters, companies often possess hard-to-measure intangible assets. Corporate intellectual property (items such as patents, trademarks, copyrights and business methodologies), goodwill and brand recognition are all common assets in today's marketplace. But they are not listed on company's balance sheets. There is also off-balance sheet debt to be aware of. This is form of financing in which large capital expenditures are kept off of a company's balance sheet through various classification methods. Companies will often use off-balance-sheet financing to keep the debt levels low. (To continue reading about the balance sheet, see Reading The Balance Sheet, Testing Balance Sheet StrengthandBreaking Down The Balance Sheet.)

Vous aimerez peut-être aussi

- Understanding Financial Statements (Review and Analysis of Straub's Book)D'EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Évaluation : 5 sur 5 étoiles5/5 (5)

- Accounting BasicsDocument26 pagesAccounting BasicsAziz MalikPas encore d'évaluation

- Principles of Finance For Small BusinessDocument24 pagesPrinciples of Finance For Small BusinessSenelwa AnayaPas encore d'évaluation

- Financial Services Industry GuideDocument73 pagesFinancial Services Industry GuideTopsy KreatePas encore d'évaluation

- Session 5 - Ledger Format & Posting of TransactionsDocument33 pagesSession 5 - Ledger Format & Posting of Transactionsanandakumar100% (1)

- Balance Sheet Financial Statement AnalysisDocument5 pagesBalance Sheet Financial Statement AnalysisOld School Value100% (4)

- Analyze Cash Flow The Easy WayDocument2 pagesAnalyze Cash Flow The Easy Wayanilnair88Pas encore d'évaluation

- Business 7 Habits EffectsDocument6 pagesBusiness 7 Habits Effectssaba4533Pas encore d'évaluation

- Statement of Financial PositionDocument7 pagesStatement of Financial PositionshengPas encore d'évaluation

- Translation of Financial Statements of Foreign AffiliatesDocument15 pagesTranslation of Financial Statements of Foreign Affiliatesayu wanasari100% (2)

- Rahma Yeni Rosada - F0120105 - EPDocument6 pagesRahma Yeni Rosada - F0120105 - EPRahma RosadaPas encore d'évaluation

- CAIIB BFM Numerical Case Study by MuruganDocument36 pagesCAIIB BFM Numerical Case Study by MuruganRakesh Singh84% (44)

- CAIIB BFM Numerical Case Study by MuruganDocument36 pagesCAIIB BFM Numerical Case Study by MuruganRakesh Singh84% (44)

- ACCOUNTING AllPapersDocument128 pagesACCOUNTING AllPapersAbbas AliPas encore d'évaluation

- Studyplan RBI Grade B Officers Preliminary Objective PhaseI Exam Booklist Strategy Previous QuestionDocument16 pagesStudyplan RBI Grade B Officers Preliminary Objective PhaseI Exam Booklist Strategy Previous QuestionSoumava Paul100% (2)

- Credit Appraisal Means An InvestigationDocument3 pagesCredit Appraisal Means An InvestigationSoumava Paul100% (1)

- "Financial Statement Analysis of Bank of Maharashtra": A Project Report OnDocument65 pages"Financial Statement Analysis of Bank of Maharashtra": A Project Report OnShashi RanjanPas encore d'évaluation

- Balance SheetDocument9 pagesBalance SheetMARL VINCENT L LABITADPas encore d'évaluation

- Corporate FininanceDocument10 pagesCorporate FininanceMohan KottuPas encore d'évaluation

- Bahasa-Inggris Profesi (Tugas 5) - Hiskia Lolowang (19304024)Document3 pagesBahasa-Inggris Profesi (Tugas 5) - Hiskia Lolowang (19304024)HISKIA LOLOWANG S1 AkuntansiPas encore d'évaluation

- Understanding Noncurrent LiabilitiesDocument8 pagesUnderstanding Noncurrent LiabilitiesThalia Rhine AbertePas encore d'évaluation

- How The Balance Sheet WorksDocument5 pagesHow The Balance Sheet Worksrimpyagarwal100% (1)

- English Assignment: Name: Fioren Patricia Venesa Kaunang ID No. 19304036 Accounting A, Sem 3Document3 pagesEnglish Assignment: Name: Fioren Patricia Venesa Kaunang ID No. 19304036 Accounting A, Sem 3Fioren KaunangPas encore d'évaluation

- Stock ResearchDocument50 pagesStock Researchvikas yadavPas encore d'évaluation

- Reading The Balance SheetDocument4 pagesReading The Balance Sheetsandipghosh123Pas encore d'évaluation

- Financial Statements ExplainedDocument7 pagesFinancial Statements ExplainedAbdul Basit ChaudhryPas encore d'évaluation

- Balance Sheet Assets Liabilities Income StatementDocument4 pagesBalance Sheet Assets Liabilities Income Statementmadhav5544100% (1)

- Current Assets & Current LiabilitiesDocument11 pagesCurrent Assets & Current LiabilitiesRoshni ChhabriaPas encore d'évaluation

- A Balance SheetDocument3 pagesA Balance SheetKarthik ThotaPas encore d'évaluation

- Assessment 2 Part ADocument11 pagesAssessment 2 Part AChriseth CruzPas encore d'évaluation

- How To Read A Balance Sheet BigDocument8 pagesHow To Read A Balance Sheet BigSumit SinghPas encore d'évaluation

- FM AssignmentDocument8 pagesFM Assignmentmihir_s9Pas encore d'évaluation

- Fs 24 FormulasDocument36 pagesFs 24 FormulasMarylinPas encore d'évaluation

- What is a Balance Sheet? (40Document5 pagesWhat is a Balance Sheet? (40John LucaPas encore d'évaluation

- Cash Management ExplanationDocument6 pagesCash Management ExplanationtacangbadettePas encore d'évaluation

- Understanding Financial StatementsDocument12 pagesUnderstanding Financial StatementsEvans MandinyanyaPas encore d'évaluation

- Accounting: 2.financial StatementsDocument4 pagesAccounting: 2.financial StatementsYinan CuiPas encore d'évaluation

- Why Negative Cash Flow from Investing Activities May Not Be a ConcernDocument3 pagesWhy Negative Cash Flow from Investing Activities May Not Be a ConcernAshish DubeyPas encore d'évaluation

- How To Read Balance SheetDocument28 pagesHow To Read Balance SheetAnupam JyotiPas encore d'évaluation

- Balance SheetDocument8 pagesBalance SheetadjeponehPas encore d'évaluation

- Balance Sheet 3Document11 pagesBalance Sheet 3Sanjay MehrotraPas encore d'évaluation

- Debt FinancingDocument8 pagesDebt FinancingZuhaib AhmedPas encore d'évaluation

- Tutorial 3 (Financial Management)Document2 pagesTutorial 3 (Financial Management)muthuPas encore d'évaluation

- Cash FlowDocument3 pagesCash FlowSaad Khan YTPas encore d'évaluation

- Profitability vs liquidity: Why cash flow matters more than profitsDocument5 pagesProfitability vs liquidity: Why cash flow matters more than profitsEdu TainmentPas encore d'évaluation

- Unit II POEDocument36 pagesUnit II POErachuriharika.965Pas encore d'évaluation

- UntitledDocument3 pagesUntitledLouella SurtinPas encore d'évaluation

- Slide 1Document17 pagesSlide 1Vishal BhadanePas encore d'évaluation

- Engineering EconomicsDocument12 pagesEngineering EconomicsAwais SiddiquePas encore d'évaluation

- Static 1Document16 pagesStatic 1Anurag SinghPas encore d'évaluation

- Financial Accounting: Sir Syed Adeel Ali BukhariDocument25 pagesFinancial Accounting: Sir Syed Adeel Ali Bukhariadeelali849714Pas encore d'évaluation

- 1.1 The Importance of Working Capital Management Working Capitalit Is The Capital Used To Run The Day-To-Day Business Operations. Usually, The GapDocument11 pages1.1 The Importance of Working Capital Management Working Capitalit Is The Capital Used To Run The Day-To-Day Business Operations. Usually, The GapShesha Nimna GamagePas encore d'évaluation

- Statement of Financial PositionDocument11 pagesStatement of Financial Positionshafira100% (1)

- ROA Net Income/Average Total Asset: Current Assets Current LiabilitiesDocument8 pagesROA Net Income/Average Total Asset: Current Assets Current Liabilitiesal pacinoPas encore d'évaluation

- Working Capital On Telecommunication IndustryDocument54 pagesWorking Capital On Telecommunication IndustrySAGARPas encore d'évaluation

- How To Read Balance SheetDocument6 pagesHow To Read Balance SheetDanish SheikhPas encore d'évaluation

- 8 Steps For Analysing A Balance Sheet PDFDocument2 pages8 Steps For Analysing A Balance Sheet PDFJaggarwal SaabPas encore d'évaluation

- LiquidityDocument5 pagesLiquidityMobin ShaleePas encore d'évaluation

- Managing Working Capital: A Guide to Current Assets and LiabilitiesDocument4 pagesManaging Working Capital: A Guide to Current Assets and LiabilitiesFabia ArshadPas encore d'évaluation

- Fofm Word File Roll No 381 To 390Document26 pagesFofm Word File Roll No 381 To 390Spandan ThakkarPas encore d'évaluation

- BT Giao Lop, Đã Chia Nhóm-Unit 3Document10 pagesBT Giao Lop, Đã Chia Nhóm-Unit 3Hoàng Ngọc ÁnhPas encore d'évaluation

- Understanding The Balance SheetDocument11 pagesUnderstanding The Balance Sheetosuna.osirisPas encore d'évaluation

- Financial Statement AnalysisDocument5 pagesFinancial Statement Analysisyashvardan shahPas encore d'évaluation

- Higher Return of CapitalDocument10 pagesHigher Return of CapitalShesha Nimna GamagePas encore d'évaluation

- 5 AbcDocument3 pages5 AbcMohammed ThousifPas encore d'évaluation

- CPA Financial AccountingDocument72 pagesCPA Financial AccountingElysé KaregeyaPas encore d'évaluation

- Corporate Finance 1Document5 pagesCorporate Finance 1kmandeepkumar1994Pas encore d'évaluation

- Oyster Price List1Document37 pagesOyster Price List1Soumava PaulPas encore d'évaluation

- 3 11 16niftysignDocument32 pages3 11 16niftysignSoumava PaulPas encore d'évaluation

- Contents RevisedDocument92 pagesContents RevisedAnoopKumarMangarajPas encore d'évaluation

- Candidates Called For Interview For GETsDocument10 pagesCandidates Called For Interview For GETsSoumava PaulPas encore d'évaluation

- Account Opening MainDocument1 pageAccount Opening MainSoumava PaulPas encore d'évaluation

- Options TraderDocument2 pagesOptions TraderSoumava PaulPas encore d'évaluation

- CH 7 OLC Two Security ModelDocument2 pagesCH 7 OLC Two Security ModelSoumava PaulPas encore d'évaluation

- Os WP 282512Document69 pagesOs WP 282512Soumava PaulPas encore d'évaluation

- Resisting Rupee Appreciation PDFDocument4 pagesResisting Rupee Appreciation PDFSoumava PaulPas encore d'évaluation

- Accounting For Regulation PSDocument65 pagesAccounting For Regulation PSbarakkat72Pas encore d'évaluation

- Tips For Sme Loans FinalDocument5 pagesTips For Sme Loans FinalSoumava PaulPas encore d'évaluation

- How To Read A Balance Sheet BigDocument8 pagesHow To Read A Balance Sheet BigSumit SinghPas encore d'évaluation

- Rupee-Dollar Option Pricing and Risk Measurement: Jump Processes, Changing Volatility and Kurtosis ShiftsDocument22 pagesRupee-Dollar Option Pricing and Risk Measurement: Jump Processes, Changing Volatility and Kurtosis ShiftsSoumava PaulPas encore d'évaluation

- CAIIB Elective Papers Low 032013Document14 pagesCAIIB Elective Papers Low 032013Soumava PaulPas encore d'évaluation

- Hostile TakeoverDocument11 pagesHostile Takeoverapi-3847322100% (1)

- VaR Models in Indian Stock MarketDocument16 pagesVaR Models in Indian Stock Marketapi-3715003100% (1)

- FFDFDocument26 pagesFFDFSoumava PaulPas encore d'évaluation

- Indian Money Market: Market Structure, Covered Parity and Term StructureDocument12 pagesIndian Money Market: Market Structure, Covered Parity and Term StructureSoumava PaulPas encore d'évaluation

- Sbi Po 2013Document3 pagesSbi Po 2013Badvel Sasidhar ReddyPas encore d'évaluation

- Vik18 1Document18 pagesVik18 1meetwithsanjayPas encore d'évaluation

- Corporate GovernanceDocument17 pagesCorporate Governanceengineerkranthi4055Pas encore d'évaluation

- Indian Financial Sector After A Decade of ReformsDocument41 pagesIndian Financial Sector After A Decade of ReformsKrishna PaudelPas encore d'évaluation

- Core BankingDocument52 pagesCore Bankingaidan4funPas encore d'évaluation

- Fdi ConceptsDocument87 pagesFdi Conceptsjp1mennakantiPas encore d'évaluation

- Group 1Document53 pagesGroup 1Nishma BaniyaPas encore d'évaluation

- Quiz 1 - Intacc 2Document9 pagesQuiz 1 - Intacc 2Eleina SwiftPas encore d'évaluation

- Analyzing Long Term AssetsDocument18 pagesAnalyzing Long Term AssetsJähäñ ShërPas encore d'évaluation

- Kota Fibres, Ltd. (FIX)Document10 pagesKota Fibres, Ltd. (FIX)Aldo MadonaPas encore d'évaluation

- CF WACC, WC NewDocument5 pagesCF WACC, WC NewSanjana PottipallyPas encore d'évaluation

- Perpetual - Financial StatementsDocument4 pagesPerpetual - Financial StatementsJeon Cyrone CuachonPas encore d'évaluation

- FAR04 01.4 Interim ReportingDocument9 pagesFAR04 01.4 Interim Reportingnicole bancoroPas encore d'évaluation

- Stability First Annual Report 2020Document12 pagesStability First Annual Report 2020Matt MundtPas encore d'évaluation

- Build a Model to Forecast Henley Corp's FCFDocument7 pagesBuild a Model to Forecast Henley Corp's FCFAmmarPas encore d'évaluation

- MC 2022 25 CooperativesDocument79 pagesMC 2022 25 CooperativesRonnell Vic Cañeda YuPas encore d'évaluation

- 6881 - Accounting ProcessDocument4 pages6881 - Accounting ProcessMaximusPas encore d'évaluation

- Financial Statements, Cash Flow AnalysisDocument41 pagesFinancial Statements, Cash Flow AnalysisMinhaz Ahmed0% (1)

- Objective of IAS 1Document10 pagesObjective of IAS 1April IsidroPas encore d'évaluation

- Workshop Lecture 4 QsDocument8 pagesWorkshop Lecture 4 QsabhirejanilPas encore d'évaluation

- Example of Deferred Tax LiabilityDocument1 pageExample of Deferred Tax Liabilityarjun-chopra-4887Pas encore d'évaluation

- Accounting Compress PDFDocument9 pagesAccounting Compress PDFJade jade jadePas encore d'évaluation

- Analisa SahamDocument10 pagesAnalisa SahamGede AriantaPas encore d'évaluation

- Basic Accounting - Ballada Problem 11, 12Document2 pagesBasic Accounting - Ballada Problem 11, 12kogigi2205Pas encore d'évaluation

- Introduction to Financial StatementsDocument4 pagesIntroduction to Financial StatementsHoàng HuyPas encore d'évaluation

- Consolidated Balance Sheets of Holding and Subsidiary CompaniesDocument11 pagesConsolidated Balance Sheets of Holding and Subsidiary CompaniesMr. 360Pas encore d'évaluation

- Analisis Studi Kelayakan Usaha Pendirian Home IndustryDocument10 pagesAnalisis Studi Kelayakan Usaha Pendirian Home IndustryNabilla FirdausPas encore d'évaluation

- Issuance of Share and DebenturesDocument5 pagesIssuance of Share and DebentureshamdanPas encore d'évaluation

- Garnet Company Financial Statement AnalysisDocument4 pagesGarnet Company Financial Statement AnalysisManuel MagadatuPas encore d'évaluation

- CH 05Document46 pagesCH 05Waseem Ahmad QurashiPas encore d'évaluation