Académique Documents

Professionnel Documents

Culture Documents

PGD in Financial Manage C-1

Transféré par

Anu VenkateshCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

PGD in Financial Manage C-1

Transféré par

Anu VenkateshDroits d'auteur :

Formats disponibles

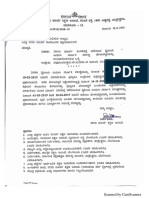

*DF01*

DF 01

P.G. Diploma in Financial Management Examination, August 2009 (New Scheme) Course I : FINANCIAL MANAGEMENT

Time : 3 Hours SECTION A 1. Answer all the sub-questions. Each question carries 2 marks. a) Define Financial Management. b) What is optimum capital structure ? c) How do you compute net working capital ? d) What is NPV ? e) Highlight two limitations of traditional capital budgeting. SECTION B Answer any five questions. Each question carries 5 marks. (55=25) 2. A rupee in hand today is worth more than a rupee to be received in the future. Explain. 3. Discuss advantages and disadvantages of CAPM Model. 4. Write a note on profit and wealth maximization. 5. Define business finance and discuss its scope. 6. Describe the major types of financial decisions that business firms make. 7. Which ratios are most useful to test the firms liquidity ? Why ? 8. What are the determinants of working capital ? 9. Describe different types of dividend policies. SECTION C Answer any three questions. Each question carries 10 marks. (310=30) 10. Examine Net Operating Income Approach to capital structure. Also compare this approach with Net Income Approach. 11. What is ratio analysis ? Discuss the significance of ratio analysis in financial decisions. (52=10) Max. Marks : 80

P.T.O.

DF 01

*DF01*

12. What do you understand by cost of capital ? Discuss its significance in capital budgeting decision. 13. Modern pharmaceutical has been in operation for 10 years. The company has total capital of Rs. 3.40 crore comprising equity capital and reserves of Rs. 2 crore and long term borrowings of Rs. 1 crore and cash credit from Banks of Rs. 40 lakh. The working capital of the company is Rs. 1.70 crore. Stocks amounted to Rs. 60 lakh, stores Rs. 28 lakh, debtors Rs. 70 lakh and advances and deposits Rs. 12 lakh. Annual sale is Rs. 1.60 crore. Calculate current ratio, quick ratio, debt-equity ratio and proprietary ratio. 14. Firms X and Y are homogeneous in all respects except 1) that firm X is levered while firm Y is unlevered. Firm X has Rs. 2 lakhs debt of 10%, 2) that tax rate is 50%, 3) that EBIT is Rs. 60,000 and that equity-capitalization rate for both the company is 12%. What would be the value for each firm according to M-Ms approach ? 15. Shakti Electricals Ltd. sells goods on cash as well as on credit. The following particulars are extracted from their financial statements for the year ending on 31st March 2008 : (Rs. in Crores) Total Gross Profit 150.0 Cash sales (included in above) 30.0 Sales returns 10.5 Total debtors for sales (as on 31-3-2008) 13.5 Bills Receivable (as on 31-3-2008) 3.0 Provision for doubtful debts (as on 31-3-2008) 1.5 Total creditors (as on 31-3-2008) 15.0 Calculate average collection period. SECTION D Answer any one question. Question carries 15 marks. (115=15) 16. What is the basic problem which a finance manager has to face while managing receivables ? How should credit policy be designed to solve the problem ? 17. The management of Jay Electric Wire desires to invest Rs. 24,000 in a project which will give earnings for five years. The earnings after tax and before depreciation will be Rs. 6,000 in the first year, Rs. 12,000 in the second year, Rs. 12,000 in the third year, Rs. 6,000 in the fourth year and Rs. 3,000 in the fifth year. Should the management invest the project ? The management uses 10% discount rate for the computation of present value.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- TBChap 010Document42 pagesTBChap 010varun cyw100% (3)

- HidesignDocument17 pagesHidesignamankanojia1992Pas encore d'évaluation

- Exam Time TableDocument3 pagesExam Time TableAnu VenkateshPas encore d'évaluation

- Curriculum Vitae: Anu. GDocument5 pagesCurriculum Vitae: Anu. GAnu VenkateshPas encore d'évaluation

- Numbers To WordsDocument3 pagesNumbers To WordsAnu VenkateshPas encore d'évaluation

- Numbers To WordsDocument3 pagesNumbers To WordsAnu VenkateshPas encore d'évaluation

- Contract Labour Regulation Abolition Act Tamil NaduDocument5 pagesContract Labour Regulation Abolition Act Tamil NaduAnu VenkateshPas encore d'évaluation

- Contract Labour Regulation Abolition Act Tamil NaduDocument5 pagesContract Labour Regulation Abolition Act Tamil NaduAnu VenkateshPas encore d'évaluation

- 6 Kvat Commodity CodeDocument11 pages6 Kvat Commodity CodeAnu VenkateshPas encore d'évaluation

- Form Ba Welath TaxDocument8 pagesForm Ba Welath TaxAnu VenkateshPas encore d'évaluation

- E-TDS RPU Setup ReadmeDocument3 pagesE-TDS RPU Setup ReadmeNitinAggarwalPas encore d'évaluation

- Form No. 1: Application For Permission To Construct, Extend or To Take Into Use Any Building As A FactoryDocument2 pagesForm No. 1: Application For Permission To Construct, Extend or To Take Into Use Any Building As A FactoryAnu VenkateshPas encore d'évaluation

- 21 - How To Export & Import Data in TallyDocument3 pages21 - How To Export & Import Data in TallyAnu VenkateshPas encore d'évaluation

- Ratio AnalysisDocument5 pagesRatio AnalysisAnu VenkateshPas encore d'évaluation

- Using Excel As Audit Tool - 1Document2 pagesUsing Excel As Audit Tool - 1joseph davidPas encore d'évaluation

- 1 Salary Wages Sheet With Esi Epf Calculation or Advance Labour Welfare FundDocument4 pages1 Salary Wages Sheet With Esi Epf Calculation or Advance Labour Welfare FundAnu VenkateshPas encore d'évaluation

- 1 Salary Wages Sheet With Esi Epf Calculation or Advance Labour Welfare FundDocument3 pages1 Salary Wages Sheet With Esi Epf Calculation or Advance Labour Welfare FundAnu VenkateshPas encore d'évaluation

- Chuẩn mực - YODocument35 pagesChuẩn mực - YOGiang Thái HươngPas encore d'évaluation

- Installment SalesDocument5 pagesInstallment SalesMarianne LanuzaPas encore d'évaluation

- 2019 Merkle Facebook Playbook Online PDFDocument20 pages2019 Merkle Facebook Playbook Online PDFLadyRiRiPas encore d'évaluation

- Social Marketing Seeks To Develop and Integrate Marketing Concepts With Other Approaches To InfluenceDocument2 pagesSocial Marketing Seeks To Develop and Integrate Marketing Concepts With Other Approaches To InfluenceMitrofan AnaPas encore d'évaluation

- PROFITMART - Franchisee-1Document17 pagesPROFITMART - Franchisee-1Suyash KhairnarPas encore d'évaluation

- Sadiq ProjectDocument110 pagesSadiq ProjectSaqlain MustaqPas encore d'évaluation

- Porter SM Ch. 10 - 2ppDocument35 pagesPorter SM Ch. 10 - 2ppmfawzi010Pas encore d'évaluation

- Manufacturing Operations ManagementDocument32 pagesManufacturing Operations ManagementPawa Web IT ConsultPas encore d'évaluation

- QuestionnaireDocument3 pagesQuestionnaireAnimesh SamalPas encore d'évaluation

- Excercise - TBDocument2 pagesExcercise - TBammadey21@gmail.comPas encore d'évaluation

- Syllabus MBA JISU Final PDFDocument51 pagesSyllabus MBA JISU Final PDFNaredla Suman KumarPas encore d'évaluation

- FHBM1124 Marketing Chapter 6-Segmentation Targeting PositioningDocument55 pagesFHBM1124 Marketing Chapter 6-Segmentation Targeting PositioningBenkingcyeoh50% (2)

- MANAC Session 2Document18 pagesMANAC Session 2Abhinav ChauhanPas encore d'évaluation

- Chapter-2 Dynamic Marketing EnvironmentDocument27 pagesChapter-2 Dynamic Marketing Environmentshilpa sardanaPas encore d'évaluation

- BUSCOM Test Bank 2Document22 pagesBUSCOM Test Bank 2Liberty NovaPas encore d'évaluation

- Jugoremedija AD, Zrenjanin - Company ProfileDocument8 pagesJugoremedija AD, Zrenjanin - Company Profilejohn_tramp_1Pas encore d'évaluation

- List Job ApplicationsDocument43 pagesList Job ApplicationsfaizahabdullahPas encore d'évaluation

- BRM Assignment 2-171063Document2 pagesBRM Assignment 2-171063Ameer hamzaPas encore d'évaluation

- Economics and Society NotesDocument46 pagesEconomics and Society NotesArkar Myo KyawPas encore d'évaluation

- Tactical Decision MakingDocument41 pagesTactical Decision Makingvania_sabrinaPas encore d'évaluation

- Chapter 7 InventoriesDocument25 pagesChapter 7 InventoriesAna Leah DelfinPas encore d'évaluation

- Analysis of BankruptcyDocument15 pagesAnalysis of BankruptcyDrRam Singh KambojPas encore d'évaluation

- Vidhyoday - BCK Revision ChartsDocument21 pagesVidhyoday - BCK Revision Chartsmishrakumkum526Pas encore d'évaluation

- Blackbook M&aDocument74 pagesBlackbook M&aSiddhartha100% (1)

- Cost Accounting 2Document1 pageCost Accounting 2ExequielCamisaCrusperoPas encore d'évaluation

- Canandaigua National Bank Annual ReportDocument59 pagesCanandaigua National Bank Annual ReportTodd ClausenPas encore d'évaluation

- Week 5 - Risk Analysis and LeverageDocument20 pagesWeek 5 - Risk Analysis and LeveragePollsPas encore d'évaluation

- SCM - Chapter 2Document35 pagesSCM - Chapter 2Talha6775Pas encore d'évaluation