Académique Documents

Professionnel Documents

Culture Documents

TaxDigests (Part II)

Transféré par

Lexie Go CedenioDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

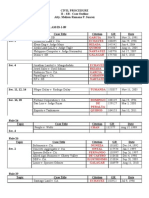

TaxDigests (Part II)

Transféré par

Lexie Go CedenioDroits d'auteur :

Formats disponibles

Progressive Development Corporation vs.

Quezon City Facts: The City Council of QC passed an ordinance known as the Market Code of QC, which imposed a 5% supervision fee on gross receipts on rentals or lease of privately-owned market spaces in QC. In case of failure of the owners of the market spaces to pay the tax for three consecutive months, the City shall revoke the permit of the privately-owned market to operate. Progressive Development Corp, owner and operator of Farmers Market, filed a petition for prohibition against QC on the ground that the tax imposed by the Market Code was in reality a tax on income, which the municipal corporation was prohibited by law to impose. Issue: Whether or not the supervision fee is an income tax or a license fee. Held: It is a license fee. A LICENSE FEE is imposed in the exerciseof the police power primarily for purposes of regulation, while TAX is imposed under the taxing power primarily for purposes of raising revenues. If the generating of revenue is the primary purpose and regulation is merely incidental, the imposition is a tax; but if regulation is the primary purpose, the fact that incidentally, revenue is also obtained does not make the imposition a tax. To be considered a license fee, the imposition must relate to an occupation or activity that so engages the public interest in health, morals, safety, and development as to require regulation for the protection and promotion of such public interest; the imposition must also bear a reasonable relation to the probable expenses of regulation, taking into account not only the costs of direct regulation but also its incidental consequences. In this case, the Farmers Market is a privately-owned market established for the rendition of service to the general public. It warrants close supervision and control by the City for the protection of the health of the public by insuring the maintenance of sanitary conditions, prevention of fraud upon the buying public, etc. Since the purpose of the ordinance is primarily regulation and not revenue generation, the tax is a license fee. The use of the gross amount of stall rentals as basis for determining the collectible amount of license tax does not, by itself, convert the license tax into a prohibited tax on income. Such basis actually has a reasonable relationship to the probable costs of regulation and supervision of Progressives kind of business, since ordinarily, the higher the amount of rentals, the higher the volume of items sold. The higher the volume of goods sold, the greater the extent and frequency of supervision and inspection may be required in the interest of the buying public.

PHILIPPINE AIRLINES, INC. v. EDU

PHILIPPINE AIRLINES, INC. v. EDU G.R. No. L- 41383, August 15, 1988

FACTS: The Philippine Airlines (PAL) is a corporation engaged in the air transportation business under a legislative franchise, Act No. 42739. Under its franchise, PAL is exempt from the payment of taxes. Sometime in 1971, however, Land Transportation Commissioner Romeo F. Elevate (Elevate) issued a regulation pursuant to Section 8, Republic Act 4136, otherwise known as the Land and Transportation and Traffic Code, requiring all tax exempt entities, among them PAL to pay motor vehicle registration fees. Despite PAL's protestations, Elevate refused to register PAL's motor vehicles unless the amounts imposed under Republic Act 4136 were paid. PAL thus paid, under protest, registration fees of its motor vehicles. After paying under protest, PAL through counsel, wrote a letter dated May 19,1971, to Land Transportation Commissioner Romeo Edu (Edu) demanding a refund of the amounts paid. Edu denied the request for refund. Hence, PAL filed a complaint against Edu and National Treasurer Ubaldo Carbonell (Carbonell).

The trial court dismissed PAL's complaint. PAL appealed to the Court of Appeals which in turn certified the case to the Supreme Court.

ISSUE: Whether or not motor vehicle registration fees are considered as taxes.

RULING: Yes. If the purpose is primarily revenue, or if revenue is, at least, one of the real and substantial purposes, then the exaction is properly called a tax. Such is the case of motor vehicle registration fees. The motor vehicle registration

fees are actually taxes intended for additional revenues of the government even if one fifth or less of the amount collected is set aside for the operating expenses of the agency administering the program.

Esso Standard Eastern Inc. vs. CIR (G.R. Nos. L-28508-9, July 7, 1989)

Post under case digests, Taxation at Saturday, March 10, 2012 Posted by Schizophrenic Mind Facts: In CTA Case No. 1251, Esso Standard Eastern Inc. (Esso) deducted from its gross income for 1959, as part of its ordinary and necessary business expenses, the amount it had spent for drilling and exploration of its petroleum concessions. This claim was disallowed by the Commissioner of Internal Revenue (CIR) on the ground that the expenses should be capitalized and might be written off as a loss only when a "dry hole" should result. Esso then filed an amended return where it asked for the refund of P323,279.00 by reason of its abandonment as dry holes of several of its oil wells. Also claimed as ordinary and necessary expenses in the same return was the amount of P340,822.04, representing margin fees it had paid to the Central Bank on its profit remittances to its New York head office.

On August 5, 1964, the CIR granted a tax credit of P221,033.00 only, disallowing the claimed deduction for the margin fees paid on the ground that the margin fees paid to the Central Bank could not be considered taxes or allowed as deductible business expenses.

Esso appealed to the Court of Tax Appeals (CTA) for the refund of the margin fees it had earlier paid contending that the margin fees were deductible from gross income either as a tax or as an ordinary and necessary business expense. However, Essos appeal was denied.

Issues: (1) Whether or not the margin fees are taxes.

(2) Whether or not the margin fees are necessary and ordinary business expenses.

Held: (1) No. A tax is levied to provide revenue for government operations, while the proceeds of the margin fee are applied to strengthen our country's international reserves. The margin fee was imposed by the State in the exercise of its police power and not the power of taxation.

(2) No. Ordinarily, an expense will be considered 'necessary' where the expenditure is appropriate and helpful in the development of the taxpayer's business. It is 'ordinary' when it connotes a payment which is normal in relation to the business of the taxpayer and the surrounding circumstances. Since the margin fees in question were incurred for the remittance of funds to Esso's Head Office in New York, which is a separate and distinct income taxpayer from the branch in the Philippines, for its disposal abroad, it can never be said therefore that the margin fees were appropriate and helpful in the development of Esso's business in the Philippines exclusively or were incurred for purposes proper to the conduct of the affairs of Esso's branch in the Philippines exclusively or for the purpose of realizing a profit or of minimizing a loss in the Philippines exclusively. If at all, the margin fees were incurred for purposes proper to the conduct of the corporate affairs of Esso in New York, but certainly not in the Philippines.

Apostolic Prefect of Mt. Province vs Treasurer of Baguio

Exemption From Taxation Assessment

FACTS

In 1937, an ordinance (Ord. 137) was passed in the City of Baguio. The said ordinance sought to assess properties of property owners within the defined city limits. APMP, on the other hand, is a religious corporation duly established under Philippine laws. Pursuant to the ordinance, it contributed a total amount of P1,019.37. It filed the said contribution in protest. APMP later averred that it should be exempt from the said special contribution since as a religious institution, it has a constitutionally guaranteed right not to be taxed including its properties. ISSUE:

Whether or not APMP is exempt from taxes.

HELD:

The test of exemption from taxation is the use of the property for purposes mentioned in the Constitution. Based on Justice Cooleys words: "While the word 'tax' in its broad meaning, includes both general taxes and special assessments, and in a general sense a tax is an assessment, and an assessment is a tax, yet there is a recognized distinction between them in that assessment is confined to local impositions upon property for the payment of the cost of public improvements in its immediate vicinity and levied with reference to special benefits to the property assessed. The differences between a special assessment and a tax are that (1) a special assessment can be levied only on land; (2) a special assessment cannot (at least in most states) be made a personal liability of the person assessed; (3) a special assessment is based wholly on benefits; and (4) a special assessment is exceptional both as to time and locality. The imposition of a charge on all property, real and personal, in a prescribed area, is a tax and not an assessment, although the purpose is to make a local improvement on a street or highway. A charge imposed only on property owners benefited is a special assessment rather than a tax notwithstanding the statute calls it a tax." In the case at bar, the Prefect cannot claim exemption because the assessment is not taxation per se but rather a system for the benefits of the inhabitants of the city.

NDC V. CIR 151 SCRA 472 FACTS: NDC entered into contracts with several shipbuilders in Japan for the construction of ocean-going vessels. The purchase price was to be secured by proceeds of bonds issued by the Central Bank. Cash payments were made together with letters of credit as well as promissory notes. In the end, it made a huge remittance to the companies and was then assessed by the BIR for deficiency in taxes because NDC failed to withhold tax from its payments.

HELD: Petitioner forgets thatitis not the NDC thatis being taxed. The tax was due from the interests earned by the shipbuilders. It was the income of these companies and notthe RP that was subjectto the tax thatthe NDC didnt withhold. In effect, the imposition of deficiency taxes on the NDC was a penalty for its failure to withhold the same from the shipbuilders. It was remiss in the discharge of its obligations as the withholding agent of the government and so should be held liable for its omission.

LUTZ VS. ARANETA [98 Phil 148; G.R. No. L-7859; 22 Dec 1955] Friday, January 30, 2009 Posted by Coffeeholic Writes Labels: Case Digests, Political Law

Facts: Walter Lutz, as the Judicial Administrator of the Intestate Estate of Antonio Jayme Ledesma, seeks to recover from J. Antonio Araneta, the Collector of Internal Revenue, the sum of money paid by the estate as taxes, pursuant to the Sugar Adjustment Act. Under Section 3 of said Act, taxes are levied on the owners or persons in control of the lands devoted to the cultivation of sugar cane. Furthermore, Section 6 states all the collections made under said Act shall be for aid and support of the sugar industry exclusively. Lutz contends that such purpose is not a matter of public concern hence making the tax levied for that cause unconstitutional and void. The Court of First Instance dismissed his petition, thus this appeal before the Supreme Court.

Issue: Whether or Not the tax levied under the Sugar Adjustment Act ( Commonwealth Act 567) is unconstitutional.

Held: The tax levied under the Sugar Adjustment Act is constitutional. The tax under said Act is levied with a regulatory purpose, to provide means for the rehabilitation and stabilization of the threatened sugar industry. Since sugar production is one of the great industries of our nation, its promotion, protection, and advancement, therefore redounds greatly to the general welfare. Hence, said objectives of the Act is a public concern and is therefore constitutional. It follows that the Legislature may determine within reasonable bounds what is necessary for its protection and expedient for its promotion. If objectives and methods are alike constitutionally valid, no reason is seen why the state may not levy taxes to raise funds for their prosecution and attainment. Taxation may be made with the implement of the states police power. In addition, it is only rational that the taxes be obtained from those that will directly benefit from it. Therefore, the tax levied under the Sugar Adjustment Act is held to be constitutional.

PASCUAL VS. SEC. OF PUBLIC WORKS [110 PHIL 331; G.R. NO.L-10405; 29 DEC 1960] Saturday, January 31, 2009 Posted by Coffeeholic Writes Labels: Case Digests, Political Law

Facts: Petitioner, the governor of the Province of Rizal, filed an action for declaratory relief with injunction on the ground that RA 920, Act appropriating funds for public works, providing P85,000 for the construction, reconstruction, repair, extension and improvement of Pasig feeder road terminals, were nothing but projected and planned subdivision roads within Antonio Subdivision. Antonio Subdivision is owned by the respondent, Jose Zulueta, a member of the Senate of the Philippines. Respondent offered to donate the said feeder roads to the municipality of Pasig and the offer was accepted by the council, subject to a condition that the donor would submit plan of the roads and an agreement to change the names of two of the street. However, the donation was not executed, which prompted Zuleta to write a letter to the district engineer calling attention the approval of RA 920. The district engineer, on the other hand, did not endorse the letter that inasmuch the feeder roads in question were

private property at the time of passage and approval of RA 920, the appropriation for the construction was illegal and therefore, void ab initio. Petitioner, prayed for RA 920 be declared null and void and the alleged deed of donation be declared unconstitutional. Lower court dismissed the case and dissolved the writ of preliminary injunction.

Issue: Whether or Not the deed of donation and the appropriation of funds stipulated in RA 920 are constitutional.

Held: The ruling case law rules that the legislature is without power to appropriate public revenue for anything but public purpose. The taxing power must be exercised for public purposes only and the money raised by taxation can be expended only for public purposes and not for the advantage of private individuals.

In the case at bar, the legality of the appropriation of the feeder roads depend upon whether the said roads were public or private property when the bill was passed by congress or when it became effective. The land which was owned by Zulueta, the appropriation sought a private purpose and hence, null and void. The donation did not cure the nullity of the appropriation; therefore a judicial nullification of a said donation need not precede the declaration of unconstitutionality of the said appropriation. The decision appealed from is reversed.

Manila Electric Co, Inc. vs Province of Laguna Facts: MERALCO was granted franchise for the supply of electric light, heat and power by certain municipalities of the Province of Laguna including, Bian, Sta Rosa, San Pedro, Luisiana, Calauan and Cabuyao. On 19 January 1983, MERALCO was likewise granted a franchise by the National Electrification Administration to operate an electric light and power service in the Municipality of Calamba, Laguna. On 12 September 1991, Republic Act No. 7160, otherwise known as the Local Government Code of 1991, was enacted to take effect on 01 January 1992 enjoining local government units to create their own sources of revenue and to levy taxes, fees and charges, subject to the limitations expressed therein, consistent with the basic policy of local autonomy. Pursuant to the provisions of the Code, respondent province enacted Laguna Provincial Ordinance providing for franchise tax at a rate of 50% of 1% of the gross annual receipts. Provincial Treasurer, then sent a demand letter to MERALCO for the corresponding tax payment. Petitioner MERALCO paid the tax, which then amounted to P19,520,628.42, under protest. A formal claim for refund was thereafter sent by MERALCO to the Provincial Treasurer of Laguna claiming that the franchise tax it had paid and continued to pay to the National Government pursuant to P.D. 551 already included the franchise tax imposed by the Provincial Tax Ordinance. MERALCO contended that the imposition of a franchise tax under Section 2.09 of Laguna Provincial Ordinance No. 01-92, insofar as it concerned MERALCO, contravened the provisions of Section 1 of P.D. 551 which provides Any provision of law or local ordinance to the contrary notwithstanding, the franchise tax payable by all grantees of franchises to generate, distribute and sell electric current for light, heat and power shall be two per cent (2%) of their gross receipts received from the sale of electric current and from transactions incident to the generation, distribution and sale of electric current Such franchise tax shall be payable to the Commissioner of Internal Revenue or his duly authorized representative. On 28 August 1995, the claim for refund of petitioner was denied in a letter signed by Governor Jose D. Lina. In denying the claim, respondents relied on a more recent law, i.e., Republic Act No. 7160 or the Local Government Code of 1991, than the old decree invoked by petitioner. On 14 February 1996, petitioner MERALCO filed with the RTC a complaint for refund against the Province of Laguna and also Benito R. Balazo in his capacity as the Provincial Treasurer of Laguna. RTC dismissed the complaint holding that the power to tax exercised by the province of Laguna was valid.

ISSUE: Whether or not the power to tax was validly exercised. HELD:

Prefatorily, it might be well to recall that local governments do not have the inherent power to tax except to the extent that such power might be delegated to them either by the basic law or by statute. Presently, under Article X of the 1987 Constitution, a general delegation of that power has been given in favor of local government units. Under the regime of the 1935 Constitution no similar delegation of tax powers was provided, and local government units instead derived their tax powers under a limited statutory authority. Whereas, then, the delegation of tax powers granted at that time by statute to local governments was confined and defined (outside of which the power was deemed withheld), the present constitutional rule (starting with the 1973 Constitution), however, would broadly confer such tax powers subject only to specific exceptions that the law might prescribe. Under the now prevailing Constitution, where there is neither a grant nor a prohibition by statute, the tax power must be deemed to exist although Congress may provide statutory limitations and guidelines. The basic rationale for the current rule is to safeguard the viability and self-sufficiency of local government units by directly granting them general and broad tax powers. Nevertheless, the fundamental law did not intend the delegation to be absolute and unconditional; the constitutional objective obviously is to ensure that, while the local government units are being strengthened and made more autonomous,[6] the legislature must still see to it that (a) the taxpayer will not be overburdened or saddled with multiple and unreasonable impositions; (b) each local government unit will have its fair share of available resources; (c) the resources of the national government will not be unduly disturbed; and (d) local taxation will be fair, uniform, and just. The 1991 Code explicitly authorizes provincial governments, notwithstanding any exemption granted by any law or other special law, x x x (to) impose a tax on businesses enjoying a franchise. Indicative of the legislative intent to carry out the Constitutional mandate of vesting broad tax powers to local government units, the Local Government Code has effectively withdrawn under Section 193 thereof, tax exemptions or incentives theretofore enjoyed by certain entities. The Code, in addition, contains a general repealing clause in its Section 534 which states that All general and special laws, acts, city charters, decrees, executive orders, proclamations and administrative regulations, or part or parts thereof which are inconsistent with any of the provisions of this Code are hereby repealed or modified accordingly. WHEREFORE, the instant petition is hereby DISMISSED. No costs. Pepsi Cola vs The City of Butuan on November 16, 2011 Political Law Uniformity in Taxation

In 1960, Ordinance 110 was passed in Butuan. It was later amended by Ordinance 122. This Ordinance imposes a tax on any person, association, etc., of P0.10 per case of 24 bottles of Pepsi- Cola. Pepsi operates within the Butuan and it paid under protest the amount of P4.926.63 from August 16 to December 31, 1960 and the amount of P9,250.40 from January 1 to July 30, 1961. Pepsi filed a complaint for the recovery of the total amount of P14,177.03 paid under protest and those that it may later on pay until the termination of this case on the ground that Ordinance No. 110 as amended of the City of Butuan is illegal, that the tax imposed is excessive and that it is unconstitutional. Pepsi averred it is unconstitutional because it partakes of the nature of an import tax and it is highly unjust and discriminatory.

ISSUE: Whether or not the Ordinance is valid.

HELD: The tax prescribed in sec 3 of Ordinance No. 110, as originally approved, was imposed upon dealers engaged in selling soft drinks or carbonated drinks. Thus, it would seem that the intent was then to levy a tax upon the sale of said merchandise. As amended by Ord No. 122, the tax is, however, imposed only upon any agent

and/or consignee of any person, association, partnership, company or corporation engaged in selling . . . soft drinks or carbonated drinks. As a consequence, merchants engaged in the sale of soft drinks or carbonated drinks, are not subject to the tax, unless they are agents and/or consignees of another dealer, who, in the very nature of things, must be one engaged in business outside the City. Besides, the tax would not be applicable to such agent and/or consignee, if less than 1,000 cases of soft drinks are consigned or shipped to him every month. When we consider, also, that the tax shall be based and computed from the cargo manifest or bill of lading . . . showing the number of cases not sold but received by the taxpayer, the intention to limit the application of the ordinance to soft drinks and carbonated drinks brought into the City from outside thereof becomes apparent. Viewed from this angle, the tax partakes of the nature of an import duty, which is beyond defendants authority to impose by express provision of law. It is true that the uniformity essential to the valid exercise of the power of taxation does not require identity or equality under all circumstances, or negate the authority to classify the objects of taxation. The classification made in the exercise of this authority, to be valid, must, however, be reasonable and this requirement is not deemed satisfied unless: (1) it is based upon substantial distinctions which make real differences; (2) these are germane to the purpose of the legislation or ordinance; (3) the classification applies, not only to present conditions, but, also, to future conditions substantially identical to those of the present; and (4) the classification applies equally to all those who belong to the same class. These conditions are not fully met by the ordinance in question. Indeed, if its purpose were merely to levy a burden upon the sale of soft drinks or carbonated beverages, there is no reason why sales thereof by dealers other than agents or consignees of producers or merchants established outside the City of Butuan should be exempt from the tax.

Manila International Airport Authority vs CA GR No. 155650, July 20, 2006, 495 SCRA 591 Facts: Manila International Airport Authority (MIAA) is the operator of the Ninoy International Airport located at Paranaque City. The Officers of Paranaque City sent notices to MIAA due to real estate tax delinquency. MIAA then settled some of the amount. When MIAA failed to settle the entire amount, the officers of Paranaque city threatened to levy and subject to auction the land and buildings of MIAA, which they did. MIAA sought for a Temporary Restraining Order from the CA but failed to do so within the 60 days reglementary period, so the petition was dismissed. MIAA then sought for the TRO with the Supreme Court a day before the public auction, MIAA was granted with the TRO but unfortunately the TRO was received by the Paranaque City officers 3 hours after the public auction.

MIAA claims that although the charter provides that the title of the land and building are with MIAA still the ownership is with the Republic of the Philippines. MIAA also contends that it is an instrumentality of the government and as such exempted from real estate tax. That the land and buildings of MIAA are of public dominion therefore cannot be subjected to levy and auction sale. On the other hand, the officers of Paranaque City claim that MIAA is a government owned and controlled corporation therefore not exempted to real estate tax.

Issues: Whether or not MIAA is an instrumentality of the government and not a government owned and controlled corporation and as such exempted from tax. Whether or not the land and buildings of MIAA are part of the public dominion and thus cannot be the subject of levy and auction sale.

Ruling: Under the Local government code, government owned and controlled corporations are not exempted from real estate tax. MIAA is not a government owned and controlled corporation, for to become one MIAA should either be a stock or non stock corporation. MIAA is not a stock corporation for its capital is not divided into shares. It is not a non stock corporation since it has no members. MIAA is an instrumentality of the government vested with corporate powers and government functions.

Under the civil code, property may either be under public dominion or private ownership. Those under public dominion are owned by the State and are utilized for public use, public service and for the development of national wealth. The ports included in the public dominion pertain either to seaports or airports. When properties under public dominion cease to be for public use and service, they form part of the patrimonial property of the State.

The court held that the land and buildings of MIAA are part of the public dominion. Since the airport is devoted for public use, for the domestic and international travel and transportation. Even if MIAA charge fees, this

is for support of its operation and for regulation and does not change the character of the land and buildings of MIAA as part of the public dominion. As part of the public dominion the land and buildings of MIAA are outside the commerce of man. To subject them to levy and public auction is contrary to public policy. Unless the President issues a proclamation withdrawing the airport land and buildings from public use, these properties remain to be of public dominion and are inalienable. As long as the land and buildings are for public use the ownership is with the Republic of the Philippines.

PHILIPPINE FISHERIES DEVELOPMENT AUTHORITY VS. CENTRAL BOARD OF ASSESSMENT APPEALS- REAL PROPERTY TAX

FACTS: Petitioner owned the Iloilo Fishing Port Complex which was on reclaimed land and consisted of a breakwater, landing quay, water and fuel oil supply system, refrigeration building, market hall and a municipal shed. Petitioner then leased portions of the IFPC to private firms engaged in the fishing business. Iloilo city then assessed the entire IFPC for Real Property Tax.

ISSUE: Is the entirety of the IFPC subject to the Real Property Tax?

HELD: NO. The Real Property Tax liability of the IFPC is only on portions leased out to private entities. PFDA is not a GOCC but is actually an instrumentality of the national government exempt from Real Property Tax. Given this, it will only be subject to Real Property Tax on the portions of the IFPC which is leased to private entities. It is not a GOCC since a GOCC must satisfy two requirements: (i) capital stock divided into shares and (ii) authorized to distribute dividends/profits. PFDA does have capital stock but the same is not divided into shares and neither is it a non-stock corporation because it does not have members. (Note: This was the same decision reached in MIAA vs. Paranaque (July 20, 2006) and again in MIAA vs. Pasay (April 2, 2009) where the property in question was the airport premises. In those cases, the Court additionally provided that other examples of government instrumentalities vested with corporate powers or what are know as government corporate entities are Philippine Ports Authority, BSP and University of the Philippines.)

COMMISSIONER OF CUSTOMS V CAMPOS RUEDA & CTA

Facts:

Campos Rueda imported 46 cartons or 27,000 pieces of Tungsol flashers. Before the goods arrived at the port of Manila, Campos Rueda filed with the Collector of Customs of Manila a request for value information for the declaration of the imported flashers under Tariff Heading No. 85.09 of the Tariff and Customs Code at 30% ad valorem duty, for classification purpose. The Customs appraiser however, re-classified the goods under Tariff Heading No. 85.19 of the Tariff and Customs Code at 50% ad valorem.

When the goods arrived at the port of Manila, Campos Rueda immediately filed a Customs Import Entry and Internal Revenue Declaration under Tariff Heading No. 85.19 of the Tariff and Customs Code at 50% ad valorem but, under protest and paid duties and taxes on the goods, also under protest. It then filed a timely protest against the re-classification resulting in the payment of additional customs duty and advance sales tax and prayed for the refund of the said.

The Collector of Customs dismissed the protest. Campos Rueda appealed to the Commissioner but was denied, and then appealed to CTA which modified the Commissioners decision by ordering the refund to Campos Rueda of the sum of the additional customs duty but not the advance sales tax. The Commissioner now appeals via petition for review the said decision.

Issue: W/N Campos Rueda should pay 30% or 50% ad valorem duty

Held:

30%. TH No 85.09 of the Tariff and Customs Code provides:

85.09. Electrical lighting and signalling equipment and electrical windscreen wipers, defrosters and demisters, for cycles or motor vehicles ad val. 30%.

On the other hand, the same Code provides under TH No. 85.19:

85.19. Electrical apparatus for making and breaking electrical circuits, for the protection of electrical circuits, or for making connections to or in electric circuits (for example, switches, relays, fuses, lighting arresters, surge suppressors, plugs, lamp-holders and junction boxes); resistors, fixed or variable (including potentiometers), other than heating resistors, printed circuits, switch boards (other than telephone switchboards) and control panels:

In finding for Campos Rueda, CTA found that it has adduced sufficient evidence to establish the general purpose or predominating use to which flashers are applied, and for which petitioner imported them, is precisely as electrical equipment for signalling purposes for motor vehicles; that is, to signal or indicate a right or left hand turn by means of electrical flashes in front and at the rear of motor vehicles and not merely as electrical apparatus as the Commissioner claims.

It is the predominating use to which articles are generally applied or used that determines their character for the purpose of fixing the duty, and not the specific or special use which any particular importer may make of the articles imported.

Parts of machines, apparatus of appliances which are suitable for use solely or principally with a particular kind of machine or with a number of machines falling within a specific heading, as a rule, are to be classified with the machines in the same heading. Also, the law does not provide that an article imported for electrical lighting and signalling equipment for motor vehicles falling under Tariff Heading No. 85.09, if imported alone, shall be classified under Tariff Heading No. 85.19 as electrical apparatus for making and breaking electrical circuits that provision should not be read into the law per the circular of the former Acting Customs Collector. Petition denied. CTA decision affirmed.

PHIL. BANK OF COMMUNICATIONS V CIR January 28, 1999 Monday, January 26, 2009 Posted by Coffeeholic Writes Labels: Case Digests, Taxation

Facts: Petitioner Philippine Bank of Communications (PBCom), a commercial banking corp. duly organized under Philippine Laws, filed its quarterly income tax returns for the 1st and 2nd quarters of 1985, reported profits, and paid the total income tax of P5,016,954.00. The taxes due were settled by applying PBComs tax credit memos and accordingly, the BIR issued tax Debit Memo.

Subsequently, however, PBCom suffered losses so that when it filed its Annual Income Tax Returns for the yearended December 31, 1985, it declared a net loss of P25,317,228.00, thereby showing no income tax liability. For the succeeding year, ending December 31, 1986, it likewise declared no tax payable for the year.

But during these two years, PBCom earned rental income from leased properties. The lessees withheld and remitted to the BIR withholding creditable taxes in 1985 and 1986.

On August 7, 1987, petitioner requested the CIR, among others, for a tax credit of P5,016,954.00 representing the overpayment of taxes in the 1st and 2nd quarters of 1985.

Thereafter on July 25, 1988, petitioner filed on claim for refund of creditable taxes withheld by their lessees from property rentals in 1985 for P282,795.50 and in 1986 for 234,077.69.

Pending the investigation of the respondent CIR, petitioner instituted a Petition for Review on November 18, 1988 before the CTA.

On May 20, 1993, the CTA denied the request of petitioner for a tax refund or credit in the sum of P5,299,849.95 on the ground that it was field beyond the 2-year reglementary period provided for by law. The petitioners claim for refund in 1986 amounting to P234,077.69 was likewise denied on the assumption that it was automatically credited by PBCom against its tax payment in the succeeding year.

Issue: Whether or not the need to signify whether a taxpayer intends to avail of a tax refund or a tax should be made on its annual corporate adjustment return.

Held: Sec. 69 of 1977 NIRC (now Sec. 76 of 1997 NIRC) provides that any excess of the total quarterly payments over the actual income tax computed in the adjustment or final corporate income tax return, shall either:

a.) be refunded to the corporation, or b.) may be credited against the estimated quarterly income tax liabilities or the quarters of the succeeding taxable year.

The corporation must signify in its annual corporate adjustment return (by marking the option box provided in the BIR form) its intention, whether to request for a refund or claim for an automatic tax credit for the succeeding taxable year. To ease the administration of tax collection, these remedies are in the alternative, and the choice of one precludes the other.

Sison vs Ancheta GR No. L-59431, 25 July 1984

Facts: Section 1 of BP Blg 135 amended the Tax Code and petitioner Antero M. Sison, as taxpayer, alleges that "he would be unduly discriminated against by the imposition of higher rates of tax upon his income arising from the exercise of his profession vis-a-vis those which are imposed upon fixed income or salaried individual taxpayers. He characterizes said provision as arbitrary amounting to class legislation, oppressive and capricious in character. It therefore violates both the equal protection and due process clauses of the Constitution as well asof the rule requiring uniformity in taxation.

Issue: Whether or not the assailed provision violates the equal protection and due process clauses of the Constitution while also violating the rule that taxes must be uniform and equitable.

Held: The petition is without merit. On due process - it is undoubted that it may be invoked where a taxing statute is so arbitrary that it finds no support in the Constitution. An obvious example is where it can be shown to amount to the confiscation of property from abuse of power. Petitioner alleges arbitrariness but his mere allegation does not suffice and there must be a factual foundation of such unconsitutional taint. On equal protection - it suffices that the laws operate equally and uniformly on all persons under similar circumstances, both in the privileges conferred and the liabilities imposed. On the matter that the rule of taxation shall be uniform and equitable - this requirement is met when the tax operates with the same force and effect in every place where the subject may be found." Also, :the rule of uniformity does not call for perfect uniformity or perfect equality, because this is hardly unattainable." When the problem of classification became of issue, the Court said: "Equality and uniformity in taxation means that all taxable articles or kinds of property of the same class shall be taxed the same rate. The taxing power has the authority to make reasonable and natural classifications for purposes of taxation..." As provided by this Court, where "the differentation" complained of "conforms to the practical dictates of justice and equity" it "is not discriminatory within the meaning of this clause and is therefore uniform."

Shell Co. vs. Vano GR L-6093, 24 February 1954 En Banc, Padilla (J): 10 concur Facts: The municipal council of Cordova, Cebu adopted Ordinance 10 (1946) imposing an annual tax of P150 on occupation or the exercise of the privilege of installation manager; Ordinance 9 (1947) imposing an annual tax of P40 for local deposits in drums of combustible and inflammable materials and an annual tax of P200 for tin can factories; and Ordinance 11 (1948) imposing an annual tax of P150 on tin can factories having a maximum annual output capacity of 30,000 tin cans. Shell Co., a foreign corporation, filed suit for the refund

of the taxes paid by it, on the ground that the ordinances imposing such taxes are ultra vires.

Issue: Whether Ordinance 10 is discriminatory and hostile because there is no other person in the locality who exercise such designation or occupation.

Held: The fact that there is no other person in the locality who exercises such a designation or calling does not make the ordinance discriminatory and hostile, inasmuch as it is and will be applicable to any person or firm who exercises such calling or occupation named or designated as installation manager.

Tiu v Ca G.R. No. 127410. January 20, 1999 J. Panganiban

Facts: On March 13, 1992, Congress, with the approval of the President, passed into law RA 7227. This was for the conversion of former military bases into industrial and commercial uses. Subic was one of these areas. It was made into a special economic zone. In the zone, there were no exchange controls. Such were liberalized. There was also tax incentives and duty free importation policies under this law. On June 10, 1993, then President Fidel V. Ramos issued Executive Order No. 97 (EO 97), clarifying the application of the tax and duty incentives. It said that On Import Taxes and Duties. Tax and duty-free importations shall apply only to raw materials, capital goods and equipment brought in by business enterprises into the SSEZ On All Other Taxes. In lieu of all local and national taxes (except import taxes and duties), all business enterprises in the SSEZ shall be required to pay the tax specified in Section 12(c) of R.A. No. 7227.

Nine days after, on June 19, 1993, the President issued Executive Order No. 97-A (EO 97-A), specifying the area within which the tax-and-duty-free privilege was operative. Section 1.1. The Secured Area consisting of the presently fenced-in former Subic Naval Base shall be the only completely tax and duty-free area in the SSEFPZ. Business enterprises and individuals (Filipinos and foreigners) residing within the Secured Area are free to import raw materials, capital goods, equipment, and consumer items tax and duty-free. Petitioners challenged the constitutionality of EO 97-A for allegedly being violative of their right to equal protection of the laws. This was due to the limitation of tax incentives to Subic and not to the entire area of Olongapo. The case was referred to the Court of Appeals. The appellate court concluded that such being the case, petitioners could not claim that EO 97-A is unconstitutional, while at the same time maintaining the validity of RA 7227. The court a quo also explained that the intention of Congress was to confine the coverage of the SSEZ to the "secured area" and not to include the "entire Olongapo City and other areas mentioned in Section 12 of the law. Hence, this was a petition for review under Rule 45 of the Rules of Court.

Issue: Whether the provisions of Executive Order No. 97-A confining the application of R.A. 7227 within the secured area and excluding the residents of the zone outside of the secured area is discriminatory or not owing to a violation of the equal protection clause.

Held. No. Petition dismissed.

Citing Section 12 of RA 7227, petitioners contend that the SSEZ encompasses (1) the City of Olongapo, (2) the Municipality of Subic in Zambales, and (3) the area formerly occupied by the Subic Naval Base. However, they claimed that the E.O. narrowed the application to the naval base only.

OSG- The E.O. Was a valid classification.

Court- The fundamental right of equal protection of the laws is not absolute, but is subject to reasonable classification. If the groupings are characterized by substantial distinctions that make real differences, one class may be treated and regulated differently from another. The classification must also be germane to the purpose of the law and must apply to all those belonging to the same class. Inchong v Hernandez- Equal protection does not demand absolute equality among residents; it merely requires that all persons shall be treated alike, under like circumstances and conditions both as to privileges conferred and liabilities enforced. Classification, to be valid, must (1) rest on substantial distinctions, (2) be germane to the purpose of the law, (3) not be limited to existing conditions only, and (4) apply equally to all members of the same class.

RA 7227 aims primarily to accelerate the conversion of military reservations into productive uses. This was really limited to the military bases as the law's intent provides. Moreover, the law tasked the BCDA to specifically develop the areas the bases occupied.

Among such enticements are: (1) a separate customs territory within the zone, (2) tax-and-duty-free importations, (3) restructured income tax rates on business enterprises within the zone, (4) no foreign exchange control, (5) liberalized regulations on banking and finance, and (6) the grant of resident status to certain investors and of working visas to certain foreign executives and workers. The target of the law was the big investor who can pour in capital.

Even more important, at this time the business activities outside the "secured area" are not likely to have any impact in achieving the purpose of the law, which is to turn the former military base to productive use for the benefit of the Philippine economy. Hence, there was no reasonable basis to extend the tax incentives in RA 7227.

It is well-settled that the equal-protection guarantee does not require territorial uniformity of laws. As long as there are actual and material differences between territories, there is no violation of the constitutional clause.

Besides, the businessmen outside the zone can always channel their capital into it.

RA 7227, the objective is to establish a "self-sustaining, industrial, commercial, financial and investment center. There will really be differences between it and the outside zone of Olongapo.

The classification of the law also applies equally to the residents and businesses in the zone. They are similarly treated to contribute to the end gaol of the law.

Villegas vs Hiu Chiong Tsai Pao Ho (1978)

Facts: The Municipal Board of Manila enacted Ordinance 6537 requiring aliens (except those employed in the diplomatic and consular missions of foreign countries, in technical assistance programs of the government and another country, and members of religious orders or congregations) to procure the requisite mayors permit so as to

be employed or engage in trade in the City of Manila. The permit fee is P50, and the penalty for the violation of the ordinance is 3 to 6 months imprisonment or a fine of P100 to P200, or both. Issue: Whether the ordinance imposes a regulatory fee or a tax. Held: The ordinances purpose is clearly to raise money under the guise of regulation by exacting P50 from aliens who have been cleared for employment. The amount is unreasonable and excessive because it fails to consider difference in situation among aliens required to pay it, i.e. being casual, permanent, part-time, rank-and-file or executive. [ The Ordinance was declared invalid as it is arbitrary, oppressive and unreasonable, being applied only to aliens who are thus deprived of their rights to life, liberty and property and therefore violates the due process and equal protection clauses of the Constitution. Further, the ordinance does not lay down any criterion or standard to guide the Mayor in the exercise of his discretion, thus conferring upon the mayor arbitrary and unrestricted powers

Ormoc Sugar Company Inc. vs Treasurer of Ormoc City Facts:

The Municipal Board of Ormoc City passed a municipal tax ordinance imposing on any and all productions of centrifugal sugar milled at the Ormoc Sugar Company Inc. one percent per export sale to the US and other foreign countries. Said company filed before the CFI of Leyte a complaint against the City of Ormoc, its Treasurer, Municipal Board and Mayor, alleging sasid ordinance is violative of the equal protection clause and the rule of uniformity of taxation, among other things. Ormoc Sugar Company Inc. was the only sugar central in Ormoc City at the time. Issue: WON the constitutional limits on the power of taxation, specifically the EPC and uniformity of taxation, were infringed. Held: Yes. Though Ormoc Sugar Company Inc. is the only sugar central in the city of Ormoc at the time, the classification, to be reasonable, should be in terms applicable to future conditions as well. Said ordinance shoouldnt be singular and exclusive as to exclude any subsequently established sugar central, of the same class as plaintiff, for coverage of the tax. EPC applies only to persons or things identically situated and doesnt bar a reasonable classificationof the subject of legislation. A classification is reasonable where: 1) it is based on substantial distinctions which make real differences; (2) these are germane to the purpose of the law; (3) the classification applies not only to present conditions but also to future conditions which are substantially identical to those of the present; (4) the classification applies only to those who belong to the same class.

ARTURO M. TOLENTINO VS. THE SECRETARY OF FINANCE and THE COMMISSIONER OF INTERNAL REVENUE 1994 Aug 25 G.R. No. 115455 235 SCRA 630 FACTS: The valued-added tax (VAT) is levied on the sale, barter or exchange of goods and properties as well as on the sale or exchange of services. It is equivalent to 10% of the gross selling price or gross value in money of goods or properties sold, bartered or exchanged or of the gross receipts from the sale or exchange of services. Republic Act No. 7716 seeks to widen the tax base of the existing VAT system and enhance its administration by amending the National Internal Revenue Code.

The Chamber of Real Estate and Builders Association (CREBA) contends that the imposition of VAT on sales and leases by virtue of contracts entered into prior to the effectivity of the law would violate the constitutional provision of non-impairment of contracts.

ISSUE: Whether R.A. No. 7716 is unconstitutional on ground that it violates the contract clause under Art. III, sec 10 of the Bill of Rights.

RULING: No. The Supreme Court the contention of CREBA, that the imposition of the VAT on the sales and leases of real estate by virtue of contracts entered into prior to the effectivity of the law would violate the constitutional provision of non-impairment of contracts, is only slightly less abstract but nonetheless hypothetical. It is enough to say that the parties to a contract cannot, through the exercise of prophetic discernment, fetter the exercise of the taxing power of the State. For not only are existing laws read into contracts in order to fix obligations as between parties, but the reservation of essential attributes of sovereign power is also read into contracts as a basic postulate of the legal order. The policy of protecting contracts against impairment presupposes the maintenance of a government which retains adequate authority to secure the peace and good order of society. In truth, the Contract Clause has never been thought as a limitation on the exercise of the State's power of taxation save only where a tax exemption has been granted for a valid consideration.

Such is not the case of PAL in G.R. No. 115852, and the Court does not understand it to make this claim. Rather, its position, as discussed above, is that the removal of its tax exemption cannot be made by a general, but only by a specific, law.

Further, the Supreme Court held the validity of Republic Act No. 7716 in its formal and substantive aspects as this has been raised in the various cases before it. To sum up, the Court holds:

(1) That the procedural requirements of the Constitution have been complied with by Congress in the enactment of the statute;

(2) That judicial inquiry whether the formal requirements for the enactment of statutes - beyond those prescribed by the Constitution - have been observed is precluded by the principle of separation of powers;

(3) That the law does not abridge freedom of speech, expression or the press, nor interfere with the free exercise of religion, nor deny to any of the parties the right to an education; and

(4) That, in view of the absence of a factual foundation of record, claims that the law is regressive, oppressive and confiscatory and that it violates vested rights protected under the Contract Clause are prematurely raised and do not justify the grant of prospective relief by writ of prohibition.

WHEREFORE, the petitions are DISMISSED.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Aviation Methodology SampleDocument4 pagesAviation Methodology SampleLexie Go CedenioPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Po FiestaDocument3 pagesPo FiestaLexie Go CedenioPas encore d'évaluation

- BIR Form 1905 PDFDocument2 pagesBIR Form 1905 PDFHeidi85% (13)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Sample Event Service ContractDocument1 pageSample Event Service ContractLexie Go CedenioPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Types of Hydraulic FluidsDocument5 pagesTypes of Hydraulic FluidsLexie Go CedenioPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- EulaDocument3 pagesEulaLexie Go CedenioPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Law II Case DoctrinesDocument39 pagesLaw II Case DoctrinesLexie Go CedenioPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Straw BillDocument3 pagesStraw BillLexie Go CedenioPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Straw BillDocument3 pagesStraw BillLexie Go CedenioPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- CodecDocument68 pagesCodecLexie Go CedenioPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Statics Practice Problems - SolutionsDocument4 pagesStatics Practice Problems - SolutionsLexie Go CedenioPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Jayhw 2Document1 pageJayhw 2Lexie Go CedenioPas encore d'évaluation

- Jayhw 2Document1 pageJayhw 2Lexie Go CedenioPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Hacienda Luisita Inc. (HLI) v. Presidential Agrarian Reform Council (PARC), Et Al., G.R. No. 171101, July 5, 2011Document7 pagesHacienda Luisita Inc. (HLI) v. Presidential Agrarian Reform Council (PARC), Et Al., G.R. No. 171101, July 5, 2011Lexie Go CedenioPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Simple HuffmanDocument26 pagesSimple HuffmanLexie Go CedenioPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Taxation ReviewerDocument145 pagesTaxation ReviewerJingJing Romero95% (96)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Taxation ReviewerDocument145 pagesTaxation ReviewerJingJing Romero95% (96)

- Sales VillanuevaDocument110 pagesSales Villanuevanadz91_mabz100% (2)

- Law On Sales - Villanueva 2009Document688 pagesLaw On Sales - Villanueva 2009Don Sumiog93% (27)

- Taxation ReviewerDocument145 pagesTaxation ReviewerJingJing Romero95% (96)

- Law II Case DoctrinesDocument39 pagesLaw II Case DoctrinesLexie Go CedenioPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Oblicon March 16 ...Document11 pagesOblicon March 16 ...Lexie Go CedenioPas encore d'évaluation

- Hacienda Luisita Inc. (HLI) v. Presidential Agrarian Reform Council (PARC), Et Al., G.R. No. 171101, July 5, 2011Document7 pagesHacienda Luisita Inc. (HLI) v. Presidential Agrarian Reform Council (PARC), Et Al., G.R. No. 171101, July 5, 2011Lexie Go CedenioPas encore d'évaluation

- Necessito V ParasDocument8 pagesNecessito V ParasNgan TuyPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Persons 2Document2 pagesPersons 2Lexie Go CedenioPas encore d'évaluation

- Labor DigestDocument2 pagesLabor DigestLexie Go CedenioPas encore d'évaluation

- Tocqueville Gold Investor Letter - Third Quarter 2012Document18 pagesTocqueville Gold Investor Letter - Third Quarter 2012Gold Silver WorldsPas encore d'évaluation

- CH 9 Lecture NotesDocument14 pagesCH 9 Lecture NotesraveenaatPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Mathfinance BookDocument282 pagesMathfinance BookLoodyMohammadPas encore d'évaluation

- Chapter 7 - Problem SOlvingDocument26 pagesChapter 7 - Problem SOlvingDesirre Transona100% (1)

- ACCCOB2-Introduction To Financial Accounting PDFDocument34 pagesACCCOB2-Introduction To Financial Accounting PDFJose GuerreroPas encore d'évaluation

- Frank Spence ValuationDocument2 pagesFrank Spence ValuationShivam AryaPas encore d'évaluation

- Lecture 2 - Answer Part 1Document3 pagesLecture 2 - Answer Part 1Thắng ThôngPas encore d'évaluation

- DWI BinderDocument23 pagesDWI BinderarappPas encore d'évaluation

- VWAP WITH OH, OL, BB, BB TRAP-converted-compressedDocument14 pagesVWAP WITH OH, OL, BB, BB TRAP-converted-compressedroughimPas encore d'évaluation

- CFA Level 1 NotesDocument154 pagesCFA Level 1 Noteskazimeister172% (18)

- Fin3020 2211es2 1 97 PDFDocument4 pagesFin3020 2211es2 1 97 PDFSteven LiPas encore d'évaluation

- DFDL Vietnam Investment Guide 2018 WebsiteDocument192 pagesDFDL Vietnam Investment Guide 2018 WebsiteHoài NguyễnPas encore d'évaluation

- @ProCA - Inter Law Question BankDocument165 pages@ProCA - Inter Law Question Bankacct offr maduraiPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- PowerStrike User's ManualDocument16 pagesPowerStrike User's Manualgeoham38Pas encore d'évaluation

- Islamic Finance Qualification Cisi Chartered2Document2 pagesIslamic Finance Qualification Cisi Chartered2Ali Hyder ZaidiPas encore d'évaluation

- History of Cooperative: P. Rizal and Teodoro SandikoDocument5 pagesHistory of Cooperative: P. Rizal and Teodoro SandikoHannel Grace100% (2)

- Term Fixed Deposit EnglishDocument2 pagesTerm Fixed Deposit EnglishAbhijit PatilPas encore d'évaluation

- Project Report On Tea PackagingDocument8 pagesProject Report On Tea PackagingEIRI Board of Consultants and PublishersPas encore d'évaluation

- Ipca Laboratories (IPCLAB) : Weak Formulation Exports Drag NumbersDocument14 pagesIpca Laboratories (IPCLAB) : Weak Formulation Exports Drag NumbersManu GuptaPas encore d'évaluation

- Financial and Managerial AccountingDocument1 pageFinancial and Managerial Accountingcons thePas encore d'évaluation

- Internship Report On Habib Bank LimitedDocument75 pagesInternship Report On Habib Bank LimitedMariyam Khan87% (15)

- Lesson No. 1: What Is Forex Trading?Document8 pagesLesson No. 1: What Is Forex Trading?Zubair AhmedPas encore d'évaluation

- Itr-4 Sugam Presumptive Business or Profession Income Tax ReturnDocument7 pagesItr-4 Sugam Presumptive Business or Profession Income Tax ReturnAman AnandPas encore d'évaluation

- Rule 23-38Document5 pagesRule 23-38Resci Angelli Rizada-NolascoPas encore d'évaluation

- Share Based CompensationDocument3 pagesShare Based CompensationYeshua DeluxiusPas encore d'évaluation

- LLA Financing OverviewDocument41 pagesLLA Financing OverviewCarlos Moscoso AllelPas encore d'évaluation

- Biglari 2015Document100 pagesBiglari 2015CanadianValue100% (1)

- Remedies Under The Tax Code of 1997Document7 pagesRemedies Under The Tax Code of 1997mnyngPas encore d'évaluation

- SIP1308003 P Aida Prelims (1011) C PDFDocument540 pagesSIP1308003 P Aida Prelims (1011) C PDFInvest Stock0% (1)

- BrochureDocument1 pageBrochureMarioPas encore d'évaluation