Académique Documents

Professionnel Documents

Culture Documents

Sandra Miller's Summary of Bill 19-32

Transféré par

Byron PojolCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sandra Miller's Summary of Bill 19-32

Transféré par

Byron PojolDroits d'auteur :

Formats disponibles

LEGAL MEMORANDUM July 5, 2013 TO: FROM: CC: SUBJECT: The Governor Chief Legal Counsel Chief of Staff

Bill No. 19-32

The purpose of this memo is to provide a quick summary of Bill 19-32. Essentially, the intent and purpose of the Bill is to create a method for collecting tax and license fees from Guam gaming activities, and then using the funds collected from the taxes and fees to finance certain Government of Guam agencies and activities.

WHAT THIS BILL DOES: 1. Taxes current existing non-profit bingo, lottery, cockfighting, carnival gaming, pinball, kiddie rides, coin-operated childrens video games, video horse/greyhound racing, and symbolic amusement devices. All these activities currently are legal and operating on Guam [See 11 GCA 22202]. 2. Uses the extra taxes to fund sports facilities and activities throughout the villages (through the mayors, Dept. of Parks & Recreation and public schools), to operate urgent care activities at Guam Memorial Hospital, and to pay for GMH operations and debt. WHAT THIS BILL DOES NOT DO: 1. DOES NOT legalize casino gambling, poker machines, slot machines, etc. 2. DOES NOT do away with current non-profit bingo, lottery, cockfighting, Carnival gaming, pinball, kiddie rides, childrens video games, video horse/greyhound racing, and symbolic amusement devices. While the bill purports to have a sunset provision, this provision is contingent upon an appendix that was not appended.

Ricardo J. Bordallo Governors Complex Adelup, Guam 96910 Tel: (671) 472-8931 Fax: (671) 477-4826 www.governor.guam.gov calendar.guam.gov Eddie Baza Calvo

DISCUSSION Bill 19-32 accomplishes the primary goal of collecting taxes and fees by creating two (2) new funds: (1) the Limited Gaming Tax Fund; and (2) the GMHA Healthcare Trust and Development Fund. The details of each fund are summarized below: (1) CREATION OF THE LIMITED GAMING TAX FUND: Creates a four percent (4%) Limited Gaming Tax (LGT) on gross receipts from limited gaming activities authorized pursuant to statute. Limited gaming activities allowed by the Act and which are subject to the LGT include: Non-profit bingo or lottery; Cockfighting; Carnival or Liberation Day gaming; and Other limited gaming activities authorized by statute. o Per 11 G.C.A. 22202, the following are gaming activities presently authorized by statute: pinball, kiddie rides, childrens video games, video horse/greyhound racing, and symbolic amusement devices.

Activities which are NOT authorized, and which continue to not be authorized include: (a) slot machines; (b) amusement devices set to make progressive or automatic payouts; and (c) gambling devices defined by 9 G.C.A. 64.20(b) [i.e., any coin operated device which, when operated, may return winnings (other than free games not redeemable for cash) of value to the user based partially or completely upon chance, by the operation of which a person may become entitled to receive winnings of value. Includes slot machines, video poker machines and other machines or devices which afford the opportunity of winnings, payouts, malfunction refunds to the player, or giving the player or user anything of value under any guise or form based partially or completely upon chance.]

Use of monies in the LGT Fund are allocated as follows: 5% for Fund administration, but not for personnel costs After administrative expenses are paid, the balance of monies in the LGT Fund may be used as follows:

o 1/3 to the Mayors Council for village recreational facilities & community centers; o 1/3 to Dept. of Parks & Recreation for its facilities; and o 1/3 to DOE for repair and construction of sports facilities. (2) CREATION OF THE GMHA HEALTHCARE TRUST AND DEVLOPMENT FUND Creates the GMHA Healthcare Trust and Development Fund, which is financed separately from the Limited Gaming Tax Fund. The GMHA Fund is financed by two (2) sources: Licensing fees, business privilege tax, and income taxes from companies involved in gaming under the Gaming Rules & Regulations, including the Liberty, Symbolix, and Match Play gaming devices. o Only those gaming devices registered prior to August 1, 2011 are allowed to be licensed. Special 4% assessment fee on income from gaming devices. This assessment fee is known as the GMHA Trust Fund Fee. The new 4% GMHA Trust Fee is intended to be imposed on income from gaming devices on top of and in addition to the regular license fee, GRT, and other income taxes. Use of monies in the GMHA Fund are allocated as follows: 60% for establishment & operation of an Urgent Healthcare Center 40% for delivery of healthcare services (including funding for medication, supplies and equipment e.g., payments to vendors).

In addition to establishing the two gaming-related funds, Bill 19-32 also authorizes the establishment of a GMHA Urgentcare Health Center working group, as well as the establishment of a gaming fee schedule by the Guam Gaming Commission: (3) ESTABLISHMENT OF THE GMHA URGENT HEALTHCARE CENTER: Authorizes the establishment of an urgent healthcare medical services center at GMHA.

(4)

Requires that a working group to be established 30 days after enactment into law to develop criteria, siting, and a plan of action. A report from the working group is due 90 days after the working group is established. SCHEDULE / RULES AND REGULATIONS TO BE

GAMING FEE DEVELOPED:

Within 180 days after empanelling of the Guam Gaming [Control] Commission, the Commission shall develop rules & regulations to provide a fee schedule for the assessment of across-the-board fees for all gaming activities. The fee schedule shall be consistent with the manner in which existing gaming devices have been legally authorized pursuant to 11 G.C.A. 22202(f) AND 3 G.A.R. 7114(a)(5).

(5)

OTHER COMPLIANCE SECTIONS:

If Bill 19-32 becomes law, then certain deadlines must be met. That is, within 30 days after enactment, GMHA must establish a working group for the Urgent Healthcare Center, and then a report from the working group is due 90 days after that. GovGuam will also have to empanel the Gaming Control Commission, which consists of (five) 5 members appointed by the Governor with the consent and approval of the Legislature. The Director of DRT is also a member of the Commission, however, he is ex officio and has no vote. Once the Gaming Control Commission is empanelled, the Commission will have 180 days to develop a fee schedule for the assessment of across-the-board fees for all gaming activities. Sincerely,

SANDRA MILLER

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- KampoDocument331 pagesKampozomb100% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Binary Numbers Gamecock MarkingsDocument1 pageBinary Numbers Gamecock MarkingsByron Pojol67% (3)

- Clinical Core Laboratory Testing Molinaro, McCudden, Bonhomme & Saenger (Eds.) - 1st Ed. (2017)Document115 pagesClinical Core Laboratory Testing Molinaro, McCudden, Bonhomme & Saenger (Eds.) - 1st Ed. (2017)Beatriz Belotti100% (1)

- NFGB Derby RulesDocument48 pagesNFGB Derby RulesByron Pojol100% (5)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Universal Declaration of Human Rights - Illustrated VersionDocument72 pagesUniversal Declaration of Human Rights - Illustrated VersionByron Pojol100% (1)

- Strategic Audit of PfizerDocument6 pagesStrategic Audit of PfizerKairos Le50% (2)

- Indicators of HealthDocument12 pagesIndicators of HealthAmbarish PanigrahiPas encore d'évaluation

- Gamecock - Common Inbreeding Patterns - Blood Percentage ComparisonDocument1 pageGamecock - Common Inbreeding Patterns - Blood Percentage ComparisonByron Pojol83% (6)

- Assignment On Psychotherapy: Submitted by Maj Mercy Jacob 1 Yr MSC Trainee Officer Con CH (Ec) KolkataDocument27 pagesAssignment On Psychotherapy: Submitted by Maj Mercy Jacob 1 Yr MSC Trainee Officer Con CH (Ec) KolkataMercy Jacob100% (2)

- TP Leads - GurgaonDocument32 pagesTP Leads - GurgaonDeepika Aggarwal0% (1)

- Engineered Viral Vaccine Constructs With Dual Specificity: Avian Influenza and Newcastle DiseaseDocument6 pagesEngineered Viral Vaccine Constructs With Dual Specificity: Avian Influenza and Newcastle DiseaseByron PojolPas encore d'évaluation

- 2016 World Slasher Cup 2 ResultsDocument45 pages2016 World Slasher Cup 2 ResultsByron PojolPas encore d'évaluation

- State Dept Philippines Drug War LetterDocument2 pagesState Dept Philippines Drug War LettergmanewsPas encore d'évaluation

- NCA 2016 World Championship Derby 1 ResultsDocument10 pagesNCA 2016 World Championship Derby 1 ResultsByron PojolPas encore d'évaluation

- 2016 Candelaria Intl DerbyDocument34 pages2016 Candelaria Intl DerbyByron PojolPas encore d'évaluation

- Veganism Is A Religion of Totalitarianism and TerrorismDocument8 pagesVeganism Is A Religion of Totalitarianism and TerrorismByron PojolPas encore d'évaluation

- 2016 World Slasher Cup 1 ResultsDocument81 pages2016 World Slasher Cup 1 ResultsByron PojolPas encore d'évaluation

- NCA 2015 World Championship Derby 2 ResultsDocument20 pagesNCA 2015 World Championship Derby 2 ResultsByron PojolPas encore d'évaluation

- 2014 World Slasher Cup 2 Results - UNSORTEDDocument12 pages2014 World Slasher Cup 2 Results - UNSORTEDByron PojolPas encore d'évaluation

- 2015 Candelaria Intl Derby ResultsDocument25 pages2015 Candelaria Intl Derby ResultsByron PojolPas encore d'évaluation

- 2014 World Slasher Cup 2 Results - SORTEDDocument12 pages2014 World Slasher Cup 2 Results - SORTEDByron PojolPas encore d'évaluation

- 2015 World Slasher Cup 1 ResultsDocument51 pages2015 World Slasher Cup 1 ResultsByron PojolPas encore d'évaluation

- 2015 World Slasher Cup 2 ResultsDocument53 pages2015 World Slasher Cup 2 ResultsByron PojolPas encore d'évaluation

- NCA 2015 World Championship Derby 1 ResultsDocument22 pagesNCA 2015 World Championship Derby 1 ResultsByron PojolPas encore d'évaluation

- 2013 World Slasher Cup 2 Final Complete ResultsDocument10 pages2013 World Slasher Cup 2 Final Complete ResultsByron PojolPas encore d'évaluation

- 2014 Bakbakan Grand Finals Scores SortedDocument2 pages2014 Bakbakan Grand Finals Scores SortedByron PojolPas encore d'évaluation

- 2014 World Slasher Cup 1 Complete Results - SORTEDDocument18 pages2014 World Slasher Cup 1 Complete Results - SORTEDByron PojolPas encore d'évaluation

- AMCGCE Resolution 4 (21 July 2012)Document9 pagesAMCGCE Resolution 4 (21 July 2012)Byron PojolPas encore d'évaluation

- 2014 World Slasher Cup 1 Complete Results - UNSORTEDDocument18 pages2014 World Slasher Cup 1 Complete Results - UNSORTEDByron Pojol100% (1)

- 2013 World Championship Derby 1 Final Complete ResultsDocument8 pages2013 World Championship Derby 1 Final Complete ResultsByron PojolPas encore d'évaluation

- We Love MeatsDocument31 pagesWe Love MeatsByron PojolPas encore d'évaluation

- Guam Cockfighting Law: 3 Chapter 3Document54 pagesGuam Cockfighting Law: 3 Chapter 3Byron PojolPas encore d'évaluation

- Guam Cockfighting Law: Title 22 Chapter 39Document7 pagesGuam Cockfighting Law: Title 22 Chapter 39Byron PojolPas encore d'évaluation

- Albert Einstein The AgnosticDocument28 pagesAlbert Einstein The AgnosticByron Pojol100% (1)

- 2013 WSC 1 Complete Final Results (Owner Name)Document9 pages2013 WSC 1 Complete Final Results (Owner Name)Byron PojolPas encore d'évaluation

- Impaired Skin IntegrityDocument3 pagesImpaired Skin IntegrityAubrey SungaPas encore d'évaluation

- Focus Pdca WorksheetDocument2 pagesFocus Pdca Worksheetapi-256214553Pas encore d'évaluation

- Growth Monitoring - GIDocument19 pagesGrowth Monitoring - GIokwadha simionPas encore d'évaluation

- Admed Claimant'S Statement: A. Personal DetailsDocument2 pagesAdmed Claimant'S Statement: A. Personal Detailsshemina armorerPas encore d'évaluation

- NCM 116 Rle Special Activity ScriptDocument2 pagesNCM 116 Rle Special Activity Scriptalexander abasPas encore d'évaluation

- Modification of The Treatment Protocol As A Strategy in The Control of The Cholera Epidemic in Haiti 2016-2017Document3 pagesModification of The Treatment Protocol As A Strategy in The Control of The Cholera Epidemic in Haiti 2016-2017Carlos Efraín Montúfar SalcedoPas encore d'évaluation

- NSLHD Policy Procedure Guideline Communique 14 Oct 2019Document3 pagesNSLHD Policy Procedure Guideline Communique 14 Oct 2019Andrew WongPas encore d'évaluation

- Progress Portfolio For 2003Document4 pagesProgress Portfolio For 2003api-302714942Pas encore d'évaluation

- San Pablo (DILG) - GAD Plan 2021Document12 pagesSan Pablo (DILG) - GAD Plan 2021CA T HePas encore d'évaluation

- Nurses Knowledge and Practices Toward PreventionDocument26 pagesNurses Knowledge and Practices Toward PreventionmadilaPas encore d'évaluation

- Practitioners of Electropathy Are Not Doctors, Rules Kerala High Court - Times of IndiaDocument3 pagesPractitioners of Electropathy Are Not Doctors, Rules Kerala High Court - Times of Indiasachinpatel9Pas encore d'évaluation

- filedate_3665Document67 pagesfiledate_3665craig.denn458Pas encore d'évaluation

- Educational Topic 33 - Family PlanningDocument2 pagesEducational Topic 33 - Family PlanningEmily VlasikPas encore d'évaluation

- Kuesioner Skripsi Burnout Dan Beban KerjaDocument8 pagesKuesioner Skripsi Burnout Dan Beban KerjaAgita LiliandariPas encore d'évaluation

- Nursing Code of Ethics guide nursesDocument2 pagesNursing Code of Ethics guide nursesNicole GumolonPas encore d'évaluation

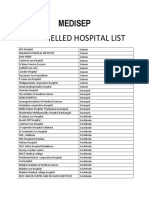

- Empanelled Hospital ListDocument7 pagesEmpanelled Hospital ListExpress WebPas encore d'évaluation

- Transes - Pharma Lec - IntroductionDocument5 pagesTranses - Pharma Lec - IntroductionJayla MariePas encore d'évaluation

- Porter's 5 Force Model - The Pharmaceutical IndustryDocument2 pagesPorter's 5 Force Model - The Pharmaceutical IndustryShalaka PhatakPas encore d'évaluation

- The Real ThesisDocument35 pagesThe Real ThesisDanielle Cezarra FabellaPas encore d'évaluation

- National Quality Assurance Program Updates: Standards, Awards and InitiativesDocument48 pagesNational Quality Assurance Program Updates: Standards, Awards and InitiativessourabhPas encore d'évaluation

- Huntington Hospital Non-Profit STRAMADocument10 pagesHuntington Hospital Non-Profit STRAMADiana LiPas encore d'évaluation

- Ethics Assignment Sem 3Document9 pagesEthics Assignment Sem 3api-314566363Pas encore d'évaluation

- Deborah Levenson's Resume - ScribdDocument2 pagesDeborah Levenson's Resume - ScribdDeborah LevensonPas encore d'évaluation

- Weekly specialty rosterDocument1 pageWeekly specialty rosterHaytham SaadonPas encore d'évaluation