Académique Documents

Professionnel Documents

Culture Documents

Vat Enhancements

Transféré par

alexandro_novora6396Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Vat Enhancements

Transféré par

alexandro_novora6396Droits d'auteur :

Formats disponibles

A Comprehensive Look at VAT

October 25, 2005

Tax BaSe

Key features of the VAT Enhancements

Joel L. Tan-Torres Partner, SGV & Co.

SL-0

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Topics for discussion

A. B. C. D. E. F. G. H. I. J. K. VAT through the years SC TRO Pertinent compliance requirements Transitory provisions Apportionment of input tax VAT on government contracts 70% Limitation on Input VAT Input Tax on capital goods Revised VAT return Repealing clause Increase in VAT rate in 2006

SL-1

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Enhancement of VAT through the years

_Adopted in January 1, 1988 under Executive Order No. 273 (IRR RR No. 5-87) Expanded starting January 1, 1996 under Republic Act (RA) No. 7716 (IRR RR No. 7 -95) Amended in January 1, 1997 by RA No. 8241 (IRR RR No. 6-97) RA 9010 included professionals, including CPAs in the VAT system beginning 2003 RA 9337 expanded further the coverage of VAT (IRRRR No 14-2005 which was amended by RR No 162005)

SL-2

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Supreme Court TRO

RA 9337 would have taken effect on July 1, 2005. However, in response to several petitions filed with the court, the SC issued a TEMPORARY RESTRAINING ORDER (TRO) on the implementation of R.A. 9337. The TRO on RA 9337 was lifted on October 18, 2005 per SC Resolution. BIR issued RR 16-2005 on VAT to take effect on November 1, 2005. What about effectivity of amendments in RA 9337 pertaining to nonVAT items such as income tax, PT, ET ?

SL-3

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Pertinent compliance requirements

Registration Invoicing Summary list

SL-4

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

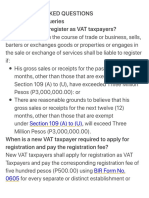

Registration

Mandatory registration for those: i. With gross sales or receipts for the past 12 months, other than those that are exempt under Sec. 109 (1)(A) to (U) of the Tax Code, exceeding P1.5 million; or ii. Expecting to exceed gross sales or receipts for the next 12 months, other than those that are exempt undder Sec. 109(1)(A) to (U) of the Tax Code, of P1.5 million.

SL-5

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Registration

Those previously registered as non-VAT, but are now subject to VAT, shall update their records using BIR Form 1905 Those previously registered as VAT, but does not exceed the P1.5M annual sales threshold, may opt to change to a non-VAT registration Those liable to VAT, but fails to register, shall still be liable to VAT but without benefit of input tax

SL-6

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Invoicing

VAT invoice to be issued for every sale, barter or exchange of goods or properties VAT OR to be issued for every lease of goods or properties, and every sale, barter or exchange of services

SL-7

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Invoicing : content

1. Notation of VAT-registered followed by Taxpayers Identification Number (TIN) or per RR 16-2005, TIN followed by term VAT 2. The total amount of transaction, with the amount of VAT shown as a separate item in the invoice/OR. Note: Previously, the VAT was not allowed to be shown separately on the invoice/OR.

SL-8

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Invoicing : content

3. 4. For exempt transactions, the term VAT-Exempt Sale shall be written or printed prominently on the invoice/OR For zero-rated transactions, the term Zero-Rated Sale shall be written or printed prominently in the invoice/OR

or alternatively, at the option of seller if the sale involves items which are subject to VAT and some of which are VAT zero-rated or VAT-exempt: the invoice or receipt shall clearly indicate the breakdown of the sales price between its taxable, exempt and zero-rated components, and the calculation of the VAT on each portion of the sale shall be shown on the invoice or receipt;

SL-9

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Invoicing : content

3. The date of transaction, quantity, unit cost and description of the goods or properties or nature of services Name, business style and address of seller In the case of sales in the amount of P1,000 or more where the sale is made to a VAT-registered person, the name, business style, if any, address and TIN of the buyer Notation: Not to be issue for Non-VAT/Exempt sales of goods, properties or services. If issued, sales shall be subject to 10% VAT. BIR permit to print information

4. 5.

6.

7.

SL-10

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Summary list

Who are required to submit Quarterly Summary Lists of Sales? All persons liable for VAT with quarterly total sales/receipts (net of VAT) exceeding Two Million Five Hundred Thousand Pesos (P2,500,000) Who are required to submit Quarterly Summary Lists of Purchases? All persons liable for VAT with quarterly total purchases (net of VAT) exceeding One Million Pesos (P1,000,000)

SL-11

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Summary list of Sales

Quarterly Summary Lists of Sales shall show the monthly total sales generated from regular buyers/ customers, regardless of amount, as well as from casual buyers/customers with individual sales amounting to P100,000 or more. Regular buyers/customers Those who are engaged in business or exercise of profession and those with whom the taxpayer has transacted at least six (6) transactions regardless of the amount. Casual buyers/customers Those who are engaged in business or practice of profession but did not qualify as regular buyers/ customers as defined above.

SL-12

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Summary List of Sales Content

BIR-registered name of the buyer who is engaged in business/exercise of profession TIN of the buyer (only for sales that are subject to VAT) Exempt Sales Zero-rated Sales Sales Subject to VAT (exclusive of VAT) Output Tax (VAT on sales subject to 10%)

SL-13

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Summary list of Purchases: Content

(i)

BIR - registered name of the seller / supplier / service provider Address of seller/supplier/service provider TIN of the seller Exempt Purchases Zero-rated Purchases Purchases Subject to VAT (exclusive of VAT) on

services (ii) capital goods (iii) other goods

SL-14

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Summary list : Content

The names of sellers/suppliers/service-providers and the buyers/customers shall be alphabetically arranged and presented in the schedules The summary lists shall reflect the consolidated monthly transactions per seller/supplier or buyer for each of the three months of VAT taxable quarter Note: It is not clear how the capital goods amortization and 70% cap on input VAT will be taken into account The summary lists shall be submitted in magnetic form using 3.5-inch floppy diskettes following the format provided in RR 16-2005.

SL-15

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Transitionary provisions

Recognize transitional input tax credit Report unused invoices/receipts Report billed but uncollected sale of services

SL-16

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Transitional input tax

Extended to taxpayers who become VATregistered upon exceeding P1.5 M annual sales Equivalent to 2% of the value of the inventory of goods, materials and supplies as of start of VAT status, or actual VAT thereof, whichever is higher . Capital goods and goods exempt from VAT are excluded from the computation,

SL-17

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Transitional input tax

Inventory of goods must be submitted to the BIR within 30 days from start of VAT status. Adjusting entry to record transitional input tax Input Tax Inventory xxx xxx

SL-18

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Use of existing invoices/receipts

Non-VAT receipts/invoices may still be used by new VAT taxpayers until end of the year Submit to BIR within 30 days the inventory of unused receipts/invoices Unused non-VAT receipts/invoices should be stamped VAT-registered as of November 1, 2005

SL-19

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Billed but uncollected sale of services

Amounts collected after Nov. 1 for bills for services issued on or before Oct. 31 not subject to VAT Information return of uncollected bills to be submitted to BIR on or before Dec. 30 Copies of bills attached to information return Record the amount of accounts receivable

SL-20

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Computation of VAT

Gross Sales/ Receipts Less: Sales Returns Sales Allowances Allowable Sales Discounts Net OUTPUT TAX INPUT TAX: Carried over from previous period Domestic Purchases Importations Capital goods subject to depreciation(amortized over 60 mo) Total INPUT TAX XXX XXX XXX

10% VAT XXX

0% VAT XXX

10% Govt XXX

XXX XXX 10% XXX [A]

XXX XXX 0% 0 [A]

XXX XXX 10% XXX -

XXX XXX XXX XXX XXX XXX * [B] XXX* [B]

XXX **[B]

VAT PAYABLE/REFUNDABLE XXX [A-B] (XXX)[A-B] XXX[A-B] Note: All amounts in the formula are assumed to be net of VAT *subject to limitation (70% of output tax) under RA No. 9337 **fixed at 5% standard input VAT

SL-21

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Apportionment of Input Tax

In case there are VAT and non-VAT activities, input tax shall be allowed as follows: Total input tax which can be directly attributed to transactions subject to VAT; and A ratable portion of any input tax (common input tax) which cannot be directly attributed to either activity.

Note: Example in RR 16-2005 presents a monthly attribution computation. However, the Quarterly VAT Return provides for a quarterly computation.

SL-22

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Apportionment of Input Tax

Input Tax Attributed to Exempt Activity Common Input Tax X Exempt Sales Total Sales

Input Tax Attributed to VATable Activity* Common Input Tax X Taxable Sales Total Sales

* This in turn will have to be apportioned to different VATable activities (10%, 0%, and Government sales) SL-23 SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Illustration: Mixed Transaction

ERA Corporation (RR 16-2005 example) Total Sales for the month Breakdown of Total Sales: Sales to private entities subject to 10% VAT Sale to private entities subject to 0% VAT Sale of VAT-exempt goods Sale to govt. subjected to 5% final VAT withholding P400,000

P100,000 P100,000 P100,000 P100,000

SL-24

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Illustration: Mixed Transaction

The following input taxes were passed on by its VAT suppliers:

Input tax on taxable goods (10%) Input tax on zero-rated sales Input tax on sale of exempt goods Input tax on sale to government Input tax on depreciable capital good not attributable to any specific activity (monthly amortization for 60 months) P 5,000 3,000 2,000 4,000 P20,000

SL-25

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Illustration: Mixed Transaction

Creditable input tax for the month

Input tax on sale subject to 10% Input tax on zero-rated sale Ratable portion of the input tax not directly attributable to any activity:

P 5,000 3,000

Taxable sales (0% and 10%) X Amount of input tax Total Sales not directly attributable P 200,000 400,000 x 20,000 = P 10,000

Total creditable input tax for the month

SL-26

P 18,000

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Illustration: Mixed Transaction

Input tax attributable to sales to government Input tax on sale to govt Ratable portion of the input tax not directly attributable to any activity: Taxable sales to government X Amount of input Total Sales tax not directly attributable P 100,000 400,000 X P 20,000 - P 5,000 - P 9,000 - P 4,000

Total input tax attributable to sales to government

SL-27

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Illustration: Mixed Transaction

Input tax attributable to VAT-exempt sales Input tax on VAT-exempt sales Ratable portion of the input tax not directly attributable to any activity: VAT-exempt sales X Amount of input Total Sales tax not directly attributable P 100,000 400,000 X P 20,000 P 5,000 P 7,000 P 2,000

Total input tax attributable to VAT-exempt sales

SL-28

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Illustration: Summary of the transactions of ERA Corp

Output VAT Input VAT directly Attributab le Input VAT not directly attributable to any activity 5,000 Total Input VAT Creditable Input VAT Net VAT Payable Excess Input VAT for carry over/ 0 Input VAT for refund Unrecover able input VAT

Sale Subject to 10% VAT Sale Subject to 0% VAT Sale of Exempt Goods Sale to Governme nt subject to 5% Final withholding VAT

10,000

5,000

10,000

10,000

3,000

5,000

8,000

8,000

8,000

2,000

5,000

7,000

7,000*

10,000

4,000

5,000

9,000

5,000**

5,000

4,000*

* These amounts are not available for input tax credit but may b e recognized as cost expense ** Standard input VAT of 5% on sales to Government as provided i n Sec. 4.114-2(a) Withheld by Government entity as Final Withholding VAT

SL-29

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

VAT on Government Contracts

RA No. 9337 and RR No. 16-2005 (Final Withholding VAT) The Government or any of its political subdivisions, instrumentalities or agencies, including government owned or controlled corporations (GOCCs) shall, before making payment on account of its purchase of goods and/or services which are subject to 10% VAT shall deduct and withhold a final VAT of 5% of the gross payment. The five percent (5%) final VAT withholding rate shall represent the net VAT payable of the seller.

SL-30

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

VAT on Government Contracts

RA No. 9337 and RR No. 16-2005 (Final Withholding VAT) The remaining five percent (5%) effectively accounts for the standard input VAT for sales of goods or services to government or any of its political subdivisions, instrumentalities or agencies including GOCCs, in lieu of the actual input VAT directly attributable or ratably apportioned to such sales. Should actual input VAT exceed five percent (5%) of gross payments, the excess may form part of the sellers expense or cost. If actual input VAT is less than 5% of gross payment, the difference must be closed to expense or cost. The certificate or statement to be issued is the Certificate of Final tax Withheld at source (BIR Form No. 2306), a copy of which is to be issued to the payee.

SL-31

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Example: Sales to Government

Case 1: Sales to government Purchases with valid input taxes Output Tax (10%) VAT withheld final (5%) Actual input tax Standard input VAT (5%) Cost/expense [A-B] P110,000 (VAT inclusive) P 88,000 (VAT inclusive) P 10,000 5,000 8,000 5,000 3,000

[A] [B]

SL-32

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Suggested Journal Entries: Sales to Govt

Goods: Sale to Government Purchases with valid input taxes Journal Entries: To record the sale Dr Accounts Receivable Cr Sales Output Tax 110,000 100,000 10,000 P110,000 (VAT inclusive) 88,000 (VAT inclusive)

SL-33

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Suggested Journal Entries: Sales to Govt

To record the purchase Dr Expense/Asset Input Tax Cr Accounts Payable To record collection Dr Cash Cr Accounts Receivable 105,000 105,000 80,000 8,000 88,000

SL-34

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Suggested Journal Entries: Sales to Govt

To record VAT withheld by Government Dr Output Tax Cr Accounts Receivable 5,000 5,000

To close the balance of output tax on sales to Government and the related input tax Dr Output Tax Expense/Cost Cr Input Tax 5,000 3,000 8,000*

*Not allowed as input tax credits. Effectively, the allowable input tax credits on sales to Government is 50% of output tax. Any excess input tax should be charged to cost or expense.

SL-35

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Example: Sales to government

Case 2: Sales to government Purchases with valid input taxes Output Tax (10%) VAT withheld final (5%) Actual input tax Standard input VAT (5%) Cost/expense [A-B] P110,000 (VAT inclusive) P 44,000 (VAT inclusive) P 10,000 5,000 4,000 5,000 (1,000)

[A] [B]

SL-36

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Suggested Journal Entries: Sales to Govt

Sale to Government P110,000 (VAT inclusive) Purchases with valid input taxes 44,000 (VAT inclusive) Journal Entries: To record the sale Dr Accounts Receivable Cr Sales Output Tax 110,000 100,000 10,000

SL-37

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Suggested Journal Entries: Sales to Govt

To record the purchase Dr Expense/Asset Input Tax Cr Accounts Payable To record collection Dr Cash Cr Accounts Receivable 105,000 105,000 40,000 4,000 44,000

SL-38

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Suggested Journal Entries: Sales to Govt

To record VAT withheld by the Government Dr Output Tax 5,000 Cr Accounts Receivable 5,000 To close the balance of output tax on sales to Government and the related input tax Dr Output Tax 5,000 Cr Input Tax 4,000* Cost/expense 1,000 *Not allowed as input tax credits. Effectively the allowable input credits on sales to Government is equivalent to 50% of output tax. Any excess input tax should be charged to cost or expense, resulting in increase in taxable income

SL-39

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

70% limitation on Input Tax Credit

RR No. 16-2005

If at the end of any taxable quarter the output tax exceeds the input tax, the excess shall be paid by the VAT-registered person. Example: Quarter x Output VAT Input VAT Net VAT payable

SL-40

P100 80 20

Note: 70% limitation will not apply

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

70% Limitation on Input Tax Credit

RR No. 16-2005

If the input tax inclusive of input tax carried over from the previous quarter exceeds the output tax, the input tax inclusive of input tax carried over from the previ ous quarter that may be credited in every quarter shall not exceed seventy percent (70%) of the output tax; Provided, That, the excess input tax shall be carried over to the succeeding quarter or quarters

SL-41

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Example: Limit on Input Tax Credit

Quarter x Output VAT Input VAT - actual Limit (70% of Output) Excess input carryover Input Tax allowed VAT Payable *Carryover to next month Note: VAT return provides for monthly determination of limitation

SL-42

P100 P 110 70 40* 70 P 30

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Input Tax on Capital Goods

RR No. 16-2005 Input tax on purchases or importation of capital goods which are depreciable assets for income tax purposes, the aggregate acquisition cost of which (exclusive of VAT) in a calendar month exceeds P1 million, regardless of acquisition cost of each capital good, shall be claimed as credit against output tax, as follows: 1. Estimated useful life of capital good is 5 years or more

Monthly input tax =

Total Input Tax 60 months

SL-43

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Input Tax on Capital Goods

2. Estimated useful life is less than 5 years

Monthly Input Tax = Total Input Tax Estimated Useful Life in Months

If the aggregate acquisition cost (exclusive of VAT) of the existing or finished depreciable capital goods purchased or imported during any calendar month does not exceed P1 million: the total input taxes will be allowable as credit against output tax in the month of acquisition

SL-44

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Input Tax on Capital Goods

The aggregate acquisition cost of a depreciable asset in any calendar month refers to the total price agreed upon for one or more assets acquired and not on the payments actually made during the calendar month. Thus, an asset acquired in instalment for an acquisition cost of more than P 1,000,000.00 will be subject to the amortization of input tax despite the fact that the monthly payments/instalments may not exceed P 1,000,000.00.

SL-45

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Input Tax on Capital Goods

RR 16-2005 Start of Time to Claim Claim for input tax shall commence in the calendar month of acquisition. If the depreciable capital good is sold/transferred within a period of 5 years or prior to the exhaustion of the amortizable input tax, the entire unamortized input tax on the capital goods sold/transferred can be claimed as input tax credit during the month/quarter when the sale or transfer was made but subject to the limitation prescribed under Sec. 4.110-7 of these Regulations.

SL-46

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Illustration: Input tax on Capital Goods

Capital goods used in trade or business if total acquisition cost (excluding VAT) exceeds P1M, for one month XYZ Company purchased machineries for P1.5M (excluding VAT). All have estimated useful lives of 5 years. This is supported by a VAT invoice dated November 1, 2005. Input VAT will be claimed as follows: Input VAT claimable = P1.5M x 10% = P150,000 Claimable as follows: For the month of November = P150,000/60 months = P2,500 Succeeding 59 months = P2,500/month

SL-47

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Suggested Journal Entries Input Tax

Purchase of capital goods (input tax claimable over 60 months or useful life whichever is shorter) i. Upon purchase of capital goods Dr Capital Goods Deferred Input Tax Capital Goods Cr Accounts Payable

xxx xxx xxx

ii. Upon claiming or amortization of input tax on a monthly basis Dr Input tax Capital Goods xxx Cr Deferred Input Tax-Capital Goods xxx Note: Taxpayer should maintain a subsidiary record in ledger form for the acquisition, purchase or importation of depreciable assets or capital goods

SL-48

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Journal Entries Excess Input Tax

VAT Liability/Excess Input Tax Credits At the end of each VAT month/quarter, the following entry should be effected to reflect the VAT payable or excess input tax credits for the month/quarter: To record VAT payable Dr Output Tax xxx Cr Input Tax-Capital Goods* Input Tax* VAT Payable/Cash *Subject to 70% limitation

SL-49

xxx xxx xxx

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Old VAT return

19 Total Sales/Receipts (Sum of Items 14B to 18B) and Output Tax Due (Sum of Items 14C to 18C) - 10% 20 Zero Rated Sales/Receipts 21 Exempt Sales/Receipts 22 Total Sales/Receipts (Sum of Items 19A, 20 and 21) 23 Less: Input Tax 23A Transitional Input Tax

23B 23C 23D/E 23F/G 23H/I 23J/K 23L/M 23N/O

19A 20 21 22 Purchases

19B

23A 23B 23C 23E 23G 23I 23K 23M 23O

Presumptive Input Tax Input Tax Carried Over from Previous Quarter 23D Domestic Purchases-Capital Goods Domestic Purchases - Goods other than Capital Goods 23F Domestic Purchases-Services Services rendered by Non-Resident Importations - Capital Goods 23H 23J 23L 23N 23P 23Q

Importations- Goods other than capital goods 23P Purchases Not Qualified for Input Tax

23QTotal Purchases (Sum of Items 23D,23F,23H,23J,23L,23N & 23P)

24 25

Total Available Input Tax (Sum of Items 23A,23B, 23C, 23E, 23G, 23I, 23K,23M & 23O) Less: Deduction from Input Tax 25A Any VAT Refund/ TCC Claimed 25B Excess input tax carrried over to succeeding quarter, if this is an amended return 25C Total (Sum of Items 25A and 25B)

24 25A 25B 25C 26 27

26 Net Creditable Input Tax (Item 24 less Item 25C) 27 VAT Payable/(Excess Input Tax) (Item 19B less Item 26)

This will be modified by the BIR.

SL-50

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Revised VAT return

Revised Monthly VAT Declaration and Quarterly VAT Return (Sept 2005) Provide for 9 schedules in the second page Require detailed reporting of capital goods and amortization of allowable input tax for the period

SL-51

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Repealing Clause

RR 16-2005 All other laws, acts, decrees, executive orders, issuances and rules and regulations or parts thereof which are contrary to and inconsistent with any provisions of R.A. No. 9337 are deemed repealed, amended or modified. All other issuances and rules and regulations or parts thereof which are contrary to and inconsistent with any provisions of these Regulations are deemed repealed, amended or modified.

SL-52

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

Repealing Clause

RR 16-2005 No VAT exemptions may be granted by the BIR except those explicitly stated in Sec. 109(1) of the Tax Code, as amended by RA No. 9337. All previous exemptions granted through laws, acts, decrees, executive orders, issuances and rules and regulations or parts thereof promulgated or issued prior to the effectivity of RA No. 9337 are deemed repealed, amended or modified accordingly.

SL-53

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

A Comprehensive Look at VAT

October 25, 2005

Increase in VAT rate in 2006

Provided, that the President, upon recommendation of the Secretary of Finance, shall, effective January 1, 2006, raise the rate to 12% after any of the following conditions has been satisfied: i. VAT collection as a percentage of GDP of the previous year exceeds two and four-fifth percent (2 4/5%); or ii. National government deficit as a percentage of GDP of the previous year exceeds one and onehalf percent (1 %)

SL-54

SGV & CO

A MEMBER PRACTICE OF ERNST & YOUNG GLOBAL

Quality In Everything We Do

The Peninsula Manila

2005 SGV & Co.

Vous aimerez peut-être aussi

- Working Capital Management Theories & TechniquesDocument10 pagesWorking Capital Management Theories & Techniquesalexandro_novora639671% (14)

- Requirements For Summary List of Sales and PurchasesDocument2 pagesRequirements For Summary List of Sales and PurchasesMary Joy Villanueva100% (2)

- Value Added Tax (Vat) .PPT FinalDocument57 pagesValue Added Tax (Vat) .PPT FinalNick254Pas encore d'évaluation

- VAT-VALUE ADDED TAX(UAEDocument64 pagesVAT-VALUE ADDED TAX(UAEAlex ko100% (1)

- Algebra Review SolvedDocument18 pagesAlgebra Review Solvedalexandro_novora6396Pas encore d'évaluation

- Algebra Review SolvedDocument18 pagesAlgebra Review Solvedalexandro_novora6396Pas encore d'évaluation

- MsgSpec v344 PDFDocument119 pagesMsgSpec v344 PDFqwecePas encore d'évaluation

- Geneva IntrotoBankDebt172Document66 pagesGeneva IntrotoBankDebt172satishlad1288Pas encore d'évaluation

- Bir ReliefDocument15 pagesBir ReliefHenry Mapa100% (1)

- Vat Input and Output TaxDocument137 pagesVat Input and Output TaxLen100% (1)

- Value Added TaxDocument20 pagesValue Added Taxrpd2509Pas encore d'évaluation

- ALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXDocument37 pagesALL ABOUT VALUE ADDED TAX - Mamalateo 2014POWERMAXjohn apostolPas encore d'évaluation

- Business Tax GuideDocument30 pagesBusiness Tax GuideKristelle Mae BautistaPas encore d'évaluation

- Accounting For VAT in Th... Accounting Center, Inc.Document4 pagesAccounting For VAT in Th... Accounting Center, Inc.Martin EspinosaPas encore d'évaluation

- VAT GUIDE 2nd EditionDocument28 pagesVAT GUIDE 2nd EditionLoretta Wise100% (1)

- Frequently Asked QuestionsDocument40 pagesFrequently Asked Questionsroy rebosuraPas encore d'évaluation

- Ease of Paying Taxes ActDocument4 pagesEase of Paying Taxes ActwhitekaisuPas encore d'évaluation

- Value Added Tax Part 1Document35 pagesValue Added Tax Part 1422002590Pas encore d'évaluation

- Exercises 15-1 discussion questions simplified business tax system VAT scopeDocument1 pageExercises 15-1 discussion questions simplified business tax system VAT scopesamsungacerPas encore d'évaluation

- Value Added Tax-PDocument20 pagesValue Added Tax-PMa. Corazon CaramalesPas encore d'évaluation

- Lecture VAT With ExercisesDocument82 pagesLecture VAT With ExercisesAko C JamzPas encore d'évaluation

- Everything You Need to Know About Sales TaxDocument26 pagesEverything You Need to Know About Sales TaxMudassar GillaniPas encore d'évaluation

- PRSN / VVK / Rad Indirect Taxes Dept. - HQDocument107 pagesPRSN / VVK / Rad Indirect Taxes Dept. - HQprabhu85Pas encore d'évaluation

- VAT Concepts Tax 321Document28 pagesVAT Concepts Tax 321justinePas encore d'évaluation

- Business Tax: Consumption Tax Payable by Persons Engaged in BusinessDocument42 pagesBusiness Tax: Consumption Tax Payable by Persons Engaged in BusinessEmersonPas encore d'évaluation

- Tax 2 - VATDocument37 pagesTax 2 - VATShirley Marie Cada - CaraanPas encore d'évaluation

- Report EvatDocument22 pagesReport EvatlauronlizPas encore d'évaluation

- Business and Transfer TaxationDocument22 pagesBusiness and Transfer TaxationNicole Rivera100% (1)

- Business Taxes ExplainedDocument51 pagesBusiness Taxes ExplainedLuna CakesPas encore d'évaluation

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Document3 pagesExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoPas encore d'évaluation

- Chapter 6 The Value Added TaxDocument20 pagesChapter 6 The Value Added TaxCathy Marie Angela ArellanoPas encore d'évaluation

- Income-Tax-4 24 18Document25 pagesIncome-Tax-4 24 18Ma. Divina B. LapuraPas encore d'évaluation

- 5.0 Intro To Income TaxDocument31 pages5.0 Intro To Income TaxAllan BacudioPas encore d'évaluation

- VAT Presentation To The General PublicDocument27 pagesVAT Presentation To The General PublicJoette PennPas encore d'évaluation

- CHAPTER 6 TaxDocument24 pagesCHAPTER 6 TaxVencint LaranPas encore d'évaluation

- Guide For Value Added Tax Via EFiling - External GuideDocument39 pagesGuide For Value Added Tax Via EFiling - External GuidemusvibaPas encore d'évaluation

- BUSINESS TAX GUIDE: Types, Requirements & MoreDocument23 pagesBUSINESS TAX GUIDE: Types, Requirements & Morerayjoshua12Pas encore d'évaluation

- 1 Basics of Value Added TaxDocument58 pages1 Basics of Value Added TaxHazel Andrea Garduque LopezPas encore d'évaluation

- Accounting For VAT in The Philippines - Tax and Accounting Center, IncDocument8 pagesAccounting For VAT in The Philippines - Tax and Accounting Center, IncJames SusukiPas encore d'évaluation

- Taxation - Real EstateDocument9 pagesTaxation - Real EstateArun KumarPas encore d'évaluation

- Business-Tax VAT FAQsDocument11 pagesBusiness-Tax VAT FAQsBryan VidalPas encore d'évaluation

- 2 Value Added TaxDocument216 pages2 Value Added TaxnichPas encore d'évaluation

- 2018 Financial Services Banking Industry Vat Awareness SessionDocument65 pages2018 Financial Services Banking Industry Vat Awareness SessionWaqas AtharPas encore d'évaluation

- Allama Iqbal Open University: Assignment # 2Document13 pagesAllama Iqbal Open University: Assignment # 2Irfan AslamPas encore d'évaluation

- Value Added Tax Ust PDFDocument23 pagesValue Added Tax Ust PDFcalliemozartPas encore d'évaluation

- Implication of VAT On Individuals: Value Added Tax (VAT)Document4 pagesImplication of VAT On Individuals: Value Added Tax (VAT)Jabir U V KaladiPas encore d'évaluation

- M2 Introdution To Business TaxDocument19 pagesM2 Introdution To Business TaxAlicia FelicianoPas encore d'évaluation

- Revised VAT Guidelines for Philippine TaxpayersDocument15 pagesRevised VAT Guidelines for Philippine Taxpayersdencave1Pas encore d'évaluation

- Special Topics in Corporate Income TaxationDocument159 pagesSpecial Topics in Corporate Income TaxationLadybird MngtPas encore d'évaluation

- Chapter 6 Introduction To The Value Added TaxDocument27 pagesChapter 6 Introduction To The Value Added TaxJoanna Louisa GabawanPas encore d'évaluation

- VAT Guide: Rates, Returns, Filing ProceduresDocument33 pagesVAT Guide: Rates, Returns, Filing ProceduresvicsPas encore d'évaluation

- VAT-ADDED TAXDocument22 pagesVAT-ADDED TAXDiossaPas encore d'évaluation

- Module 3 - Value Added TaxDocument113 pagesModule 3 - Value Added TaxAllan C. MarquezPas encore d'évaluation

- GSTR-9 Annual Return AnalysisDocument15 pagesGSTR-9 Annual Return Analysisarun alwaysPas encore d'évaluation

- Business Tax - VATDocument165 pagesBusiness Tax - VATAlgen Lyn MendozaPas encore d'évaluation

- Invoicing and Regn FlyerDocument2 pagesInvoicing and Regn FlyerMie TotPas encore d'évaluation

- 43677RMO 3-2009 - Suspension GroundsDocument29 pages43677RMO 3-2009 - Suspension GroundsAnonymous OyhbxcjPas encore d'évaluation

- Rmo 3-2009Document29 pagesRmo 3-2009sheena100% (2)

- Nigeria Tax Data CardDocument44 pagesNigeria Tax Data CardF KPas encore d'évaluation

- Value-Added Tax: DescriptionDocument26 pagesValue-Added Tax: DescriptionGIGI BODOPas encore d'évaluation

- Value Added Tax IVDocument52 pagesValue Added Tax IVPCPas encore d'évaluation

- 06 VAT Compliance-RequirementsDocument2 pages06 VAT Compliance-RequirementsJaneLayugCabacungan100% (1)

- VAT ReportDocument21 pagesVAT ReportNoel Christopher G. BellezaPas encore d'évaluation

- Eagle Localization MexicanRequirementsDocument36 pagesEagle Localization MexicanRequirementsAgnaldo GomesPas encore d'évaluation

- FM-SR-10v0 SREAccreditationCertificate 21D30 FDocument1 pageFM-SR-10v0 SREAccreditationCertificate 21D30 Falexandro_novora6396Pas encore d'évaluation

- Basic Concepts (Cost Accounting)Document9 pagesBasic Concepts (Cost Accounting)alexandro_novora6396Pas encore d'évaluation

- FM-SR-15v0 - SRETOOLData ProcessingDocument1 pageFM-SR-15v0 - SRETOOLData Processingalexandro_novora6396Pas encore d'évaluation

- FM SR 11v0 - BiodataDocument1 pageFM SR 11v0 - Biodataalexandro_novora6396Pas encore d'évaluation

- Sarbanes-Oxley Act, Internal Control, and Management AccountingDocument2 pagesSarbanes-Oxley Act, Internal Control, and Management Accountingalexandro_novora6396Pas encore d'évaluation

- Bir Form 0605Document2 pagesBir Form 0605alona_245883% (6)

- Law - Senate Bill 1319 National Market Code PDFDocument19 pagesLaw - Senate Bill 1319 National Market Code PDF1004.100% (1)

- FM SR 12v0 - SRETOOLAEMDocument1 pageFM SR 12v0 - SRETOOLAEMalexandro_novora6396Pas encore d'évaluation

- A. Electronics B. ElectricalDocument1 pageA. Electronics B. Electricalalexandro_novora6396Pas encore d'évaluation

- 1905 January 2018 ENCS - Corrected PDFDocument3 pages1905 January 2018 ENCS - Corrected PDFJoseph Jr TengayPas encore d'évaluation

- Department of Health Workplace HandbookDocument99 pagesDepartment of Health Workplace Handbooklnd cmroPas encore d'évaluation

- Magna Carta for Public School TeachersDocument21 pagesMagna Carta for Public School Teachersalexandro_novora6396Pas encore d'évaluation

- 1905 January 2018 ENCS - Corrected PDFDocument3 pages1905 January 2018 ENCS - Corrected PDFJoseph Jr TengayPas encore d'évaluation

- DTI-DOLE Joint Memorandum Circular No. 20-04-ADocument22 pagesDTI-DOLE Joint Memorandum Circular No. 20-04-AdonhillourdesPas encore d'évaluation

- BPS Product Certification - PhilippinesDocument19 pagesBPS Product Certification - Philippinesalexandro_novora6396Pas encore d'évaluation

- 10 Bible Verses About God's Will - Yahoo! Voices - Voices - YahooDocument6 pages10 Bible Verses About God's Will - Yahoo! Voices - Voices - Yahooalexandro_novora6396Pas encore d'évaluation

- Top Ten: James M Novora Jesus Abellano Lourdes R. BigcasDocument1 pageTop Ten: James M Novora Jesus Abellano Lourdes R. Bigcasalexandro_novora6396Pas encore d'évaluation

- Open EconomyDocument46 pagesOpen EconomyREALMARIDPas encore d'évaluation

- NINJA Study PlannerDocument8 pagesNINJA Study Planneralexandro_novora6396100% (1)

- Magna Carta for Public School TeachersDocument21 pagesMagna Carta for Public School Teachersalexandro_novora6396Pas encore d'évaluation

- Algebra SolDocument5 pagesAlgebra Solalexandro_novora6396Pas encore d'évaluation

- Contract of Loan Inter AffiliateDocument3 pagesContract of Loan Inter Affiliatealexandro_novora6396Pas encore d'évaluation

- RainbowDocument14 pagesRainbowalexandro_novora6396Pas encore d'évaluation

- 2303 Section 57Document7 pages2303 Section 57alexandro_novora6396Pas encore d'évaluation

- RA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesDocument12 pagesRA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesCrislene Cruz83% (12)

- RA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesDocument12 pagesRA 6713 - Code of Conduct and Ethical Standard For Public Officials and EmployeesCrislene Cruz83% (12)

- Haryana Retial GarmentsDocument8 pagesHaryana Retial Garmentssudesh.samastPas encore d'évaluation

- ContactsDocument10 pagesContactsSana Pewekar0% (1)

- Group 4-Hospital Information System - His - QuizDocument2 pagesGroup 4-Hospital Information System - His - QuizGeeyan Marlchest B NavarroPas encore d'évaluation

- RTL8316C GR RealtekDocument93 pagesRTL8316C GR RealtekMaugrys CastilloPas encore d'évaluation

- Jurisdiction On Criminal Cases and PrinciplesDocument6 pagesJurisdiction On Criminal Cases and PrinciplesJeffrey Garcia IlaganPas encore d'évaluation

- LPM 52 Compar Ref GuideDocument54 pagesLPM 52 Compar Ref GuideJimmy GilcesPas encore d'évaluation

- EDI810Document11 pagesEDI810ramcheran2020Pas encore d'évaluation

- Keya PandeyDocument15 pagesKeya Pandeykeya pandeyPas encore d'évaluation

- Indian Institute of Management KozhikodeDocument5 pagesIndian Institute of Management KozhikodepranaliPas encore d'évaluation

- Civil Aeronautics BoardDocument2 pagesCivil Aeronautics BoardJayson AlvaPas encore d'évaluation

- Week 3 SEED in Role ActivityDocument2 pagesWeek 3 SEED in Role ActivityPrince DenhaagPas encore d'évaluation

- People vs. Ulip, G.R. No. L-3455Document1 pagePeople vs. Ulip, G.R. No. L-3455Grace GomezPas encore d'évaluation

- 1990-1994 Electrical Wiring - DiagramsDocument13 pages1990-1994 Electrical Wiring - Diagramsal exPas encore d'évaluation

- Chapter 1: The Investment Environment: Problem SetsDocument5 pagesChapter 1: The Investment Environment: Problem SetsGrant LiPas encore d'évaluation

- 4.5.1 Forestry LawsDocument31 pages4.5.1 Forestry LawsMark OrtolaPas encore d'évaluation

- Wind EnergyDocument6 pagesWind Energyshadan ameenPas encore d'évaluation

- Fujitsu Spoljni Multi Inverter Aoyg45lbt8 Za 8 Unutrasnjih Jedinica KatalogDocument4 pagesFujitsu Spoljni Multi Inverter Aoyg45lbt8 Za 8 Unutrasnjih Jedinica KatalogSasa021gPas encore d'évaluation

- Variable Displacement Closed Circuit: Model 70160 Model 70360Document56 pagesVariable Displacement Closed Circuit: Model 70160 Model 70360michael bossa alistePas encore d'évaluation

- ASCE - Art Competition RulesDocument3 pagesASCE - Art Competition Rulesswarup babalsurePas encore d'évaluation

- Cib DC22692Document16 pagesCib DC22692Ashutosh SharmaPas encore d'évaluation

- AWC SDPWS2015 Commentary PrintableDocument52 pagesAWC SDPWS2015 Commentary PrintableTerry TriestPas encore d'évaluation

- CST Jabber 11.0 Lab GuideDocument257 pagesCST Jabber 11.0 Lab GuideHải Nguyễn ThanhPas encore d'évaluation

- L-1 Linear Algebra Howard Anton Lectures Slides For StudentDocument19 pagesL-1 Linear Algebra Howard Anton Lectures Slides For StudentHasnain AbbasiPas encore d'évaluation

- BA 9000 - NIJ CTP Body Armor Quality Management System RequirementsDocument6 pagesBA 9000 - NIJ CTP Body Armor Quality Management System RequirementsAlberto GarciaPas encore d'évaluation

- Software EngineeringDocument3 pagesSoftware EngineeringImtiyaz BashaPas encore d'évaluation

- Entrepreneurship WholeDocument20 pagesEntrepreneurship WholeKrizztian SiuaganPas encore d'évaluation

- 2006-07 (Supercupa) AC Milan-FC SevillaDocument24 pages2006-07 (Supercupa) AC Milan-FC SevillavasiliscPas encore d'évaluation

- Teleprotection Terminal InterfaceDocument6 pagesTeleprotection Terminal InterfaceHemanth Kumar MahadevaPas encore d'évaluation