Académique Documents

Professionnel Documents

Culture Documents

01 Final Irrbam

Transféré par

Vev'z Dangpason BalawanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

01 Final Irrbam

Transféré par

Vev'z Dangpason BalawanDroits d'auteur :

Formats disponibles

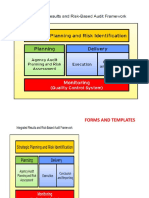

Commission on Audit

INTEGRATED RESULTS AND RISK-BASED AUDIT MANUAL

(Funded by The World Bank IDF Grant No. TF 092158)

Strategic Planning and Risk Identification Planning

Agency Audit Planning and Risk Assessment

Delivery

Execution Conclusion and Reporting

Monitoring

(Quality Control System)

SEPTEMBER 2011

Integrated Results and Risk-Based Audit Manual

TABLE OF CONTENTS

Introduction Overview of IRRBAM

1.

Strategic Planning and Risk Identification 1.1 Perform Government Risk Identification 1.1.1 Develop/Update the Government Risk Model 1.1.2 Identify Government Risks 1.1.3 Report the Results of GRI Conduct COA Strategic Planning

1.2 2.

Agency Audit Planning and Risk Assessment 2.1 2.2 2.3 Prepare Agency Audit Workstep Understand the Agency Identify Significant Agency Risks 2.3.1 Update Agency Risk Model 2.3.2 Identify Agency Risks 2.3.3 Prioritize Significant Agency Risks Understand and Assess Agency-level Controls Understand the Process 2.5.1 Identify Critical Path of the Processes 2.5.2 Identify Process Risks 2.5.3 Identify Impact 2.5.4 Identify Existing Controls Conduct Audit Risk Assessment and Planning 2.6.1 Financial and Compliance 2.6.2 Performance 2.6.3 Determine Audit Scope and Timing 2.6.4 Determine need for specialized skills

2.4 2.5

2.6

3A.

Execution 3A.1 Design Audit Tests 3A.2 Execute Audit Tests 3A.3 Evaluate Audit Results 3A.4 Communicate Audit Results Supplemental: 3A-S1 Execution Financial & Compliance 3A-S2 Execution Performance 3A-S3 Sample Test of Control Working Paper

Last updated Version

: March 2011 : 00-01/2011/v1

1|Pa ge

Integrated Results and Risk-Based Audit Manual 3A-S4 Sample Substantive Test Audit Program 3B. Conclusion and Reporting 3B.1 Summarize Audit Results 3B.1.1 Prepare summary of audit results and recommendations 3B.1.2 Discuss results of different types of audit conducted 3B.2 Prepare Audit Report 3B.3 Perform Overall Audit Review 3B.3.1 Perform overall review and approval 3B.3.2 Issue report 3B.4 Wrap-up and Archive the Engagement 3B.5 Follow-up Agency Action Plan Monitor quality control on audit services

4.

Last updated Version

: March 2011 : 00-01/2011/v1

2|Pa ge

Integrated Results and Risk-Based Audit Manual

FORMS AND TEMPLATES

1. Strategic Planning and Risk Identification Form 01-01 Government Risk Model (GRM) Form 01-02 Government Risk Identification Template (GRIT) Agency Audit Planning and Risk Assessment Form 02-01 Agency Audit Workstep Form 02-02 Understanding the Agency (UTA) Template Form 02-03 Agency Risk Model (ARM) Form 02-04 Agency Risk Identification (AgRI) Matrix Form 02-05 Agency-level Control Checklist (ALCC) Form 02-06 Process-Risk-Control (PRC) Matrix Form 02-07 Audit Risk Assessment and Planning (ARAP) Tool Delivery: Execution Form 03A-01 Audit Test Summary (ATS) Delivery: Conclusion and Reporting Form 03B-01 Summary of Audit Results and Recommendations (SARR) Form 03B-02 Quality Inspection Tool (QIT) Form 03B-03 Agency Action Plan (AAP) Form 03B-04 Action Plan Monitoring Tool (APMT)

2.

3A.

3B.

Last updated Version

: March 2011 : 00-02/2011/v1

1|Pa ge

Integrated Results and Risk-Based Audit Manual

Introduction

Introduction

The services provided by the Commission on Audit, as a Constitutional Body and as the countrys Supreme Audit Institution are critical to meet the uttermost expectation of the public. The evolution of audit approaches, revision and emergence of old and new laws, rules and regulations necessitates a more integrated and holistic approach in the conduct of COAs audit services. With this regard, the Philippine Government entered into a contractual agreement with the International Bank for Reconstruction and Development (World Bank) for a grant (IDF Grant TF092158) to improve the effectiveness and efficiency of the COA in its audit of government revenues and expenditures through the development and adoption of a results-based integrated audit methodology that will focus on the outputs and outcomes of public expenditures, using a risk-based approach. As early as 2003, COA has already introduced the risk-based approach in the conduct of its audit services. Various risk-based manuals have been developed such as the Government-wide and Sectoral Performance Audit (GWSPA) Manual, Risk-based Audit Approach (RBAA) Manual and the Risk-based Financial Audit Manual (RBFAM). A significant addition in this manual is the inclusion of the Organizational Performance Indicators Framework of the Department of Budget and Management to support the Governments Public Finance Management (PFM) reform agenda. This will be introduced in this manual to complement the results-based evaluation of the projected and actual outputs and outcomes of programs, activities and projects of government agencies that will focus on the role of public audit in promoting increased accountability and transparency to improve capacity in the overall governance framework of the Philippines. This Integrated Results and Risk-based Audit Manual aims to integrate the different COA audit services such as: Financial and Compliance Audit; Agency-based Performance Audit; Government-wide and Sectoral Performance Audit; and Fraud Audit into a common audit approach. The IRRBA approach will provide for a consistent set of processes that will guide the COA auditors in performing COAs audit services. The silo approach in the conduct of the audit will be addressed by introducing linkages of each type of audit and its results for a more effective service delivery.

Last updated Version

: March 2011 : 00-03/2011/v1

1|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

Overview Government auditing plays a vital role in the public sector governance through its oversight, insight and foresight responsibilities. Government auditors help the government achieve accountability and integrity, improve operations, and instill confidence among citizens and stakeholders. The Commission on Audit, as mandated to be the countrys Supreme Audit Institution by Article IX-D of the 1987 Philippine Constitution, plays a significant role in the Public Sector Governance. This mandate gives the COA the responsibility to serve as the check and balance in the use of public funds; to become part of the development of a sound financial management; to examine proper execution of administrative activities; and to provide information to public authorities and the general public through the publication of objective reports. This manual will discuss the COAs fulfillment of its role in the countrys public governance through the delivery of the following audit services: Comprehensive Audit - Financial and Compliance - Agency-based Performance Audit Government-wide and Sectoral Performance Audit (GWSPA) Fraud Audit

The need for an Integrated-Results and Risk-based Audit Integration is defined in this manual as the establishment of a common public sector audit approach and a consistent set of audit processes that reduces redundant activities, eliminate duplication in the audit of an agency and drive down resource costs through identifying opportunities to create efficiencies and streamlining public sector audit processes to allow the delivery of a comprehensive attestation and advisory audit services. The Commission has long been implementing risk-based audit in the conduct of its audit services. However, to meet the evolving developments in the public governances expenditure management, the COA shall incorporate the results-based approach in its audit.

Last updated Version

: March 2011 : 00-04/2011/v1

1|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

Organizational Performance Indicator Framework (OPIF) The Organizational Performance Indicator Framework (OPIF) is one of the two reform components of the Public Expenditure Management (PEM) being implemented by the government. The reform is being headed by the Department of Budget and Management (DBM) in coordination with other oversight agencies such as the COA and the National Economic and Development Authority (NEDA). OPIF is an expenditure management approach that links public resources towards results and accounts for performance. This approach guides agencies to focus their efforts and public resources on core functions and on delivering high impact activities at reasonable costs and qualities. The role of the COA comes in to assess the agencys performance through indicators that are initially set to account for accomplishments based on pre-determined targets and measures.

Linkage of COAs audit services The diagram below shows how COAs audit services are linked to different audit services, as well as to the countrys Public Expenditure Management reform, the OPIF.

AGENCY Regularity (Financial and Compliance Audit)

INTER-AGENCY

Linkage with other government agencies

Agency-based Value For Money Audit

Economy Efficiency Effectiveness

Governmentwide and Sectoral Performance Audit (GWSPA) Impact

ELEMENTS

AUDIT

Resource

Inputs

Processes

Outputs

Outcome

Performance Indicator

Budget Legislation

Enacted Budget Other Inputs

Programs Activities Projects

Major Final Outputs

Organizational Outcome

Sector Goals Societal Goals

Diagram 1: Overview of COAs audit services

Last updated Version

: March 2011 : 00-04/2011/v1

2|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

The diagram depicts the different audit services provided by the Commission: Comprehensive Audit Financial Audit This type of audit seeks to determine the accuracy of the data contained in the financial statements and reports of the agency including the reliable recording and reporting of historical financial information. Compliance Audit Compliance audit seeks to ensure that public funds are obtained and used in accordance with law and propriety, as well as to determine whether the accountable agency has properly discharged its responsibilities in a legal and ethical manner. Agency-based Performance Audit This audit examines the economy, efficiency and effectiveness of an agency in using its public resources. Government-wide and Sectoral Performance Audit (GWSPA) This type of audit deals with determining the economy, efficiency and effectiveness of publicly funded projects, activities and programs among different agencies. The diagram shows the focus of the different audit services provided by the COA by differentiating the elements of an agencys process. Each element (resource, input, process, output, outcome and impact) is interrelated and plays a significant role in an agency and the government as a whole. The COAs results-based approach will be used in assessing an agencys performance indicators indicated in its OPIF. The OPIF element in an agencys logframe can be traced into its processes which will be taken into account during the conduct of the audit. Although not mentioned in the diagram, auditors shall be aware of any possible fraud indications which may arise during the course of the audits conducted. Fraud audit shall always be embedded in the delivery of the COAs audit services.

Last updated Version

: March 2011 : 00-04/2011/v1

3|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

The role of OPIF in public sector performance audit

Introduction The starting point in the performance audit planning process is selecting the right scope for audit from the multitude of government activities. This is a multifaceted and demanding exercise that requires good knowledge of the government agencys business or sector of action and how it contributes to governments strategic ends. It is, however, one of the most essential steps in the process. If the breadth and depth of audit fail to address the governments major final outputs and outcomes, all the audit effort that follows will have little chance of generating better managed government programs, better state accountability to the public and an ethical and effective public service. The Organizational Performance Indicator Framework, or OPIF, sets out a structure that provides an important compass in deciding the content and substance of performance audit. As its name suggests, OPIF is a systematic approach to planning that seeks to align the tasks government agencies are funded to do (i.e., the goods and/or services they provide to external consumers or end-users) with the desired outcomes, objectives or goals that the government hopes to achieve or influence in critical societal areas such as health, education, economic well-being, law and order, and environmental sustainability. The audit planning process involves several layers of activity that interrelate with OPIF in a complex manner before an audit begins. These include the recognition of external trends and strategic risks facing government instrumentalities; the defining of output or product lines, functional areas and sectors to be reviewed over time; and the choice of agency programs or activities to be examined. Typically, these are driven by the relevance of performance audit to the government agencys mandate, the major risks associated with the agencys mission, and auditability (or inability to carry out the audit, as in the case of societal outcomes where suitable criteria are not available to assess performance). Risk-based audit planning is emphasized at the outset because of the crucial role it plays in ascertaining how well a government agency is responding to key challenges, opportunities and critical success factors that shape the accomplishment of government objectives and the discharge of stewardship responsibilities for public resources and assets.

Last updated Version

: March 2011 : 00-05/2011/v1

1|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

Outcome orientation: twinning of performance audit and OPIF In the past, many audits were driven by control and process concerns rather than addedvalue considerations in assessing public sector performance. However, the current trend is toward a more outcome-based audit. The need of government to achieve more concrete results in societal goals such as poverty reduction, full employment and education for all is shifting the emphasis of public sector audit, in recent years, to pay more attention on results. Regardless of whether the scope of the audit is a program, an operation, a system or a control, a focus on results is being maintained, if somewhat unsystematically. The relationship of the agencys agenda to the desired ends is increasingly becoming indispensable to the auditors learning curve. Performance auditing by nature is not a regular audit with by the book opinions. The auditor might not have to confront a traditional, rule-bound situation. Performance audit is wide-ranging, operating from a quite different knowledge base to that of traditional auditing. This type of audit looks at the outputs or outcomes first and avoids conducting an initial scrutiny of the details of the methods or processes. Of course this presumes that indicators are on hand to gauge the quality, quantity and cost of the outputs. If the auditor finds the result to be all right, serious flaws in the design or implementation of the activity or process are discounted, making the entire audit procedure more cost-effective. It is only when the result is substandard that controls are examined to pinpoint what is troubling the system. The greater challenge for performance audit occurs when it has to delve into policy questions. Auditors must understand policies amenable to audit effectively, and resultsoriented auditing inevitably brings performance auditing closer to policy matters. They must have the expertise to check (1) whether agency practices comply with policy expectations (for example, extent of compliance with enacted policy on service standards); (2) the sufficiency of the agencys cost-benefit analysis on which a policy or program is based; (3) opportunities to fill policy gaps (for example, the need for a government-wide policy on emergency preparedness); and (4) the need to update or improve existing policy (for example, the need for a new directive for national security). A caveat is that it is generally accepted that performance audit should confine itself to examining policy and program implementation and not to throwing the development of policy into doubt (although auditors may evaluate the clarity of the grounds for setting the objectives). Note too that the risks of mandate concerns proportionately get bigger as policies get broader. It is easy enough for auditors to deal with departmental administrative policies (such as service delivery procedures), but the stakes grow to be larger when auditors tackle program policy goals (such as fisheries conservation policy, healthcare policy) as well as national policy goals (such as reducing poverty).

Last updated Version : March 2011 : 00-05/2011/v1

2|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

OPIF provides a good platform for auditors not to second-guess the strategic intentions of government, when government selects a certain policy direction. Departments and agencies are now required to define results commitments in their corporate plans and to report goals and actual performance annually. These provide excellent points of reference for results-oriented auditing. The Department of Budget and Management, the implementor of OPIF, acts as the agent for government in negotiating performance contracts with the departments and agencies, to assist them in linking the goods and services that they deliverthe major final outputs (MFOs)to the results they have committed to (organizational outcomes, sectoral and societal goals). Indeed, the key features of OPIF embody a clear crossover between a results-oriented performance framework and a results-based audit perspective. These include: (1) a shift of emphasis in department/agency accountability towards outputs and results (outcomes) measured against performance indicators; (2) clarification of expected performance and accountability of departments/agencies through these results; (3) focus on the delivery of outputs relevant to the results/outcomes specified in agency mandates; (4) establishment of an integrated performance management system in which performance targets zero in on the efficiency of departments/agencies in delivering their MFOs; and (5) reporting to the public and to Congress in clear terms the outcomes achieved. Both OPIF and performance audit deal mainly with questions such as: What has been the upshot of the agencys performance, and have the requirements or the objectives been fulfilled? In this approach, the inquiry centers on performance (concerning economy, efficiency, and effectiveness) and relates observations to the given norms (goals, objectives, regulations and so on). To be sure, there is a striking parallel between what they strive for, as indicated in the following table: Performance Audit Economy - minimizing the cost of resources used for an activity, having regard to appropriate quality Efficiency producing similar results with fewer resources or better results with the same resources Effectiveness achieving the stipulated aims or objectives by the means employed and the outputs produced OPIF Fiscal discipline - living within the means (resources) available to the Government Allocative efficiency - spending money on the right things or right priorities Operational efficiency - obtaining the best value for the money or resources available Effectiveness - success of process and outputs in delivering societal and sectoral changes

Last updated Version

: March 2011 : 00-05/2011/v1

3|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

At the very basic level, performance auditing has been mainly concerned with different aspects of the economy or the efficiency of operations of agencies. Auditors try to answer the question Are things being done in the right way?, that is, whether policy decisions are being carried out properly. This question often partakes of a normative outlook, i.e., the auditor wants to know whether government officials have observed the rules or the requirements. Audits of economy may provide answers to questions such as: Do the means chosen or the equipment obtainedthe inputsrepresent the most economical use of public funds, consistent with the quality needs of the program? Have the human, financial or material resources been used cost-effectively? Are the management activities performed in accordance with sound administrative principles, contract requirements, acceptable standards, and good management policies? In short, has the agency kept the costs low? Audits of efficiency answer the question whether agency resources have been put to optimal or suitable use or whether identical results in terms of quality and turn-around time could have been achieved with fewer resources. Auditors examine productivity, unit cost, or indicators such as utilization rates, backlogs and service wait times. In short, has the agency made the most of available resources? The OPIF approach to performance management displays the same adherence to efficiency and economy. The focus is on allocative efficiency (in terms of national and sector goals and organizational outcomes) in the execution of the budget, but also on the operational efficiency of departments/agencies in the provision of services (and, in some cases, goods) for the purpose of achieving the desired government goals and outcomes. Sound OPIF-based management means that the responsible authority will promote the optimal use of resources to achieve intended outcomes with the lowest possible costs. The scope for analysis becomes considerably wider when a second-order question whether the right things are being doneis asked. This line of inquiry refers to effectiveness or impact on societywhether the adopted policies have been suitably put into service or whether ample means have been utilized to achieve the predetermined aims. There are two parts to the issue of effectiveness: if the policy objectives have been achieved, and if the impacts observed are really the upshot of the policy rather than other circumstances. It is here where a chosen measure to achieve a certain objective runs the risk of being contested. Effectiveness audits are also on the lookout for unintended consequences or spillover effects (such as environmental degradation resulting from economic policy). The figure below indicates how audit perspectives enter into an effectiveness model.

Last updated Version

: March 2011 : 00-05/2011/v1

4|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

In assessing effectiveness, performance auditing may ask whether (1) government programs have been effectively designed, whether the means provided (legal, financialand so on) are proper, consistent, suitable, or relevant; (2) the program supplements, duplicates, overlaps, or counteracts other related programs; (3) the quality of the public services meets the publics expectations or the stipulated objectives; (4) the system for measuring, monitoring and reporting is adequate; (5) the observed direct or indirect social, economic and environmental impacts of a policy are due to other causes; and (6) alternative approaches can yield better performance or eliminate factors that inhibit program effectiveness. OPIF effectiveness measures rest on the same underpinnings as those of performance audit. OPIF seeks to measure the effectiveness of the agencys outputs in delivering societal and sectoral changes. OPIF measures of effectiveness (as well as of efficiency and economy) begin as part of a budget proposal, and attain official standing or legislative base once the government budget is passed by Congress. Once they reach this stage, government agencies can prepare a blueprint of how these criteria will be used when policy goals, programs and projects are implemented. Thus the concept of a results-oriented approach applies irrespective of whether it is used by OPIF or performance audit. Both follow the same input-throughput-output-outcome cycle illustrated below.

Last updated Version

: March 2011 : 00-05/2011/v1

5|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

Finally, both performance audit and OPIF allow for scrutiny and planning across government departments, which should be the case since public sector activities and projects often cross agency lines. Inquiring on the activity or project as a whole is in general more useful than dwelling on a slice of action carried out by a specific agency. The types of performance audits are (1) agency or program audits, which provide a substantive review of the whole or part of the operations of a department or agency; (2) government-wide audits, which focus on cross-sectional issues or functional areas, such as procurement, in a number of departments; and sectoral audits, which focus on program areas delivered by a number of agencies, for example, disaster mitigation operations. In a similar vein, OPIF is carried out singularly in specific agencies, or jointly across sectors (e.g., education, health, agriculture, science and technology).

Understanding the agency Each audit should be based on a thorough understanding of the audited agency, and the environment in which it operates, as it relates to the audit assignment. Performance audit begins by having a good grasp of department/agency objectives, expected results and stewardship responsibilities. The audit team then identifies the major threats and opportunities that may affect the agency or entities within a functional area. Prior to starting field work, a process of setting priorities, developing strategic and long-range plans, submitting audit proposals, rationalizing resources and assessing anticipated audit worth should take place. Regardless of the size and nature of the subject, it is important for the audit team to understand the big picture. Generating audit conclusions or reporting failings without this overall familiarity may result in sterile audit work or ambiguous and confusing findings. A first round knowledge of the agency forms a reasonable basis for believing that the audit can be completed in accordance with the performance audit policies. An agency analysis framework will be required. An environmental scan to identify external trends and long-term risks and challenges that the agency faces will kick this off. All agencies operate against a background of broad external forces that influence their

Last updated Version : March 2011 : 00-05/2011/v1

6|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

operations in substantial ways. These forces affect not just the agency, but also the public and its resources. Some examples are (1) economic trends that include recession, inflation, unemployment, and unfair trade practices; (2) political and regulatory factors that involve world trade agreements, government subsidy programs, and political instability; (3) demographic patterns that dictate the characteristics of the work force and the demand preferences of the public (e.g., aging population affect demand for healthcare); (4) technological advances that lead to dramatic changes in the way things are done, such as computerization and the internet; (5) social/cultural changes that affect the way people live, work and behave (e.g., more women in the workplace, concerns about drug abuse); and (6) ecological concerns about acid rain, global warming, recycling and waste management that can lead to substantial changes in the way agencies operate. The audit team should have up-to-date knowledge of significant legislative authorities; organizational arrangements; the bureaucratic environment in which the entity operates; key personnel; spending levels and revenues; the entitys clients; major operations, including in the field; the accountability arrangements; the major control systems; major risks facing the entity; and prior deficiencies/known weaknesses. How are the OPIF elements incorporated in understanding the agency? First, it is necessary to check whether the OPIF logical framework will match up with an agency program structureotherwise known as a program accountability model.

Last updated Version

: March 2011 : 00-05/2011/v1

7|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

It is easy to see from the above figure that the OPIF framework elements have corresponding components in the program accountability model. A comparison of the building blocks of the two models, shown in the in the table below, illustrates how wellmatched they are. Auditors will not have to search far and wide to understand the workings of an OPIF-based agency.

OPIF Logical Framework Societal goal describes the intended desirable impacts of the department/agencys goods and services on the country, the environment or the economy. As end-points to be aimed for, they represent the high-level vision the Government has for the country. Sectoral goals the longer-term benefits for the sector from organizational changes. Organizational outcomes benefits to the community that result from the department/agencys provision of goods or services Major final outputs the products (goods and services) the department/agency delivers to external clients. PAPS programs, activities and projects that are necessary undertakings pursued by departments/agencies to be able to deliver the goods, products or services.

Program Accountability model Impacts, or effects refer to all the consequences of the program, whether intended or unintended

Outcomes intended consequences of producing or delivering the goods or services; ranked from the immediate to the ultimate Outputs refer to the products or services produced or delivered by the program Activities a collection of activities directed to achieving the programs objectives.

In performance audit, the audit team checks if there is a logical link between the activities undertaken, the output and the program objectives and other effects. They also ascertain whether the agency is clear on what the expected outputs are (the MFOs in OPIF terms) and whether performance indicators are available for guiding the audit. Similarly, within OPIF, the building blocks are viewed in a sequence or chain, leading from activities and processes to long-term goals such as poverty reduction. Each result in the

Last updated Version : March 2011 : 00-05/2011/v1

8|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

chain is a link and is joined to other results in the chain by causality. The chain starts with projects, activities and programs (PAPs), and moves through MFOs to outcomes and finally to higher-level goals at the sectoral and societal levels. The Medium-Term Philippine Development Plan defines the societal goals and sectoral goals, providing an overarching structure for OPIF logframe. The diagram below shows the linkage between these different levels. The key level for OPIF is the MFO level. MFOs are tangible and can be more easily quantified as compared to outcomes and goals. Each of the other levels can be defined in relation to MFOs: activities are how MFOs are produced; outcomes and higher-level goals are the reason or why MFOs are produced; and for the MFOs themselves, there is a need to know what is produced and for whom. Measuring the marginal contribution that an MFO makes toward improving a societal welfare (reduced poverty incidence and improved quality of life) is a critical element of strategic budgeting and the development of the MTPDP. The OPIF logframe of the Department of Agrarian Reform (shown on next page), is an example of a well-formulated results-based framework. The OPIF process can assist performance audit through the following: 1. Review of the department/agency mandates and functions and articulation of the organizational outcomes or results of the department/agency. 2. Identifying the links between the department/agencys organizational outcomes and the higher government objectives (sectoral and societal goals) enunciated in the MTPDP, government priorities, sectoral policies and so on. 3. Documenting the MFOs and organizational outcomes in a framework that shows the linkages between resource inputs, the programs, activities and projects that the department/agency implements to produce its MFOs, and the organizational outcomes for which it is mandated. 4. Identification of performance indicators (PIs) with performance measures (targets) for each MFO. These PIs are the major means by which the department/agency can track progress and will be held accountable to the government as a whole, the Congress, the general public and other stakeholders. There are four classes of PIs: Quantity indicates the volume of service (output) delivered during a given period of time Quality indicates how well the service (output) is delivered Timeliness indicates the rate at which service (output) is delivered Cost indicates the amount of input used to produce the service (output).

Last updated Version

: March 2011 : 00-05/2011/v1

9|Pa ge

Integrated Results and Risk-Based Audit Manual

Overview

Department of Agrarian Reform

Last updated Version

: March 2011 : 00-05/2011/v1

10 | P a g e

Integrated Results and Risk-Based Audit Manual

Overview

The following chart would be of immense help to auditors in pinpointing the agencys extent of control and accountability over each activity/output level.

Under the OPIF process, each agency constructs a corporate plan that details out the operating environment, business conditions and planned process improvements for delivering MFOs and sub-outputs. Since the MFOs are the lynchpin of the OPIF framework, it is essential to say a few more words about them, in a way that would make clear their critical importance to understanding the audited agency. MFOs can be defined relative to the outcomes that they contribute to the client or community group that they serve and the business lines or functional business unit of the department/agency. To derive the MFOs, the department/agency should ask: What outputs are we providing to external clients to achieve our mandate (organizational outcomes)? MFOs may reflect delivery of saleable products, provision of policy advice or other advisory services, regulatory services, case management services, and government provision of services not readily available in the market place. It may include goods and services delivered through outsourcing. Each MFO should reflect a core output, deliverable or business line of the department/agency and will typically comprise a grouping of PAPs undertaken with a common outcome in mind. This grouping of PAPs should also help the department/agency to assess whether it is providing the right

Last updated Version

: March 2011 : 00-05/2011/v1

11 | P a g e

Integrated Results and Risk-Based Audit Manual

Overview

services (or mix of services) to achieve the organizational outcomes. It is intended that, in due course, the department/agency budgets will be appropriated at MFO level. Following are examples of MFOs: 1. DOF - Fiscal policies (domestic and international), plans and programs; cash and debt management services; Anti-corruption in public finance management, antismuggling and tax evasion activities and exercise of regulatory power; policies, plans and programs for domestic financial and capital market development; policies, plans and programs for public sector debt management as well as risk management; policies, plans and programs for the government corporate sector as well as other government assets; policy oversight on LGUs financial operations; administration of Locally-Sourced and ODA Funds for LGUs. 2. DOH Health, nutrition and population policy and program development; capability building services for LGUs and other stakeholders; leveraging services for priority health programs; regulatory services for health products, devices, equipment and facilities; tertiary and other specialized health care. 3. DOT - Tourism promotional services; tourism development planning services; standards for tourism facilities and services; development, restoration and maintenance services, regulatory services. The background knowledge that the auditors accumulate provides the basis for describing the agency that is the subject of audit, enabling them to make initial scoping decisions and defining lines of inquiry, such as those shown in the following figure. This knowledge includes an understanding of the character of the government agency being audited (role and function, activities and processes in general, development trends), legislation and general programs and performance goals, organizational structure and accountability relationships, internal and external environment and the stakeholders, external constraints affecting program delivery, and management processes and resources.

Last updated Version

: March 2011 : 00-05/2011/v1

12 | P a g e

Integrated Results and Risk-Based Audit Manual

Overview

An audit team with considerable experience in auditing the department or agency may have cumulative knowledge to satisfy these requirements without engaging in a formal overview stage. An in-depth perspective is required where a government-wide or sectoral audit is being carried out. In some cases, a survey may be conducted to come up with a broad-based appraisal of the operations subject to audit, without carrying out detailed verification. The auditors gather information in order to fine-tune initial decisions about scope, cost, timing and skills, and to propose audit objectives, areas for in-depth review, criteria, and examination approach. In finalizing these decisions, the audit team designs an audit to reduce the risk of making erroneous observations, faulty conclusion and inappropriate recommendations in the report to correspond with the level of assurance provided by the audit work. All things considered, the purpose of the scoping exercise is to allow the concentration of audit resources and effort on the areas that can have a significant impact on the performance and results of the subject being audited. Unrelenting attention by the auditor is needed to identify and focus the audit on the critical operations. In using OPIF, the auditors must be aware of its limitations: First, it is a work in progress. In view of the innovative nature of the OPIF system, which requires shifts in practices/procedures, knowledge/capacity and value-orientation of the implementers, changes in the current system cannot be done overnight. Second, implementation is done through learning by doing. While the literature is replete with the available methodology

Last updated Version : March 2011 : 00-05/2011/v1

13 | P a g e

Integrated Results and Risk-Based Audit Manual

Overview

and tools for a performance and results-oriented system, capacity building can only be made more effective if the agency staff go through the actual process of implementing the system and learning from the lessons of experience. Third, the OPIF system is homegrown and indigenized. Technical assistance from various sources, have been provided to the government based on the experiences of countries that have adopted OPIF in their respective planning and budgeting processes. This technical assistance provided very valuable inputs in bringing OPIF to its status today. However, the technical inputs have to be adjusted to suit the domestic institutional conditions.

A word about risk management An important device used in all phases of the planning process is risk assessment. Risk is defined as the probability that an event or action may harmfully affect the organization, such as exposure to financial failure, loss of reputation, or inability to deliver the program with economy, efficiency, cost-effectiveness or take into account the environmental implications. Risk estimation requires the auditor to ask the following type of questions: What can go wrong? What is the probability of it going wrong? What are the consequences? Can the risk be minimized or controlled? Can OPIF provide guidance and tools to assist auditors to identify and assess environmental issues and risks in their performance audit work? OPIF can point to the inherent risks in dealing with organizational outputs beyond the control of the agency (the susceptibility of the subject matter by its nature to significant error where there are no related controls). But an agency which is careless in applying OPIF to its operations may itself induce failure risk. The fact that OPIF is to be carried out through learning by doing raises significant risks in terms of timing and adequacy of results. Likewise, risk can attend the consequences of the publics perception of fairness and equitable treatment of citizens as agencies carry out MFOs. Changes in mandate occasioned by the introduction of new MFOs may increase the level of exposure to uncertainties. There is also the matter of process riskOPIF requires a sometimes painful alignment with operation strategies and alternative delivery approaches. On the other hand, a circumspectly crafted department/agency OPIF may prevent failure risk by avoiding redundant activities, nonessential undertakings, uncoordinated policy/program implementation, poor sector management, superfluous committees, and the politicization of the bureaucracy.

Last updated Version

: March 2011 : 00-05/2011/v1

14 | P a g e

Integrated Results and Risk-Based Audit Manual

Overview

Recap: OPIF value-adding contribution to performance audit OPIF should, where the opportunity arises, add value in a variety of ways, including: Helping auditors to respond effectively to changes in the way public services are organized and delivered, including, identifying opportunities for worthwhile innovation; Providing new insights into the way an audited body manages its resources, delivers its programs, achieves its objectives and develops business opportunities, including how cost-effective improvements might be identified and achieved; Helping generate the audit framework, by providing a convenient way to ascertain the audit scope; Keeping audit costs in balance with the significance of the issues being examined; Taking account of the management circumstances and operational environment as well as the governance milieu; Sustaining an iterative planning process to maintain a focus on matters of significance and interest to decision-makers and Congress; Helping auditors to recognize institutional risks and to respond to them effectively; Contributing to new accounting systems by making clear what the auditors requirements are; and Benchmarking and developing yardsticks, collating and distilling information, for example, on good practice from across ranges of public sector agencies.

Last updated Version

: March 2011 : 00-05/2011/v1

15 | P a g e

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

STRATEGIC PLANNING AND RISK IDENTIFICATION

Integrated Results and Risk-Based Audit Framework

Strategic Planning and Risk Identification Planning

Agency Audit Planning and Risk Assessment

Delivery

Execution Conclusion and Reporting

Monitoring

(Quality Control System)

Introduction The complexity of todays public environment necessitates for a more systematic, integrated and holistic approach to plan for the detection and management of the risks faced by government institutions. Thus, the mandate of COA to safeguard the transparency and accountability of the transactions of the government is getting more complicated. This phase covers the first integration point wherein all COA audit services namely: Financial and Compliance Audit, Agency-based Performance Audit, Government-wide and Sectoral Performance Audit and Fraud Audit, will meet through a common strategic planning and risk identification process. The succeeding topics will describe the strategic planning and risk identification processes and outputs of COA in relation to the conduct of its audit services. However, for purposes of illustration and functional relation, some items on COAs Annual Strategic Planning process will be referred. Nevertheless, the steps provided in this manual will not supersede the processes defined in the Operations Manual of the Planning, Financial and Management Office (PFMO).

Last updated Version

: March 2011 : 01-00/2011/v1

1|Pa ge

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

The following are the activities involved in this phase: 1.1 Perform Government Risk Identification (GRI) 1.1.1 Develop/Update the Government Risk Model (GRM) 1.1.2 Identify Government Risks 1.1.3 Report the results of Government Risk Identification (GRI) Conduct COA Strategic Planning

1.2

Procedures

1.1

Perform Government Risk Identification

Risk is defined as the threat that an event, action or inaction will adversely affect the agencys ability to successfully achieve its mandate and objectives and execute its strategies. The Government is always faced with internal and external factors that may influence and make it uncertain whether and when it will achieve its objectives stated in the Medium-Term Philippine Development Plan (MTPDP) and State of the Nation Address (SONA) among others. The Commission on Audit (COA) as the countrys Supreme Audit Institution shall independently identify the risks that the Government as a whole may face in achieving its objectives. This is to determine the focus areas which need to be prioritized given the limited resources. The results will also be an input in the determination of the appropriate audit strategies needed to be applied by COA for the allocation of resources appropriate for the audit services such as the people, skills, competence, processes and procedures. The objectives of this activity are: to obtain high-level inputs from COA directors assigned in the audit of agencies representing the three audit sectors, regions and auditors performing Government-wide and Sectoral Performance Audit (GWSPA) and Fraud Audit; to have a common language of risk; and to have a unified thrust in government auditing. This activity shall be conducted annually, supervised by the Assistant Commissioners and attended by directors from the following sectors/offices: o National Government Sector (NGS) o Corporate Government Sector (CGS) o Local Government Sector (LGS)

Last updated Version

: March 2011 : 01-00/2011/v1

2|Pa ge

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

o o o o o 1.1.1

Regional Offices Special Audits Office (SAO) Information Technology Office (ITO) Technical Services Office (TSO) Fraud and Investigation Office (FAIO)

Develop/update the Government Risk Model The Government Risk Model (GRM) is a framework consisting of risks categorized into groups that could threaten the government as a whole or the specific processes of the government. The GRM includes a definition of each risk to have a common understanding of risks. The GRM, populated with a list of government risks, is the foundation for conducting Government Risk Identification. It shall be developed to facilitate the identification of risks faced by the government as a whole. Risks are categorized as follows: Strategic risk arises when forces in the environment could significantly change the fundamentals that drive governments overall social and/or operating objectives, strategies and, in the extreme, result in failure of the Governments operations. Operation risk risks that operations are inefficient and ineffective in executing the governments operating model, satisfying the public, and achieving the governments quality, cost and time performance objectives. This arises when operation processes: o Are not clearly defined o Are poorly aligned with agencys strategies, goals and objectives o Are not performed effectively and efficiently in satisfying the public o Expose significant financial, physical and intellectual resources to unacceptable losses, risk taking, misappropriation or misuse Financial risk risk that cash flows and financial risks are not managed costeffectively to: (a) maximize cash availability; (b) reduce uncertainty of currency, interest rate, and other financial risks; or (c) move cash funds quickly and without loss of value to wherever they are needed most. It also includes risks that government agencies face when misleading financial information becomes the basis for decision making by the governing management. Compliance risk non-compliance with prescribed policies and procedures or laws and regulations resulting in lower quality, higher execution costs, lost revenues, unnecessary delays, penalties, fines and so on.

Last updated Version

: March 2011 : 01-00/2011/v1

3|Pa ge

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

Government Risk Model COA directors representing the three audit sectors, regions, SAO, TSO, ITO, and FAIO shall identify and define risks inherent to their sector/region to develop a comprehensive list of government risks and have a common understanding of risks within the COA. Presented below (Diagram 1.1) is a sample of the GRM.

Strategic

Planning and resource allocation Organizational structure Strategic planning Operational planning Budgeting Forecasting Resource allocation Capital/fund availability Operational model Operational portfolio Outsourcing Major initiatives Vision and direction Planning and execution Measurement and monitoring Technology implementation Project evaluation Change readiness Climate change and sustainability initiatives Education Healthcare services delivery Energy and water management (supply/distribution)

Operations

Public service and operations Customer/public satisfaction Channel effectiveness Cycle time Service failure Efficiency Capacity Performance measure/gap Partnering/contracting Citizen relationship management system and organization Corruption and fraud People Culture Recruiting and retention Development and performance Succession planning Knowledge capital Compensation and benefits Performance incentives Health and safety Information technology Information management Security/access Availability/continuity Integrity Infrastructure

Compliance

Mandate Functions Governance Board performance/Agency Management Committee Tone at the top Authority/limit Control environment Corporate social responsibility Reputation Code of conduct Ethics Fraud Employee/third party fraud Illegal acts Management fraud Unauthorized use Legal Contract Liability Intellectual property Anticorruption Legal

Financial

Market Interest rate Foreign currency Commodity Financial instrument Public policies Debt and fiscal policy Liquidity and credit Cash management Opportunity cost Funding Hedging Credit and collections Insurance Foreign assisted loan Accounting and reporting Accounting, reporting and disclosure Internal control Investment evaluation Tax strategy and planning

Diagram 1.1 Sample GRM

The GRM shall be revisited at least annually and updated/revised regularly or as required to reflect changes in government risks brought about by the changing environment and current events. The GRM shall be used as one of the inputs in identifying government risks. Documentation Form 01-01 Government Risk Model (GRM) documents all the identified government risks and its corresponding definition.

Last updated Version

: March 2011 : 01-00/2011/v1

4|Pa ge

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

1.1.2

Identify government risks Risk identification is the process of finding, recognizing, and describing risks. It involves the identification of risk sources, events, their causes and their potential consequences. The fundamental principle of a risk-based audit is to identify risks and focus the audit on those areas which may have a significant effect on the achievement of the governments objectives. As the countrys Supreme Audit Institution, it is imperative for the Commission to identify risks which may hinder the government as a whole to achieve its objectives. Identification of government risks shall be conducted by the COA to determine the areas needed to be focused in their audit activities. This is an input to the development of the Commissions overall audit focus areas during the Annual Strategic Planning. Identification of government risks is done by the COA as an auditor and is independent from the management of the government and its agencies. Any risk assessment as part of the risk management process which will be carried out by the COA as an agency is distinct and separate from this activity. At the same time, the results of the COAs risk identification cannot be considered as a substitute for the governments or agency managements own risk assessment process. Identification of government risks shall be conducted annually. This activity can be done through workshops, surveys or interviews. In any case, this activity shall be supervised by the Assistant Commissioners and attended by directors from the following sectors/offices: o National Government Sector (NGS) o Corporate Government Sector (CGS) o Local Government Sector (LGS) o Regional Offices o Special Audits Office (SAO) o Information Technology Office (ITO) o Technical Services Office (TSO) o Fraud and Investigation Office (FAIO) This activity is conducted to have an over-all consideration of risks of the government as a whole. As an agency that is mandated to look at the transparency and accountability as well as to recommend measures to improve the efficiency and effectiveness of government operations, the COA shall have a unified approach and same risk language in identifying the exposures of the government. This is the first integration point of different audit services performed by the COA.

Last updated Version

: March 2011 : 01-00/2011/v1

5|Pa ge

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

Identification of government risks should not be done on a silo approach. This activity will be conducted in order to identify risks or potential issues that may cut across different government agencies. Inputs of each audit sector are therefore relevant to capture the real risk scenarios of the government as a whole. Linkage of government objectives and initiatives, risks and agencies

Diagram 1.2 - Linkage of objectives and initiatives, risks and agencies

Identifying risks in government objectives and initiatives Understanding the objectives of the government is the first step in this process. After the objectives have been substantiated, risks that may hinder the achievement of the set objectives shall be identified. In identifying government risks, the COA should identify sources of risks, areas of impacts, events, causes and potential consequences. This is to generate a list of risks based on those events that might create, enhance, prevent, degrade, accelerate or delay the achievement of objectives. The following shall be used as inputs in identifying government risks: o SONA o MTPDP

Last updated Version : March 2011 : 01-00/2011/v1

6|Pa ge

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

o o o o o o o o

Medium-Term Public Investment Program (MTPIP) GRM Previous AARs Sector risks Media releases and media reports Fraud and geographic risks Government-wide and sectoral programs and activities Knowledge of the auditors

Risk analysis involves considering the causes and sources of risk, their positive and negative consequences, and the likelihood that those consequences can occur. Factors that affect consequences and likelihood should be identified. Risk is analyzed by determining consequences and their likelihood, and other attributes of the risk. An event can have multiple consequences and can affect multiple objectives. Risks are evaluated and prioritized based on the outcomes of risk analysis.

Link risks to Agency/Programs/Activities

Department of Public Works and Highways Metropolitan Waterworks and Sewerage System

Inputs

Identify Government Risks

SONA, MTPDP and MTPIP

Media releases and reporting

Knowledge and prior audit reports

COA Direction/ SSAP

Fraud and geographic risks

City Government of Navotas

Hunger mitigation program

GRM

Industry/ sector risks

Health sector development project

Diagram 1.3 Risk Identification Process Flow

Risks on fraud covered by FAIO and government programs/activities under the scope of Government-wide and Sectoral Performance Audit (GWSPA) covered by SAO shall also be considered in this activity. Government Risk Identification, based on the results, may result directly in the identification of fraud audits and/or GWSPAs.

Last updated Version

: March 2011 : 01-00/2011/v1

7|Pa ge

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

In this activity, the participants may identify potential GWSPAs. SAO shall also recommend government programs and activities to be subjected to GWSPA. Potential GWSPAs shall be analyzed and evaluated.

Locate identified government risks to affected agency and its programs/activities After the risks have been identified for a particular government objective, the COA shall now locate these risks with the concerned agencies and the related processes, programs, activities or projects. Form 01-02 Government Risk Identification Template (GRIT) is prepared to plot the key government risks and the affected agencies including processes, programs, activities or projects. Diagram 1.8 below illustrates the linking of risks to processes.

Key Government Risks

Link key government risks to government agencies within the cluster

Government Agency

Link key government risks to government processes/programs/activities

Government processes/ programs/activities

Legal Intellectual property

Compliance

Liability Contract Anticorruption Legal

Department of Public Works and Highways

Department of Transportation and Communication

Procurement Process

Diagram 1.4 Linkage of risks to processes

Fraud audit and GWSPA For key government risks that resulted directly to the identification of fraud audits and GWSPAs (as risk response or planned action), FAIO and SAO shall perform the audits following the guidelines set forth in their respective manuals (Fraud Audit Manual and GWSPA Manual). Documentation The results of this activity shall be documented in Form 01-02 Government Risk Identification Template (GRIT).

Last updated Version

: March 2011 : 01-00/2011/v1

8|Pa ge

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

1.1.3

Report the results of Government Risk Identification The COA shall ensure that the results of the government risk identification will be presented to and approved by the Assistant Commissioners and Commission Proper, and distributed to concerned sectors/offices who participated in this activity. The report on the results of GRI contains/documents the GRIT and the minutes of the GRI activity. The results of this activity shall be cascaded down to the concerned sectors, clusters, audit groups through the COA Strategic Planning process. The results will also be an input to the Agency Audit Planning and Risk Assessment Phase (refer to phase 2 of the manual).

1.2

Conduct COA Strategic Planning

This section covers the COA Strategic Planning conducted annually. The elements and processes described here are captured from the PFMO manual to show the linkage of Strategic Planning of the COA as an agency to the IRRBAs Strategic Planning and Risk Identification of the COA as an auditor. The IRRBA Manual does not supersede any activity presented in the PFMO Operations Manual. Strategic planning is an essential element in the development of an IRRBA approach. A long-term perspective for the audit services may be provided by this process. Likewise, it provides efforts to allocate resource properly and drives the implementation of the COAs audit objectives and priorities. Strategic Planning process Strategic planning is an iterative and never-ending process. The COA shall continuously set goals, values and objectives aligned to its mandate and monitor its progress all throughout the year. Each element of the planning process cannot stand alone and is necessary to be linked with other elements to fully achieve its objective. The following are some of the Strategic Planning models used by other organizations. There is however no perfect strategic planning model for a specific Supreme Audit Institution. It is still the managements responsibility to select and ensure a model that is tailor-fitted to the needs and culture of the COA.

Last updated Version

: March 2011 : 01-00/2011/v1

9|Pa ge

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

Basic Strategic Planning Basic strategic planning starts with the identification of the organizations purpose or mission statement. Goals will then be established to define what an organization needs to accomplish to meet its purpose or mission, and address major issues facing the organization. After the mission statement and goals have been identified, specific approaches or strategies will be set. Strategies often change the most as the organization eventually conducts more robust strategic planning. Specific action plans will then be based on the strategies identified. This is the specific activities set out for each major sector or department. Then, regular monitoring and update of the plans are performed as the year progresses. Goal-based/Issue-based Planning The processes are almost the same with the Basic Strategic Planning model except that the organization conducts an assessment of its Strengths, Weaknesses, Opportunities and Threats (SWOT). Scenario Planning This model, as the title implies, relates factors which might influence the organization such as: new standards; laws, rules and regulations; economic downturns; and natural disasters. Each possible change in circumstance or scenarios will be provided with strategies. Alignment Planning The alignment model ensures strong alignment among the organizations mission and resources to effectively deliver the services. This model focuses on the adjustments to be made to fine-tune the strategies needed to align with the organizations mission, programs, resources and needed support. Self-Organizing/Traditional Planning These are often liner in nature, e.g. general-to-specific, cause-and-effect. Typically, the organization starts the planning process with the SWOT Analysis, then prioritizing issues which will be provided with specific strategies. Seeking consultation and interaction among the participants during the planning process is significant. Concurrence shall be obtained not just on the outcomes of development but also on the strategies and tradeoffs needed in establishing the level of the COA audit services to be provided.

Last updated Version

: March 2011 : 01-00/2011/v1

10 | P a g e

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

Reasons for Planning The following are some of the reasons for the strategic planning process: It is a requirement of the auditing standards It is a guide for the achievement of the audit objectives It is a tool used to monitor an organizations progress It measures accomplishment It provides control over activities It assigns responsibility and accountability Benefits of Strategic Planning Strategic planning provides benefits such as: Clearly define the purpose of the organization and to establish realistic goals and objectives consistent with that mission in a defined time frame within the organizations capacity for implementation. Serves as a communication tool to disseminate the organizations goals and objectives Assigns ownership of action plans and strategies Utilizes resources by focusing on the key priorities Provides a measuring tool for the performance and progress of each segment Elements of a strategic plan Development of strategic plan requires consideration of values and priorities. The plan should reflect the needs of the COA as a whole in response to its mandated functions. Key message from the Commission Proper Mission Vision Goals Strategic thrusts Key national programs and the entities responsible Monitoring process Review and communication In any case, plans must be adaptable and flexible in response to a changing environment. Assessment on the capacity and resources shall also be regularly done to determine any needs for adjustment on the plans set.

Last updated Version

: March 2011 : 01-00/2011/v1

11 | P a g e

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

Timing Ideally, the strategic planning process should be conducted at least once a year in order to be ready for the coming year. This includes identification of the organizational goals to be achieved at least over the coming fiscal year, resources needed to achieve those goals, and funding needed to obtain the resources. Linkage of COAs Annual Strategic Planning process with IRRBA The diagram below shows the linkage of the COAs Annual Strategic Planning Process with the Strategic Planning and Risk Identification phase of the IRRBA approach. The previous activity, Government Risk Identification will be an input in the Annual Strategic Planning of COA to determine the focus areas of the audit sectors. The GRIT, as accomplished by the COA Directors and approved by the Assistant Commissioners will be cascaded as an attachment to the Sector Strategic Action Plan (SSAP) and Cluster/Regional Operation Plan (COP/ROP) of the audit sectors. The results of the COAs Annual Strategic Planning process specific to the conduct of the audit services will be an input in the Phase 2 of the IRRBA methodology Agency Audit Planning and Risk Assessment.

Diagram 1.5 Linkage of COAs Annual Strategic Planning process with IRR

Last updated Version

: March 2011 : 01-00/2011/v1

12 | P a g e

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification

Policy and Standard Policy/Standard ISSAI 100 ISSAI 200 ISSAI 300 ISSAI 1300 INTOSAI GOV 9130 ISO/FDIS 31000:2009 COA Memorandum No. 79-205 Description Basis principles in Government Auditing General standards in government auditing and standards with ethical significance Field standards in government auditing Financial audit guideline Planning an audit of financial statements Guidelines for internal control standards for the public sector Further information on entity risk management Risk management Principles and guidelines Reiteration of unnumbered COA Memorandum dated May 8, 1978 re: Alignment/Coordination of all Projects/Programs of COA offices/Committees by the Planning, Financial & Management Office July 6, 1979 Preparation of a Consolidated Annual Report (CAAR) by Region and by Department 2008 COA Organization Restructuring Implementing guidelines on audit operations under the 2008 COA organizational restructuring

COA Memorandum No. 95-051 COA Resolution No. 2008-012 COA Memorandum No. 2009-028

Documentation Procedure 1.1 Perform Government Risk Identification Sub-procedure Develop/Update the Government Risk Model Identify Government Risks Report the Results of Government Risk Identification 1.2 Conduct COA Strategic Planning Output/Tools Form 01-01 Government Risk Model (GRM) Form 01-02 Government Risk Identification Template (GRIT) Report on the results of GRI

Last updated Version

: March 2011 : 01-00/2011/v1

13 | P a g e

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification Form 01-01: Government Risk Model

GOVERNMENT RISK MODEL

Objective Part of the Strategic Planning and Risk Identification process of the Integrated Results and Riskbased Audit (IRRBA) is the identification of government risks. This activity will be conducted annually, supervised by the Assistant Commissioners and attended by directors from the following sectors/offices: National Government Sector (NGS) Corporate Government Sector (CGS) Local Government Sector (LGS) Regional Offices Fraud and Investigation office (FAIO) Special Audits Office (SAO) Information Technology Office (ITO) Technical Services Office (TSO) The Government Risk Model is introduced to guide the participants in the identification of government risks. The Government Risk Model is a comprehensive list of risks that a government may encounter which could threaten the achievement of its mandate and objectives. This model shall be regularly reviewed, updated and customized to consider changes in the public sector environment, as well as to consider the impact of new standards, laws, rules and regulations.

*The COA shall identify the process champion in this activity, which will ensure the maintenance and updating of this tool.

Accomplishing this tool Risk Listing - The Risk Listing is a table of government risks divided into the following risk categories: a. Strategic b. Operations c. Compliance d. Financial

Last updated Version : March 2011 : 01-01/2011/v1

1|Page

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification Form 01-01: Government Risk Model

The table lists down all potential risks that the government may face. Therefore, there are risks that may be identified as a risk of the government in the current audit period that was not identified in the preceding audit period. In either case, the risk listing shall be maintained regardless of the existence of the risk at the time of the identification. Likewise, the list shall be regularly updated to include emerging risks that may affect the achievement of the governments mandate and objectives.

Risk Definition - Customize/create the definition of the risks based on the nature of the risk. a. Risk Title The label for the risks identified shall be properly chosen to reflect the nature of the risk even by just looking at the risk title. b. Risk Description - The risk description shall be clear on the cause and effect of the risk once it materializes. The risk definition shall be generic in nature and shall avoid including process-level effects to not limit/restrict the risk descriptions.

NOTE: The items in the succeeding pages are just samples to illustrate the tool. It does not represent any factual data nor any result of prior audit projects.

Last updated Version

: March 2011 : 01-01/2011/v1

2|Page

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification Form 01-01: Government Risk Model

Last updated Version

: March 2011 : 01-01/2011/v1

3|Page

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification Form 01-01: Government Risk Model

GOVERNMENT RISK MODEL

Prepared by Reviewed by Approved by : : : Date Date Date : : :

Strategic

Planning and resource allocation Organizational structure Strategic planning Operational planning Budgeting Forecasting Resource allocation Capital/fund availability Operational model Operational portfolio Outsourcing Major initiatives Vision and direction Planning and execution Measurement and monitoring Technology implementation Project evaluation Change readiness

Operations

Public service and operations Customer/public satisfaction Channel effectiveness Cycle time Service failure Efficiency Capacity Performance measure/gap Partnering/contracting Citizen relationship management system and organization Corruption and fraud People Culture Recruiting and retention Development and performance Succession planning Knowledge capital Compensation and benefits Performance incentives Health and safety Information technology Information management Security/access Availability/continuity Integrity Infrastructure Hazards Natural events Terror and malicious acts Physical assets Real estate Property, plant and facilities Maintenance and performance Inventory

Compliance

Mandate Functions Governance Board performance/Agency Management Committee Tone at the top Authority/limit Control environment Corporate social responsibility Reputation Code of conduct Ethics Fraud Employee/third party fraud Illegal acts Management fraud Unauthorized use Legal Contract Liability Intellectual property Anticorruption Legal Regulatory Trade Customs Procurement Road-right of way (RROW )Acquisition Labor Securities Environment Data protection and privacy International Product/service quality Health and safety Competitive practice/antitrust

Financial

Market Interest rate Foreign currency Commodity Financial instrument Public policies Debt and fiscal policy Liquidity and credit Cash management Opportunity cost Funding Hedging Credit and collections Insurance Foreign assisted loan Accounting and reporting Accounting, reporting and disclosure Internal control Investment evaluation Tax strategy and planning Capital structure Debt Equity Pension funds

Climate change and sustainability initiatives

Education Healthcare services delivery Energy and water management (supply/distribution) Environment dynamics Economic changes Financial market Sovereign/political Customer/public wants Technological innovation Environment scan Agency environment/industry Sensitivity Market dynamics Macroeconomic factors Lifestyle trends Sociopolitical Technology changes Communication and public relations Media relations Public relations Crisis communications Employee communication

Last updated Version

: March 2011 : 01-01/2011/v1

4|Page

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification Form 01-01: Government Risk Model

Risk Definition

RISK TITLE STRATEGIC Planning and Resource Allocation Organizational structure Strategic planning Operational planning The overall structure of the government instrumentalities does not support the achievement of strategic objectives in an efficient manner. This risk pertains to the inability to discover, evaluate and select among alternatives to provide direction and allocate resources for effective execution to achieve the strategic objectives of the government. This risk pertains to the misalignment of operating plans and execution to strategic planning. There is also a lack of information needed to make the right decisions. This risk pertains to the inability to effectively budget for new and existing initiatives that support the overall strategic goals and objectives for growth, expansion, acquisition for public welfare. It also pertains to the inability to effectively budget for programs and projects that would meet the governments Medium Term Philippine Development Plan (MTPDP). Forecasting Resource allocation Capital/fund availability This risk pertains to the inability to forecast financial information to enable the allocation of resources to new and existing initiatives. Unavailability and inappropriateness of resource allocation process prohibits the governments ability to provide value for public. Insufficient access to fund threatens the governments capacity to grow, execute its strategies and achieve its objectives. The government has an obsolete operation model and does not recognize it and/or lacks the information needed to make an up-to-date assessment of its current model and build a compelling operational case form modifying that model in a timely manner. Lack of relevant and reliable information that enables agency management to effectively prioritize its services or balance its operations in a strategic context may preclude a diversified agency from maximizing its overall performance. Outsourcing activities to third parties may result in the third parties not acting within the intended limits of their authority or not performing in a manner consistent with the governments strategies and objectives. This risk pertains to the failure to establish a vision and direction for major initiatives, including services, products and programs that will drive future growth. It also pertains to failure to establish project acceptance criteria and adequately measure against the criteria. This risk pertains to the failure to plan and execute major initiatives due in a coordinated manner. RISK DESCRIPTION

Budgeting

Operational model

Operational portfolio

Outsourcing Major initiatives Vision and direction

Planning and execution

Last updated Version

: March 2011 : 01-01/2011/v1

5|Page

Integrated Results and Risk-Based Audit Manual

Phase 1 Strategic Planning and Risk Identification Form 01-01: Government Risk Model

RISK TITLE Measurement and monitoring Technology implementation Project evaluation Change readiness Climate change and sustainability initiatives Environment Dynamics Economic changes Financial market