Académique Documents

Professionnel Documents

Culture Documents

Dream's Trade Ideas by Dreamytrader: Stock Name

Transféré par

dreamytraderTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Dream's Trade Ideas by Dreamytrader: Stock Name

Transféré par

dreamytraderDroits d'auteur :

Formats disponibles

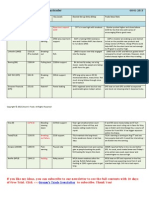

Dreams Trade Ideas by Dreamytrader

Stock Name

last Close Price Status Key Levels Desired Set-up Entry &Stop Trade Ideas Note

07-14-2013

Current Watch-list

S&P500 Index ETF (SPY) $167.51 Attempted rally Near-term resistance $170 SPYs steady and attempted rally Market moved from QE tapering focus to the near its $170 mark. Price action earning season. We should hear some good suggesting Bulls in control. news. AAPLs now above $423, mini uprun starts from here. Long-term in Bullish mode. Waiting for new entry if you are in this stock before. UPS suffered bleeding-sellof after co issued earning warning. Gapping down with volume likely to see follow-through Monday. LNKD charging and collecting buying power and ready to push through the old $200 resistance. BAs suffered from a Dreamliner fire bad news again. Created big selling on Friday. However, $99ish showing supports. GPS steady rise shown some sign of weakness, normal after a run. It needs a rest. AAPL really need some game-changing plan to boost the stock price. The up-trend is intact for NKE despite recent market chills. UPS had its own price moving catalyst, but not for the upside. Earning warning ahead its planned earning release triggered big sell-off Friday. LNKD supporters not getting out. A good earning would initialize a new upside move.

Apple(AAPL)

$426.51

Attempted mini rally Try to hold 50D MA Serious gap-down

$420ish area nearterm support. $62ish lower support N/A

Nike (NKE)

$63.67

UPS (UPS)

$86.12

LinkedIn (LNKD)

$199.96

Charging $200ish resistance zone

Boeing (BA)

$101.87

Newsdriven selling

$99ish support

Boeings Dreamliner came back for bad news and earning is coming. I think this would create another buying opportunity when people cooling down. GPS is expect another quarter of solid earning growth. Good for stock. A bullish stock.

GAP.INC (GPS)

$45.10

print new high

New High

Copyright 2013 Dream's Trade. All Rights Reserved

Discover Financial. (DFS)

$50.89

Breaking to high

In defense mode

DFS is ready to test the high with ranging price action. Entry was $49.50 with volume. Visas price action has been Bullish for a long time, while it is Longterm intact, short swing is normal. TSLA is rising star, with increased volume since last earning report. Price action shown sign of money inflow. AMZN is one of many stocks that stayed strong during the correction and now it is very bullish for many days. NFLX is recovering from its loss since it topped $300 two years ago. Price action suggesting it has ability to move higher from here.

DFS about to pot its new earning report and people are expecting a good-looking result.

Visa (V)

$190.72

Bouncing

Pulling back from new high

Years of strong earning and growing and not showing sign of slowing down, this is what people look for as a Bull Stock. Another earning beat could send TSLA into $160 zone. Replaced ORCL in NASDAQ 100 and other ETFs are bullish. AMZN continued to rise amid non-stopping questionable its profitability. But so far, its price is saying people still in favor of its business. NFLX made very successful business change from DVD rental to online streaming provider and also create Netflix only series and are welcomed by many. More subscribers than HBO is a powerful proof that it is smart ass.

Tesla(TSLA)

$129.90

Probing

Continued to high

Amazon (AMZN)

$307

Rising

Charged rally

Netflix (NFLX)

$257.26

Recovering

Attempted to rally

If you like my ideas, you can subscribe to our newsletter to see the full contents with 10 days of Free Trial. Click >>>Dream's Trade Newsletter to subscribe. Thank You!

Copyright 2013 Dream's Trade. All Rights Reserved

Current Watch-list Featured Chart: N/A Fridays BA and UPS told people that they should always have a stop-loss in case of sudden out of nowhere news could have a serious impact to your position.

Copyright 2013 Dream's Trade. All Rights Reserved

Vous aimerez peut-être aussi

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas 07.15.2013Document3 pagesDream's Trade Ideas 07.15.2013dreamytraderPas encore d'évaluation

- Dream's Trade Ideas 07.22.2013Document3 pagesDream's Trade Ideas 07.22.2013dreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock Namedreamytrader100% (1)

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Dream's Trade Ideas 04.30.2013Document9 pagesDream's Trade Ideas 04.30.2013dreamytraderPas encore d'évaluation

- Dream's Trade Ideas by Dreamytrader: Stock NameDocument3 pagesDream's Trade Ideas by Dreamytrader: Stock NamedreamytraderPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Management of HondaDocument8 pagesManagement of HondafarhansufiyanPas encore d'évaluation

- Chennai CMDA Master Plan 2026 Volume 3 Sectorial BackgroundDocument270 pagesChennai CMDA Master Plan 2026 Volume 3 Sectorial BackgroundMalathi Kathirvel100% (1)

- Puch Moped Horn Wiring Diagram (Chrome Oval Switches)Document1 pagePuch Moped Horn Wiring Diagram (Chrome Oval Switches)MopedgalPas encore d'évaluation

- ChinatownDocument1 pageChinatownAiken KomensenPas encore d'évaluation

- Ashirvad SWR and SWR PLUS - Price List - 02nd April 2022Document14 pagesAshirvad SWR and SWR PLUS - Price List - 02nd April 2022Magnum ConstructionsPas encore d'évaluation

- Ems Accounting Term 2Document39 pagesEms Accounting Term 2Paballo KoopediPas encore d'évaluation

- ExamDocument446 pagesExamkartikPas encore d'évaluation

- Retail Scenario in IndiaDocument10 pagesRetail Scenario in IndiaSeemaNegiPas encore d'évaluation

- CIVPRO - Case Compilation No. 2Document95 pagesCIVPRO - Case Compilation No. 2Darla GreyPas encore d'évaluation

- IEC947-5-1 Contactor Relay Utilization CategoryDocument1 pageIEC947-5-1 Contactor Relay Utilization CategoryipitwowoPas encore d'évaluation

- Lecture6 - RPGT Class Exercise QDocument4 pagesLecture6 - RPGT Class Exercise QpremsuwaatiiPas encore d'évaluation

- Spice Board BBLDocument24 pagesSpice Board BBLvenkatpficoPas encore d'évaluation

- Questionnaire On EthnocentrismDocument14 pagesQuestionnaire On Ethnocentrismkalpa vrikshaPas encore d'évaluation

- Principles of Care-Nursing For Children: Principle DescriptionDocument3 pagesPrinciples of Care-Nursing For Children: Principle DescriptionSanthosh.S.UPas encore d'évaluation

- Tactical Radio BasicsDocument46 pagesTactical Radio BasicsJeff Brissette100% (2)

- Metric MIL-STD-1504C (USAF) 01 March 2007 Supersedes MIL-STD-1504B 8 June 1989Document11 pagesMetric MIL-STD-1504C (USAF) 01 March 2007 Supersedes MIL-STD-1504B 8 June 1989HenryPas encore d'évaluation

- Harmony Radio, R2.8: Order Codes ReferenceDocument51 pagesHarmony Radio, R2.8: Order Codes ReferenceRalaivao Solofohery Dieu-donnéPas encore d'évaluation

- ALP Final Test KeyDocument3 pagesALP Final Test KeyPetro Nela50% (2)

- SIConitDocument2 pagesSIConitJosuePas encore d'évaluation

- Trail Beaver Valley Edition of May 29, 2012 PennywiseDocument56 pagesTrail Beaver Valley Edition of May 29, 2012 PennywisePennywise PublishingPas encore d'évaluation

- Hydraulic Power Unit: RE 51057, Edition: 2020-11, Bosch Rexroth AGDocument20 pagesHydraulic Power Unit: RE 51057, Edition: 2020-11, Bosch Rexroth AGHanzil HakeemPas encore d'évaluation

- Read Me - CADWorx Plant 2019 SP2 HF1Document4 pagesRead Me - CADWorx Plant 2019 SP2 HF1Himanshu Patel (Himan)Pas encore d'évaluation

- Tapspp0101 PDFDocument119 pagesTapspp0101 PDFAldriel GabayanPas encore d'évaluation

- Moot Problem FinalDocument2 pagesMoot Problem FinalHimanshi SaraiyaPas encore d'évaluation

- Introduction To Investment AppraisalDocument43 pagesIntroduction To Investment AppraisalNURAIN HANIS BINTI ARIFFPas encore d'évaluation

- TQM - Juran ContributionDocument19 pagesTQM - Juran ContributionDr.K.Baranidharan100% (2)

- NO.76 Method Statement for Chemical Anchoring of Rebars on Piles - Rev.0第一次Document5 pagesNO.76 Method Statement for Chemical Anchoring of Rebars on Piles - Rev.0第一次Amila Priyadarshana DissanayakePas encore d'évaluation

- Daily Activities List - TCF3 (Safety Aramco) : Work Description Date LocationDocument2 pagesDaily Activities List - TCF3 (Safety Aramco) : Work Description Date LocationSheri DiĺlPas encore d'évaluation

- P102 Lesson 4Document24 pagesP102 Lesson 4Tracy Blair Napa-egPas encore d'évaluation

- Cylinder Clamp For N2 Cylinder 84L and FM-200 Cylinder 82.5LDocument1 pageCylinder Clamp For N2 Cylinder 84L and FM-200 Cylinder 82.5LNguyễn Minh ThiệuPas encore d'évaluation