Académique Documents

Professionnel Documents

Culture Documents

146 Ambank Hartalega Update 130503

Transféré par

Piyu MahatmaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

146 Ambank Hartalega Update 130503

Transféré par

Piyu MahatmaDroits d'auteur :

Formats disponibles

HARTALEGA HOLDINGS

(HART MK, HTHB.KL)

3 May 2013

Capacity constraints curb near-term growth

Company report

Cheryl Tan cheryl-tan@ambankgroup.com +603 2036 2333

Price Fair Value 52-week High/Low Key Changes Fair value EPS YE to Mar Revenue (RMmil) Core net profit (RMmil) EPS (Sen) EPS growth (%) Consensus EPS (Sen) DPS (Sen) PE (x) EV/EBITDA (x) Div yield (%) ROE (%) Net Gearing (%) Stock and Financial Data Shares Outstanding (million) Market Cap (RMmil) Book value (RM/share) P/BV (x) ROE (%) Net Gearing (%) Major Shareholders Free Float (%) Avg Daily Value (RMmil) Price performance Absolute (%) Relative (%)

6.00

HOLD

(Maintained)

Rationale for report: Company Update

RM5.25 RM5.00 RM5.29/RM3.58

Investment Highlights

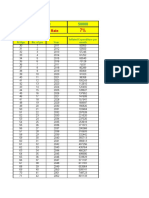

FY12 931.1 201.4 25.0 n/a 201.6 11.3 20.9 14.2 2.2 36.2 n/a FY13F 1,025.0 226.7 28.2 12.6 229.4 13.0 18.6 12.7 2.5 33.2 n/a FY14F 1,237.6 268.8 33.4 18.5 264.1 15.0 15.7 10.7 2.9 32.5 10.3 FY15F 1,344.7 287.0 35.7 6.8 296.0 16.0 14.7 9.7 3.1 29.1 10.5

Following our recent company visit, we reaffirm our HOLD recommendation on Hartalega Holdings (Hartalega) with a slightly lower fair value of RM5.00/share (vs. RM5.10/share previously). Our fair value is now pegged to a PE of 15x FY14F EPS, a premium to the sectors 14x but 20% below industry proxy Top Gloves 19x. While we maintain our FY13F (Mar YE) estimates, we have cut our FY14F and FY15F earnings by 9% and 21%, respectively, to reflect:- (1) the delays in its capacity expansion plans; and (2) declining ASPs on the back of intensifying price competition. Against the backdrop of healthy global rubber glove demand (FY13F: +10%-15%), the groups expansion delays (CY13-CY14 capacity growth of 2% vs. peers average of 3%) and current oversold position place it at a disadvantage to its peers. This is more pressing given that nitrile (NBR) gloves, of which Hartalega is the market leader at 17%, remain the key growth segment. (NBR 3-yr CAGR: +37% vs. latex:-5%). Hartalegas current installed capacity of 11bil pcs per annum (p.a.) is set to rise by 26% in FY14F and a lower 10% in FY15F. This follows an 8-month delay in the construction and commissioning (estimated August 2014) of its NGC project in Sepang, which we anticipate would result in a loss of production of 220mil pcs or a topline decline of RM23mil over both years. To mitigate this, we understand that Hartalega has ongoing plans to acquire a 25,000-acre land in Bestari Jaya to build 3 plants dedicated to the production of higher-valued specialty gloves (margins +8% above NBR gloves). While concerns about overcapacity of NBR gloves are abating, the more hostile pricing environment and declining input costs have prompted Hartalega to reduce its ASPs by 8% for FY14F to USD31/1,000pcs. Further discounts are limited by the industrys rising cost following:- (1) the implementation of the minimum wage policy (FY13F impact for Hartalega: +10%); (2) potential hike in fuel prices; as well as (3) loss of tax incentives by its peers. Nonetheless, we expect Hartalegas superior EBITDA margin to remain stable ahead at ~32% (FY12: 31%) contributed by:- (1) its high productivity and efficient operations; and (2) nitriles intrinsic pricing advantage over latex (discount to latex of 10%). Concomitant to our FY14F-FY15F earnings cut, we have revised downwards our gross DPS forecast to 15 sen and 16 sen, respectively. Its yields of ~3% are comparable to Top Gloves but 1ppt below Kossans and Supermaxs. Hartalega is set to release its FY13 results on May 7. We believe our FY13 earnings estimate of RM227mil (+13% YoY) will be met, supported by:- (1) favourable NBR input prices (-24% YoY); and (2) healthy +24% YoY growth in volume sales.

804.7 4,216.6 0.77 6.8 36.2 n/a Hartalega Industries Sdn Bhd (50.2%) Budi Tenggara (5.0%) 44.8 3.3 3mth 12.9 8.6 6mth 15.1 13.0 12mth 33.4 25.4

4.50

1,648 I n d e x 1,493 P o i n t s

) M 3.00 R (

1.50

1,337

0.00

A p r 0 8

O c t 0 8

A p r 0 9

O c t 0 9

A p r 1 0

Hartalega

O c t 1 0

A p r 1 1

FBMKLCI

O c t 1 1

A p r 1 2

O c t 1 2

A p r 1 3

1,182

PP 12247/06/2013 (032380)

Hartalega Holdings

3 May 2013

Nitrile gloves to lead the way This is more pressing given that nitrile (NBR) gloves, of which Hartalega is the market leader at 17%, remain the key growth segment. (NBR 3-yr CAGR: +37% vs. latex:5%). According to MREPCs 2012 report, nitrile gloves comprise 46% of rubber glove exports, more than double that in 2009 (22%).

REAFFIRM HOLD, LOWER FAIR VALUE

Following our recent company visit, we reaffirm our HOLD recommendation on Hartalega Holdings (Hartalega) with a slightly lower fair value of RM5.00/share. Our fair value is now pegged to a PE of 15x FY14F EPS, a premium to the sectors 14x but 20% below industry proxy Top Gloves 19x. Share price rises in-line with sectors YTD, Hartalegas share price has done well, in-line with the upward trend of the other rubber glove counters. The stock and sector, on average, has outperformed the FBM KLCI by 9ppts. While the surge in the past month was mostly due to speculative behaviour spurred by the H7N9 bird flu outbreak, we reckon that the defensive nature and growth prospects of the industry as well as strong company fundamentals have also played a role. However, we do caution that share prices may retrace should the H7N9 bird flu not escalate into an actual pandemic as had been widely expected.

CHART 1 : BREAKDOWN OF MALAYSIAN RUBBER GLOVE EXPORT BY MATERIAL

Synthetic Rubber 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2008 2009 2010 2011 2012 82.7 77.7 69.0 58.1 17.3 22.3 31.0 41.9 Natural Rubber

45.8

54.2

FY14F-FY15F EARNINGS CUT

While we maintain our FY13F (Mar YE) estimates, we have cut our FY14F and FY15F earnings by 9% to RM269mil and 21% to RM287mil, respectively, to reflect:(1) the delays in its capacity expansion plans; and (2) declining ASPs on the back of intensifying price competition. Hartalega is set to release its FY13 results on May 7. We believe our FY13 earnings estimate of RM227mil (+13% YoY) will be met, supported by:- (1) favourable NBR input prices (-24% YoY); and (2) healthy +24% YoY growth in volume sales.

Source: MREPC, AmResearch

Competition closing in Note that the other top three glove manufacturers, namely Top Glove Corp, Kossan Rubber Industries and Supermax Corp, have been aggressively expanding into this segment since 2011. Together, they have added close to 10bil pcs of NBR gloves in the past 2 years and are embarking on expansion plans for another 11bil pcs by Dec 2013. Meanwhile, Hartalegas capacity growth of 2% for CY13CY14 is 1ppt behind that of its major competitors. To paint a clearer picture, Top Glove, who was a lateentrant into the nitrile segment, will have a NBR glove capacity of 12bil pcs by April 2014. This is comparable to Hartalegas 14bil pcs p.a. by FY14F. Can it capitalise on H7N9 threat?

HANDICAPPED BY PRODUCTION CONSTRAINTS

Healthy global glove demand Against the backdrop of healthy global rubber glove demand (FY13F: +10%-15%), the groups expansion delays and current oversold position place it at a disadvantage to its peers. Management did indicate that should rubber glove demand grow exponentially following the H7N9 bird flu threat being declared a pandemic, Hartalega has the ability to ramp up its capacity utilisation to 95% (from 88% currently) to produce a further 500mil pcs p.a.

TABLE 1: EXPORTS BY MATERIAL TYPE (VOLUMES)

Volume (mil pcs) 2009 2010 Natural Rubber 25,375 25,577 Synthetic Rubber 7,303 11,494 Total 32,678 37,071

Source: MREPC, AmResearch

2011 20,594 14,825 35,419

2012 22,084 18,624 40,708

AmResearch Sdn Bhd

Hartalega Holdings

3 May 2013

Initially slated to be a backup site for its NGC project following difficulties in procuring the 112-acre Sepang land, Hartalega now plans to build 3 plants dedicated to the production of specialty gloves. These gloves command greater margins, 8% above that of NBR gloves and 10% over latex gloves. The construction of the plants will run alongside the groups NGC plans although it was to be fast-tracked earlier on.

DISRUPTED EXPANSION PLANS

At present (FY13F), Hartalega has an installed capacity of 11 bil pcs per annum (p.a.). This is set to rise by 26% in FY14F as the final 3 (out of 10) lines from Plant 6 are commissioned by July 2013, and a slower 10% in FY15F to reach 15bil pcs p.a. Growth stunted by NGC The passive growth in the latter can be mainly attributed to the delay in the construction of its Next Generation Integrated Glove Manufacturing Complex (NGC) in Sepang as relevant approvals from authorities have been held up. With commissioning being pushed back by ~8 months to August 2014, we anticipate a loss in production of 220mil pcs, which translate into a topline decline of RM23mil over both years, with the bulk in FY15F. Recall, the NGC project is a RM1.5-RM1.9bil, 8-year investment to build 7 plants with 10 lines each to raise Hartalegas installed capacity by 24.4bil pcs p.a. announced a year ago. Construction was scheduled to begin in 1H2013 with commissioning beginning in January 2014. In its latest update, however, management has indicated that construction will begin in 2H2013 and 6 plants with 12 lines each will be built. Coupled with the groups technological capabilities, the projected installed capacity is raised to 28.5bil pcs p.a., bringing Hartalegas FY2023 total installed capacity to 42.5bil pcs p.a. Back-up site not needed, transformed to specialty

CHART 2 : HARTALEGAS NITRILE GLOVE SALES

12,000 10,200 10,000 8,000

(mil pcs)

7,752 5,986

6,000 4,366 4,000 2,000 FY13F

3

3,080 1,859 504

FY06

963

FY07

FY08

FY09

FY10

FY11

Source: Company, AmResearch

glove plants

We understand that Hartalega has ongoing plans to acquire a 25,000-acre land in Bestari Jaya.

CHART 3 : CAPACITY PROJECTION WITH NGC CONTRIBUTION FROM FY15F

45.0 40.0 35.0 30.0 29.3 30.7 24.7 20.0 14.0 9.7 11.0 15.4 33.4 38.0 42.1 42.5

(bil pcs)

25.0 20.0 15.0 10.0 5.0 0.0

Source: Company, AmResearch

AmResearch Sdn Bhd

FY12

Hartalega Holdings

3 May 2013

ASPS ON A DOWNWARD TREND

ASPs to fall 8% While concerns about overcapacity of NBR gloves are abating, the more hostile pricing environment and declining input costs have prompted Hartalega to reduce its ASPs by 8% for FY14F to USD31/1,000 pcs. (RM105 to RM98 per thousand pcs). Not keen on entering a price war Priding itself as a premium rubber glove seller and not a price competitor, management has indicated that it will not be slashing prices to gain market share. With their higher margins and position as the lowest cost nitrile glove producer (71 cents/pc), we believe that Hartalega may still have room for a further cut of up to USD25/1,000 pcs. Supported by higher cost floor We reckon that further discounting is limited by the industrys rising cost floor following:(1) the implementation of the minimum wage policy; The FY13F impact on wage costs for Hartalega was +10% as it had also increased its headcount by 700 workers in preparation of the NGC project. (2) potential hike in fuel prices from a gradual subsidy pullback; as well as (3) loss of tax incentives by its peers. The expiry of reinvestment allowance (RA) taxes by most of the rubber glove manufacturers this year requires more prudence in ensuring they stay deeper in the black. Hartalegas effective tax rates are ~22% as it can still claim deductions from capital allowances.

EBITDA MARGINS TO REMAIN STABLE

Overall, we expect Hartalegas superior EBITDA margins to remain stable at ~32% (FY12: 31%) moving forward contributed by:- (1) the groups high productivity and efficient operations; and (2) nitriles intrinsic pricing advantage over latex (discount to latex of 10%). Management reckons that each additional factory potentially expands margins by ~1% as a result of automation, increased production line speed and economies of scale.

CHART 5 : EBITDA MARGINS OF GLOVE MAKERS

Top Glove Kossan Hartalega Supermax

40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0

Source: Companies, AmResearch

DIVIDEND YIELDS DECENT AT 3%

Concomitant to our FY14F-FY15F earnings cut, we have revised downwards our gross DPS forecast by 12%-24% to 15 sen and 16 sen, respectively, based on a 45% payout ratio. Its yields of ~3% are comparable to Top Gloves but 1ppt below Kossans and Supermaxs.

CHART 4 : MONTHLY NATURAL RUBBER AND NITRILE PRICE TRENDS

8.00 7.50 7.00 6.50 6.00 5.50 5.00 Jan-12 Mar-12 May-12

NR Prices (RM/kg)

Prices on a downward trend Holding relatively steady of late

1,800 1,700 1,600 1,500 1,400 1,300 1,200 1,100 1,000

Jul-12

Sep-12

Nov-12

Jan-13

Mar-13

NBR Prices (USD/tonne)

Source: Company, AmResearch

AmResearch Sdn Bhd

Hartalega Holdings

3 May 2013

CHART 6 : NITRILE TO LATEX PRICE DISCOUNT/(PREMIUM)

17.9%

13.7% 9.8% 6.6% 5.2% 11.1% 12.2% 9.8% 6.1% 4.3% 7.1% 10.6%

9.3%

5.5%

Jan-12

Mar-12

May-12

Jul-12

Sep-12 -2.5%

Nov-12

Jan-13

Mar-13

Source: Company, AmResearch

CHART 7 : YTD RELATIVE PERFORMANCE OF RUBBER GLOVE STOCKS VS FBM KLCI

125 120 115 110 105 100 95 90

Kossan Top Glove Hartalega

FBM KLCI Supermax

12-Feb

19-Feb

26-Feb

16-Apr

23-Apr

12-Mar

19-Mar

26-Mar

Source: Bloomberg, AmResearch

AmResearch Sdn Bhd

30-Apr

5-Feb

1-Jan

8-Jan

2-Apr

15-Jan

22-Jan

29-Jan

5-Mar

9-Apr

Hartalega Holdings

3 May 2013

CHART 8 : PB BAND CHART

7.0 20.0 18.5 5.8 17.0 15.5 4.6 ) x ( 3.4 14.0 12.5 ) x ( 11.0 9.5 8.0 2.2 6.5 5.0 3.5 1.0 M a y 0 8 A u g 0 8 N o v 0 8 F e b 0 9 M a y 0 9 A u g 0 9 N o v 0 9 F e b 1 0 M a y 1 0 A u g 1 0 N o v 1 0 F e b 1 1 M a y 1 1 A u g 1 1 N o v 1 1 F e b 1 2 M a y 1 2 A u g 1 2 N o v 1 2 F e b 1 3 2.0 M a y 1 0 A u g 1 0 N o v 1 0

CHART 9 : PE BAND CHART

+1s

Avg

-1s

F e b 1 1

M a y 1 1

A u g 1 1

N o v 1 1

F e b 1 2

M a y 1 2

A u g 1 2

N o v 1 2

F e b 1 3

AmResearch Sdn Bhd

Hartalega Holdings

3 May 2013

TABLE 2: FINANCIAL DATA

Income Statement (RMmil, YE 31 Mar) Revenue EBITDA Depreciation Operating income (EBIT) Other income & associates Net interest Exceptional items Pretax profit Taxation Minorities/pref dividends Net profit Core net profit Balance Sheet (RMmil, YE 31 Mar) Fixed assets Intangible assets Other long-term assets Total non-current assets Cash & equivalent Stock Trade debtors Other current assets Total current assets Trade creditors Short-term borrowings Other current liabilities Total current liabilities Long-term borrowings Other long-term liabilities Total long-term liabilities Shareholders funds Minority interests BV/share (RM) Cash Flow (RMmil, YE 31 Mar) Pretax profit Depreciation Net change in working capital Others Cash flow from operations Capital expenditure Net investments & sale of fixed assets Others Cash flow from investing Debt raised/(repaid) Equity raised/(repaid) Dividends paid Others Cash flow from financing Net cash flow Net cash/(debt) b/f Net cash/(debt) c/f Key Ratios (YE 31 Mar) Revenue growth (%) EBITDA growth (%) Pretax margins (%) Net profit margins (%) Interest cover (x) Effective tax rate (%) Net dividend payout (%) Debtors turnover (days) Stock turnover (days) Creditors turnover (days) Source: Company, AmResearch estimates 2011 734.9 268.2 (25.0) 243.2 0.0 (0.4) 0.0 242.8 (52.5) 0.0 190.3 190.3 2011 348.6 0.1 0.2 348.9 117.0 64.7 95.7 8.7 286.1 34.4 14.5 29.9 78.9 24.5 36.9 61.3 494.4 0.4 0.68 2011 242.8 25.0 (40.9) (42.1) 184.8 (21.7) 0.2 (59.5) (81.0) (2.5) 0.0 (56.9) 0.3 (59.1) 44.7 47.2 78.0 2011 28.5 34.3 33.0 25.9 98.5 21.6 40.1 43 23 14 2012 931.1 288.2 (29.0) 259.2 0.0 (0.8) 0.0 258.4 (57.0) (0.1) 201.4 201.4 2012 370.3 0.0 9.9 380.2 163.2 97.5 107.7 9.5 377.9 29.5 12.6 43.4 85.5 12.1 40.5 52.6 619.5 0.6 0.77 2012 258.4 29.0 (44.5) (42.6) 200.3 (35.4) 0.1 (24.8) (60.1) (14.6) 0.0 (87.4) 6.9 (95.0) 45.2 59.7 138.6 2012 26.7 7.5 27.8 21.6 149.3 22.0 45.3 40 32 13 2013F 1,025.0 328.6 (37.4) 291.2 0.0 (2.4) 0.0 288.9 (62.1) (0.1) 226.7 226.7 2013F 561.4 0.0 9.9 571.4 152.7 107.4 145.1 9.5 414.7 40.7 42.3 42.7 125.7 72.4 40.5 112.9 746.9 0.6 0.93 2013F 288.9 37.4 (36.0) (62.1) 228.2 (200.0) 0.1 (30.0) (229.9) 90.0 0.0 (99.8) 0.0 (9.8) (11.6) (101.5) 38.1 2013F 10.1 14.0 28.2 22.1 83.6 21.5 46.1 45 36 13 2014F 1,237.6 402.9 (54.0) 349 0.0 (6.4) 0.0 342.4 (73.6) (0.1) 268.8 268.8 2014F 836.2 0.0 9.9 846.1 124.4 132.7 153.3 9.5 420.0 46.6 84.3 42.7 173.6 144.3 40.5 184.9 907.1 0.6 1.13 2014F 342.4 54.0 (27.7) (73.6) 295.2 (300.0) 0.1 (30.0) (329.9) 114.0 0.0 (108.6) 0.0 5.4 (29.3) (143.3) (104.2) 2014F 20.7 22.6 27.7 21.7 40.6 21.5 44.9 44 35 13 2015F 1,344.7 448.3 (70.7) 377.6 0.0 (11.9) 0.0 365.7 (78.6) (0.1) 287.0 287.0 2015F 994.2 0.0 9.9 1,004.1 222.9 149.7 170.9 9.5 553.0 60.4 128.2 42.7 231.3 219.5 40.5 260.0 1,065.3 0.6 1.32 2015F 365.7 70.7 (20.8) (78.6) 337.0 (200.0) 0.1 (30.0) (229.9) 119.0 0.0 (128.8) 0.0 (9.8) 97.4 (21.6) (124.8) 2015F 8.7 11.3 27.2 21.3 26.2 21.5 44.9 44 38 15

AmResearch Sdn Bhd

Hartalega Holdings

3 May 2013

Anchor point for disclaimer text box

Published by AmResearch Sdn Bhd (335015-P) (A member of the AmInvestment Bank Group) 15th Floor Bangunan AmBank Group 55 Jalan Raja Chulan 50200 Kuala Lumpur Tel: ( 0 3 ) 2 0 7 0 - 2 4 4 4 ( r e s e a r c h ) Fax: (03)2078-3162 Printed by AmResearch Sdn Bhd (335015-P) (A member of the AmInvestment Bank Group) 15th Floor Bangunan AmBank Group 55 Jalan Raja Chulan 50200 Kuala Lumpur Tel: ( 0 3 ) 2 0 7 0 - 2 4 4 4 ( r e s e a r c h ) Fax: (03)2078-3162

The information and opinions in this report were prepared by AmResearch Sdn Bhd. The investments discussed or recommended in this report may not be suitable for all investors. This report has been prepared for information purposes only and is not an offer to sell or a solicitation to buy any securities. The directors and employees of AmResearch Sdn Bhd may from time to time have a position in or with the securities mentioned herein. Members of the AmInvestment Group and their affiliates may provide services to any company and affiliates of such companies whose securities are mentioned herein. The information herein was obtained or derived from sources that we believe are reliable, but while all reasonable care has been taken to ensure that stated facts are accurate and opinions fair and reasonable, we do not represent that it is accurate or complete and it should not be relied upon as such. No liability can be accepted for any loss that may arise from the use of this report. All opinions and estimates included in this report constitute our judgement as of this date and are subject to change without notice. For AmResearch Sdn Bhd

Benny Chew Managing Director

AmResearch Sdn Bhd

Vous aimerez peut-être aussi

- Supermax PDFDocument7 pagesSupermax PDFperkisasPas encore d'évaluation

- TA Securities Hartalega NGC Land Acquisition June 2013Document4 pagesTA Securities Hartalega NGC Land Acquisition June 2013Piyu MahatmaPas encore d'évaluation

- PBB Hartalega NGC Land 13 June 2013Document5 pagesPBB Hartalega NGC Land 13 June 2013Piyu MahatmaPas encore d'évaluation

- Alliance Hartalega NGC Land Acquisition June 2013Document5 pagesAlliance Hartalega NGC Land Acquisition June 2013Piyu MahatmaPas encore d'évaluation

- (58119) 20121010 Top Glove CorporationDocument8 pages(58119) 20121010 Top Glove CorporationGurrajvin SinghPas encore d'évaluation

- 143 Interpac Hartalega Positive Economic Backdrop 30 April 2013Document5 pages143 Interpac Hartalega Positive Economic Backdrop 30 April 2013Piyu MahatmaPas encore d'évaluation

- Hartalega Holdings (HART MK) : Malaysia DailyDocument4 pagesHartalega Holdings (HART MK) : Malaysia DailyPiyu MahatmaPas encore d'évaluation

- Poised To Catch Asean’s Growth WaveDocument9 pagesPoised To Catch Asean’s Growth WavebodaiPas encore d'évaluation

- CRG Consumer Demerger to Unlock ValueDocument14 pagesCRG Consumer Demerger to Unlock Valuerohitkhanna1180Pas encore d'évaluation

- See Hup Seng 3Q13 Net Profit Gains 44% To S$2.5 Million: EWS EleaseDocument3 pagesSee Hup Seng 3Q13 Net Profit Gains 44% To S$2.5 Million: EWS EleaseInvest StockPas encore d'évaluation

- Financial Study On Public Listed CorporationDocument17 pagesFinancial Study On Public Listed CorporationvinyspPas encore d'évaluation

- Company Report Detailed TGL 19042016Document9 pagesCompany Report Detailed TGL 19042016Sobia FaizPas encore d'évaluation

- BIMBSec - Company Update - Wah SeongDocument4 pagesBIMBSec - Company Update - Wah SeongBimb SecPas encore d'évaluation

- Top Recommendation - 140911Document51 pagesTop Recommendation - 140911chaltrikPas encore d'évaluation

- Top PicksDocument7 pagesTop PicksKarthik KoutharapuPas encore d'évaluation

- UOB Kayhian Hartalega 1Q2014Document4 pagesUOB Kayhian Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- Sharekhan Top Picks: October 01, 2011Document7 pagesSharekhan Top Picks: October 01, 2011harsha_iitmPas encore d'évaluation

- Stylam IDBI Capital 200516Document20 pagesStylam IDBI Capital 200516Vikas AggarwalPas encore d'évaluation

- Top Glove CorporationDocument13 pagesTop Glove CorporationVivek BanerjeePas encore d'évaluation

- RHB Equity 360° - 21 October 2010 (Media, Rubber Gloves, Puncak Niaga, WCT, Axis REIT, BAT Technical: AFG)Document4 pagesRHB Equity 360° - 21 October 2010 (Media, Rubber Gloves, Puncak Niaga, WCT, Axis REIT, BAT Technical: AFG)Rhb InvestPas encore d'évaluation

- TCPL Packaging LTD: Environment Friendly GrowthDocument17 pagesTCPL Packaging LTD: Environment Friendly Growthswati choudharyPas encore d'évaluation

- MRF 1Q Fy2013Document12 pagesMRF 1Q Fy2013Angel BrokingPas encore d'évaluation

- 22032016115700JK Tyre Intiating CoverageDocument19 pages22032016115700JK Tyre Intiating CoverageJason SoansPas encore d'évaluation

- Crompton Greaves LTD.: Investment RationaleDocument0 pageCrompton Greaves LTD.: Investment Rationalespatel1972Pas encore d'évaluation

- RKFL ReportDocument19 pagesRKFL ReportpriyaranjanPas encore d'évaluation

- Group Project AsignmentDocument22 pagesGroup Project AsignmentAzizi MustafaPas encore d'évaluation

- SharekhanTopPicks 070511Document7 pagesSharekhanTopPicks 070511Avinash KowkuntlaPas encore d'évaluation

- Esearch Eport: Riddhi Siddhi Gluco Biols LTDDocument9 pagesEsearch Eport: Riddhi Siddhi Gluco Biols LTDanny2k1Pas encore d'évaluation

- HSIE Results Daily - 12 Nov 22-202211120745240401459Document18 pagesHSIE Results Daily - 12 Nov 22-202211120745240401459N KhanPas encore d'évaluation

- Stocks For Investment-1Document8 pagesStocks For Investment-1Balkrishna PatelPas encore d'évaluation

- 2013 Apr 2 - ATDocument13 pages2013 Apr 2 - ATalan_s1Pas encore d'évaluation

- Hitachi Home & Life Solutions: Performance HighlightsDocument13 pagesHitachi Home & Life Solutions: Performance HighlightsAngel BrokingPas encore d'évaluation

- BirlaCorp - InitiatingCoverage + ICICIDocument20 pagesBirlaCorp - InitiatingCoverage + ICICIshahavPas encore d'évaluation

- AIA Engineering LTD: Q3FY18 Result UpdateDocument6 pagesAIA Engineering LTD: Q3FY18 Result Updatesaran21Pas encore d'évaluation

- Diwali Picks Low ResDocument36 pagesDiwali Picks Low ResRakesh HPas encore d'évaluation

- MRF 2Q Sy 2013Document12 pagesMRF 2Q Sy 2013Angel BrokingPas encore d'évaluation

- Finolex Cables Poised for Growth on Derivative Losses CleanupDocument9 pagesFinolex Cables Poised for Growth on Derivative Losses CleanupsanjeevpandaPas encore d'évaluation

- Performance Highlights: Company Update - AutomobileDocument13 pagesPerformance Highlights: Company Update - AutomobileZacharia VincentPas encore d'évaluation

- TA Securities: Pantech Group Holdings BerhadDocument2 pagesTA Securities: Pantech Group Holdings BerhadcrickdcricketPas encore d'évaluation

- RHB Equity 360° - 12 October 2010 (Plantation, Globetronics Technical: Kulim, IOI, Sime, Genting Plant, CPO)Document4 pagesRHB Equity 360° - 12 October 2010 (Plantation, Globetronics Technical: Kulim, IOI, Sime, Genting Plant, CPO)Rhb InvestPas encore d'évaluation

- APL Apollo Tubes Motilal Oswal PDFDocument4 pagesAPL Apollo Tubes Motilal Oswal PDFsameerPas encore d'évaluation

- 2013-3-13 Kim Eng First ResourcesDocument10 pages2013-3-13 Kim Eng First ResourcesphuawlPas encore d'évaluation

- SAM Engineering & Equipment 20230817 HLIBDocument4 pagesSAM Engineering & Equipment 20230817 HLIBkim heePas encore d'évaluation

- Music BroadcastDocument12 pagesMusic BroadcastSBPas encore d'évaluation

- RHB Equity 360° - (IJM Land, Consumer, Construction, Dialog, Top Glove Technical: WCT)Document3 pagesRHB Equity 360° - (IJM Land, Consumer, Construction, Dialog, Top Glove Technical: WCT)Rhb InvestPas encore d'évaluation

- Prima Plastics Initiating Coverage IDBI CapitalDocument12 pagesPrima Plastics Initiating Coverage IDBI CapitalAkhil ParekhPas encore d'évaluation

- Jasmine International PCL: Very Strong Growth MomentumDocument11 pagesJasmine International PCL: Very Strong Growth MomentumVishan SharmaPas encore d'évaluation

- Voltamp Transformers LTD: Invest ResearchDocument8 pagesVoltamp Transformers LTD: Invest ResearchDarwish MammiPas encore d'évaluation

- Greenlam Q1 Result UpdateDocument7 pagesGreenlam Q1 Result UpdateshrikantbodkePas encore d'évaluation

- RHB Equity 360° (Market, Motor, Ta Ann, Evergreen, ILB, MAS Technical: MAS) - 17/08/2010Document4 pagesRHB Equity 360° (Market, Motor, Ta Ann, Evergreen, ILB, MAS Technical: MAS) - 17/08/2010Rhb InvestPas encore d'évaluation

- Top Glove 20080414 Initiate PDFDocument20 pagesTop Glove 20080414 Initiate PDFChin Hoong50% (2)

- Fundamental Analysis of SRF Ltd in 40 CharactersDocument7 pagesFundamental Analysis of SRF Ltd in 40 CharactersKunal JainPas encore d'évaluation

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaPas encore d'évaluation

- Binging Big On BTG : BUY Key Take AwayDocument17 pagesBinging Big On BTG : BUY Key Take AwaymittlePas encore d'évaluation

- Engro Fertilizer LimitedDocument36 pagesEngro Fertilizer LimitedAsmaIqbalPas encore d'évaluation

- TRIM DailyDocument17 pagesTRIM DailyJoyce SampoernaPas encore d'évaluation

- Engineering Service Revenues World Summary: Market Values & Financials by CountryD'EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryD'EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryPas encore d'évaluation

- Loose Coarse Pitch Worms & Worm Gearing World Summary: Market Sector Values & Financials by CountryD'EverandLoose Coarse Pitch Worms & Worm Gearing World Summary: Market Sector Values & Financials by CountryPas encore d'évaluation

- Drycleaning Plant Revenues World Summary: Market Values & Financials by CountryD'EverandDrycleaning Plant Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Complied & Adapted by Ajaan Rob Hatfield, M.EdDocument41 pagesComplied & Adapted by Ajaan Rob Hatfield, M.EdPiyu MahatmaPas encore d'évaluation

- Natural Approach Stephen KrashenDocument20 pagesNatural Approach Stephen KrashenPiyu Mahatma100% (2)

- Marion D March & Joan Mcevers The OnlyDocument256 pagesMarion D March & Joan Mcevers The OnlyPiyu Mahatma85% (13)

- Alphee Lavoie Lose This Book and FindDocument140 pagesAlphee Lavoie Lose This Book and FindPiyu Mahatma100% (6)

- Drawing Nakshtra KP WheelDocument1 pageDrawing Nakshtra KP WheelPiyu MahatmaPas encore d'évaluation

- Abraham Ibn Ezra - 120 Aphorisms For Astrologers PDFDocument8 pagesAbraham Ibn Ezra - 120 Aphorisms For Astrologers PDFMassimiliano GaetanoPas encore d'évaluation

- AspectsDocument1 pageAspectspitchumaniPas encore d'évaluation

- S.D. Krashen & T.D. Terrell: The Natural Approach: Language Acquisition in The ClassroomDocument2 pagesS.D. Krashen & T.D. Terrell: The Natural Approach: Language Acquisition in The ClassroomRenz RiveraPas encore d'évaluation

- The Natural Approach PDFDocument196 pagesThe Natural Approach PDFABZY1Pas encore d'évaluation

- A New Approach To KPDocument6 pagesA New Approach To KPPiyu MahatmaPas encore d'évaluation

- Öner Döser The Art of Horary AstrologyDocument213 pagesÖner Döser The Art of Horary AstrologyPiyu Mahatma92% (12)

- Richard Ball An Astro Physical Compendium HoraryDocument159 pagesRichard Ball An Astro Physical Compendium HoraryPiyu MahatmaPas encore d'évaluation

- John Worsdale - Genethliacal AstronomyDocument488 pagesJohn Worsdale - Genethliacal AstronomyPiyu MahatmaPas encore d'évaluation

- Alphee Lavoie Horary at Its Best MustDocument181 pagesAlphee Lavoie Horary at Its Best MustPiyu Mahatma100% (4)

- Jyotish Meena Nadi Part 1 Gopalakrishna Row 1939Document133 pagesJyotish Meena Nadi Part 1 Gopalakrishna Row 1939Piyu MahatmaPas encore d'évaluation

- Jyotish Meena Nadi Part 2 Gopalakrishna Row 1939Document116 pagesJyotish Meena Nadi Part 2 Gopalakrishna Row 1939Piyu Mahatma100% (1)

- Latexx Partners Alliance Bank Initiate CoverageDocument11 pagesLatexx Partners Alliance Bank Initiate CoveragePiyu MahatmaPas encore d'évaluation

- Jyotish Meena Nadi Part 3 Gopalakrishna Row 1939Document112 pagesJyotish Meena Nadi Part 3 Gopalakrishna Row 1939Piyu MahatmaPas encore d'évaluation

- Latexx Corporate Presentation 4Q2011Document36 pagesLatexx Corporate Presentation 4Q2011Piyu MahatmaPas encore d'évaluation

- UOB Kayhian Hartalega 1Q2014Document4 pagesUOB Kayhian Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- PBB Hartalega 1Q2014Document5 pagesPBB Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- PBB Hartalega 1Q2014Document5 pagesPBB Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- HDBS Hartalega 1Q2014Document7 pagesHDBS Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- BIMB Hartalega 1Q2014Document3 pagesBIMB Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- PBB Hartalega 1Q2014Document5 pagesPBB Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- Apex Hartalega 1Q2014Document3 pagesApex Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- Macquarie Hartalega 1Q2014Document5 pagesMacquarie Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- HLB Hartalega 1Q2014Document4 pagesHLB Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- CLSA Hartalega 1Q2014 BDocument6 pagesCLSA Hartalega 1Q2014 BPiyu MahatmaPas encore d'évaluation

- CIMB Hartalega 1Q2014Document6 pagesCIMB Hartalega 1Q2014Piyu MahatmaPas encore d'évaluation

- Literature ReviewDocument50 pagesLiterature ReviewMohmmedKhayyumPas encore d'évaluation

- MODULE BLR301 BusinessLawsandRegulations1Document14 pagesMODULE BLR301 BusinessLawsandRegulations1Jr Reyes PedidaPas encore d'évaluation

- Ben Stein - Can Your Retirement SurviveDocument8 pagesBen Stein - Can Your Retirement SurviveJulietaPas encore d'évaluation

- End of Chap 6 AnswersDocument28 pagesEnd of Chap 6 AnswersAdamPas encore d'évaluation

- Aik CH 5Document10 pagesAik CH 5rizky unsPas encore d'évaluation

- FAQs Regulation SDocument24 pagesFAQs Regulation SAnonymous 5Tucu52u4Pas encore d'évaluation

- University of Lay Adventists of Kigali (Unilak)Document7 pagesUniversity of Lay Adventists of Kigali (Unilak)Mugabo Romeo ChristianPas encore d'évaluation

- DGKC Research ReportDocument34 pagesDGKC Research Reportgbqzsa100% (1)

- Introduction to the BFSI Sector: Banking, Financial Services and InsuranceDocument2 pagesIntroduction to the BFSI Sector: Banking, Financial Services and InsuranceGopal Gidwani0% (1)

- Direct Lenders First Real Test: Deloitte Alternative Lender Deal Tracker Spring 2020Document56 pagesDirect Lenders First Real Test: Deloitte Alternative Lender Deal Tracker Spring 2020fjdglf klfdPas encore d'évaluation

- Crypto Portfolio Tracker: Coin / Item Units Held Invested Value Profit / LossDocument4 pagesCrypto Portfolio Tracker: Coin / Item Units Held Invested Value Profit / Lossrav123Pas encore d'évaluation

- Understanding Regulation SDocument12 pagesUnderstanding Regulation SSofyan Deny Saputro100% (1)

- ESENECO (5) Capital FinancingDocument23 pagesESENECO (5) Capital FinancingTobias FatePas encore d'évaluation

- Shahjalal Islami Bank-Performance AnalysisDocument21 pagesShahjalal Islami Bank-Performance Analysisraihans_dhk3378100% (4)

- 9Document5 pages9mukeshgangulyPas encore d'évaluation

- ASSET LIABILITIES Mnagament in BanksDocument25 pagesASSET LIABILITIES Mnagament in Bankspriyank shah100% (6)

- Nepal Stock Exchange Ltd. Closing Price: Nepse Commercial Banks. PriceDocument15 pagesNepal Stock Exchange Ltd. Closing Price: Nepse Commercial Banks. PriceChakra DahalPas encore d'évaluation

- DSP Mutual Fund OverviewDocument5 pagesDSP Mutual Fund OverviewSarika ArotePas encore d'évaluation

- Inflation Impact on Monthly Expenditure over 30 YearsDocument8 pagesInflation Impact on Monthly Expenditure over 30 Yearslove4u1lyPas encore d'évaluation

- Final Sip SRDocument40 pagesFinal Sip SRdpusinghPas encore d'évaluation

- Agam Sastrowibowo IRRDocument6 pagesAgam Sastrowibowo IRRHendra YudisaputroPas encore d'évaluation

- Data Interpretation Level 1 QuestionsDocument19 pagesData Interpretation Level 1 Questionsaish2ksPas encore d'évaluation

- Fullpaper Icopss2017 PDFDocument1 095 pagesFullpaper Icopss2017 PDFNurul AidaPas encore d'évaluation

- CRISIL Research - Ipo Grading Rat - Modern TubeDocument12 pagesCRISIL Research - Ipo Grading Rat - Modern Tubejaydeep davePas encore d'évaluation

- Sustainability 13 01933 v2Document15 pagesSustainability 13 01933 v2ronPas encore d'évaluation

- Chapter 8 StudentDocument15 pagesChapter 8 Studentmaha aleneziPas encore d'évaluation

- Here Are Some IdeasDocument3 pagesHere Are Some IdeasBrahim OuhammouPas encore d'évaluation

- Cash Flow FormulaDocument2 pagesCash Flow FormulaSubhas ChettriPas encore d'évaluation

- Dividend PolicyDocument27 pagesDividend PolicyMohammad ShibliPas encore d'évaluation

- Mod 1 - Framework For Analysis & ValuationDocument33 pagesMod 1 - Framework For Analysis & ValuationbobdolePas encore d'évaluation