Académique Documents

Professionnel Documents

Culture Documents

Bullishstock Market

Transféré par

shahvshahTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Bullishstock Market

Transféré par

shahvshahDroits d'auteur :

Formats disponibles

THE 60-YEAR GREAT CYCLE APPEARS TO STILL BE PREEMINENT IN LIGHT OF THE RECENT TRADE, POTENTIAL RUNAWAY MOVES REMAIN

IN EFFECT

By James Flanagan

STUDY OF THE PAST

By studying past history and knowing that the future is but a repetition of the past, you can determine the cause according to the time and conditions. You cannot have too much information or too many records when you are going to risk your capital. Sometimes it is necessary to go a long way back to determine the cause, because you must study war, its effect, and the conditions before war and what follows. Nothing will help you more than going over the past history of markets, studying its actions under different periods. If you know what a market has done in the past, you have a better chance to determine what it will do in the future. When you learn the past history of a market, learn the way it is running, what cycle it is in, and then make a trade on definite knowledge, your chances for success are 100% greater. You should keep charts and records of past market movements because your memory is too short.

30-YEAR TREASURY YIELDS

S&P 500 CASH

S&P 500 CASH

S&P 500 CASH

PRICE MOVES INTO TERRITORY WHICH HAS NOT BEEN REACHED FOR YEARS

When a stock [or commodity] moves into new territory or to prices which it has not reached for months or years, it shows that the force or driving power is working in that direction. It is the same principle as any other force which has been restrained and breaks out. Water may be held back by a dam, but if it breaks through the dam, you would know that it would continue downward until it reached another dam, or some obstruction or resistance which would stop it. Therefore, it is very important to watch old levels of stocks. The longer the time that elapses between the breaking into new territory, the greater the move you can expect, because the accumulative energy over a long period naturally will produce a larger movement than if it only accumulated during a short period of time.

S&P 500 CASH WEEKLY

RUSSELL 3000 WEEKLY

DURATION OF TIME BETWEEN OLD HIGHS OR LOWS BEING TESTED

The longer the period of time that elapses before a previous high level is crossed or a previous low level is broken, the greater the advance or decline which follows.

S&P 500 CASH

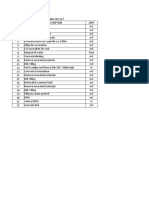

TIME DURATION DISTRIBUTION OF EVERY LEG UP IN HISTORY SINCE 1886

SEP S&P 500

30-YEAR TREASURY YIELDS

30-YEAR TREASURY YIELDS

30-YEAR TREASURY YIELDS

BONDS NEAREST FUTURES

BONDS NEAREST FUTURES

BONDS NEAREST FUTURES

SEP BONDS

GOLD CASH

LOST MOTION

There is lost motion in every kind if machinery. There is also lost motion in the grain market or any other commodity due to momentum, which drives wheat and other commodities slightly above or below a resistance level.

SILVER CASH

GOLD CASH: LONGEST LEGS DOWN SINCE 1968

SILVER NF: LONGEST LEGS DOWN SINCE 1962

PLATINUM NF

GOLD/SILVER RATIO

XAU GOLD STOCK

MASSIVE # OF SELL STOPS HIT TODAY IN GOLD, SILVER AND PLATINUM

PAID-SUBSCRIBER CALIBER UPDATES

What is are these updates?

Over the course of the next week or so, we will provide you with a virtual paid subscription to our Trade Opportunities and Alerts.

Format: You will receive emails with a link to a video containing

nearly identical content to our current paid subscription content. These updates will be timely, and will cover the same markets and opportunities we cover for paid subscribers.

Note #1: Timely updates will only be sent to paid subscribers in the event we have a time sensitive recommendation or situation. Note #2: We do not recommend you take any action based upon our analysis unless you know you will be subscribing. Without the follow up and support provided in our paid publications this would not make sense.

CRB SPOT COMMODITY INDEX

CRB SPOT COMMODITY INDEX

CASH CRUDE OIL

JUNE EURO

CASH CRUDE OIL: SMALLEST LEGS UP IN HISTORY

CASH CRUDE OIL: SMALLEST LEGS DOWN IN HISTORY

GOLDMAN SACHS COMMDOITY INDEX

AUG CRUDE OIL

JUNE DOLLAR INDEX

JUNE EURO

CRUDE OIL NEAREST FUTURES

HEATING OIL NEAREST FUTURES

UNLEADED GAS NEAREST FUTURES

SELLING AGAINST OLD HIGHS

Remember, it is safe to sell short when a commodity reacts to old tops the first, second, or third time, but when it advances a fourth time, it is dangerous to sell, as it nearly always goes higher.

DURATION OF TIME BETWEEN OLD HIGHS OR LOWS BEING TESTED

The longer the period of time that elapses before a previous high level is crossed or a previous low level is broken, the greater the advance or decline which follows.

LEADER FROM ONE BULL MARKET TO THE NEXT

If the commodity has been a leader in a previous bull campaign or a leader in a previous bear campaign, the chances are that it may not be a leader in the next campaign, unless the chart distinctly shows that it is going to lead in an advance or decline.

UNLEADED GAS CASH

CRUDE OIL CASH

Vous aimerez peut-être aussi

- Artifical IntilligenceDocument30 pagesArtifical IntilligenceshahvshahPas encore d'évaluation

- Bullishstock MarketDocument61 pagesBullishstock MarketshahvshahPas encore d'évaluation

- Introduction to the SKI Gold Stock Prediction SystemDocument9 pagesIntroduction to the SKI Gold Stock Prediction SystemshahvshahPas encore d'évaluation

- The End of Time-Part I 05-22-2011Document36 pagesThe End of Time-Part I 05-22-2011verdibluePas encore d'évaluation

- Introduction to the SKI Gold Stock Prediction SystemDocument9 pagesIntroduction to the SKI Gold Stock Prediction SystemshahvshahPas encore d'évaluation

- A Primer in Price ActionDocument6 pagesA Primer in Price ActionshahvshahPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- March 17, 2017 - Letter From Dave Brown and Megan McCarrin Re "Take Article Down" - IRISH ASSHOLES TODAY!Document459 pagesMarch 17, 2017 - Letter From Dave Brown and Megan McCarrin Re "Take Article Down" - IRISH ASSHOLES TODAY!Stan J. CaterbonePas encore d'évaluation

- GI Tags Complete ListDocument17 pagesGI Tags Complete Listrameshb87Pas encore d'évaluation

- 5 Nighttime Image Enhancement Using A NewDocument7 pages5 Nighttime Image Enhancement Using A NewNithish CenaPas encore d'évaluation

- A Cranial Approach To Sinus Congestion: By, Nathan Widboom D.ODocument31 pagesA Cranial Approach To Sinus Congestion: By, Nathan Widboom D.ONancyPas encore d'évaluation

- Philips Solar+LED Marketing StrategyDocument15 pagesPhilips Solar+LED Marketing StrategyrejinairPas encore d'évaluation

- Dof Omm Ss Skirting Sk-02Document8 pagesDof Omm Ss Skirting Sk-02Ideal DesignerPas encore d'évaluation

- Next-Generation Widebody Conversion: in Service From 2017 ONWARDSDocument6 pagesNext-Generation Widebody Conversion: in Service From 2017 ONWARDSAgusPas encore d'évaluation

- ELEC-E8714 Homework 3 - Life Cycle Assessment of LED Lamps - Manufacturing and UseDocument2 pagesELEC-E8714 Homework 3 - Life Cycle Assessment of LED Lamps - Manufacturing and UseŞamil NifteliyevPas encore d'évaluation

- Populist Movement (Anant)Document7 pagesPopulist Movement (Anant)Siddhi JoshiPas encore d'évaluation

- Procurement of Railway Infrastructure Projects - ADocument15 pagesProcurement of Railway Infrastructure Projects - ADan NanyumbaPas encore d'évaluation

- CH 9 - Spontaneity, Entropy, and Free EnergyDocument65 pagesCH 9 - Spontaneity, Entropy, and Free EnergyCharbel RahmePas encore d'évaluation

- Ahmed (2018)Document9 pagesAhmed (2018)zrancourttremblayPas encore d'évaluation

- Cardboard Dream HouseDocument1 pageCardboard Dream Houseapi-630719553Pas encore d'évaluation

- Anectodal RecordsDocument10 pagesAnectodal RecordsSchahyda ArleyPas encore d'évaluation

- Procedures in Using Ge-Survey System PDFDocument54 pagesProcedures in Using Ge-Survey System PDFJoel PAcs73% (11)

- WBLFFDocument10 pagesWBLFFMohd IzatPas encore d'évaluation

- Vandergrift - Listening, Modern Theory & PracticeDocument6 pagesVandergrift - Listening, Modern Theory & PracticeKarolina CiPas encore d'évaluation

- FELDocument71 pagesFELElimel Rome Rico100% (4)

- Physical GEOGRAPHY - TIEDocument432 pagesPhysical GEOGRAPHY - TIEnassorussi9Pas encore d'évaluation

- Adoption ApplicationDocument3 pagesAdoption ApplicationwriterhildPas encore d'évaluation

- Human Resource Planning and Corroporate Strategies: Meaning and Definition of StrategyDocument19 pagesHuman Resource Planning and Corroporate Strategies: Meaning and Definition of StrategyRashmi KhublaniPas encore d'évaluation

- Samsung Investor Presentation CE 2022 v1Document22 pagesSamsung Investor Presentation CE 2022 v1Sagar chPas encore d'évaluation

- Cambridge Ext2 Ch1 Complex Numbers IWEBDocument62 pagesCambridge Ext2 Ch1 Complex Numbers IWEBchenPas encore d'évaluation

- Rate of Change: Example 1 Determine All The Points Where The Following Function Is Not ChangingDocument5 pagesRate of Change: Example 1 Determine All The Points Where The Following Function Is Not ChangingKishamarie C. TabadaPas encore d'évaluation

- C-Core-A3-Fold-Double-Side AMCC COREDocument2 pagesC-Core-A3-Fold-Double-Side AMCC CORESandeep SPas encore d'évaluation

- Logistic RegressionDocument17 pagesLogistic RegressionLovedeep Chaudhary100% (1)

- Responsibility Matrix D&B Rev 3 22 - Sep - 2014Document10 pagesResponsibility Matrix D&B Rev 3 22 - Sep - 2014hatemsharkPas encore d'évaluation

- BSC6900 UMTS Hardware Description (V900R017C10 - 01) (PDF) - enDocument224 pagesBSC6900 UMTS Hardware Description (V900R017C10 - 01) (PDF) - enmike014723050% (2)

- Css Recommended BooksDocument6 pagesCss Recommended Booksaman khanPas encore d'évaluation

- Computer Assisted Language LearningDocument9 pagesComputer Assisted Language Learningapi-342801766Pas encore d'évaluation