Académique Documents

Professionnel Documents

Culture Documents

Zimplow AbridgedPrelistingStatement PDF

Transféré par

Kristi DuranDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Zimplow AbridgedPrelistingStatement PDF

Transféré par

Kristi DuranDroits d'auteur :

Formats disponibles

Zimplow Holdings Limited

( Incorporated in Zimbabwe on 10 August 1939 under registration number 96/25/48) Directors: Z. Rusike (Chairman), Z. Kumwenda (Chief Executive), P. Devenish, A. Kurauone, E. Mlambo, T. Moyo, N. Nhira, F. Rwakonda, G. Manhambara, S. Mngomezulu, T. Johnson Address: 39 Steelworks Road, P.O. Box 1059, Bulawayo

ABRIDGED PRE-LISTING STATEMENT

RELATING TO THE PROPOSED ACQUISITION OF THE BALANCE OF THE ISSUED SHARE CAPITAL OF TRACTIVE POWER HOLDINGS AND THE SUBSEQUENT CREATION OF ZIMPLOW HOLDINGS LIMITED

2.

HISTORY, OVERVIEW AND FUTURE PROSPECTS Overview Overview of Zimplow Limited Background Zimplow, incorporated in 1939 and subsequently listed on the Zimbabwe Stock Exchange in 1951, is the largest manufacturer and distributor of animal drawn implements in Sub-Saharan Africa, and a distributor of engine drawn consumer, farming and mining implements. The Company operates through three divisions namely Mealie Brand, CT Bolts and Tassburg; and two subsidiaries namely TPHL and Afritrac. Zimplow's registered and branded products are actively marketed and exported to several countries in Africa through a wellestablished distribution network. The Company also manufactures and distributes fasteners for the mining, construction and agricultural sectors. Description of Business The Mealie Brand Division is the largest of the three divisions, with a factory based in Bulawayo. The division is engaged in the manufacture and export of animal drawn farm implements, hoes and associated spare parts. It is the Company's flagship brand and actively markets its products in Sub Sahara Africa. CT Bolts is a distributor of mild steel bolts and nuts, nails and a wide range of other fasteners. The division also manufactures specialised fasteners at its Bulawayo factory for distribution in Zimbabwe. The business supplies a number of sectors in Zimbabwe from agricultural and mining to automotive and manufacturing sectors. Besides distribution, the division has a specialized fastener manufacturing section. The Tassburg Division was acquired in December of 2008 and is involved in the manufacture of woodscrews, pop rivets, verandah bolts and high tensile bolts and nuts. It serves the construction, furniture and mining industries, predominantly. The Company's Tassburg factory is based in Harare. Tractive Power Holdings Limited is a subsidiary of Zimplow that was acquired in June 2012. Zimplow owns 57.21% of the issued share capital of TPHL. TPHL is a Zimbabwean Company listed on the ZSE and a retailer of internationally recognised brands through its four operating units namely Northmec Zimbabwe, Farmec, Puzey & Payne and Barzem. Details of this company are given in the next section of this Abridged ZPHL Pre-listing Statement. African Traction and Associated Technologies is a subsidiary of Zimplow that was acquired in March 2011. Zimplow owns 49% of the issued share capital of Afritrac. Afritrac is a South African registered company that is engaged in marketing of animal drawn farm implements and related products. Current Outlook Post dollarization, Zimplow's performance has largely been driven by the success of Mealie Brand. Mealie Brand's success has been in turn driven by strong export sales growth. Going forward, it is expected that the export market will drive the growth of the division and hence significant resources are being channelled to market products in other countries. However, post the Transaction being proposed, Zimplow is planning to leverage on the distribution infrastructure of TPHL to stimulate domestic sales.

THIS ABRIDGED PRE-LISTING STATEMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION

This Zimplow Holdings Limited (ZPHL) Abridged Pre-listing Statement is not a prospectus, nor does it constitute an invitation to the public to subscribe for shares in ZPHL and will, consequently, not be registered with the Registrar of Companies. It is, rather, supplied in accordance with ZSE Listing Requirements to provide ZPHL Shareholders with appropriate and necessary information on the profile of ZPHL assuming the proposed Transaction is effected in accordance with the terms and conditions set out in the Circular to Zimplow Shareholders dated Tuesday, December 18 2012. The full ZPHL Pre-listing Statement is incorporated in the Zimplow Circular to Shareholders dated Tuesday, December 18 2012 and should accordingly be read in conjunction with that circular and the definitions set out therein. This ZPHL Abridged Pre-listing Statement has been prepared on the assumption that the ordinary and special resolutions proposed in the Notice of EGM forming part of the Circular to which the full ZPHL Pre-listing Statement is attached will be passed at the Zimplow EGM to be held on Tuesday, January 15, 2012, and fulfillment of all Conditions Precedent. Action Required: If you are in any doubt as to the action you should take in relation to this document please consult your stockbroker, banker, accountant, attorney or other professional advisor immediately.

2.1. 2.1.1.

Lead Financial Advisors

Sponsoring Brokers

Reporting Accountants and Auditors

Legal Advisors

Independent Financial Advisors

Transfer Secretaries

ABRIDGED CIRCULAR TO SHAREHOLDERS

The Directors of ZPHL, whose names appear hereunder, collectively and individually accept full responsibility for the accuracy of the information contained in this Abridged Pre-listing Statement and further confirm that they have made all reasonable enquiries and declare that to the best of their knowledge and belief there are no facts, the omission of which would make any statement in this Abridged Pre-listing Statement false or misleading. 1. CORPORATE INFORMATION ZPHL's corporate information before and on implementation of the Transaction are as follows: Company Secretary and Registered Office Design Mkonto 39 Steelworks Road, Steeldale P.O Box 1059 Bulawayo, Zimbabwe Lead Financial Advisor African Banking Corporation of Zimbabwe Limited 1 Endeavour Crescent Mount Pleasant Business Park Mount Pleasant Harare, Zimbabwe Transfer Secretaries Corpserve Registrars (Private) Limited 2nd Floor, ZB Centre Corner 1st Street/Kwame Nkrumah Avenue Harare, Zimbabwe

2.1.2.

Overview of Tractive Power Holdings Limited (TPHL) Background TPHL is a Zimbabwean Company incorporated under the Companies Act (Chapter 24:03). TPHL is listed on the ZSE having demerged from Astra Holdings in 2001. The Group is a retailer of internationally recognised brands through its four operating units namely Northmec Zimbabwe, Farmec, Puzey & Payne and Barzem. Description of Business Liftquip (Private) Limited, trading as Northmec Zimbabwe is a joint venture between TPHL and Hulumani Investments (Private) Limited [Hulumani]. The company holds franchise representative agreements for Case tractors and combine harvesters for CNH of Italy. Farmec is a division of TPHL. It holds franchise agreements for Massey Ferguson tractors and generator sets, Monosem planters, and implement brands for Kongskilode, Vicon, Howard, Ferri, Falcon, and GC Tillage. The business has a heritage spanning over 50 years and has branches in Harare, Bindura, Chinhoyi, Chiredzi, Mutare, Mvurwi, Bulawayo, Gweru, Kariba, Karoi and Masvingo. Puzey and Payne is a division of TPHL. It is a registered importer for Peugeot vehicles and is also a dealer for Mazda, Mitsubishi and Forland. The business is involved in the sale and servicing of vehicles under these brands. They also sell spares and have a limited fuel sales in Gweru and Masvingo. Recently this strategic business unit managed to also get a contract to be a Toyota dealer in the Manicaland Province of Zimbabwe. Barzem Enterprises (Private) Limited is a subsidiary company of TPHL in which they hold a 65% stake. Barloworld Equipment Company [Barloworld], a South African company owns the remaining 35%. The Company has a dealer representative agreement for Caterpillar and Hyster with Barloworld who represent Caterpillar and Hyster. Caterpillar is a USA based manufacturer of heavy earth moving machines, generator sets and associated equipment. Hyster is a USA based manufacturer of lift truck products. Current Outlook TPHL is expecting to benefit significantly from the growth of investment in the agricultural and mining sectors. In line with this, strategies are being employed at strategic business unit level, to avail customer financing to drive product sales to these sectors. TPHL's strategic impetus in the short run will, however, be centered on rationalising group operations.

Reporting Accountants and Auditors Ernst & Young Chartered Accountants (Zimbabwe) Angwa City Corner Julius Nyerere Way/Kwame Nkrumah Avenue PO Box 702 or 62 Harare, Zimbabwe Sponsoring Brokers Prime Stockbrokers 37 Victoria Drive Newlands Harare, Zimbabwe (Members of the Zimbabwe Stock Exchange) Principal Bankers African Banking Corporation of Zimbabwe Limited 1 Endeavour Crescent Mount Pleasant Business Park P.O. Box 2786 Mount Pleasant Harare, Zimbabwe

Legal Advisors Coghlan and Welsh Legal Practitioners Barclays Bank Building Corner Eighth Avenue/Main Street P O Box 22 Bulawayo, Zimbabwe

01

HAYLETT LITHO.286

3.

INVESTMENT CASE FOR THE TRANSACTION The Transaction is set to benefit shareholders for both companies. Below are some of the key driving factors that have motivated this Transaction.

7.2.

Impact of the proposed Transaction on Shareholding On implementation of the Transaction, assuming that all TPHL shareholders elect to receive New Zimplow Shares for the TPHL ordinary shares they currently hold, the top ten shareholding for ZPHL would be as follows: Shareholder Name T F S Nominees (Private) Limited CTB Investments (Private) Limited Datvest Nominees (Private) Limited Yumiko Investments (Private) Limited Cyrus Holding Corporation Limited Equivest Nominees (Private) Limited Old Mutual Life Assurance Co. Zim Limited Standard Chartered Nominees (Private) Limited National Social Security Authority Tractive Power Holdings Workers Trust (Private) Limited Shares Selected Shares Not Selected Shares Issued Number of Shares Held 264 851 796 63 500 000 36 338 883 34 905 677 29 363 734 28 713 431 23 378 036 22 440 380 18 020 156 14 732 807 536 244 900 151 188 482 687 433 382 Percentage Holding 38.53% 9.24% 5.29% 5.08% 4.27% 4.18% 3.40% 3.26% 2.62% 2.14% 78.01% 21.99% 100%

3.1.

Improved Organisational Efficiencies The merger of Zimplow and TPHL will form a platform for enhanced organisational efficiencies. In particular, the merged entity will be able to pursue cost reduction strategies through initiatives such as staff rationalisation by reducing duplicated roles within the merged entity, and resource sharing amongst business units. The merged entity will also have greater bargaining power with suppliers, customers and even regulators to some extent. Internal and external efficiency gains can thus be derived from merging the Zimplow and TPHL. Access to Finance at Lower Costs By combining the financial, tangible and intangible resources of Zimplow and TPHL, the merged entity will be able to raise significant amounts of debt and equity capital at favourable terms for future projects and other critical investments. Access to capital will allow the merged entity to have greater capacity to respond to competition or lead innovation in the industries in which its strategic business units operate. This will therefore enhance the sustainability of the merged entity over time. Product and Market Diversification There is potential for the merged entity to benefit from economies of scope by offering a wider product range to a broader market. The merged entity will be better placed to integrate distribution and retail strategies for its various strategic business units in a manner that maximises product reach. This will allow greater volumes of product to be sold and thus increase the merged entity's revenue. FUTURE PROSPECTS OF ZPHL ZPHL is well-positioned to experience robust growth as the agricultural and mining sectors continue to recover. Government and various multilateral institutions expect the agricultural and mining sectors to drive the growth of the economy in the short to medium term. The mining sector in particular, will benefit significantly from firming global commodity prices, and expected investments in power and infrastructure. The country, however, has been experiencing erratic rainfall patterns and at times full blown drought. Zimbabwe's sovereign risk has also been viewed as high by international investors thus limiting access to international capital for investment in various utilities. These factors present significant risk for ZPHL entity going forward. The merged entity will, however, be better placed to absorb such risks should they arise owing to a better-diversified revenue stream. 8. 8.1.

3.2.

3.3.

4.

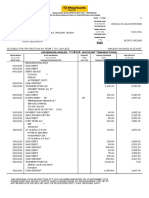

PROFORMA FINANCIAL SATEMENTS OF ZPHL Unaudited Proforma Consolidated Statement of Comprehensive Income Unaudited Consolidated ZPHL Pro Forma 12 months to 31 August 2012 US$ 58 608 042 52 527 104 6 080 939 (38 823 022) 19 785 020 (17 086 683) 2 698 338 230 000 235 200 (1 077 086) 2 086 452 (492 598) 1 593 854

Unaudited Zimplow 12 months to 31 August 2012 US$ REVENUE Domestic Export Cost of sales 15 848 713 9 767 775 6 080 939 (9 436 730) 6 411 983 (5 032 265) 1 379 719 65 838 (222 029) 1 223 528 (321 514) 902 014

Audited TPHL 12 months to 31 August 2012 US$ 42 759 329 42 759 329 (29 386 292) 13 373 037 (12 054 418) 1 318 619 230 000 169 362 (855 057) 862 924 (171 084) 691 840

5.

ORGANISATIONAL STRUCTURE OF ZPHL The organisational Structure of ZPHL will be as follows:

Zimplow Holdings Limited

Gross profit Net operating expenses Operating profit Fair value gain on investment property Finance income Finance costs Profit before tax Income tax expense Profit for the year Other comprehensive income Fair value gain on AFS financial assets Gain on revaluation of properties Exchange differences translation of foreign operations Income tax relating to other comprehensive income Other comprehensive income for the year net of tax Total comprehensive income for the year Profit attributable to: Owners of the parent entity Non controlling interests

MEALIE BRAND (a Division of ZPHL) Manufactures and distributes animal drawn farm implements, hoes and associated spare parts

TPHL (a 100% Subsidiary of ZPHL)

C.T. BOLTS FASTENERS* (a Division of ZPHL) Manufacturer of wood screws, pop rivets, verandah bolts and tensile bolts and nuts. Distributor of mild steel bolts and nuts, nails and a wide range of other fasteners

MANICA ROAD INVESTMENTS (a 100% Subsidiary of TPHL) Property Investment Company

BARZEM (a subsidiary Company, 65% owned by TPHL and 35% by Barloworld Equipment Company) Has a dealer representative agreement for Carterpiller and Hyster equipment

NORTHMEC ZIMBABWE (a Joint Venture Company 50% owned by TPHL and 50% by Hulumani Investments (Pty) Ltd) Holds a franchise for Case tractors and implements

(14 485) (65 283) 3 243 (76 525) 825 489

527 841 527 841 1 219 681

(14 485) 527 841 (65 283) 3 243 451 316 2 045 170

873 666 28 348 902 014

248 860 442 980 691 840

1 122 526 471 328 1 593 854

FARMEC (a Division of TPHL(100%)) Holds franchises for Masey Fergerson Perkins, and implement brands for Monosem and Kongskilde

PUZEY AND PAYNE (a Division of TPHL(100%)) Handle Peugot, Mazda, Toyota and Mitsubishi vehicles

Total comprehensive income attributable to: Owners of the parent Non controlling interests

830 435 (4 946) 825 489

711 009 508 672 1 219 681

1 541 444 503 726 2 045 170

*Tassburg and C. T. Bolts will be merged into one operating division by the name C. T. Bolts Fasteners. 6. SHARE CAPITAL Set out below is an analysis of the impact the Transaction will have on share capital. Zimplow Share capital before the EGM: Current number of authorised Ordinary Shares Current number of issued Ordinary Shares Current number of Ordinary Shares currently under the control of Directors Nominal value of Ordinary Shares ZPHL Share capital immediately after the implementation of the Transaction*: Number of authorised Ordinary Shares Number of issued Ordinary Shares Number of Ordinary Shares under the control of Directors Nominal value of Ordinary Shares 800 000 000 687 433 381 112 566 619 US$0.0001 800 000 000 560 462 713 239 537 287 US$0.0001

Reviewed Zimplow Limited Note 1 US$ ASSETS Non current assets 12 626 116 Property, plant and equipment 2 694 809 Available for sale financial assets 154 598 Investment property Investment in subsidiaries 9 737 967 Long term receivables Goodwill 38 742 Current assets Inventories Trade and other receivables Cash and bank balances Total assets EQUITY AND LIABILITIES Equity attributable to owners of the parent Non controlling interests Total equity Non current liabilities Deferred tax liability Long term borrowings Current liabilities Trade and other payables Short term borrowings Current tax liabilities Total equity and liabilities 13 813 310 8 063 489 2 830 482 2 919 339 26 439 426 15 455 702 10 555 037 4 500 000 157 747 242 918 17 650 387 8 249 065 8 692 590 708 732 33 106 089 (9 737 967) (9 737 967) (9 737 967) 18 343 851 13 249 846 154 598 4 500 000 157 747 281 660 31 463 697 16 312 554 11 523 072 3 628 071 49 807 548 6 296 641 6 296 641 6 296 641 (6 296 641) (6 296 641) (6 296 641) (250 000) (250 000) (250 000) 18 343 851 13 249 846 154 598 4 500 000 157 747 281 660 31 213 697 16 312 554 11 523 072 3 378 071 49 557 548

8.2.

Unaudited Proforma Statement of Financial Position

Effects of Effects of consolidating Effects of consolidating Zimplow and Unaudited issuance of the Zimplow TPHL prior Consolidated Zimplow shares and TPHL after to 100% Zimplow in exchange for the 100% acquisition Limited TPHL shares acquisition Note 3 Note 4 Note 5 Note 6 US$ US$ US$ US$

Audited TPHL Note 2 US$

Effects transaction expenses Note 7 US$

Unaudited consolidated ZPHL Pro Forma Note 8 US$

*Assuming that all TPHL shareholders participating in the Transaction elect to receive Zimplow Shares in respect of their shareholding in TPHL.

7. 7.1.

SHAREHOLDING Current Shareholding As at Thursday, November 29, 2012, the last practicable date before publication of this Abridged Pre-Listing Statement, the top ten (10) shareholders of Zimplow were as detailed below. Shareholder Name T F S Nominees (Private) Limited CTB Investments (Private) Limited Datvest Nominees (Private) Limited Yumiko Investments (Private) Limited Old Mutual Life Assurance Co. Zim Limited Standard Chartered Nominees (Private) Limited National Social Security Authority Mining Industry Pension Fund Bernard N Chitepo National Railways Of Zimbabwe Contributory Pension Fund Shares Selected Shares Not Selected Shares Issued Number of Shares Held 264 851 796 63 500 000 36 338 883 34 905 677 23 378 036 22 440 380 18 020 156 6 880 066 6 860 486 6 042 294 483 217 774 77 244 939 560 462 713 Percentage Holding 47.26% 11.33% 6.48% 6.23% 4.17% 4.00% 3.22% 1.23% 1.22% 1.08% 86.22% 13.78% 100%

22 700 100 456 571 23 156 670 579 094 579 094 -

15 013 535 2 511 819 17 525 354 2 345 898 2 220 898 125 000

(9 737 967) (9 737 967) (9 737 967)

27 975 668 2 968 390 30 944 057 2 924 992 2 799 992 125 000 15 938 498 8 924 651 7 026 140 (12 293) 49 807 548

(6 296 641) (6 296 641) (6 296 641)

6 296 641 6 296 641 6 296 641

(250 000) (250 000) (250 000)

27 725 668 2 968 390 30 694 057 2 924 992 2 799 992 125 000 15 938 498 8 924 651 7 026 140 (12 293) 49 557 548

2 703 661 13 234 837 1 184 339 7 740 312 1 550 853 5 475 287 (31 531) 19 238 26 439 426 33 106 089

02

HAYLETT LITHO.286

NOTES Note 1: Note 2: Note 3: Note 4: Note 5: Note 7: Note 8: 9. 9.1. Represents the reviewed company statement of financial position of Zimplow as at 31 August 2012 Represents the audited company statement of financial position of TPHL as at 31 August 2012 Represents the effects of Zimplow's consolidation of the 57.21% equity stake in TPHL Represents the unaudited consolidated company statement of financial position of Zimplow as at 31 August 2012 Represents the effects of issuing enough new Zimplow shares to acquire the remaining 43.79% in TPHL. This effect assumes no TPHL shares are acquired through consideration of cash Represents estimated transaction costs Represents the unaudited pro forma consolidated statement of financial position of ZPHL as at 31 August 2012

amount of the moneys so borrowed or raised) shall not without the previous sanction of an Ordinary Resolution of the Company exceed the aggregate of (i) the nominal amount of the issued and paid-up share capital for the time being of the Company (subject to any variations therein since the date of the last accounts referred to in this clause) and (ii) the aggregate of the amounts standing to the credit of all capital and revenue reserve accounts (other than reserves created by the writing up of any assets of the Company or of any of its subsidiaries after acquisition thereof by the Company or any provisions for taxation), any share premium accounts and the profit and loss accounts as set out in the consolidated balance sheet of the Company and its subsidiaries certified by the Company's Auditors and as attached to or forming part of the last accounts of the Company which shall have been drawn up to be laid before the Company in General Meeting at the relevant time, provided that no such sanction shall be required to the borrowing of any moneys intended to be applied and actually applied within ninety days in the repayment (with or without any premium) of any moneys then already borrowed and outstanding and notwithstanding that new borrowing may result in the abovementioned limit being exceeded. 10.1. BORROWINGS

DIRECTORS Details of Directors Prior to the Implementation of the Transaction The Directors of Zimplow prior to the implementation of the Transaction are as follows: Name of Director Zivanayi Rusike Zondi Kumwenda Francis Rwakonda Design Mkonto Brendan Mitchell Todd Moyo Patrick Devenish Antiock Kurauone Eugene Mlambo Nathan Nhira Board Position Non Executive Board Chairman Chief Executive Officer Group Finance Director Group Commercial Director & Company Secretary Managing Director of CT Bolts Division Non Executive Director Non Executive Director Non Executive Director Non Executive Director Non Executive Director

ZPHL's borrowings as at 31 August 2012 are as follows: Nature Non-currentliabilities Curent liabilities Total 11. SOLVENCY, LIQUIDITY AND WORKING CAPITAL STATEMENT The Directors are of the opinion that, post the Transaction, both the issued share capital and working capital of ZPHL will be adequate to finance operations on a sustainable basis going forward. 12. LITIGATION As at the date of the Abridged Pre-listing Statement, the Directors confirm that neither ZPHL nor any of its subsidiaries is not involved in any material litigation, dispute, or arbitration proceedings which may have or have had in the past twelve months preceding the date of this Abridged Pre-listing Statement, a significant effect on the financial position of the Company, nor is ZPHL aware of such material litigation, dispute or arbitration proceedings pending or threatened. 13. SIGNIFICANT CONTRACTS Zimplow entered into an underwriting agreement earlier in the year for a Rights Issue to fund the acquisition of TPHL. Other than this underwriting agreement, and contracts entered into by Zimplow to effect the acquisition of African Traction and Association Technologies and the acquisition of Tractive Power Holdings Limited, there are no significant contracts that have been entered into by ZPHL or its subsidiaries, not being contracts in the ordinary course of business, during the 2 (two) years immediately preceding the date of this Pre-listing Statement. 14. EXPERTS' CONSENT African Banking Corporation of Zimbabwe Limited, Ernst & Young Chartered Accountants (Zimbabwe), Coghlan and Welsh Legal Practitioners, Corpserve Transfer Secretaries (Private) Limited, PricewaterhouseCoopers Chartered Accoutants (Zimbabwe) and Prime Stockbrokers (Private) Limited have given, and not withdrawn, their consents, as at date of issue of this Abridged Pre-listing Statement, to its issue with the inclusion of their names and reports in the forms and contexts in which they appear. 15. DOCUMENTS AVAILABLE FOR INSPECTION The following documents, or copies thereof, will be available for inspection at the registered Company's offices and at Corpserve Transfer Secretaries (full addresses on page 3 of this circular), during normal business hours, on weekdays, until Monday, January 14, 2013: The full ZPHL Pre-listing Statement; the memorandum and articles of association of Zimplow; the audited financial statements of Zimplow for the three financial years ended 31 December 2011, 31 December 2010, and 31 December 2009; the audited financial statements of TPHL for the three financial years ended 31 August 2011, 31 August 2010 and 31 August 2012; the Zimplow litigation report; the TPHL litigation report; and the written consents of the experts referred to in this Abridged Pre-listing Statement. 16. DIRECTORS RESPONSIBILITY STATEMENT The Directors of ZPHL, whose names appear below, collectively and individually accept full responsibility for the accuracy of the information given in this Abridged Pre-listing Statement and certify that to the best of their knowledge and belief there are no other facts, the omission of which would make any statement in this Abridged Pre-listing Statement false or misleading, that they have made all reasonable enquiries to ascertain such facts and that this Abridged Pre-listing Statement contains all such information required by law. The Directors of ZPHL also confirm that this Abridged Pre-listing Statement includes all such information within their knowledge (or which it would be reasonable for them to obtain by making enquiries) that investors and their professional advisors would reasonably expect to find, for purposes of making informed assessment of the assets and liabilities, financial position, profits and losses and prospects of ZPHL in order to vote at the EGM. Signed at Harare, this 17th day of December 2012, by the following, being Directors of Zimplow Holdings Limited: NAME Zivanayi Rusike Zondi Kumwenda Francis Rwakonda Todd Moyo Patrick Devenish Antiock Kurauone Eugene Mlambo DESIGNATE Non Executive Board Chairman Chief Executive Officer Group Finance Director Non Executive Director Non Executive Director Non Executive Director Non Executive Director Non Executive Director Non Executive Director Non Executive Director Non Executive Director SIGNATURES Signed on original Signed on original Signed on original Signed on original Signed on original Signed on original Signed on original Signed on original Signed on original Signed on original Signed on original Amount (USD) 125 000 7 026 140 7 151 140

9.2.

Details of Directors Post the Implementation of the Transaction Assuming that the Transaction is implemented, Messrs Godfrey Manhambara, Sibani Mngomezulu and Timothy Johnson, will be asked to join the Board of ZPHL. Mrs. Design Mkonto, Mr. Brendan Mitchel and Mr. Anthony Renfric Rowland will be retiring from the Board of Zimplow after the implementation of the Transaction. Consequently, on implementation of the Transaction, the Board of Directors of ZPHL is expected to comprise the following members: Name of Director Zivanayi Rusike Zondi Kumwenda Francis Rwakonda Todd Moyo Patrick Devenish Antiock Kurauone Eugene Mlambo Nathan Nhira Godfrey Tsikayi Manhambara Sibani Mngomezulu Timothy Michael Johnson Age 56 45 34 55 55 50 53 51 53 40 66 Nationality Zimbabwean Zimbabwean Zimbabwean Zimbabwean Zimbabwean Zimbabwean Zimbabwean Zimbabwean Zimbabwean South African Zimbabwean Physical Address 285 Fairway Avenue, Borrowdale Brooke, Harare 2 Livingstone Road, Suburbs, Bulawayo 79 Moffat Avenue, Hillside, Bulawayo Stand 14940 Imvubu Crescent, Selbourne Park, Bulawayo 30 Staley Road, Borrowdale, Harare 5 Duxford Avenue, Greencroft, Harare 77 Umwinisdale, Borrowdale, Harare 25 Northway, Burnside, Bulawayo 24 Binton Road, Greystone Park, Harare 5 Harrier Cresent Douglasdale 2191, South Africa 43 Orange Grove Drive, Highlands, Harare Board Position Non-Executive Board Chairman Group Chief Executive Officer Group Finance Director Non-Executive Director Non-Executive Director Non-Executive Director Non-Executive Director Non-Executive Director Non-Executive Director Non-Executive Director Non-Executive Director

9.3.

Directors Interests The Directors, as detailed above, had the following direct and indirect interests in Zimplow Shares as at Thursday, November 29, 2012 (being the Last Practicable Date).

Name of Director Zivanayi Rusike Design Mkonto Brendan Mitchell Nathan Nhira Patrick Devinish Antiock Kurauone Eugine Mlambo Todd Moyo Zondi Kumwenda Francis Rwakonda Anthony Renfric Rowland

Direct Shareholding 1 000 148 129 63 501 000 1 276 420 1 213 1 000 1 000 1 000 15 609 1 000 310 261

Indirect Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil

Share Options Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil

Assuming the Appointment of Messrs Godfrey Manhambara, Sibani Mngomezulu and Timothy Johnson and the retirement of Mrs. Design Mkonto, Mr. Brendan Mitchel and Mr. Anthony Renfric Rowland, the interests of the Directors of ZPHL on implementation of the Transaction are as follows Name of Director Zivanayi Rusike Nathan Nhira Patrick Devinish Antiock Kurauone Eugine Mlambo Todd Moyo Zondi Kumwenda Francis Rwakonda Godfrey Tsikayi Manhambara Sibani Mngomezulu Timothy Michael Johnson Direct Shareholding 1 000 1 276 420 1 213 1 000 1 000 1 000 15 607 1 000 Nil Nil Nil Indirect Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil Share Options Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil Nil

10.

BORROWING POWERS Below is an excerpt of section 47 of the Company's Articles of Association outlining the Borrowing Powers of the Directors: 47.(a) Subject to the provisions of (b), the Directors may borrow or raise from time to time for such purposes of the Company such sums as they deem fit. (b) The Directors shall procure (but as regards subsidiaries of the Company only insofar as by the exercise of voting and other rights or powers of control exercisable by the Company they can procure) that the aggregate principal amount at any one time outstanding in respect of moneys so borrowed or raised by the Company and all the subsidiaries for the time being of the Company (excluding moneys borrowed or raised by any of such companies from any other of such companies but including the principal amount secured by any outstanding guarantees or suretyships given by the Company or any of its subsidiaries for the time being for the share capital or indebtedness of any company or companies whatsoever other than the Company or any of its subsidiaries and not already included in the aggregate

Nathan Nhira Godfrey Tsikayi Manhambara Sibani Mngomezulu Timothy Michael Johnson 17. QUERIES

If you have any questions on any aspect of this Document, please contact your stockbroker, accountant, banker, lawyer or other professional advisor. Alternatively please contact the BancABC Investment Banking team on +263 4 338027 or by email on tmapfumo@bancabc.com or schikengezha@bancabc.com.

03

HAYLETT LITHO.286

Vous aimerez peut-être aussi

- Analisis Banco SantanderDocument6 pagesAnalisis Banco Santanderperro_mx0% (1)

- Statement of Account: Penyata AkaunDocument3 pagesStatement of Account: Penyata AkaunYanz NelsonzPas encore d'évaluation

- JEEVES Invoice PDFDocument1 pageJEEVES Invoice PDFBijay BeheraPas encore d'évaluation

- Https Doc 08 1g Apps Viewer - GoogleusercontentDocument5 pagesHttps Doc 08 1g Apps Viewer - GoogleusercontentIsmaliza IshakPas encore d'évaluation

- Í Qdo - È Hayco Loveâfaithâââââ P Çrâ'54Eî Ms. Love Faith Pasetes HaycoDocument5 pagesÍ Qdo - È Hayco Loveâfaithâââââ P Çrâ'54Eî Ms. Love Faith Pasetes HaycoLove Faith HopePas encore d'évaluation

- LCL - ItaliaDocument1 pageLCL - ItaliaAnonymous etJzlRkyPas encore d'évaluation

- Softtech Engineers LimitedDocument5 pagesSofttech Engineers LimitedHimanshu ChavanPas encore d'évaluation

- Demand Deposit Account Transaction History: Histórico de Movimentos de Conta À OrdemDocument4 pagesDemand Deposit Account Transaction History: Histórico de Movimentos de Conta À Ordemshahid2opuPas encore d'évaluation

- 2016 17 Press StatementDocument19 pages2016 17 Press StatementcharliemopicPas encore d'évaluation

- Noa-Iit Ob2620220516204800b91Document2 pagesNoa-Iit Ob2620220516204800b91Tha OoPas encore d'évaluation

- Statement859 092010Document2 pagesStatement859 092010Behnam AryafarPas encore d'évaluation

- 6388r13 Uk PC Order FRM FinalDocument2 pages6388r13 Uk PC Order FRM Finalapi-307674357Pas encore d'évaluation

- Statement of Account: Penyata AkaunDocument3 pagesStatement of Account: Penyata AkaunWaNazren Wan KacangPas encore d'évaluation

- Tax Invoice / Statement of Account: Invoice Cukai / Penyata AkaunDocument3 pagesTax Invoice / Statement of Account: Invoice Cukai / Penyata Akaunqasihsuci82Pas encore d'évaluation

- Ap 6050003562019Document1 pageAp 6050003562019Vijayraj SriramPas encore d'évaluation

- MBBsavings - 151061 295176 - 2018 12 31 PDFDocument66 pagesMBBsavings - 151061 295176 - 2018 12 31 PDFTENGKU ARIFFANDI TUAN MATPas encore d'évaluation

- 01-Jul-2021Document1 page01-Jul-2021SardarPas encore d'évaluation

- AadmDocument6 pagesAadmSandhya ParabPas encore d'évaluation

- The Interest Rate On Your Savings Account Is Going Down Soon - 01072020Document2 pagesThe Interest Rate On Your Savings Account Is Going Down Soon - 01072020PawełPas encore d'évaluation

- Governing Body: International Labour OfficeDocument33 pagesGoverning Body: International Labour OfficeMu Eh HserPas encore d'évaluation

- Instruction: Telegraphic TransferDocument4 pagesInstruction: Telegraphic TransferBokulPas encore d'évaluation

- State Bank of IndiaDocument1 pageState Bank of IndiaAnjusha NairPas encore d'évaluation

- June 2022 StatementDocument1 pageJune 2022 StatementjohanPas encore d'évaluation

- MBBsavings - 162432 992088 - 2016 12 31 PDFDocument7 pagesMBBsavings - 162432 992088 - 2016 12 31 PDFprem160682Pas encore d'évaluation

- iweu8IlWb6jUnH8b7uv2svDG8N8S70cQLe2lGyUFvZ4quaBPLxqt0sXM70w PDFDocument8 pagesiweu8IlWb6jUnH8b7uv2svDG8N8S70cQLe2lGyUFvZ4quaBPLxqt0sXM70w PDFthiviyasri2422Pas encore d'évaluation

- KC 8979 PDFDocument1 pageKC 8979 PDFPushpendra SinghPas encore d'évaluation

- Application Form Account Opening20112016031008Document4 pagesApplication Form Account Opening20112016031008Jim AlanPas encore d'évaluation

- Primary Account Holder Name: Shree Aadinath Metal: Your Current A/C StatusDocument28 pagesPrimary Account Holder Name: Shree Aadinath Metal: Your Current A/C Statusamanaggarwal1708Pas encore d'évaluation

- Registered Person PEDocument8 pagesRegistered Person PEMuhammad Syahir BadruddinPas encore d'évaluation

- Invoice: Invoice Address Delivery AddressDocument5 pagesInvoice: Invoice Address Delivery AddressOnkar PotdarPas encore d'évaluation

- Next Steps: You Need To Write Your Customer Reference Number On Every Document You Send UsDocument8 pagesNext Steps: You Need To Write Your Customer Reference Number On Every Document You Send UsPaul FlorinPas encore d'évaluation

- Statement of Account: Penyata AkaunDocument5 pagesStatement of Account: Penyata AkaunyogsivaPas encore d'évaluation

- Statement of Account: Penyata AkaunDocument4 pagesStatement of Account: Penyata AkaunseelanshathiaPas encore d'évaluation

- 616 Units Rs. 8,609.25: Munawar MughalDocument2 pages616 Units Rs. 8,609.25: Munawar MughalStudents LinkPas encore d'évaluation

- Statement Oct 19 XXXXXXXX5737Document15 pagesStatement Oct 19 XXXXXXXX5737Ravi TejaPas encore d'évaluation

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document2 pagesHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971golu84Pas encore d'évaluation

- Summary of Current Charges (RS) : Talk To Us SMSDocument7 pagesSummary of Current Charges (RS) : Talk To Us SMSpavandattaPas encore d'évaluation

- BillingStatement - Hanaumi FathimaDocument1 pageBillingStatement - Hanaumi FathimaAwal SafarPas encore d'évaluation

- Tax Invoice: TÜV Rheinland (India) Pvt. LTDDocument2 pagesTax Invoice: TÜV Rheinland (India) Pvt. LTDHansraj GargPas encore d'évaluation

- Your Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodDocument2 pagesYour Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodMichael FissehaPas encore d'évaluation

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesAvinash GollaPas encore d'évaluation

- Dintle StatementDocument3 pagesDintle StatementMANDLAPas encore d'évaluation

- This Bill Is Net of Earlier Adjustment in Previous Advice. This Is A Computer Generated Payment Advice, Hence No Signature Is RequiredDocument1 pageThis Bill Is Net of Earlier Adjustment in Previous Advice. This Is A Computer Generated Payment Advice, Hence No Signature Is Requiredtapas kumar biswalPas encore d'évaluation

- AprilDocument3 pagesAprilLathaRajRajandrenPas encore d'évaluation

- 000011254894 (1)Document1 page000011254894 (1)Zuraida BashariPas encore d'évaluation

- Customer StatementDocument1 pageCustomer StatementadesinaifakunlePas encore d'évaluation

- PDFDocument1 pagePDFAnonymous olLygfjnPas encore d'évaluation

- Ooccmkn01 PDFDocument1 pageOoccmkn01 PDFnnuuyy 22Pas encore d'évaluation

- View Certificate PDFDocument1 pageView Certificate PDFRaj Kumar GuleriaPas encore d'évaluation

- Temporary: Your DetailsDocument2 pagesTemporary: Your Detailsmankumyad.05100% (1)

- Account Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)Document1 pageAccount Statement: (Company Name) (Street Address, City, ST ZIP Code) (Phone) (Fax) (Email)mr batmanPas encore d'évaluation

- Yoseph H Simanjuntak: Account SummaryDocument5 pagesYoseph H Simanjuntak: Account SummaryPutra UtamaPas encore d'évaluation

- STMT 3640731 PDFDocument3 pagesSTMT 3640731 PDFRoger BumgarnerPas encore d'évaluation

- 18 Apr 2020 - (Free) ..cg11NTQKdgU - FXpwFhZhdQVyA3wCGXwCdhwEBxp-CHEOcw0DfBkIdgdzBQR1dgh2B3MDBn11DnECcgwHcQDocument1 page18 Apr 2020 - (Free) ..cg11NTQKdgU - FXpwFhZhdQVyA3wCGXwCdhwEBxp-CHEOcw0DfBkIdgdzBQR1dgh2B3MDBn11DnECcgwHcQLovemore Mutyambizi MuchenjePas encore d'évaluation

- Admg PDFDocument3 pagesAdmg PDFyohannestampubolonPas encore d'évaluation

- Syed Kamran Hussain Zaidi Syed Shaker Hussain Zaidi H.19/1 B-Block Jafaria Cly B RD LHRDocument1 pageSyed Kamran Hussain Zaidi Syed Shaker Hussain Zaidi H.19/1 B-Block Jafaria Cly B RD LHRSaqib ZaidiPas encore d'évaluation

- Trustwave Asv Report 072817Document115 pagesTrustwave Asv Report 072817Allison WillsPas encore d'évaluation

- Elgi 290311 01Document4 pagesElgi 290311 01accendoPas encore d'évaluation

- Star Africa CorpDocument5 pagesStar Africa CorpBusiness Daily ZimbabwePas encore d'évaluation

- Prospectus JAT Holdings LimitedDocument244 pagesProspectus JAT Holdings LimitedthugnaturePas encore d'évaluation

- National Budget 2017Document256 pagesNational Budget 2017Kristi DuranPas encore d'évaluation

- Wacc DecomposedDocument1 pageWacc DecomposedKristi DuranPas encore d'évaluation

- Citizens Budget 2022Document17 pagesCitizens Budget 2022Kristi DuranPas encore d'évaluation

- Hippo Valley Annual Report 2014 - Final Printers' Draft PDFDocument61 pagesHippo Valley Annual Report 2014 - Final Printers' Draft PDFKristi Duran50% (2)

- Illovo Sugar Malawi LTD 2015 Annual ReportDocument60 pagesIllovo Sugar Malawi LTD 2015 Annual ReportKristi DuranPas encore d'évaluation

- 2014 Annual ReportDocument124 pages2014 Annual ReportKristi DuranPas encore d'évaluation

- Innscor AR 2014Document98 pagesInnscor AR 2014Kristi DuranPas encore d'évaluation

- TA Holdings Annual Report 2013Document100 pagesTA Holdings Annual Report 2013Kristi DuranPas encore d'évaluation

- Barclays Zimbabwe Annual Report 2013Document74 pagesBarclays Zimbabwe Annual Report 2013Kristi DuranPas encore d'évaluation

- Ariston Annual Report 2013Document57 pagesAriston Annual Report 2013Kristi DuranPas encore d'évaluation

- Zimbabwe: Travel & Tourism Forging Ahead The 2004 Travel & Tourism Economic ResearchDocument32 pagesZimbabwe: Travel & Tourism Forging Ahead The 2004 Travel & Tourism Economic ResearchKristi DuranPas encore d'évaluation

- Powerspeed H1 2014Document2 pagesPowerspeed H1 2014Kristi DuranPas encore d'évaluation

- Brainworks Capital Management Interim Financial Results 30 June 2013Document42 pagesBrainworks Capital Management Interim Financial Results 30 June 2013Kristi DuranPas encore d'évaluation

- 04-Acid Test RatioDocument2 pages04-Acid Test RatioGna OngPas encore d'évaluation

- Lenich Ratios 2024Document2 pagesLenich Ratios 2024mumbinganga6Pas encore d'évaluation

- PBRX Financial Report Dec 2018 (Audited)Document84 pagesPBRX Financial Report Dec 2018 (Audited)ronaldi lioePas encore d'évaluation

- PT Gihon Telekomunikasi Indonesia TBK Dan Entitas Anak / and SubsidiaryDocument62 pagesPT Gihon Telekomunikasi Indonesia TBK Dan Entitas Anak / and SubsidiaryDhen NurdiansyahPas encore d'évaluation

- Lesson 08a - Financial Statements From TB - 2023Document66 pagesLesson 08a - Financial Statements From TB - 2023IGTDRipZPas encore d'évaluation

- Chapter 9: Cash Flow Statement: Solutions To Problems and Cases Try It YourselfDocument7 pagesChapter 9: Cash Flow Statement: Solutions To Problems and Cases Try It YourselfSaurabh KhuranaPas encore d'évaluation

- Terminal Sample 1 SolvedDocument14 pagesTerminal Sample 1 SolvedFami FamzPas encore d'évaluation

- Entreprenerial Finance Master DocumentDocument65 pagesEntreprenerial Finance Master DocumentemilspurePas encore d'évaluation

- Auto Car WashDocument20 pagesAuto Car WashAmeya Pai AnglePas encore d'évaluation

- 5 - Capital StructureDocument3 pages5 - Capital StructureSlim CharniPas encore d'évaluation

- Table 15. Total Project CostDocument9 pagesTable 15. Total Project CostjanePas encore d'évaluation

- CH 11Document6 pagesCH 11Saleh RaoufPas encore d'évaluation

- Analisis Kredit Macet (Pt. Bank Sulut, TBK Di Manado) : Jurnal Administrasi BisnisDocument15 pagesAnalisis Kredit Macet (Pt. Bank Sulut, TBK Di Manado) : Jurnal Administrasi BisnisAdinda Arum MeiPas encore d'évaluation

- Steve MavDocument131 pagesSteve MavAnonymous 4Y4GA3tPas encore d'évaluation

- Auditing Assurance - Specialized IndustriesDocument10 pagesAuditing Assurance - Specialized IndustriesTOLENTINO, Joferose AluyenPas encore d'évaluation

- Loans and MortgagesDocument3 pagesLoans and MortgagesLimario ManobanPas encore d'évaluation

- "Full" Pfrss Refer To The Standards That We Had DiscussedDocument7 pages"Full" Pfrss Refer To The Standards That We Had DiscussedJustine VeralloPas encore d'évaluation

- Hira Textile Mill Horizontal Analysis 2014-13 1Document8 pagesHira Textile Mill Horizontal Analysis 2014-13 1sumeer shafiqPas encore d'évaluation

- Atom Bomb of CA Final Total Pages 763 PDFDocument763 pagesAtom Bomb of CA Final Total Pages 763 PDFPrem Prakash Sinha33% (3)

- 8-Security-Valuation 2Document29 pages8-Security-Valuation 2saadullah98.sk.skPas encore d'évaluation

- Sources of Long Term FinanceDocument30 pagesSources of Long Term FinanceManu Mallikarjun NelagaliPas encore d'évaluation

- Basics of Accounting: For SEBI Grade A ExamDocument13 pagesBasics of Accounting: For SEBI Grade A ExamALANKRIT TRIPATHI100% (1)

- Chapter 1Document25 pagesChapter 1chanreaksmeytepPas encore d'évaluation

- 5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A PlanDocument6 pages5 Parkin Samantha Chapter 2 - Measuring Your Financial Health and Making A Planapi-245262597100% (1)

- (Cpar2016) AP-8007 (Audit of Receivables)Document4 pages(Cpar2016) AP-8007 (Audit of Receivables)Dawson Dela CruzPas encore d'évaluation

- Ross CorpFin Casemap1Document44 pagesRoss CorpFin Casemap1alokkuma05Pas encore d'évaluation

- Alternative Models of Bank PerformanceDocument50 pagesAlternative Models of Bank Performancechikku8764Pas encore d'évaluation

- Restructuring and ReschedulingDocument16 pagesRestructuring and ReschedulingJeyashankar Ramakrishnan100% (1)

- Cash Flow Statement Format Indirect MethodDocument2 pagesCash Flow Statement Format Indirect Methodkashifaslam022Pas encore d'évaluation

- Answer Key AccgovDocument13 pagesAnswer Key AccgovDeloria DelsaPas encore d'évaluation