Académique Documents

Professionnel Documents

Culture Documents

Reliance Gold Saving Fund20122013

Transféré par

John Maldonado0 évaluation0% ont trouvé ce document utile (0 vote)

50 vues36 pagesmutual fund

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentmutual fund

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

50 vues36 pagesReliance Gold Saving Fund20122013

Transféré par

John Maldonadomutual fund

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 36

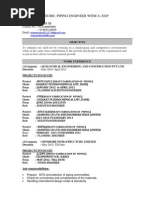

Annual Report 2012 - 2013

Reliance Gold Savings Fund

An Open ended Fund of Fund Scheme

Reliance Capital Asset Management Limited

A Reliance Capital Company

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound,

841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully.

Reliance Mutual Fund (A Trust under the ndian Trust Act, 1882)

SPONSOR

Reliance Capital Limited

(Incorporated under the Companies Act, 1956)

Regd. Offce :

'H' Block, 1st Floor, Dhirubhai Ambani Knowledge City, Koparkhairane,

Navi Mumbai - 400 710.

Tel.: +9122 3032 7000, Fax: +9122 3032 7202

TRUSTEE

Reliance Capital Trustee Co. Limited

(Incorporated under the Companies Act, 1956)

Corporate Ofce :

11th Floor & 12th Floor, One ndiabulls

Centre, Tower 1, Jupiter Mills Compound,

841, Senapati Bapat Marg,

Elphinstone Road, Mumbai - 400 013.

Tel.: 022-30994600 Fax: 022-30994699

Website : www.reliancemutual.com

Regd. Ofce :

'H' Block, 1st Floor,

Dhirubhai Ambani Knowledge City,

Koparkhairane,

Navi Mumbai - 400 710.

DIRECTORS OF RELIANCE CAPITAL TRUSTEE CO. LIMITED

Mr. A. N. Shanbhag Mr. P. P. Vora

Mr. S. Santhanakrishnan CA. Uttam Prakash Agarwal

INVESTMENT MANAGER

Reliance Capital Asset Management Limited

(Incorporated under the Companies Act, 1956)

Corporate Ofce :

11th foor & 12th foor, One ndiabulls Centre,

Tower 1, Jupiter Mills Compound, 841,

Senapati Bapat Marg,

Elphinstone Road, Mumbai - 400 013.

Tel.: 022-30994600 Fax: 022-30994699

Website : www.reliancemutual.com

Regd. Ofce :

'H' Block, 1st Floor,

Dhirubhai Ambani Knowledge City,

Koparkhairane,

Navi Mumbai - 400 710.

DIRECTORS OF RELIANCE CAPITAL ASSET MANAGEMANT LIMITED

Mr. Soumen Ghosh Mr. Kanu Doshi

Mr. S. C. Tripathi Mr. Yutaka deguchi

AUDITORS

Haribhakti & Co.

Chartered Accountants

42, Free Press House,

Nariman Point,

Mumbai - 400 021.

CUSTODIAN

Deutsche Bank A.G.

Kodak House, Ground Floor,

222, D. N. Road,

Mumbai - 400 001

REGISTRAR

Karvy Computershare Private Limited

46, Avenue 4,

Street No 1, Banjara Hills,

Hyderabad - 500034

Ph : 040-23312454

Fax : 040-23311968

INTERNAL AUDITORS

Price Waterhouse

252, Veer Savarkar Marg,

Shivaji Park, Dadar,

Mumbai 400 028

Annual Report 2012 - 2013 2

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

Trustee Report

1. Scheme Performance, Future Outlook and Operations of the Scheme

Name of the Scheme

/ Benchmarks

Date of

Inception

Compounded Annualised Returns

as on 31.03.2013 (in %)

1 year 3 years 5 years Since

Inception

Reliance Gold

Savings Fund-

Growth

14-Mar-11 2.95 N.A. N.A. 16.25

Domestic Price Gold 4.28 N.A. N.A. 18.69

Reliance Gold

Savings Fund- Direct

Plan Growth

1-Jan-13 N.A. N.A. N.A. -4.97

Domestic Price Gold N.A. N.A. N.A. -2.51

Past performance may or may not be sustained in future.

Returns are for Growth Option for Reliance Gold Savings Fund. Returns less

than 1 year are on absolute basis and more than or equal one year are on

compounded annualised basis.

Reliance Gold Savings Fund is the frst gold fund of fund in the industry which

opens a new avenue for investing in gold as an asset class. The fund seeks to

provide returns of gold through investments in R* Shares Gold ETF, which in

turn invest in physical gold. t enables you to reap the returns of gold in a paper

form without the need of a demat account.

Future Outlook - The ndian Mutual Fund industry is one of the fastest growing

industries in the fnancial services sector with 44 AMCs currently operating in the

country. The industry AAUM has grown at a CAGR of 25% since 1965 and at a

CAGR of 10% in the last three years, with Rs. 8,16,657 crores of average assets

as on March 31, 2013.

Your Company intends to aggressively pursue growth opportunities in the

mutual fund industry both domestic and international and therefore be the

most preferred investment choice for investors. Your Company expects that an

emerging market like ndia would experience a sustained higher growth rate.

Given the country's high household savings rate along with the current low levels

of investments by retail investors where only less than 3% of the household

savings is channeled into capital markets, your Company believes that the

Mutual Fund ndustry is still in a nascent stage and has a huge opportunity

for growth and expansion. Being one of the large players in the ndustry, your

Company will continue investing in growing the market size, achieving product

innovation, educating the investors, increasing the distribution reach, enhancing

customer service infrastructure with aggressive expansion strategies.

2. Brief background of Sponsors, Trust, Trustee Co. and AMC.

a. Reliance Capital Limited [Sponsor]

Reliance Mutual Fund has been sponsored by Reliance Capital Limited

(RCL), which also happens to be the Settler of this Trust i.e. Reliance Mutual

Fund. RCL is a RB registered Non-Banking Finance Company (NBFC) and

has its business interests in Asset Management, Life nsurance, General

nsurance, Private Equity, Proprietary nvestments, Stock Broking, & other

activities in the Financial Services Sector.

b. Reliance Mutual Fund [Trust]

Reliance Mutual Fund (RMF) has been set up as a Trust in accordance with

the provisions of the ndian Trust Act, 1882 by RCL acting as its Settlor /

Sponsor. The Trust came into being vide Trust Deed dated April 25, 1995

(the Original Trust Deed ), which was duly registered under the ndian

Registration Act, 1908. The Original Trust Deed has also been subsequently

amended from time to time. n order to consolidate all amendments to the

Original Trust Deed, an Amended and Restated Trust Deed was executed

on March 15, 2011 (the Amended and Restated Trust Deed ), which

was then duly registered under the ndian Registration Act, 1908 and also

submitted with the Securities & Exchange Board of ndia (SEB).

c. Reliance Capital Trustee Co Limited [Trustee]

Reliance Capital Trustee Co. Limited (RCTC) is an unlisted Public Limited

Company incorporated under the Companies Act, 1956 on February 24,

1995, having its registered offce at 'H' Block, 1st Floor, Dhirubhai Ambani

Knowledge City, Koparkhairane, Navi Mumbai 400710 and its Corporate

Offce at "One ndiabulls Centre Tower One, 11th and 12th foor, Jupiter

Mills Compound, Elphinstone Road, Mumbai 400 013. RCTC is a

subsidiary of RCL. RCTC has been appointed as the Trustee of RMF vide

Trust Deed dated April 25, 1995 and which Trust Deed has been amended

from time to time. As Trustee to RMF, RCTC is discharging its duties and

carrying out its responsibilities in terms of the applicable SEB Regulations

and as more particularly provided in the Trust Deed.

d. Reliance Capital Asset Management Limited [Asset Manager]

Reliance Capital Asset Management Limited (RCAM) is an unlisted Public

Limited Company incorporated under the Companies Act, 1956 on February

24, 1995, having its registered offce at 'H' Block, 1st Floor, Dhirubhai

Ambani Knowledge City, Koparkhairane, Navi Mumbai 400710 and its

Corporate Offce at "One ndiabulls Centre Tower One, 11th and 12th foor,

Jupiter Mills Compound, Elphinstone Road, Mumbai 400 013. RCAM

is a subsidiary of RCL. RCAM has been appointed as an Asset Manager

of Reliance Mutual Fund by the Trustee i.e. RCTC, vide nvestment

Management Agreement (MA) dated May 12, 1995. The MA has been

executed between RCTC and RCAM and has since been amended on

August 12, 1997, on January 20, 2004 and then on February 17, 2011.

3. Investment Objective of the Scheme:

Reliance Gold Savings Fund (An Open Ended Fund of Fund Scheme): The

investment objective of the Scheme is to seek to provide returns that closely

correspond to returns provided by R* Shares Gold ETF.

4. Signicant Accounting PoIicies:

Accounting policies followed by Reliance Mutual Fund are in accordance with

Securities Exchange Board of ndia (Mutual Funds) Regulations, 1996.

5. Unclaimed Dividend & Redemptions:

Unclaimed Dividend Unclaimed Redemptions

No. of investors Amount (Rs) No. of investors Amount (Rs.)

- - 122 597,312.72

6. Statutory Information:

a. The Sponsors are not responsible or liable for any loss resulting from the

operation of the Schemes of the Fund beyond their initial contribution (to the

extent contributed) of Rs. 1 Lakh for setting up the Fund, and such other

accretions / additions to the same.

b. The price and redemption value of the units, and income from them, can

go up as well as down with fuctuations in the market value of its underlying

investments.

c. Full Annual Report shall be disclosed on the website (www.reliancemutual.

com) and shall be available for inspection at the Head Offce of the mutual

fund. Present and prospective unit holder can obtain copy of the trust deed,

the full Annual Report of the Fund / AMC at a price.

For and on behalf of

Reliance Capital Trustee Co. Limited

Sd/- Sd/-

Place: Mumbai A.N. Shanbhag P.P. Vora

Date: June 27, 2013 Director Director

Annual Report 2012 - 2013 3

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

Annexure to Trustee Report

Redressal of Complaints received against Reliance Mutual Fund during F.Y.2012-2013

Name of the MutuaI Fund : Reliance Mutual Fund

TotaI Number of FoIios : 6309394 (As on 31

st

March, 2013)

Complaint

code

Type of complaint# (a) No. of

complaints

pending at the

beginning of

the year

(b) No of

complaints

received

during the

year

Action on (a) and (b)

Resolved Non

Actionable*

Pending

Within

30 days

30-60

days

60-180

days

Beyond

180

days

0-3

months

3-6

months

6-9

months

9-12

months

A Non receipt of Dividend on

Units

0 224 204 19 0 0 0 1 0 0 0

B nterest on delayed payment

of Dividend

0 51 48 3 0 0 0 0 0 0 0

C Non receipt of Redemption

Proceeds

0 652 607 33 1 0 0 12 0 0 0

D nterest on delayed payment

of Redemption

1 65 59 6 1 0 0 0 0 0 0

A Non receipt of Statement of

Account/Unit Certifcate

0 706 696 6 0 0 0 3 0 0 0

B Discrepancy in Statement of

Account

0 5042 5038 4 0 0 0 0 0 0 0

C Non receipt of Annual

Report/Abridged Summary

0 0 0 0 0 0 0 0 0 0 0

A Wrong switch between

Schemes

0 56 53 2 0 0 0 1 0 0 0

B Unauthorized switch between

Schemes

0 0 0 0 0 0 0 0 0 0 0

C Deviation from Scheme

attributes

0 0 0 0 0 0 0 0 0 0 0

D Wrong or excess charges/

load

0 0 0 0 0 0 0 0 0 0 0

E Non updation of changes viz.

address, PAN, bank details,

nomination, etc

0 2843 2823 20 0 0 0 0 0 0 0

V Others 3 4040 3896 98 3 0 0 46 0 0 0

Total 4 13679 13424 191 5 0 0 63 0 0 0

# including against its authorized persons/ distributors/ employees. etc.

*Non actionable means the complaint that are incomplete / outside the scope of the mutual fund

CIassication of compIaints

Type of Complaint

TYPE I Delay/Non-receipt of money

A Dividend on Units

B nterest on delayed payment of Dividend

C Redemption Proceeds

D nterest on delayed payment of Redemption

TYPE II Statement of Account/Unit Certicate/AnnuaI Report

A Non receipt of Statement of Account/Unit Certifcate

B Discrepancy in Statement of Account

C Non receipt of Annual Report/Abridged Summary

TYPE III Service related

A Wrong switch between Schemes

B Unauthorized switch between Schemes

C Deviation from Scheme attributes

D Wrong or excess charges/load

E Non updation of changes viz. address, PAN, bank details, nomination, etc

TYPE IV Others

Annual Report 2012 - 2013 4

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

AUDITORS REPORT

To

The Board of Directors

Reliance Capital Trustee Co. Limited

Reliance Mutual Fund

We have audited the accompanying fnancial statements of the Reliance Gold

Savings Fund ("the Scheme), which comprises the Balance Sheet as at March

31, 2013, and the Revenue Account and Cash Flow Statement of the scheme for

the year then ended and a summary of signifcant accounting policies and other

explanatory information.

Managements Responsibility for the Financial Statements

Trustees of Reliance Mutual Fund and Reliance Capital Asset Management Limited

are responsible for the preparation of these fnancial statements that give a true

and fair view of the fnancial position, fnancial performance and cash fows of the

Scheme in accordance with the accounting policies and standards as specifed in

the Ninth Schedule of the Securities and Exchange Board of ndia (Mutual Funds)

Regulations, 1996 and amendments thereto ("the Regulations). This responsibility

includes the design, implementation and maintenance of internal control relevant to

the preparation and presentation of the fnancial statements that give a true and fair

view and are free from material misstatement, whether due to fraud or error.

Auditors Responsibility

Our responsibility is to express an opinion on these fnancial statements based on

our audit. We conducted our audit in accordance with the Standards on Auditing

issued by the nstitute of Chartered Accountants of ndia. Those Standards require

that we comply with ethical requirements and plan and perform the audit to obtain

reasonable assurance about whether the fnancial statements are free from material

misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts

and disclosures in the fnancial statements. The procedures selected depend on the

auditors' judgment, including the assessment of the risks of material misstatement

of the fnancial statements, whether due to fraud or error. n making those risk

assessments, the auditor considers internal control relevant to the Scheme's

preparation and fair presentation of the fnancial statements in order to design

audit procedures that are appropriate in the circumstances. An audit also includes

evaluating the appropriateness of accounting policies used and the reasonableness

of the accounting estimates made by management, as well as evaluating the overall

presentation of the fnancial statements.

We believe that the audit evidence we have obtained is suffcient and appropriate to

provide a basis for our audit opinion.

Opinion

n our opinion and to the best of our information and according to the explanations

given to us, the fnancial statements give the information required by the Regulations

as applicable and give a true and fair view in conformity with the accounting

principles generally accepted in ndia:

(a) in the case of the Balance Sheet, of the state of affairs of the Scheme as at

March 31, 2013;

(b) in the case of the Revenue Account , of the surplus, for the year ended on that

date; and

(c) in the case of the Cash Flow Statement, of the cash fows for the year ended

on that date.

Report on Other Legal and Regulatory Requirements

As required under the Regulations, we report that:

1. We have obtained all the information and explanations which to the best of our

knowledge and belief were necessary for the purpose of our audit;

2. The Balance Sheet, Revenue Account, and Cash Flow Statement dealt with

by this Report are in agreement with the books of accounts of the Scheme;

3. n our opinion, the Balance Sheet, Revenue Account, and Cash Flow

Statement dealt with by this report have been prepared in accordance with

the accounting policies and standards as specifed in Ninth Schedule of the

Regulations.

4. The methods used to value non traded securities, as determined by Reliance

Capital Asset Management Limited under procedures approved by the

trustees of Reliance Mutual Fund are in good faith and in accordance with

the guidelines for valuation of securities for mutual funds as mentioned in the

Eighth Schedule of the Regulations issued by the Securities and Exchange

Board of ndia, are fair and reasonable.

For HARIBHAKTI & CO.

Chartered Accountants

Firm Membership No.103523W

Sd/-

CHETAN DESAI

(Partner)

Membership No. 17000

Place: Mumbai

Date: 27

th

June, 2013

Annual Report 2012 - 2013 5

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

Abridged Balance Sheet as at March 31, 2013

Rupees in Lakhs

RELIANCE GOLD

SAVINGS FUND

As at

31.03.2013

As at

31.03.2012

LIABILITIES

1 Unit Capital 160,022.22 161,715.32

2 Reserves & Surplus 58,582.18 53,250.65

2.1 Unit Premium Reserves 18,280.62 17,997.84

2.2 Unrealised Appreciation Reserve 38,118.19 34,637.12

2.3 Other Reserves 2,183.37 615.69

3 Loans & Borrowings - -

4 Current Liabilities & Provisions 1,399.85 1,736.21

4.1 Provision for doubtful ncome/Deposits - -

4.2 Other Current Liabilities & Provisions 1,399.85 1,736.21

TOTAL 220,004.25 216,702.19

ASSETS

1 Investments

1.1. Listed Securities: - -

1.1.1 Equity Shares - -

1.1.2 Preference Shares - -

1.1.3 Equity Linked Debentures -

1.1.4 Other Debentures & Bonds - -

1.1.5 Securitised Debt securities - -

1.1.6 Derivatives - -

1.1.7 Others - -

1.2 Securities Awaited Listing: - -

1.2.1 Equity Shares - -

1.2.2 Preference Shares - -

1.2.3 Equity Linked Debentures - -

1.2.4 Other Debentures & Bonds - -

1.2.5 Securitised Debt securities - -

1.3 Unlisted Securities - -

1.3.1 Equity Shares - -

1.3.2 Preference Shares - -

1.3.3 Equity Linked Debentures - -

1.3.4 Other Debentures & Bonds - -

1.3.5 Securitised Debt securities - -

1.4 Government Securities - -

1.5 Treasury Bills - -

1.6 Commercial Paper - -

1.7 Certifcate of Deposits - -

1.8 Bill Rediscounting - -

1.9 Units of Domestic Mutual Fund 218,266.28 214,353.48

1.10 Foreign Securities - -

Total Investments 218,266.28 214,353.48

2 Deposits - -

3 Other Current Assets 1,737.96 2,348.71

3.1 Cash & Bank Balance 402.54 182.64

3.2 CBLO/ Reverse Repo Lending 528.06 505.45

3.3 Others 807.36 1,660.62

4 Deferred Revenue Expenditure - -

(to the extent not written off)

TOTAL 220,004.25 216,702.19

Notes to Accounts - Annexure

Abridged Revenue Account For The Year / Period

Ended March 31, 2013

Rupees in Lakhs

RELIANCE GOLD SAVINGS FUND

Year Ended

31.03.2013

Period Ended

31.03.2012

1 INCOME

1.1 Dividend - -

1.2 nterest 95.05 71.08

1.3 Realised Gain / (Loss) on Foreign

Exchange Transactions

- -

1.4 Realised Gains / (Losses) on

nterscheme sale of investments

- -

1.5 Realised Gains / (Losses) on

External sale / redemption of

investments

2,792.80 381.35

1.6 Realised Gains / (Losses) on

Derivative Transactions

- -

1.7 Other ncome 472.43 877.37

( A ) 3,360.28 1,329.80

2 EXPENSES

2.1 Management fees - -

2.2 Service tax on Management fees - -

2.3 Transfer agents fees and expenses - 24.92

2.4 Custodian fees 7.75 10.85

2.5 Trusteeship fees 0.66 -

2.6 Commission to Agents 1,109.05 488.10

2.7 Marketing & Distribution expenses 257.16 253.69

2.8 Audit fees 1.48 1.30

2.9 Other operating expenses 4.45 19.60

( B ) 1,380.55 798.45

3 NET REALISED GAINS / (LOSSES)

FOR THE YEAR / PERIOD (A -B = C)

1,979.73 531.35

4 Change in Unrealised Depreciation in

value of investments (D)

- 95.07

5 NET GAINS / (LOSSES) FOR THE

YEAR / PERIOD (E=(C+D))

1,979.73 626.42

6 Change in unrealised appreciation in the

value of investments (F)

- -

7 NET SURPLUS / (DEFICIT) FOR THE

YEAR / PERIOD ( E + F = G )

1,979.73 626.42

7.1 Add: Balance transfer from

Unrealised Appreciation Reserve

- -

7.2 Less: Balance transfer to

Unrealised Appreciation Reserve

- -

7.3 Add / (Less): Equalisation (412.06) 25.89

7.4 Net Gain/(Loss) Brought Forward

From Previous Year

615.69 (36.62)

8 Total 2,183.37 615.69

9 Dividend appropriation - -

9.1 ncome Distributed during the year /

period

- -

9.2 Tax on income distributed during

the year / period

- -

10 Retained SurpIus / (Decit) carried

forward to Balance sheet

2,183.37 615.69

Notes to Accounts - Annexure

Annual Report 2012 - 2013 6

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

Notes to Accounts - Annexure I to the Abridged Balance Sheet and Revenue Account for the Year / Period ended March 31, 2013

1 Investments:-

1.1. All the investments are held in the name of the Scheme, (except for Government Securities and Treasury Bills which are held in the name of the fund) as per clause 7

of the Seventh Schedule under Regulation 44(1) of SEB (Mutual Funds) Regulations, 1996.

1.2. Open Position of derivatives (outstanding market value & % to Net Assets as of the Year end) is NL

For details on derivative positions please refer to Annexure .

1.3. nvestments in Associates and Group Companies : NL

1.4. There are NL Open position of Securities Borrowed and / or Lent by the scheme.

1.5. There are no NPA's as on March 31, 2013

1.6. Aggregate Unrealised Gain / Loss as at the end of the Financial Year / Period and percentage to net assets.

Scheme Name

2012-2013 2011-2012

Aggregate Unrealised Gain /

(Loss) (Rs. In lakhs)

% of Net Assets Aggregate Unrealised Gain /

(Loss) (Rs. In lakhs)

% of Net Assets

RELIANCE GOLD SAVINGS FUND 38,118.19 17.44% 34,637.12 16.11%

1.7. Aggregate Value of Purchase and Sale with Percentage to average assets.

2012-2013 2011-2012

Purchases Sales Purchases Sales

Amount

(Rs. In lakhs)

% to average

Net Assets

Amount

(Rs. In lakhs)

% to average

Net Assets

Amount

(Rs. In lakhs)

% to average

Net Assets

Amount

(Rs. In lakhs)

% to average

Net Assets

RELIANCE GOLD

SAVINGS FUND

12,632.69 5.50% 14,993.76 6.53% 128,779.04 80.64% 2,459.47 1.54%

1.8. Non-Traded securities in the portfolio: NL

2 Details of Transaction with Associates under regulation 25(8).

Brokerage paid to associates/related parties/group companies of Sponsor/AMC : Nil

Commission Paid to associates/related parties/group companies of Sponsor/AMC

Name of associate/related

parties/group companies of

sponsor/AMC

Nature of

Association/

Nature of relation

Period covered Business given (Rs. Cr. &

% of total business

received by the fund)

Commission paid

( Rs Cr& % of total

commission paid by the fund)

ndusind Bank Limited Associate 2012-2013 10.50 0.00% 0.21 0.05%

2011-2012 37.30 0.01% 0.76 0.22%

Quant Capital Advisors Private

Limited

Associate 2012-2013 0.00 0.00% 0.00 0.00%

2011-2012 0.00 0.00% 0.00 0.00%

Reliance Securities Limited Associate 2012-2013 3.25 0.00% 0.03 0.01%

2011-2012 2.37 0.00% 0.06 0.02%

3 Large Holdings in the Scheme (i.e. in excess of 25% of the net assets) as on March 31, 2013 is NL

4 Unit Capital movement during the year ended / period ended : Refer ANNEXURE

5 Prior Year Comparatives: The fgures of the previous period have been regrouped / rearranged, wherever applicable, to conform to current year's presentation

6 Contingent Liability - NL

7 Expenses other than management fee is inclusive of service tax where applicable.

8 Other ncome : Other ncome includes exit load income, interest on delayed receipt and gain/loss on foreign exchange etc.

9 Details of Credit Default Swap as follows

1. No. of transactions during the year - NL

2. Amount of protection bought during the year - NL

3. No. of transactions where credit event payment was received during the year:

a. Pertaining to current years transactions. - NL

b. Pertaining to previous year (s) transactions- NL

4. Outstanding transactions as on year end:

a. No. of transactions - NL

b. Amount of protection - NL

5. Net income/ expense in respect of CDS transactions during year-to-date:

a. Premium Paid - NL

b. Credit event payments received (net of value of derivable obligations)- NL

Annual Report 2012 - 2013 7

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

Key Statistics for the year / period ended March 31, 2013

RELIANCE GOLD

SAVINGS FUND

Year Ended

March 31, 2013

Period Ended

March 31, 2012

1. NAV per unit (Rs.):

Growth Plan

Open 13.2929 9.9967

High 15.1554 13.8543

Low 13.1246 10.0170

End 13.6615 13.2929

Dividend Plan

Open 13.2929 9.9967

High 15.1554 13.8544

Low 13.1247 10.0170

End 13.6615 13.2929

Direct Plan-Growth Plan

Open - -

High 14.5633 -

Low 13.5231 -

End 13.6771 -

Direct Plan-Dividend Plan

Open - -

High 14.5632 -

Low 13.5231 -

End 13.6771 -

2. Closing Assets Under Management

(Rs. in Lakhs)

End 218,604.40 214,965.98

Average (AAuM) 229,483.13 159,690.03

3. Gross income as % of AAuM

1

1.46% 0.83%

4. Expense Ratio:

a. Total Expense as % of AAuM

(plan wise)

Other than Direct Plan 0.60% 0.50%

Direct Plan 0.30% -

b. Management Fee as % of

AAuM (plan wise)

Other than Direct Plan 0.00% 0.00%

Direct Plan 0.00% -

For and on behalf of

Reliance Capital Asset Management Limited

Sd/-

Soumen Ghosh

Director

Sd/-

Kanu Doshi

Director

Sd/-

Sundeep Sikka

CEO

Sd/-

Hiren Chandaria

Fund Manager

Place : Mumbai

Date : June 27, 2013

For and on behalf of

Reliance Capital Trustee Co. Limited

Sd/-

A.N. Shanbhag

Director

Sd/-

P.P. Vora

Director

RELIANCE GOLD

SAVINGS FUND

Year Ended

March 31, 2013

Period Ended

March 31, 2012

5. Net Income as a percentage of

AAuM

2

0.86% 0.33%

6. Portfolio turnover ratio

3

0.06 0.02

7. Total Dividend per unit distributed

during the year / period (plan wise)

Dividend Plan - -

Direct Dividend Plan - -

8. Returns:

a. Last One Year

Growth Plan 2.95% 32.91%

Direct Growth Plan N.A. -

Benchmark (Price of Gold) 4.28% 37.00%

b. Since nception

Growth Plan 16.25% 30.56%

Direct Growth Plan -4.97% -

Benchmark (Price of Gold)

Growth Plan 18.69% 34.37%

Direct Growth Plan -2.51% -

1. Gross income = amount against (A) in the Revenue account i.e. ncome.

2. Net income = amount against (C) in the Revenue account i.e. NET REALSED

GANS / (LOSSES) FOR THE YEAR / PEROD

3. Portfolio Turnover = Lower of sales or purchase divided by the Average AuM

for the year/period.

4. AAuM=Average daily net assets

Annual Report 2012 - 2013 8

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

ANNEXURE II

Unit Capital movement during the year ended 31st March 2013

GROWTH PLAN DIVIDEND PLAN

Reliance Gold Savings Fund 2012-2013 2011-2012 2012-2013 2011-2012

Face Value of Rs. 10 Each Units Amount in Rs Units Amount in Rs Units Amount in Rs Units Amount in Rs

Unit Capital (Opening Balance) 1,282,915,640 12,829,156,396 397,648,429 3,976,484,295 334,237,586 3,342,375,860 150,194,611 1,501,946,106

Add : Subscription during nitial Offer

period

- - - - - - - - -

Add : Subscription during the year /

period

640,587,667 6,405,876,666 1,425,379,132 14,253,791,316 85,352,555 853,525,552 367,306,908 3,673,069,082

Less : Redemption during the year /

period

588,049,374 5,880,493,741 540,111,921 5,401,119,215 162,221,796 1,622,217,956 183,263,933 1,832,639,328

Unit Capital (Closing Balance) 1,335,453,932 13,354,539,321 1,282,915,640 12,829,156,396 257,368,346 2,573,683,456 334,237,586 3,342,375,860

DIRECT GROWTH PLAN DIRECT DIVIDEND PLAN

Reliance Gold Savings Fund 2012-2013 2011-2012 2012-2013 2011-2012

Face Value of Rs. 10 Each Units Amount in Rs Units Amount in Rs Units Amount in Rs Units Amount in Rs

Unit Capital (Opening Balance) - - - - - - - -

Add : Subscription during nitial Offer

period

- - - - - - - -

Add : Subscription during the year /

period

6,982,622 69,826,218 - - 608,385 6,083,851 - -

Less : Redemption during the year /

period

139,603 1,396,034 - - 51,498 514,983 - -

Unit Capital (Closing Balance) 6,843,018 68,430,183 - - 556,887 5,568,868 - -

ANNEXURE III

Derivatives Disclosure

A. Hedging Positions through Futures as on March 31, 2013 NL.

Total %age of existing assets hedged through futures NL.

For the Year ended March 31, 2013 following details specifed for hedging transactions through futures which have been squared off/expired: NL.

B. Other than Hedging Position through Futures as on March 31, 2013 NL.

Total exposure due to futures (non hedging positions) as a %age of net assets : NL.

For the Year ended March 31, 2013 following details specifed for non-hedging transactions through futures which have been squared off/expired:

NL.

C. Hedging Position through Put Options as on March 31, 2013 : NL.

Total % age of existing assets hedged through Put Options : NL.

For the Year ended March 31, 2013 following details specifed for hedging transactions through options which have already been exercised/

expired : NL.

D. Other than Hedging Position through Options as on March 31, 2013 : NL

Total Exposure through options as a %age of net assets NL.

For the Year ended March 31, 2013 following details specifed with regard to non-hedging transactions through options which have already been

exercised/expired :NL.

E. Hedging Positions through swaps as on March 31, 2013 : NL.

Note on Derivatives:

The disclosure with respect to nvestments in derivatives have been made basis SEB Circular on Abridged Scheme-wise Annual Report Format and

periodic disclosures to the unitholders vide reference MD/CR No.8/132968/2008 dated July 24, 2008 and Review of norms for investment and disclosure

by Mutual Funds in derivatives vide reference Cir/ MD/ DF/ 11/ 2010 dated August 18, 2010.

Annual Report 2012 - 2013 9

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

Proxy Voting Policy and Procedures

Background

Securities & Exchange Board of ndia (SEB), vide circular ref. SEB/MD/Cir No. 18/198647/2010 dated March 15, 2010 stipulated that mutual funds should play an active

role in ensuring better corporate governance of listed Companies. n this regard, SEB has mandated that, Asset Management Companies shall disclose their policy and

procedure, for exercising the voting rights in respect of shares held on behalf of the mutual funds on their website as well as in the annual reports of the schemes.

Pursuant to the aforesaid SEB circular, Reliance Capital Asset Management Limited, (henceforth referred to as "RCAM and/or AMC), the nvestment Manager of Reliance

Mutual Fund, has formulated the Proxy Voting Policy and Procedure ('the Policy') for Reliance Mutual Fund

Voting Policy Guidelines and Procedures

Reliance Capital Asset Management Ltd (RCAM) is the nvestment Manager to the Reliance Mutual Fund (RMF). Proxy voting is the paramount, fduciary duty of the AMC

on behalf of the unit holders. The AMC recognizes that this duty requires it, to vote on behalf of the unit-holders in a timely manner and make voting decisions in advancing

the economic interests of the unit-holders and protecting their rights as benefcial owners of the companies in whose securities the AMC invests through the schemes that

it manages.

RCAM will generally vote with the issuer company's management on routine matters. With respect to non-routine matters such as proposed anti-takeover provisions or

mergers, the fnancial impact will be analyzed and the proxy will be voted on a case-by-case basis, in the best interest of the unit-holders.

While arriving at the decision to vote, views of the Fund Managers, Research Analysts and other executives and sources may be considered. The requirements from SEB

shall be complied with as may be applicable from time to time.

A. Corporate Governance matters (incIuding changes in the state of incorporation, merger and other corporate restructuring and anti takeover provisions):

Mergers and acquisitions and corporate restructuring proposals will be subject to appropriate review on a case-by-case basis to determine whether they would be

benefcial to shareholders' interest.

B. Changes to capital structure, (incIuding increases or decreases of capitaI and preferred stock issuances): The proposals for approval to alter the capital

structure of the company, such as an increase in authorized capital will generally be supported. However, each proposal shall be evaluated on a case-by-case basis,

to determine whether the proposed changes are in the best interest of the shareholders.

C. Stock option plans and other management compensation issues: n general, compensation matters are normally determined by the Company's Board of Directors,

rather than the shareholders. The AMC would generally support proposals for Employee Stock option plans and other management compensation plans, but would

oppose excessive compensation, if it feels that approval of the plan would be against shareholder interest.

D. Corporate Social Responsibilities: The AMC would generally support proposals on social issues that have demonstrable economic beneft to the issuer and long

term economic value of the securities held in the scheme on case-by-case basis.

E. Appointment and Removal of Directors: The foundation of good corporate governance is in the selection of responsible and qualifed, ndependent Directors who are

likely to diligently represent the interest of the shareholders and oversee management of the Company in the manner that will seek to maximize shareholder value over

time. Hence, the AMC would generally support the Board's nominees in the election of Directors and generally support proposals that strengthen the independence of

Board of Directors. However, each such proposal shall be evaluated on a case-by-case basis.

There may be circumstances where the AMC believes it is in the best interests of a Fund to vote differently than the manner contemplated by the Guidelines. The ultimate

decision as to the manner in which the AMC's representatives/proxies will vote rests with Proxy Voting Committee

Proxy Voting Committee

The Proxy Voting Committee would consist of the following members

Chief Executive Offcer

Head Equity nvestments

Head Compliance, Legal and Secretarial

Head- Service Delivery & Operations Excellence

Head Risk Management

Quorum

Minimum 3 members, out of which one should be from the Risk Management Team and one should be either of Chief Executive Offcer or Head Legal, Secretarial &

Compliance and one should be from the nvestments Team.

For the purposes of quorum, the presence may either be in person or via teleconference/ video conference.

Members and personnel from various departments may be asked to participate when considered necessary.

Chairman of the Meeting

CEO or any other member present

Frequency

As and when required subject to at least one meeting per quarter.

The Minutes of the Committee to be fnal shall to be signed by the chairperson of the relevant committee meeting.

The above committee composition, quorum, and chairpersons would be subject to approval and revision by the board of directors from time to time.

There may be circumstances where the AMC believes it is in the best interests of a Fund to vote differently than the manner contemplated by the Guidelines. The ultimate

decision as to the manner in which the AMC's representatives/proxies will vote rests with Proxy Voting Committee.

Corporate Governance standards, disclosure requirements, and voting mechanisms vary greatly among the markets outside ndia in which the schemes may invest. RCAM

will accordingly cast the vote in a manner believed to be consistent with the policy, while taking into account differing practices by market. n addition there may be instances

in which the RCAM may refrain from voting if, the cost of voting in foreign markets may be substantially higher. t may also refrain from voting on the issues presented in

which RCAM feels are unlikely to have a material impact on shareholder value and its unit-holders.

Conict of Interest

RCAM recognizes that there may be a potential confict of interest when it votes on an entity with which RCAM may have some relationship. However, RCAM will ensure to

vote in the interest of the unit holders.

DiscIosure of Exercise of Proxy Voting in AGM/EGMs etc of Investee companies for ReIiance GoId Savings Fund during FinanciaI Year 2012 2013 : NIL

As the scheme did not hold any securities which entitled voting on resolutions no disclosure is made in the annual report.

Disclosure of Actual Exercise of Proxy Voting in AGM/EGMs etc of Investee companies across all schemes of Reliance Mutual Fund during Financial Year 2012

2013 are provided on the website www.reliancemutual.com under Voting Policy Section

Annual Report 2012 - 2013 10

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

VARIOUS ADDENDA TO THE SCHEME INFORMATION DOCUMENT,STATEMENT OF ADDITIONAL INFORMATION & KEY

INFORMATION MEMORANDUM

NOTICE CUM ADDENDUM NO. 2 DATED APRIL 03, 2012

Notice is hereby given that Reliance Mutual Fund (RMF)/ Reliance Capital Asset Management Limited (RCAM) has decided to introduce / modify features of special product

offered by schemes of RMF as mentioned below -

I CIassication pertaining to processing of transactions such as Systematic Investment PIan ("SIP"), Systematic Transfer PIan ("STP") and Dividend

Transfer Plan ( DTP ) of all the eligible schemes of the Reliance Mutual Fund.

Considering the investor convenience, following modifcations are been carried out in the features of SP and STP facility of the Reliance Mutual Fund Scheme.

A. Systematic Investment Plan (SIP)

1. DefauIt SIP date:

f an investor does not mention SP Date in the application form or multiple SP dates are mentioned in the SP Mandate or the SP Date is unclear in the

application form / SP Mandate, the default SP date shall be treated as 10th of every month/quarter as per the frequency defned by the investor.

2 DefauIt SIP EnroIIment period when start date is not specied:

f an investor does not mention SP start date or the SP start date is unclear in the application form/SP Mandate, the SP date will by default start from the next

subsequent month after meeting the minimum registration requirement of 21 working days.

3. DefauIt SIP EnroIIment period when end date is not provided:

f an investor does not mention SP end date or the SP end date is not expressly mentioned/ unclear in the application form/SP Mandate, the tenure of SP will

be treated as perpetual i.e. the end date shall be considered as December 2099.

4. Termination of SIP:

n case of three consecutive failures due to insuffcient balance in bank account while processing request for SP, RCAM shall reserve the right to terminate the

SP without any written request from the investor.

B. Systematic Transfer Plan (STP)

1. Reduction in Minimum BaIance Amount for STP:

t is proposed to standardize the minimum balance amount that an unitholder (new or existing) has to maintain in his folio to opt for STP facility for all the eligible

schemes to Rs 5,000 or the minimum application amount as stated in the SD of the respective Transferor scheme, whichever is higher.

2. Introduction of PerpetuaI STP option:

An investor who opts for perpetual option, his STP will continue forever with no end date unless a written request for cancellation is given by the investor in this

regard.

3. Frequency of STP:

f an investor does not mention any frequency or mentions multiple frequencies on the STP application form or the frequency is unclear on the STP application

form, the default frequency shall be monthly

4. DefauIt STP Date:

f an investor opts for Monthly or Quarterly frequency of STP but does not mention the STP Date or mentions multiple STP dates on the mandate or the STP date

is unclear on the STP Mandate, the default STP date shall be treated as 10th of every month/quarter as per the frequency defned by the investor

5. DefauIt STP EnroIIment period when start date is not provided:

f an investor does not mention STP start date, or the STP start date is unclear/not expressly mentioned on the STP Application form, then by default STP would

start from the next subsequent cycle after meeting the minimum registration requirement of 7 working days as per the defned frequency by the investor.

6. DefauIt STP EnroIIment period when end date is not provided:

f an investor does not mention STP end date or the STP end date is unclear, it will be considered as perpetual STP .

7. AppIication processing of Systematic Transfer PIan ("STP"):

The Enrolment form completed in all respects can be submitted at any of the Designated nvestor Service Centre (DSC) of RCAM at least seven calendar days

before the commencement of frst execution date of STP. n case the required time of seven calendar days are not met then the STP will be processed from the

next STP cycle

C. Dividend Transfer PIan ("DTP") Registration & CanceIIation:

t is proposed to reduce the timeline for DTP registration & cancellation from existing T + 10 days to T + 7 days.

The aforesaid changes/ modifcation in features of SP, STP and DTP shall be effective from April 20, 2012.

II Changes in Scheme Information Document offering facility of Reliance Any Time Money Card.

Reliance Mutual Fund (RMF) / Reliance Capital Asset Management Limited (RCAM) has decided to notify the following clarifcation in one of the Special Facility termed

as " Redemption by means Reliance Any Time Money Card ("hereinafter referred to as "the Card) mentioned in the respective Scheme nformation Document (SD).

The Card issued / to be issued by RMF is a Co-Branded debit Card, called as Reliance Any Time Money Card (a mutual fund linked debit card), which will be / is

facilitating instant cash withdrawal / Purchase by unit holders of the eligible schemes offering this faclity, at all VISA enabled ATMs and Merchant Establishments/ Point

of Sale (PoS) terminals across the world. This Co-Branded Card is issued / being issued by RMF in collaboration with HDFC Bank Ltd. This facility is a unique offering

and rst of its kind being offered by RCAM in the Indian Mutual Fund Industry.

The aforesaid change will be effective from April 04, 2012.

This addendum shall form an integral part of the Scheme nformation Document(s)/ Statement of Additional nformation/ Key nformation Memorandum(s)(KM) of

the Scheme(s) of RMF as amended from time to time. All the other terms and conditions of the SD/KM read with the addenda issued from time to time shall remain

Annual Report 2012 - 2013 11

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

unchanged.

NOTICE CUM ADDEDNUM NO. 7 DATED APRIL 27, 2012

. Notice is hereby given that pursuant to AMF circular no. 135/BP/26/11-12 dated March 21, 2012 with respect to Uniform procedure for change/ updation of Bank details

& Change of Address, Reliance Mutual Fund (RMF)/ Reliance Capital Asset Management Limited ("RCAM) has decided to make the following changes to Scheme

nformation Documents ("SD)/ Key nformation Memorandum ("KM) /Statement of Additional nformation ("SA) (as may be applicable) with effect from May 1, 2012:

1. In case of Updation / Change of Bank Details

A. nvestor can change bank account details in their account/ folio either through Multiple Bank Account Registration Form or a standalone separate change of Bank

Mandate form.

B. n case of standalone change of bank details request, nvestors shall provide the supporting documents towards the proof of existing and new bank account.

Details of the documents to be submitted by the investor are as follows;

i) Documents to be submitted for New bank account:

Original of any one of the following documents or originals should be produced for verifcation or copy should be attested by the Bank:

Cancelled original cheque of the new bank mandate with frst unit holder name and bank account number printed on the face of the cheque OR

Self attested copy of bank statement OR

Bank passbook with current entries not older than 3 months OR

Bank Letter duly signed by branch manager/authorized personnel

AND

ii) Documents to be submitted for existing bank mandate currently registered in the folio/account

Original of any one of the following documents or copy should be attested by the Bank or originals should be produced for verifcation:

Cancelled original cheque with frst unit holder name and bank account number printed on the face of the cheque OR

Original bank account statement / Pass book OR

n case such bank account is already closed, a duly signed and stamped original letter from such bank on the letter head of the bank confrming the closure

of said account.

C. n case of Updation of bank details wherein bank details were not recorded/ registered with us/in the records of Registrar & Transfer Agent/ not available in SoA (Legacy

folios), nvestors shall provide the supporting documents towards the new bank account proof and photo identity proof.

Details of the documents to be submitted by the investor are as follows:

i) Documents to be submitted for New bank account:

Original of any one of the following documents or originals should be produced for verifcation or copy should be attested by the Bank:

Cancelled original cheque of the new bank mandate with frst unit holder name and bank account number printed on the face of the cheque OR

Self attested copy of bank statement OR

Bank passbook with current entries not older than 3 months OR

Bank Letter duly signed by branch manager/authorized personnel

AND

ii) Self attested copy of any one of the documents admissible as Proof of dentity (PO) as follows:

a) Unique dentifcation Number (UD) (Aadhaar)/ Passport/ Voter D card/ Driving license.

b) PAN card with photograph.

c) dentity card/ document with applicant's Photograph, issued by any of the following: Central/State Government and its Departments, Statutory/Regulatory

Authorities, Public Sector Undertakings, Scheduled Commercial Banks, Public Financial nstitutions, Colleges affliated to Universities, Professional Bodies

such as CA, CWA, CS, Bar Council etc., to their Members; and Credit cards/Debit cards issued by Banks.

RCAM may at its own discretion collect additional documents in order to mitigate risk as a Proof of investment such as copy of acknowledgement of investment, debit

entry in pass book, counterfoil of the dividend warrant or SoA (issue date more than 2 years old)*/ Membership Advice/ certifcate from where the investment has been

converted / merged to the present scheme, if applicable.

(*Account statement issued on current date shall not be treated as investment proof.)

n case if the investor is not able to produce any of the above mentioned supporting documents, RCAM may devise an alternate procedure to establish genuineness

of the request before executing the request or making payment to the investor

nvestors will have an option to choose any of the registered bank accounts towards receipt of redemption proceeds. However, any unregistered bank account or a

new bank account forming part of redemption request will not be entertained or processed.

Any change of bank mandate request received / processed few days prior to submission of a redemption request or on the same day as a standalone request or

received along with the redemption request, RCAM will follow cooling period of 10 calendar days for validation and registration of new bank account and dispatch/credit

of redemption proceeds shall be completed within 10 working days.

2. Modication to the process of Change of Address:

A. In case of KYC Not Complied folios below list of documents will be collected by RCAM

i) Proof of new Address (POA)*,

ii) Proof of dentity (PO) *: Only PAN card copy if PAN is updated in the folio, or PAN/other proof of identity if PAN is not updated in the folio

Annual Report 2012 - 2013 12

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

B. In case of KYC CompIied foIios the investor are requested to submit the supporting documents as specied by KYC Registration Agency (KRA) /

Regulators from time to time.

* List of admissible documents for Proof of new Address (POA) and Proof of dentity (PO) above should be in conformity with SEB circular no. MRSD/SE/

Cir21/2011 dated October 5, 2011.

Copies of all the documents submitted by the applicants/clients will be self-attested and accompanied by originals for verifcation. n case the original of any

document is not produced for verifcation, then the copies will be properly attested / verifed by entities authorized for attesting/verifcation of the documents.

NOTICE CUM ADDENDUM NO. 12 DATED MAY 10, 2012

Changes in Designated nvestor Service Center (DSC)

1. With effect from May 14, 2012, the existing DSC of Reliance Capital Asset Management Limited situated at 575 C, Shylaja Chambers, D B Road, R S Puram;

Coimbatore - 641002 is proposed to be shifted and shall operate from its new address i.e. Second Floor, Ahuja Towers, 42/15, T.V.Swamy Road (West), R.S.Puram,

Coimbatore- 641002.

2. The following DSCs shall be cease to operate with effect from May 31, 2012:

1st Floor, Srinath Complex, 87B, Veer Dugra Das Nagar, Pali 306401- Rajasthan

1st Floor, Plot No 4, NH-15, Opposite Bihani Petrol Pump, Sri Ganganagar 335001- Rajasthan

Ground Floor, Offce No. 1, Pooja Complex, Next to CC Bank, Station Road, Bhuj 3700 01- Gujarat

2nd Floor, Gurukrupa Complex, LC Road, Near SB, Godhara 389001-Gujarat

1st Floor, D No 40-3-4-4, Bhagya Nagar, Near Moorya nn Hotel, Kurnool 518004- Andhra Pradesh

3rd Floor, Chandra Square, Cullen Road, Alappuzha 688011- Kerala

1st Floor,(Rear side), Dharussalam Complex, Private Bus stand Road, Thamarakulam, Kollam-691001- Kerala

1st Floor, Dr.Aboos Arcade, Kunnummel, Near St. James Girls High school, Malappuram 676505- Kerala

NOTICE CUM ADDENDUM NO. 15 DATED MAY 22, 2012

Notice is hereby given that Reliance Mutual Fund (RMF)/ Reliance Capital Asset Management (RCAM) has decided the following changes to Statement of Additional

nformation (SA) or Scheme nformation Document (SD)/Key nformation Memorandum (KM) (as applicable) of the respective scheme of Reliance Mutual Fund

I Changes in Designated Investor Service Center (DISC)

1. The existing DSC of Reliance Capital Asset Management Limited situated at Ground Floor 57, Karamkala Building, Opp. Old Corporation Building, New Pandit

Colony, Saharanpur Road, Nasik - 422002 shall be shifted to First Floor, Plot No.5/2,Survey No. 649/A/1/17/2,CTS No.- 6862, Kulkarni Garden, Saharanpur

Road, Nashik-422002 with effect from May 24, 2012.

2. The existing DSC of Reliance Capital Asset Management Limited situated at Jawahar Market, 1st Floor, 323 / 321, Delhi Road, Nr D Park, Rohtak Haryana

124004 shall be shifted to 2nd Floor, Ashoka Plaza, Delhi Road, Rohtak 124001 with effect from May 28, 2012

3. The existing DSC of Reliance Capital Asset Management Limited situated at 637-B, 2nd Floor, Bhansali Tower, Residency Road, Jodhpur - 342001shall be

shifted to Dhir Jhankar, 3rd Floor, Opp. Gulab Halwa Wala, rd B Road, Sardarpura, Jodhpur 342003 with effect from May 31, 2012.

4. The existing DSC of Reliance Capital Asset Management Limited situated at Jai Complex, 1st Floor, Plot No. 1, Road No. 2, Alwar 301001 shall be shifted to

1st Floor, Offce No 137, Jai Complex, Plot No. 1, Near Canara Bank, Road No. 2, Alwar - 301001with effect from June 1, 2012.

5. With reference to Notice cum Addendum No. 12, the communication for closure of DSC located at 1st Floor, Plot No 4, NH-15, Opposite Bihani Petrol Pump,

Sri Ganganagar 335001- Rajasthan with effect from May 31, 2012 is shall stand cancelled.

NOTICE CUM ADDENDUM NO. 17 DATED MAY 29, 2012

Changes in Designated nvestor Service Center (DSC) With reference to Notice cum Addendum No. 12, the communication for closure of DSC located at Ground Floor,

Offce No. 1, Pooja Complex, Next to CC Bank, Station Road, Bhuj 3700 01- Gujarat with effect from May 31, 2012 shall stand cancelled.

This addendum forms an integral part of the Statement of Additional nformation (SA) or Scheme nformation Document (SD)/ Key nformation Memorandum (KM) (as

applicable) of the respective scheme of Reliance Mutual Fund. All the other terms and conditions of the aforesaid documents read with the addenda issued from time to time

will remain unchanged.

NOTICE CUM ADDEDNUM NO. 20 DATED JUNE 06, 2012

NOTICE S HEREBY GVEN THAT Reliance Mutual Fund ('RMF') / Reliance Capital Asset Management Limited ('RCAM') have decided to accept investment / redemption

requests from eligible Qualifed Foreign nvestors ('QFs') in the schemes of RMF. The aforesaid acceptances shall be subject to and effective from the date of implementation

of the operational processes by RCAM / relevant intermediaries and the framework and guidelines as prescribed by the appropriate authorities / intermediaries in terms of

the SEB Circular CR / MD / DF / 14 / 2011 dated August 9, 2011.

n view of the above, the following changes shall be made in the Scheme nformation Document(s)/ Key nformation Memorandum(s) of the eligible Schemes of RMF and

Statement of Additional nformation (as applicable) of RMF.

n terms of the SEB Circular CR / MD / DF / 14 / 2011 dated August 9, 2011, the Qualifed Foreign nvestors (QFs) who meet KYC requirement shall be eligible to make

investment in the existing as well as prospective equity schemes, and debt schemes which invest in nfrastructure debt (as and when launched) of RMF as well as such

other scheme(s) of RMF, as may be permitted to accept investments from QFs as per the extant regulatory provisions, applicable from time to time, subject to the following

guidelines:

QuaIied Foreign Investor ('QFI') shall mean a person resident in a country that is compliant with Financial Action Task Force (FATF) standards and that is a signatory to

nternational Organization of Securities Commission's (OSCO's) Multilateral Memorandum of Understanding;

Provided that such person is not resident in ndia;

Provided further that such person is not registered with SEB as a Foreign nstitutional nvestor or as a Sub-account.

Explanation - For the purposes of this subject matter:

Annual Report 2012 - 2013 13

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

(1) the term "Person shall carry the same meaning under Section 2(31) of the ncome Tax Act, 1961.

(2) the phrase "resident in ndia shall carry the same meaning as in the ncome Tax Act, 1961.

(3) "resident in a country, other than ndia, shall mean resident as per the direct tax laws of that country.

RCAM reserves the right to include/exclude new/existing categories of the Schemes of RMF, as may be permitted by the SEB Regulations from time to time.

Guidelines applicable for QFIs

QF(s) who meet the KYC and other requirements stip ulated by SEB / RMF/ RCAM and other applicable regulator(s), may invest in existing as well as prospective schemes

(as and when launched) of RMF, as may permitted by extant applicable laws, through holding mutual fund ('MF') units through the following route:

1. Direct Route - Holding MF units in Demat account maintained by the QF with a SEB registered depository participant (DP).

2. Indirect Route - Holding MF units via Unit Confrmation Receipt (UCR).

QFs are required to submit the necessary information for the purpose of obtaining PAN. For this the QFs are required to submit the combined PAN cum KYC form, which

is notifed by CBDT or other appropriate authorities from time to time, for QFs. Further, RCAM reserves the right to obtain any additional information / documents from the

QF to ensure the compliance of extant laws and regulations.

A person who satisfes the requirements of QF, as stated above, can only invest under the Direct Route or ndirect Route. Further, such investment(s) shall be in compliance

with the extant applicable laws of the country in which the QF is resident and from which the investment is made.

n case of Direct Route, a QF can open only one demat account with any one of the qualifed DPs and shall subscribe and redeem the units of RMF only through that DP.

The bank account which QF has designated for the purposes of investment(s) in the units of RMF schemes should be based in either of the countries as are permitted by

the appropriate regulatory authorities from time to time. Further, QFs are requested to note that, when subscriptions are received from bank account, the same bank account

will only be eligible for receipt of redemption/dividend proceeds.

Units which are held by QFs, of any scheme of RMF, shall be non-transferrable and non tradable.

QFs shall be entitled to only subscribe or redeem units of schemes of RMF and shall not be entitled to carry out systematic investments/ systematic transfer / systematic

withdrawals and switches of such units.

Further, the QFs shall not be entitled to create any encumbrance i.e. pledge or lien on the units/UCRs of the schemes of RMF that are held by them and they shall be

required to hold such units free from all encumbrances.

Process for subscription / redemption of units by QFIs through Direct Route:

There shall be 3 parties under this route - QFs, qualifed DP and RMF:

1. Subscription Process

a) Subscription from QF

i. The QF will make an application for purchase / subscription to the concerned DP, mentioning the name of the RMF scheme and remit the funds.

ii. The DP in turn will forward the purchase / subscription order to RMF / RCAM and remit the funds received by it to the relevant RMF scheme bank account

on the same day as the receipt of the funds from the QF.

iii. n case the funds are received by the DP after business hours, then the DP will remit the funds to the RMF scheme bank account on the next business day.

b) RMF / RCAM shall process the purchase / subscription request and credit the units into the demat account of the QF, held with the DP.

c) Units will be allotted on the basis of NAV of the day when funds are received in the RMF scheme bank account, subject to the receipt of the purchase /

subscription application from the QF, through the DP.

2. Redemption Process

a. QFs can redeem, either through delivery instruction (physical/ electronic) or any another mode prescribed by the DP.

b. QF shall issue redemption instruction to the DP and the DP shall in turn process the same and forward the redemption instruction(s) to RMF / RCAM.

c. DP shall simultaneously transfer the relevant units held in demat account of the QF to the respective RMF scheme demat account.

d. Upon receipt of the redemption instructions and the concerned units, RMF/ RCAM shall process the redemption request and credit the redemption amount, net

of all applicable taxes, within the timelines for redemption specifed elsewhere in the SD.

e. NAV in case of redemption would be applicable on the basis of time stamping of transaction slip & applicable cut off timing of the concerned RMF scheme.

f. DP will, in turn, remit the funds to bank account of the QF.

3. Dividend

a. Dividend amount will be credited by RMF / RCAM to the single rupee pool bank account of the DP.

b. The DP will, in turn, transfer the dividend amounts to the bank account of the QF within 2 working days of the date of receipt of the money from RMF / RCAM.

4. Refund Process

f for any reason units are not allotted by RMF / RCAM, after receipt of funds from the DP, then RMF / RCAM shall refund the funds to DP. RMF/DP /RCAM will remit

money back to the bank account of the QF, within the prescribed timelines.

Process for subscription / redemption of units by QFIs through Indirect Route:

There shall be 4 parties under this route - QFs, UCR issuer (based overseas), SEB registered Custodian (based in ndia) and RMF.

RMF / RCAM shall appoint one SEB registered custodian in ndia and one or more UCR issuer(s) overseas from time to time, in accordance with the extant laws and

regulations and notify the same appropriately.

1. Subscription Process

(a) QFs can subscribe only through the UCR issuer

Annual Report 2012 - 2013 14

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

(b) The rupee denominated units of the respective schemes of RMF would be held as underlying by the custodian in ndia in demat mode against which the UCR

issuer would issue UCR(s) to be held by QFs.

(c) RMF / RCAM may, at their discretion, receive funds from the QF towards subscription, either in any freely convertible foreign currency or in ndian Rupees;

(d) n case RMF / RCAM intends to receive funds from the QFs, towards transactions, in any freely convertible foreign currency, RMF / RCAM will open a bank

account overseas and the following process shall be followed by the QF in respect of his investments:

i. The QF(s) shall place a purchase/ subscription order through the UCR issuer and remit the funds to the overseas bank account of RMF.

ii. UCR issuer shall forward the order(s) of QF(s) to RMF / RCAM / Custodian.

iii. Upon receipt and transfer of funds to ndia, RMF / RCAM shall issue units to the custodian and custodian in turn will confrm to the UCR ssuer to issue

UCR(s) to the QFs.

(e) n case RMF / RCAM intend to receive funds from the QFs, towards transactions, in ndia, then upon receipt of the subscription form and the funds in ndia from

the QF(s) in the relevant scheme's account of RMF, RMF / RCAM shall issue units to the custodian and the custodian shall in turn confrm to the UCR ssuer to

issue relevant UCR(s) to the QF(s).

2. Redemption Process

(a) QFs can redeem only through the UCR issuer

(b) Upon receipt of redemption instruction(s), RMF / RCAM shall process the same and shall either

i. transfer the redemption proceeds to the overseas bank account of RMF for making payment to the bank account of the QF(s); or

ii. remit redemption proceeds to the UCR issuer which in turn shall remit redemption proceeds to the bank account of the QF(s).

3. Dividend

n case of dividend payout, RMF / RCAM shall either:

(a) transfer the dividend amounts to overseas bank account of RMF for making payment to the bank account of the QF(s); or

(b) remit the dividend amount proceeds to the UCR issuer which in turn shall remit the dividend amount to the bank account of the QF(s).

All payments by RMF / RCAM to the QF(s) shall be made net of applicable taxes.

The investment(s) by the QF(s) in RMF schemes shall also be subject to the relevant and extant FEMA regulations and guidelines issued by the Reserve Bank of ndia

from time to time.

RCAM reserves the right to introduce / modify any terms and conditions for processing the transactions of QFs in line with applicable regulations and amendments

from time to time.

All other features and terms and conditions of the Scheme nformation Document / Key nformation Memorandum cum Application Form of the Scheme(s) of RMF and

the Statement of Additional nformation (as applicable) of RMF will remain unchanged.

This addendum forms an integral part of the Scheme nformation Document / Key nformation Memorandum cum Application Form of the Scheme(s) of RMF and the

Statement of Additional nformation (as applicable) of RMF, read with the addenda issued therefore.

NOTICE CUM ADDENDUM NO. 23 DATED JUNE 13, 2012

Changes in Designated Investor Service Centre (DISC)

The investors are requested to note that the existing DSC of Reliance Capital Asset Management Limited located at Reliance House, No 6, Haddows Road, Opposite

Shastri Bhavan, Nungambakkam, Chennai 600006 shall be shifted to 2nd Floor, Old door No.52,New door No.8,North Boag Road, TNagar, Chennai-600017 with effect

from June 18, 2012.

This addendum forms an integral part of the Scheme nformation Document(s), Statement of Additional nformation and Key nformation Memorandum(s) of the Schemes of

Reliance Mutual Fund, read with the Addenda issued from time to time.

NOTICE CUM ADDENDUM NO. 26 DATED JUNE 15, 2012

Changes in Designated Investor Service Centre (DISC)

The existing DSC of Reliance Capital Asset Management Limited situated at Old No. 31 & 32, New no. 52 & 54, TVL Boag Willa, North Boag Road, T Nagar, Near

Kariakudi Restaurant Chennai - 600 017 shall cease to operate with effect from June 16, 2012.

The existing DSC of Reliance Capital Asset Management Limited situated at 1st Floor, 2/2, Surya Towers, Above CC Bank, Salai Road, Dindigul - 624001 shall cease

to operate with effect from June 30, 2012.

The existing DSC of Reliance Capital Asset Management Limited situated at 1st Floor, DK Complex, SCO-514/515 A Gobind Puri Road. Yamuna Nagar, Haryana

-135001 shall be shifted to 2nd Floor, 221, Professor Colony, Gobindpuri Road, Yamunanagar 135001 with effect from June 20, 2012.

nvestors are requested to take note of the above. This addendum forms an integral part of the Scheme nformation Document(s), Statement of Additional nformation and

Key nformation Memorandum(s) of the Schemes of Reliance Mutual Fund, read with the Addenda issued from time to time.

NOTICE CUM ADDENDUM NO. 34 DATED JULY 05, 2012

Notice is hereby given that Ms. Geeta Chandran - Head - Operations has retired from the services of Reliance Capital Asset Management Limited, with effect from the close

of business hours on June 30, 2012 and hence, she ceased to be a Key Personnel of the Company.

nvestors are requested to take note of the above. This addendum forms an integral part of the Statement of Additional nformation (SA). All the other terms and conditions

of SA read with the addenda issued from time to time will remain unchanged.

NOTICE CUM ADDENDUM NO. 35 DATED JULY 11, 2012

CA. Uttam Prakash Agarwal has been appointed as an independent director on the Board of Reliance Capital Trustee Company Limited (RCTC) with effect from the June

29, 2012.

The Reliance Capital Asset Management Limited ("RCAM)/Reliance Mutual Fund ("RMF) has decided to modify the Statement of Additional nformation ("SA) of RMF in

Annual Report 2012 - 2013 15

11th foor & 12th foor, One ndiabulls Centre, Tower 1, Jupiter Mills Compound, 841, Senapati Bapat Marg, Elphinstone Road, Mumbai - 400 013.

Reliance Gold Savings Fund

order to include the details of CA. Uttam Prakash Agarwal, the same are as follows:

Name Age QuaIication Brief Experience

CA. Uttam Prakash

Agarwal

49 B.Com, FCA,

CA (Australia),

CPA (Australia)

CA. Uttam Prakash Agarwal, is a senior partner in M/s. Uttam Abuwala & Co., Chartered Accountants. Having qualifed

as a Chartered Accountant in 1988 and being in the practice of Chartered Accountancy for about 2 decades, CA. Agarwal

specializes in the area of implementation of XBRL, Corporate Advisory, Taxation, and Management Consultancy. CA.

Agarwal is coming out with a new concept of Uttam Prakash Agarwal Chartered Accountants Academy to systemize the

educational framework in the feld of Accountancy and Finance, with specifc emphasis on Chartered Accountancy to create

industry ready professionals.

CA. Agarwal was elected as the President of the nstitute of Chartered Accountants of ndia for the year 2009-10. He also

holds the honorary membership of nstitute of Chartered Accountants of Australia. As a prolifc speaker, he has addressed

various conferences, seminars and workshops, organized nationally and internationally by CA and has authored several

books as well.

CA. Agarwal has been rewarded by the President of ndia, Her Excellency Smt. Pratibha Devisngh Patil with "Recognition

of Excellence Award. He was also awarded with "UDAN 2011 by the Times of ndia Group Newspaper Navbharta Times

the same has been handed over by Shri Uddhav Thackeray, Executive President, Shiv Sena, for being one of the youngest

President of CA, taking ndia Chartered Accountancy profession worldwide & for his contribution towards nfrastructure

Development at CA.

He had held memberships on several Boards viz. nternational Federation of Accountants (FAC), Developing Nations

Committee (DNC) of FAC, Small and Medium Practices Committee (SMP) of FAC, Confederation of Asian and Pacifc

Accountants (CAPA), CAPA Sub-Committee on Environmental Accounting, South Asian Federation of Accountants (SAFA),

Central Direct Taxes Advisory Committee (CDTAC), nsurance Regulatory and Development Authority (RDA), Tariff Advisory

Committee of RDA, Standing Committee on Accounting ssues (SCA) constituted by RDA, National Advisory Committee on

Accounting Standards constituted by the Ministry of Corporate Affairs, Audit Advisory Board and the Government Accounting

Standards Advisory Board both constituted by the Comptroller and Auditor General of ndia, nternal Audit constituted by

the Offce of Controller General of Accounts, Government of ndia.

He also holds Directorship in various companies and has been actively associated, for a number of years, with various

professional and social associations. Articles contributed by him on various matters of interest and importance to the

profession have been published in leading Journals.

nvestors are requested to take note of the above. This addendum forms an integral part of the SA. All the other terms and conditions of SA read with the addenda issued

by RCAM/RMF from time to time will remain unchanged.

NOTICE CUM ADDENDUM NO. 37 DATED JULY 30, 2012

Notice is hereby given to the Unitholders of the schemes of Reliance Mutual Fund ("RMF) that Nippon Life nsurance Company ('Nippon') is proposing to acquire 26% of

the total issued and paid up equity share capital of Reliance Capital Asset Management Limited ("RCAM), subject to the fulfllment of certain conditions precedent, including

the receipt of necessary regulatory approvals ("the Acquisition).

t may be noted that Reliance Capital Limited ("RCL) will continue in its capacity as Sponsor of RMF. t may also be noted that pursuant to the Acquisition, there will not be

any change in the shareholding pattern of Reliance Capital Trustee Co. Limited (the "Trustee Company) and that there will not be any change in the name of RMF, RCAM

or that of the Trustee Company.

Securities and Exchange Board of India ( SEBI ), vide its letter no. OW/12971/2012 dated June 12, 2012, has already accorded its No Objection for the

Acquisition.

Information about Nippon

Nippon is a mutual company incorporated and existing under the laws of Japan, having its registered offce at 3-5-12, mabashi, Chuo-ku, Osaka 541-8501, Japan and is

regulated by the Financial Services Agency of Japan.

Nippon is engaged in the business activities of (a) providing life insurance; (b) providing agency services or administration services to other insurance companies (including

foreign insurers) or fnancial institutions, providing guarantees for liabilities, and other businesses incidental to the businesses of the preceding items; and (c) sale and

purchase of government bonds, local government bonds or government-guaranteed bonds, handling of the offering or administration and other business permitted under

the nsurance Business Act of local government bonds, corporate bonds or other debentures, and other businesses which life insurance companies may conduct under the

laws other than the nsurance Business Act.

Nippon is a 122-year old Global Fortune 100 company, and manages over USD 600,000,000,000 (United States Dollars Six Hundred Billion) (approximately, Rs.

30,000,000,000,000 (Rupees Thirty Trillion)) in assets, amongst the largest total assets managed in the world by any life insurer. Nippon is the 7th (Seventh) largest life

insurer in the world and the number one private life insurer in Asia and Japan. Nippon has over 14,000,000 (Fourteen Million) policies in Japan.

Nippon also has an asset management arm, Nissay Asset Management Corporation ("Nissay), which manages assets worth about USD 60,000,000,000 (United States

Dollars Sixty Billion).

Exit Option for Unitholders

Pursuant to Regulation 22(e) read with 2 (g) of SEB (Mutual Funds) Regulations, 1996, in case of change in the controlling interest of the asset management company (in