Académique Documents

Professionnel Documents

Culture Documents

w2 l2 Measuringthecostofliving Handout

Transféré par

Imran KhanDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

w2 l2 Measuringthecostofliving Handout

Transféré par

Imran KhanDroits d'auteur :

Formats disponibles

Measuring the Cost of Living

ARSC1432MacroeconomicsCoSeminar SPRING2009

Consumer Price Index (CPI): A measure of the overall cost of the goods and services bought by a typical consumer. How the CPI is calculated: 1. Fix the basket: Survey consumer to determine a fixed basket of goods. 2 Pizzas, 4 cokes 2. Find the prices: Find the price of each good in each year Year Price of Pizza Price of Coke 2001 $10 $1 2002 $15 $2 2003 $20 $3 3. Compute the baskets cost: Compute the cost of the basket of goods in each year 2001 ($10 per pizza X 2 pizzas)+($1 per coke X 4 cokes) = $24 2002 ($15 per pizza X 2 pizzas)+($2 per coke X 4 cokes) = $38 2003 ($20 per pizza X 2 pizzas)+($4 per coke X 4 cokes) = $56 4. Choose a base year and compute the index: Choose one year as a base year (2001) and compute the Consumer Price Index in each year 2001 ($24/$24)X100=100.0 2002 ($38/$24)X100=158.3 2003 ($56/$24)X100=233.3 5. Compute the inflation rate: Use the consumer price index to compute the inflation rate from previous year Inflation rate: the percentage change in the price index from the preceding period Inflation rate = CPI new CPI old X100 CPI old 2002 2003 [(158.3-100.0)/100] X100= 58.3% [(233.3-158.3)/100] X100= 47.4%

Also calculate by the Bureau of Labor Statistics the Producer Price Index: A measure of the cost of basket of goods and services bought by firms.

Problems in Measuring the Cost of Living: 1

1. Substitution bias: When prices change from one year to another they dont change proportionately(overstatement of the increase in the cost of living) 2. Introduction of new goods: When a new good introduced, consumers have more variety from which to choose(it does not reflect the change in purchasing power of the dollar) 3. Unmeasured quality change: If the quality of a good deteriorates from one year to the next, the value of a dollar falls, even if the price of the good stays the same(overstating inflation) The GDP Deflator versus the CPI 1. When the price of oil increases, the consumer price index rises by much more than GDP deflator 2. The group of goods and services used to compute GDP deflator changes automatically over time Inflating variables: Nominal variable in current dollars = Nominal variable past dollars X CPI current year CPI past year Deflating variables: Nominal variable past dollars= Nominal variable current dollars X CPI past year CPI current year Nominal Interest Rate: The interest rate as actually reported without a correction for the effects of inflation. Real Interest Rate: The interest rate corrected for the effects of inflation. Real Interest Rate = Nominal Interest Rate - Inflation rate

Vous aimerez peut-être aussi

- Consumer Price IndexDocument20 pagesConsumer Price IndexBritt John Ballentes0% (1)

- Measuring The Cost of LivingDocument47 pagesMeasuring The Cost of LivingSZAPas encore d'évaluation

- InflationDocument47 pagesInflationMAATAPas encore d'évaluation

- Measuring The Cost of LivingDocument4 pagesMeasuring The Cost of LivingAmna NawazPas encore d'évaluation

- Measuring The Cost of Living: Author: Prof. Sharif MemonDocument21 pagesMeasuring The Cost of Living: Author: Prof. Sharif MemonHardip MaradiaPas encore d'évaluation

- And Compute The Index:: - The Inflation Rate Is Calculated As FollowsDocument4 pagesAnd Compute The Index:: - The Inflation Rate Is Calculated As FollowsAmna NawazPas encore d'évaluation

- Macro NotesDocument9 pagesMacro NotesVarshini NagarajuPas encore d'évaluation

- Kinh T Ế Vĩ Mô: Chương Trình H Ỗ TR Ợ H Ọ CT Ậ P Sinh Viên Ch Ấ TLƯ Ợ Ng CaoDocument6 pagesKinh T Ế Vĩ Mô: Chương Trình H Ỗ TR Ợ H Ọ CT Ậ P Sinh Viên Ch Ấ TLƯ Ợ Ng CaoThao KuyenPas encore d'évaluation

- CPIDocument27 pagesCPISimantoPreeomPas encore d'évaluation

- Macro Economics: Measuring The Cost of LivingDocument36 pagesMacro Economics: Measuring The Cost of LivingSarfaraj OviPas encore d'évaluation

- Topic3 - StudentsDocument14 pagesTopic3 - StudentsTy VoPas encore d'évaluation

- Measuring The Cost of LivingDocument34 pagesMeasuring The Cost of LivingSarfaraj OviPas encore d'évaluation

- Chapter 11 Measuring The Cost of LivingDocument4 pagesChapter 11 Measuring The Cost of LivingGiang LinhPas encore d'évaluation

- Lesson 8 - InflationDocument21 pagesLesson 8 - Inflationhyunsuk fhebiePas encore d'évaluation

- Lesson 8 - InflationDocument21 pagesLesson 8 - InflationJoshua CabinasPas encore d'évaluation

- Macroeconomic Problems: InflationDocument30 pagesMacroeconomic Problems: Inflationtaufeek_irawan7201Pas encore d'évaluation

- Measuring The Cost of Living: Aman 22 February 2013Document37 pagesMeasuring The Cost of Living: Aman 22 February 2013safdar2020Pas encore d'évaluation

- Week of Jan 24Document12 pagesWeek of Jan 24Fabian GonzalezPas encore d'évaluation

- Chapter 1 Preliminaries2021SummerDocument2 pagesChapter 1 Preliminaries2021SummersarahPas encore d'évaluation

- Measuring The Cost of LivingDocument27 pagesMeasuring The Cost of LivingAnikPas encore d'évaluation

- Chapter 24 - Measuring The Cost of LivingDocument35 pagesChapter 24 - Measuring The Cost of LivingFTU K59 Trần Yến LinhPas encore d'évaluation

- Lesson 3Document3 pagesLesson 3Maurice AgbayaniPas encore d'évaluation

- Lec-3 - Chapter 24 - Cost of LivingDocument47 pagesLec-3 - Chapter 24 - Cost of LivingMsKhan0078Pas encore d'évaluation

- Measuring The Price Level: Prices in The Economy. To Measure The Average LevelDocument31 pagesMeasuring The Price Level: Prices in The Economy. To Measure The Average Leveljhean dabatosPas encore d'évaluation

- The Consumer Price IndexDocument10 pagesThe Consumer Price Indexanhtran.31201020005Pas encore d'évaluation

- Chapter 11 (Data Makro Ekonomi)Document31 pagesChapter 11 (Data Makro Ekonomi)Kevin HutabaratPas encore d'évaluation

- 02 MeasuringDocument19 pages02 MeasuringAnoosh RazaPas encore d'évaluation

- MACROECONOMICSDocument14 pagesMACROECONOMICSShovee Kyle DelantesPas encore d'évaluation

- ECN202 - Lecture 3Document16 pagesECN202 - Lecture 3Annur ZaraPas encore d'évaluation

- Engineering Economics CH 4Document42 pagesEngineering Economics CH 4karim kobeissiPas encore d'évaluation

- Measuring The Cost of LivingDocument47 pagesMeasuring The Cost of LivingDillYoungPas encore d'évaluation

- Measuring The Cost of Living: Michael ParkinDocument21 pagesMeasuring The Cost of Living: Michael ParkinOyon Nur newazPas encore d'évaluation

- How The Consumer Price Index Is CalculatedDocument3 pagesHow The Consumer Price Index Is CalculatedEdwin SamisPas encore d'évaluation

- Lecture 4. Macro 1Document41 pagesLecture 4. Macro 1ShanePas encore d'évaluation

- Chapter2 - GDP and CPI - EngDocument48 pagesChapter2 - GDP and CPI - EngvietzergPas encore d'évaluation

- #3 Measuring The Cost of Living - 3aDocument17 pages#3 Measuring The Cost of Living - 3amjgx12Pas encore d'évaluation

- Chapter 24chapter 24 Measuring The Cost of LivingDocument11 pagesChapter 24chapter 24 Measuring The Cost of Livingnguyen tuanhPas encore d'évaluation

- Nominal, Real GDP, GDP Deflator, Price Indices Used in IndiaDocument19 pagesNominal, Real GDP, GDP Deflator, Price Indices Used in IndiateliumarPas encore d'évaluation

- Notes On Principles of Macroeconomics: X Year Base in Basket Market of Cost T Year in Basket Market of Cost PIDocument5 pagesNotes On Principles of Macroeconomics: X Year Base in Basket Market of Cost T Year in Basket Market of Cost PIRamanatharshanan ArasanayagamPas encore d'évaluation

- 011 - Measuring The Cost of LivingDocument24 pages011 - Measuring The Cost of LivingRanjitPas encore d'évaluation

- Consumer Price IndexDocument4 pagesConsumer Price Indexbt0826100% (2)

- Chapter 24Document44 pagesChapter 24yexin003Pas encore d'évaluation

- Measuring InflationDocument25 pagesMeasuring InflationAnonymous E9ESAecw8x0% (2)

- NotesDocument4 pagesNotestahmeemPas encore d'évaluation

- Macroeconomics Microeconomics Definition: Measurement of GDPDocument22 pagesMacroeconomics Microeconomics Definition: Measurement of GDPKavya ShahPas encore d'évaluation

- Cost of LivingDocument15 pagesCost of LivingChandrahas ReddyPas encore d'évaluation

- Macro 2Document1 pageMacro 2Gega XachidEPas encore d'évaluation

- Distributing Prohibited - Downloaded by Havishma Haranath: Lomoarcpsd - 1709270Document9 pagesDistributing Prohibited - Downloaded by Havishma Haranath: Lomoarcpsd - 1709270Samantha EstilongPas encore d'évaluation

- Ch.16 OutlineDocument26 pagesCh.16 OutlinehappybeansssPas encore d'évaluation

- Macro Lecture 4 PDFDocument40 pagesMacro Lecture 4 PDFpulkit guptaPas encore d'évaluation

- Macroeconomic Measurements: Prices and InflationDocument25 pagesMacroeconomic Measurements: Prices and InflationRAFEU YEADPas encore d'évaluation

- Notes On Principles of MacroeconomicsDocument5 pagesNotes On Principles of MacroeconomicsSuniel ChhetriPas encore d'évaluation

- MECO Lecture3Document17 pagesMECO Lecture3saif ur rehmanPas encore d'évaluation

- GDP Deflator Vs CpiDocument6 pagesGDP Deflator Vs CpiAli HasanPas encore d'évaluation

- Introduction To Macroeconomics Unit 1 National Income and National OutputDocument5 pagesIntroduction To Macroeconomics Unit 1 National Income and National OutputNordia BrysonPas encore d'évaluation

- No 03. Chapter 2: Measuring Macroeconomic VariablesDocument23 pagesNo 03. Chapter 2: Measuring Macroeconomic VariablesBushra NaumanPas encore d'évaluation

- Macroeconomic Objective (2) - Low and Stable InflationDocument15 pagesMacroeconomic Objective (2) - Low and Stable Inflationinfo.acc231Pas encore d'évaluation

- Problem Set 1 BSC II - BDocument9 pagesProblem Set 1 BSC II - BFA20-BBA-017 (AHMAD SOHAIL) UnknownPas encore d'évaluation

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationD'EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationPas encore d'évaluation

- Bangladesh Railway e TicketDocument1 pageBangladesh Railway e TicketImran KhanPas encore d'évaluation

- Great Book of DeathDocument1 pageGreat Book of DeathImran KhanPas encore d'évaluation

- Mika Securities LTD.: 1203260073546191 29-Aug-2021 102554 Md. Wazidur RahmanDocument2 pagesMika Securities LTD.: 1203260073546191 29-Aug-2021 102554 Md. Wazidur RahmanImran KhanPas encore d'évaluation

- Cow Rearing - 19Document47 pagesCow Rearing - 19Imran KhanPas encore d'évaluation

- Breakout Stock: Thursday, September 16, 2021Document1 pageBreakout Stock: Thursday, September 16, 2021Imran KhanPas encore d'évaluation

- SL No Code Cate.. T. Share (CR) P/E 52 Days High 52 Days Low Current EPSDocument3 pagesSL No Code Cate.. T. Share (CR) P/E 52 Days High 52 Days Low Current EPSImran KhanPas encore d'évaluation

- Kazi Shibli Sakib: ObjectiveDocument2 pagesKazi Shibli Sakib: ObjectiveImran KhanPas encore d'évaluation

- Vertex RMG Division: Vertex Wears Ltd. Plan For January, February & MarchDocument1 pageVertex RMG Division: Vertex Wears Ltd. Plan For January, February & MarchImran KhanPas encore d'évaluation

- Web Circullar-7th IssueDocument2 pagesWeb Circullar-7th IssueImran KhanPas encore d'évaluation

- Md. Imran Khan: House: Ka 53/2, Jaman Vila, Jogonnathpur, Vatara Thana, DhakaDocument3 pagesMd. Imran Khan: House: Ka 53/2, Jaman Vila, Jogonnathpur, Vatara Thana, DhakaImran KhanPas encore d'évaluation

- Computer PerformanceDocument5 pagesComputer PerformancefakhruddinahmedrubaiPas encore d'évaluation

- Bio CoverDocument1 pageBio CoverImran KhanPas encore d'évaluation

- CF Chapter 06 Excel Master StudentDocument41 pagesCF Chapter 06 Excel Master StudentImran KhanPas encore d'évaluation

- Problem 7.1 Peso Futures: Amber Mcclain Sells June Futures A) B) C) Assumptions Values Values ValuesDocument1 pageProblem 7.1 Peso Futures: Amber Mcclain Sells June Futures A) B) C) Assumptions Values Values ValuesImran KhanPas encore d'évaluation

- 1.1 Profile of Square Pharmaceuticals LTD.: SQUARE Today Symbolizes A NameDocument23 pages1.1 Profile of Square Pharmaceuticals LTD.: SQUARE Today Symbolizes A NameImran KhanPas encore d'évaluation

- Cover LetterDocument1 pageCover LetterImran KhanPas encore d'évaluation

- Md. Abid Burhan: GPA 4.70 Out of Scales 5.00Document2 pagesMd. Abid Burhan: GPA 4.70 Out of Scales 5.00Imran KhanPas encore d'évaluation

- Bank Asia LimitedDocument4 pagesBank Asia LimitedImran KhanPas encore d'évaluation

- Md. Imran Khan: Career ObjectiveDocument2 pagesMd. Imran Khan: Career ObjectiveImran KhanPas encore d'évaluation

- Cover Letter11Document1 pageCover Letter11Imran KhanPas encore d'évaluation

- Home Post Resume - My Bdjobs Job Mail Service Career CounsellingDocument2 pagesHome Post Resume - My Bdjobs Job Mail Service Career CounsellingImran KhanPas encore d'évaluation

- HrhhreDocument3 pagesHrhhreImran KhanPas encore d'évaluation

- Fin 301sdDocument23 pagesFin 301sdImran KhanPas encore d'évaluation

- Retail Math FormulasDocument6 pagesRetail Math FormulasMurat AnlıPas encore d'évaluation

- Assessment of The Impact of CSR Implementation Social Investment Using Social Return On Investment (SROI) MethodsDocument15 pagesAssessment of The Impact of CSR Implementation Social Investment Using Social Return On Investment (SROI) MethodsCho bitzPas encore d'évaluation

- HWK - 4Document4 pagesHWK - 4Karen Nicole LopezPas encore d'évaluation

- United States Core Consumer Price Index (CPI) YoYDocument1 pageUnited States Core Consumer Price Index (CPI) YoYLuis ChigchónPas encore d'évaluation

- Economics Amendments Part 1 National IncomeDocument11 pagesEconomics Amendments Part 1 National IncomeSavya Sachi100% (1)

- GROSS DOMESTIC PRODUCT STATISTICS (Report) - Powerpoint PresentationDocument37 pagesGROSS DOMESTIC PRODUCT STATISTICS (Report) - Powerpoint PresentationCyryhl GutlayPas encore d'évaluation

- Apple Supplier ListDocument29 pagesApple Supplier Listapi-380255226Pas encore d'évaluation

- Demand and SupplyDocument3 pagesDemand and SupplySamiracomputerstation Kuya MarvsPas encore d'évaluation

- World Population DataDocument48 pagesWorld Population DataSokoine Hamad DenisPas encore d'évaluation

- 2023-1 Macro Assignment 4Document2 pages2023-1 Macro Assignment 4이가빈[학생](국제대학 국제학과)Pas encore d'évaluation

- Measuring The Cost of LivingDocument43 pagesMeasuring The Cost of LivingAman MallPas encore d'évaluation

- Labour Index Base Year-2016 100Document6 pagesLabour Index Base Year-2016 100Vikrant DeshmukhPas encore d'évaluation

- 2018 EPI Results - Environmental Performance IndexDocument9 pages2018 EPI Results - Environmental Performance IndexxeniaPas encore d'évaluation

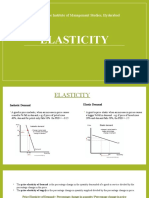

- Ahmed Saad Alkhabery 1B: AAST-HLM Program Managerial Economics Dr. Marwa Elsherif Name: Group: Assignment 2 ElasticityDocument5 pagesAhmed Saad Alkhabery 1B: AAST-HLM Program Managerial Economics Dr. Marwa Elsherif Name: Group: Assignment 2 ElasticityAhmed SaadPas encore d'évaluation

- Pages 140 Block Wise Survey ReportDocument1 pagePages 140 Block Wise Survey ReportJohana VangchhiaPas encore d'évaluation

- Analisis Rasio Keuangan: Rasio Profitabilitas Rasio SolvencyDocument11 pagesAnalisis Rasio Keuangan: Rasio Profitabilitas Rasio SolvencyFrans KristianPas encore d'évaluation

- Asset Management's Guide To The MarketsDocument71 pagesAsset Management's Guide To The MarketsKhaled battichePas encore d'évaluation

- Unit-1 Elasticity of SupplyDocument18 pagesUnit-1 Elasticity of SupplyKappala PranithPas encore d'évaluation

- API NY - GDP.PCAP - CD DS2 en Excel v2 3469429Document74 pagesAPI NY - GDP.PCAP - CD DS2 en Excel v2 3469429shahnawaz G 27Pas encore d'évaluation

- Nominal GDP, Real GDP, and GDPDocument17 pagesNominal GDP, Real GDP, and GDPEistellaPas encore d'évaluation

- Assignment 1 Solution Eco 403Document2 pagesAssignment 1 Solution Eco 403Mubeen RazaPas encore d'évaluation

- 07a) Income Elasticity of DemandDocument3 pages07a) Income Elasticity of DemandMohamed YasserPas encore d'évaluation

- National IncomeDocument15 pagesNational IncomeAjil Raj83% (18)

- OECD in Figures - 2005 Edition - ISBN 9264013059: Economic Growth and PerformanceDocument4 pagesOECD in Figures - 2005 Edition - ISBN 9264013059: Economic Growth and PerformanceAayush ChoudhuryPas encore d'évaluation

- Uas AnalisisDocument14 pagesUas Analisisnadia safitriPas encore d'évaluation

- Elasticity: Narsee Monjee Institute of Management Studies, HyderabadDocument5 pagesElasticity: Narsee Monjee Institute of Management Studies, HyderabadAishwaryaPas encore d'évaluation

- Topic 3Document13 pagesTopic 3Darshilla Rive ChandramPas encore d'évaluation

- Icici Branches DataDocument12 pagesIcici Branches DatananiPas encore d'évaluation

- National Income Formula and NumericalsDocument17 pagesNational Income Formula and Numericalsbhaskarvishal100% (6)

- 07a) Income Elasticity of DemandDocument3 pages07a) Income Elasticity of DemandBenPas encore d'évaluation