Académique Documents

Professionnel Documents

Culture Documents

Digests Tax Cases

Transféré par

tumasitoeCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Digests Tax Cases

Transféré par

tumasitoeDroits d'auteur :

Formats disponibles

Chamber of Real Estate and Builders Associations, Inc., v. The Hon. Executive Secretary Alberto Romulo, et al G.R. No.

160756. March 9, 2010

FACTS: CREBA assails the imposition of the minimum corporate income tax (MCIT) as being violative of the due process clause as it levies income tax even if there is no realized gain. They also question the creditable withholding tax (CWT) on sales of real properties classified as ordinary assets stating that (1) they ignore the different treatment of ordinary assets and capital assets; (2) the use of gross selling price or fair market value as basis for the CWT and the collection of tax on a per transaction basis (and not on the net income at the end of the year) are inconsistent with the tax on ordinary real properties; (3) the government collects income tax even when the net income has not yet been determined; and (4) the CWT is being levied upon real estate enterprises but not on other enterprises, more particularly those in the manufacturing sector. ISSUE: Are the impositions of the MCIT on domestic corporations and properties classified as ordinary assets unconstitutional? HELD: NO. MCIT does not tax capital but only taxes income as shown by the fact that the MCIT is arrived at by deducting the capital spent by a corporation in the sale of its goods, i.e., the cost of goods and other direct expenses from gross sales. Besides, there are sufficient safeguards that exist for the MCIT: (1) it is only imposed on the 4th year of operations; (2) the law allows the carry forward of any excess MCIT paid over the normal income tax; and (3) the Secretary of Finance can suspend the imposition of MCIT in justifiable instances. The regulations on CWT did not shift the tax base of a real estate business income tax from net income to GSP or FMV of the property sold since the taxes withheld are in the nature of advance tax payments and they are thus just installments on the annual tax which may be due at the end of the taxable year. As such the tax base for the sale of real property classified as ordinary assets remains to be the net taxable income and the use of the GSP or FMV is because these are the only factors reasonably known to the buyer in connection with the performance of the duties as a withholding agent. Neither is there violation of equal protection even if the CWT is levied only on the real industry as the real estate industry is, by itself, a class on its own and can be validly treated different from other businesses. CWT on income from sales of real

G.R. No. 3473 March 22, 1907 J. CASANOVAS, plaintiff-appellant, vs. JNO. S. HORD, defendant-appellee. WILLARD, J.: FACTS: In 1897, the Spanish Government, in accordance with the provisions of the royal decree of 14 may 1867, granted J. Casanovas certain mines in the province of Ambos Camarines, of which mines the latter is now the owner. That these were validly perfected mining concessions granted to prior to 11April 1899 is conceded. They were so considered by the Collector of Internal Revenue and were by him said to fall within the provisions of section 134 of Act No. 1189, known as the Internal Revenue Act. That section is as follows: SEC. 134. On all valid perfected mining concessions granted prior to April eleventh, eighteen hundred and ninety-nine, there shall be levied and collected on the after January first, nineteen hundred and five, the following taxes:2. (a) On each claim containing an area of sixty thousand square meters, an annual tax of one hundred pesos; (b) and at the same rate proportionately on each claim containing an area in excess of, or less than, sixty thousand square meters.3. On the gross output of each an ad valorem tax equal to three per centum of the actual market value of such output. The defendant accordingly imposed upon these properties the tax mentioned in section 134, which tax, as has before been stated, J. Casanovas paid under protest. ISSUE: Whether Section 134 of Act 1189 is valid. HELD: The fact that this concession was made by the Government of Spain, and not by the Government of the United States, is not important. Our conclusion is that the concessions granted by the Government of Spain to the plaintiff, constitute contracts between the parties; that section 134 of the Internal Revenue Law impairs the obligation of these contracts, and is therefore void as to them. We think that this section is also void because in conflict with section 60 of the act of Congress of July 1, 1902. This section is as follows:

That nothing in this Act shall be construed to effect the rights of any person, partnership, or corporation, having a valid, perfected mining concession granted prior to April eleventh, eighteen hundred and ninety-nine, but all such concessions shall be conducted under the provisions of the law in

force at the time they were granted, subject at all times to cancellation by reason of illegality in the procedure by which they were obtained, or for failure to comply with the conditions prescribed as requisite to their retention in the laws under which they were granted: Provided, that the owner or owners of every such concession shall cause the corners made by its boundaries to be distinctly marked with permanent monuments within six months after this act has been promulgated in the Philippine Islands, and that any concessions, the boundaries of which are not so marked within this period shall be free and open to explorations and purchase under the provisions of this act.

This section seems to indicate that concessions, like those in question, can be cancelled only by reason of illegality in the procedure by which they were obtained, or for failure to comply with the conditions prescribed as requisite for their retention in the laws under which they were granted. There is nothing in the section which indicates that they can be cancelled for failure to comply with the conditions prescribed by subsequent legislation. In fact, the real intention of the act seems to be that such concession should be subject to the former legislation and not to any subsequent legislation. There is no claim in this case that there was any illegality in the procedure by which these concessions were obtained, nor is there any claim that the plaintiff has not complied with the conditions prescribed in the said royal decree of 1867. The judgment of the court below is reversed, and judgment is ordered in favour of the plaintiff and against the defendant for P9,600, with interest thereon, at6 per cent, from the 21st day of February, 1906, and the costs of the Court of First Instance. No costs will be allowed to either party in this court.

G.R. No. L-31364 March 30, 1979 MISAEL P. VERA, as Commissioner of Internal Revenue, and JAIME ARANETA, as Regional Director, Revenue Region No. 14, Bureau of Internal Revenue, petitioners, vs. HON. JOSE F. FERNANDEZ, Judge of the Court of First Instance of Negros Occidental, Branch V, and FRANCIS A. TONGOY, Administrator of the Estate of the late LUIS D. TONGOY, respondents.

Jaime Araneta in his capacity as Regional Director of BIR filed a Motion for allowance of claim against the estate of Luis D. Tongoy. The claim represents the indebtedness to the Government of the late Luis D.Tongoy for deficiency income taxes in the total sum of P3,254.80. The Administrator opposed the motion solely on the ground that the claim was barred under Section 5, Rule 86 of the Rules of Court. The motion was denied by respondent Judge Fernandez and a motion for reconsideration was also denied. Petitioners filed an appeal on certiorari contending that the claim for taxes was filed

beyond the period provided in Section 2, Rule 86 of the Rules of Court and that the same was barred by the said provision.

Issue: Whether or not the Government through BIR can claim unpaid taxes from a decedents estate

Ruling: In the case of Pineda vs. CFI of Tayabas, 52 Phil. 803, it was even more pointedly held that taxes assessed against the estate of a deceased person ... need not be submitted to the committee on claims in the ordinary course of administration. In the exercise of its control over the administrator, the court may direct the payment of such taxes upon motion showing that the taxes have been assessed against the estate. The reason for the more liberal treatment of claims for taxes against a decedent's estate in the form of exception from the application of the statute of non-claims, is not hard to find. Taxes are the lifeblood of the Government and their prompt and certain availability are imperious need. Upon taxation depends the Government ability to serve the people for whose benefit taxes are collected. To safeguard such interest, neglect or omission of government officials entrusted with the collection of taxes should not be allowed to bring harm or detriment to the people, in the same manner as private persons may be made to suffer individually on account of his own negligence, the presumption being that they take good care of their personal affairs. This should not hold true to government officials with respect to matters not of their own personal concern. This is the philosophy behind the government's exception, as a general rule, from the operation of the principle of estoppel. Wherefore the decision appealed from is reversed.

Vous aimerez peut-être aussi

- Ordinance One-Way RoadDocument2 pagesOrdinance One-Way Roadtumasitoe100% (4)

- SHS Implementation Updates For R7Document141 pagesSHS Implementation Updates For R7tumasitoePas encore d'évaluation

- Procedure in Extra-Judicial Foreclosure of Mortgage - 99-10-05-0 - August 7, 2001 - en BancDocument2 pagesProcedure in Extra-Judicial Foreclosure of Mortgage - 99-10-05-0 - August 7, 2001 - en BancKristina LayugPas encore d'évaluation

- Admin - Truth CommissionDocument4 pagesAdmin - Truth CommissiontumasitoePas encore d'évaluation

- Performance Challenge Fund Project ProposalDocument2 pagesPerformance Challenge Fund Project Proposaltumasitoe100% (1)

- Applicable Laws Civil CaseDocument3 pagesApplicable Laws Civil CasetumasitoePas encore d'évaluation

- The Recto and Maceda LawDocument3 pagesThe Recto and Maceda LawtumasitoePas encore d'évaluation

- Cases in Tax 1 and Tax 2Document3 pagesCases in Tax 1 and Tax 2tumasitoePas encore d'évaluation

- Digests Tax CasesDocument4 pagesDigests Tax CasestumasitoePas encore d'évaluation

- 2011 Taxation Bar Exam Questions and AnswerDocument7 pages2011 Taxation Bar Exam Questions and Answerwwe_jhoPas encore d'évaluation

- Article Viii JudiciaryDocument6 pagesArticle Viii JudiciarytumasitoePas encore d'évaluation

- Digests Tax CasesDocument4 pagesDigests Tax CasestumasitoePas encore d'évaluation

- Courses: Codes Used in The CBMS Household Profile QuestionnaireDocument32 pagesCourses: Codes Used in The CBMS Household Profile QuestionnairetumasitoePas encore d'évaluation

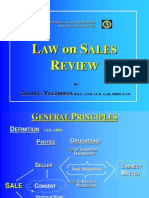

- Sales VillanuevaDocument110 pagesSales VillanuevaCarlota Nicolas VillaromanPas encore d'évaluation

- Sample of ResolutionDocument4 pagesSample of Resolutionrhon3179% (24)

- Article Viii JudiciaryDocument6 pagesArticle Viii JudiciarytumasitoePas encore d'évaluation

- Sop On Conduct of Crime Scene InvestigationDocument28 pagesSop On Conduct of Crime Scene InvestigationJayr Nacional75% (4)

- Civil Procedure Digest Pre MidtermsDocument116 pagesCivil Procedure Digest Pre Midtermskramsaga100% (1)

- Find The Greatest Number. Circle The Correct AnswerDocument1 pageFind The Greatest Number. Circle The Correct AnswertumasitoePas encore d'évaluation

- Regional OfficesDocument2 pagesRegional OfficestumasitoePas encore d'évaluation

- Paguio Transport Corporation Vs NLRCDocument6 pagesPaguio Transport Corporation Vs NLRCtumasitoePas encore d'évaluation

- Succession Outline 2011Document13 pagesSuccession Outline 2011tumasitoePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)