Académique Documents

Professionnel Documents

Culture Documents

Chapter 6 Income Statement & Statement of Changes in Equity

Transféré par

kajsdkjqwelCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 6 Income Statement & Statement of Changes in Equity

Transféré par

kajsdkjqwelDroits d'auteur :

Formats disponibles

CHAPTER 6 Income Statement & Statement of Changes in Equity

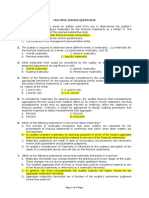

Purpose & importance of measuring financial performance

Entities aim to CREATE VALUE. Companies listed on securities exchange value creation (or lack thereof) is generally evidenced by movements in the companys share price. Entities w/o share price value creation is realized when the business is sold.

The definition of income encompasses o o Revenue arising in the ordinary course of activities (e.g. sales, fees & dividends) Gains (e.g. gains on disposal of non-current assets, and unrealized gains on revaluing assets)

An entity cant remain viable in the long term if it continually generates operating losses

Reporting period concept

The reporting period period of time to which the FS relate

Accrual accounting vs. cash accounting

Accrual accounting = transactions & events are recorded in the periods they occur, rather than in the

periods the cash is received or paid. o The entity doesnt have to receive cash associated w/ a transaction for it to be regarded as income o Purpose to better reflect the performance of the entity, timing of cash payments & cash receipts has the potential to distort performance in a period if a cash basis of accounting is used to measure financial performance o o Accrued income amounts not yet received for G+S that have been provided Accrued expenses amounts not yet paid for eco benefits used/consumed.

Cash accounting = transactions are recorded in the period the cash is received or paid

Depreciation

Depreciation allocation of the depreciable amount of a depreciable asset (tangible) over its estimated useful life.

Amortisation allocation of the cost of an intangible asset over its estimated useful life. Straight line depreciable method same depreciation expense being recorded each year for the assets useful life: o

CHAPTER 6 Income Statement & Statement of Changes in Equity Diminishing balance depreciation method assumes that the benefits of using the asset will decrease over its useful life o Calculated by applying a constant % to the assets carrying amount @ the start of each reporting period Units of production method charges depreciation expense based on activity or output Accumulated depreciation = total depreciation charges for a particular asset Contra account (Accumulated depreciation account) an account that is offset against another

Accounting policy choices, estimates & judgements

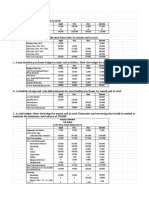

Many entities are required to prepare there is using accrual accounting. Depreciation an entity can select straight-line, diminishing balance or units of production depreciation method. Method selected should be representative of the pattern in which the assets benefits are expected to be consumed. Estimates need to be made in relation to assets useful life & residual value. o E.g. Consider an asset that is purchased for $20,000 @ start of reporting period & has an estimated life of 4 years, with 0 residual (salvage) value Straight-live depreciation an expense $5000 would be recognised in the income statement for each of the next 4 reporting periods. Diminishing Balance depreciation if the asset was depreciated by 25% each year, the depreciation expense for the next 4 reporting periods would be $5000 (25% of $20,000), $3750 (25% of $20,000-$5000), $2813 (25% of $20,000-$5000-$3750) & $2109 Unit of production method assume the car travels 60,000km, 40,000km, 30,000km, 20,000km in year 1-4.The depreciation expense would be $8000 (60,000km/150,000km x $20,000) etc.

Quality of earnings o Earnings management managers use of accounting discretion via accounting policy choices and/or estimates to report a desired level of profit o Reported profits are used in entities contractual arrangements & to value entities an important financial number o Managers choices determined by their desire to portray the eco reality of the entity or self interest. A particular profit range may be desired to avoid breaching loan covenants, to maintain share price/to max salary bonuses.

Measuring financial performance

Profit or loss for a reporting period is measured as the income during the reporting period less the expenses in the reporting period. If income exceeds expenses in a particular reporting period, a profit results. If expenses

CHAPTER 6 Income Statement & Statement of Changes in Equity exceed income, the entity reports a loss for that reporting period.

CHAPTER 6 Income Statement & Statement of Changes in Equity Income = increases in eco benefits in the form of inflows or enhancements of assets/decreases of liabilities Income (revenue) recognition There must be an increase in future eco benefits Does an agreement for the provisions of G&S exist between the entity & an external party? Has cash been received; or does the entity have a claim against an external party that is for a specified consideration is unavoidable w/o penalty? Have all acts of performance necessary to establish a valid claim against the external party been completed? Is it possible to reliably estimate the collectability of debts?

Expenses = decreases in eco benefits in the form of outflows or depletion of assets or incurrences of liabilities

resulting in a decrease in equity. Doesnt include distribution to owners. Cost of sales (inventory @ beginning of period + purchases inventory @ end of period) o Imagine that an entity purchases goods on credit from a supplier on 15 June. For the reporting period ended 30 June, the purchases would be included in the cost of sales determination, even though no cash has been paid to the supplier by 30 June. Accounts payable is increased, thereby reducing equity. When supplier is paid, the accounts payable is reduced & cash is also reduced, with no reduction in equity the payment isnt recognize as an expense Other expenses include advertising, sales staff salaries, investing & financing activities, utility charges etc. Acquisition of certain assets e.g. PPE, is not an expense since theres no reduction in equity When the value of an asset is lower than its carrying amount asset is impaired must be written down to its recoverable amount (an impairment expense) o Impairment = when an assets carrying value exceeds its recoverable amount

CHAPTER 6 Income Statement & Statement of Changes in Equity

Presenting the income statement Material income & expenses

Separate disclosures of material items are required helps users to identify permanent vs. transitory earnings charges & thereby better predict future earnings E.g. disposals of PPE, assets impairments

Format for entities not required to comply w/ accounting standards

Presentation & classification of items can exhibit great diversity. More detailed & less aggregated as info is prepared more for internal users

Cost of sales

For retailers it is the opening stock value + purchases closing stock value For manufacturing operation opening value of finished goods + cost of goods manufactured closing value of finished goods

Financial performance measures Differentiate alternative financial performance measures

Gross profit = revenue less cost of sales, reflects % by which a entity marks up cost of its products for sale o An entity cant be sustainable unless it has positive gross profit

Profit = gross profit all other expenses AKA income expenses o Profit pre- & post-tax tax is an expense Owners are more interested in profit after tax since tax obligations must be satisfied before profits can be distributed Financial analyst would be interested in profit pre-tax reflects the outcomes of the entitys investing & financing activities w/o the affect of variable determined by external forces o Profit pre- & post-interest Earnings before interest & taxation (EBIT) profit before net interest & tax Net finance costs interest income interest expense (including finance lease charges)

CHAPTER 6 Income Statement & Statement of Changes in Equity

Profit pre- & post-depreciation & amortisation EBITDA measure of the raw operating earnings of an entity, excludes asset diminution, tax + financing charges ^ used for financial statement analysis & credit analysis

Profit pre- & post-material items Maintainable earnings income MINUS expense from ordinary activities Exclusion of material items from profit better reflection of the trend & sustainability of profit

Profit from continuing & discontinued operations Separation assist users to better predict future profits

Pro forma earnings earnings to in accordance with GAAP earnings Selective reporting allows entities to include items of their choosing to determine profit Usual for pro forma to be higher than GAAP

Statement of Comprehensive Income = statement showing all items of income & expense during reporting

period, including items recognised in determining profit/loss + items of other comprehensive income Other comprehensive income all changes in equity during reporting period OTHER than profit or loss and those resulting from transactions with owners as owners

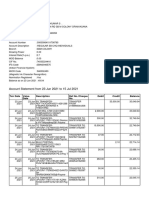

Statement of changes in equity = statement showing the changes in an entitys equity b/w 2 reporting periods

E.g. if CCS commenced 2013 with $50 000 equity, reported profit of $50 000 for the year, and Leyton Cash withdrew $15 000 during the year, the change in equity would be an increase of $35 000. Equity at the end of 2013 would be $85 000 comprising equity at the start of 2013 ($50 000) plus the increase in equity ($35 000).

Entities complying with GAAP has to present this statement Purpose: provide users with better info by requiring aggregation of items w/ similar characteristics & separation of items w/ different characteristics.

CHAPTER 6 Income Statement & Statement of Changes in Equity

Relationship between income statement, balance sheet, statement of comprehensive income & statement of changes in equity

The income statement reports the P/L generated in the reporting period that belongs to owners. It is added to the retained earnings from prev. periods to determine the pool of retained earnings available for distribution. Retained earnings is included in the equity section of the BS as at the end of the period. The statement of comprehensive income details the profit / loss for the period (i.e. income statement) as well as items of I+E not recognised by P/L. These items of I+E bypass the income statement & are recorded in the equity section of the BS. The statement of changes in equity explains the change in equity from start to end.

Vous aimerez peut-être aussi

- Audit Receivables and SalesDocument10 pagesAudit Receivables and SalesJoris YapPas encore d'évaluation

- Auditing ProcessDocument11 pagesAuditing ProcessJuliana ChengPas encore d'évaluation

- Toa PreboardDocument9 pagesToa PreboardLeisleiRagoPas encore d'évaluation

- Module 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVDocument56 pagesModule 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVCale Robert RascoPas encore d'évaluation

- Capital StructureDocument42 pagesCapital Structurevarsha raichalPas encore d'évaluation

- Chapter 8 Consolidation IDocument18 pagesChapter 8 Consolidation IAkkama100% (1)

- Philippine Framework For Assurance EngagementsDocument15 pagesPhilippine Framework For Assurance EngagementsAnonymous LC5kFdtcPas encore d'évaluation

- Test BankDocument33 pagesTest BankShiva Sankar100% (2)

- LG 03A Overview of Auditing and The Audit Process 2018 PDFDocument4 pagesLG 03A Overview of Auditing and The Audit Process 2018 PDFNash JuaqueraPas encore d'évaluation

- GoodwillDocument16 pagesGoodwillapoorva100% (1)

- APC 4 Reviewer Before FinalsDocument38 pagesAPC 4 Reviewer Before Finalsjeremy groundPas encore d'évaluation

- Audit of The Payroll and Personnel Cycle: Chapter Opening Vignette - The Staff Auditor Must Never "Simply Follow Orders"Document7 pagesAudit of The Payroll and Personnel Cycle: Chapter Opening Vignette - The Staff Auditor Must Never "Simply Follow Orders"ዝምታ ተሻለ0% (1)

- Subsequent Measurement Accounting Property Plant and EquipmentDocument60 pagesSubsequent Measurement Accounting Property Plant and EquipmentNatalie SerranoPas encore d'évaluation

- Leverage Analysis BreakdownDocument38 pagesLeverage Analysis BreakdownMariePas encore d'évaluation

- Responsibility AccountingDocument3 pagesResponsibility AccountinglulughoshPas encore d'évaluation

- Marginal & Differential CostingDocument11 pagesMarginal & Differential CostingShahenaPas encore d'évaluation

- CORRECTING FINANCIAL STATEMENT ERRORSDocument56 pagesCORRECTING FINANCIAL STATEMENT ERRORSKimberly Pilapil MaragañasPas encore d'évaluation

- Course Book 2018-2019Document40 pagesCourse Book 2018-2019AdrianaPas encore d'évaluation

- Chapter 7 Risk and Rates of ReturnDocument16 pagesChapter 7 Risk and Rates of Returnsekolah futsalPas encore d'évaluation

- Magnachip Case StudyDocument6 pagesMagnachip Case Studyapi-282483815Pas encore d'évaluation

- Audit Sampling ConceptsDocument41 pagesAudit Sampling ConceptsMisshtaCPas encore d'évaluation

- Cost Volume Profit CRDocument28 pagesCost Volume Profit CRMichiko Kyung-soonPas encore d'évaluation

- ReviewerDocument43 pagesReviewergnim1520Pas encore d'évaluation

- Accounts Receivable - Demo TeachingDocument59 pagesAccounts Receivable - Demo TeachingNicole Flores100% (1)

- Relevant CostsDocument46 pagesRelevant CostsManzzie100% (1)

- CW6 - MaterialityDocument3 pagesCW6 - MaterialityBeybi JayPas encore d'évaluation

- CPA Review School Philippines Final Preboard ExamDocument13 pagesCPA Review School Philippines Final Preboard ExamMyAccntPas encore d'évaluation

- Shareholder's Equity: ReviewDocument12 pagesShareholder's Equity: ReviewG7 HexagonPas encore d'évaluation

- Test Bank Ch6 ACCTDocument89 pagesTest Bank Ch6 ACCTMajed100% (1)

- Quiz on Decentralization and Performance EvaluationDocument6 pagesQuiz on Decentralization and Performance EvaluationマーチンMartinPas encore d'évaluation

- Acctg 15 - Midterm ExamDocument6 pagesAcctg 15 - Midterm ExamAngelo LabiosPas encore d'évaluation

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Auditing Attestation and AssuranceDocument10 pagesAuditing Attestation and Assurancechiji chzzzmeowPas encore d'évaluation

- Absorption CostingDocument3 pagesAbsorption CostingThirayuth BeePas encore d'évaluation

- #15 Investment in AssociatesDocument3 pages#15 Investment in AssociatesZaaavnn VannnnnPas encore d'évaluation

- MAS-07: RESPONSIBILITY ACCOUNTING & TRANSFER PRICINGDocument7 pagesMAS-07: RESPONSIBILITY ACCOUNTING & TRANSFER PRICINGClint AbenojaPas encore d'évaluation

- Auditing Theory Review Notes (AT-3) Page 1 of 13: Industry ConditionsDocument13 pagesAuditing Theory Review Notes (AT-3) Page 1 of 13: Industry ConditionsJane Michelle EmanPas encore d'évaluation

- Ob7e Ge Imchap006Document22 pagesOb7e Ge Imchap006Hemant HuzooreePas encore d'évaluation

- Related Party DisclosuresDocument15 pagesRelated Party DisclosuresArthur PlazaPas encore d'évaluation

- Lecture 13 Provisions and ContingenciesDocument23 pagesLecture 13 Provisions and ContingenciesWinston 葉永隆 DiepPas encore d'évaluation

- Chapter 4 Underlying AssumptionsDocument7 pagesChapter 4 Underlying AssumptionsMicsjadeCastilloPas encore d'évaluation

- Inventory Estimation MethodsDocument14 pagesInventory Estimation Methodskrisha milloPas encore d'évaluation

- Bsat 2019Document23 pagesBsat 2019rowena adobasPas encore d'évaluation

- Aging of Accounts ReceivableDocument2 pagesAging of Accounts ReceivableAira Nicole SabornidoPas encore d'évaluation

- Case 8-31: April May June QuarterDocument2 pagesCase 8-31: April May June QuarterileviejoiePas encore d'évaluation

- At 1 Theory Palang With Questions 1Document12 pagesAt 1 Theory Palang With Questions 1Sharmaine JoycePas encore d'évaluation

- Ia2 Prob 1-32 & 33Document1 pageIa2 Prob 1-32 & 33maryaniPas encore d'évaluation

- Accounting Standard-18: Related Party DisclosureDocument26 pagesAccounting Standard-18: Related Party DisclosurelulughoshPas encore d'évaluation

- Chapter 4 Auditing Database Systems (Multiple Choice)Document3 pagesChapter 4 Auditing Database Systems (Multiple Choice)belle cris100% (1)

- Ap 06 REO Receivables - PDF 074431Document19 pagesAp 06 REO Receivables - PDF 074431ChristianPas encore d'évaluation

- This Study Resource Was: Profit Loss Profit LossDocument9 pagesThis Study Resource Was: Profit Loss Profit LossrogealynPas encore d'évaluation

- IFRS 11 SummaryDocument4 pagesIFRS 11 SummaryJoshua Capa Fronda100% (1)

- Cost Classification Lecture NotesDocument7 pagesCost Classification Lecture Notesmichellebaileylindsa100% (1)

- Cost Accounting Questions and Their AnswersDocument5 pagesCost Accounting Questions and Their Answerszulqarnainhaider450_Pas encore d'évaluation

- Cost accounting systems productivity measuresDocument5 pagesCost accounting systems productivity measuresrandyPas encore d'évaluation

- Revenue Cycle TestsDocument3 pagesRevenue Cycle TestsFaith Reyna TanPas encore d'évaluation

- Financial Asset MILLANDocument6 pagesFinancial Asset MILLANAlelie Joy dela CruzPas encore d'évaluation

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamPas encore d'évaluation

- Trial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesDocument24 pagesTrial Balance To Profit & Loss A/c and Balance Sheet For Corporate & Non-Corporate EntitiesChintan PatelPas encore d'évaluation

- US CMA - Part 1 TerminologyDocument127 pagesUS CMA - Part 1 TerminologyamitsinghslidesharePas encore d'évaluation

- Chapter 2 Business SustainabilityDocument4 pagesChapter 2 Business SustainabilitykajsdkjqwelPas encore d'évaluation

- Formula Sheet for Portfolio Risk and ReturnDocument1 pageFormula Sheet for Portfolio Risk and ReturnkajsdkjqwelPas encore d'évaluation

- Music Makes You SmarterDocument9 pagesMusic Makes You SmarterkajsdkjqwelPas encore d'évaluation

- Investments Revision NotesDocument3 pagesInvestments Revision NoteskajsdkjqwelPas encore d'évaluation

- TUTORIAL 3 - Case & Questions (PEDIGREE Adoption Drive)Document7 pagesTUTORIAL 3 - Case & Questions (PEDIGREE Adoption Drive)kajsdkjqwelPas encore d'évaluation

- Sample Completed OHS TrainingNeedsPlanDocument1 pageSample Completed OHS TrainingNeedsPlankajsdkjqwelPas encore d'évaluation

- Student Example Report DellDocument42 pagesStudent Example Report DellkajsdkjqwelPas encore d'évaluation

- BSBMGT401A Assess Part B Element 3Document1 pageBSBMGT401A Assess Part B Element 3kajsdkjqwelPas encore d'évaluation

- Chapter 1 Introduction To AccountingDocument7 pagesChapter 1 Introduction To AccountingkajsdkjqwelPas encore d'évaluation

- Safe Work Procedure Step LadderDocument1 pageSafe Work Procedure Step LadderkajsdkjqwelPas encore d'évaluation

- BSBITU402A Dev Use Complex Spreadsheets Assess4Document6 pagesBSBITU402A Dev Use Complex Spreadsheets Assess4kajsdkjqwelPas encore d'évaluation

- IFA Week 3 Tutorial Solutions Brockville SolutionsDocument9 pagesIFA Week 3 Tutorial Solutions Brockville SolutionskajsdkjqwelPas encore d'évaluation

- French HistoriographyDocument5 pagesFrench Historiographykajsdkjqwel100% (1)

- Summary SheetDocument4 pagesSummary SheetkajsdkjqwelPas encore d'évaluation

- ThemesDocument2 pagesThemeskajsdkjqwelPas encore d'évaluation

- French HistoriographyDocument5 pagesFrench Historiographykajsdkjqwel100% (1)

- Answering Assignment QuestionsDocument4 pagesAnswering Assignment Questionskajsdkjqwel100% (1)

- Sample Completed OHS TrainingNeedsPlanDocument1 pageSample Completed OHS TrainingNeedsPlankajsdkjqwelPas encore d'évaluation

- Intro Micro Assignment 1Document12 pagesIntro Micro Assignment 1kajsdkjqwelPas encore d'évaluation

- Chapter 5 Balance SheetDocument9 pagesChapter 5 Balance SheetkajsdkjqwelPas encore d'évaluation

- Why a Statement of Cash Flows is Critical for Business SuccessDocument5 pagesWhy a Statement of Cash Flows is Critical for Business SuccesskajsdkjqwelPas encore d'évaluation

- Task 4 - Employee Performance AppraisalDocument1 pageTask 4 - Employee Performance AppraisalkajsdkjqwelPas encore d'évaluation

- Sample OHS TrainingNeedsAnalysisDocument2 pagesSample OHS TrainingNeedsAnalysiskajsdkjqwelPas encore d'évaluation

- Sample OHS TrainingNeedsAnalysisDocument2 pagesSample OHS TrainingNeedsAnalysiskajsdkjqwelPas encore d'évaluation

- MSFW13 Volunteer Position Description - Event AssistantDocument1 pageMSFW13 Volunteer Position Description - Event AssistantkajsdkjqwelPas encore d'évaluation

- Third Party Report for Developing Teams and IndividualsDocument2 pagesThird Party Report for Developing Teams and IndividualskajsdkjqwelPas encore d'évaluation

- ECON10005 Lecture 3Document11 pagesECON10005 Lecture 3kajsdkjqwelPas encore d'évaluation

- Chapter 1 Introduction To AccountingDocument7 pagesChapter 1 Introduction To AccountingkajsdkjqwelPas encore d'évaluation

- Training Plan BSB40207Document1 pageTraining Plan BSB40207kajsdkjqwelPas encore d'évaluation

- Financial Consultant Excel SkillsDocument1 pageFinancial Consultant Excel SkillsOlgaPas encore d'évaluation

- NSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedDocument24 pagesNSU FALL 2012 FIN254.9 Term Paper On Aramit LimitedSamaan RishadPas encore d'évaluation

- American Medical Assn. v. United States, 317 U.S. 519 (1943)Document9 pagesAmerican Medical Assn. v. United States, 317 U.S. 519 (1943)Scribd Government DocsPas encore d'évaluation

- Consumer Buying Behaviour - FEVICOLDocument10 pagesConsumer Buying Behaviour - FEVICOLShashank Joshi100% (1)

- How industrial engineering can optimize mining operationsDocument6 pagesHow industrial engineering can optimize mining operationsAlejandro SanchezPas encore d'évaluation

- Living To Work: What Do You Really Like? What Do You Want?"Document1 pageLiving To Work: What Do You Really Like? What Do You Want?"John FoxPas encore d'évaluation

- Filipino Terminologies For Accountancy ADocument27 pagesFilipino Terminologies For Accountancy ABy SommerholderPas encore d'évaluation

- Swift MessageDocument29 pagesSwift MessageAbinath Stuart0% (1)

- Moneyback and EndowmentDocument14 pagesMoneyback and EndowmentSheetal IyerPas encore d'évaluation

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterprisePas encore d'évaluation

- Customer Sample Report BSR For S4hanaDocument79 pagesCustomer Sample Report BSR For S4hanaHarpy AhmedPas encore d'évaluation

- Stars 1.06Document22 pagesStars 1.06ratiitPas encore d'évaluation

- CF Wacc Project 2211092Document34 pagesCF Wacc Project 2211092Dipty NarnoliPas encore d'évaluation

- Israel SettlementDocument58 pagesIsrael SettlementRaf BendenounPas encore d'évaluation

- Det Syll Divisional Accountant Item No 19Document2 pagesDet Syll Divisional Accountant Item No 19tinaantonyPas encore d'évaluation

- Special Offers to Colombo from London on SriLankan AirlinesDocument32 pagesSpecial Offers to Colombo from London on SriLankan AirlinesSri Sakthi SumananPas encore d'évaluation

- CVP Solutions and ExercisesDocument8 pagesCVP Solutions and ExercisesGizachew NadewPas encore d'évaluation

- Allen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Document9 pagesAllen Solly (Retail Managemant Project Phase 1) (Chandrakumar 1501009)Chandra KumarPas encore d'évaluation

- Kotler & Keller (Pp. 325-349)Document3 pagesKotler & Keller (Pp. 325-349)Lucía ZanabriaPas encore d'évaluation

- Analyzing Transactions and Double Entry LectureDocument40 pagesAnalyzing Transactions and Double Entry LectureSuba ChaluPas encore d'évaluation

- MD - Nasir Uddin CVDocument4 pagesMD - Nasir Uddin CVশুভবর্ণPas encore d'évaluation

- SC upholds conviction for forgery under NILDocument3 pagesSC upholds conviction for forgery under NILKobe Lawrence VeneracionPas encore d'évaluation

- Finance TestDocument3 pagesFinance TestMandeep SinghPas encore d'évaluation

- Accountancy Answer Key Class XII PreboardDocument8 pagesAccountancy Answer Key Class XII PreboardGHOST FFPas encore d'évaluation

- IBM Brand Equity Restoration and Advertising EvolutionDocument17 pagesIBM Brand Equity Restoration and Advertising EvolutionJuandtaPas encore d'évaluation

- Supply Chain Management Course Syllabus for Integrated MBADocument4 pagesSupply Chain Management Course Syllabus for Integrated MBAJay PatelPas encore d'évaluation

- VRS NotesDocument82 pagesVRS NotesrisingiocmPas encore d'évaluation

- Financial Statement of A CompanyDocument49 pagesFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- Expertise in trade finance sales and distributionDocument4 pagesExpertise in trade finance sales and distributionGabriella Njoto WidjajaPas encore d'évaluation

- Case Study: When in RomaniaDocument3 pagesCase Study: When in RomaniaAle IvanovPas encore d'évaluation