Académique Documents

Professionnel Documents

Culture Documents

Project - 111

Transféré par

King Nitin AgnihotriTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Project - 111

Transféré par

King Nitin AgnihotriDroits d'auteur :

Formats disponibles

H Y D E R A B AD

PREFACE

Preparing a project of this nature is an arduous task and I was fortunate enough to get support from a large number o persons. I wish to express my deep sense of gratitude to all those who generously helped in successful completion of this report by sharing their invaluable time and knowledge. It is my proud and previledge to express my deep regards to Respected HOD Dr.Pramesh Gautam, Head of Department of Business Management , SVN.I.T. SAGAR for allowing me to undertake this project. I feel extremely exhilarated to have completed this project under the able and inspiring guidance of Dr. Pramesh Gautom he rendered me all possible help me guidance while reviewing the manuscript in finalising the report. I also extend my deep regards to my teachers , family members , friends and all those whose

1 |Page

H Y D E R A B AD

encouragement has infused courage in me to complete to work successfully.

BRIJESH TAMRAKAR MBA IIND SEM.

ACKNOWLEDGEMENT

Preparing a project of this nature is an arduous task and I was fortunate enough to get support from a large number o persons. I wish to express my deep sense of gratitude to all those who generously helped in successful completion of this report by sharing their invaluable time and knowledge. It is my proud and previledge to express my deep regards to Respected , Head of Department Dr.Pramesh Gautam,

Department of Business Management , S.V.N.I.T. SAGAR for allowing me to undertake this project. I feel extremely exhilarated to have completed this project under the able and inspiring guidance of He rendered me all possible help me guidance while reviewing the manuscript in finalising the report. I also extend my deep regards to my teachers , family members , friends and all those whose encouragement has infused courage in me to complete to work successfully.

2 |Page

H Y D E R A B AD

BRIJESH TAMRAKAR MBA IIND SEM.

DELCLARATION BY THE CANDIDATE

Date :

I declare that the project report titled

"

A STUDY OF

APPRAISING POLICIES OF MAX NEW YORK" on Market

Segmentation is nay own work conducted under the supervision of DR. PRAMESH GAUTAM Department of Business

Management,

S.V.N.I.T. SAGAR To the best of my

knowledge the report does not contain any work , which has been submitted for the award of any degree , anywhere.

BRIJESH TAMRAKAR

3 |Page

H Y D E R A B AD

MBA IIND SEM.

CERTIFICATE

The project report " A STUDY OF APPRAISING

POLICIES OF MAX NEW YORK"

been prepared by SEM. of DR.

BRIJESH

TAMRAKAR

MBAII

PRAMESH GAUTAM for the partial fulfillment of the Degree of MBA

4 |Page

H Y D E R A B AD

Signature of the Supervisor

Signature of the Head of the Department

Signature of the Examiner

CONTENTS

PREFACE ACKNOWLEDGEMENT CERTIFICATE DECLARATION CHAPTER I INTRODUCTION ABOUT PROJECT AN INSIGHTOF COMPANY HISTORY MISSION AND VISION STANDING POSITION OF COMPANY BRAND VALUE CHAPTER II OBJECTIVE OF THE STUDY CHAPTER III RESEARCH METHODOLOGY CHAPTER IV MARKET ANALYSIS

5 |Page

H Y D E R A B AD

OVERVIEW BRANDS CHAPTER V CONSUMER GROUPS CONSUMER BEHAVIOUR CHAPTER VI PRODUCT PROFILE PLAN FOR PRODUCT MIX PRODUCT RANGE CHAPTER VII MARKETING STRATEGY PRICING POSITION AND DISTRIBUTION PROMOTION CHAPTER VIII ABOUT COMPETITORS COMPETITOR FOR PRODUCT PRICE OF COMPETITOR PRODUCT CHAPTER IX DATA ANALYSISAND INTERPRETATION CHAPTER X LIMITATION CHAPTER XI CONCLUSION & SUGGESTION BIBLIOGRAPHY QUESTIONNAIRE

INTRODUCTION

INSURANCE

INTRODUCTION:The story of insurance is probably as old as the story of mankind. The same instinct that prompts modern businessmen today to secure themselves against loss and disaster existed in primitive men also. They too sought to avert the evil consequences of fire and flood and loss of life and were willing to make some sort of sacrifice in order to achieve security. Though the concept of insurance is largely

6 |Page

H Y D E R A B AD

a development of the recent past, particularly after the industrial era past few centuries yet its beginnings date back almost 6000 years.

MEANING OF INSURANCE:Insurance is a policy from a large financial institution that offers a person, company, or other entity reimbursement or financial protection against possible future losses or damages. DEFINITION OF INSURANCE:Insurance is defined as form of contract or agreement under which one party agrees in return for a consideration to pay an agreed amount of moNEW to another party to make good a loss, damage or injury to something value, as a result of some uncertain event in which the insured has pecuniary interest.

PRINCIPLES OF INSURANCE

1. Utmost good faith 2. Indemnity 3. Subrogation 4. Contribution

7 |Page

H Y D E R A B AD

5. Insurable Interest 6. Proximate Cause

1. Utmost Good Faith As a client it is your duty to disclose all material facts to the risk being covered. A material fact is a fact which would influence the mind of a prudent underwriter in deciding whether to accept a risk for insurance and on what terms. The duty to disclose operates at the time of inception, at renewal and at any point midterm. 2. Indemnity On the happening of an event insured against, the Insured will be placed in the same monetary position that he/she occupied immediately before the event taking place. In the event of a claim the insured must:

Prove that the event occurred Prove that a monetary loss has occurred Transfer any rights which he/she may have for recovery from another source to the Insurer, if he/she has been fully indemnified.

3. Subrogation The right of an insurer which has paid a claim under a policy to step into the shoes of the insured so as to exercise in his name all rights he might have with regard to the recovery of the loss which was the subject of the relevant claim paid under the

8 |Page

H Y D E R A B AD

policy up to the amount of that paid claim. The insurers subrogation rights may be qualified in the policy. In the context of insurance subrogation is a feature of the principle of indemnity and therefore only applies to contracts of indemnity so that it does not apply to life assurance or personal accident policies. It is intended to prevent an insured recovering more than the indemnity he receives under his insurance (where that represents the full amount of his loss) and enables his insurer to recover or reduce its loss. 4. Contribution The right of an insurer to call on other insurers similarly, but not necessarily equally, liable to the same insured to share the loss of an indemnity payment i.e. a travel policy may have overlapping cover with the contents section of a household policy. The principle of contribution allows the insured to make a claim against one insurer who then has the right to call on any other insurers liable for the loss to share the claim payment. 5. Insurable Interest If an insured wishes to enforce a contract of insurance before the Courts he must have an insurable interest in the subject matter of the insurance, which is to say that he stands to benefit from its preservation and will suffer from its loss. In non-marine insurances, the insured must have insurable interest when the policy is taken out and also at the date of loss giving rise to a claim under the policy. 6. Proximate Cause An insurer will only be liable to pay a claim under an insurance contract if the loss that gives rise to the claim was proximately caused by an insured peril. This means that the loss must be directly attributed to an insured peril without any break in the chain of causation.

9 |Page

H Y D E R A B AD

TYPES OF INSURANCE 1. LIFE INSURANCE 2. GENERAL INSURANCE 3. HEALTH INSURANCE 4. CREDIT INSURANCE 5. PROPERTY INSURANCE

6. 7. 8.

LIABILITY INSURANCE TRAVEL INSURANCE AUTO INSURANCE

10 | P a g e

H Y D E R A B AD

HISTORY

LIFE INSURANCE Fun is like life insurance; the older you get, the more it costs.

In 1818 the British established the first insurance company in India in Calcutta, the Oriental Life Insurance Company. First attempts at regulation of the industry were made with the introduction of the Indian Life Assurance Companies Act in 1912. A number of amendments to this Act were made until the Insurance Act was drawn up in 1938. In the Act were the power given to the Government to collect statistical information about the insured and the high level of protection the Act gave to the public through regulation and control. When the Act was changed in 1950, this meant far reaching changes in the industry. The extra requirements included a statutory requirement of a certain level of equity capital, a ceiling on share holdings in such companies to prevent dominant control (to protect the public

11 | P a g e

H Y D E R A B AD

from any adversarial policies from one single party), stricter control on investments and, generally, much tighter control. In 1956, the market contained 154 Indian and 16 foreign life insurance companies. Business was heavily concentrated in urban areas and targeted the higher echelons of society. Unethical practices adopted by some of the players against the interests of the consumers then led the Indian government to nationalize the industry. In September 1956, nationalization was completed, merging all these companies into the so- called Life Insurance Corporation (LIC). It was felt that nationalization has lent the industry fairness, solidity, growth and reach. Some of the important milestones in the life insurance business in India are: 1912: The Indian Life Assurance Companies Act enacted as the first statute to regulate the life insurance business. 1928: The Indian Insurance Companies Act enacted to enable the government to collect statistical information about both life and non-life insurance businesses. 1938: Earlier legislation consolidated and amended to by the Insurance Act with the objective of protecting the interests of the insuring public. 1956: The market contained 154 Indian and 16 foreign life insurance companies. 1. GENERAL INSURANCE:The General insurance business in India started with the establishment of Triton Insurance Company Limited in 1850 at Calcutta. In 1907, the first company, The Mercantile Insurance Ltd. Was set up to transact all classes of general insurance business. General Insurance Council, a wing of the Insurance Association of India in 1957, framed a code of conduct for ensuring fair conduct and sound business practices. In 1968 the Insurance Act was amended to regulate investments and to set minimum solvency margins.

12 | P a g e

H Y D E R A B AD

In the same year the Tariff Advisory Committee was also set up. In 1972, The General Insurance Business (Nationalization) Act was passed to nationalize the general insurance business in India with effect from 1st January 1973. For these 107 insurers was amalgamated and grouped into four companys viz., the National Insurance Company Ltd., the New India Assurance Company Ltd., the Oriental Insurance Company Ltd., and the United India Insurance Company Ltd. General Insurance Corporation of India was incorporated as a company. Some of the important milestones in the general insurance business in India are: 1907: The Indian Mercantile Insurance Ltd. set up, the first company to transact all classes of general insurance business. 1957: General Insurance Council, a wing of the Insurance Association of India, frames a code of conduct for ensuring fair conduct and sound business practices. 1968: The Insurance Act amended to regulate investments and set minimum solvency margins and the Tariff Advisory Committee set up. 1972: The General Insurance Business (Nationalization) Act, 1972 nationalize the general insurance business in India with effect from 1st January 1973. 107 insurers amalgamated and grouped into four companies viz. the National Insurance Company Ltd., the New India Assurance Company Ltd., the Oriental Insurance Company Ltd. and the United India Insurance Company Ltd. GIC incorporated as a company.

VISION AND MISSTION

VISION To become one of the most admired life insurance company of India. MISSION Become one of the top quartile life insurance companies in India Be a national player Be the brand of first choice Be the employer of choice

13 | P a g e

H Y D E R A B AD

Become principal of choice for agents

VALUES Knowledge: Knowledge leads to expertise; and our expertise is in helping people protect themselves. Perfectly combining global expertise with local knowledge, we are India's life insurance specialist. Max New York Life believes that for knowledge to be of value it must be focused, current, tested and shared. Caring: Max New York Life is redefining the life insurance paradigm by focusing on customers first. The service process is responsive, personalized, humane and empathetic. Every individual who represents the company is for us our brand champion. Honesty: Honesty is the heart of the life insurance business. It is all about trust. Transparency, integrity and dependability form the cornerstones of the Max New York Life experience. The company ensures that everyone who represents the brand carries a promise : we care in word as well as deed. Excellence: Excellence at Max New York Life implies the ability to perform at a consistently high level. Focused on the value of continuous improvement in people, processes and the organization, the company strives for the highest standards of quality in every aspect of its business.

14 | P a g e

H Y D E R A B AD

OBJECTIVE OF THE STUDY

To find out market share of Insrance. To study the awareness level of MAX.products. To find out various types of Organizations. To find out the requirements in Infrastructure of various Organizations. Insurance being used by various

15 | P a g e

H Y D E R A B AD

To compare other Companies with Max on various Insurance parameters. To promote the MAX.products. To find out marketing strategy of Max newyorks .

RESEARCH METHODOLOGY

RESEARCH DESIGN

16 | P a g e

H Y D E R A B AD

A research design is a framework or blueprint for conducting the marketing research project. It specifies the details of the procedures necessary for obtaining the information needed to structure and/or solve marketing research problem. On the basis of fundamental objectives of the research we can classify research design into two general types: 1) EXPLORATORY RESEARCH 2) CONCLUSIVE RESEARCH Exploratory research is one type of research design, which has its primary objective the provision of insights into, and comprehension of, the problem situation confronting the researcher. Conclusive research is designed to assist the decision maker in determining evaluating and selecting the best course of action to take in a given situation.

Conclusive research can be further divided into two types: Descriptive Experimental The research design used in this project is a DESCRIPTIVE DESIGN.

Descriptive study as the name implies is designed to describe something-for example the characteristics of users of a given product, the degree to which the product use the varies with income, age, etc.

SAMPLING TECHNIQUE USED: This research has used convenience sampling technique. 1) Convenience sampling technique: Convenience sampling is used in exploratory research where the researcher is interested in getting an

17 | P a g e

H Y D E R A B AD

inexpensive approximation of the truth. As the name implies, the sample is selected because they are convenient. SELECTION OF SAMPLE SIZE: For the study, a sample size of 30 has been taken into consideration. SOURCES OF DATA COLLECTION: Rsearch will be based on two sources: 1. Primary data 2. Secondary data 1) PRIMARY DATA: Questionnaire: Primary data was collected by preparing questionnaire and the people were randomly being requested to fill them. 2) SECONDARY DATA: Secondary data will consist of different literatures like books which are published, articles, internet and websites. In order to reach relevant conclusion, research work needed to be designed in a proper way. STATISTICAL TOOLS USED The main statistical tools used for the collection and analyses of data in this project are: Questionnaire Pie Charts Bar Charts Line Charts Column Charts Gender M/F

18 | P a g e

H Y D E R A B AD

Area

Rural / Urban

MARKETING ANALYSIS

Market Research for the project was conducted in Delhi and Ghaziabad. It is adescriptive type of research and sampling for responses is simple randomsamplin g. The sample size for the research is 100 for comparative analysis and100 for recruiting Life Advisors.Till date the customers still believe in government sector i.e. LIC but one thing canalso be kept in mind that till 1999 LIC had a 100% market share. From the survey Ihave also found out that a very people are insured and the interesting fact is thatthe persons who are insured, very few know about the type of policy they havetaken.Max New York Life has not yet come into terms with the common people. Thismay be because Max New York Life is new to the market as compared to other Insurance companies like ICICI Prudential, Allianz Bajaj etc. While recruiting Life Advisors one very significant thing I found out that th epersons whose house hold income is in between 2-5 lakhs are or were involved ininsurance business. The persons who are below the age of 25 years were notkeen to join theinsurance sector as compared to those who are in between 25-30 years of age.Also the persons who are in insurance business have a willingness to join theprivate companies.In the survey I have also found out the persons who are working and the studentswere keen in taking on line training as compared to housewives and retiredpersons

19 | P a g e

H Y D E R A B AD

CONSUMER GROUPS

CUSTOMER SATISFACTION: Customer satisfaction refers to the extent to which customers are happy with the products and services provided by a business. Gaining high levels of customer satisfaction is very important to a business because satisfied customers are most likely to be loyal and to make repeated orders and to use a wide range of services offered by a business. Since sales are the most important goal of any commercial enterprise, it becomes necessary to satisfy customers. For customer satisfaction it is necessary to establish and maintain certain important characteristics like: a. Quality b. Fair prices c. Good customer handling skills d. Efficient delivery e. Serious consideration of consumer complaints. Satisfaction is the feeling of pleasure or disappointment attained from comparing a products perceived performance (outcome) in relation to his or her expectations. If the performance falls short of expectations, the customer is dissatisfied. If the performance matches the expectations, the customer is

20 | P a g e

H Y D E R A B AD

satisfied. If the performance exceeds expectations, the customer is highly satisfied or delighted. MNYL is an ISO 9001-2001 Certified Company. Some of the benefits it provides to its customers are as follows: MNYL issues Policies to its customers in quick time and with maximum accuracy. Fast settlement of Claims and demonstrate reliability and trust our customers Effective touch points for the customers who are regularly working towards resolving customers queries and needs. MNYL is constantly designing products keeping in mind long term customer benefits and responsibly fulfill the regulatory requirements. amongst

21 | P a g e

H Y D E R A B AD

CUSTOMER DEVELOPMENT PROCESS

Potentials Prospects First time customers Repeat customers Inactive or Ex-customers Disqualified Prospects

Clients

Members

CUSTOMER RELATIONSHIP MANAGEMENT: CUSTOMER RELATIONSHIP Advocates MANAGEMENT is the process of carefully

managing detailed information about individual customers and all customers touch

22 | P a g e Partners

H Y D E R A B AD

points to maximize customer loyalty. A customer touch point is any occasion on which a customer encounters the brand and product-from actual experience to personal or mass communications to casual observation. Max New York Life Insurance Company has also undertaken various steps to strengthen its customer relationship management.

Max New York Life Insurance has announced the introduction of INTERACTIVE VOICE RESPONSE (IVR) service in 10 different languages. The leap is in a bid to enhance and improve max New York Lifes customer and distributor experience by availing the customer service in their own language. Sanjeev Mago, executive vice president, Customer Operations and Service Delivery, Max New York Life Insurance, said, "This initiative is yet another step towards improving customer satisfaction by enhancing their ease of resolving pre and post policy issues. At Max New York Life, we lay emphasis in

PRODUCT PROFILE

23 | P a g e

H Y D E R A B AD

Max New York Life Insurance Company Ltd. is a joint venture between Max India Limited, one of India's leading multi-business corporations and New York Life International, the international arm of New York Life, a Fortune 100 company. The company has positioned itself on the quality platform. In line with its vision to be the most admired life insurance company in India, it has developed a strong corporate governance model based on the core values of excellence, honesty, knowledge, caring, integrity and teamwork.

Incorporated in 2000, Max New York Life (MNYL) started commercial operation in 2001. In line with its values of financial responsibility, Max New York Life has adopted prudent financial practices to ensure safety of policyholder's funds. The Company's paid up capital as on 30th April, 2009 is Rs 1782 crore. MYNL shares a market share of 5.9% in the life insurance sector.

MNYL has multi-channel distribution spread across the country. Agency distribution is the primary channel complemented by partnership distribution, banc assurance, alliance marketing and dedicated distribution for emerging markets. The Company places a lot of emphasis on its selection process for agent advisors, which comprises four stages - screening, psychometric test, career seminar and final interview. The agent advisors are trained in-house to ensure optimal control on quality of training. The company currently has around 92,760 agent advisors at 710 offices across 385 cities. The company also has 36 referral tie-ups with banks, 24 partnership distribution and alliance marketing relationships each. Max New York Life has put in place a unique hub and spoke model of distribution to deepen our rural penetration. The company has 133 offices dedicated to rural areas.

24 | P a g e

H Y D E R A B AD

MNYL offers a suite of flexible products. It now has 43 life insurance products and 8 riders that can be customized to over 800 combinations enabling customers to choose the policy that best fits their need. The company currently has more than 13,923 employees. HOW NEW YORK LIFE ENTERED THE INDIAN MARKET:-

25 | P a g e

H Y D E R A B AD

New York Life International, INC., a Fortune 100 company, decided to select JOINT VENTURE as a medium to enter into the market of India. It has chosen MAX INDIA LTD., one of the Indias leading multi-business corporations. Through its wide network of highly competent wide network of highly competent agent advisors and flexible product solutions, MYNL is creating a partnership for life with its customers in INDIA to meet their life stage needs.. VISION To become one of the most admired life insurance company of India. Strong Corporate Governance Model MISSION

Become one of the top quartile life insurance companies in India Be a national player Be the brand of first choice Be the employer of choice Become principal of choice for agents VALUES

Knowledge: Knowledge leads to expertise; and our expertise is in helping people protect themselves. Perfectly combining global expertise with local knowledge, we are India's life insurance specialist. MNYL believes that for knowledge to be of value it must be focused, current, tested and shared. Caring: MNYL is redefining the life insurance paradigm by focusing on customers first. The service process is responsive, personalized, humane and empathetic. Every individual who represents the company is for us our brand champion. Honesty:

26 | P a g e

H Y D E R A B AD

Honesty is the heart of the life insurance business. It is all about trust. Transparency, integrity and dependability form the cornerstones of the MNYL experience. The company ensures that everyone who represents the brand carries a promise: we care in word as well as deed. Excellence: Excellence at MNYL implies the ability to perform at a consistently high level. Focused on the value of continuous improvement in people, processes and the organization, the company strives for the highest standards of quality in every aspect of its business ACHEIVEMENTS

MNYL Insurance felicitated with the Golden Peacock Innovation Award for the year 2008 for Excellence in innovation in conceptualizing and marketing Max Vijay.

MNYL is the first life insurance company in India to be awarded the IS0 9001:2000 certification. MNYL was among the top 25 companies to work with in India, according to 2003 Business World magazine, "Great Workplaces In India", MNYL was ranked at the 20th position. This survey is the local version of the "Great Places To Work" survey carried out every year in 22 countries. Been among top five most respected private life insurance companies in India according to a 2004 and 2006 Business World survey. MNYL Insurance has emerged as one of the best employer in the recently announced Business Today-Mercer-TNS Survey of 'The Best Companies to

27 | P a g e

H Y D E R A B AD

Work For in India'. The company was ranked 7th in the survey and the best life insurance company to work for in India.

THE MAX VIJAY NEW PRODUCT DEVELOPMENT PROCESS A. IDEA GENERATION Since no other insurance company had ventured into the rural market, MNYL came with an idea to serve the lower strata of the society, which represents the maximum population in the country.

B. IDEA SCREENING Since Uttar Pradesh is the biggest and the most populous state in India, the company strategists suggested implementing Max Vijay scheme in all the 52 districts of the state. They felt that there would not be any dearth in the number of people who are ambitious and wish to achieve something in their lives, in such a populous state.

28 | P a g e

H Y D E R A B AD

C. CONCEPT DEVELOPMENT AND TESTING The scheme would be valid for 10 years Maturity period 10 years Max Vijay would give a choice to the customer for making payment using three premium options 1) Rajat 2) Swarna 3) Heera The sum assured from the policy is guaranteed with choice to invest any amount ranging from Rs.10 to Rs.2500000, anytime, anywhere

29 | P a g e

H Y D E R A B AD

D. MARKETING STRATEGY DEVELOPMENT Affordable, accessible and flexible Widespread distribution network Payment through neighborhood retail outlets and grocery stores NGOs E. BUSINESS ANALYSIS MNYL has set a target of achieving a collection of Rs.100 Crore premium in three months through Max Vijay scheme.

30 | P a g e

H Y D E R A B AD

It further plans to implement the scheme to 50,000 customers in 52 districts through 15000 counters. F. PRODUCT DEVELOPMENT Minimum formality in buying the policy Premium can be paid easily just like TOPPING UP A MOBILE

G. MARKET TESTING Before launching the scheme throughout India, they have chosen the state of Uttar Pradesh as a pilot project ( - testing). This also ensured that any drawbacks and loopholes, if any, would be corrected before launching the scheme nationwide.

H. COMMERCIALIZATION Commercialization involves the following four processes: 1) WHEN (timing): In commercializing a new product like Max Vijay, market entry timing is critical. MNYL was first to capitalize the opportunity created during the financial crisis and enter the untapped market. 2) WHERE (geographical strategy): Uttar Pradesh, the biggest and the most populous state was chosen. 3) TO WHOM (target market): Lower strata of the population, Rural India. 4) HOW:

31 | P a g e

H Y D E R A B AD

Tie up with Indian Oil Corporation: 2000 Kisan Seva Kendras Outsourcing agreement with technology major, IBM Recently, Mr. Amitabh Bacchan was roped in as the brand ambassador for Max Vijay product. The reason behind using him as a Brand ambassador is his strong association with the character Vijay who symbolized peoples hero who fought for the cause of the common man by standing up for their rights. His appointment as the brand ambassador for Max Vijay is a rebirth of the old Vijay, who is today propagating the cause of small savings and financial inclusion for the underserved masses of the country.

32 | P a g e

H Y D E R A B AD

33 | P a g e

H Y D E R A B AD

ULTI CHANNEL DISTRIBUTION MNYL has mainly used ZERO Level channels to sell its products to the customers. This helps in removal of the intermediaries which dilutes the profit. The various channels employed are: Insurance Agents Direct Selling Agents Internet Banc-assurance (First level): Here the Banks act as a mediator between MNYL & the customer. Hence it comes under the First Level Channel for distribution. Eg: It has tied up with Andhra Pradesh Rural Bank to distribute its products.

34 | P a g e

H Y D E R A B AD

35 | P a g e

H Y D E R A B AD

Different Channels of Distribution i) Agency Channel:- In MNYL , business is done mainly through Agent Advisor. In India it has more than 55000 agents. Two Programs are run under Agency Channel AAP(Agency Association Program) CEIP ii) Banc assurance: Banc assurance is an innovative distribution channel involving banks to sell insurance products of Insurance Companies. MNYL has tied up with several banks iii) Direct Sales Team(DST ):- Max New York Life Insurance makes a data base of potential customers; contact them on the telephone to market different policy of the company. iv) Alternate channel- Business is done through associate partners, internet etc.

36 | P a g e

H Y D E R A B AD

PRODUCT LIFE CYCLE

The MNYL lies in the growth stage of the PRODUCT LIFE CYCLE (PLC). There has been a period of rapid market acceptance and substantial profit improvement. The different strategies that have been adopted by MNYL in this stage are as follows: Persuasive advertisements (display of regular ads during prime time shows) Addition of new product features

37 | P a g e

H Y D E R A B AD

Increase in the distribution coverage (tie-ups with IOC, AP Rural bank, Mercantile Bank etc.) It has shifted its focus from product-awareness to product-preference advertising Product Hierarchy : Seven levels for life insurance sector are: 1. Need family: The core need that underlies the existence of a product family. E.g. security. 2. Product family: All the product classes that can satisfy a core need. E.g. savings. 3. Product class: A group of products having a certain functional coherence. E.g. financial instruments. 4. Product line: a group of closely related product w.r.t (e.g. life insurance) Functions Same customers Channels Price range

38 | P a g e

H Y D E R A B AD

5. Product Type: A group of items within a product line that share on of the possible forms of the product. E.g. term life insurance

6. Item: a distinct unit within a brand or product line distinguishable by size, prize, appearance, or some other attribute E.g. Max New York SMART Steps Plus insurance.

MARKETING STRATEGY

INTERNAL MARKETING:As far as the Internal Marketing of the MNYL is concerned, it regularly motivates its employees to perform better in difficult times. Training is a continuous process for agents at MNYL and ensures development of skills and knowledge through a structured programme spread over 500 hours in two years. This focus on continuous quality training has resulted in the company having amongst the highest agent pass rate in IRDA examinations and the agents have the highest productivity among private life insurers. MNYL has been awarded the best employer to work with; hence it shows the commitment it has towards its employees.

INTERACTIVE MARKETING:-

39 | P a g e

H Y D E R A B AD

MNYL has developed skills in its workforce i.e. agents to serve their clients effectively and with ease. The technology backup provided by the IBM also helps MNYL to have an edge over the other insurance companies.

40 | P a g e

H Y D E R A B AD

PRODUCT STRATEGIES

The Insurance Industry exhibits the following FIVE product levels:CORE BENEFIT: SECURITY BASIC PRODUCT: HEALTH, CHILD, LIFE, PENSION, GROWTH EXPECTED PRODUCT: CLAIM SETTLEMENT AUGMENTED PRODUCT: ELECTRONIC FUND TRANSFER FACILITY FOR CLAIM SETTLEMENT (DONE BY MNYL)

41 | P a g e

H Y D E R A B AD

PRODUCT LEVELS OF AN INSURANCE INDUSTRY

MNYL has extended its brand by introducing the MAX VIJAY in a new Product Category.

42 | P a g e

H Y D E R A B AD

The brand name remains the same i.e. MAX NEW YORK LIFE after the launch of the new product in the market. The product category was new in this case, it was specially designed to cater the lower strata of the society giving them multiple paying options of the premium.

DIVERSIFICATION BY MAX VIJAY:

ANSOFF GRID

43 | P a g e

H Y D E R A B AD

MNYL has diversified by introducing the Max Vijay Scheme, which is a new product and offered into a new market. The new market is Uttar Pradesh, since it was earlier catering to the other parts of the country.

44 | P a g e

H Y D E R A B AD

ABOUT COMPETITORS The insurance sector in India has come a full circle from being an open competitive market to nationalization and back to a liberalized market again. It is known to all that now a days Insurance sectors are going to boom in the Indian as well as International market, so it is natural that there will be a great competition among all the companies.

45 | P a g e

H Y D E R A B AD

Similarly, Max New York Life has also many competitors, some of them are as follows: ICICI prudential Bajaj Allianz SBI Life HDFC Standard Reliance Life Birla Sunlife Aviva Life Tata AIG Kotak Mahindra Old Mutual ING Vysya Met Life

DATA ANALYSIS AND INTERPRETATION

46 | P a g e

H Y D E R A B AD

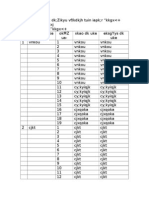

My project titled Study on Recruitment and Selection Process of employees in MAX. home developers Ltd. For this project I prepared a questionnaire on assessment of current recruitment and selection practice at MAX.. I took a sample size of 30 and collected the data where I personally met employees working at their respective department. Source of recruitment in their recruitment

47 | P a g e

H Y D E R A B AD

They are satisfied by the recruitment process by which they are selected

48 | P a g e

H Y D E R A B AD

Colleagues very pleasant and helping or not

49 | P a g e

H Y D E R A B AD

The recruitment conducted fare at MAX.

50 | P a g e

H Y D E R A B AD

Whether they like to put their relatives/friends for job in MAX.

51 | P a g e

H Y D E R A B AD

Time duration given for the recruitment process is sufficient

52 | P a g e

H Y D E R A B AD

How long will they like to continue with this organization

They believe their Job security in MAX.

53 | P a g e

H Y D E R A B AD

Whether they are satisfied with their daily schedule

54 | P a g e

H Y D E R A B AD

On quality of work life dimension of recruitment and selection effectiveness in MAX. recognition system is followed impartially or not

55 | P a g e

H Y D E R A B AD

SUGGESTION

This study inferred that most of the employers and employees are satisfied with the present process.

This study was helpful to study the sources of recruitment and selection techniques & methods used.

HR professional is having a big responsibility to hire a best person from the available talent pool. At the same time, one needs to be cost conscious.

The employer should judge on individual merits and set the same standards for all. In the present scenario, It is the biggest challenge for a HR manager to hunt for talent.

Though consultancy has already owned a good reputation, but it always need some type of publicity as heavily cost incurred while recruiting and selecting employees through consultancy.

56 | P a g e

H Y D E R A B AD

CONCLUSION Our exhaustive research in the field of Life Insurance threw up some interesting trends, which can be seen in the above analysis. A general impression that we gathered during Data collection was the immense awareness and knowledge among people about various companies and their insurance products. People are beginning to look beyond LIC for their insurance needs and are willing to trust private players with their hard earned moNEW. People in general have been impressed by the marketing and advertising campaigns of insurance companies. A high penetration of print, radio and Television Ad campaigns over the years is beginning to have its impact now. Another heartening trend was in terms of people viewing insurance as a tax saving and investment instruments as much as a protective one. A very high number of respondents have opted for insurance for such purposes and it shows how insurance companies have been successful to attract public moNEW in recent times. The general satisfaction levels among public with regards to policy and agents still requires improvement. But therein lies the opportunity for a relative player like

57 | P a g e

H Y D E R A B AD

Max New York Life. LIC has never been known for prompt service or customer oriented methods and Max New York Life can build on these factors.

QUESTIONNAIRE

NAME: GENDER: M/F CONTACT NO: AGE: ADDRESS: Occupation

1. From which source of recruitment they come to know about the job? Internal References Advertisement Other Sources 2. Whether they are satisfied by the recruitment process by which they are selected or not? Satisfied by the process Unsatisfied by the process 3. Whether their colleagues are helping & pleasant with them? Colleagues are helping Colleagues are not helping

4. Is the recruitment conducted fare at MAX.? YES NO

58 | P a g e

H Y D E R A B AD

5. Whether they like to put their relatives/friends for job in MAX.? YES NO CANT SAY

6. Is the Time duration given for the recruitment process is sufficient? YES 5-10 YEAR TILL RETIREMENT NO 10-15 YEAR 15-20 YEAR 7. How long will they like to continue with this organization?

8. They believe their Job security in MAX.? YES YES NO NO 9. Whether they are satisfied with their daily schedule? 10. On quality of work life dimension of recruitment and selection effectiveness, the question was asked whether recognition system is followed impartially or not? FAVORABLE NOT FAVOURABLE

BIBLIOGRAPHY

Marketing management by Philip Kotler

59 | P a g e

H Y D E R A B AD

www.maxnewyorklife.com www.4psbusinessandmarketing.com www.wikipedia.com

www.thehindubusinessline.com

www.business-standard.com www.financialexpress.com www.businessweek.com www.afaqs.com

www.investing.businessweek.com

www.mydigitalfc.com www.nextbillion.net www.business.mapsofindia.com

www.info2india.com

http://www.researchandmarkets.com/reports/223363 http://www.nabard.org/pdf/report_financial/Chap_XI.pdf

60 | P a g e

Vous aimerez peut-être aussi

- Poona Bai vs. ParshottamDocument44 pagesPoona Bai vs. ParshottamKing Nitin AgnihotriPas encore d'évaluation

- Vkosnu IDocument4 pagesVkosnu IKing Nitin AgnihotriPas encore d'évaluation

- SKLDKJFDocument3 pagesSKLDKJFKing Nitin AgnihotriPas encore d'évaluation

- Verification FormDocument1 pageVerification FormKing Nitin AgnihotriPas encore d'évaluation

- Signature of Parent Name in FullDocument2 pagesSignature of Parent Name in FullKing Nitin AgnihotriPas encore d'évaluation

- SHAILESH Dubey SVN 9098569028Document1 pageSHAILESH Dubey SVN 9098569028King Nitin AgnihotriPas encore d'évaluation

- Paper ExcellenceDocument2 pagesPaper ExcellenceKing Nitin AgnihotriPas encore d'évaluation

- Kerwana 1STDocument707 pagesKerwana 1STKing Nitin AgnihotriPas encore d'évaluation

- Izfr 2Document2 pagesIzfr 2King Nitin AgnihotriPas encore d'évaluation

- In Words Rs. Four Thousand Nine Hundred Fourty Nine OnlyDocument1 pageIn Words Rs. Four Thousand Nine Hundred Fourty Nine OnlyKing Nitin AgnihotriPas encore d'évaluation

- Project ActivityDocument12 pagesProject ActivityKing Nitin AgnihotriPas encore d'évaluation

- Anjali Patel Final1Document52 pagesAnjali Patel Final1King Nitin AgnihotriPas encore d'évaluation

- Methods of StrugglDocument3 pagesMethods of StrugglKing Nitin AgnihotriPas encore d'évaluation

- Management Information SystemDocument20 pagesManagement Information SystemKing Nitin AgnihotriPas encore d'évaluation

- PrashantDocument59 pagesPrashantKing Nitin AgnihotriPas encore d'évaluation

- Project Media1Document30 pagesProject Media1King Nitin AgnihotriPas encore d'évaluation

- Izfr 1Document3 pagesIzfr 1King Nitin AgnihotriPas encore d'évaluation

- Amit Kumar GoutaDocument56 pagesAmit Kumar GoutaKing Nitin AgnihotriPas encore d'évaluation

- Ac 73112453Document1 pageAc 73112453King Nitin AgnihotriPas encore d'évaluation

- Life Insurance Corporation of IndiaDocument2 pagesLife Insurance Corporation of IndiaKing Nitin AgnihotriPas encore d'évaluation

- Parle GDocument41 pagesParle GKing Nitin AgnihotriPas encore d'évaluation

- Project On Dainik Jagran Dushyant DuttDocument67 pagesProject On Dainik Jagran Dushyant DuttKing Nitin AgnihotriPas encore d'évaluation

- Birla Whit CementDocument54 pagesBirla Whit CementKing Nitin AgnihotriPas encore d'évaluation

- CastrolDocument50 pagesCastrolKing Nitin Agnihotri33% (3)

- Feuh Ihtk@Mini Pizza Ost Ihtk@Veg Pizza Vekvks Ihtk@Tomato PizzaDocument2 pagesFeuh Ihtk@Mini Pizza Ost Ihtk@Veg Pizza Vekvks Ihtk@Tomato PizzaKing Nitin AgnihotriPas encore d'évaluation

- Cricket ProjectDocument31 pagesCricket ProjectKing Nitin AgnihotriPas encore d'évaluation

- Watch: A Project Report On Marketing Strategies of Top Five Brands ofDocument51 pagesWatch: A Project Report On Marketing Strategies of Top Five Brands ofKing Nitin AgnihotriPas encore d'évaluation

- Bajaj AlianceDocument49 pagesBajaj AlianceKing Nitin AgnihotriPas encore d'évaluation

- Shahgarh ListDocument23 pagesShahgarh ListKing Nitin AgnihotriPas encore d'évaluation

- C.A. ProjectDocument62 pagesC.A. ProjectKing Nitin AgnihotriPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Ch-6 - Pricing of ServicesDocument32 pagesCh-6 - Pricing of ServicesYashashvi RastogiPas encore d'évaluation

- Digital Marketing SyallbusDocument4 pagesDigital Marketing SyallbusSamanta Aryadevi TanPas encore d'évaluation

- Monthly Review: Period - Jan 2010Document8 pagesMonthly Review: Period - Jan 2010Maneesh PandePas encore d'évaluation

- Rep AWAI Copywriting Pricing Guide 2018 PDFDocument58 pagesRep AWAI Copywriting Pricing Guide 2018 PDFNoah Neal100% (2)

- Edited Business PlanDocument44 pagesEdited Business PlanHanna GicoPas encore d'évaluation

- MSR 201906Document26 pagesMSR 201906Damian Alfredo SalasPas encore d'évaluation

- Alok Deo SMBD Rflective NotesDocument6 pagesAlok Deo SMBD Rflective NotesMegha KushwahPas encore d'évaluation

- 1.4 Classification of ProductDocument11 pages1.4 Classification of Productbabunaidu2006Pas encore d'évaluation

- Kumpulan ZigotDocument2 pagesKumpulan ZigotRizal HaronPas encore d'évaluation

- Impact of Advertisement On Consumer Buying Behaviour (With Special Reference To FMCG Sector)Document17 pagesImpact of Advertisement On Consumer Buying Behaviour (With Special Reference To FMCG Sector)Varun KaliaPas encore d'évaluation

- Project Report: Hartwall CompanyDocument16 pagesProject Report: Hartwall CompanyKun KunPas encore d'évaluation

- BepDocument2 pagesBepOkky Raymond CorneliusPas encore d'évaluation

- IKEA Sustainability ReportDocument15 pagesIKEA Sustainability ReportDesiree StiernstamPas encore d'évaluation

- AN ANALYSIS OF EMARGING TRENDS IN THE USAGE OF DissertationDocument61 pagesAN ANALYSIS OF EMARGING TRENDS IN THE USAGE OF DissertationSabyasachi MajumdarPas encore d'évaluation

- International Finance 315 v1 PDFDocument280 pagesInternational Finance 315 v1 PDFKavita KumawatPas encore d'évaluation

- Market Research Chapter 1 2 CompletedDocument22 pagesMarket Research Chapter 1 2 CompletedJerson PepinoPas encore d'évaluation

- Cia - Iii Marketing Management: Submitted ToDocument9 pagesCia - Iii Marketing Management: Submitted ToTejas YadavPas encore d'évaluation

- Retailing Research: Past, Present, and Future: Dhruv Grewal, Michael LevyDocument18 pagesRetailing Research: Past, Present, and Future: Dhruv Grewal, Michael LevyAlice Uchoa100% (1)

- Consumers' Brand Preference and Buying Behaviour of Cosmetic Products at Coimbatore CityDocument8 pagesConsumers' Brand Preference and Buying Behaviour of Cosmetic Products at Coimbatore CityBhanu TejaPas encore d'évaluation

- Vlogger Titan Tyra Yang Mengulas Produk Kosmetik Make Over)Document6 pagesVlogger Titan Tyra Yang Mengulas Produk Kosmetik Make Over)Ghaliyah AlmiraPas encore d'évaluation

- E Business PDFDocument29 pagesE Business PDFPrada DeriPas encore d'évaluation

- Curriculum Vitae: Personal DetailsDocument2 pagesCurriculum Vitae: Personal DetailsPrateek KumarPas encore d'évaluation

- Business Plan: Goal Target Strategies Tactics / Messages Calendar MeasurementDocument2 pagesBusiness Plan: Goal Target Strategies Tactics / Messages Calendar Measurementmuna mubaPas encore d'évaluation

- AdidasDocument32 pagesAdidasSai PrabhasPas encore d'évaluation

- Chick-Fil-A Media Plan - Media Planning Master's ProjectDocument39 pagesChick-Fil-A Media Plan - Media Planning Master's ProjectRebecca K. Roussell100% (2)

- Naisud National High School Senior High School: Final Examination in Organization and ManagementDocument2 pagesNaisud National High School Senior High School: Final Examination in Organization and ManagementRupelma Salazar PatnugotPas encore d'évaluation

- Cambridge International AS & A Level: BUSINESS 9609/21Document4 pagesCambridge International AS & A Level: BUSINESS 9609/21VinjeroPas encore d'évaluation

- Effective Business Communication Case StudyDocument8 pagesEffective Business Communication Case StudyamritaPas encore d'évaluation

- (EMEA Version) RedHat Training Partner Program Enablement ResourcesDocument2 pages(EMEA Version) RedHat Training Partner Program Enablement Resourcesvadym_kovalenko4166Pas encore d'évaluation

- What Does Adding Value MeansDocument3 pagesWhat Does Adding Value MeansAleem Ahmad RindekharabatPas encore d'évaluation