Académique Documents

Professionnel Documents

Culture Documents

APC Outlook and Research Report

Transféré par

tradespoonCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

APC Outlook and Research Report

Transféré par

tradespoonDroits d'auteur :

Formats disponibles

Anadarko Petroleum Corporation

(NYSE:

APC)

Last

Price:

$88.88

VIEW:

SELL

7/18/2013

Anadarko Petroleum Corporation (Anadarko) is an independent exploration and production company. As of December 31, 2011, the Company had over 2.5 billion barrels of oil equivalent (BOE) of proved reserves. Anadarko's asset portfolio includes positions in onshore resource plays in the Rocky Mountains region, the southern United States, and the Appalachian basin. The Company is also independent producers in the deep-water Gulf of Mexico, and has production and exploration activities globally, including positions in high- potential basins located in East and West Africa, Algeria, China, Alaska, and New Zealand. The Company operates in three segments: Oil and gas exploration and production, Midstream, and Marketing. In August 2012, Western Gas Partners, LP acquired an additional 24% membership interest in Chipeta Processing LLC from Anadarko.

Sector: Basic Materials Highlights: Anadarko is an independent exploration and production company; the Company had over 2.5 billion barrels of oil equivalent (BOE) of proved reserves. The stock closed yesterdays trading session at $88.88. In the past year, the stock has hit a 52-week low of $65.38 and 52-week high of $92.18. The intrinsic value of the stock is higher than the current price. APC has a market cap of $44.57 billion and is part of the Basic materials sector. Industry: Independent Oil & Gas

GROWTH AND BALANCE SHEET The company reported that it earned $460 million, or 91 cents basic earnings per share, for the quarter that ended March 31. That's down from $2,156 million, $4.30 basic earnings per share for the same quarter last year. The huge difference can be attributed entirely to the Algeria exceptional profit tax settlement of 1,804 which occurred in the first quarter of last year. Revenue increased 12.9 percent, to a record first quarter $3,893 million from $3,447 million, with revenue increasing in segments Oil and Gas Exploration & Production, Midstream, and Other and Intersegment Elimination; and decreasing only in the Marketing segment of the company. APCs consensus earnings forecast for the quarter ending June 2013 is of $0.69 to $1.10 per share. Operating margin was 33.1 percent, compared to 78.39 percent in the first quarter of fiscal 2012. The decline is due to the previously mentioned Algeria exceptional tax profit settlement. If the first quarter is adjusted for the Algeria exceptional tax profit settlement than the operating margin for the first quarter of fiscal 2012 would be 26.05 percent. Cash flow from operating activities was $2,503 million, compared to $1,891 million in the first quarter of fiscal 2012. VALUATION APC PE stands at 64.55 above the industry average of 33.71 and above the S&P 500 average of 18.43. The company is currently trading above the preferable P/E ratio of 15x and over the last five years, the companys shares have traded in the range of 66.66x to 16.24 x trailing 12-month earnings. APC's current Price/Sales of 3.27 is above the average of its industry, of 2.40. APCs head to head comparison to its main competitors shows that the company has better gross margin, but operating margin; lower net income and EPS that is worse only to ConocoPhillips. APC trading at higher P/E and P/S multiples than the main competitors. The stock is currently trading 34% above its intrinsic value of $64.47 this suggests that the stock is overvalued at these levels. The beta of 2.18 implies higher volatility of the stock with respect to the S&P 500. APC has not shown satisfying earnings consistency over the last five. APCs earnings per share over the last five years have grown by -9.91%. The current quarter earnings in comparison to the same quarter last year have decreased by -78.70% which is well below the required level of 15%. APCs current price levels are only 3.6% below the 52 week high of $92.18, and the technical indicators are neutral. The majority of the analyst ratings are buy. APCs Total Debt/Equity of 66.12 is above the required maximum, however it is below the industry average of 82.36. APC have a dividend payout ratio of 26%. RECOMMENDATION for next 6 months: We initiate our coverage with SELL. The company has demonstrated neutral signs but the valuation is expensive at current price level. APC is up 19.89% year-to-date. Our overall score for APC is 4.91.

For options trading we suggest: Anadarko Petroleum Corporation APC 44.57B Beta 56.56B 1 Month Stock Returns 64.55 Year to Date Stock Returns 0.95 1 Year Stock Returns 3.27 3 Year Stock Returns 2.11 52-Week Change 4.16 S&P500 52-Week Change 7.46 52-Week High 0.40% 52-Week Low 50-Day Moving Average 0.31% 200-Day Moving Average Buy the July 2013 put with a strike of 87.50 priced at $0.12 per contract Net credit to start: $0.12

VALUATION Market Cap: Enterprise Value P/E PEG Ratio Price/Sales Price/Book Enterprise Value/Revenue Enterprise Value/EBITDA Dividend Yield Held by insiders NEWS and CALENDAR

2.18 2.10% 19.89% 24.32% 90.06% 22.44% 22.45% 92.18 65.38 87.25 84.24

Thu, Jul 18, 2013 Once-Coveted Asian Oil Riches Take Backseat to U.S. Shale Wed, Jul 17, 2013 Anadarko, Unshaken By Its Deepwater Horizon Legacy, Builds Big In The Gulf Of Mexico Wed, Jul 17, 2013 Oil Production in the Gulf of Mexico Is Here to Stay Tue, Jul 16, 2013 Anadarko to Face Investor Suit Over BP Spill, Judge Says APC Strengths APC Weakness High profile litigation Cost of environmental requirement High debt/Overleveraged acquisition Diversified operations Significant reserves Incremental increase in supply

Competitor Comparison APC Market Cap: 44.57B Employees: 5,200 Qtrly Rev Growth 0.09 Revenue 13.61B Gross Margin 0.86 EBITDA 7.58B Operating Margin 0.15 Net Income 689.00M EPS 4.07 P/E 64.55 PEG 0.95 P/S 3.27 BG.L 40.40B 5,710 0.006 18.96 N/A 11.14 0.43 3.27B 1.32 18.01 1.04 3.21 TLW.L 9.92B 1,420 -0.05 2.34B 0.57 1.71B 0.19 624.3M 0.68 24.5 2.68 6.47 COP 80.16B 17,100 -0.04 59.80B 0.47 21.66B 0.24 7.26B 6.16 10.64 3.47 1.33 Industry N/A N/A N/A N/A 0.47 N/A 0.28 N/A N/A 33.71 N/A 2.4

Stock valuation model

The model rates stocks from 1 to 10, with 10 being the best using a system of advanced mathematics to determine a stock's expected risk and return. I am using different fundamental and technical factors in order to rank a stock. Intrinsic value of the stock Investors should buy stocks selling at a discount to their intrinsic value, and then patiently wait for the fair value of their investments to be realized. APC Intrinsic Value EPS ttm EPS Growth (Assumption) PE DIVIDEND PAYOUT EXPECTED STOCK RETURN Forecasted Stock Price in 2022 Earnings Per Share after the 10th year TOTAL DIVIDENDS Forecasted Stock Price in 2022+DIVIDENDS 4.53 138.92

1.38 1.04 64.55 26% 1.08

134.39 2.08

Year 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 TOTAL EPS

EPS 1.44 1.50 1.56 1.63 1.70 1.77 1.84 1.92 2.00 2.08 17.42

Net Present Value 66.47 trades 34% above its fair APCs intrinsic value is $66.47 the current price is $88.88, the stock value. The Sensitivity analysis of the stock varying the growth rate of the EPS are presented in the table below. EPS Growth (Assumption) Value 2% 53.87 3% 59.31 4% 65.23 4.20% 66.47 5% 71.69 6% 78.73 7% 86.38 Based on the prospects of the company the valuation range is from $53.87 to $86.38. Financials The financial health of the company the higher the better, we evaluate all the financial ratios of the company. Sentiment Investors sentiment for the stock. Analyst ratings The model assigns a value according to analysts recommendation for the stock. Analyst rating on Reuters.com is 15 Buy, 13 Outperform, and 3 Hold. Earnings Consistency We are searching for EPS numbers that are better than the previous year's. One dip is allowed, but the following year's earnings should be higher than the previous year. APCs annual EPS for the last 5 years were 6.79, -0.28, 1.53, -5.32, and 4.76 this type of earnings action is not favorable. Total Debt/Equity The company must have a low Debt/Equity ratio, which indicates a strong balance sheet. The Debt/Equity ratio should not be greater than 20% or should be less than the average Debt/Equity for its industry APCs Total Debt/Equity of 66.12 is above the required maximum, however it is below the industry average of 82.36.

EPS This Quarter VS Same Quarter Last Year The EPS growth for this quarter relative to the same quarter a year earlier is above the minimum 15% that this model likes to see for a "good" growth company. Stocks with improving earnings are worthy of your extra attention. APCs EPS growth for this quarter relative to the same quarter a year earlier is -78.70 %, is well below our target. Annual Earnings Growth This stock valuation model looks for annual earnings growth above 12%, but prefers higher than 20%. APCs annual earnings growth rate over the past five years is -9.91%, is well below our target growth rate. Current Price Level Investors should keep an eye open for stocks that are trading within 10% of their 52-week highs, as it is likely to continue in its upward trend. APC's 52 week high is $92.18 current price is $88.88, is 3.60% below the 52 week high. P/E Ratio The Price/Earnings (P/E) ratio, based on the greater of the current PE or the PE using average earnings over the last 3 fiscal years, must be "moderate", which in this model states is not greater than 15. Stocks with moderate P/Es are more defensive by nature. The company has a P/E ratio of 64.55 the average industry P/E ratio is 33.71 and is above the S&P 500 P/E ratio of 18.43. Insider Ownership When there is strong insider ownership which we define as 8% or more, management is more likely to act in the best interest of the company, as their interests are right in line with that of the shareholders. Insiders own 0.31% of APC stock. Management's representation is not large enough. This does not satisfy our minimum requirement; companies that pass this test are more attractive to our valuation model. Technical Analysis The model is using several technical indicators (MACD, RSI, MFI, OBV, position Indicators) to forecast the trend of the stock for 6 and 12 months, and assign a value.

APC is trading in the range of $80.44 - $90.85 in the past 30 days. The stock has been showing support around $86.70 and resistance in the $90 range. The stock is trading above the 50-Day Moving Average and 200-Day Moving Average. RSI(14): 55.43. From the graph on page 1 it can be seen that the stock has been in an upward trend since end of October last year until the end of May 2013. The company has hit the psychological level of $90 in the end on May and the end of last week, however the price has been going below the $90 level in the next following day in both instances. The Companys stock is trading at the highest levels in 10 years period. Our indicators give a neutral view on APC. Anadarko Petroleum Corporation APC COMPANY:

the stock Intrinsic value of

Financials Sentiment Analyst ratings Earnings Consistency Total Debt/Equity Quarterly EPS change Annual Earnings Growth Current Price Level P/E Ratio Insider Ownership Technical Analysis SCORE RECOMMENDATION:

3 3 9 9 3 4 1 3 8 2 3 6 54

4.91 SELL

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Embedded CoderDocument8 pagesEmbedded Coderجمال طيبيPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Salesforce Platform Developer 1Document15 pagesSalesforce Platform Developer 1Kosmic PowerPas encore d'évaluation

- Real Estate Developer Resume SampleDocument1 pageReal Estate Developer Resume Sampleresume7.com100% (2)

- NFPA 99 Risk AssessmentDocument5 pagesNFPA 99 Risk Assessmenttom ohnemusPas encore d'évaluation

- Habawel V Court of Tax AppealsDocument1 pageHabawel V Court of Tax AppealsPerry RubioPas encore d'évaluation

- Business Plan - Docx 3-Star Hospitality and Tourism Devt Centre in Mbarara - UgandaDocument49 pagesBusiness Plan - Docx 3-Star Hospitality and Tourism Devt Centre in Mbarara - UgandaInfiniteKnowledge100% (9)

- WDC Outlook and Research ReportDocument8 pagesWDC Outlook and Research ReporttradespoonPas encore d'évaluation

- FCX Outlook and Research ReportDocument3 pagesFCX Outlook and Research ReporttradespoonPas encore d'évaluation

- UNH Outlook and Research ReportDocument4 pagesUNH Outlook and Research ReporttradespoonPas encore d'évaluation

- VMW Outlook and Research ReportDocument8 pagesVMW Outlook and Research ReporttradespoonPas encore d'évaluation

- SLB Outlook and Research ReportDocument8 pagesSLB Outlook and Research ReporttradespoonPas encore d'évaluation

- JNJ Outlook and Research ReportDocument4 pagesJNJ Outlook and Research ReporttradespoonPas encore d'évaluation

- NFLX Outlook and Research ReportDocument7 pagesNFLX Outlook and Research ReporttradespoonPas encore d'évaluation

- NOC Outlook and Research ReportDocument7 pagesNOC Outlook and Research ReporttradespoonPas encore d'évaluation

- EBAY Outlook and Research ReportDocument8 pagesEBAY Outlook and Research ReporttradespoonPas encore d'évaluation

- MAT Outlook and Research ReportDocument4 pagesMAT Outlook and Research ReporttradespoonPas encore d'évaluation

- EMR Outlook and Research ReportDocument7 pagesEMR Outlook and Research ReporttradespoonPas encore d'évaluation

- DE Outlook and Research ReportDocument4 pagesDE Outlook and Research ReporttradespoonPas encore d'évaluation

- CHK Outlook and Research ReportDocument8 pagesCHK Outlook and Research ReporttradespoonPas encore d'évaluation

- TDC Outlook and Research ReportDocument9 pagesTDC Outlook and Research ReporttradespoonPas encore d'évaluation

- AMAT Outlook and Research ReportDocument7 pagesAMAT Outlook and Research ReporttradespoonPas encore d'évaluation

- PFE Outlook and Research ReportDocument8 pagesPFE Outlook and Research ReporttradespoonPas encore d'évaluation

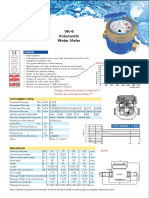

- Baylan: VK-6 Volumetric Water MeterDocument1 pageBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaPas encore d'évaluation

- Lunakleen: Standard Type Hepa FilterDocument1 pageLunakleen: Standard Type Hepa FilterRyan Au YongPas encore d'évaluation

- CASE FLOW AT REGIONAL ARBITRATIONDocument2 pagesCASE FLOW AT REGIONAL ARBITRATIONMichael Francis AyapanaPas encore d'évaluation

- SS Corrosion SlidesDocument36 pagesSS Corrosion SlidesNathanianPas encore d'évaluation

- 2.1 Elements of Computational ThinkingDocument25 pages2.1 Elements of Computational ThinkingHamdi QasimPas encore d'évaluation

- Identifying Community Health ProblemsDocument4 pagesIdentifying Community Health ProblemsEmvie Loyd Pagunsan-ItablePas encore d'évaluation

- Ermac vs. MedeloDocument1 pageErmac vs. MedeloJessa F. Austria-CalderonPas encore d'évaluation

- CSCI5273 PS3 KiranJojareDocument11 pagesCSCI5273 PS3 KiranJojareSales TeamPas encore d'évaluation

- Educ 3 ReviewerDocument21 pagesEduc 3 ReviewerMa.Lourdes CamporidondoPas encore d'évaluation

- SQL DBA Mod 1 IntroDocument27 pagesSQL DBA Mod 1 IntroDivyaPas encore d'évaluation

- Master List of Approved Vendors For Manufacture and Supply of Electrical ItemsDocument52 pagesMaster List of Approved Vendors For Manufacture and Supply of Electrical ItemsBhoopendraPas encore d'évaluation

- Household Budget Worksheet - Track Income & ExpensesDocument1 pageHousehold Budget Worksheet - Track Income & ExpensesJohn GoodenPas encore d'évaluation

- Timesheet 2021Document1 pageTimesheet 20212ys2njx57vPas encore d'évaluation

- Cis285 Unit 7Document62 pagesCis285 Unit 7kirat5690Pas encore d'évaluation

- Which Delivery Method Is Best Suitable For Your Construction Project?Document13 pagesWhich Delivery Method Is Best Suitable For Your Construction Project?H-Tex EnterprisesPas encore d'évaluation

- Appendix 9A: Standard Specifications For Electrical DesignDocument5 pagesAppendix 9A: Standard Specifications For Electrical Designzaheer ahamedPas encore d'évaluation

- Mecafix 120: Description Technical DataDocument1 pageMecafix 120: Description Technical DataJuan Carlos EspinozaPas encore d'évaluation

- Soal Pat Inggris 11Document56 pagesSoal Pat Inggris 11dodol garutPas encore d'évaluation

- Caf 8 Aud Spring 2022Document3 pagesCaf 8 Aud Spring 2022Huma BashirPas encore d'évaluation

- Spec 2 - Activity 08Document6 pagesSpec 2 - Activity 08AlvinTRectoPas encore d'évaluation

- TMA - ExerciseDocument3 pagesTMA - ExercisemorrisioPas encore d'évaluation

- Merging - Scaled - 1D - & - Trying - Different - CLassification - ML - Models - .Ipynb - ColaboratoryDocument16 pagesMerging - Scaled - 1D - & - Trying - Different - CLassification - ML - Models - .Ipynb - Colaboratorygirishcherry12100% (1)

- Analytic Solver Platform For Education: Setting Up The Course CodeDocument2 pagesAnalytic Solver Platform For Education: Setting Up The Course CodeTrevor feignarddPas encore d'évaluation

- ESA 7.6 Configuration GuideDocument460 pagesESA 7.6 Configuration GuideaitelPas encore d'évaluation