Académique Documents

Professionnel Documents

Culture Documents

Accounting System

Transféré par

Pooja MaldeDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting System

Transféré par

Pooja MaldeDroits d'auteur :

Formats disponibles

A fixed asset is an asset of a business intended for continuing use, rather than a short-term, temporary asset such as stocks.

Fixed assets must be classified in a company's balance sheet as intangible, tangible, or investments. Examples of intangible assets include goodwill, patents, and trademarks. Examples of tangible fixed assets include land and buildings, plant and machinery, fixtures and fittings, motor vehicles and IT equipment. How should the changing value of a fixed asset be reflected in a company's accounts? The benefits that a business obtains from a fixed asset extend over several years. For example, a company may use the same piece of production machinery for many years, whereas a company-owned motor car used by a salesman probably has a shorter useful life. By accepting that the life of a fixed asset is limited, the accounts of a business need to recognise the benefits of the fixed asset as it is "consumed" over several years. This consumption of a fixed asset is referred to as depreciation. What is the relevant cost of a fixed asset? The cost of a fixed asset includes all amounts incurred to acquire the asset and any amounts that can be directly attributable to bringing the asset into working condition. Directly attributable costs may include: - Delivery costs - Costs associated with acquiring the asset such as stamp duty and import duties - Costs of preparing the site for installation of the asset - Professional fees, such as legal fees and architects' fees Note that general overhead costs or administration costs would not be included as part of the total costs of a fixed asset (e.g. the costs of the factory building in which the asset is kept, or the cost of the maintenance team who keep the asset in good working condition). The cost of subsequent expenditure on a fixed asset will be added to the cost of the asset provided that this expenditure enhances the benefits of the fixed asset or restores any benefits consumed. This means that major improvements or a major overhaul may be capitalised and included as part of the cost of the asset in the accounts. However, the costs of repairs or overhauls that are carried out simply to maintain existing performance will be treated as expenses of the accounting period in which the work is done, and charged in full as an expense in that period. What is the Useful Life of a fixed asset? An asset may be seen as having a physical life and an economic life. Most fixed assets suffer physical deterioration through usage and the passage of time. Although care and maintenance may succeed in extending the physical life of an asset, typically it will, eventually, reach a condition where the benefits have been exhausted.

However, a business may not wish to keep an asset until the end of its physical life. There may be a point when it becomes uneconomic to continue to use the asset even though there is still some physical life left. The economic life of the asset will be determined by such factors as technological progress and changes in demand. For purposes of calculating depreciation, it is the estimated economic life rather than the potential physical life of the fixed asset that is used. What about the Residual Value of a fixed asset? At the end of the useful life of a fixed asset the business will dispose of it and any amounts received from the disposal will represent its residual value. This, again, may be difficult to estimate in practice. However, an estimate has to be made. If it is unlikely to be a significant amount, a residual value of zero will be assumed. The cost of a fixed asset less its estimated residual value represents the total amount to be depreciated over its estimated useful life. Fixed Assets Definition and Explanation Fixed assets, also known as Property, Plant and Equipment, are tangible assets held by an entity for the production or supply of goods and services, for rentals to others, or for administrative purposes. These assets are expected to be used for more than one accounting period. Fixed assets are generally not considered to be a liquid form of assets unlike current assets. Examples of common types of fixed assets include buildings, land, furniture and fixtures, machines and vehicles. The term 'Fixed Asset' is generally used to describe tangible fixed assets. This means that they have a physical substance unlike intangible assets which have no physical existence such as copyright and trademarks. Fixed assets are not held for resale but for the production, supply, rental or administrative purposes. Assets that held for resale must be accounted for as inventory rather than fixed asset. So for example, if a company is in the business of selling cars, it must not account for cars held for resale as fixed assets but instead as inventory assets. However, any vehicles other than those held for the purpose of resale may be classified as fixed assets such as delivery trucks and employee cars. Fixed assets are normally expected to be used for more than one accounting period which is why they are part of Non Current Assets of the entity. Economic benefits from fixed assets are therefore derived in the long term. In order for fixed assets to be recognized in the financial statements of an entity, the basic criteria for the recognition of assets laid down in the IASB Framework must be met: 1. The inflow of economic benefits to entity is probable. 2. The cost/value can be measured reliably. Introduction to fixed assets 1. Financial statements disclose certain information relating to fixed assets. In many enterprises these assets are grouped into various categories, such as land, buildings, plant and machinery, vehicles, furniture and fittings, goodwill, patents, trade marks and designs. This standard deals with accounting for such fixed assets except as described in paragraphs 2 to 5 below. 2. This standard does not deal with the specialised aspects of accounting for fixed assets that arise under a comprehensive system reflecting the effects of changing prices but applies to financial statements prepared on historical cost basis. 3. This standard does not deal with accounting for the following items to which special considerations apply: (i) forests, plantations and similar regenerative natural resources;

(ii) wasting assets including mineral rights, expenditure on the exploration for and extraction of minerals, oil, natural gas and similar non-regenerative resources; (iii) expenditure on real estate development; and

(iv) livestock. Expenditure on individual items of fixed assets used to develop or maintain the activities covered in (i) to (iv) above, but separable from those activities, are to be accounted for in accordance with this Standard.98 AS 10 4. This standard does not cover the allocation of the depreciable amount of fixed assets to future periods since this subject is dealt with in Accounting Standard 6 on Depreciation Accounting. 5. This standard does not deal with the treatment of government grants and subsidies, and assets under leasing rights. It makes only a brief reference to the capitalisation of borrowing costs and to assets acquired in an amalgamation or merger. These subjects require more extensive consideration than can be given within this Standard Definitions 6. The following terms are used in this Standard with the meanings specified: 6.l Fixed asset is an asset held with the intention of being used for the purpose of producing or providing goods or services and is not held for sale in the normal course of business. 6.2 Fair market value is the price that would be agreed to in an open and unrestricted market between knowledgeable and willing parties dealing at arms length who are fully informed and are not under any compulsion to transact. 6.3 Gross book value of a fixed asset is its historical cost or other amount substituted for historical cost in the books of account or financial statements. When this amount is shown net of accumulated depreciation, it is termed as net book value. 7. Fixed assets often comprise a significant portion of the total assets of an enterprise, and therefore are important in the presentation of financial position. Furthermore, the determination of whether an expenditure represents an asset or an expense can have a material effect on an enterprises reported results of operations. 8. Identification of Fixed Assets 8.1 The definition in paragraph 6.1 gives criteria for determining whether items are to be classified as fixed assets. Judgement is required in applying the criteria to specific circumstances or specific types of enterprises. . It may be appropriate to aggregate individually insignificant items, and to apply the criteria to the aggregate value. An enterprise may decide to expense an item which could otherwise have been included as fixed asset, because the amount of the expenditure is not material. 8.2 Stand-by equipment and servicing equipment are normally capitalised. Machinery spares are usually charged to the profit and loss statement as and when consumed. However, if such spares can be used only in connection with an item of fixed asset and their use is expected to be irregular, it may be appropriate to allocate the total cost on a systematic basis over a period not exceeding the useful life of the principal item. 8.3 In certain circumstances, the accounting for an item of fixed asset may be improved if the total expenditure thereon is allocated to its component parts, provided they are in practice separable, and estimates are made of the useful lives of these components. For example, rather than treat an aircraft and its engines as one unit, it may be better to treat the engines as a separate unit if it is likely that their useful life is shorter than that of the aircraft as a whole.

9. Components of Cost 9.1 The cost of an item of fixed asset comprises its purchase price, including import duties and other nonrefundable taxes or levies and any directly attributable cost of bringing the asset to its working condition for its intended use; any trade discounts and rebates are deducted in arriving at the purchase price. Examples of directly attributable costs are: (i) site preparation; (ii) initial delivery and handling costs; (iii) installation cost, such as special foundations for plant; and

(iv) professional fees, for example fees of architects and engineers. The cost of a fixed asset may undergo changes subsequent to its acquisition or construction on account of exchange fluctuations, price adjustments, changes in duties or similar factors. 9.2 Administration and other general overhead expenses are usually excluded from the cost of fixed assets because they do not relate to a specific fixed asset. However, in some circumstances, such expenses as are specifically attributable to construction of a project or to the acquisition of a fixed asset100 AS 10 or bringing it to its working condition, may be included as part of the cost of the construction project or as a part of the cost of the fixed asset. 9.3 The expenditure incurred on start-up and commissioning of the project, including the expenditure incurred on test runs and experimental production, is usually capitalised as an indirect element of the construction cost. However, the expenditure incurred after the plant has begun commercial production, i.e., production intended for sale or captive consumption, is not capitalized and is treated as revenue expenditure even though the contract may stipulate that the plant will not be finally taken over until after the satisfactory completion 9.4 If the interval between the date a project is ready to commence commercial production and the date at which commercial production actually begins is prolonged, all expenses incurred during this period are charged to the profit and loss statement. However, the expenditure incurred during this period is also sometimes treated as deferred revenue expenditure to be amortised over a period not exceeding 3 to 5 years after the commencement 10. Self-constructed Fixed Assets 10.1 In arriving at the gross book value of self-constructed fixed assets, the same principles apply as those described in paragraphs 9.1 to 9.5. Included in the gross book value are costs of construction that relate directly to the specific asset and costs that are attributable to the construction activity in general and can be allocated to the specific asset. Any internal profits are eliminated in arriving at such costs. 11. Non-monetary Consideration 11.1 When a fixed asset is acquired in exchange for another asset, its cost is usually determined by reference to the fair market value of the consideration given. It may be appropriate to consider also the fair market value of the asset acquired if this is more clearly evident. An alternative accounting treatmentthat is sometimes used for an exchange of assets, particularly when the assets exchanged are similar, is to record the asset acquired at the net book value of the asset given up; in each case an adjustment is made for any balancing receipt or payment of cash or other consideration.

11.2 When a fixed asset is acquired in exchange forshares or othersecurities in the enterprise, it is usually recorded at its fair market value, or the fair market value of the securities issued, whichever is more clearly evident. 12. Improvements and Repairs 12.1 Frequently, it is difficult to determine whether subsequent expenditure related to fixed asset represents improvements that ought to be added to the gross book value or repairs that ought to be charged to the profit and loss statement. Only expenditure that increases the future benefits from the existing asset beyond its previously assessed standard of performance is included in the gross book value, e.g., an increase in capacity. 12.2 The cost of an addition or extension to an existing asset which is of a capital nature and which becomes an integral part of the existing asset is usually added to its gross book value. Any addition or extension, which has a separate identity and is capable of being used after the existing asset is disposed of, is accounted for separately. 13. Amount Substituted for Historical Cost 13.1 Sometimes financial statements that are otherwise prepared on a historical cost basis include part or all of fixed assets at a valuation in substitution for historical costs and depreciation is calculated accordingly. Such financial statements are to be distinguished from financial statements prepared on a basis intended to reflect comprehensively the effects of 13.2 A commonly accepted and preferred method of restating fixed assets is by appraisal, normally undertaken by competent valuers. Other methods sometimes used are indexation and reference to current prices which when applied are cross checked periodically by appraisal method. 13.3 The revalued amounts of fixed assets are presented in financial statements either by restating both the gross book value and accumulated depreciation so as to give a net book value equal to the net revalued amount or by restating the net book value by adding therein the net increase on account of revaluation. An upward revaluation does not provide a basis forcrediting to the profit and loss statement the accumulated depreciation existing at the date of revaluation. 13.4 Different bases of valuation are sometimes used in the same financial statements to determine the book value of the separate items within each of the categories of fixed assets or for the different categories of fixed assets. In such cases, it is necessary to disclose the gross book value included on each basis. 13.5 Selective revaluation of assets can lead to unrepresentative amounts being reported in financial statements. Accordingly, when revaluations do not cover all the assets of a given class, it is appropriate that the selection of assets to be revalued be made on a systematic basis. For example, an enterprise may revalue a whole class of assets within a unit. 13.6 It is not appropriate for the revaluation of a class of assets to result in the net book value of that class being greater than the recoverable amount of the assets of that class. 13.7 An increase in net book value arising on revaluation of fixed assets is normally credited directly to owners interests under the heading of revaluation reserves and is regarded as not available for distribution. A decrease in net book value arising on revaluation of fixed assets is charged to profit and loss statement except that, to the extent that such a decrease is considered to be related to a previous increase on revaluation that is included in revaluation reserve, it is sometimes charged against that earlier increase. It sometimes happens that an increase to be recorded is a reversal of a previous decrease arising on revaluation which has been charged to profit and loss statement in which case the increase is credited to profit and loss statement to the extent that it offsets the previously recorded decrease

Valuation of Fixed Assets in Special Cases 14.1 In the case of fixed assets acquired on hire purchase terms, although legal ownership does not vest in the enterprise, such assets are recorded at their cash value, which, if not readily available, is calculated by assuming an appropriate rate of interest. They are shown in the balance sheet with an appropriate narration to indicate that the enterprise does not have full ownership thereof. 14.2 Where an enterprise owns fixed assets jointly with others (otherwise than as a partner in a firm), the extent of its share in such assets, and the proportion in the original cost, accumulated depreciation and written down value are stated in the balance sheet. Alternatively, the pro rata cost of such jointly owned assets is grouped together with similar fully owned assets. Details of such jointly owned assets are indicated separately in the fixed assets register. 14.3 Where several assets are purchased for a consolidated price, the consideration is apportioned to the various assets on a fair basis as determined by competent valuers. 15. Fixed Assets of Special Types 15.1 Goodwill, in general, is recorded in the books only when some consideration in money or moneys worth has been paid for it. Whenever a business is acquired for a price (payable either in cash or in shares or otherwise) which is in excess of the value of the net assets of the business taken over, the excess is termed as goodwill. Goodwill arises from business connections, trade name or reputation of an enterprise or from other intangible benefits enjoyed by an enterprise. 15.2 As a matter of financial prudence, goodwill iswritten off over a period. However, many enterprises do not write off goodwill and retain it as an asset. 16. Disclosure 16.1 Certain specific disclosures on accounting for fixed assets are already required by Accounting Standard 1 on Disclosure of Accounting Policies and Accounting Standard 6 on Depreciation Accounting. 16.2 Further disclosures that are sometimes made in financial statements include: (i) gross and net book values of fixed assets at the beginning and end of an accounting period showing additions, disposals, acquisitions and other movements; (ii) expenditure incurred on account of fixed assets in the course of construction or acquisition; and (iii) revalued amounts substituted for historical costs of fixed assets, the method adopted to compute the revalued amounts, the nature of any indices used, the year of any appraisal made, and whether an external valuer was involved, in case where fixed assets are stated at revalued amount

BILLS PAYABLE

Bills payable can be defined in three ways: Bills payable can be the funds that a bank borrows from other banks. These are typically due in the very short term and are used to provide liquidity to the receiving bank. Bills payable can be short-term notes issued by a business that are due on demand or by a specific date. The duration of these forms of indebtedness tends to be quite short.

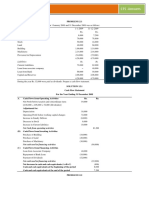

Bills payable can be the same as accounts payable, which are usually comprised of invoices from suppliers that are received and recorded by a business within the current liabilities section of the balance sheet. What is accounts payable? Accounts payable is the balance owed by the entity to its suppliers in respect of purchase of goods and services on credit. Accounting for Payables Credit Purchase As credit purchase results in increase in the expense and liabilities of the entity, expense must be debited while accounts payable must be credited. Therefore in case of a credit purchase, the following double entry is recorded: Debit Credit Purchases (Income Statement) Payable

When the payable is paid his due, the payable balance will be reduced to nil. The following double entry is recorded: Debit Credit Payable Cash

Best Practices: Accounts Payable How a company manages its accounts payable processing affects two important business matters: cash flow and supplier relationships. Companies that apply best practices manage accounts payable so that the process both contributes positively to cash flow and supports mutually beneficial relationships with suppliers. Regarding cash flow, accounts payable practices make a significant difference both in minimizing late-payment costs -- such as late-payment penalties, interest charges, and lost prompt-payment discounts -- and in creating efficient operations. A company with smooth-running, streamlined accounts payable operations saves money by processing invoices with a minimum of staff and a low cost of materials. Regarding supplier relations, accounts payable actions inevitably impact the trust between a company and its suppliers. Whether or not a company honours its agreed-upon payment terms -- by paying its bills on time, as promised -- does more to build trust with suppliers or to tear it down than any other action the company can take. And strong relations with suppliers are important to a company because suppliers provide valuable trade credit, have ideas for new methods and products, and play an important role in customer service. Best Practices Implementing the best practices in this report helps a company to manage its accounts payable activities with multiple goals in mind: (1) to pay invoices on a predetermined schedule of the company's choosing, (2) to ensure the accuracy and authenticity of invoices that the company pays, and (3) to process accounts payable paperwork with a minimum of handling and expense. Payment Management Management of payment timing is important; use of an automated accounts payable system can be very helpful.

Establish clear payment policies that are put into practice. Are payments made based on invoices or statements? Are payments made upon receipt of the goods or service, or upon receipt of the invoice? Is the practice taking advantage of prompt pay discounts and negotiating with vendors for favourable payment terms? While it is desirable to manage payments in a way that will maximize cash flow, it is important to be cautious about aging payables. Bills should never be allowed to age more than 45 to 60 days unless special payment arrangements have been made. Outstanding and aging balances drive interest penalties. Also, it has been observed many times by bankers, attorneys and accountants that nothing signals financial problems as much as slow payments. Conduct a big picture review of accounts payable operations. Each week review the aged payables, copies of invoices matched with payment checks, and reports of late charges and early payments. It is also important to review the chart of accounts (COA) to make certain entries are correctly reported. Usually problems are the result of miscommunication, encoding errors or sloppy or inadequate recording keeping.

Accounts Receivable Accounting( BILLS RECEIVABLE)

Overview of Accounts Receivable When you sell goods or services to a customer and allow it to pay you at a later date, this is known as selling on credit, and creates a liability for the customer to pay your business. Conversely, this creates an asset for your company, which is called accounts receivable. This is considered a short-term asset, since you are normally paid in less than one year. An account receivable is documented through an invoice, which you are responsible for issuing to the customer. The invoice describes the goods or services you have sold to the customer, the amount it owes you, and when it is supposed to pay you. If you are operating under the cash basis of accounting, you only record transactions in your accounting records (which are then compiled into the financial statements) when cash is either paid or received. Since issuing an invoice does not involve any change in cash, there is no record of accounts receivable in your accounting records. Only when the customer pays you do you record a sale. If you are operating under the more widely-used accrual basis of accounting, you record transactions irrespective of any changes in cash. This is the system under which you record an account receivable. In addition, there is a risk that the customer will not pay you. If so, you can either charge these losses to expense when they occur (known as the direct write-off method) or you can anticipate the amount of such losses or charge an estimated amount to expense (known as the allowance method). The later method is preferred, because you are matching revenues with bad debt expenses in the same period (known as the matching principle). Illustrations Recording Sales of Services on Credit When you sell services to a customer, you normally create an invoice in your accounting software, which automatically creates an entry to credit the

sales account and debit the accounts receivable account. When the customer later pays the invoice, you would debit the cash account and credit the accounts receivable account. For example, ABC International billings a customer for $10,000 in services, and records the following entry:

This journal entry increases the accounts receivable asset for ABC, which appears as a short-term asset in its balance sheet. In addition, it increases sales, which appear in ABC's income statement. Recording Sales of Goods on Credit If you were to sell goods to a customer on credit, then not only would you have to record the sale and related account receivable, but you would also record the reduction in inventory that was sold to the customer, which then appears in the cost of goods sold expense. This later transaction reduces the inventory asset in the balance sheet and increases the expenses in the income statement. For example, if ABC International were to conclude a sale transaction for $25,000 in which it sold $12,000 of merchandise to the customer, its journal entry would be:

There is an issue with the timing of the preceding sale transaction. If the sale is made under FOB shipping point terms, the seller is supposed to record both the sale transaction and related charge to cost of goods sold at the time when the shipment leaves its shipping dock. From that point onward, the delivery is technically the responsibility of either a third-party shipper or the buyer. If the sale is made under FOB destination terms, then the seller is supposed to record these transactions when the shipment arrives at the customer; this is because the delivery is still the responsibility of the seller until it reaches the customer's location. From a practical perspective, many companies record their sale transactions as though the delivery terms were FOB shipping point, because it is easy to verify. Accounting for Bad Debt If you sell on credit, customers will occasionally be unable to pay, in which case you should charge the account receivable to expense as a bad debt. The best way to do so is to estimate the amount of bad debt that you think will eventually arise, and accrue an expense for it at the end of each reporting period. The debit is to the bad debt expense account, which causes an expense to appear in the income statement. The credit is to the allowance for bad debts account, which is a reserve account that appears in the balance sheet. Later, when a specific invoice is clearly identifiable as a bad debt, you eliminate the account receivable with a credit, and reduce the reserve with a debit.

For example, ABC International invoices $1 million of invoices to various customers in January, and estimates that $40,000 of this amount will not be paid. Accordingly, it records the following entry to create a bad debt reserve:

In March, ABC clearly identifies $18,000 of invoices that will not be paid. It uses the following entry to eliminate the invoices and draw down the reserve balance:

If the customer were to later pay the invoice, ABC would simply reverse the entry, so that the allowance account is increased back to its former level. An alternative method is the direct write-off method, where you only recognize a bad debt expense when you can identify a specific invoice that will not be paid. Under this approach, you debit the bad debt expense and credit accounts receivable (thereby avoiding the use of an allowance account). It is not the preferred method for recording bad debts, because it introduces a delay between the recognition of a sale and the recognition of any related bad debt expense (which violates the matching principle). Accounting for Early Payment Discounts If you offer customers a discount if they pay early and they take advantage of the offer, then they will pay an amount less than the invoice total. You need to eliminate this residual balance by charging it to the sales discounts account, which will appear in the income statement as a profit reduction. For example, ABC International offers a $100 discount to a customer if it pays a $2,000 invoice within 10 days of the invoice date. The customer does so. ABC uses the following entry to record the transaction:

The Accounts Receivable Aging All outstanding accounts receivable are compiled into the accounts receivable aging report, which is typically structured to show invoices that are current, overdue by 0 to 30 days, by 31 to 60 days, 61 to 90 days, or 90+ days. This report is used to derive the allowance for bad debts, and is also a key tool of the collections department, which uses it to determine which invoices are sufficiently overdue to require follow-up action. INVENTORY MANAGEMENT

Inventory management is a very important function that determines the health of the supply chain as well as the impacts the financial health of the balance sheet. Every organization constantly strives to maintain optimum inventory to be able to meet its requirements and avoid over or under inventory that can impact the financial figures. Inventory is always dynamic. Inventory management requires constant and careful evaluation of external and internal factors and control through planning and review. Most of the organizations have a separate department or job function called inventory planners who continuously monitor, control and review inventory and interface with production, procurement and finance departments. Types of Inventory and Inventory Accounts for manufacturing company

In Manufacturing Company, the cycle start from purchase of raw material and end at the selling of finished goods: Correspondingly, three inventory accounts are needed. 1) Raw Material Inventory Account 2) Work-in-Progress (WIP) Inventory Account 3) Finished Goods Inventory Account When raw material is purchased, the cost of the raw material will be posted to the Raw Material Inventory account. Raw Material Inventory Account will store the value of raw materials received but not yet issued to production department. When the raw material is transferred to production department, the cost of the material will be transferred from Raw Material Inventory Account to WIP Inventory Account. Direct Manufacturing Labour Cost and Manufacturing Overhead Cost will also be debited into WIP Inventory Account. When the finished good is completed, the WIP Inventory Account will be credited with the total manufacturing cost and the cost will be debited into Finished Goods Inventory account. When the Finished Good is sold, the cost will be transferred from Finished Goods Inventory Account to Cost of Goods Sold (COGS) Account.

Methods of Inventory Accounting

The valuation of inventory is not a minor issue, because the accounting method used to create a valuation has a direct bearing on the amount of expense charged to the cost of goods sold in an accounting period, and therefore on the amount of income earned. The basic formula for determining the cost of goods sold in an accounting period is: Beginning inventory + Purchases - Ending inventory = Cost of goods sold Thus, the cost of goods sold is largely based on the cost assigned to ending inventory, which brings us back to the accounting method used to do so. There are several possible inventory costing methods, which are:1-Specific Identification Method.

Under this approach, the cost of each item is separately tracked in inventory, and charge specific cost of an item to the cost of goods sold when you sell the specific item to which that cost has been assigned. This approach requires a massive amount of data tracking, so it is only usable for very high-cost, unique items, such as automobiles or works of art. It is not a viable method in most other situations.

2-First In, First Out The First In, First Out, or FIFO, method of inventory accounting assumes that the oldest goods purchased for resale or for use in manufacturing are used prior to more recent inventory additions. When you take a physical inventory count at month-end, the inventory is valued by applying the most recent cost of the inventory to the number of inventory items remaining unless the number of inventory items remaining exceeds the last purchase quantity. In that case, you apply the previous purchase price to the inventory that exceeds the most recent purchase and add the two together in order to obtain a current valuation for the inventory.

Last In, First Out The Last in First Out, or LIFO, method of inventory accounting is the exact opposite of the FIFO method in that it assumes the most recently purchased goods are the first goods used or sold. The LIFO method applies the previous cost of the goods to the remaining inventory amount, unless the amount exceeds the previous quantity purchased. In that case, you apply the most recent purchase price to the amount of inventory that exceeds the previous purchase quantity and add the two together in order to obtain a current valuation for the inventory. Weighted Average Method The average cost method assigns value to ending inventory based on an average cost to purchase the inventory over the accounting period. For each item purchased, you add the individual item purchase prices together, and then divide by the total number of purchase prices to determine the average price of the inventory for the accounting period. Inventory Systems: Perpetual or Periodic Companies may use either the perpetual system or the periodic system to account for inventory. Under the periodic system, merchandise purchases are recorded in the purchases account, and the inventory account balance is updated only at the end of each accounting period. Perpetual inventory systems have traditionally been associated with companies that sell small numbers of high-priced items, but the development of modern scanning and computer technology has enabled almost any type of merchandiser to consider using this system. Under the perpetual system, purchases, purchase returns and allowances, purchase discounts, sales, and sales returns are immediately recognized in the inventory account, so the inventory account balance should always remain accurate, assuming there is no theft, spoilage, or other losses. Inventory management is the process of efficiently overseeing the constant flow of units into and out of an existing inventory. This process usually involves controlling the transfer in of units in order to prevent the inventory from becoming too high, or dwindling to levels that could put the operation of the company into jeopardy. Competent inventory management also seeks to control the costs associated with the inventory, both from the perspective of the total value of the goods included and the tax burden generated by the cumulative value of the inventory. Balancing the various tasks of inventory management means paying attention to three key aspects of any inventory. The first aspect has to do with time. In terms of materials acquired for inclusion in the total inventory, this means understanding how long it takes for a supplier to process an order and execute a delivery. Inventory management also demands that a solid understanding of how long it will take for those materials to transfer out

of the inventory be established. Knowing these two important lead times makes it possible to know when to place an order and how many units must be ordered to keep production running smoothly. Calculating what is known as buffer stock is also key to effective inventory management. Essentially, buffer stock is additional units above and beyond the minimum number required to maintain production levels. For example, the manager may determine that it would be a good idea to keep one or two extra units of a given machine part on hand, just in case an emergency situation arises or one of the units proves to be defective once installed. Creating this cushion or buffer helps to minimize the chance for production to be interrupted due to a lack of essential parts in the operation supply inventory. Inventory management is not limited to documenting the delivery of raw materials and the movement of those materials into operational process. The movement of those materials as they go through the various stages of the operation is also important. Typically known as a goods or work in progress inventory, tracking materials as they are used to create finished goods also helps to identify the need to adjust ordering amounts before the raw materials inventory gets dangerously low or is inflated to an unfavourable level. Finally, inventory management has to do with keeping accurate records of finished goods that are ready for shipment. This often means posting the production of newly completed goods to the inventory totals as well as subtracting the most recent shipments of finished goods to buyers. When the company has a return policy in place, there is usually a sub-category contained in the finished goods inventory to account for any returned goods that are reclassified as refurbished or second grade quality. Accurately maintaining figures on the finished goods inventory makes it possible to quickly convey information to sales personnel as to what is available and ready for shipment at any given time. 4 Categories of an Inventory Management Tool

There are an unlimited number of subjects that deserve discussion as an inventory management tool. They fall into four categories:

- software, - hardware, - theoretical management models, and - audit systems.

Having all four properly integrated and working in harmony is the job of the experienced inventory manager. Sometimes this requires the manager to be a change agent, bringing a new inventory management tool into a facility or an organization. Software The backbone of inventory management in any organization is the inventory control software that maintains the systemic record of product location, quantity, inventory transactions, and resupply orders. While some organizations are small enough to use a spreadsheet as their primary inventory management tool, most are databases with a menu-driven user interface. Some organizations use off-the-shelf software, while others have internal development teams. Business model differences call for different solutions. Hardware The software requires input to manage the inventory. Servers, desktops, dumb terminals, RF devices, asset tags, RFID tags, scannable bar code label printers, and Point of Sale devices can all play a role as an inventory management tool. Selecting the right tools to balance labour versus infrastructure is part of the art of inventory management. Theoretical Inventory Management Models From independent to dependent demand to the specific science of calculating safety stock, the models available to the logistics community are critical tools of inventory control. Whether it is an upper level model of the entire system or the local tactics on how to execute periodic reviews, having a framework is critical to inventory success.

Audit Systems Audit systems are the space where lean manufacture meets your warehouse. This critical inventory management tool is where you measure your success rate. What you audit depends in a large part on how you define success. Both individuals and overall processes need regular reviews to ensure that both people and process are in line with organizational goals. Each of these four critical categories represents the legs that hold up the work-space that is your inventory. Whether you are a distributor of end-products or a manufacturer supporting a production facility, failure to leverage the power in each of these categories can be costly in ways difficult to calculate. Mastered, and they take your organization to the next level. Top 5 Principles of Inventory Management

There five key principles of inventory management: 1. 2. 3. 4. 5. demand forecasting, warehouse flow, inventory turns/stock rotation, cycle counting and process auditing.

1-Demand Forecasting Depending on the industry, inventory ranks in the top five business costs. Accurate demand forecasting has the highest potential savings for any of the principles of inventory management. Both over supply and under supply of inventory can have critical business costs. Whether it is end-item stocking or raw component sourcing, themore accurate the forecast can be. 2. Warehouse Flow The old concept of warehouses being dirty and unorganized is out dated and costly. Lean manufacturing concepts, including 5S have found a place in warehousing. Sorting, setting order, systemic cleaning, standardizing, and sustaining the discipline 3. Inventory turns/ Stock Rotation Inventory turns is one of the key metrics used in evaluating how effective your execution is of the principles of inventory management. 4. Cycle Counting One of the key methods of maintaining accurate inventory is cycle counting. This helps measures the success of your existing processes and maintain accountability of potential error sources. There are financial implications to cycle counting. Some industries require periodic 100% counts. These are done through perpetual inventory count maintenance or though full-building counts. 5. Process Auditing Proactive error source identification starts with process audits. One of the cornerstone principles of inventory management is to audit early and often. Process audits should occur at each transactional step, from receiving to shipping and all inventory transactions in between. Top 3 Considerations in Small Business Inventory Management Some of the key critical inventory practices vital to small business inventory management include:

Safety Stock Lead time reduction Consignment inventory

Vous aimerez peut-être aussi

- Real Estate GlossaryDocument52 pagesReal Estate GlossaryJustine991Pas encore d'évaluation

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav180% (30)

- AFAR - Forex 2019Document3 pagesAFAR - Forex 2019Joanna Rose DeciarPas encore d'évaluation

- Libby Financial Accounting Solution Manual Chapter 8 Entire VersionDocument5 pagesLibby Financial Accounting Solution Manual Chapter 8 Entire Versionmercy ko0% (1)

- Financial Accounting TextbookDocument1 253 pagesFinancial Accounting Textbookmorobangwato12Pas encore d'évaluation

- Lesson 1: Concept of Business CombinationDocument20 pagesLesson 1: Concept of Business CombinationSHARMAINE CORPUZ MIRANDAPas encore d'évaluation

- Depriciation AccountingDocument42 pagesDepriciation Accountingezek1elPas encore d'évaluation

- Accounting For Fixed AssetsDocument35 pagesAccounting For Fixed Assetsphillipmutambo_87865Pas encore d'évaluation

- Advanced Accounting: Business CombinationsDocument42 pagesAdvanced Accounting: Business Combinations19-Geby Agnes LG100% (1)

- Ias 16 PropertyDocument11 pagesIas 16 PropertyFolarin EmmanuelPas encore d'évaluation

- Depreciation AccountingDocument42 pagesDepreciation AccountingGaurav SharmaPas encore d'évaluation

- Corporate Valuation: Theory, Evidence and Practice Chapter 1Document28 pagesCorporate Valuation: Theory, Evidence and Practice Chapter 1Pj GuptaPas encore d'évaluation

- Soal Soal AklanDocument30 pagesSoal Soal AklanFikri Sya'bana100% (1)

- Practical Accounting Problem 2Document18 pagesPractical Accounting Problem 2JimmyChao100% (2)

- Midterm Exam-Advacctgii 2Nd Sem 2011-2012Document18 pagesMidterm Exam-Advacctgii 2Nd Sem 2011-2012Allie LinPas encore d'évaluation

- Fixed AssetsDocument46 pagesFixed AssetsSprancenatu Lavinia0% (1)

- Accounting Standards AS-10, As-26: A Project ONDocument25 pagesAccounting Standards AS-10, As-26: A Project ONShivam JaiswalPas encore d'évaluation

- Accounting Standard 10Document13 pagesAccounting Standard 10Dipali ManjuchaPas encore d'évaluation

- Banking Technology Information ItDocument13 pagesBanking Technology Information ItMughilan MPas encore d'évaluation

- DepreciationDocument17 pagesDepreciationTahirAli100% (1)

- Chapter 6Document48 pagesChapter 6Nigussie BerhanuPas encore d'évaluation

- CH 5 Depreciation and AmortisationDocument50 pagesCH 5 Depreciation and AmortisationdeepakPas encore d'évaluation

- Chapter 6: Accounting For Plant Assets and Depreciation. ContentsDocument46 pagesChapter 6: Accounting For Plant Assets and Depreciation. ContentsSimon MollaPas encore d'évaluation

- Depreciation TheoryDocument17 pagesDepreciation Theoryvarun rajPas encore d'évaluation

- Accounting Standard 6Document9 pagesAccounting Standard 6api-3828505Pas encore d'évaluation

- BBA II Chapter 3 Depreciation AccountingDocument28 pagesBBA II Chapter 3 Depreciation AccountingSiddharth Salgaonkar100% (1)

- Dep. AccDocument9 pagesDep. AccGurkiran WaliaPas encore d'évaluation

- Concept and Accounting of Depreciation: Learning OutcomesDocument35 pagesConcept and Accounting of Depreciation: Learning OutcomesShristiPas encore d'évaluation

- Accounting StandardsDocument98 pagesAccounting Standardsbudsy.lambaPas encore d'évaluation

- Unit 5 BBA SEM I DepreciationDocument24 pagesUnit 5 BBA SEM I DepreciationRaghuPas encore d'évaluation

- Summary PpeDocument8 pagesSummary PpeJenilyn CalaraPas encore d'évaluation

- Ias 16Document9 pagesIas 16ADEYANJU AKEEMPas encore d'évaluation

- 5 Property, Plant and Equipment: 5.1.1 ObjectiveDocument44 pages5 Property, Plant and Equipment: 5.1.1 ObjectivemaatPas encore d'évaluation

- Study Note 1.2, Page 12 32Document21 pagesStudy Note 1.2, Page 12 32s4sahithPas encore d'évaluation

- Accounting StandardDocument9 pagesAccounting StandardVanshika GaneriwalPas encore d'évaluation

- 69238asb55316 As10Document26 pages69238asb55316 As10GybcPas encore d'évaluation

- Name:-Akash Jaiswal ROLL NO.:-0645 ROOM NO.:-045 SESSION:-2014-2017 Topic:-Accounting For FixedDocument6 pagesName:-Akash Jaiswal ROLL NO.:-0645 ROOM NO.:-045 SESSION:-2014-2017 Topic:-Accounting For FixedAKASH JAISWALPas encore d'évaluation

- GNP CHP 6Document21 pagesGNP CHP 6fentaw melkiePas encore d'évaluation

- Chapter 1 Property Plant and EquipmentDocument26 pagesChapter 1 Property Plant and EquipmentJellai TejeroPas encore d'évaluation

- PP (A) - Lect 2 - Ias 16 PpeDocument19 pagesPP (A) - Lect 2 - Ias 16 Ppekevin digumberPas encore d'évaluation

- IAS 16 Property, Plant and EquipmentDocument4 pagesIAS 16 Property, Plant and EquipmentSelva Bavani SelwaduraiPas encore d'évaluation

- Nepal Accounting Standards On Property, Plant and Equipment: Initial Cost 11 Subsequent Cost 12-14Document24 pagesNepal Accounting Standards On Property, Plant and Equipment: Initial Cost 11 Subsequent Cost 12-14Gemini_0804Pas encore d'évaluation

- TA07b - Current AssetsDocument11 pagesTA07b - Current AssetsMarsha Sabrina LillahPas encore d'évaluation

- Unit - 5 DepreciationDocument19 pagesUnit - 5 DepreciationGeethaPas encore d'évaluation

- Accounting PoliciesDocument3 pagesAccounting PoliciesSatish Ranjan PradhanPas encore d'évaluation

- Week 10 - 01 - Module 22 - Property, Plant & Equipment (Part 1)Document17 pagesWeek 10 - 01 - Module 22 - Property, Plant & Equipment (Part 1)지마리Pas encore d'évaluation

- Accounting Standard 6Document208 pagesAccounting Standard 6aanu1234Pas encore d'évaluation

- Standard No. 03 Tangible Fixed AssetsDocument7 pagesStandard No. 03 Tangible Fixed AssetsVy NguyenPas encore d'évaluation

- CA Notes Concept and Accounting of Depreciation PDFDocument36 pagesCA Notes Concept and Accounting of Depreciation PDFBijay Aryan Dhakal100% (2)

- Fixed Assest Management-UltratechDocument6 pagesFixed Assest Management-UltratechMr SmartPas encore d'évaluation

- 55002bosfndnov19 p1 cp5Document35 pages55002bosfndnov19 p1 cp5Priti Daga100% (1)

- Test Bank For Intermediate Accounting Volume 1-2-12th Canadian Edition Donald e Kieso Isbn 1119496330 Isbn 9781119496335 Full DownloadDocument66 pagesTest Bank For Intermediate Accounting Volume 1-2-12th Canadian Edition Donald e Kieso Isbn 1119496330 Isbn 9781119496335 Full Downloadkellidunnobpqjdixan100% (24)

- Concept of DepreciationDocument8 pagesConcept of Depreciationuyphiljoshua06Pas encore d'évaluation

- Ppacct II Chapter 2Document13 pagesPpacct II Chapter 2Nigussie BerhanuPas encore d'évaluation

- Chapter 9Document30 pagesChapter 9desy adawiyahPas encore d'évaluation

- What Is The Purpose of DepreciationDocument17 pagesWhat Is The Purpose of Depreciationtahsim laptopPas encore d'évaluation

- Module 4 (Topic 5) - Depreciation (Straight Line and Variable Method)Document9 pagesModule 4 (Topic 5) - Depreciation (Straight Line and Variable Method)Ann BergonioPas encore d'évaluation

- Ias 16 - PpeDocument4 pagesIas 16 - Ppecar itselfPas encore d'évaluation

- As-28 (Impairment of Assets)Document11 pagesAs-28 (Impairment of Assets)api-3828505100% (1)

- Accounting Standards (AS) 2 (Revised 1999) : Valuation of InventoriesDocument6 pagesAccounting Standards (AS) 2 (Revised 1999) : Valuation of InventoriesHardik JoshiPas encore d'évaluation

- Fixed Assets and DepreciationDocument7 pagesFixed Assets and DepreciationArun PeterPas encore d'évaluation

- Fixed Asset: Fixed Assets, Also Known As A Non-Current Asset or As Property, Plant, and Equipment (PP&E), Is ADocument7 pagesFixed Asset: Fixed Assets, Also Known As A Non-Current Asset or As Property, Plant, and Equipment (PP&E), Is ARandal SchroederPas encore d'évaluation

- Financial Accounting Assignment No: 1Document4 pagesFinancial Accounting Assignment No: 1kaweriorrPas encore d'évaluation

- Word FormateDocument17 pagesWord Formatetahsim laptopPas encore d'évaluation

- Capital Expenses or Expenditures Are Payments by A Business For Fixed Assets, Like BuildingsDocument4 pagesCapital Expenses or Expenditures Are Payments by A Business For Fixed Assets, Like BuildingsMichelle MirandaPas encore d'évaluation

- Unit 1 - IAS 16: Property, Plant and Equipment Objective: Advanced Financial ReportingDocument18 pagesUnit 1 - IAS 16: Property, Plant and Equipment Objective: Advanced Financial ReportingRobin G'koolPas encore d'évaluation

- Indian Accounting Standard (Ind AS) 16 Property, Plant and EquipmentDocument20 pagesIndian Accounting Standard (Ind AS) 16 Property, Plant and EquipmentSandeepPusarapuPas encore d'évaluation

- Stock Valuation Accounting and Financial Management - I F. Y. 1644477121Document49 pagesStock Valuation Accounting and Financial Management - I F. Y. 1644477121Yu ya WynePas encore d'évaluation

- Week 10 - 02 - Module 23 - Property, Plant & Equipment (Part 2)Document10 pagesWeek 10 - 02 - Module 23 - Property, Plant & Equipment (Part 2)지마리Pas encore d'évaluation

- Differentiation Between Garnishee Order and IT Attachment OrderDocument1 pageDifferentiation Between Garnishee Order and IT Attachment OrderPooja MaldePas encore d'évaluation

- Factor Analysis - Research MethodologyDocument1 pageFactor Analysis - Research MethodologyPooja MaldePas encore d'évaluation

- Banking Regulation Act 1949Document17 pagesBanking Regulation Act 1949Sargam MehtaPas encore d'évaluation

- Portfolio Hedging AssignmentDocument2 pagesPortfolio Hedging AssignmentPooja MaldePas encore d'évaluation

- Banker Customer RelationshipDocument26 pagesBanker Customer RelationshipPooja MaldePas encore d'évaluation

- Banker Customer RelationshipDocument26 pagesBanker Customer RelationshipPooja MaldePas encore d'évaluation

- Future Workplace 2025Document16 pagesFuture Workplace 2025Pooja MaldePas encore d'évaluation

- Phoenix Mills FinalDocument28 pagesPhoenix Mills FinalPooja MaldePas encore d'évaluation

- 07 Chapter-IDocument45 pages07 Chapter-IJanie SoniPas encore d'évaluation

- Assignment/ Quiz: Business Ethics: Name: - Roll No: - BBA Term - 7thDocument7 pagesAssignment/ Quiz: Business Ethics: Name: - Roll No: - BBA Term - 7thBlue StonePas encore d'évaluation

- May 2016 c1 RegularDocument10 pagesMay 2016 c1 RegularKenneth Bryan Tegerero TegioPas encore d'évaluation

- Unit - I - Corporate Accounting Ii - Sba1401: School of Management StudiesDocument99 pagesUnit - I - Corporate Accounting Ii - Sba1401: School of Management StudiesPalani Udhayakumar100% (1)

- Week 6 Homework - Financial AccountingDocument5 pagesWeek 6 Homework - Financial Accountinglamvolamvo0912Pas encore d'évaluation

- Review Sheet Midterm PDFDocument12 pagesReview Sheet Midterm PDFelePas encore d'évaluation

- Sheetband & Halyard Inc The Correct AnswerDocument6 pagesSheetband & Halyard Inc The Correct Answermaran_navPas encore d'évaluation

- FAR2 Quiz On CorpDocument16 pagesFAR2 Quiz On CorpYami Sukehiro100% (1)

- FM Model Test PaperDocument59 pagesFM Model Test PaperMOHAMMAD NADEEMPas encore d'évaluation

- 188 205Document17 pages188 205Fritzie Ann ZartigaPas encore d'évaluation

- Fimiam: Financial Method of Intangible Assets Measurement: Irena Rodov and Philippe LeliaertDocument14 pagesFimiam: Financial Method of Intangible Assets Measurement: Irena Rodov and Philippe LeliaertterongbelandaPas encore d'évaluation

- Explaining MAperformanceDocument49 pagesExplaining MAperformancerohit smithPas encore d'évaluation

- Quizzes - Topic 4 - Xem L I Bài LàmDocument4 pagesQuizzes - Topic 4 - Xem L I Bài LàmHải YếnPas encore d'évaluation

- Calculation For Liquidation Value at Closure Date Is Somewhat Like The Book Value CalculationDocument3 pagesCalculation For Liquidation Value at Closure Date Is Somewhat Like The Book Value CalculationALYZA ANGELA ORNEDOPas encore d'évaluation

- Unique Consultancy and Training Center Solution Mannual 2023Document25 pagesUnique Consultancy and Training Center Solution Mannual 2023Firdows SuleymanPas encore d'évaluation

- Financial Statement Analysis Antonio Jaramillo DayagDocument11 pagesFinancial Statement Analysis Antonio Jaramillo DayagAldrin RomeroPas encore d'évaluation

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesRonamae RevillaPas encore d'évaluation

- FS AnalysisDocument1 pageFS AnalysisLark WarPas encore d'évaluation

- (FINA2207: Business Analysis and Valuation) Solution To Workshop 1 QuestionsDocument5 pages(FINA2207: Business Analysis and Valuation) Solution To Workshop 1 QuestionsYi Lin LimPas encore d'évaluation

- Plant Asset Natural ResourcesDocument21 pagesPlant Asset Natural ResourcesMarco LawinataPas encore d'évaluation

- Cash Flow EstimationDocument35 pagesCash Flow EstimationAtheer Al-AnsariPas encore d'évaluation