Académique Documents

Professionnel Documents

Culture Documents

UMS Holdings Limited

Transféré par

Chan Weng HongTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

UMS Holdings Limited

Transféré par

Chan Weng HongDroits d'auteur :

Formats disponibles

UMSH.SI is overvalued compared to its Price of $0.

51 per share, has somewhat above average safety, and is currently rated a Hold. UMS Holdings Limited (UMSH.SI) InfoTech(Semiconductors&Equip)

Company Information Business: UMS Holdings Limited is an investment holding company. The Company operates in two segments: semiconductor, and contract equipment manufacturing (CEM) and others. Capital Appreciation Value: Value is a measure of a stock's current worth. UMSH.SI has a current Value of $0.45 per share. Therefore, it is overvalued compared to its Price of $0.51 per share. Value is computed from forecasted earnings per share, forecasted earnings growth, profitability, interest, and inflation rates. Value increases when earnings, earnings growth rate and profitability increase, and when interest and inflation rates decrease. VectorVest advocates the purchase of undervalued stocks. At some point in time, a stock's Price and Value always will converge. RV (Relative Value): RV is an indicator of long-term price appreciation potential. UMSH.SI has an RV of 1.01, which is fair on a scale of 0.00 to 2.00. This indicator is

far superior to a simple comparison of Price and Value because it is computed from an analysis of projected price appreciation three years out, AAA Corporate Bond Rates, and risk. RV solves the riddle of whether it is preferable to buy High growth, High P/E stocks, or Low growth, Low P/E stocks. VectorVest favors the purchase of stocks with RV ratings above 1.00. RS (Relative Safety): RS is an indicator of risk. UMSH.SI has an RS rating of 1.25, which is very good on a scale of 0.00 to 2.00. RS is computed from an analysis of the consistency and predictability of a company's financial performance, debt to equity ratio, sales volume, business longevity, price volatility and other factors. A stock with an RS rating greater than 1.00 is safer and more predictable than the average stock in the VectorVest database. VectorVest favors the purchase of stocks of companies with consistent, predictable financial performance. RT (Relative Timing): RT is a fast, smart, accurate indicator of a stock's price trend. UMSH.SI has a Relative Timing rating of 1.16, which is good on a scale of 0.00 to 2.00. RT is computed from an analysis of the direction, magnitude, and dynamics of a stock's price movements over one day, one week, one quarter and one year time periods. Once a stock's price has established a strong trend, it is expected to continue in that trend for the short-term. If a trend dissipates, RT will gravitate toward 1.00. RT will explode from bottoms, dive from tops, and reflect changes in price momentum. VectorVest favors the purchase of stocks with RT ratings above 1.00. VST (VST-Vector): VST is the master indicator for ranking every stock in the VectorVest database. UMSH.SI has a VST rating of 1.15, which is good on a scale of 0.00 to 2.00. VST is computed from the square root of a weighted sum of the squares of RV, RS, and RT. Stocks with the highest VST ratings have the best combinations of Value, Safety and Timing. These are the stocks to own for above average, long-term capital appreciation. VectorVest advocates the purchase of safe, undervalued stocks rising in price. Recommendation (REC): VectorVest gives a Buy, Sell, Hold recommendation on every stock, every day. UMSH.SI has a Hold recommendation. REC reflects the cumulative effect of all the VectorVest parameters working together. These parameters are designed to help investors buy safe, undervalued stocks rising in price. They also help investors avoid or sell risky, overvalued stocks falling in price. VectorVest recommends that investors buy high VST-Vector, Buy-rated stocks in rising markets. Stop (Stop-Price): Stop is an indicator of when to sell a long position or cover a short position. UMSH.SI has a Stop of $0.47 per share. This is $0.03 below below UMSH.SI's current closing Price. A stock's Stop is computed from a 13 week moving average of its closing prices, and is fine-tuned according to the stock's fundamentals. High RV, high RS stocks have lower Stops, and low RV, low RS stocks have higher Stops. In the VectorVest system, a stock gets a 'B' or 'H' recommendation

if its Price is above its Stop and an 'S' recommendation if its Price is below its Stop. GRT (Earnings Growth Rate): GRT reflects a company's one to three year forecasted earnings growth rate in percent per year. UMSH.SI has a forecasted Earnings Growth Rate of -6.00%, which VectorVest considers to be very poor. GRT is computed from historical, current and forecasted earnings data. It is updated each week for every stock in the VectorVest database. GRT often foretells a stock's future price trend. If a stock's GRT trend is upward, the stock's price will likely rise. If GRT is trending downward, the stock's Price will probably fall. VectorVest favors the purchase of stocks whose GRT is rising and is greater than the sum of current inflation and interest rates, as shown weekly in our investment climate report. EPS (Earnings per Share): EPS stands for leading 12 months Earnings Per Share. UMSH.SI has a forecasted EPS of $0.06 per share. VectorVest determines this forecast from a combination of recent earnings performance and traditional fiscal and/or calendar year earnings forecasts. P/E (Price to Earnings Ratio): P/E is a popular measure of stock valuation which shows the dollars required to buy one dollar of earnings. UMSH.SI has a P/E of 8.42. This ratio may be deemed to be high or low depending upon your frame of reference. The average P/E of all the stocks in the VectorVest database is 12.63. P/E is computed daily using the formula: P/E = Price/EPS. EY (Earnings Yield): EY reflects earnings per share as a percent of Price. EY is related to P/E via the formula, EY = 100 / (P/E), and may be used in place of P/E as a measure of valuation. EY has the advantages that it is always determinate and can reflect negative earnings. UMSH.SI has an EY of 12.57 percent. This is above the current average of 7.43% for all the stocks in the VectorVest database. EY equals 100 x (EPS/Price). GPE (Growth to P/E Ratio): GPE is another popular measure of stock valuation. It compares earnings growth rate to P/E ratio. UMSH.SI has a GPE rating of -0.75. High growth stocks are believed to be able to justify high P/E ratios. A stock is commonly considered to be undervalued when GPE is greater than 1.00 and overvalued when GPE is below 1.00. Unfortunately, this rule of thumb does not take into account the effect of interest rates on P/E ratios. The operative GPE ratio of 1.00 is valid when and only when interest rates equal 10%. With long-term interest rates currently at 5.26%, the operative GPE ratio is 0.28. Therefore, UMSH.SI may be considered to be overvalued. Dividend Information DIV (Dividend): VectorVest reports annual, regular, cash dividends as indicated by the most recent payments. Special distributions, one-time payments, stock dividends, etc., are not generally included in DIV. UMSH.SI pays an annual dividend

of $0.05 per share. DY (Dividend Yield): DY reflects dividend per share as a percent of Price. UMSH.SI has a Dividend Yield of 9.9 %. This is above the current average of 2.97% for all the stocks in the VectorVest database. DY equals 100 x (DIV/Price). It is useful to compare DY with EY. If DY is not significantly lower than EY, the dividend payment may be in jeopardy. DS (Dividend Safety): DS is an indicator of the assurance that regular cash dividends will be declared and paid at current or at higher rates for the foreseeable future. UMSH.SI has a Dividend Safety of 59 which is good on a scale of 0 to 99. Stocks with DS values above 75 typically have RS values well above 1.00 and EY levels that are much higher than DY. DG (Dividend Growth Rate): Dividend Growth is a forecasted annual growth rate of a company's dividend based on historical dividend payments and dividend predictability. It is a subtle yet important indicator of a companys financial performance. It also provides some insight into the boards outlook on the companys ability to increase earnings. UMSH.SI has a Dividend Growth of 14% This is above the current average of 2.97% for all the stocks in the VectorVest database. YSG (YSG-Vector): YSG is an indicator which combines DIV, DY and DG into a single value, and allows direct comparison of all dividend-paying stocks in the database. UMSH.SI has a YSG rating of 1.45 which is excellent. Stocks with the highest YSG values have the best combinations of Dividend Yield, Safety and Growth. These are the stocks to buy for somewhat above current income and long-term growth. Price-Volume Data Price: UMSH.SI closed on Friday, August 02, 2013 at $0.51 per share. Open:UMSH.SI opened trading at a price of $0.51 per share on Friday, August 02, 2013. High: UMSH.SI traded at a High price of $0.51 per share on Friday, August 02, 2013. Low: UMSH.SI traded at a Low price of $0.51 per share on Friday, August 02, 2013. Close: UMSH.SI closed on Friday, August 02, 2013 at $0.51 per share. (Close is also called Price in the VectorVest system) Range: Range reflects the difference between the High and Low prices for the day. UMSH.SI traded with a range of $0.00 per share on Friday, August 02, 2013.

$ Change: UMSH.SI up 0.00 from the prior day's closing Price. %PRC: UMSH.SI's Price changed 1.00% from the prior day's closing price. Volume: UMSH.SI traded 542,000 shares on Friday, August 02, 2013. AvgVol: AvgVol is the 50 day moving average of daily volume as computed by VectorVest. UMSH.SI has an AvgVol of 766,500 shares traded per day. %Vol: %Vol reflects the percent change in today's trading volume as compared to the AvgVol. %Vol equals ((Volume - AvgVol) / AvgVol ) * 100. UMSH.SI had a %Vol of 29.29% on Friday, August 02, 2013 CI (Comfort Index): CI is an indicator which reflects a stock's ability to resist severe and/or lengthy price declines.UMSH.SI has a CI rating of 1.45, which is excellent on a scale of 0.00 to 2.00. CI is quite different from RS in that it is based solely upon a stock's long-term price history. VectorVest advocates the purchase of high CI stocks. Sales / Market Capitalization Information Sales: UMSH.SI has annual sales of 113,000,000 Sales Growth: Sales Growth is the Sales Growth Rate in percent over the last 12 months. UMSH.SI has a Sales Growth of -14.00% per year. This is very poor. Sales Growth is updated each week for every stock. It is often useful to compare Sales Growth to Earnings Growth to gain an insight into a company's operations. Sales Per Share (SPS): UMSH.SI has annual sales of $0.33 per share. SPS can be used as a measure of valuation when comparing stocks within an Industry Group. Price to Sales Ratio (P/S): UMSH.SI has a P/S of 1.53. This ratio is also used as a measure of valuation. Here, too, it is useful when comparing stocks within an Industry Group. Shares: UMSH.SI has 343,000,000 shares of stock outstanding. Market Capitalization: UMSH.SI has a Market Capitalization of 173,000,000. Market Capitalization is calculated by multiplying price times shares outstanding.

Vous aimerez peut-être aussi

- Hafary Holdings LTDDocument5 pagesHafary Holdings LTDChan Weng HongPas encore d'évaluation

- Cordlife Group LTDDocument5 pagesCordlife Group LTDChan Weng HongPas encore d'évaluation

- Oceanus Group Limited PDFDocument6 pagesOceanus Group Limited PDFChan Weng HongPas encore d'évaluation

- Nera Telecommunications LTDDocument5 pagesNera Telecommunications LTDChan Weng HongPas encore d'évaluation

- Relatorio Sobre XPDocument5 pagesRelatorio Sobre XPCarlos TresemePas encore d'évaluation

- Dividends Per Share: What Is The 'Price-Earnings Ratio - P/E Ratio'Document4 pagesDividends Per Share: What Is The 'Price-Earnings Ratio - P/E Ratio'Gokul NathPas encore d'évaluation

- ANFI Stock Analysis 14.05.2016Document6 pagesANFI Stock Analysis 14.05.2016Elena CampagnaPas encore d'évaluation

- Var Margin: With 99% Confidence, What Is The Maximum Value That An Asset or Portfolio May Loose Over The Next Day"?Document11 pagesVar Margin: With 99% Confidence, What Is The Maximum Value That An Asset or Portfolio May Loose Over The Next Day"?Utkrisht SethiPas encore d'évaluation

- The Concepts of Return On Investment & RiskDocument16 pagesThe Concepts of Return On Investment & Riskrc_prabirPas encore d'évaluation

- Strategy Description ResultsDocument5 pagesStrategy Description Resultsp17vinaykhPas encore d'évaluation

- Technical AnalysisDocument93 pagesTechnical AnalysisAnshul Agrawal50% (4)

- Powershares Buyback Achievers Portfolio: As of Dec. 31, 2013Document2 pagesPowershares Buyback Achievers Portfolio: As of Dec. 31, 2013hkm_gmat4849Pas encore d'évaluation

- Chart HelpDocument76 pagesChart HelpRustom SuiPas encore d'évaluation

- WeeklyTechnicalPicks 04june2021Document6 pagesWeeklyTechnicalPicks 04june2021RkkvanjPas encore d'évaluation

- MF Comparison & Important RatiosDocument22 pagesMF Comparison & Important RatiosSantanu MukherjeePas encore d'évaluation

- Zeus Case StudyDocument7 pagesZeus Case StudyBobYuPas encore d'évaluation

- Assignment On SAPM Portfolio Constructio1Document11 pagesAssignment On SAPM Portfolio Constructio1pratheeka puthranPas encore d'évaluation

- PegejagedanojonojukDocument2 pagesPegejagedanojonojukTafi SidinilePas encore d'évaluation

- ValueResearchFundcard DSPBRTop100EquityReg 2011jun22Document6 pagesValueResearchFundcard DSPBRTop100EquityReg 2011jun22Aditya TiplePas encore d'évaluation

- Technical Stock PicksDocument4 pagesTechnical Stock PicksumaganPas encore d'évaluation

- Data Analytics Manual - Mero LaganiDocument3 pagesData Analytics Manual - Mero Laganicalibertrader100% (3)

- Private Equity FundDocument19 pagesPrivate Equity FundClint AyersPas encore d'évaluation

- Earnings Per Share-ProDocument3 pagesEarnings Per Share-ProVibhorBajpaiPas encore d'évaluation

- US Corporate High Yield Reaching Extreme Reward / Risk RatioDocument3 pagesUS Corporate High Yield Reaching Extreme Reward / Risk Ratioapi-245850635Pas encore d'évaluation

- Retail Research: Indian Currency MarketDocument3 pagesRetail Research: Indian Currency MarketumaganPas encore d'évaluation

- Technical Analysis of SharesDocument27 pagesTechnical Analysis of Sharesjinalsinh1433Pas encore d'évaluation

- Quantum Strategy: Winning Strategies of Professional InvestmentD'EverandQuantum Strategy: Winning Strategies of Professional InvestmentPas encore d'évaluation

- Risk Return Analysis of Mutual FundsDocument23 pagesRisk Return Analysis of Mutual FundsAnand Mishra100% (1)

- Stock Analysis Checklist: Sr. No. What WhyDocument4 pagesStock Analysis Checklist: Sr. No. What WhyAshish AroraPas encore d'évaluation

- Stock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc URS As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCPas encore d'évaluation

- Zeus Asset Management SubmissionDocument5 pagesZeus Asset Management Submissionxirfej100% (1)

- Top 25 Finance Interview QsDocument11 pagesTop 25 Finance Interview QsBala VigneshPas encore d'évaluation

- Exploring Oscillators and IndicatorsDocument20 pagesExploring Oscillators and Indicatorsmsamala09Pas encore d'évaluation

- ValuEngine Weekly Newsletter July 22, 2011Document12 pagesValuEngine Weekly Newsletter July 22, 2011ValuEngine.comPas encore d'évaluation

- 2019 July 14Document15 pages2019 July 14Alejandro MufardiniPas encore d'évaluation

- Stock Research Report For Yamana Gold Inc ETR As of 11/17/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For Yamana Gold Inc ETR As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCPas encore d'évaluation

- Stock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsDocument4 pagesStock Research Report For HNZ As of 2/29/12 - Chaikin Power ToolsChaikin Analytics, LLCPas encore d'évaluation

- Ratio Calculation Comments Gross Profit Margin: 1.1 Profitability RatiosDocument3 pagesRatio Calculation Comments Gross Profit Margin: 1.1 Profitability RatiosUttara NaktodePas encore d'évaluation

- Drredlab 20110725Document2 pagesDrredlab 20110725Arun SadhanandhamPas encore d'évaluation

- WMAI - Assignment 2Document6 pagesWMAI - Assignment 2044046Pas encore d'évaluation

- MF EducationDocument5 pagesMF EducationVikash ChaurasiaPas encore d'évaluation

- DerivativesStrategy-Oct28 11Document2 pagesDerivativesStrategy-Oct28 11Preetham PatibandlaPas encore d'évaluation

- Frasers Commercial Trust: Charted TerritoryDocument2 pagesFrasers Commercial Trust: Charted TerritoryventriaPas encore d'évaluation

- A Study On Technical Analysis of Stocks Listed in Nse With Reference To Pharmaceutical IndustriesDocument7 pagesA Study On Technical Analysis of Stocks Listed in Nse With Reference To Pharmaceutical IndustriesSagar KattimaniPas encore d'évaluation

- ValuEngine Free Weekly Newsletter Has Been PostedDocument10 pagesValuEngine Free Weekly Newsletter Has Been PostedValuEngine.comPas encore d'évaluation

- 7 Terms To Know For Making Money in Stock MarketDocument10 pages7 Terms To Know For Making Money in Stock MarketAdvisesure.comPas encore d'évaluation

- Importance of PE Ratio For Investing in Mutual FundsDocument5 pagesImportance of PE Ratio For Investing in Mutual FundsAnonymous So5qPSnPas encore d'évaluation

- Stock Research Report For DFS As of 7/27/11 - Chaikin Power ToolsDocument4 pagesStock Research Report For DFS As of 7/27/11 - Chaikin Power ToolsChaikin Analytics, LLCPas encore d'évaluation

- Technical Report (Equity) - 26 Dec 2019 - 26!12!2019 - 09Document3 pagesTechnical Report (Equity) - 26 Dec 2019 - 26!12!2019 - 09Avismith DuttaPas encore d'évaluation

- Alpha: How To Use Alpha With Mutual FundsDocument17 pagesAlpha: How To Use Alpha With Mutual FundsshafeeksngsPas encore d'évaluation

- Forex Engulfing Trading Strategy: A Complete Forex Trading Strategy That Really Makes MoneyD'EverandForex Engulfing Trading Strategy: A Complete Forex Trading Strategy That Really Makes MoneyÉvaluation : 4 sur 5 étoiles4/5 (13)

- Ahead of the Market (Review and Analysis of Zacks' Book)D'EverandAhead of the Market (Review and Analysis of Zacks' Book)Pas encore d'évaluation

- 20-Relative Strenght Index-1611440002-Muh Awal Tasir (Makalah)Document19 pages20-Relative Strenght Index-1611440002-Muh Awal Tasir (Makalah)nanda awaliaPas encore d'évaluation

- Trailing Stop PercentDocument3 pagesTrailing Stop Percentchristophermrequinto100% (2)

- Advance Trading Algorithms ExplanationDocument9 pagesAdvance Trading Algorithms ExplanationMadhav GoyalPas encore d'évaluation

- Technical Focus - 5aug16Document3 pagesTechnical Focus - 5aug16Faizal FazilPas encore d'évaluation

- Week 2 NotesDocument2 pagesWeek 2 NotesLuke NogueiraPas encore d'évaluation

- Retail Research: Technical Stock IdeaDocument2 pagesRetail Research: Technical Stock IdeaumaganPas encore d'évaluation

- How CPF Member Cheat CPF MoneyDocument5 pagesHow CPF Member Cheat CPF MoneyChan Weng HongPas encore d'évaluation

- OSK DMG - Market Outlook For The YearDocument87 pagesOSK DMG - Market Outlook For The YearChan Weng HongPas encore d'évaluation

- SG Dividend Yield Monitor - OIR - 150112Document8 pagesSG Dividend Yield Monitor - OIR - 150112Chan Weng HongPas encore d'évaluation

- Nikko AM STI ETFDocument2 pagesNikko AM STI ETFChan Weng HongPas encore d'évaluation

- FHT - Frasers Hospitality TrustDocument3 pagesFHT - Frasers Hospitality TrustChan Weng HongPas encore d'évaluation

- REIT Ranking - June 2014Document1 pageREIT Ranking - June 2014Chan Weng HongPas encore d'évaluation

- King WanDocument7 pagesKing WanChan Weng HongPas encore d'évaluation

- King WanDocument7 pagesKing WanChan Weng HongPas encore d'évaluation

- Weekly S-Reit TrackerDocument4 pagesWeekly S-Reit TrackerChan Weng HongPas encore d'évaluation

- Capital Mall TrustDocument7 pagesCapital Mall TrustChan Weng HongPas encore d'évaluation

- Vardia - Final Prospectus - 150507Document139 pagesVardia - Final Prospectus - 150507Will HarrisPas encore d'évaluation

- English Ratio Analysis For Real-Estate CompanyDocument14 pagesEnglish Ratio Analysis For Real-Estate CompanyMohamad RizwanPas encore d'évaluation

- Trading Pocket PivotsDocument18 pagesTrading Pocket PivotsJose Rodriguez100% (9)

- 1.0 Ratio AnalysisDocument6 pages1.0 Ratio Analysissam1702Pas encore d'évaluation

- Adr & GDRDocument19 pagesAdr & GDRmanishg_17100% (3)

- Evaluation of Investor Awareness On Techniques UseDocument12 pagesEvaluation of Investor Awareness On Techniques UseRonat JainPas encore d'évaluation

- The HMC & Inflation Protected Bonds - Case StudyDocument13 pagesThe HMC & Inflation Protected Bonds - Case StudySandeep K Biswal100% (2)

- Asset Classes and Financial Instruments: Bodie, Kane, and Marcus Tenth EditionDocument49 pagesAsset Classes and Financial Instruments: Bodie, Kane, and Marcus Tenth EditionA SPas encore d'évaluation

- Handouts ConsolidationIntercompany Sale of Plant AssetsDocument3 pagesHandouts ConsolidationIntercompany Sale of Plant AssetsCPAPas encore d'évaluation

- Century 21 Broker Properti Jual Beli Sewa Rumah IndonesiaDocument2 pagesCentury 21 Broker Properti Jual Beli Sewa Rumah IndonesiaAyunk SyahPas encore d'évaluation

- Non-Resident Alien Engaged in Business in The Phil: Income Tax RR2Document8 pagesNon-Resident Alien Engaged in Business in The Phil: Income Tax RR2Jm CruzPas encore d'évaluation

- Formula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NDocument5 pagesFormula Sheet For Midterm Examination: 0 1 W Acc 2 W Acc 2 N W Acc N N W Acc N N+1 W Acc FCFF FCFF W Acc FCFF NrohansahniPas encore d'évaluation

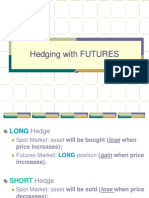

- 2 Hedging With FUTURESDocument28 pages2 Hedging With FUTURESivona_dutuPas encore d'évaluation

- General Compilation Engagement Checklist (For Financial Statements With Periods Ending Before December 15, 2010)Document16 pagesGeneral Compilation Engagement Checklist (For Financial Statements With Periods Ending Before December 15, 2010)LadyOwll311Pas encore d'évaluation

- The Institute of Bankers Pakistan: Sample PaperDocument5 pagesThe Institute of Bankers Pakistan: Sample PaperkoolyarPas encore d'évaluation

- Dorset Energy Fund Up 50 Percent Topping Hedge Fund Performance ListDocument1 pageDorset Energy Fund Up 50 Percent Topping Hedge Fund Performance ListPeter BatsakisPas encore d'évaluation

- Emergent Capital Investment Management, LLC v. Stonepath Group, Inc., Previously Known As Net Value Holdings, Inc., Andrew Panzo and Lee Hansen, 343 F.3d 189, 2d Cir. (2003)Document12 pagesEmergent Capital Investment Management, LLC v. Stonepath Group, Inc., Previously Known As Net Value Holdings, Inc., Andrew Panzo and Lee Hansen, 343 F.3d 189, 2d Cir. (2003)Scribd Government DocsPas encore d'évaluation

- Chapter16 PDFDocument29 pagesChapter16 PDFervin sasongkoPas encore d'évaluation

- Why Banco Filipino FailedDocument2 pagesWhy Banco Filipino FailedRommel Anthony Tayag50% (2)

- Divestment ReportDocument180 pagesDivestment ReportLa Tía Eulogia RosasPas encore d'évaluation

- Ias 1 Presentation of Financial StatementsDocument42 pagesIas 1 Presentation of Financial StatementsEjaj-Ur-RahamanPas encore d'évaluation

- Secretary of Finance Vs Illarde and CabalunaDocument8 pagesSecretary of Finance Vs Illarde and Cabalunajetzon2022Pas encore d'évaluation

- Interest, Discount, Equivalent RatesDocument4 pagesInterest, Discount, Equivalent RatesChristian GoPas encore d'évaluation

- Conversation With BankerDocument6 pagesConversation With BankerMatthew EcclesPas encore d'évaluation

- Cash Flow Statement Problems - Cpaj2007Document7 pagesCash Flow Statement Problems - Cpaj2007Iqra MughalPas encore d'évaluation

- 04 MusharakahDocument8 pages04 MusharakahNur IskandarPas encore d'évaluation

- Solution AP Test Bank 1Document6 pagesSolution AP Test Bank 1Brian BascoPas encore d'évaluation

- Uy V BuenoDocument6 pagesUy V BuenoMiguelPas encore d'évaluation

- MSDocument36 pagesMSJason WangPas encore d'évaluation

- Introduction To Financial Markets - LocalDocument19 pagesIntroduction To Financial Markets - LocalColettePas encore d'évaluation