Académique Documents

Professionnel Documents

Culture Documents

Tax Management Model

Transféré par

Zacharia VincentCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tax Management Model

Transféré par

Zacharia VincentDroits d'auteur :

Formats disponibles

SATHYABAMA UNIVERSITY (Established under section 3 of UGC Act , 1956) Jeppiaar Nagar, Rajiv Gandhi Salai , Chennai -119

DEPARTMENT OF MANAGEMENT STUDIES

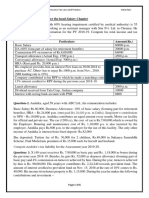

TAX MANAGEMENT- SBAX5025 Unit I Section A 1. Define Tax 2. Write short notes on a) person b) Income. 3. Define a) Previous year b) Assessment year 4. Define a) Direct taxes 6. Define Total Income? 7. Who is an ordinary resident? 8. Mr. K, an Indian citizen leaves India for the first time on 31st May 2006 and comes back on 15th May 2009. He again leaves India on 10th June 2010 to come back on 14th January 2011. He is living in India since then. Determine his status for the previous year 2011-12. 9. What is capital Expenses? 10. Explain capital Lessees? Section B 1.Which of the following incomes are taxable when the residential status of Mr. Umesh is : (i) Resident, (ii) Not Ordinary Resident, (iii) Non Resident. Income accrued in Canada but received in India Rs. 2,000. Rs. 5,000 were earned in Africa and received in India Rs. 2,000. Rs. 5,000 earned in India but received in Canada. Rs. 10,000 earned and received in Srilanka from a business controlled from India. House property income (computed)from Srilanka Rs. 2,000. Rs.4,000 was past untaxed foreign income which was brought to India during the previous year. b) Indirect taxes. 5. Write a short note on residential status.

Profit earned from a business in Kanpur Rs. 10,000. 2. Explain the term assessee of state the different classes of Assesses. 3. What is Agricultural Income as per Income as per income tax act? 4. What are different categories of assesses according to residential status? 5. What test would you distinguish capital receipts and revenue receipts? 6. Explain any ten items exempted from Income tax? 7.What are the tax free incomes ?give examples of any eight tax free incomes? 8.Give eight examples for income partially exempt from income tax U/S 86. 9.Enumarete the exception to the rule that income of the previous year is taxable in the following assessment year. 10.Bring out the meaning of income received and income deemed to be received in India. Unit II Section A 1. 2. 3. Define salaries under the income tax act. Write short note on perquisites. What is profit in lieu of salary? working and living in chennai. Rs. Basic Salary Dearness allowance (Service benefit) H.R.A. Rent paid per annum 5. 7, 800 11, 700 13, 200 78, 000

4. From the following details calculate taxable house rent allowance of Mr. Kannan who is

Mr. Prakash retired in September 2010 after having put in 42 years of services in a company. His average salary for 10 months preceding September was Rs. 2,500 p.m. He receives gratuity of Rs. 60,000 compute his taxable gratuity.

6. 7. 8.

What are allowances? What are the items included under the head salary u/s 80 c? How do you exempt House Rent Allowance?

9. 10.

What is Recognized provident Fund? Explain who is specified employee. Section B 1. 2. 3. 4. What are Allowances? How will you treat them? Define Perquisites. Describe the fully exempted perquisites as per I.T Act. Describe the methods of savings available to save the tax for salaried individual . Following are the particulars of salary of Mr.R an employee of ABC Ltd of Bangalore. i. ii. iii. iv. v. vi. vii. viii. ix. x. Basic Salary Rs.30,000 p.m DA Rs.5000 p.m ( 50% enters in retirement benefits ) Transport Allowance Rs. 2000 p.m Helper Allowance Rs.2000 p.m. he is paying Rs.1600 p.m to a helper which he got engaged for his office work. Bonus Rs.10,000 Commission Rs.40,000 Reimbursement of medical bills Rs.60, 000 out of his wife and she got her medical treatment from a private hospital. Amount paid by employee for free supply of gas, electricity at his residence Rs.18,000 Educational Allowance @ Rs.200 p.m per child for three children. House Rent Allowance Rs.4000 p.m Rent paid for the house Rs.5000 p.m Compute income under the head of salary for the assessment year 2011-12. 5. Mr. A is an employee in PQR Ltd in a place where population is 15 lakhs. He draws a basic salary of Rs . 2400 p. m ; D.A is Rs.1200 p. m ( enters for service benefits ) ; Bonus is Rs.1600 p. m , Traveling Allowance Rs.1600 p. a ( actually incurred Rs.1200 only ) He has been provided a rent free accommodation by the company. The company provided furniture on hire for Rs.800 p.a. Calculate taxable value of RFA if Rs.200 p. m is deducted as rent free accommodation from his salary.

6.Form the particulars given below compute his salary income: i. ii. iii. iv. v. vi. Basic Salary Rs. 13,000 p.m. Dearness Allowance Rs. 900 p.m. (Rs. 500 p.m. enters into pay for service benefits). Bonus Rs. 8,400. Salary in lieu of leave Rs. 3,000. Entertainment allowance Rs. 1,500 p.m. Traveling expenses Rs. 1000 p.m. 25 lakhs] Fair Rental Value Rs. 2,500 p.m. Cost of furniture Rs. 35,000. Salary of gardener Rs. 1,000 p.a. viii.Club bill paid by employer Rs. 2,200 p.a. ix. x. xi. Own life Wifes life Major son Contribution by employer to R.P.F. 13%(each) of salary. Advance salary Rs. 2,000. Life Insurance Premium (Paid by employee) = 3,000 p.a. = 4,000 p.a. = 2,000 p.a.

vii. Furnished House at Concessional rent of Rs. 800 p.m. in Chennai [population above

xii. Professional tax Rs. 1020. 7. P and Q are officers in the State Bank of India. The bank has allotted free of rent identical flats to both P and Q in Nariman Point Mumbai [population above 25 lakhs], the fair market rent of each flat being Rs. 6,000 p.m. in April, 2010.P was promoted its Chief officer but he continues to occupy the same flat. The Bank has also furnished the above flat. The original cost of furniture provided in each flat works out to Rs. 45,000. The salary particulars of P and Q are as follows. P Rs. Basic Dearness Pay (enter) Dearness allowance Educational allowance 9,000 p.m. 1,750 p.m. 1,500 p.m. 1,300 p.m. Q Rs. 7,500 p.m. 1,600 p.m. 1,400 p.m. 1,300 p.m.

Children hostel allowance Petrol allowance studying and staying in hostel in each case.

1,800 p.m. 900 p.m.

1,500 p.m. 800 p.m.

Determine the perquisite value of the flat in the hands of P and Q. Two children are

8.The Following are the particulars of the income of Sh. Arvind for the previous year ending on 31st March 2011 xiii.Salary Rs. 12,000 p.m. xiv.Contribution to Recognized P.F. Rs. 1,610 per month. xv. Employer contributes the same amount as the employee contributes towards P.F. xvi.Dearness Allowance : Rs. 300 p.m. It is not considered for computation of his retirement benefits. xvii. xviii. Interest credited to P.F.@13% is Rs. 13,000. Contribution to Public Provident Fund is Rs. 9,000.

xix.Bonus Rs. 3,000. xx. His ration bill of Rs. 2,000 p.m. is paid by employer. xxi.Premium of life Policy is Rs. 12,000 on a Policy of Rs. 1,00,000. xxii. xxiii. Employer company has provided him free club facility which costed Repayment of house building loan taken from HDFC (a Govt. agency) Rs. 24000 and free lunch for 300 days cost being Rs. 450 per day 20,500 during the year. Find out taxable income of Shri Arvind for the assessment year 2011 12. 9.Following details are available from Shri. P.N. Dutta, a resident individual for the year ending on 31.03.2008. you are required to compute his taxable income under the head Salaries. a. b. c. d. e. f. Salary received Income-tax deducted at source Own contribution to R.P.F. deducted from salary Dearness allowance 50% of salary. Employers contribution to R.P.F. Interest on accumulated balance of R.P.F. @ 9.5% 8,000 2,400 Rs. 71,800 1,200 8,000

g.

He is provided with a furnished free quarter for residential purposes in Calcutta [Population above 25 lakhs] owned by his employer, the fair rent of which is at Rs. 4,000 p.m. Cost of Furnishing is Rs. 45,000. Gardeners salary paid by employer is Rs. 3,000 p.a.

h.

He is provided with a car of 1.5 lt. capacity by his employer for both personal and official use and expenses of maintaining and running the car with chauffeur are borne by the employer.

i.

He had two life insurance policies : one on his own life policy value of Rs. 80,000 on which annual premium paid for his employer is Rs. 8,000 and other life of his wife a policy value of Rs. 20,000 on which premium paid by him is Rs. 1,800.

Compute his salary income and Q.A. for deduction u/s 80C. 10. Compute the taxable salary of Mrs. Devi of Madurai for the assessment year 2011 12 from the following particulars. a. Basic salary Rs. 8000 p.m. b. D.A. (S.B.) 2000 p.m. c. Bonus Rs. 8,000 p.a. d. Rent free accommodation provided by the employer, the fair rent value of which is Rs. 20,000 p.a. The cost of furniture provided there is Rs. 10,000 e. Entertainment allowance Rs. 500 p.m. f. Her contribution to R.P.F. is at 15% if salary. g. Employers contribution to R.P.F. is Rs. 15,000 p.a. h. Interest credited to R.P.F. balance at Rs. 9.5% p.a. Rs. 1,900. i. Free use of large motor car both official and personal purposes. Driver is also provided by the employer. Unit III 1. 2. 3. 4. Define Annual value. Define gross annual value. Write a note on self occupied property. Calculate Net annual value of a house from the following. Actual Rent received Rs. 6000 p.m.

Municipal rental value Rs. 60,000 Fair rental value Rs. 66,000 Standard rent Rs. 69,000 Municipal taxes paid 10% of municipal rental value. 5. The Net annual value of a House property is Rs. 12,000. The deductions claimed are as follows. Repairs Rs. 2000 Ground rent Rs.600 Insurance premium due Rs. 1,000 Find income from house property. 6. 7. 8. Write short notes on vacancy allowance. How will you compute income from let out house property? Mr. X owns two houses which are used by him for his residential purposes. House I Municipal valuation Fair rent Standard rent 30,000 38,000 25,000 House II 35,000 40,000 42,000

Calculate the GAV of the house properties. 9. 10. What is Expected Rental value? Mr. X has constructed a multistory building at Delhi consisting of 40 flats. Each flat is let out @ 1,000 p.m. the municipal authorities have fixed the rental value of this property as Rs. 4,50,000 p.a. The owner bears the following expenses. Rs. i. Lift Maintenance ii. Pump maintenance iii. Salary of Gardener and Watchman iv. Swimming pool expenses Compute the Annual Rental Value for the property, Sec B 1. How you will determine Net Annual Value of house property? 12,000 p.a. 8,000 p.a. 3,600 p.a. 9,000 p.a.

2.What deductions are allowed from the annual value in computing taxable income from house property? 3.Enumerate the incomes from house property which are wholly exempt from tax. 4.Explain the provisions relating to vacancy allowance under the head of Income from house property With Examples. 5.Mr. X, the owner of two houses, occupies one for his own residence and the other he lets to a tenant at a monthly rent of Rs. 500. The municipal valuation of the house occupied is Rs. 2,600 and of the other is Rs. 5,200. The municipal taxes of the two amounted to Rs.600. The other expenses in respect of the two houses are as follows. Rs. Insurance premium (for both houses) Annual charge in respect of the house occupied Ground rent for the house let Repairs of the house let Interest on loan taken to repair the two houses 1,200 300 100 700 400

Mr. X also had income from other sources amounting to Rs. 20,000 during the year, Calculate Mr. Xs income from house property and total income. 6.What deductions are allowed from the annual value in computing taxable Income from house property? 7.Mr. Parampal Singh owns a house property consisting of 4 equal independent units at Chandigarh. It was completed on 1.11.2006 and is used as follows. a. b. c. d. 25% of floor area is used for his own business. 25% of floor area is self occupied for his own residence. 25% of floor area is let out for residential purpose @ Rs. 1,00 p.m. 25% of floor area was let out for non residential purposes @ Rs. 1,000 p.m. with effect from 1-4-2010 to 28-2-2011 and self occupied from 1-3-2011 onwards. The other expenses incurred by Mr. Singh is respect of house property are : Municipal Taxes 4,000 p.a. Fire Insurance Premium Rs. 1,200 p.a. Repairs of House Property Rs. 3,200 p.a. Interest on loan for construction of house Rs. 36,000.

Compute income under the head house property for the assessment year 2011 12. 8.Compute Income from house property from the particulars given below for the assessment year 2011 12 : Rs. Municipal rental value Actual rent received Municipal taxes Date of completion Date of letting Fire insurance premium (due) Ground rent (due) Interest on loan taken to construct the house 2001 02 to 2006 07 @ Rs. 15,000 p.a. 2007-08 Rs. 10,000 Interest on delayed payment of interest 9. about his house property income: Rental income of the year (after deducting following items). i. Depreciation ii. Lift maintenance charges iii. Municipal Taxes (10% of MRV of Rs. 1,50,000) iv. Vacancy v. Repairs vi. Pay of chowkidar vii Bank commission viii Legal expenses on recovery of rent ix. Salary of gardener 1,000 Rs. 1,00,000 24,500 7,500 15,000 10,000 18,000 1,000 500 8,000 1,200 Ray who has income only from house property, submits the following information 24,000 p.a. 30,000 p.a. 2,400 p.a. 31-3-2004 1-4-2004 400 p.a. 600 p.a.

Compute Mr. Rays income from house property for the previous year ending on 31.03.2011 10. Mr. B. owns a house property at Cochin. It consists of 3 independent units and information about the property is given below:

unit 1 : Own residence, Unit 2 : Let out, Unit 3 : Own business MRV FRV Standard Rent Rent Unrealized rent Repairs Insurance Interest on money borrowed for purchase of property Municipal Taxes Date of completion Compute income from house property Unit IV Sec- A 1. Define clearly the term Business 2. Define the term profession 3. What are capital Assets? Where are its kinds? 4. What is cost of acquisition?. 5. What is casual Income? 6. Explain Deemed Profit? 7. Explain the method of computing income from business? 8. What are the provisions relating to preliminary expenses? 9. Explain long term and short term capital gains? 10. What is grossing up? Sec B

Rs. 1,20,000 p.a. 1,32,000 p.a. 1,08,000 p.a. . 3,500 p.m. for three months 10,000 2,000 96,000 14,400 1.11.1998

1.What are the assets eligible for depreciation ?What are the approved methods of depreciation under the income tax act? 2.Explain the provisions relating to exempted capital gains. 3.What is cost of acquisition ?How would you determine cost of acquisition? 4.What are the incomes from other sources ? State any five such incomes and deductions allowed while calculating income from other sources.

6.The following is the Profit and Loss Account of Mr. X for the year ended on 31.3.2011. Compute his taxable Business income for the assessment year 2011 12. Rs. To opening Stock Purchase Wages Rent Repair to Motor Car Wealth Tax Paid Medical Expenses General Expenses Depreciation on Motor Car Advance Income Tax paid Profit for the year 15,000 40,000 20,000 6,000 3,000 3,000 3,000 10,000 3,000 1,000 26,000 1,30,000 Following further information is given:. 1. 2. Mr. X carries on his business from rented premises at Delhi, half of which is used as his residence. Mr. X bought a car during the year for Rs.20,000. He charged depreciation on the value of the car. The car was sold during the year for Rs. 9,000. The use of the car was 3/4th for the business and 1/4th for personal purposes. 3. 4. Medical expenses were incurred during sickness of Mr. X for his treatment. Wages include Rs. 250 per month on account of Mr. Xs driver for 10 months. 2011 1,30,000 By Sales Closing Stock Gift from Father Sale of Motor Car Income Tax Refund Rs. 80,000 20,000 18,000 9,000 3,000

7.Following is the Profit and Loss Account of Kesari Malya for the previous year 12. PROFIT AND LOSS ACCOUNT Rs. To Salaries 25,650 By Gross Profit

Rs. 80,000

Rent Commission on sales Income-Tax Entertainment expenses Commission paid to collect interest on securities Embezzlement by cashier Municipal tax of H.P. Bad Debts (allowed) Repairs to house Office expenses Depreciation L.I.C. premium Net profit

1,000 100 2,600 600 25 1,000 600 450 1,625 9,180 5,000 1,320 40,100 89,250

Bank Interest Bad Debts recovered (last year allowed Interest on commercial securities

450 2,000

Rent from house property 4,800 2,000

89,250

Depreciation on the assets is Rs. 4,500 Compute the taxable business income for the assessment year 2011 12. Rs. 8.(i) Sale Price of Jewellery in Oct. 2010 (C.I.I. : 711) (ii) Cost of acquisition in 1983 84 (C.I.I. : 116) (iv) Amount deposited in Capital Gain Deposit Scheme for completing the construction of house (Deposited on 27-6-2011)12,00,000 Compute the taxable capital gain assuming that he does not own any other house. 9.From the following particulars given below compute the taxable income of A.K. Syal for the assessment year 2011 12. Rs. i. Sale price of shares of A Ltd., acquired on 1.6.2009and sold on 1.5.2010 2,00,000 cost price of these shares ii. Sale price of shares of B Ltd acquired in 1989-90 (C.I.I. : 172) sold on 1.12.10(C.I.I. 711) 1,40,000 1,00,000 Shri. 20,00,000 3,00,000

(iii) Amount invested in construction of new house upto 31-7.2011 4,00,000

Cost price of shares of B Ltd. iii. Sale price of Jewellery sold on 1.9.2010 Cost of Jewellery acquired in 1985-86 (C.I.I. : 133) Long Term Capital loss of Rs. 86,000 has been B/F from assessment year 2009-10

60,000 3,50,000 60,000

10.From the following particulars of Mr. Edward for the previous year ended 31st March, 2011 compute his total Income for the Assessment year 2011 12. He received i. Directors fee from a company ii Interest on Bank Deposits iii Income from undisclosed sources iv Winning from lotteries (Net) v Royalty on a book written by him vi By giving lectures in functions vii Interest on loan given to a relative viii Interest on tax free debentures of a company (listed in recognized stock exchange) (Net) ix Divided on shares x Interest on post office savings bank A/c xi Interest on Government Securities 6,400 500 2,200 Rs. 10,000 3,000 12,000 24,185 8,000 5,000 7,000 3,588

He paid Rs. 100 for collection of dividend and Rs. 1,000 for typing the manuscript of book written by him. Unit V Sec - A 1. What is carry forward and set-off of losses? 2. How are speculation Losses set off? 3. Explain Intra-hand and Inter-hand set-off

4. Mr. X discuses the following incomes from business or profession for the previous year 2010 2011 Rs. i) Profit from A business ii) Loss from B business iii) Loss from profession C iv) Profit from speculation business D v) Loss from speculation business E Determine the income from business / profession. 5.Sanjay submits the following information relevant for the Assessment year 2008-09 Salary income(Gross) Business Income(Loss) House property (Loss) Determine the net income of Sanjay. 6.What is Inter Source Adjustment? 7.Write a short note on set-off business loss? 8.Write a short notes on set-off capital losses? 9.Explain the rules governing the sett-off of unabsorbed depericiation. 10. How is gambling losses set off? Sec B 1.Explain the provision relating to set off of losses. 2. What are the provisions regarding set-off of losses When a person has income from different heads? 3. State losses which can be carried forward and set off in subsequent year. 4.Under What are the circumstances are losses allowed to be set-off? 5.State the order in which current and brought forward losses are to be adjust. 6.The assessment of M Co. Ltd., Indian Company, for the years 2010-11 and 2011-12 show the following results: Ass. year 2010 11 Ass.year 2011-12 63,000 80,000 20,000 5,00,000 1,00,000 1,50,000 2,00,000 3,00,000

i. Interest on securities ii Income from house Property iii Profit and Gains of Business or Profession (a) dealing in fruits (b) manufacturing glass : Profit before depreciation Depreciation (c) Speculative transactions iv Income from other Sources : Bank Interest v Short term Capital Gains

(-) 2,000 (+)8,000 (-)30,000 (+)50,000 80,000 (+) 6,000 (+) 2,000 Nil

(+)2,000 (+)8,000 (-)12,000 (+)1,40,000 75,000 (-) 9,000 (+) 5,000 (-)25,000

Compute the net assessable results for each of the two years giving full reasons for your workings. 7.How would you determine the net income of an individual? 8..Given below is the profit and loss account of Shri Rajaram for the year ended 31-3-2011: Dr. To Salaries Drawings Insurance Premium on his life Depreciation Donation to the recognized institutions General expenses Education expenditure on his three dependent sons in England Provisions for doubtful debts Income - tax Rent Net profit 6,600 1,500 2,000 1,700 25,200 60,600 60,600 500 2,600 Rs. 7,000 8,000 1,000 4,500 Cr. By Gross Profit Interest on Post office Saving Bank Account Proceeds from Life Insurance Policy Interest on Bank deposit 6,900 3,600 100 Rs. 50,000

Compute his taxable income for current assessment year after taking the following information into consideration: (a) The amount of depreciation allowable is Rs. 4,000. (b) General expenses include Rs. 600 for his private expenses. 9.From the following particulars, calculate the taxable income, tax and deduction available under Section 80 for assessment year 2011-12: Rs. Salary per month Dearness allowances per month House rent allowance per month (Rent paid Rs. 1,500 p.m.) House property is let out on a monthly rent of Rs. 2,000. The annual value of the house property is Rs. 30,000. Municipal tax paid is Rs. 1,800 for whole year. Interest payable on capital borrowed for the construction of the house is Rs. 6,000. Repayment of house building loans taken from friends is Rs. 5,000 and from Life Insurance Corporation is Rs.3,000 Rs. Interest on Savings Bank A/c Dividend on master shares of UTI Interest on PPF A/c Interest on Govt. securities Life insurance premium Contribution to public provident fund Deposits in account under National Saving Scheme (1992) Interest accrued on NSCs VIII issue 7,000 3,000 2,000 7,000 6,000 6,000 10,000 4,000 6,000 1,600 1,000

10.The following are the particulars of the income of a lecturer for the financial year ending 31st March 2011. a. b. c. d. e. f. g. h. i. j. Salary Rs. 10,000 p.m. from which 15% is deducted or provident fund to which the college contributes 12%. Hardenship allowance Rs. 1,200 p.m. Rent free house of which the annual letting value is Rs. 20,000. Dividend received from co-operative society Rs. 800. 8% interest on Government loan of Rs. 5,000 Rent from house property Rs. 12,000. Interest on postal savings Bank Account Rs. 500 LTCG on sale of old car Rs. 2,500 and Jewellery Rs. 10,500. STCG on sale of shares Rs. 9,000 Examinership remuneration Rs. 3,700.

During the year, he deposited Rs. 6,000 in NSS. He also purchased books worth Rs. 650. Compute his total income for the Assessment year 2011 12.

Vous aimerez peut-être aussi

- BC 501 Income Tax Law 740766763 PDFDocument15 pagesBC 501 Income Tax Law 740766763 PDFSakshi JainPas encore d'évaluation

- Income Tax - I Subj - Code:113020 Section-ADocument3 pagesIncome Tax - I Subj - Code:113020 Section-AThiru VenkatPas encore d'évaluation

- Income Tax Question BankDocument8 pagesIncome Tax Question Banksurya.notes19Pas encore d'évaluation

- Business Taxation MBA III 566324802Document5 pagesBusiness Taxation MBA III 566324802mohanraokp2279Pas encore d'évaluation

- Business TaxationDocument3 pagesBusiness TaxationatvishalPas encore d'évaluation

- Income From Salary Chapter QuestionsDocument5 pagesIncome From Salary Chapter Questionsanon_595315274100% (1)

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbPas encore d'évaluation

- Short Numerical Practice Problems for Income Tax ComputationDocument3 pagesShort Numerical Practice Problems for Income Tax ComputationFarhan CheemaPas encore d'évaluation

- +++C$C, CCC$ CDocument7 pages+++C$C, CCC$ CKomal Damani ParekhPas encore d'évaluation

- Numericals of SalaryDocument7 pagesNumericals of SalaryAnas ShaikhPas encore d'évaluation

- Assessment of FirmDocument9 pagesAssessment of FirmJitendra VernekarPas encore d'évaluation

- IT AssignmentDocument5 pagesIT AssignmentAlena AlenaPas encore d'évaluation

- Tax AssignmentDocument4 pagesTax AssignmentkaRan GUptД100% (1)

- Mba E307 - Mbe E332 - MBF C303Document4 pagesMba E307 - Mbe E332 - MBF C303Shashank TripathiPas encore d'évaluation

- ITL (2) (3rd) Dec2020Document15 pagesITL (2) (3rd) Dec2020jassdeosi849Pas encore d'évaluation

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliPas encore d'évaluation

- Tax NumericalsDocument11 pagesTax NumericalsRohit PanpatilPas encore d'évaluation

- Watch Live Tax Updates on YouTube Channel - cmavipulshahDocument4 pagesWatch Live Tax Updates on YouTube Channel - cmavipulshahjesurajajosephPas encore d'évaluation

- Watch Live Tax Updates on YouTube Channel - cmavipulshahDocument4 pagesWatch Live Tax Updates on YouTube Channel - cmavipulshahShrikant MahajanPas encore d'évaluation

- 4 (A) Income Tax-1Document4 pages4 (A) Income Tax-1anjanaPas encore d'évaluation

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarPas encore d'évaluation

- SRI NITHYANANDA SWAMY EDUCATIONAL TRUST DEGREE COLLEGE TAX PROBLEMSDocument2 pagesSRI NITHYANANDA SWAMY EDUCATIONAL TRUST DEGREE COLLEGE TAX PROBLEMSHarish NaikPas encore d'évaluation

- Salary QuestionsDocument3 pagesSalary QuestionsgixPas encore d'évaluation

- Nirmal Multiple CampusDocument2 pagesNirmal Multiple CampusSabitaPas encore d'évaluation

- Finance Management Specialisation - Ii 304 - B: Direct TaxationDocument3 pagesFinance Management Specialisation - Ii 304 - B: Direct TaxationRohit ParmarPas encore d'évaluation

- Income From SalaryDocument9 pagesIncome From Salaryvinod nainiwalPas encore d'évaluation

- PerquisitesDocument29 pagesPerquisitesAmit ChaubeyPas encore d'évaluation

- 4.2 Home Assignment Questions - Income From SalaryDocument3 pages4.2 Home Assignment Questions - Income From SalaryAashi Gupta100% (1)

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelPas encore d'évaluation

- Calculating tax exemptions for HRA, gratuity, and other allowancesDocument1 pageCalculating tax exemptions for HRA, gratuity, and other allowancesSiva SankariPas encore d'évaluation

- Questions On Income From SalaryDocument3 pagesQuestions On Income From SalaryAniket AgrawalPas encore d'évaluation

- Income from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionDocument53 pagesIncome from Salaries: Calculating Exempted Allowances, Taxable Gratuity & PensionSiva SankariPas encore d'évaluation

- Income from Salaries: Taxation of Salary IncomeDocument15 pagesIncome from Salaries: Taxation of Salary IncomeAliakbar SayaniPas encore d'évaluation

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhPas encore d'évaluation

- Bachelor's Degree Programme (BDP) : Assignment 2015-16Document4 pagesBachelor's Degree Programme (BDP) : Assignment 2015-16Paras JainPas encore d'évaluation

- CA IPCC Taxation Mock Test Series 1 - Sept 2015Document7 pagesCA IPCC Taxation Mock Test Series 1 - Sept 2015Ramesh GuptaPas encore d'évaluation

- ITA (4th) May2015Document3 pagesITA (4th) May2015yukkiyukki171Pas encore d'évaluation

- QP 2 PDFDocument7 pagesQP 2 PDFShankar ReddyPas encore d'évaluation

- The Income Tax ActDocument32 pagesThe Income Tax Actapi-3832224Pas encore d'évaluation

- BBM 5dec2009-Bmincometax PDFDocument9 pagesBBM 5dec2009-Bmincometax PDFSanjay YadavPas encore d'évaluation

- FPDocument20 pagesFPRadhika ParekhPas encore d'évaluation

- Income TaxDocument4 pagesIncome TaxsebastianksPas encore d'évaluation

- B.Com. (Hons.) Degree Exam II Semester Income Tax Law and PracticeDocument4 pagesB.Com. (Hons.) Degree Exam II Semester Income Tax Law and PracticeBhuvaneswari karuturiPas encore d'évaluation

- Calculate Income from Salaries Including Entertainment Allowance and House Rent AllowanceDocument3 pagesCalculate Income from Salaries Including Entertainment Allowance and House Rent AllowanceSiva SankariPas encore d'évaluation

- September: (CBCS) (F +R) (2016-17 and Onwards)Document7 pagesSeptember: (CBCS) (F +R) (2016-17 and Onwards)Gracy GeorgePas encore d'évaluation

- Calculating Income Tax for Individuals and BusinessesDocument36 pagesCalculating Income Tax for Individuals and BusinessesVelayudham ThiyagarajanPas encore d'évaluation

- Aa 498 AssignmentDocument2 pagesAa 498 AssignmentMeena SinghPas encore d'évaluation

- Taxation Cia 3Document27 pagesTaxation Cia 3Soumya KesharwaniPas encore d'évaluation

- CFP Sample Paper Tax PlanningDocument4 pagesCFP Sample Paper Tax PlanningamishasoniPas encore d'évaluation

- Income Tax - Previous Years Question PapersDocument17 pagesIncome Tax - Previous Years Question PapersPrabhakar BhattacharyaPas encore d'évaluation

- Taxable Allowances ExplainedDocument3 pagesTaxable Allowances ExplainedNitin RajPas encore d'évaluation

- BBA Taxation Exam PaperDocument4 pagesBBA Taxation Exam Papershen kinoPas encore d'évaluation

- Income From SalaryDocument26 pagesIncome From SalaryAkash VisputePas encore d'évaluation

- Salary - Practice QuestionsDocument8 pagesSalary - Practice Questionssyedameerhamza762Pas encore d'évaluation

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerPas encore d'évaluation

- Income From Other SourcesDocument4 pagesIncome From Other SourcesKiran UpadhyayPas encore d'évaluation

- Employment IncomeDocument14 pagesEmployment IncomeMussaPas encore d'évaluation

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysD'EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysPas encore d'évaluation

- Advance Accounting Ebook - Part 11Document23 pagesAdvance Accounting Ebook - Part 11Zacharia VincentPas encore d'évaluation

- FM Ebook - Part 3-Finaciall ModellingDocument36 pagesFM Ebook - Part 3-Finaciall ModellingtejaasPas encore d'évaluation

- CFA Level 1 Quantitative Analysis E Book - Part 4Document40 pagesCFA Level 1 Quantitative Analysis E Book - Part 4Zacharia VincentPas encore d'évaluation

- Indian Automobile Industry AnalysisDocument42 pagesIndian Automobile Industry AnalysisZacharia VincentPas encore d'évaluation

- Depreciation and Amortization SchedulesDocument36 pagesDepreciation and Amortization SchedulestejaasPas encore d'évaluation

- CFA Level 1 Quantitative Analysis E Book - Part 1Document26 pagesCFA Level 1 Quantitative Analysis E Book - Part 1Zacharia VincentPas encore d'évaluation

- CFA Level 1 Corporate Finance E Book - Part 4Document5 pagesCFA Level 1 Corporate Finance E Book - Part 4Zacharia VincentPas encore d'évaluation

- Fundamental of Accounting and Auditing ICSIDocument408 pagesFundamental of Accounting and Auditing ICSIKimi WaliaPas encore d'évaluation

- Project Review II - Panel MembersDocument10 pagesProject Review II - Panel MembersZacharia VincentPas encore d'évaluation

- Performance Highlights: Company Update - AutomobileDocument13 pagesPerformance Highlights: Company Update - AutomobileZacharia VincentPas encore d'évaluation

- XSCDDocument83 pagesXSCDZacharia VincentPas encore d'évaluation

- Parental Consent for University Placement of StudentDocument2 pagesParental Consent for University Placement of StudentZacharia VincentPas encore d'évaluation

- ConclutionDocument1 pageConclutionZacharia VincentPas encore d'évaluation

- XSCDDocument83 pagesXSCDZacharia VincentPas encore d'évaluation

- Student Project CircularDocument2 pagesStudent Project CircularZacharia VincentPas encore d'évaluation

- Advance Accounting Ebook - Part 9Document29 pagesAdvance Accounting Ebook - Part 9Zacharia VincentPas encore d'évaluation

- CFA Level 1 Corporate Finance E Book - Part 1 PDFDocument23 pagesCFA Level 1 Corporate Finance E Book - Part 1 PDFZacharia Vincent67% (3)

- Diwali-Picks Microsec 311013 PDFDocument14 pagesDiwali-Picks Microsec 311013 PDFZacharia VincentPas encore d'évaluation

- CFA Level 1 Corporate Finance E Book - Part 2Document31 pagesCFA Level 1 Corporate Finance E Book - Part 2Zacharia VincentPas encore d'évaluation

- CFA Level 1 Corporate Finance E Book - Part 4Document5 pagesCFA Level 1 Corporate Finance E Book - Part 4Zacharia VincentPas encore d'évaluation

- Rupee-Impact DolatCap 210613 PDFDocument16 pagesRupee-Impact DolatCap 210613 PDFZacharia VincentPas encore d'évaluation

- Accounting - Basics Easy PC TrainingDocument13 pagesAccounting - Basics Easy PC TrainingRahul ShakyaPas encore d'évaluation

- Vishnu Prasad Kavinyap: ProfileDocument2 pagesVishnu Prasad Kavinyap: ProfileZacharia VincentPas encore d'évaluation

- CFA Level 1 Corporate Finance E Book - Part 3Document19 pagesCFA Level 1 Corporate Finance E Book - Part 3Zacharia VincentPas encore d'évaluation

- CFA Level 1 Corporate Finance E Book - Part 6Document13 pagesCFA Level 1 Corporate Finance E Book - Part 6Zacharia VincentPas encore d'évaluation

- Advance Accounting Ebook - Part 7 PDFDocument33 pagesAdvance Accounting Ebook - Part 7 PDFZacharia VincentPas encore d'évaluation

- Impact of Euro Crisis and Global Slowdown On India-12!05!2011Document9 pagesImpact of Euro Crisis and Global Slowdown On India-12!05!2011kushal-sinha-680Pas encore d'évaluation

- India-Consumer ARathi 210613Document2 pagesIndia-Consumer ARathi 210613roy_kohinoorPas encore d'évaluation

- Parental Consent for University Placement of StudentDocument2 pagesParental Consent for University Placement of StudentZacharia VincentPas encore d'évaluation

- Advance Accounting Ebook - Part 7 PDFDocument33 pagesAdvance Accounting Ebook - Part 7 PDFZacharia VincentPas encore d'évaluation

- MTSU Men's Basketball Coach Nick McDevitt MOUDocument5 pagesMTSU Men's Basketball Coach Nick McDevitt MOUUSA TODAY NetworkPas encore d'évaluation

- Individual Income TaxationDocument50 pagesIndividual Income TaxationGab RielPas encore d'évaluation

- Advance Tax Provisions ExplainedDocument12 pagesAdvance Tax Provisions ExplainedPrakhar KesharPas encore d'évaluation

- National Internal Revenue CodeDocument296 pagesNational Internal Revenue CodeJose Walo Camilon IIIPas encore d'évaluation

- Calicut University B.Com Sixth Semester Income Tax Law Question BankDocument16 pagesCalicut University B.Com Sixth Semester Income Tax Law Question BankAbdul Salim NPas encore d'évaluation

- BIR Revenue Regulations No. 12-2018Document24 pagesBIR Revenue Regulations No. 12-2018Ednel LotertePas encore d'évaluation

- Trinidad & Tobago TaxDocument26 pagesTrinidad & Tobago TaxHaydn Dunn100% (4)

- M4 - Income TaxationDocument12 pagesM4 - Income TaxationGraceCayabyabNiduazaPas encore d'évaluation

- @deloitte #Yemen Highlights - Tax & Duties 2011Document3 pages@deloitte #Yemen Highlights - Tax & Duties 2011Yemen ExposedPas encore d'évaluation

- National Economics UniversityDocument98 pagesNational Economics UniversityNguyễn Hương QuỳnhPas encore d'évaluation

- Income Tax Introduction FinalDocument39 pagesIncome Tax Introduction FinalSammar EllahiPas encore d'évaluation

- Bachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeDocument9 pagesBachelor of Science in Accounting Information System: Bulacan Polytechnic CollegeReena BoliverPas encore d'évaluation

- Module29 Version2010-09 Income TaxDocument113 pagesModule29 Version2010-09 Income TaxJohn Rey Bantay RodriguezPas encore d'évaluation

- Income-From-House-Property-converted 1Document11 pagesIncome-From-House-Property-converted 1annnoyynnmussPas encore d'évaluation

- Chapter 2 - Deductions From The Gross EstateDocument9 pagesChapter 2 - Deductions From The Gross EstateElla Marie WicoPas encore d'évaluation

- (OPINION) Train Law: What Does It Change?: Tax Reform For Acceleration and Inclusion (Train) LawDocument10 pages(OPINION) Train Law: What Does It Change?: Tax Reform For Acceleration and Inclusion (Train) Lawksulaw2018Pas encore d'évaluation

- TOA QUIZZER 3 - Provisions and Contingencies, Deferred Revenue and Income TaDocument20 pagesTOA QUIZZER 3 - Provisions and Contingencies, Deferred Revenue and Income TaHamida Ismael MacabantogPas encore d'évaluation

- This Study Resource Was: Njpia Region 3 CouncilDocument7 pagesThis Study Resource Was: Njpia Region 3 CouncilPeachy Rose TorenaPas encore d'évaluation

- Public Finance in IndiaDocument22 pagesPublic Finance in IndiaGauravSahaniPas encore d'évaluation

- Greenfield V MeerDocument4 pagesGreenfield V MeerBenedick LedesmaPas encore d'évaluation

- AP Government Payment Slip for September 2020Document1 pageAP Government Payment Slip for September 2020Rajesh pvkPas encore d'évaluation

- Capital Budgeting DecisionsDocument120 pagesCapital Budgeting Decisionsgizex2013Pas encore d'évaluation

- Estate Tax Problems Quizzer 1104Document10 pagesEstate Tax Problems Quizzer 1104Fate Serrano100% (1)

- CasesDocument24 pagesCasesXuan LieuPas encore d'évaluation

- Tax1 Final Landmark Case DigestDocument29 pagesTax1 Final Landmark Case DigestasterPas encore d'évaluation

- BJZPP3740D Partb 2021-22Document3 pagesBJZPP3740D Partb 2021-22sagar lovzPas encore d'évaluation

- Chapter 8 - TaxationDocument35 pagesChapter 8 - Taxationancaye1962Pas encore d'évaluation

- Taxation in EthiopiaDocument50 pagesTaxation in EthiopiaAbdii Dhufeera75% (4)

- Taxation LawDocument10 pagesTaxation LawflorPas encore d'évaluation

- Mcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaDocument11 pagesMcqs For Second Year of Articleship: © The Institute of Chartered Accountants of IndiaSajal GoyalPas encore d'évaluation