Académique Documents

Professionnel Documents

Culture Documents

2013 06 05 PH S SMPH

Transféré par

Ed GopsDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2013 06 05 PH S SMPH

Transféré par

Ed GopsDroits d'auteur :

Formats disponibles

WEDNESDAY, 05 JUNE 2013

SM Prime Holdings, Inc: Transforming into a property giant

Three-step merger plan disclosed

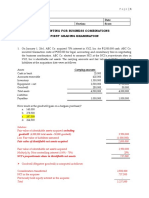

The SM Group announced on Friday a detailed plan for the consolidation of its property assets. The plan involves three steps, with SMPH as the surviving entity. Upon completion, SMPH will become the largest real estate company in the country with a market capitalization of around Php500 Bil. Step 1: SM Land makes tender offer for SMDC and Highland Prime through share swap SM Land will make a tender offer for 34.82% of SMDC shares (SM Land already owns 65.18% of SMDC) and 100% of HP shares by offering shares of SMPH in exchange (SM Land owns 40.96% of SMPH). SM Land will offer 0.472 share of SMPH for 1 SMDC share and 0.135 SMPH share for 1 HP share. Upon conclusion of the tender offer and provided that at least 90% of outstanding shares of SMDC and HP are acquired by SM Land, SMDC and HP will initiate a voluntary delisting. We estimates that a total of 2.02 Bil SMPH shares held by SM Land will be used to acquire 100% of SMPH and HP, leaving SM Land with 5.01 Bil SMPH shares after the transaction.

Exhibit 1. Stake of SM Land

SMDC HPI

Source: COL estimates

Before 47.20% 0%

After 100% 100%

Exhibit 2. Exchange offer by SM Land

# of SMPH shares for SMDC # of SMPH shares for HPI Total number of SMPH to be exchanged

Source: COL estimates

1,715.8 303.2 2,019.1

Exhibit 3. Share of SM Land on SMPH

# of SMPH shares held by SM Land

Source: COL estimates

Before 7,114.8

After 5,095.7

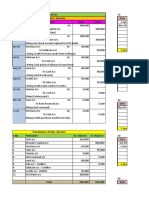

Step 2: SMPH issues new shares to acquire SM Land After consolidating SMDC and HP under SM Land, SMPH will issue 14.34 Bil new shares to acquire 100% of SM Land. From its current outstanding shares of 17.27 Bil, SMPH will increase outstanding shares to 26.64 Bil. Note that SM Land still owned 5.01 Bil shares of SMPH after step 1 of the transaction, and these shares will be put under treasury shares. Step 3: SMPH issues new shares to acquire SMICs other property assets Finally, SMPH will issue another 1.55 Bil new shares to consolidate other property assets held by SMIC and the Sy Family. Companies to be acquired are Tagaytay Resort Development Corp, SM Hotels and Conventions Corp, SM Arena Complex Corp., Costa Del Hamilo Inc.

RICHARD LAEDA, CFA r i c h a r d . l a n e d a @ co l fi n a n ci a l .co m

PHILIPPINE EQUITY RESEARCH

After all the transactions, SMPH will have increased its total issued shares to 33.3 Bil while outstanding shares (net of treasury shares) will be around 28.2 Bil. Consolidated revenues of the new company for FY12 is around Php57.4 Bil with a net income of Php16.34 Bil. Net debt-to-equity would drop from 0.60X to 0.42X

Exhibit 4. Summary of changes to SMPH due to merger (data as of FY12)

in Php Mil

Authorized capital stock Issued shares Treasury shares Shares outstanding Revenues Net Income to shareholders EPS (in Php) Net Debt-to-equity ratio (X) ROE

Source: COL estimates

Before 20,000 17,411 19 17,393 30,726 10,530 0.606 0.60 15.05%

After 40,000 33,307 5,115 28,192 57,399 16,337 0.579 0.42 10.99%

An integrated real estate company

The merger is intended to create a large integrated real estate company capable of undertaking larger projects wherein all business units will be able to participate in. Based on our estimates, the merged SMPH will have around 7.7 Mil sqm GFA of mall space (Philippines and China) and 428,412sqm of office GFA by FY14, 1,019 hotel rooms by the end of this year, and over 29,000sqm of leasable convention and exhibit space. In addition to that, SMPH will have more than 3 Mil sqm of condominium inventory. To support its future growth, SMPH will have 920 hectares of raw land.

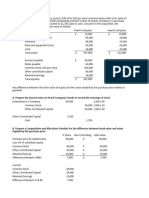

Exhibit 5. Summary of assets to be acquired by SMPH

100% direct interest in SM Land at least 84% direct interest in SMDC at least 89% interest in Highlands Prime 100% effective interest in Prime Metro Estate 100% direct interest in SM Hotels and Conventions Corporation 100% direct interest in SM Arena Complex Corp. 100% direct interest in Costa Del Hamilo Inc. 100% effective interst in Tagaytay Resort Development Corp. 100% interest in the following assets previously owned by SMIC: Taal Vista Hotel Radisson Cebu Hotel Pico Sands Hotel SMX Convention Center MoA Arena Moa Arena Annex Corporate Office Casino and Waste Water Treatment Plant Tagaytay EDSA West Park Inn Davao

Source: SMPH

Wednesday, 05 June 2013

SMPH

COMPANY UPDATE

page 2

PHILIPPINE EQUITY RESEARCH

The merged company is expected to have a market capitalization of around US$12 Bil. With a much larger market cap, the company would be able to take advantage of more financing options. Note that with the exception of SMPH, the funding options of the individual companies are limited due to their size. The company will also be able to capitalize on its size operationally and create value through its scale and synergies.

Value-unlocking move by the group

We believe that the merger will unlock a significant portion of the groups value. According to management, the merged companys landbank will rise from 110 hectares to 920 hectares and given the size of the merged entity, it would have the capability to realize the value of these properties by developing them. Recurring income, majority from malls but also from offices and hotels, will still account for more than 50% of the groups income, which would give them the stable cash flow needed for the developments and the ability to take on higher gearing as a group.

Fair value estimate to be re-evaluated

Now that the merger plans have been announced, we need to re-evaluate our FV estimate of SMPH to take into account the consolidation and the increase in outstanding shares. Our valuation of SM would also change as a result of the consolidation of real estate assets under SMPH.

Wednesday, 05 June 2013

SMPH

COMPANY UPDATE

page 3

PHILIPPINE EQUITY RESEARCH

Investment Rating Definitions

BUY

Stocks that have a BUY rating have attractive fundamentals and valuations, based on our analysis. We expect the share price to outperform the market in the next six to twelve months.

HOLD

Stocks that have a HOLD rating have either 1.) attractive fundamentals but expensive valuations; 2.) attractive valuations but near term earnings outlook might be poor or vulnerable to numerous risks. Given the said factors, the share price of the stock may perform merely inline or underperform the market in the next six to twelve months.

SELL

We dislike both the valuations and fundamentals of stocks with a SELL rating. We expect the share price to underperform in the next six to twelve months.

Important Disclaimers

Securities recommended, offered or sold by COL Financial Group, Inc.are subject to investment risks, including the possible loss of the principal amount invested. Although information has been obtained from and is based upon sources we believe to be reliable, we do not guarantee its accuracy and it may be incomplete or condensed. All opinions and estimates constitute the judgment of COLs Equity Research Department as of the date of the report and are subject to change without notice. This report is for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of a security. COL Financial ans/or its employees not involved in the preparation of this report may have investments in securities or derivatives of securities of securities of the companies mentioned in this report, and may trade them in ways different from those discussed in this report.

2401-B East Tower, Philippine Stock Exchange Centre, Exchange Road, Ortigas Center, Pasig City, 1605 Philippines Tel: +632 636-5411 Fax: +632 635-4632 Website: http://www.colfinancial.com

Wednesday, 05 June 2013

SMPH

COMPANY UPDATE

page 4

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Certificate of Increase of Capital StockDocument2 pagesCertificate of Increase of Capital StockmarkPas encore d'évaluation

- Accounting For Business Combinations First Grading ExaminationDocument18 pagesAccounting For Business Combinations First Grading Examinationjoyce77% (13)

- Financial Ratio Analysis ProblemDocument6 pagesFinancial Ratio Analysis ProblemMaribel ZafePas encore d'évaluation

- Capital Structure: Limits To The Use of DebtDocument9 pagesCapital Structure: Limits To The Use of DebtTridha BajajPas encore d'évaluation

- Date Date Particulars Debit CreditDocument13 pagesDate Date Particulars Debit Creditswarna sPas encore d'évaluation

- Adani Group Hindenburg ReportDocument150 pagesAdani Group Hindenburg Reportsunita singhaniaPas encore d'évaluation

- Chapter 2 - Notes PayableDocument10 pagesChapter 2 - Notes PayableIra Charisse BurlaosPas encore d'évaluation

- Project Report On OPTCLDocument63 pagesProject Report On OPTCLKaranDevlikarPas encore d'évaluation

- AFAR 12 Foreign Currency TransactionsDocument6 pagesAFAR 12 Foreign Currency TransactionsLouie RobitshekPas encore d'évaluation

- Formulate An Offer: Stephen Lawrence and Frank MoyesDocument13 pagesFormulate An Offer: Stephen Lawrence and Frank Moyesvkavtuashvili100% (2)

- Consolidated Financial Statement Excercise 3-4Document2 pagesConsolidated Financial Statement Excercise 3-4Winnie TanPas encore d'évaluation

- BMW AG Financial Statements 2022 enDocument60 pagesBMW AG Financial Statements 2022 enNitesh SinghPas encore d'évaluation

- FABM2 Q3 Module 1Document27 pagesFABM2 Q3 Module 1Sharlyn Marie An Noble-BadilloPas encore d'évaluation

- Share Based Payments - Problems: Problem 1Document79 pagesShare Based Payments - Problems: Problem 1tan dinhPas encore d'évaluation

- CYIENT Kotak 22102018Document6 pagesCYIENT Kotak 22102018ADPas encore d'évaluation

- Portfolio SummaryDocument3 pagesPortfolio SummaryPravin AwalkondePas encore d'évaluation

- BMW Financial Statement Analysis PDFDocument27 pagesBMW Financial Statement Analysis PDFsaurabhm707Pas encore d'évaluation

- Format Quotation ServiceDocument7 pagesFormat Quotation ServiceazizalloginPas encore d'évaluation

- Fingyaan PNLDocument32 pagesFingyaan PNLDeep PadhPas encore d'évaluation

- Assignment 6-24-20Document13 pagesAssignment 6-24-20AlexandritePas encore d'évaluation

- Stevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsDocument2 pagesStevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsAmit PandeyPas encore d'évaluation

- NI Approach MainDocument9 pagesNI Approach MainRevati ShindePas encore d'évaluation

- Investment Attitude QuestionnaireDocument6 pagesInvestment Attitude QuestionnairerakeshmadPas encore d'évaluation

- CH0620100916181206Document4 pagesCH0620100916181206Shubharth BharadwajPas encore d'évaluation

- Answer For Tutorial 4Document2 pagesAnswer For Tutorial 4Ellie QarinaPas encore d'évaluation

- 2019 Real Estate Accounting Reporting WhitepaperDocument24 pages2019 Real Estate Accounting Reporting Whitepaperrose querubinPas encore d'évaluation

- CHA Certification Study Guide Volume IDocument483 pagesCHA Certification Study Guide Volume IReda KeraghelPas encore d'évaluation

- СHASE 20181218-statements-7322Document6 pagesСHASE 20181218-statements-7322Myt WovenPas encore d'évaluation

- Cash Cash Equivalents - Part 1Document35 pagesCash Cash Equivalents - Part 1Lily of the ValleyPas encore d'évaluation

- Audit Entry Sheet 2Document43 pagesAudit Entry Sheet 2Charles MarkeyPas encore d'évaluation