Académique Documents

Professionnel Documents

Culture Documents

Davidson Fixed Income Weekly Comment - August 12, 2013

Transféré par

Davidson CompaniesCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Davidson Fixed Income Weekly Comment - August 12, 2013

Transféré par

Davidson CompaniesDroits d'auteur :

Formats disponibles

Fixed Income Capital Markets Trading Desk Commentary

A Case for Credit

Weekly Market Comment: By: Fixed Income Strategy Group

Date: August 11, 2013

3mth Libor 2-yr 3-yr 5-yr 10-yr 30-yr DJIA S&P 500

08/09/2013 0.265% 0.30 0.61 1.35 2.57 3.63 15,424.51 1,691.42

08/02/2013 0.266% 0.30 0.57 1.36 2.60 3.69 15,646.5 1,707.27

Wkly Change -.001 Unchg +4 -1 -3 -6 -1.49% -1.07%%

U.S. bond yields were mixed last week, with short term yields slightly higher and the 10-year down 6 bps. After suffering a beating in June, portfolio managers have had time to readjust to a new world of rising rates and wider spreads. Bonds no longer hold the favored nation status of the past few years, as both domestic and European economies improve and fears of a hard landing in the Chinese economy appear to have dissipated. As a result, central banks, led by the U.S. Federal Reserve, are preparing an orderly exit from the bond market in the coming year. Equity indices closed lower last week. The Dow led the drop by falling 1.5 percent followed by 1.1 percent on the S&P 500 and -.80 percent on the NASDAQ. Most major industry sectors including telecom, industrials, financials and utilities fell. The lone gainer on the week was materials. Despite the previous weeks poor performance, all equity indices are up quarter-to-date. The debate over the timing of the Feds tapering announcement seesaws between September and December. Recent economic news could support either date, but the genie is out of the bottle and the markets appear prepared for the inevitable. September 19th, the conclusion of the next FOMC meeting and date of the next official press conference, will be the most logical time to provide a detailed plan. The reduction in Treasury auctions will provide an opportunity for the Fed to decrease the level of buying without great market disruption in addition to reducing MBS purchases. I expect an equal weighting of both in the Feds plan. Be Brave In light of this forecast, I continue to favor repositioning in shorter duration bonds with an overweight in lower investment grade credit. The spreads remain very wide in the credit markets, especially municipal bonds, a sector that has been plagued with a series of negative events in addition to the ongoing issues associated with the Detroit bankruptcy filing. For those that have a longer investment horizon, (e.g. 1-2 years), this sector offers attractive opportunities to capture yield in shorter duration bonds. To put it more bluntly, when everyone seems to be running away out of fear, the brave ones walk toward to source and find there is very little to fear. Credit due diligence is essential in any market environment, but especially in a recovering economic scenario. The U.S. consumer has just begun to regain its

Please refer to the Appendix of this communication for detailed disclosure information.

D.A. Davidson & Co. propensity to shop (saving appears to be a passing fad of the Great Recession) and hopefully companies will have an incentive to invest in the coming year. All of these metrics bode well for U.S. corporate earnings and local government revenues. In the near term, the corporate spreads will ebb and flow with each news report which may cause more outflows from funds. The rates sector of the bond market will offer opportunities to sell longer duration bonds and reduce exposure to rising interest rates without a significant reduction in current portfolio yield. The economy is grinding higher, but the pace has been painfully slow. Last weeks report from the Institute for Supply Management (ISM) on services showed better than expected expansion and the trade deficit narrowed which should provide a boost to second quarter GDP growth. The unemployment rate fell to 7.4 percent in July, after hovering at 8 percent in 2012, 9 percent in 2011 and 2010. The tepid pace exists in spite of the most aggressive monetary stimuli in history. Many have noted the severity of the recession as a reason for the slow growth environment, but the absence of effective fiscal stimuli is also to blame. Business investment led the country out of the Great Recession, but the pace of spending has decelerated in the past year. Company executives are more cautious to commit to permanent expenditures such as new hires, acquisitions and inventory due to uncertainties surrounding tax and healthcare liabilities in addition to a frugal consumer. Focus Shifts to Fiscal Policy The market should begin to focus on the most pressing fiscal issues in the coming months which include (1) the debt ceiling needs to be raised and a new budget cycle begins, (2) the expiration of the continuing resolution in September, (3) the impact of the Affordable Care Act on businesses as provisions are implemented in early 2014. The negotiations regarding the debt ceiling and budget will occur in September and October. It wasnt long ago that a logjam led to a credit downgrade of U.S. debt and a selloff in Treasuries as investors expressed dismay at the lack of fiscal leadership in the U.S. I anticipate more spending cuts to emerge from the negotiations but no action on tax reform, to the detriment of domestic businesses. The continuing resolution allowed the government to maintain funding for various programs (thus avoiding work stoppages) without a budget. This extension of the programs will expire on September 30th. The expiration of a continuing resolution has become an annual event in this country, and although a last minute compromise always seems to emerge, the angst that comes along with a threat that workers may be furloughed and government spending severely reduced always creates another uncertainty that rankles market participants. In the event I am wrong, the market disruption may be minor since only non-essential functions of the government will cease operations. The potential additional cost of healthcare for both individuals and business may also constrain growth next year as the industry adjusts for new payment schemes. The uncertainty associated with fiscal policy will continue to restrict the pace of the economic recovery in the next year, which suggests GDP growth will remain below 3.00 percent in 2014. Watch Retail Sales Trends Key data to be released this week include the July retail sales report, expected to show a slight pullback from the previous month, but generally good trends excluding autos. After surging the past six months, the pace of auto sales is expected to slow. The back-to-school season has just begun, but the news has been disappointing thus far and may be an indication of tepid consumer spending in the coming months. Inflation data in the form of the producer and consumer price indices will provide some insight as to

D.A. Davidson & Co. how far we are from the Feds 2.0 to 2.5 percent target. The core CPI estimated to rise 1.7 percent yearover-year. Manufacturing reports on industrial production, the New York manufacturing index and Philadelphia Business Outlook are all likely to show a slight improvement in activity. A light Fed calendar ahead of the Kansas City Economic Summit in Jackson Hole at the end of the month. Atlanta Fed president Lockhart and St. Louis Fed president Bullard are all scheduled to speak this week.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Rubberworld (Phils.), Inc. v. NLRCDocument2 pagesRubberworld (Phils.), Inc. v. NLRCAnjPas encore d'évaluation

- LDocument408 pagesLvmarthyPas encore d'évaluation

- Atip Bin Ali V Josephine Doris Nunis & AnorDocument7 pagesAtip Bin Ali V Josephine Doris Nunis & Anorahmad fawwaz100% (1)

- FloridaDocument2 pagesFloridaAbhay KhannaPas encore d'évaluation

- The Effect of Big-Data On The HEC of ChinaDocument9 pagesThe Effect of Big-Data On The HEC of ChinaAbdulGhaffarPas encore d'évaluation

- 2.-A-Journal & Ledger - QuestionsDocument3 pages2.-A-Journal & Ledger - QuestionsLibrarian 19750% (1)

- Acme Corporation: Strategic Plan 2014-2016: What Is Our Purpose? Financial How Will We Measure Success?Document1 pageAcme Corporation: Strategic Plan 2014-2016: What Is Our Purpose? Financial How Will We Measure Success?Peter Garga PanalanginPas encore d'évaluation

- Abarientos PR1Document33 pagesAbarientos PR1Angelika AbarientosPas encore d'évaluation

- Instructions For Form 3520-A: Annual Information Return of Foreign Trust With A U.S. OwnerDocument4 pagesInstructions For Form 3520-A: Annual Information Return of Foreign Trust With A U.S. OwnerIRSPas encore d'évaluation

- Wood Magazine 253 05.2018 PDFDocument92 pagesWood Magazine 253 05.2018 PDFJd Diaz83% (6)

- The Melodramatic ImaginationDocument254 pagesThe Melodramatic ImaginationMarcela MacedoPas encore d'évaluation

- Rejoinder AffidavitDocument3 pagesRejoinder AffidavitNeil bryan MoninioPas encore d'évaluation

- Scout-Handbook Eng PDFDocument11 pagesScout-Handbook Eng PDFTai Nguyen DucPas encore d'évaluation

- Mark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsDocument10 pagesMark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Word(s) OPPOSITE in Meaning To The Underlined Word(s) in Each of The Following QuestionsPhạm Trần Gia HuyPas encore d'évaluation

- Internal Assignment Applicable For June 2017 Examination: Course: Cost and Management AccountingDocument2 pagesInternal Assignment Applicable For June 2017 Examination: Course: Cost and Management Accountingnbala.iyerPas encore d'évaluation

- Hist Fwoi MCQDocument3 pagesHist Fwoi MCQOnline SubsPas encore d'évaluation

- Congressional Record - House H104: January 6, 2011Document1 pageCongressional Record - House H104: January 6, 2011olboy92Pas encore d'évaluation

- A Research Paper Submited To Department of Management For Partalfulfilment of The Requirement in Ba Degree in ManagementDocument44 pagesA Research Paper Submited To Department of Management For Partalfulfilment of The Requirement in Ba Degree in ManagementEng-Mukhtaar CatooshPas encore d'évaluation

- Bernini, and The Urban SettingDocument21 pagesBernini, and The Urban Settingweareyoung5833Pas encore d'évaluation

- Chit ChatDocument5 pagesChit ChatErmin KicoPas encore d'évaluation

- Civil 20procedure 20final PalsDocument185 pagesCivil 20procedure 20final PalsPaul EspinosaPas encore d'évaluation

- Libanan, Et Al. v. GordonDocument33 pagesLibanan, Et Al. v. GordonAlvin ComilaPas encore d'évaluation

- When The Artists of This Specific Movement Gave Up The Spontaneity of ImpressionismDocument5 pagesWhen The Artists of This Specific Movement Gave Up The Spontaneity of ImpressionismRegina EsquenaziPas encore d'évaluation

- Negros Oriental State University Bayawan - Sta. Catalina CampusDocument6 pagesNegros Oriental State University Bayawan - Sta. Catalina CampusKit EdrialPas encore d'évaluation

- Accomplishment Report For The 2023 GSP Orientation and Update For Troop LeadersDocument6 pagesAccomplishment Report For The 2023 GSP Orientation and Update For Troop LeadersMarianne Hilario100% (1)

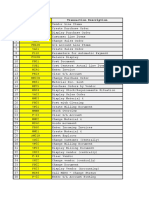

- # Transaction Code Transaction DescriptionDocument6 pages# Transaction Code Transaction DescriptionVivek Shashikant SonawanePas encore d'évaluation

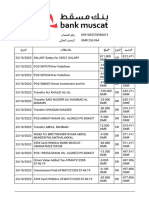

- DefaultDocument2 pagesDefaultBADER AlnassriPas encore d'évaluation

- Investing in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterDocument18 pagesInvesting in Indian Stock Markets - The 5 Minute WrapUp - EquitymasterAtanu PaulPas encore d'évaluation

- KTQTE2Document172 pagesKTQTE2Ly Võ KhánhPas encore d'évaluation

- Caste Endogamy A Multidimensional Analogy of Caste in The Indian SocietyDocument12 pagesCaste Endogamy A Multidimensional Analogy of Caste in The Indian SocietyRakshith L1Pas encore d'évaluation