Académique Documents

Professionnel Documents

Culture Documents

HVS - Art Science of Hotel Valuation in An Economic Downturn

Transféré par

SoftkillerDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

HVS - Art Science of Hotel Valuation in An Economic Downturn

Transféré par

SoftkillerDroits d'auteur :

Formats disponibles

OCTOBER2010

TheArt& &Scie enceofHo otel Valu uation nina anEco onom mic Dow wntur rn

AnImp provedM Methodol logyforaConstr rained Market t

ANACAMPOSBLANC CO,Associat te SOPHIEPE ERRET,Asso ociateDirect tor HVSLON NDONOFFIC CE

TheArt&ScienceofHotelValuationinan EconomicDownturn

Following the significant and continuing impact of the global financial and economic crisis on the hotel industry, HVSs valuation assumptions and methodologyhaveevolvedtomoreaccuratelyreflecttheactionsoftypicalbuyers and sellers in the market place who have modified their valuation procedures basedonthecurrentfinancingenvironment. Europeanhotelvalueshavecomeundersignificantpressureinthepasttwoanda halfyearsowingtothecreditandoperatingconstraintsofthecurrentmarket.In this context, we have adapted our valuation assumptions and methodology to ensure that we consider current and mediumterm operating and lending conditions to provide a fair estimate of Market Value rather than a value which overemphasisestheeffectsoffinancialand/oroperationaldistress. In this article we demonstrate how distressed values are at least 1520% lower thanMarketValues.Hence,theimportanceofmakingsurethatthevaluedoesnt penalise the medium and longerterm performance of the asset by assuming currentlydepressedinvestmentparametersandoperatingconditionsthroughout theentireholdingperiod.Havingobservedsomeofthestrategiesputinplaceby currently active buyers, we propose a more flexible, realistic and transparent routetoMarketValuesinuncertaintimes.Theproposedmethodologyconsiders currentcreditmarketconditionsintheshorttermandarefinancingeventinthe mediumterm,basedonimprovedbusinesscashflowsandthesubsequentreturn ofinvestorsandlendersconfidence. Themainpurposeofthismethodologyistorepresentmorecloselybothdebtand equityinvestorssentimentandbehaviourinthecurrentmarketmakingsurethat the true earning potential of the asset is reflected in our conclusion of Market Value, whilst at all times complying with the strict requirements of the Royal InstitutionofCharteredSurveyers(RICS)RedBook.

HVSLondon

TheArt&ScienceofHotelValuationinAnEconomicDownturn2

Current Challenges

The main challenges to hotel valuation during the current crisis have been the lack of transactions, the limited availability of finance, the depressed operating returnsandtheunknownrecoverytimetable.Morethanever,itisimportantthat the valuer has a specialist understanding of the industry and the specific hotel markets to be able to accurately assess the hotels earning potential. Moreover, theprofessionalvaluershouldbeconsciousofthebenefitsandlimitationsofthe different property valuation methods available and systematically adopt two or threevaluationmethodsascrosschecks. A tenyear leveraged discounted cash flow is the most accurate method of valuation,providingthatthereistransparencyforthevaluertoprovethesource of all market assumptions and investment parameters. This valuation method consists of forecasting the hotels future earnings and discounting them to the present value based on the typical investment parameters and return requirementsthatdriveequityanddebtmarketparticipants. Investors and lenders appetite for prime hotels and riskfree deals with fixed leaseincomeand/orguaranteeshascontinuedandevenincreasedthroughoutthe crisis. In contrast, most other type of hotel deals have been very difficult to financeowingtothevolatilityofhotelearningsatthisstageoftheeconomiccycle and lenders more conservative and riskaverse approach. However, as the general economy and hotel earnings recover and there is less default risk, it is likelythatbetterfinancingtermswillbecomeavailable. Therefore, if we were to simply adopt the assumptions and investment parametersofthecurrentmarketandrollthemforwardthroughoutthetenyears projected, we would be purely reporting a distressed value, not allowing for an improvement in the hotels operating cash flows, debt coverage and credit marketsinthemediumterm.Historically,thispotentialupsidehasbeenreflected by merging the investment parameters available today with those from a stable market. However, in essence all that does is to use investment parameters that areeitheroverlyaggressiveforthecurrentmarketortooconservativeforastable market. To represent marketwide investment parameters at all stages, we have adapted our normal tenyear leveraged cash flow method of valuation and builtin a refinancingscenariowhichconsidersboththecurrentandtheimprovedmarket conditions and reflects the likelihood of refinancing in a few years time under morefavourablelendingconditions.Thisscenarioassumesthattheloantovalue ratio will improve, and investors will look to release some of their equity when additional finance and/or better terms are available. We have reviewed this assumption with many experienced hotel lenders and investors, most of whom have confirmed the validity of our approach as it reflects their investment and lendingrationale.

HVSLondon

TheArt&ScienceofHotelValuationinAnEconomicDownturn3

The Science in Practice

The following example will help to illustrate the impact of the refinancing assumptionsontheMarketValueofaspecifichotelproperty.

THEHOTEL

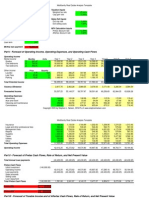

We present the valuation of a hypothetical 250room full service hotel affiliated with an international brand. This hotel enjoys a very good location, in a main Europeanbusinessandleisuredestination,andwasrefurbishedin2007/08. The market has high barriers to entry, and therefore supply has been relatively stableoverthepastdecade;supplyisexpectedtoincreasebyapproximately5% from2010to2012. The hotel has historically generated an annual net operating income of nearly 4,000,000 per year. However, the hotels operating income shrank by nearly 40%in2009. From our forecast of occupancy, average rate, food and beverage revenue, banqueting revenue, other income and operating, undistributed and fixed expenses for the hotel, we have projected the resulting tenyear net operating incomecashflows,whicharepresentedinTable1. The debt service coverage ratio (DSCR) decreased to 1.05 in 2009 due to the reduced level of earnings. We observe that this is below the 1.31.5 minimum DSCRtypicallyrequiredbylendersandisnotexpectedtoexceedthatleveluntil 2012. Table1 TenYearNetOperatingIncomeCashFlowHistoryandProjections (000s)

Net Existing Income DebtService DSCR 4,000 2,100 1.90 3,700 2,100 1.76 2,200 2,100 1.05 2,400 2,800 3,700 3,900 3,960 4,020 4,080 4,140 4,200 4,260 2,100 2,100 2,100 2,100 2,100 2,100 2,100 2,100 2,100 2,100 1.14 1.33 1.76 1.86 1.89 1.91 1.94 1.97 2.00 2.03

Historical

Year 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Projected

Our projections consider the gradual recovery of the trading performance from 2010 onwards, a similar revenue and cost structure to the historical, a 4.0% reserveforreplacementtofundreinvestmentinthehotelthroughouttheholding periodandinflationarygrowthfromthestabilisedyear(2013)onwards.

HVSLondon

TheArt&ScienceofHotelValuationinAnEconomicDownturn4

THEVALUATION

TheMarketValueofthehotelisestimatedviathecapitalisationoftheprojected net operating income cash flows through a tenyear leveraged discounted cash flowanalysis. We consider two valuation scenarios. Scenario One considers a theoretical purchase of the hotel assuming investment parameters in line with those available in the market as of today, and no refinancing. Scenario Two assumes current investment parameters but with a refinancing at the end of year three, undermorefavourablelendingterms,aspresentedinTable2. Table2 ValuationParametersScenariosOneandTwo

ValuationParameters StabilisedInflation: Initial Loan/Value: RefinancingLTV Amortisation(years): InterestRate: Terminal CapRate: Transaction/RefinancingCosts: EquityYield: Overall DiscountRate: Scenario1 1.5% 50% none 20 6.0% 8.0% 1.5% 18.5% 13.7% Scenario2 1.5% 50% 70% 20 6.0% 7.0% 1.5% 17.5% 12.2%

Scenario One

We have used our forecast of net operating income for the hotel, deducted the correspondingdebtserviceandaddedthenetsaleproceedsfromdisposingofthe hotel at the end of an assumed ten year holding period to obtain the net cash flowstoequityanddebtcoverageratiobasedoncurrentoperatingandavailable lendingconditions,asshowninTable3. Table3 NetCashFlowstoEquity()

NetIncome Available for DebtService 2,400,000 2,800,000 3,700,000 3,900,000 3,960,000 4,020,000 4,080,000 4,140,000 4,200,000 4,260,000 Total Annual DebtService 1,441,000 1,441,000 1,441,000 1,441,000 1,441,000 1,441,000 1,441,000 1,441,000 1,441,000 1,441,000 + + + + + + + + + + Plus: NetSale Proceeds 0 0 0 0 0 0 0 0 0 42,370,000 = = = = = = = = = = Total CashFlow toEquity 959,000 1,359,000 2,259,000 2,459,000 2,519,000 2,579,000 2,639,000 2,699,000 2,759,000 45,189,000

Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

DSCR 1.67 1.94 2.57 2.71 2.75 2.79 2.83 2.87 2.91 2.96

Note:Figureshave beenroundedforpresentationpurposes

Theannualdebtservicepaymenthasbeencalculatedbasedontheloantovalue ratio assumed and the mortgage constant, which reflects the periodic cost of

HVSLondon

TheArt&ScienceofHotelValuationinAnEconomicDownturn5

financing as a percentage of the total loan amount. We note that the projected earningsallowforahealthycoverageofdebtservice. Thenetsalesproceedsresultfromcapitalisingthe11thyearnetoperatingincome into perpetuity at the terminal capitalisation rate and deducting the typical transaction costsbornebythesellerandtheremainingmortgagebalanceatthe endoftheholdingperiod. We have then discounted the annual cash flows to equity at the assumed equity yieldwhichreflectsthereturnrequirementsofequityparticipantsinthecurrent market. This results in the value of the equity component (16,765,000), as showninTable4. Table4 DiscountedCashFlowAnalysisScenarioOneBaseValue()

Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 NetIncome ToEquity 959,000 1,359,000 2,259,000 2,459,000 2,519,000 2,579,000 2,639,000 2,699,000 2,759,000 45,189,000 Equity Discount 18.5% 18.5% 18.5% 18.5% 18.5% 18.5% 18.5% 18.5% 18.5% 18.5% x x x x x x x x x x Discount Factor 0.84388 0.71214 0.60096 0.50714 0.42796 0.36115 0.30477 0.25719 0.21704 0.18315 = = = = = = = = = = Discounted CashFlow 809,000 968,000 1,358,000 1,247,000 1,078,000 931,000 804,000 694,000 599,000 8,277,000 16,765,000 16,765,000 0 33,530,000 33,500,000 134,000 13.66%

Value ofEquityComponent: Plus:Value of the Mortgage: Less:Capital Deduction: Total PropertyValue: RoundedTo: Value perRoom: PropertyYield:

Note:Figureshave beenroundedforpresentationpurposes

Thevalueofthemortgageisbasedonthevalueoftheequitycomponentandthe equitytovalue(ETV)andloantovalueratios(LTV).

TotalValue=ETV+LTV 100%=ETV+50% ETV=100%50%=50% Thus,LTV=16,765,000

We have assumed no additional capital deduction in our analysis, beyond the alreadyforecastreserveforreplacement. As illustrated in Table 4, our tenyear leveraged discounted cash flow analysis indicates a Market Value for the hotel of approximately 33,500,000 (134,000 perroom).

HVSLondon

TheArt&ScienceofHotelValuationinAnEconomicDownturn6

Scenario Two

However,weconsiderthatpresentlendingconditionsarenotrepresentativeofa normalinvestmentenvironment.Therefore,theriskisthatbyonlyconsidering theseconditions,asshowninTable4,thehoteliseffectivelybeingundervalued. So if we were to take into consideration the very likely event that an investor wouldexpecttorefinancethisinvestmentwhenoperatingandlendingconditions improve, and we adopt the Scenario Two valuation parameters, the picture changessubstantially. ToderivethetotalcashflowtoequityunderScenarioTwowehaveusedthesame forecast of income and expense, deducted the corresponding debt service and addedthenetproceedsofrefinancingthehotelattheendofyearthree. Uponrefinancing,thehotelhasbeenvaluedusingatenyeardiscountedcashflow analysisbasedonpostrefinancingcashflowsfrom2014onwardsandimproved investmentparametersinordertoderivethequantityoftheloanandtherevised annual debt service. The inputs and outputs of this analysis are summarised in Table5. Table5 ValueBasedonPostRefinancingYearCashFlowsandNew MortgageSize()

ValuationInput YearofValue: 2013 Inflation: 1.5% Loan/Value: 70% mortisation(years): 20 Term: 10 InterestRate: 6.0% Terminal CapRate: 7.0% TransactionCosts: 1.5% EquityYield: 17.5% *Beforecapital deduction,ifany ValuationOutput Value:* 47,900,000 Value PerRoom: 191,600 Overall DiscountRate: 10.8% CapRateHistorical NOI: 8.1% CapRate1stYearNOI: 8.3% Mortgage@70.0%LTV: 33,549,000 MortgagePerRoom: 134,196 Annual DebtService: 2,884,000 DSCRRefi.Year: 1.37

Thenetproceedsofrefinancinghavebeencalculatedbasedonthesizeofthenew mortgage less the outstanding mortgage balance of the initial mortgage and an assumed1.5%costofrefinancingasafeetothelender,asshowninTable6. Table6 CalculationofNetRefinancingProceedstoEquity()

RefinancingYearValue: NewLoan/Value Ratio: NewMortgage: Less: OutstandingBalance ofInitial Mortgage: RefinancingCosts@1.50%: NetRefinancingProceeds 47,900,000 70% 33,549,000 14,801,000 503,000 18,200,000

Table 7 shows the calculation of net cash flows to equity according to the assumptionsofScenarioTwo.Weassumeasaleofthepropertyattheendofthe holdingperiod.

HVSLondon

TheArt&ScienceofHotelValuationinAnEconomicDownturn7

Table7

ScenarioTwoNetCashFlowstoEquity()

NetIncome Available for DebtService 2,400,000 2,800,000 3,700,000 3,900,000 3,960,000 4,020,000 4,080,000 4,140,000 4,200,000 4,260,000 TotalAnnual DebtService 1,441,000 1,441,000 1,441,000 1,441,000 2,884,000 2,884,000 2,884,000 2,884,000 2,884,000 2,884,000 + + + + + + + + + + Plus: Refi./Sale Proceeds 0 0 0 18,200,000 0 0 0 0 0 33,569,000 = = = = = = = = = = TotalCashFlow toEquity 959,000 1,359,000 2,259,000 20,659,000 1,076,000 1,136,000 1,196,000 1,256,000 1,316,000 34,945,000 DSCR Ratio 1.67 1.94 2.57 2.71 1.37 1.39 1.41 1.44 1.46 1.48

Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

Note:Figureshave beenroundedforpresentationpurposes

Followingtherefinancingevent,thebuyertakesadvantageofadditionalfinance based on improved level of earnings and general financing conditions and this results in larger annual debt service payments. We note that the DSCR upon refinancingisstillwithinthe1.31.5minimumrangetypicallyrequiredbylenders inthestabilisedyear. Theresultingcashflowstoequityarethendiscountedattheequityyield(initially 18.5%andthen17.5%afterrefinancing,giventhereductioninequityneededto fund the project, less operating risk and the higher returns on the existing investmentfromtherefinancingproceeds).Thisresultsinthevalueoftheequity component(22,531,000). This valuation methodology considers the upside potential of refinancing the current loan when the property is stabilised and more favourable lending conditions are available on the return to the equity participant and the current lendingconditionsonthereturntothedebtparticipant.Thus,toobtainthehotels MarketValue,weaddthevalueoftheoriginalmortgagetothevalueoftheequity componentundertherefinancingassumption. We have assumed no capital deduction in our analysis, beyond the already forecastreserveforreplacement.

HVSLondon

TheArt&ScienceofHotelValuationinAnEconomicDownturn8

Table8

DiscountedCashFlowAnalysisScenarioTwoMarketValue()

Year 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 NetIncome ToEquity 959,000 1,359,000 2,259,000 20,659,000 1,076,000 1,136,000 1,196,000 1,256,000 1,316,000 34,945,000 Equity Discount 18.5% 18.5% 18.5% 18.5% 17.5% 17.5% 17.5% 17.5% 17.5% 17.5% x x x x x x x x x x Discount Factor 0.84388 0.71214 0.60096 0.50714 0.44649 0.37999 0.32340 0.27523 0.23424 0.19935 = = = = = = = = = = Discounted CashFlow 809,000 968,000 1,358,000 10,477,000 480,000 432,000 387,000 346,000 308,000 6,966,000 22,531,000 16,765,000 0 39,296,000 39,300,000 157,000 12.2%

Value of EquityComponent: Plus:Value of Initial Mortgage: Less:Capital Deduction: Total PropertyValue: RoundedTo: Value perRoom: PropertyYield:

Note:Figureshave beenroundedforpresentationpurposes

ThisresultsinaMarketValueofthehotelof39,300,000(157,000perroom) whichinourviewmoreappropriatelyreflectstherequirementsofanexperienced andknowledgeablehotelinvestoractinginthecurrenteconomicenvironment. Agraphicillustrationoftheprocesswouldbeasfollows.

Table 9 Illustration of the Current and Changing Circumstances and Refinancing Scenario

35,000,000 33,000,000 31,000,000 Net Debt Drawdown 17,000,000 15,000,000 5,000,000 3,000,000 1,500,000 Initial Mortgage Mortgage Upon Refinancing Net Refinancing Proceeds

Net Sale Proceeds

NetIncome DebtService

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Wehighlightthefollowing. The hotels operating performance is currently depressed, achieving lower thanhistoricalearnings;

HVS SLondon

The eArt&Scienceo ofHotelValuatio oninAnEconom micDownturn9

However, improveme ents to the e hotels tr rading and profitabilit ty can be y expected over the co oming year rs as the ec conomic en nvironment reasonably recovers; The illustration show ws that the loan alw ways remain ns affordab ble to the business,w withabovet thresholdDS SCRthrough houttheholdingperiod d; Thevalueo ofthehotelundercurre entoperatin ngandlendingcondition nsisbased on a depr ressed level of earning gs and does s not factor r in the pos ssibility of obtaining higher leverage on the e investmen nt and relea asing equity y when the rkets and the t hotels trading t hav ve recovere ed. Thus, th his method credit mar undervalue esthehotel; Thevalueo ofthehoteluponrefina ancingisbas sedonanor rmalisednet toperating income an ndlendingconditions(i includingde ebtcoverageratio)and dtherefore represents safairerref flectionofth hehotelsfut tureearning gpotential.

Impact on Ma arket Values s

he following is an illu ustration of f the impac ct of using different eq quity/debt Th as ssumptionsontheMark ketValueofthehotel. Tab ble10 ImpactonMarketValu ueofDiffere entEquity/D DebtAssump ptions

As shown in Table T 10, th he impact and a importa ance of the e adoption of o sensible rameters is crucial. Although A restricted deb bt availabili ity is not part p of the par offi ficialdefiniti ionofdistre essedvalue ,perhapsitshouldbe. Ma ain Advantages In conclusion, , we note that this approach a to o hotel valu uation, considering a ref financing wh hen the hot tel has reached a stabil lised perfor rmance and the credit ma arketsareba ackinbusin ness,hasthefollowinga advantages. Itprovides smoreflexib bilityadaptingtomore econvention naloruncer rtaintimes, considerin ngcurrentan ndmedium termoperatingandlen ndingcondit tions; Itreflectsm moreaccura atelytheinv vestorssen ntimentand investment tstrategies notably, itconsiders stheverylik kelyscenari iothatthei investorwillrefinance totakeadva antageofbet tteravailabl lelendingte erms; afteraperiodoftimet It reports Market Val lue as oppo osed to a value v which is more re eflective of distress, producing p a more real a listic estima ate of the hotels true e potential earningsandcomplies swiththeRICSRedBoo ok.

HVSLondon

TheArt&ScienceofHotelValuationinAnEconomicDownturn10

AbouttheAuthors AnaCamposBlancoisanAssociatewithHVSsLondonoffice,specialising in hotel valuation and consultancy. She joined HVS in 2007 after completingadiplomainTourismManagementattheCEUUniversity,Spain and an MBA at IMHI (ESSEC Business School, Paris, France). Since joining HVS, she has provided investment advice and worked on hotel feasibility studiesandvaluationsacrossEuropeandNorthernAfrica.Sheiscurrently pursuing a MSc in Property Investment from the CEM (College of Estate Management,Reading)andisexpectingtograduatein2012.

Sophie Perret is an Associate Director with HVSs London office. She joined HVS in 2003 and has ten years operational experience in the hospitalityindustryinSouthAmericaandEurope.OriginallyfromBuenos Aires, Sophie speaks English, Spanish and French. She holds a Bachelors degree in Hotel Management from Ateneo de Estudios Terciarios, and an MBA from IMHI (Essec Business School, France, and Cornell University, USA). Since joining HVS, she has advised on a wide range of hotel investment projects and related assignments. Sophie is responsible for developingHVSsworkinFrance,Italy,andAfrica. Forfurtherinformation,pleasecontactAnaCamposBlancoorSophie Perret. AnaCamposBlancoAssociate Email:acamposblanco@hvs.com DirectLine:+442078787762 SophiePerretAssociateDirector Email:sperret@hvs.com DirectLine:+442078787722 710ChandosStreet CavendishSquare LondonW1G9DQ Tel:+442078787700 Fax:+442078787799 Orvisitwww.hvs.com

HVS2010

HVSLondon

TheArt&ScienceofHotelValuationinAnEconomicDownturn11

About HVS

HVSistheworldsleadingconsultingandservicesorganisationfocusedonthehotel,restaurant,shared ownership, gaming and leisure industries. Established in 1980, the company offers a comprehensive scopeofservicesandspecialisedindustryexpertisetohelpyouenhancetheeconomicreturnsandvalue ofyourhospitalityassets. Because hotels represent both real property and operating businesses, the founding partners of HVS decided to develop the first comprehensive valuation methodology for appraising these specialised assets. Their initial textbook on this topic entitled The Valuation of Hotels and Motels, published by the AppraisalInstitute,createdtheindustrystandardforvaluinghotelsandisnowusedbyvirtuallyevery appraiseraroundtheworld.HVScontinuestobeattheforefrontofhotelvaluationmethodology,having publishedsixtextbooksandhundredsofarticlesonthissubject,whichareusedinappraisalcoursesand seminarsandatleadinghotelschoolssuchasLausanne,IMHIandCornell.HVSassociatesareconstantly called upon to teach this methodology to hotel owners, lenders and operators and to participate at industry conferences. HVS principals literally wrote the book on hotel valuation, which significantly enhancesthecredibilityandreliabilityofourconclusions. Over the past three decades, HVS has expanded both its range of services and its geographical boundaries. The companys global reach, through a network of 30 offices staffed by 400 seasoned industry professionals, gives you access to an unparalleled range of complementary services for the hospitalityindustry: Consulting&Valuation InvestmentBanking AssetManagement&Advisory SharedOwnershipServices GolfServices ExecutiveSearch RiskManagement PropertyTaxServices Convention,Sports&EntertainmentFacilities InteriorDesign Sales&MarketingServices HotelManagement(USonly) EcoServices Food&BeverageServices GamingServices HotelParkingConsulting

Our clients include prominent hotel owners, lending institutions, international hotel companies, managemententities,governmentalagencies,andlawandaccountingfirmsfromNorthAmerica,Europe, Asia,LatinAmericaandtheCaribbean.HVSprincipalsareregardedastheleadingprofessionalsintheir respectiveregionsoftheglobe.Weareclientdriven,entrepreneurialanddedicatedtoprovidingthebest adviceandservicesinatimelyandcostefficientmanner.HVSemployeescontinuetobeindustryleaders, consistently generating a wide variety of articles, studies, and publications on all aspects of the hospitalityindustry. HVSistheindustrysprimarysourceofhotelownershipdata.Our2,000+assignmentseachyearkeepus at the forefront of trends and knowledge regarding information on financial operating results, management contracts, franchise agreements, compensation programmes, financing structures and transactions.Withaccesstoourindustryintelligenceanddata,youwillhavethemosttimelyinformation andthebesttoolsavailabletomakecriticaldecisionsaboutyourhospitalityassets. For further information regarding our expertise and specifics about our services, please visit www.hvs.com.

Vous aimerez peut-être aussi

- Applying Value Drivers To Hotel ValuationDocument20 pagesApplying Value Drivers To Hotel ValuationErsan YildirimPas encore d'évaluation

- Hotel Valuation TechniquesDocument20 pagesHotel Valuation Techniquesgallu35Pas encore d'évaluation

- Hotel Management Contracts - To Lease or Not To Lease PDFDocument10 pagesHotel Management Contracts - To Lease or Not To Lease PDFraj tanwarPas encore d'évaluation

- Valuing Hotels and Motels for Tax AssessmentDocument20 pagesValuing Hotels and Motels for Tax AssessmentglowrinnPas encore d'évaluation

- Trends and Insights: in Hotel Management ContractsDocument21 pagesTrends and Insights: in Hotel Management ContractsPuja BhallaPas encore d'évaluation

- Understanding Hotel Valuation TechniquesDocument0 pageUnderstanding Hotel Valuation TechniquesJamil FakhriPas encore d'évaluation

- The Hotel Acquisition ProcessDocument21 pagesThe Hotel Acquisition ProcessdrakovenyaPas encore d'évaluation

- HVS - Historical Trends Hotel Management ContractsDocument17 pagesHVS - Historical Trends Hotel Management Contracts*Maverick*Pas encore d'évaluation

- Valley Village Apartment ProjectDocument27 pagesValley Village Apartment ProjectSFValleyblogPas encore d'évaluation

- Sha566 TurnadotDocument7 pagesSha566 TurnadotBambang JuliantoPas encore d'évaluation

- Buy and Optimize: A Guide to Acquiring and Owning Commercial PropertyD'EverandBuy and Optimize: A Guide to Acquiring and Owning Commercial PropertyPas encore d'évaluation

- 19 - Real Estate Thesis PDFDocument206 pages19 - Real Estate Thesis PDFPriyanka MPas encore d'évaluation

- HVS Feasibility Study - FINAL - Proposed Full-Service HotelDocument128 pagesHVS Feasibility Study - FINAL - Proposed Full-Service HotelJavier Contreras100% (2)

- Fusion Real Estate Development Trust - Offering MemorandumDocument124 pagesFusion Real Estate Development Trust - Offering MemorandumAnonymous JQZgPm50% (2)

- PWC Real Estate 2020Document40 pagesPWC Real Estate 2020jcschiaffino100% (1)

- Salford University School of Built Environment BSC Property Management and InvestmentDocument26 pagesSalford University School of Built Environment BSC Property Management and InvestmentThomas MacdonaldPas encore d'évaluation

- Hotel Cap Rates Hold Steady - Values Under PressureDocument10 pagesHotel Cap Rates Hold Steady - Values Under PressureManvinderPas encore d'évaluation

- Evolution of The Hospitality Asset Management - 6-7-8 - FinalDocument27 pagesEvolution of The Hospitality Asset Management - 6-7-8 - FinalĐàoMinhPhươngPas encore d'évaluation

- Commercial Real Estate Case StudyDocument2 pagesCommercial Real Estate Case StudyKirk SummaTime Henry100% (1)

- Hotel Development ProcessDocument16 pagesHotel Development Processatul_uttam1100% (2)

- Hotels and Resorts - An Investor ' S GuideDocument389 pagesHotels and Resorts - An Investor ' S GuideAnonymous 4YqvCTlds100% (2)

- Property Management Residential Managment Plan 2010Document18 pagesProperty Management Residential Managment Plan 2010judojim100% (3)

- Mark Ratterman-Valuation - by - Comparison - Second - EditionDocument177 pagesMark Ratterman-Valuation - by - Comparison - Second - EditionTeresa Jackson100% (1)

- Forecasting Covers in Hotel Food and Beverage OutletsDocument22 pagesForecasting Covers in Hotel Food and Beverage OutletsKirby C. LoberizaPas encore d'évaluation

- Hotel Asset Management 2Document48 pagesHotel Asset Management 2Nguyễn Thế PhongPas encore d'évaluation

- HVS 2016 Hotel Cost Estimating GuideDocument117 pagesHVS 2016 Hotel Cost Estimating GuideNguyễn Thế Phong100% (1)

- How To Buy A Hotel HandbookDocument140 pagesHow To Buy A Hotel HandbookShivam Patel100% (1)

- Hotel Versus Serviced ApartmentDocument6 pagesHotel Versus Serviced ApartmentsamairaPas encore d'évaluation

- Hotel Build Cost GuideDocument80 pagesHotel Build Cost GuideAaditya Pratap SanyalPas encore d'évaluation

- Market AnalysisDocument35 pagesMarket AnalysisbtittyPas encore d'évaluation

- Uniform System of Acct 11thDocument353 pagesUniform System of Acct 11thduy dinhPas encore d'évaluation

- HVS Hotel Cost Estimating Guide 2020Document126 pagesHVS Hotel Cost Estimating Guide 2020pascal rosasPas encore d'évaluation

- Real Estate ModelDocument13 pagesReal Estate Modelgiorgiogarrido667% (3)

- Cornell Real Estate Review 2018Document102 pagesCornell Real Estate Review 2018DnukumPas encore d'évaluation

- HVS - 2013 Hotel Cost Estimating GuideDocument87 pagesHVS - 2013 Hotel Cost Estimating Guidehosam01Pas encore d'évaluation

- Retail Sales Model ValuationDocument220 pagesRetail Sales Model ValuationsaundersrealestatePas encore d'évaluation

- Real Estate Financial Modeling Training BrochureDocument21 pagesReal Estate Financial Modeling Training Brochurebkirschrefm50% (6)

- Underwriting Commercial Real Estate in a Dynamic Market: Case StudiesD'EverandUnderwriting Commercial Real Estate in a Dynamic Market: Case StudiesPas encore d'évaluation

- Step by Step Guide: Release Version 14.0 - August 21, 2008Document119 pagesStep by Step Guide: Release Version 14.0 - August 21, 2008rovvy85Pas encore d'évaluation

- Real Estate ConceptsDocument521 pagesReal Estate Conceptsrasmahee93% (14)

- Commercial Real Estate LendingDocument133 pagesCommercial Real Estate LendingMarcelo PozoPas encore d'évaluation

- Real Estate Modeling Quick Reference ReaDocument7 pagesReal Estate Modeling Quick Reference ReaKaren Balisacan Segundo RuizPas encore d'évaluation

- Commercial Appraisal OverviewDocument61 pagesCommercial Appraisal OverviewahmedPas encore d'évaluation

- Budget Hotels in Europe Feasibility Study UK Consultant LondonDocument18 pagesBudget Hotels in Europe Feasibility Study UK Consultant LondonbhupathireddyoPas encore d'évaluation

- Hotel Management DeficienciesDocument34 pagesHotel Management DeficienciessandeshPas encore d'évaluation

- Mit Commercial Real Estate Analysis and Investment Online Short Program BrochureDocument9 pagesMit Commercial Real Estate Analysis and Investment Online Short Program BrochureTino MatsvayiPas encore d'évaluation

- Preparing - The - Pro - Forma - Real Estate PDFDocument63 pagesPreparing - The - Pro - Forma - Real Estate PDFhelgerson.mail4157100% (1)

- The How To Add Value Handbook For Commercial Real EstateD'EverandThe How To Add Value Handbook For Commercial Real EstateÉvaluation : 4 sur 5 étoiles4/5 (1)

- Real Estate Valuation SeminarDocument96 pagesReal Estate Valuation SeminarSoftkiller67% (3)

- The Commercial Real Estate Investor's Handbook A Step-by-Step Road Map to Financial WealthD'EverandThe Commercial Real Estate Investor's Handbook A Step-by-Step Road Map to Financial WealthÉvaluation : 1 sur 5 étoiles1/5 (1)

- Feasibility Project Proposal: Drs. Agustinus Agus Purwanto, SE MM CHADocument36 pagesFeasibility Project Proposal: Drs. Agustinus Agus Purwanto, SE MM CHAAgustinus Agus Purwanto100% (1)

- Real Estate Investing: Master Commercial, Residential and Industrial Properties by Understanding Market Signs, Rental Property Analysis and Negotiation StrategiesD'EverandReal Estate Investing: Master Commercial, Residential and Industrial Properties by Understanding Market Signs, Rental Property Analysis and Negotiation StrategiesPas encore d'évaluation

- The Due Diligence Handbook For Commercial Real EstateD'EverandThe Due Diligence Handbook For Commercial Real EstateÉvaluation : 5 sur 5 étoiles5/5 (2)

- Strategy for Real Estate CompaniesD'EverandStrategy for Real Estate CompaniesÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Making It in Real Estate: Starting Out as a DeveloperD'EverandMaking It in Real Estate: Starting Out as a DeveloperÉvaluation : 3.5 sur 5 étoiles3.5/5 (9)

- The Residential Agent's Handbook for Commercial Real EstateD'EverandThe Residential Agent's Handbook for Commercial Real EstatePas encore d'évaluation

- Space Warp Propulsion Part 2 Alien ReproDocument5 pagesSpace Warp Propulsion Part 2 Alien ReproSoftkillerPas encore d'évaluation

- Space Warp Propulsion Part 1Document6 pagesSpace Warp Propulsion Part 1SoftkillerPas encore d'évaluation

- (Ebook) Survival in Various Situations PDFDocument21 pages(Ebook) Survival in Various Situations PDFSoftkillerPas encore d'évaluation

- Typical Characteristics of Spectral Types: Type M (B-V) T Bol. Corr. Main SequenceDocument2 pagesTypical Characteristics of Spectral Types: Type M (B-V) T Bol. Corr. Main SequenceSoftkillerPas encore d'évaluation

- John TitorDocument420 pagesJohn TitorSoftkillerPas encore d'évaluation

- 1.1 Rainwater Harvesting Fr..Document13 pages1.1 Rainwater Harvesting Fr..SoftkillerPas encore d'évaluation

- List of Nearby Stars To 21 Light YearsDocument13 pagesList of Nearby Stars To 21 Light YearsSoftkillerPas encore d'évaluation

- A Survival ScenarioDocument345 pagesA Survival Scenariohyntish82100% (1)

- 06b Settlement in Sand & Bearing CapacityDocument12 pages06b Settlement in Sand & Bearing CapacitySoftkillerPas encore d'évaluation

- NASA Surface Meteorology and Solar Energy - Available Tables 2Document2 pagesNASA Surface Meteorology and Solar Energy - Available Tables 2SoftkillerPas encore d'évaluation

- Evs 2009Document102 pagesEvs 2009voitkascribdPas encore d'évaluation

- Avaliação ProbabilisticaDocument15 pagesAvaliação ProbabilisticaSoftkillerPas encore d'évaluation

- THE 100 NEAREST STAR SYSTEMSDocument13 pagesTHE 100 NEAREST STAR SYSTEMSSoftkillerPas encore d'évaluation

- KOI HabitableDocument105 pagesKOI HabitableSoftkillerPas encore d'évaluation

- 06b Settlement in Sand & Bearing CapacityDocument12 pages06b Settlement in Sand & Bearing CapacitySoftkillerPas encore d'évaluation

- Correct Score by D Pedro ViDocument8 pagesCorrect Score by D Pedro ViSoftkiller100% (3)

- Lay Correct Score 0-0 StrategyDocument2 pagesLay Correct Score 0-0 StrategySoftkiller100% (1)

- Learn How To Trade in Forex Like A ProDocument133 pagesLearn How To Trade in Forex Like A ProSoftkillerPas encore d'évaluation

- Lay The Winning TeamDocument2 pagesLay The Winning TeamSoftkillerPas encore d'évaluation

- Correct Score OverviewDocument8 pagesCorrect Score OverviewSoftkiller100% (3)

- Avaliação ProbabilisticaDocument15 pagesAvaliação ProbabilisticaSoftkillerPas encore d'évaluation

- Risk Free FootballDocument4 pagesRisk Free FootballSoftkiller75% (4)

- Poisson DistributionDocument5 pagesPoisson DistributionSoftkillerPas encore d'évaluation

- Clever BetDocument9 pagesClever BetSoftkillerPas encore d'évaluation

- Poisson CalculatorDocument4 pagesPoisson CalculatorSoftkiller100% (1)

- Lay Correct Score 0-0 StrategyDocument2 pagesLay Correct Score 0-0 StrategySoftkiller100% (1)

- Trading Football Strategiesv3Document27 pagesTrading Football Strategiesv3Softkiller56% (9)

- The Ultimate Football Betting StrategyDocument8 pagesThe Ultimate Football Betting StrategySoftkiller60% (5)

- FINANCIAL CALCULATOR - Practice Exercises - Appraisal InstituteDocument8 pagesFINANCIAL CALCULATOR - Practice Exercises - Appraisal InstituteSoftkillerPas encore d'évaluation

- The T DistributionDocument5 pagesThe T DistributionSoftkillerPas encore d'évaluation

- 12Document24 pages12Maria G. BernardinoPas encore d'évaluation

- Takeover in Corporate RestructuringDocument20 pagesTakeover in Corporate RestructuringmandiraPas encore d'évaluation

- Balance Sheet: Telenor Group As of 31 December 2008-09Document14 pagesBalance Sheet: Telenor Group As of 31 December 2008-09born2win_sattiPas encore d'évaluation

- CE On Quasi-ReorganizationDocument1 pageCE On Quasi-ReorganizationalyssaPas encore d'évaluation

- Accounting Equation Class 11thDocument7 pagesAccounting Equation Class 11thAtul Kumar SamalPas encore d'évaluation

- Intermediate Accounting Vol 1 Canadian 3rd Edition Lo Solutions Manual 1Document35 pagesIntermediate Accounting Vol 1 Canadian 3rd Edition Lo Solutions Manual 1anthony100% (40)

- Financial Analysis of DG Khan Cement FactoryDocument12 pagesFinancial Analysis of DG Khan Cement FactoryMuhammad MushtaqPas encore d'évaluation

- Dabur ValuationDocument41 pagesDabur Valuationashwini patilPas encore d'évaluation

- Company Law QuestionsDocument9 pagesCompany Law QuestionsBadrinath ChavanPas encore d'évaluation

- The Dark Side of ValuationDocument63 pagesThe Dark Side of ValuationMiguel Vega OtinianoPas encore d'évaluation

- Unit 2 Financial Statement AnalysisDocument17 pagesUnit 2 Financial Statement AnalysisalemayehuPas encore d'évaluation

- Mergers and AcquisitionDocument20 pagesMergers and Acquisitionkako12345Pas encore d'évaluation

- Week 7 AUDIT PreTestDocument19 pagesWeek 7 AUDIT PreTestCale HenitusePas encore d'évaluation

- Exercises - Master BudgetDocument5 pagesExercises - Master BudgetUng Goy100% (1)

- ProjectDocument74 pagesProjectvinayhv1350% (4)

- Accounting Q&ADocument6 pagesAccounting Q&AIftikharPas encore d'évaluation

- 2.capital Structure QB 25-40Document12 pages2.capital Structure QB 25-40Towhidul IslamPas encore d'évaluation

- Abc-Joint ArrangementsDocument4 pagesAbc-Joint ArrangementsLeonardo MercaderPas encore d'évaluation

- Final - Davidoff Solomon - WebDocument34 pagesFinal - Davidoff Solomon - WebGiovanni EstradaPas encore d'évaluation

- RWJ FCF11e Chap 04Document25 pagesRWJ FCF11e Chap 04gttrans111Pas encore d'évaluation

- PPT3-Consolidated Financial Statement - Date of AcquisitionDocument54 pagesPPT3-Consolidated Financial Statement - Date of AcquisitionRifdah Saphira100% (1)

- Aboitiz Equity Ventures 2014 Annual ReportDocument74 pagesAboitiz Equity Ventures 2014 Annual Reportluckii8star100% (1)

- Asian PaintsDocument6 pagesAsian PaintsDivyagarapatiPas encore d'évaluation

- Non-Banking Financial Institutions - Assessment of Their Impact On The Stability of The Financial System-Eu-270 PagesDocument261 pagesNon-Banking Financial Institutions - Assessment of Their Impact On The Stability of The Financial System-Eu-270 PagesbuhaptserenPas encore d'évaluation

- MINNA PADI INVESTAMA SEKURITAS 2017 ANNUAL REPORTDocument158 pagesMINNA PADI INVESTAMA SEKURITAS 2017 ANNUAL REPORTRina KusumaPas encore d'évaluation

- Chapter 16 Notes - Complex Financial InstrumentsDocument13 pagesChapter 16 Notes - Complex Financial InstrumentsAli Nath0% (2)

- Report MIC 2022Document87 pagesReport MIC 2022dwi handariniPas encore d'évaluation

- Tài liệu của Trần Khoa - K46 - FNC05 - Khoa Tài chính - Trường Kinh Doanh - Đại học UEHDocument24 pagesTài liệu của Trần Khoa - K46 - FNC05 - Khoa Tài chính - Trường Kinh Doanh - Đại học UEHQúy ChâuPas encore d'évaluation

- Mohammed SeidDocument68 pagesMohammed SeidKhalid Muhammad100% (2)

- Module 1-Partnership FormationDocument15 pagesModule 1-Partnership FormationJonard baloyoPas encore d'évaluation