Académique Documents

Professionnel Documents

Culture Documents

Grocery Retailers in Pakistan

Transféré par

t2yangCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Grocery Retailers in Pakistan

Transféré par

t2yangDroits d'auteur :

Formats disponibles

GROCERY RETAILERS IN PAKISTAN

Euromonitor International April 2013

GROCERY RETAILERS IN PAKISTAN

Passport

LIST OF CONTENTS AND TABLES

Headlines ..................................................................................................................................... 1 Trends .......................................................................................................................................... 1 Traditional Vs Modern .................................................................................................................. 3 Competitive Landscape ................................................................................................................ 3 Prospects ..................................................................................................................................... 4 Channel Formats .......................................................................................................................... 5 Chart 1 Chart 2 Chart 3 Chart 4 Chart 5 Chart 6 Chart 7 Table 1 Table 2 Table 3 Table 4 Table 5 Table 6 Table 7 Table 8 Table 9 Table 10 Table 11 Table 12 Modern Grocery Retailers: Shell Select in Islamabad .................................. 5 Modern Grocery Retailers: A Tuk Shop Attock Petroleum in Islamabad .................................................................................................... 6 Modern Grocery Retailers: Esajee in Islamabad .......................................... 7 Traditional Grocery Retailers: Shams in Islamabad ..................................... 8 Traditional Grocery Retailers: Gourmet in Lahore ........................................ 9 Traditional Grocery Retailers: United Bakery in Islamabad ........................ 10 Traditional Grocery Retailers: Fruit and vegetable stall in Islamabad......... 11 Sales in Grocery Retailers by Channel: Value 2007-2012 ......................... 12 Grocery Retailers Outlets by Channel: Units 2007-2012 ............................ 13 Sales in Grocery Retailers by Channel: % Value Growth 2007-2012 ......... 13 Grocery Retailers Outlets by Channel: % Unit Growth 2007-2012 ............. 13 Grocery Retailers Company Shares: % Value 2008-2012 ......................... 14 Grocery Retailers Brand Shares: % Value 2009-2012 ............................... 14 Grocery Retailers Brand Shares: Outlets 2009-2012 ................................. 14 Grocery Retailers Brand Shares: Selling Space 2009-2012....................... 15 Forecast Sales in Grocery Retailers by Channel: Value 2012-2017 .......... 15 Forecast Grocery Retailers Outlets by Channel: Units 2012-2017 ............. 16 Forecast Sales in Grocery Retailers by Channel: % Value Growth 2012-2017 .................................................................................................. 16 Forecast Grocery Retailers Outlets by Channel: % Unit Growth 20122017 ........................................................................................................... 16

Channel Data ............................................................................................................................. 12

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

GROCERY RETAILERS IN PAKISTAN

HEADLINES

Grocery retailers current value sales grow by 11% in 2012 to reach PKR1.9 trillion Traditional grocery retailers experiences lower value sales growth compared to the modern grocery channel The total number of grocery retailers outlets grow by 1% in 2012 to reach 469,320 Utility Store Corp of Pakistan was the market leader among grocery retailers with 4% market share in terms of value. Grocery retailers is set to decline by a constant value CAGR of 1% over the forecast period

TRENDS

Trends and changed in grocery retailers in 2012 were in line with the ongoing changes in retailing over the review period with no significant new changes introduced to alter dynamics. Traditional grocery retailers experienced slower growth of 10% compared to modern grocery retailers which increased by 18%. Modern grocery retailers is growing from a comparatively small base in terms of value sales but is at the forefront in terms of visibility and popularity amongst consumers. In line with changing lifestyles and demands of an urbanising population, consumers are going for one-stop solutions, lured by better prices, wider range of products, better, more professional service and shopping convenience at modern grocery retailers making them less dependent on neighbourhood grocery retailers. This also means that instead of shopping for necessary items on a daily/weekly basis, consumers are shifting towards buying their grocery needs on a monthly basis. Other grocery retailers was the biggest channel in current value sales terms in 2012, with 76% share. Led by the wide network of government-owned Utility Store Corps Utility Store, these retailers serve the local population through discount pricing and easy access to a large variety of products. Present in large cities, small towns and villages, these retailers cover a wide range of the population and are attractive places to shop from for a large segment of the population. As the face of the government in retailing, expansion in the number of outlets and use as a tool to provide relief from high inflation were the major activities occurring in this channel in 2012. Hypermarkets was the fastest growing channel in 2012 due to its small base. Current value sales grew by 75% in 2012, mainly due to the opening of a new (second) outlet in a high street mall (Dolmen Mall) in Karachi. Karachi is the largest city in Pakistan and also its business hub tapping into this area is an important step forward for hypermarkets. Hyperstar is the currently the only player in hypermarkets and is planning on opening a third outlet in Karachi in the latter half of 2012. Supermarkets was also one of the top performing channels amongst grocery retailers in 2012. Current value sales grew by 14% in 2012 which is above the average for grocery retailers and outlets grew by 3% which is much higher than 1% for grocery retailers as a whole. Rising popularity of this channel amongst consumers in urban centres led to more of them frequenting supermarkets for their regular grocery needs. More outlets provided greater coverage of urban centres, making it easier for consumers to opt to shop at supermarkets instead of their neighbourhood small grocery stores.

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

The share of groceries in supermarkets declined steadily over the review period, falling from 76% in 2005 to 73% in 2012. In the case of hypermarkets, the share of groceries fell from 68% to 67% from 2009 to 2012. This indicates that these modern grocery retailers are paying more attention to non-grocery items by giving them more shelf-space this is caused by the higher margins often associated with these items and the strategy of these retailers to provide greater product variety to consumers. Another reason for this trend can be the profile of the consumers visiting supermarkets and hypermarkets urban middle to upper class shoppers are increasingly spending more on non-essential grocery items as incomes and lifestyles improve. Discounters was not present in Pakistan in 2012. There was a growing trend towards convenience in grocery retailing in Pakistan in 2012 as convenience retailing is an upcoming modern retailing channel. There is little consumer awareness or demand for more convenience stores as consumers are attuned to the traditional form of grocery retailing, but current sales are growing at a substantial pace and the trend is likely to catch on as urban consumers will appreciate the services that convenience stores has to offer. The unique selling point of forecourt retailers is that its operating hours and the association with petrol pumps and CNG stations. Consumers are spending more and more time waiting in lines at CNG stations and petrol pumps due to the frequent load shedding of CNG, especially in the winter season. Forecourt retailers witnessed an increase of 14% in current value sales in 2012. Domestic retailers completely dominated grocery retailers with only a few exceptions such as Hyperstar in hypermarkets. With the uncertain investment climate, not many foreign retailers have entered or are operating in Pakistani grocery retailers and growth and sales are almost completely driven by domestic retailers. Convenience stores grew by 18% in current value terms, which is much slower than the rapidly growing hypermarkets but marginally faster than the growth rate of supermarkets at 14%. This can be attributed to the more widespread coverage of convenience stores and the value consumers place on extended store timings. Independent small grocers also competes through location and relationship with customers proving to be its anchoring force. Its key strength is its longstanding presence and the convenience of location which is a major factor in a time of fuel shortages and high fuel prices, which make transportation an expensive commodity. Independent small grocers grew by 13% in current value terms in 2012. In 2012, the largest part of food/drink/tobacco specialists was accounted for food specialist retailers. This is because food is a daily necessity while consumption of drink and tobacco is limited to smaller population segments. Additionally, drink/tobacco specialists are decreasing in popularity, as these products are stocked by general grocery retailers with a much wider presence and even current specialists are moving towards expanding their product range to stay in business. Food/drink/tobacco specialists grew at a strong pace of 16% in current value terms in 2012 in response to growing population and demand for better quality food among Pakistans urban population. New outlets of successful chains such as Rahat Bakers, Gourmet Foods and Shezan indicated the consumers demand for quality and standardised products. Other grocery retailers include kiosks, market stalls and street vendors with a primary focus on selling food, drink and tobacco. In addition to this, other grocery retailers also includes Utility Store operated by Utility Store Corp of Pakistan, a government-run entity. This channel also includes health food stores, confectioners, newsagents, food and drink souvenir stores and regional speciality stores. Other grocery retailers increased by 9% in 2012 in current

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

value terms, slower growth than posted in 2011 due to tough economic conditions for the lower strata of the society which form the main consumers in this channel. Other grocery retailers also faced strong competition from modern retailing channels. Internet retailing of grocery products was negligible in Pakistan in 2012, with most emerging internet retailing websites focusing on non-grocery items such as electronics and apparel.

TRADITIONAL VS MODERN

Traditional grocery retailers continued to dominate grocery retailing in Pakistan. This is because Pakistan is still a developing country and a large proportion of its population lives in rural areas where the reach of modern grocery retailing has not yet extended. Even in urban areas, traditional grocery retailing has strong roots and deep linkages with society. However, the value share of modern grocery retailers is on the rise due to gradual acceptance of modern retailing among Pakistani consumers, mainly in the middle and upper class of urban populations. In particular, hypermarkets and convenience stores are rapidly gaining acceptance and value share in urban and suburban areas. Traditional grocery retailers remains an important channel in Pakistan because it is deeply rooted in the social and economic systems of society. From the credit lines extended by independent small grocers to local neighbourhood communities to the omnipresence of Utility Store outlets across the country, the traditional channels are very much alive and dominant in the system. Modern retailing appeals to a particular segment of society due to their lifestyle and income groups, and it is rapidly gaining acceptability. The value share of traditional grocery retailers declined over the review period. This is because many Pakistani consumers switched to modern grocery retailers in search of greater convenience such as longer opening hours, better service, including clearly labelled prices, as well as a wider range of products and higher product quality, specifically food which was kept fresh through the use of refrigeration and imported premium brands. Realising the potential of modern grocery retailing, many supermarkets and hypermarkets are expanding or have plans to expand into Pakistans suburban areas. There are no specific government measures in Pakistan aimed at promoting either type of grocery retailing channel over the other. Traditional grocery retailers continued to compete on low prices and personal relationships with customers. This channel usually chooses strategic locations such as neighbourhood centres and busy markets in order to capture local customers. There is also some level of support seen in the form of trade unions that attempt to protect the businesses from any aggressive new entrants. Given that many traditional grocery retailers are small family-run businesses, they may not have specific strategies in place to compete with modern grocery retailers. For many traditional grocery retailers in Pakistan, it is very much business as usual with no thought-out strategies in the face of the threat of modern grocery retailing formats.

COMPETITIVE LANDSCAPE

Utility Store Corp of Pakistan led grocery retailers during 2012 with a value share of 4%. Utility Store Corp operated 6,012 outlets in Pakistan during 2012, an increase of 312 outlets from the previous year. The wide spread of its outlets across Pakistan makes it convenient for consumers to easily access the companys outlets. Utility Store Corp witnessed the highest increase in value share in grocery retailing in 2012. This was due to the sharp increase (6%) in the number of outlets and the strategy to open mega stores in select places which has also helped boost sales. In tough economic times

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

with high inflation, the widespread network and the discount pricing that these retailers offer is a welcome sight for consumers. There were no mergers and acquisitions in 2012. Different grocery retailers leverage on different strengths in order to attract customers. Many traditional independent small grocers have established good relationships and a high level of trust with their customers, especially those operating in rural areas and small towns. On the other hand, modern grocery retailers focus more on product variety and the high quality of their goods as well as more efficient customer service such as transparent pricing with clear price label displays, electronic cash registers and the choice of either cash or credit card payment. Moreover, large grocery retailers are able to offer their products at lower prices and frequent discount promotions as they operate on a much larger scale. Both modern grocery retailers and traditional grocery retailers in Pakistan have different strengths in terms of regional coverage. Supermarkets and hypermarkets focus on major cities, where the population concentration is high and the population is relatively affluent in order to maximise sales and profits. However, these large retailers have yet to expand into Pakistans less affluent areas. Convenience stores are mainly located in cities, suburbs and town centres, where they provide extended opening hours and modern retailing facilities in order to meet the growing demand for convenience shopping. Traditional small grocers benefit from the widespread presence of these types of outlets throughout the country. Domestic retailers increased in value sales more than international retailers during 2012 due to better knowledge of consumer tastes and the cultural and the business environment in Pakistan. Additionally, they have a widespread network of outlets and strong personal relationships with consumers. Modern and traditional grocery channels in Pakistan appeal to different target audiences. Modern grocery retailers offer a greater variety of products but at above-average prices, while also offering convenience, transparent transactions using electronic cash registers and a better quality customer service, all of which are important to middle and upper-middle income consumers. Traditional grocery retailers, on the other hand, appeal to lower middle-income consumers, who account for 15% of the total population, and for whom price, convenience and location are the most important factors. There were no key new entrants in grocery retailers in 2012.

PROSPECTS

Grocery retailers in Pakistan is expected to decline by a constant value CAGR of 1% over the forecast period. The main reason for the negative growth is the high level of inflation that leaves the otherwise impressive current value growth to be insignificant in comparison. Modern grocery retailers is predicted to grow by a constant value CAGR of 4%, while traditional grocery retailers is estimated to shrink by a constant value CAGR of 1% over the forecast period. As urbanisation in Pakistan is likely to continue, modern grocery retailers will continue to enjoy high growth. Other grocery retailers will continue to grow and will remain dominant in retailing in Pakistan, particularly in small towns and rural areas. However, due to the rise of modern retailing and increasing urbanisation, this channel is expected to decline by a constant value CAGR of 2%. Hypermarkets is projected to be the fastest growing retailing channel in constant value terms, with a CAGR of 14%. This is due to several factors. Hypermarkets attracts consumers by offering a wide range of products including non-grocery merchandise. Product variety and convenience are important draws for customers. Secondly, the rapid pace of urbanisation in Pakistan is driving the expansion of hypermarkets such as Carrefour and the Metro Groups

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

Real chain. Many of these new outlets are located in out-of-town sites or as the anchor stores in new shopping centres. Convenience is expected to gain currency in grocery retailers in Pakistan as modern retailing outlets become more prevalent. Some customers may switch from independent small grocers to modern retailing channels for the various benefits on offer such as higher quality products, transparent pricing, and reliable customer service and extended opening hours. Riding on the wave of the growing popularity of modern grocery retailers, both convenience stores and forecourt retailers will enjoy steady growth. Furthermore, this growth is expected to be faster than the growth expected in independent small grocers. The growth of small grocery retailers formats is expected to be slower than that of hypermarkets and supermarkets. Food/drink/tobacco specialists is expected to post strong growth, increasing by a constant value CAGR of 4%. In particular, chained food specialists such as Gourmet Foods and Shezan Confectionaries are likely to open more outlets in Pakistans cities in order to cater to the growing demand coming from the increasing population. As consumers in Pakistans cities acquire more sophisticated tastes and become more affluent, demand for fresh bread and confectionery is also expected to grow. Other grocery retailers is expected to experience a fall in sales, declining at a constant value CAGR of 2%. This is despite the stellar performance of Utility Store, as kiosks, market stalls and street vendors, which comprise the bulk of other grocery retailers, are likely to lose sales to modern grocery retailers, which offers a larger variety of fresher products. Internet retailing will continue to remain negligible through to 2017.

CHANNEL FORMATS

Chart 1 Modern Grocery Retailers: Shell Select in Islamabad

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

Source:

Euromonitor International

Chart 2

Modern Grocery Retailers: A Tuk Shop Attock Petroleum in Islamabad

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

Source:

Euromonitor International

Chart 3

Modern Grocery Retailers: Esajee in Islamabad

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

Source:

Euromonitor International

Chart 4

Traditional Grocery Retailers: Shams in Islamabad

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

Source:

Euromonitor International

Chart 5

Traditional Grocery Retailers: Gourmet in Lahore

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

10

Source:

Euromonitor International

Chart 6

Traditional Grocery Retailers: United Bakery in Islamabad

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

11

Source:

Euromonitor International

Chart 7

Traditional Grocery Retailers: Fruit and vegetable stall in Islamabad

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

12

Source:

Euromonitor International

CHANNEL DATA

Table 1 Sales in Grocery Retailers by Channel: Value 2007-2012

PKR billion, retail value rsp excl sales tax 2007 Modern Grocery Retailers - Convenience Stores - Discounters - Forecourt Retailers -- Chained Forecourt Retailers -- Independent Forecourt Retailers - Hypermarkets - Supermarkets Traditional Grocery Retailers - Food/Drink/Tobacco Specialists - Independent Small Grocers - Other Grocery Retailers Grocery Retailers

Source:

2008 68.0 32.3 7.8 7.8 27.9 1,328.8 18.6 165.3 1,145.0 1,396.8

2009 86.0 42.3 8.7 8.7 2.0 32.9 1,388.5 25.4 191.1 1,172.0 1,474.4

2010 103.8 52.8 9.4 9.4 3.0 38.5 1,443.2 31.7 210.3 1,201.3 1,547.1

2011 124.0 64.4 10.8 10.8 4.0 44.8 1,634.1 38.0 238.6 1,357.4 1,758.1

2012 146.5 76.1 12.4 12.4 7.0 51.0 1,797.3 43.9 269.4 1,484.0 1,943.8

54.1 24.4 6.8 6.8 22.9 1,256.4 14.5 139.8 1,102.1 1,310.5

Euromonitor International from official statistics, trade associations, trade press, company research, trade interviews, trade sources

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

13

Table 2 outlets

Grocery Retailers Outlets by Channel: Units 2007-2012

2007 Modern Grocery Retailers - Convenience Stores - Discounters - Forecourt Retailers -- Chained Forecourt Retailers -- Independent Forecourt Retailers - Hypermarkets - Supermarkets Traditional Grocery Retailers - Food/Drink/Tobacco Specialists - Independent Small Grocers - Other Grocery Retailers Grocery Retailers

Source:

2008 4,316 3,865 313 313 138 442,684 20,896 375,142 46,646 447,000

2009 4,558 4,102 316 316 1 139 450,613 20,954 380,214 49,445 455,171

2010 4,766 4,302 321 321 1 142 456,940 21,064 383,214 52,662 461,706

2011 4,883 4,410 325 325 2 146 462,232 21,169 384,714 56,349 467,115

2012 5,003 4,520 330 330 2 151 464,317 21,264 386,014 57,039 469,320

4,012 3,568 309 309 135 435,227 20,586 370,214 44,427 439,239

Euromonitor International from official statistics, trade associations, trade press, company research, trade interviews, trade sources

Table 3

Sales in Grocery Retailers by Channel: % Value Growth 2007-2012

% current value growth, retail value rsp excl sales tax 2011/12 Modern Grocery Retailers - Convenience Stores - Discounters - Forecourt Retailers -- Chained Forecourt Retailers -- Independent Forecourt Retailers - Hypermarkets - Supermarkets Traditional Grocery Retailers - Food/Drink/Tobacco Specialists - Independent Small Grocers - Other Grocery Retailers Grocery Retailers

Source:

2007-12 CAGR 22.0 25.5 12.7 12.7 17.4 7.4 24.8 14.0 6.1 8.2

2007/12 Total 170.7 211.6 82.0 82.0 122.7 43.1 203.0 92.7 34.7 48.3

18.1 18.3 14.3 14.3 75.0 13.8 10.0 15.5 12.9 9.3 10.6

Euromonitor International from official statistics, trade associations, trade press, company research, trade interviews, trade sources

Table 4 % unit growth

Grocery Retailers Outlets by Channel: % Unit Growth 2007-2012

2011/12 Modern Grocery Retailers 2.5

2007-12 CAGR 4.5

2007/12 Total 24.7

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

14

- Convenience Stores - Discounters - Forecourt Retailers -- Chained Forecourt Retailers -- Independent Forecourt Retailers - Hypermarkets - Supermarkets Traditional Grocery Retailers - Food/Drink/Tobacco Specialists - Independent Small Grocers - Other Grocery Retailers Grocery Retailers

Source:

2.5 1.5 1.5 0.0 3.4 0.5 0.4 0.3 1.2 0.5

4.8 1.3 1.3 2.3 1.3 0.7 0.8 5.1 1.3

26.7 6.8 6.8 11.9 6.7 3.3 4.3 28.4 6.8

Euromonitor International from official statistics, trade associations, trade press, company research, trade interviews, trade sources

Table 5

Grocery Retailers Company Shares: % Value 2008-2012

% retail value rsp excl sales tax Company Utility Store Corp of Pakistan Carrefour MAF Hypermarkets Pakistan (Pvt) Ltd PSO Outlets Ltd Shell Pakistan Ltd Chevron Pakistan Ltd Others Total

Source:

2008 3.4 -

2009 3.5 0.1

2010 3.6 0.2

2011 3.4 0.2

2012 3.5 0.4

0.3 0.2 0.1 96.1 100.0

0.3 0.2 0.1 95.8 100.0

0.3 0.2 0.1 95.7 100.0

0.3 0.2 0.1 95.8 100.0

0.3 0.2 0.1 95.5 100.0

Euromonitor International from official statistics, trade associations, trade press, company research, trade interviews, trade sources

Table 6

Grocery Retailers Brand Shares: % Value 2009-2012

% retail value rsp excl sales tax Brand Company Utility Store Hyperstar Utility Store Corp of Pakistan Carrefour MAF Hypermarkets Pakistan (Pvt) Ltd PSO Outlets Ltd Shell Pakistan Ltd Chevron Pakistan Ltd

2009 3.5 0.1

2010 3.6 0.2

2011 3.4 0.2

2012 3.5 0.4

PSO Outlets Shell Caltex Others Total

Source:

0.3 0.2 0.1 95.8 100.0

0.3 0.2 0.1 95.7 100.0

0.3 0.2 0.1 95.8 100.0

0.3 0.2 0.1 95.5 100.0

Euromonitor International from official statistics, trade associations, trade press, company research, trade interviews, trade sources

Table 7 sites/outlets Brand

Grocery Retailers Brand Shares: Outlets 2009-2012

Company

2009

2010

2011

2012

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

15

Utility Store PSO Outlets Shell Caltex Hyperstar

Utility Store Corp of Pakistan PSO Outlets Ltd Shell Pakistan Ltd Chevron Pakistan Ltd Carrefour MAF Hypermarkets Pakistan (Pvt) Ltd

5,550 177 67 33 1

5,650 179 68 32 1

5,700 182 68 31 2

6,012 185 70 32 2

Others Total

Source:

449,343 455,171

455,776 461,706

461,132 467,115

463,019 469,320

Euromonitor International from official statistics, trade associations, trade press, company research, trade interviews, trade sources

Table 8

Grocery Retailers Brand Shares: Selling Space 2009-2012

surface area '000 sq m Brand Utility Store PSO Outlets Hyperstar

Company Utility Store Corp of Pakistan PSO Outlets Ltd Carrefour MAF Hypermarkets Pakistan (Pvt) Ltd Shell Pakistan Ltd Chevron Pakistan Ltd

2009 2,100.0 30.3 9.0

2010 2,140.0 30.5 9.0

2011 2,160.0 31.0 18.0

2012 2,268.0 31.5 18.0

Shell Caltex Others Total

Source:

13.5 4.7 40,027.6 42,185.1

13.8 4.5 41,986.9 44,184.7

13.8 4.4 44,110.0 46,337.2

14.0 4.5 44,964.5 47,300.5

Euromonitor International from official statistics, trade associations, trade press, company research, trade interviews, trade sources

Table 9

Forecast Sales in Grocery Retailers by Channel: Value 2012-2017

PKR billion, retail value rsp excl sales tax 2012 Modern Grocery Retailers - Convenience Stores - Discounters - Forecourt Retailers -- Chained Forecourt Retailers -- Independent Forecourt Retailers - Hypermarkets - Supermarkets Traditional Grocery Retailers - Food/Drink/Tobacco Specialists - Independent Small Grocers - Other Grocery Retailers Grocery Retailers 146.5 76.1 12.4 12.4 7.0 51.0 1,797.3 43.9 269.4 1,484.0 1,943.8 2013 147.2 77.6 12.8 12.8 4.9 51.8 1,750.2 44.9 267.7 1,437.6 1,897.4 2014 153.3 79.7 13.3 13.3 6.8 53.4 1,721.8 46.3 268.3 1,407.2 1,875.1 2015 160.6 82.0 13.9 13.9 9.1 55.5 1,701.5 48.0 267.7 1,385.7 1,862.0 2016 168.9 84.8 14.4 14.4 11.6 58.1 1,695.7 50.3 270.3 1,375.2 1,864.6 2017 175.9 87.3 13.9 13.9 13.6 61.0 1,691.1 52.7 273.5 1,364.9 1,867.0

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

16

Source:

Euromonitor International from trade associations, trade press, company research, trade interviews, trade sources

Table 10 outlets

Forecast Grocery Retailers Outlets by Channel: Units 2012-2017

2012 Modern Grocery Retailers - Convenience Stores - Discounters - Forecourt Retailers -- Chained Forecourt Retailers -- Independent Forecourt Retailers - Hypermarkets - Supermarkets Traditional Grocery Retailers - Food/Drink/Tobacco Specialists - Independent Small Grocers - Other Grocery Retailers Grocery Retailers

Source:

2013 5,109 4,610 339 339 3 157 465,933 21,349 387,014 57,570 471,042

2014 5,205 4,691 346 346 4 164 467,602 21,445 387,964 58,193 472,807

2015 5,293 4,761 355 355 5 172 469,315 21,531 388,864 58,920 474,608

2016 5,356 4,809 361 361 6 180 470,856 21,639 389,642 59,575 476,212

2017 5,394 4,833 365 365 7 189 472,133 21,736 390,226 60,171 477,527

5,003 4,520 330 330 2 151 464,317 21,264 386,014 57,039 469,320

Euromonitor International from trade associations, trade press, company research, trade interviews, trade sources

Table 11

Forecast Sales in Grocery Retailers by Channel: % Value Growth 2012-2017

% current value growth, retail value rsp excl sales tax 2012-17 CAGR Modern Grocery Retailers - Convenience Stores - Discounters - Forecourt Retailers -- Chained Forecourt Retailers -- Independent Forecourt Retailers - Hypermarkets - Supermarkets Traditional Grocery Retailers - Food/Drink/Tobacco Specialists - Independent Small Grocers - Other Grocery Retailers Grocery Retailers

Source:

2012/17 TOTAL 20.1 14.7 12.5 12.5 94.9 19.8 -5.9 19.8 1.5 -8.0 -3.9

3.7 2.8 2.4 2.4 14.3 3.7 -1.2 3.7 0.3 -1.7 -0.8

Euromonitor International from trade associations, trade press, company research, trade interviews, trade sources

Table 12 % unit growth

Forecast Grocery Retailers Outlets by Channel: % Unit Growth 2012-2017

2016/17

2012-17 CAGR

2012/17 Total

Euromonitor International

GROCERY RETAILERS IN PAKISTAN

Passport

17

Modern Grocery Retailers - Convenience Stores - Discounters - Forecourt Retailers -- Chained Forecourt Retailers -- Independent Forecourt Retailers - Hypermarkets - Supermarkets Traditional Grocery Retailers - Food/Drink/Tobacco Specialists - Independent Small Grocers - Other Grocery Retailers Grocery Retailers

Source:

0.7 0.5 1.1 1.1 16.7 5.0 0.3 0.4 0.1 1.0 0.3

1.5 1.3 2.0 2.0 28.5 4.6 0.3 0.4 0.2 1.1 0.3

7.8 6.9 10.6 10.6 250.0 25.2 1.7 2.2 1.1 5.5 1.7

Euromonitor International from trade associations, trade press, company research, trade interviews, trade sources

Euromonitor International

Vous aimerez peut-être aussi

- Juices in IndiaDocument10 pagesJuices in IndiaJatin KalraPas encore d'évaluation

- Juice in India: Euromonitor International December 2019Document9 pagesJuice in India: Euromonitor International December 2019Pranave NandaPas encore d'évaluation

- A Study of Audience Perception About TheDocument2 pagesA Study of Audience Perception About TheRahat HaneefPas encore d'évaluation

- Submitted To: AssignmentDocument11 pagesSubmitted To: AssignmentMeskat Hassan KHanPas encore d'évaluation

- Pakistan Retail Census 2Document1 pagePakistan Retail Census 2syedqamarPas encore d'évaluation

- Retailing Sector of Pakistan - Wholesale, General, Modern TradeDocument7 pagesRetailing Sector of Pakistan - Wholesale, General, Modern TradeFaizan Ahmad Khan100% (1)

- Juice in IndiaDocument10 pagesJuice in IndiaSoumya MukherjeePas encore d'évaluation

- Drinking Milk Products in VietnamDocument12 pagesDrinking Milk Products in VietnamĐăng Dương NguyễnPas encore d'évaluation

- Juice in PakistanDocument9 pagesJuice in Pakistanrize1159100% (1)

- Retailing in Pakistan - Updated-1Document17 pagesRetailing in Pakistan - Updated-1zunaira khanPas encore d'évaluation

- Vertical Integration in Apparel IndustryDocument15 pagesVertical Integration in Apparel IndustryAyushi ShuklaPas encore d'évaluation

- Chateau PPT - With FrameDocument85 pagesChateau PPT - With FrameBhavnaPas encore d'évaluation

- Adarsh Srivastava - 2C - Final Year ProjectDocument44 pagesAdarsh Srivastava - 2C - Final Year ProjectAdarsh SrivastavaPas encore d'évaluation

- Why TATA Nano Failed in The Market? AbstractDocument6 pagesWhy TATA Nano Failed in The Market? AbstractHarsh ChaudharyPas encore d'évaluation

- A Case Study On Engro FertilizersDocument17 pagesA Case Study On Engro FertilizersManzoor Ahmed Memon100% (2)

- Atlas Honda Pestel Analysis AssignmentDocument3 pagesAtlas Honda Pestel Analysis AssignmentSaif-ur- RehmanPas encore d'évaluation

- Analysis On The International Competitiveness of Hainan Free Trade PortDocument10 pagesAnalysis On The International Competitiveness of Hainan Free Trade PortAJHSSR JournalPas encore d'évaluation

- Online Grocery Shopping Marketing Research PresentationDocument20 pagesOnline Grocery Shopping Marketing Research Presentationhonestscarry100% (1)

- Performance Management System of KFC-with-cover-page-V2Document16 pagesPerformance Management System of KFC-with-cover-page-V2Tài Trần TấnPas encore d'évaluation

- IB1816104 EntrepreneurshipDocument22 pagesIB1816104 EntrepreneurshipNavdhaPas encore d'évaluation

- Project ReportDocument22 pagesProject Reportaastha giriPas encore d'évaluation

- Imtiaz Supermarket PVT LTD in Retailing (Pakistan)Document5 pagesImtiaz Supermarket PVT LTD in Retailing (Pakistan)Abdul Ghaffar BhattiPas encore d'évaluation

- Anudeep Gill: Big TeamDocument29 pagesAnudeep Gill: Big TeamKaran VohraPas encore d'évaluation

- Ground and Processed Spices and Cereals Project ReportDocument5 pagesGround and Processed Spices and Cereals Project ReportGirish DaryananiPas encore d'évaluation

- Bajaj Auto SM - PPTDocument46 pagesBajaj Auto SM - PPTWaibhav KrishnaPas encore d'évaluation

- FMCG Distribution Channels in IndiaDocument5 pagesFMCG Distribution Channels in IndiakshitijdwivediPas encore d'évaluation

- Marketing Presentation by Khalid & Ali On Head & Shoulder Case.Document11 pagesMarketing Presentation by Khalid & Ali On Head & Shoulder Case.Khalid TrussPas encore d'évaluation

- Grofers Market SizingDocument12 pagesGrofers Market SizingSachin s.pPas encore d'évaluation

- App Shop ExhibitDocument4 pagesApp Shop ExhibitArpit Agarwal100% (2)

- Presentation o Management Strategy and Strategic Planning of Singer BangladeshDocument11 pagesPresentation o Management Strategy and Strategic Planning of Singer BangladeshAshiqur RahmanPas encore d'évaluation

- Auto Ancillaries Sector Analysis Report ARCHIT GOELDocument4 pagesAuto Ancillaries Sector Analysis Report ARCHIT GOELArchit GoelPas encore d'évaluation

- Swiggy Order 49708082709 PDFDocument2 pagesSwiggy Order 49708082709 PDFBrahma BullPas encore d'évaluation

- Marketing PlanDocument16 pagesMarketing PlanFarasat Khan100% (1)

- The Darby Company CaseDocument18 pagesThe Darby Company CaseadarshPas encore d'évaluation

- Big BazaarDocument58 pagesBig Bazaarlekshmi517Pas encore d'évaluation

- AAC Itta Company ProfileDocument11 pagesAAC Itta Company ProfileSuRaj BoharaPas encore d'évaluation

- IBS - Metropolitan ResearchDocument3 pagesIBS - Metropolitan ResearchVISHU JAGANNATHA GUPTA EPGP 2021-22Pas encore d'évaluation

- Careem Strategic FinalDocument50 pagesCareem Strategic FinalRauf JaferiPas encore d'évaluation

- Environment For Business Analysis of Big BasketDocument3 pagesEnvironment For Business Analysis of Big BasketDivyesh ChadotraPas encore d'évaluation

- Consumer Satisfaction On Biscuit in Bangladesh MarketDocument18 pagesConsumer Satisfaction On Biscuit in Bangladesh MarketKaziTanvirAhmedPas encore d'évaluation

- E Commerce July 2021Document30 pagesE Commerce July 2021Eesha BapatPas encore d'évaluation

- SBI's Microfinance InitiativesDocument3 pagesSBI's Microfinance InitiativesSandeep MishraPas encore d'évaluation

- Cost Sheet For The Month of January: TotalDocument9 pagesCost Sheet For The Month of January: TotalgauravpalgarimapalPas encore d'évaluation

- NTM in International TradeDocument5 pagesNTM in International Tradeac93amitPas encore d'évaluation

- Stratagic Manegement Process: Orient Is A Symbol of Innovation in PakistanDocument3 pagesStratagic Manegement Process: Orient Is A Symbol of Innovation in PakistanUsama UsamaPas encore d'évaluation

- Leadership Style of Udaan: Group 5 (A)Document11 pagesLeadership Style of Udaan: Group 5 (A)Aditya Raj100% (1)

- Coconut WaterDocument3 pagesCoconut WaterShreerangan Shrinivasan0% (1)

- Initiating Coverage - Indian Hume Pipe Co.Document38 pagesInitiating Coverage - Indian Hume Pipe Co.rroshhPas encore d'évaluation

- Research Report On The Factors Behind The Use of DarazDocument18 pagesResearch Report On The Factors Behind The Use of DarazMuzamil BalochPas encore d'évaluation

- Coca ColaDocument83 pagesCoca ColaAbeer ArifPas encore d'évaluation

- Case Radiance Transaction Level PricingDocument10 pagesCase Radiance Transaction Level PricingSanya TPas encore d'évaluation

- Case Example - Delhi Metro - SolutionDocument14 pagesCase Example - Delhi Metro - Solutionlakshya jainPas encore d'évaluation

- Smruti Ranjan's Summer Internship Project 2018 PDFDocument66 pagesSmruti Ranjan's Summer Internship Project 2018 PDFRajat PradhanPas encore d'évaluation

- Are Cigarettes Overtaxed in IndiaDocument5 pagesAre Cigarettes Overtaxed in IndiaAnshul Sharma100% (1)

- Parle ProjectDocument22 pagesParle Projectabhinav_mishra67121983% (6)

- Case - MR Brown BakeryDocument3 pagesCase - MR Brown BakeryVishek Agarwal100% (2)

- PESTLE Analysis of Speciality Chemical SectorDocument9 pagesPESTLE Analysis of Speciality Chemical SectorMegha Bavaskar100% (1)

- Amul India StoryDocument47 pagesAmul India StoryBratati PaulPas encore d'évaluation

- Fast Food in Vietnam Jan2014Document22 pagesFast Food in Vietnam Jan2014ANDYLAU1234Pas encore d'évaluation

- What Is Retailing?Document7 pagesWhat Is Retailing?munish747Pas encore d'évaluation

- Laundry Care PakistanDocument10 pagesLaundry Care Pakistant2yangPas encore d'évaluation

- Consumer Lifestyles in PakistanDocument76 pagesConsumer Lifestyles in Pakistant2yangPas encore d'évaluation

- Entrepreneurs Born or Made?Document24 pagesEntrepreneurs Born or Made?t2yang100% (2)

- Colgate Palmolive Exit Laundry DetergentsDocument2 pagesColgate Palmolive Exit Laundry Detergentst2yangPas encore d'évaluation

- Olivia Lum StoryDocument3 pagesOlivia Lum Storyt2yangPas encore d'évaluation

- Conflict in Family BusinessDocument23 pagesConflict in Family Businesst2yangPas encore d'évaluation

- Integrated Marketing Communications and BrandingDocument20 pagesIntegrated Marketing Communications and Brandingt2yang50% (2)

- Marketing of Beer in MumbaiDocument112 pagesMarketing of Beer in Mumbaishailesh Maurya100% (2)

- Soap Bar QualitiesDocument3 pagesSoap Bar Qualitiest2yangPas encore d'évaluation

- Regional Sales Manager TradeDocument1 pageRegional Sales Manager Tradet2yangPas encore d'évaluation

- Composition and Digestibility of Cattle Fecal WasteDocument7 pagesComposition and Digestibility of Cattle Fecal WasteIonela HoteaPas encore d'évaluation

- Clase No. 24 Nouns and Their Modifiers ExercisesDocument2 pagesClase No. 24 Nouns and Their Modifiers ExercisesenriquefisicoPas encore d'évaluation

- Plumbing Design Calculation - North - Molino - PH1 - 5jun2017Document5 pagesPlumbing Design Calculation - North - Molino - PH1 - 5jun2017Jazent Anthony RamosPas encore d'évaluation

- Guidelines For Students Module 6 and 7Document4 pagesGuidelines For Students Module 6 and 7JasellePantePas encore d'évaluation

- PackageDocument3 pagesPackagegvspavan67% (3)

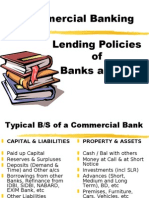

- Lending Policies of Indian BanksDocument47 pagesLending Policies of Indian BanksProf Dr Chowdari Prasad80% (5)

- A Hydrogen Generator You Can BuildDocument19 pagesA Hydrogen Generator You Can BuildTri Yuniarto0% (1)

- G1 CurvedDocument16 pagesG1 CurvedElbert Ryan OcampoPas encore d'évaluation

- Risk Management Policy StatementDocument13 pagesRisk Management Policy StatementRatnakumar ManivannanPas encore d'évaluation

- Draw-Through or Blow-Through: Components of Air Handling UnitDocument23 pagesDraw-Through or Blow-Through: Components of Air Handling Unityousuff0% (1)

- PCC 2 What Is PCC 2 and Article of Leak Box On Stream RepairGregDocument12 pagesPCC 2 What Is PCC 2 and Article of Leak Box On Stream RepairGregArif Nur AzizPas encore d'évaluation

- Textile Chemical Brochure 8.6.22 - 031Document1 pageTextile Chemical Brochure 8.6.22 - 031NIKESH PRAKASHPas encore d'évaluation

- Maintenance Service Procedure Document For AMC: Scada &telecom System For Agcl Gas Pipeline NetworkDocument17 pagesMaintenance Service Procedure Document For AMC: Scada &telecom System For Agcl Gas Pipeline NetworkanupamPas encore d'évaluation

- Excavation PermitDocument2 pagesExcavation PermitRajesh Kumar SinghPas encore d'évaluation

- Chapter 1 Section 6 Spoon Feeding BasicsDocument9 pagesChapter 1 Section 6 Spoon Feeding Basicskenneth mayaoPas encore d'évaluation

- Pinoy Ree - EeDocument138 pagesPinoy Ree - EeChilvin ChipmunkPas encore d'évaluation

- Hair OilDocument7 pagesHair OilKetanMehta100% (1)

- BS Pharmacy - ProspectusDocument9 pagesBS Pharmacy - ProspectusDomz BucadPas encore d'évaluation

- Jose de Villa National School: Home Visitation FormDocument3 pagesJose de Villa National School: Home Visitation FormNoli AsuroPas encore d'évaluation

- D 7752Document6 pagesD 7752Asep TheaPas encore d'évaluation

- اطلع علي زتونة 3 ع مراجعة الترم الثاني 2024Document60 pagesاطلع علي زتونة 3 ع مراجعة الترم الثاني 2024ahmad sholokPas encore d'évaluation

- Filipino Concept of Health and IllnessDocument43 pagesFilipino Concept of Health and IllnessFelisa Lacsamana Gregorio50% (2)

- Complete Prerequisite Program v2Document78 pagesComplete Prerequisite Program v2Ramasubramanian Sankaranarayanan100% (1)

- Wel-Come: Heat Treatment Process (TTT, CCT & CCR)Document14 pagesWel-Come: Heat Treatment Process (TTT, CCT & CCR)atulkumargaur26Pas encore d'évaluation

- Respirator LangmanDocument10 pagesRespirator LangmanSavu MalinaPas encore d'évaluation

- Kristen Swanson's Theory of CaringDocument12 pagesKristen Swanson's Theory of CaringAlexandria David50% (2)

- KDIGO 2023 CKD Guideline Public Review Draft 5 July 2023Document339 pagesKDIGO 2023 CKD Guideline Public Review Draft 5 July 2023oscar coreaPas encore d'évaluation

- CFM Tutorial 5Document26 pagesCFM Tutorial 5Nithin Yadav0% (1)

- CHN REVIEWER LESSON 1 and 2Document9 pagesCHN REVIEWER LESSON 1 and 2Imogen MasumiPas encore d'évaluation

- Endothermic ReactionDocument8 pagesEndothermic ReactionMibvase IkhuruvosePas encore d'évaluation