Académique Documents

Professionnel Documents

Culture Documents

Carlos Superdrug Corp v. DSWD

Transféré par

Danielle Angela0 évaluation0% ont trouvé ce document utile (0 vote)

47 vues2 pagescarlos superdrug

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentcarlos superdrug

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

47 vues2 pagesCarlos Superdrug Corp v. DSWD

Transféré par

Danielle Angelacarlos superdrug

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

CARLOS SUPLRDRUG CORP., et al. v. DSWD, et al.

G.R. No. J66494, 29 June 2007, Azcuna, J. (Ln Banc)

|vaer a ta aeavctiov .cbeve, tbe ta aeavctiov ov ai.covvt. ra. .vbtractea frov vet .ate. togetber

ritb otber aeavctiov. rbicb are cov.iaerea a. oerativg eev.e. before tbe ta ave ra. covvtea ba.ea ov

tbe vet taabte ivcove. eivg a ta aeavctiov, tbe ai.covvt aoe. vot reavce tae. orea ov a e.ofore.o

ba.i. bvt veret, offer. a fractiovat reavctiov iv tae. aia. aia treatvevt reavce. tbe vet ivcove of tbe

e.tabti.bvevt. covcervea. Ov tbe otber bava, vvaer tbe ta creait .cbeve, tbe avovvt of ai.covvt. rbicb i.

tbe ta creait itev, ra. aeavctea airectt, frov tbe ta ave avovvt.

]v.t covev.atiov i. tbe fvtt ava fair eqviratevt of tbe roert, ta/ev frov it. orver b, tbe

eroriator. 1be vea.vre i. vot tbe ta/er`. gaiv, bvt tbe orver`. to... . ta aeavctiov aoe. vot offer fvtt

reivbvr.evevt of tbe .evior citiev ai.covvt. .. .vcb it rovta vot veet tbe aefivitiov of ;v.t covev.atiov.

!bite tbe Cov.titvtiov rotect. roert, rigbt., etitiover vv.t accet tbe reatitie. of bv.ive.. ava tbe tate,

iv tbe eerci.e of otice orer, cav ivterreve iv tbe oeratiov. of a bv.ive.. rbicb va, re.vtt iv av

ivairvevt of roert, rigbt. iv tbe roce... 1be rigbt to roert, cav be retivqvi.bea vov tbe covvava of

tbe tate for tbe rovotiov of tbe vbtic gooa.

Republic Act 432 ,Old Senior Citizens Act, proides that the 20 discount rom

goods and serices o establishments or the exclusie use and enjoyment o the senior

citizens may be claimed by the establishments as tax credit. \ith the passage o R.A. 925

,Lxpanded Senior Citizens Act o 2003,, said discount may now be claimed by the

establishments as tax deduction based on the net cost o the goods sold or serices

rendered, proided that the cost o the discount shall be allowed as a deduction rom gross

income or the same taxable year that the discount is granted. Under this new law, more

establishments were added such as: establishments proiding medical and dental serices,

diagnostic and laboratory serices, including proessional ees o attending doctors in all

priate hospitals and medical acilities, operators o domestic air and sea transport serices,

public railways and skyways and bus transport serices.

Petitioners are domestic corporations and proprietors operating drugstores in the

Philippines, who assail the constitutionality o the said law, alleging that they are entitled to

just compensation since the allowance o the discount as a tax deduction amounts to

depriation o property.

ISSULS:

1, \hether or not Section 4,a, o R.A. 925 is constitutional

2, \hether or not petitioners are entitled to just compensation

HLLD:

Petition DLNILD.

Certain dierences o tax deduction and tax credit can be deried rom the two laws.

1he tax credit under R.A. 432 is a peso-or-peso deduction rom a taxpayer`s tax liability

due to the goernment o the amount o discounts such establishment has granted to a

senior citizen. 1he establishment recoers the ull amount o discount gien to a senior

citizen and hence, the goernment shoulders 100 o the discounts granted. 1he tax

deduction under R.A. 925 is based on the net cost o goods sold or serices rendered.

Lectiely, the goernment loses in terms o oregone reenues an amount equialent to

the marginal tax rate the said establishment is liable to pay the goernment. Under a tax

deduction scheme, the tax deduction on discounts was subtracted rom net sales together

with other deductions which are considered as operating expenses beore the tax due was

computed based on the net taxable income. Being a tax deduction, the discount does not

reduce taxes owed on a peso-or-peso basis but merely oers a ractional reduction in taxes

paid. Said treatment reduces the net income o the establishments concerned. On the other

hand, under the tax credit scheme, the amount o discounts which is the tax credit item, was

deducted directly rom the tax due amount.

Section 4(a) of R.A. 92S7 has constitutional basis.

R.A. 925 is in accord with the State`s policy to proide social justice in all phases o

national deelopment and to adopt an integrated and comprehensie approach to health

deelopment which shall endeaor to make essential goods, health and other social serices

aailable to all people at aordable cost. 1here shall be priority or the needs o the

underpriileged sick, elderly, disabled, women and children.

No just compensation is due.

Petitioners are not entitled to just compensation. Just compensation is the ull and

air equialent o the property taken rom its owner by the expropriator. 1he measure is not

the taker`s gain, but the owner`s loss. A tax deduction does not oer ull reimbursement o

the senior citizen discount. As such it would not meet the deinition o just compensation.

\hile the Constitution protects property rights, petitioner must accept the realities o

business and the State, in the exercise o police power, can interene in the operations o a

business which may result in an impairment o property rights in the process. 1he right to

property can be relinquished upon the command o the State or the promotion o the

public good.

Vous aimerez peut-être aussi

- Avt 2015 029Document11 pagesAvt 2015 029Kristavilla OlavianoPas encore d'évaluation

- EcoSport BrochureDocument3 pagesEcoSport Brochureshandzoo6029Pas encore d'évaluation

- Quisay v. PeopleDocument7 pagesQuisay v. PeopleDanielle AngelaPas encore d'évaluation

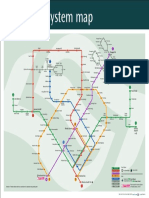

- Singapore Train System Map 2016Document1 pageSingapore Train System Map 2016Pinky KimPas encore d'évaluation

- R.A. 9858 PDFDocument10 pagesR.A. 9858 PDFDanielle AngelaPas encore d'évaluation

- AO NO 4 s'14 Amendments To The Revised Rules and Procedures Governing AcquisitionDocument20 pagesAO NO 4 s'14 Amendments To The Revised Rules and Procedures Governing AcquisitionJerome PaderesPas encore d'évaluation

- AO No. 7 s'14 Rules and Procedures Governing The Cancellation Ofd REgistered Emancipation Patents (EPS) - ...Document24 pagesAO No. 7 s'14 Rules and Procedures Governing The Cancellation Ofd REgistered Emancipation Patents (EPS) - ...tagadagat80% (5)

- Fuel, Fire, Heat, OxygenDocument1 pageFuel, Fire, Heat, OxygenDanielle AngelaPas encore d'évaluation

- Mendoza v. PeopleDocument6 pagesMendoza v. PeopleDanielle AngelaPas encore d'évaluation

- IBASCO v. CADocument18 pagesIBASCO v. CADanielle AngelaPas encore d'évaluation

- Jurisprudence On RapeDocument7 pagesJurisprudence On RapeDanielle AngelaPas encore d'évaluation

- United States Supreme Court Decisions OnDocument11 pagesUnited States Supreme Court Decisions OnDanielle AngelaPas encore d'évaluation

- Bpi v. Hon. HontanosasDocument21 pagesBpi v. Hon. HontanosasDanielle AngelaPas encore d'évaluation

- People v. GorospeDocument16 pagesPeople v. GorospeDanielle AngelaPas encore d'évaluation

- Acts of LasciviousnessDocument1 pageActs of LasciviousnessDanielle AngelaPas encore d'évaluation

- PBA NewsDocument79 pagesPBA NewsDanielle AngelaPas encore d'évaluation

- United States Supreme Court Decisions OnDocument11 pagesUnited States Supreme Court Decisions OnDanielle AngelaPas encore d'évaluation

- Republic Act No 8282 With Sec22Document2 pagesRepublic Act No 8282 With Sec22Danielle AngelaPas encore d'évaluation

- Fundamental Powers and The Bill of Rights FullDocument46 pagesFundamental Powers and The Bill of Rights FullDanielle AngelaPas encore d'évaluation

- MMDA Scope of ServicesDocument1 pageMMDA Scope of ServicesDanielle AngelaPas encore d'évaluation

- Convention On Law of The SeaDocument202 pagesConvention On Law of The SeaJhonsu30100% (2)

- Warrant The Thing SoldDocument1 pageWarrant The Thing SoldDanielle AngelaPas encore d'évaluation

- Rural Bank foreclosure dispute over redemption periodDocument52 pagesRural Bank foreclosure dispute over redemption periodDanielle AngelaPas encore d'évaluation

- Sacred Scriptures2wsazDocument34 pagesSacred Scriptures2wsazDanielle AngelaPas encore d'évaluation

- De Gillaco Et Al V Manila Railroad CompanyDocument2 pagesDe Gillaco Et Al V Manila Railroad CompanymodernelizabennetPas encore d'évaluation

- Republic Vs MeralcoDocument2 pagesRepublic Vs MeralcoDanielle AngelaPas encore d'évaluation

- Civ Credit Cases (Dean ALigada)Document68 pagesCiv Credit Cases (Dean ALigada)Danielle AngelaPas encore d'évaluation

- Freedom of Religion and Liberty of AbodeDocument28 pagesFreedom of Religion and Liberty of AbodeDanielle AngelaPas encore d'évaluation

- Republic v. CagandahanDocument2 pagesRepublic v. Cagandahanjoebanpaza1Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- International Economics: Chapter 3 (A) : Sources of Comparative AdvantageDocument14 pagesInternational Economics: Chapter 3 (A) : Sources of Comparative AdvantageAhmed FahmyPas encore d'évaluation

- Poverty, Inequality, and DevelopmentDocument56 pagesPoverty, Inequality, and DevelopmentMandy OwxPas encore d'évaluation

- HDR21-22 Statistical Annex I-HDI TableDocument24 pagesHDR21-22 Statistical Annex I-HDI TableIrjay RollodaPas encore d'évaluation

- Social Epidemiology Definition, History, and Research ExamplesDocument8 pagesSocial Epidemiology Definition, History, and Research ExamplesCarlos PosuPas encore d'évaluation

- ECON0028 Lecture 10Document44 pagesECON0028 Lecture 10Lucas X. Li100% (1)

- The Effect of Labour Force Participation On The Economy and Budget - 065818Document14 pagesThe Effect of Labour Force Participation On The Economy and Budget - 065818Ananthu SureshPas encore d'évaluation

- Brueggemann 2017Document38 pagesBrueggemann 2017hoangpvrPas encore d'évaluation

- Development Economics 1st Edition by Gerard Roland ISBN Solution ManualDocument6 pagesDevelopment Economics 1st Edition by Gerard Roland ISBN Solution Manualtimothy100% (21)

- Student Paper One Ib EconomicsDocument7 pagesStudent Paper One Ib Economicsilgyu1207Pas encore d'évaluation

- Mcqs On Poverty Economics 2281 o LevelDocument11 pagesMcqs On Poverty Economics 2281 o LevelNaRgix AyObPas encore d'évaluation

- FPSO Lease Rate CalculatorDocument1 pageFPSO Lease Rate Calculatoreduardo_ricaldi100% (4)

- ASME Career Development Series: Sample Engineering Project Financial Evaluation Worksheet ($1000s)Document1 pageASME Career Development Series: Sample Engineering Project Financial Evaluation Worksheet ($1000s)Aitazaz AhsanPas encore d'évaluation

- Income Inequality and Economic Growth Nexus in Nigeria: A Nonlinear Autoregressive Distributed Lag Model ApproachDocument10 pagesIncome Inequality and Economic Growth Nexus in Nigeria: A Nonlinear Autoregressive Distributed Lag Model ApproachInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- International Journal of Social Economics: Article InformationDocument28 pagesInternational Journal of Social Economics: Article InformationI Tech Services KamranPas encore d'évaluation

- BUSINESS AND TRANSFER TAXATION CHAPTER 1Document2 pagesBUSINESS AND TRANSFER TAXATION CHAPTER 1NeLson ALcanarPas encore d'évaluation

- JPM Brazil 2013Document140 pagesJPM Brazil 2013César León QuillasPas encore d'évaluation

- Ch20 Taxes, Inflation, and Investment StrategyDocument22 pagesCh20 Taxes, Inflation, and Investment StrategyA_StudentsPas encore d'évaluation

- Ramphoma 2014 Understanding Poverty Causes Effects and CharacteristicsDocument14 pagesRamphoma 2014 Understanding Poverty Causes Effects and Characteristicseffiong.peter85Pas encore d'évaluation

- PSNT of MFSDocument8 pagesPSNT of MFSPayal ParmarPas encore d'évaluation

- Fiscal Policy - Instruments and ObjectivesDocument9 pagesFiscal Policy - Instruments and Objectivesnital2612Pas encore d'évaluation

- Kinh tế Phát triểnDocument38 pagesKinh tế Phát triểnTrần Trà MyPas encore d'évaluation

- Worldwide Personal Tax Guide 2015-16Document1 498 pagesWorldwide Personal Tax Guide 2015-16Anonymous yKUdPvwjPas encore d'évaluation

- Radio One - Exhibits1-4Document8 pagesRadio One - Exhibits1-4meredith12120% (1)

- Relationship Between Inequality and PovertyDocument5 pagesRelationship Between Inequality and PovertykolawolebashirPas encore d'évaluation

- Balance Sheet of JK Tyre and IndustriesDocument4 pagesBalance Sheet of JK Tyre and IndustriesHimanshu MangePas encore d'évaluation

- Polytechnic University of The Philippines Sta. Mesa, Manila: Economic GrowthDocument15 pagesPolytechnic University of The Philippines Sta. Mesa, Manila: Economic GrowthJohnnie HarrisPas encore d'évaluation

- GrowingUnited (Informe Banco Mundial)Document158 pagesGrowingUnited (Informe Banco Mundial)RichardPas encore d'évaluation

- Bottom Fifth in SingaporeDocument4 pagesBottom Fifth in SingaporeMARÍA DEL ROSARIO SOLANOPas encore d'évaluation

- How Capitalism Can Work For Everyone: Audiobook Reference GuideDocument30 pagesHow Capitalism Can Work For Everyone: Audiobook Reference GuideBayuPas encore d'évaluation

- CO5117 TuteSols Topic08 2011Document2 pagesCO5117 TuteSols Topic08 2011Shibin JayaprasadPas encore d'évaluation