Académique Documents

Professionnel Documents

Culture Documents

Harris V Citimortgage

Transféré par

SP BiloxiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Harris V Citimortgage

Transféré par

SP BiloxiDroits d'auteur :

Formats disponibles

Case 3:13-cv-00783-JHM-DW Document 1 Filed 08/12/13 Page 1 of 9 PageID #: 1

3:13CV-783-M NO. ________________________

U.S. DISTRICT COURT WESTERN DISTRICT OF KENTUCKY PLAINTIFF

TAMARA HARRIS, Individually and

On Behalf of all those Similarly Situated 2606 Masemure Court Louisville, KY 40220-2330

VS.

CLASS ACTION COMPLAINT

DEFENDANTS Serve: CitiMortgage, Inc. c/o CT Corporation System 306 W. Main Street, Suite 512 Frankfort, KY 40601

CITIMORTGAGE, INC.

RUST CONSULTING, INC.

Serve: Corporation Service Company 380 Jackson Street, #700 St. Paul, MN 55101 ********* Comes the Plaintiff, Tamara Harris, individually and on behalf of all others similarly situated, upon personal knowledge as to her own acts, and upon information and belief, and for her Complaint states as follows:

NATURE OF ACTION

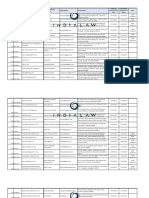

1. CitiMortgage, Inc. (CitiMortgage) has admitted to wrongfully filing foreclosure actions from January 1, 2009December 31, 2010 against people across the country who, at the time CitiMortgage filed foreclosure actions, were protected from such actions by bankruptcy stays ordered by federal bankruptcy judges. See Independent Foreclosure Review Payment Agreement Details, Row 4 at Exhibit 1. 2. Plaintiff is one of these people. 3. As a result of a variety of wrongful and unlawful conduct committed by Defendant, including (but certainly not limited to) the violations of bankruptcy stay protection, in 2013, CitiMortgage entered into an agreement with the Office of Comptroller

Case 3:13-cv-00783-JHM-DW Document 1 Filed 08/12/13 Page 2 of 9 PageID #: 2

Currency (OCC) to pay money to those people it identified as victims of the various abuses. 4. Under the settlement, CitiMortgage paid the people it wrongfully foreclosed upon while they were protected by federal bankruptcy law varying amounts depending upon whether the property owner had a foreclosure that was either a) completed, b) rescinded, or c) in process. See Independent Foreclosure Review Payment Agreement Details at Exhibit 1. 5. Additionally, property owners who requested a review received more than borrowers who did not. Exhibit 1. 6. Property owners who requested a review whose foreclosures were completed received $62,500, while others received $7,500. Exhibit 1. 7. Property owners who did not request a review, but whose foreclosures were completed received $31,250, while others received $3,750. Exhibit 1. 8. Plaintiff requested a review and CitiMortgage completed her foreclosure in 2009. The sale of Plaintiffs home occurred on May 29, 2009 and a new deed was delivered to the new owner on July 20, 2009. See Case History at Exhibit 2. 9. Even after wrongfully foreclosing on Plaintiff, CitiMortgage negligently reported inaccurate information regarding the status of Ms. Harriss foreclosure to its paying agent, Rust Consulting, Inc. (Rust). 10. Upon information and belief, CitiMortgage reported to Rust that Plaintiffs foreclosure was in process rather than completed. 11. As a result, Ms. Harris received only $7,500 to compensate her for CitiMortgages wrongful and unlawful conduct; because CitiMortgage completed her foreclosure, she is instead entitled to $62,500. 12. This is a class action brought by Plaintiff individually and on behalf of all persons against whom who CitiMortgage, Inc. first wrongfully filed foreclosure actions while the Plaintiff and putative class members were protected by federal bankruptcy law and

Case 3:13-cv-00783-JHM-DW Document 1 Filed 08/12/13 Page 3 of 9 PageID #: 3

then, years later, classified incorrectly by CitiMortgage as having an In process foreclosure when, in fact, their foreclosure had been completed. 13. Plaintiff and members of the Class are victims of Defendants negligence and gross negligence during its participation in the Independent Foreclosure Review program. 14. In the alternative, Rust Consulting, Inc., acted negligently when it paid Plaintiff and other class members $55,000 less than the amount to which they were entitled under the payment matrix. 15. The Defendants mismanagement has injured the Plaintiff and the Class by misclassifying the status of her foreclosure, resulting in a payment $55,000 less than she was due under the terms of the Independent Foreclosure Review program. In this class action, Plaintiff and members of the Class seek recovery of all damages caused by the Defendants negligence and gross negligence, and punitive damages.

JURISDICTION AND VENUE

16. The Plaintiff herself, and on behalf of the proposed Class, allege claims under the common law of the Commonwealth of Kentucky. 17. The amount in controversy exceeds the minimum jurisdictional requirement. 18. Plaintiff asserts no federal causes of action.

THE PARTIES

19. Plaintiff Tamara Harris is a resident of Jefferson County, Kentucky. 20. Defendant CitiMortgage, Inc., is a corporation incorporated under the laws of New York. Its principal office is located at 1000 Technology Dr., MS 140, OFallon, MO 63304. 21. Defendant CitiMortgage, Inc. is a subsidiary of CitiGroup, Inc., (hereinafter CitiGroup) a corporation which is also incorporated under the laws of New York. 22. Defendant Rust Consulting, Inc. is a corporation incorporated under the laws of Minnesota. Its principal office is located at 3232 McKinney Ave., Dallas, TX 75204.

Case 3:13-cv-00783-JHM-DW Document 1 Filed 08/12/13 Page 4 of 9 PageID #: 4

STATEMENT OF FACTS

The Independent Foreclosure Review 23. In response to rampant foreclosure abuses, the Office of the Comptroller of the Currency (hereinafter OCC) entered into an agreement with foreclosing banks, including CitiGroup, called the Independent Foreclosure Review. 24. Under the Independent Foreclosure Review, the participating banks agreed to review their individual residential foreclosure actions, including pending or completed foreclosures from January 1, 2009 to December 31, 2010, to determine whether, among other things, these foreclosures were initiated lawfully according to applicable laws and contract terms. See Exhibit 3 Consent Order, Art. VII. 25. After said Review, CitiGroup was to submit to the OCC a plan to remediate financial injury to borrowers caused by any errors, misrepresentations, or other deficiencies identified in their review. See id. 26. Thereafter, pursuant to this plan, CitiGroup provided names of borrowers whose foreclosures fell within the scope of practices deemed abuses by the OCC. CitiGroup divided these In-Scope Borrowers into several different categories within a matrix, depending on the specific wrongful practice and the status of the foreclosure at the time. 27. The placement within the matrix determined what payment an In-Scope Borrower would receive. The Foreclosure Settlement 28. Plaintiff Tamara Harris entered into a Chapter 13 bankruptcy in 2006. 29. While Plaintiff was current on her Chapter 13 bankruptcy plan, her house was protected by bankruptcy. 30. Defendant foreclosed on Plaintiffs house while Plaintiff was current on her Chapter 13 bankruptcy plan. 31. This foreclosure was completed in August 2009.

Case 3:13-cv-00783-JHM-DW Document 1 Filed 08/12/13 Page 5 of 9 PageID #: 5

32. On April 12, 2013, Defendants paying agent, Rust Consulting, Inc. sent Plaintiff a letter. Enclosed with the letter was a check for $7,500. See Exhibit 4. 33. This letter stated that Plaintiff received this money based on the stage of your foreclosure process and other considerations related to your foreclosure. Exhibit 4. 34. According to the matrix, this was the amount provided to borrowers whose house was subject to a foreclosure either in process or subject to a rescission. 35. For a completed foreclosure under such circumstances, the amount provided was $62,500. 36. The Plaintiff called Defendant CitiMortgage and asked if she would receive the remaining $55,000 of the payment she was due. Defendant advised that its records showed that her foreclosure was still pending. CitiMortgage told her that rescinded meant that the foreclosure had been dismissed, and that she was still in process. The Plaintiff disputed that with the Defendant and the Defendant thereafter said that on another screen its records showed that her foreclosure had indeed completed in August 2009. 37. Defendant CitiMortgage, Inc. told her to seek other help because it could do nothing about the error; payments were handled by its payment agent, Rusk Consulting, LLC (Rusk) 38. Plaintiff called Defendant Rusk who advised that it relied on the information provided to it by Defendant CitiMortgage and only handled the payout. Rusk referred her back to Defendant. 39. Thereafter, Plaintiff sought legal counsel.

CLASS ACTION ALLEGATIONS

40. Plaintiff brings this class action against the Defendants pursuant to FRCP 23(b)(1) and 23(b)(3), on behalf of all persons who were wrongfully foreclosed upon by CitiMortgage while protected by federal bankruptcy law and then wrongfully

Case 3:13-cv-00783-JHM-DW Document 1 Filed 08/12/13 Page 6 of 9 PageID #: 6

classified by CitiMortgage as having an in process or rescinded foreclosure when their foreclosure had been completed. 41. The members of the Class are so numerous that joinder of all members is impracticable. The exact number of class members is unknown to Plaintiff at the present time. However, according to the matrix, there are 22,449 In-Scope Borrowers listed as having pending or rescinded foreclosures. 42. Despite the numerical size, the identities of the Class members can be ascertained. Plaintiff is one of potentially 22,449 In-Scope Borrowers whose foreclosure the Defendant misrepresented as pending or rescinded. 22,448 potentially similarly situated persons are known to the Defendant and can be ascertained through discovery of Defendants records and files. 43. Plaintiff is a member of a subclass of injured individuals who received $55,000 less than what they should have received because a) they requested a review from CitiMortgage and b) either CitiMortgage or Rust Consulting misclassified their loan status during the Independent Foreclosure Review process. 44. A second subclass exists of individuals who received $27,500 than what they should have received because a) they did not request review and b) CitiMortgage or Rust Consulting misclassified their loan status during the Independent Foreclosure Review process. 45. Plaintiff will fairly and adequately represent the interests of the Class and subclasses. Plaintiff is committed to vigorously prosecuting this action and has retained competent counsel to prosecute this matter. Plaintiff is a member of the Class and has no interests antagonistic to or in conflict with other Class members. Plaintiffs attorneys have experience prosecuting class actions and will adequately represent the Class in this question. 46. This action raises questions of law and fact which are common to the Class members, including, but not limited to the following:

Case 3:13-cv-00783-JHM-DW Document 1 Filed 08/12/13 Page 7 of 9 PageID #: 7

a. Whether Defendant CitiMortgage breached its duty to maintain accurate and timely records of its borrowers; b. Whether Defendant CitiMortgage breached its duty to provide accurate and timely records of its borrowers to third parties who request this information; and c. Whether Defendant Rust Consulting breached its duty to process payments made under the Independent Foreclosure Review settlement accurately. 47. The claims or defenses of the represented party are typical of the claims or defenses of the Class. Plaintiff was harmed by the Defendants negligence and gross negligence. Plaintiff has the same interests as the other Class members in prosecuting those claims against the Defendants. Plaintiff and all the members of the Class sustained damages as a result of the Defendants negligent and grossly negligent conduct. 48. A class action is superior to other available methods for the fair and efficient adjudication of this controversy. Common issues predominate. Furthermore, the expense and burden of individual litigation make it extraordinarily difficult for Class members to redress the wrongs done to them individually. 49. Defendants have or had access to address information for the Class members, which may be used for the purpose of providing notice of the pendency of this action.

COUNT ONE: NEGLIGENCE

50. The Plaintiff incorporates all above allegations as though set forth herein. 51. The Defendant CitiMortgage is under a duty to keep up-to-date records and provide accurate information about its customers to third parties who lawfully request it. 52. The Defendant CitiMortgage breached this duty by failing to exercise reasonable care in the maintenance and disclosure of its customer records. 53. The Defendant CitiMortgage failed to exercise reasonable care in the maintenance and disclosure of its customer records with wanton disregard for the property of its customers.

Case 3:13-cv-00783-JHM-DW Document 1 Filed 08/12/13 Page 8 of 9 PageID #: 8

54. Because the Defendant CitiMortgage breached its duty, the Plaintiff was damaged. Specifically, because of the Defendants failure to keep and provide accurate records of its transactions with its customers, the Plaintiff and other class members received substantially smaller payments than they should have received under the Independent Foreclosure Review settlement.

COUNT TWO: NEGLIGENCE

55. The Plaintiff incorporates all above allegations as though completely set forth herein. 56. At all times material hereto, Defendant Rust Consulting, Inc. was an agent of Defendant CitiMortgage, Inc. 57. As paying agent of Defendant CitiMortgage, Rust Consulting, Inc. had a duty to process payments under the payment matrix accurately based upon the prescribed factors articulated in the Independent Foreclosure Review settlement and the payment matrix. 58. The Defendant Rust Consulting, Inc. breached this duty by failing to exercise reasonable care in the administration and payment of funds according to the settlement matrix. 59. In breaching its duty, the Defendant Rust Consulting acted with wanton disregard for the property of the class. 60. Because of the Defendant Rust Consultings breach of its duty, the Plaintiff was damaged. Specifically, because of the Defendants failure to administer the settlement accurately, the Plaintiff and other class members received substantially smaller payments than they should have received under the Independent Foreclosure Review settlement.

JURY DEMAND

Plaintiff hereby demands a jury trial on all claims to which she is entitled to a jury trial.

Case 3:13-cv-00783-JHM-DW Document 1 Filed 08/12/13 Page 9 of 9 PageID #: 9

PRAYER FOR RELIEF

WHEREFORE, the Plaintiff, on behalf of herself and all others similarly situated, pray for an Order and Judgment certifying the Class and appointing Plaintiff as class representative and granting the following relief: 1. Payment to Plaintiff and the members of the Class of the difference between what they were paid through the Independent Foreclosure Review process and what Defendants should have paid but for their negligence; 2. That the Plaintiff and all others so similarly situated be awarded judgment against the Defendants for punitive damages for the conduct of the Defendants alleged herein; 3. 4. 5. For pre- and post-judgment interest; For their attorneys fees; A jury trial; and

Any and all other relief to which the Plaintiff and all others so similarly so situated may be entitled. Respectfully Submitted,

/s/Ben Carter Ben Carter Ben Carter Law pllc 312 South Fourth Street, Sixth Floor Louisville, KY 40202 (502) 509-3231 ben@bencarterlaw.com Brian Cook Bahe Cook Cantley & Nefzger PLC Marion E. Taylor Building 312 South Fourth Street, 6th Floor Louisville, KY 40202 (502) 587-2002 brian@bccnlaw.com Counsel for Plaintiff

Vous aimerez peut-être aussi

- Class ComplaintDocument13 pagesClass ComplaintForeclosure Fraud100% (3)

- Uscourts Ca10!11!04008 0 10thc OntilaDocument16 pagesUscourts Ca10!11!04008 0 10thc OntilapolychromePas encore d'évaluation

- Jenkins v. Equifax - ComplaintDocument35 pagesJenkins v. Equifax - ComplaintABC Action NewsPas encore d'évaluation

- Us7ed3 1Document10 pagesUs7ed3 1larry-612445Pas encore d'évaluation

- In The United States District Court For The District of ColumbiaDocument9 pagesIn The United States District Court For The District of ColumbiaMartin AustermuhlePas encore d'évaluation

- La Villita Motor InnsDocument26 pagesLa Villita Motor InnsavramciPas encore d'évaluation

- (15-000293 424-10) Expert Report of PayneDocument10 pages(15-000293 424-10) Expert Report of PayneJessie SmithPas encore d'évaluation

- Equifax ComplaintDocument23 pagesEquifax ComplaintDaily Kos100% (1)

- McLellan CaseDocument13 pagesMcLellan CaseThe Heritage FoundationPas encore d'évaluation

- Opp To MTLSDocument15 pagesOpp To MTLSbryllawPas encore d'évaluation

- United States Court of Appeals: Opinion On Rehearing UnpublishedDocument11 pagesUnited States Court of Appeals: Opinion On Rehearing UnpublishedScribd Government DocsPas encore d'évaluation

- Complaint Foreclosure CitiMortgage Template Example OnlyDocument10 pagesComplaint Foreclosure CitiMortgage Template Example OnlyshelbymachPas encore d'évaluation

- Order Dismissing Case - Public Disclosure Bar, U .S. Ex Rel. Szymoniak V American Home Mtg. 10-01465 (D.S.C.) (D.E. 359)Document9 pagesOrder Dismissing Case - Public Disclosure Bar, U .S. Ex Rel. Szymoniak V American Home Mtg. 10-01465 (D.S.C.) (D.E. 359)larry-612445Pas encore d'évaluation

- Beattie v. Nations Credit, 4th Cir. (2003)Document10 pagesBeattie v. Nations Credit, 4th Cir. (2003)Scribd Government DocsPas encore d'évaluation

- 218 Cal. AppDocument25 pages218 Cal. AppKarmel RoePas encore d'évaluation

- FRAUD Upon The Court Motion - BOA V Julme-FL Case#CACE09-21933-051 - 2010-09-29 PDFDocument30 pagesFRAUD Upon The Court Motion - BOA V Julme-FL Case#CACE09-21933-051 - 2010-09-29 PDFStar Gazon100% (2)

- 424-20 Expert Report of Andrien 9 30 2019Document22 pages424-20 Expert Report of Andrien 9 30 2019Jessie SmithPas encore d'évaluation

- (15-00293 424-20) Expert Report of Andrien 9 30 2019Document22 pages(15-00293 424-20) Expert Report of Andrien 9 30 2019Jessie SmithPas encore d'évaluation

- Indymac Lawsuit TILA and RESPA Indymac ComplaintDocument33 pagesIndymac Lawsuit TILA and RESPA Indymac Complaint4MTTERRAFACEBOOKPas encore d'évaluation

- Not PrecedentialDocument14 pagesNot PrecedentialScribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Ninth CircuitDocument7 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Sixth CircuitDocument3 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsPas encore d'évaluation

- Motion Vacate Judgment - Fraud On Court-Request Evidentiary HearingDocument30 pagesMotion Vacate Judgment - Fraud On Court-Request Evidentiary Hearingwinstons2311100% (2)

- Court Order Remanding Case Back To State CourtDocument10 pagesCourt Order Remanding Case Back To State CourtMartin AndelmanPas encore d'évaluation

- McKenna v. First Horizon, 475 F.3d 418, 1st Cir. (2007)Document12 pagesMcKenna v. First Horizon, 475 F.3d 418, 1st Cir. (2007)Scribd Government DocsPas encore d'évaluation

- Ekerson v. MERS, CitiMortgage Inc., Et AlDocument12 pagesEkerson v. MERS, CitiMortgage Inc., Et AlForeclosure FraudPas encore d'évaluation

- In Re Nita B. Smith, Debtor. Nita B. Smith, Cross-Appellant v. First America Bank, N.A., Cross-Appellee, 876 F.2d 524, 1st Cir. (1989)Document5 pagesIn Re Nita B. Smith, Debtor. Nita B. Smith, Cross-Appellant v. First America Bank, N.A., Cross-Appellee, 876 F.2d 524, 1st Cir. (1989)Scribd Government DocsPas encore d'évaluation

- Circuit JudgesDocument62 pagesCircuit JudgesScribd Government DocsPas encore d'évaluation

- United States v. Leon Craddock, 993 F.2d 338, 3rd Cir. (1993)Document9 pagesUnited States v. Leon Craddock, 993 F.2d 338, 3rd Cir. (1993)Scribd Government DocsPas encore d'évaluation

- Santos-Rodriguez v. Doral Mortgage Corp, 485 F.3d 12, 1st Cir. (2007)Document10 pagesSantos-Rodriguez v. Doral Mortgage Corp, 485 F.3d 12, 1st Cir. (2007)Scribd Government DocsPas encore d'évaluation

- Bac Home - Country.complaint FTCDocument15 pagesBac Home - Country.complaint FTCdmedstromPas encore d'évaluation

- Complaint For Permanent Injunction and Other Equitable ReliefDocument15 pagesComplaint For Permanent Injunction and Other Equitable ReliefFidel Edel ArochaPas encore d'évaluation

- Not PrecedentialDocument13 pagesNot PrecedentialScribd Government DocsPas encore d'évaluation

- MRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017Document88 pagesMRS V JPMC Doc 151-1, Fourth Amended Complaint, March 6, 2017FraudInvestigationBureau100% (2)

- Arthur v. Ticor Title Ins. Co. of Florida, 569 F.3d 154, 4th Cir. (2009)Document13 pagesArthur v. Ticor Title Ins. Co. of Florida, 569 F.3d 154, 4th Cir. (2009)Scribd Government DocsPas encore d'évaluation

- Gemini and IRA Financial Class ActionDocument42 pagesGemini and IRA Financial Class ActionGMG EditorialPas encore d'évaluation

- Lender Liability in Securitized MortgagesDocument21 pagesLender Liability in Securitized MortgagesForeclosure Fraud100% (3)

- RescissionNotice Fin Charge COMPLAINTDocument23 pagesRescissionNotice Fin Charge COMPLAINTLoanClosingAuditors100% (1)

- IIMPORTANT OPINION IN MORTGAGE FORECLOSURE DEFENSE: Cosajay V Mortgage Electronic Registration Systems IncDocument11 pagesIIMPORTANT OPINION IN MORTGAGE FORECLOSURE DEFENSE: Cosajay V Mortgage Electronic Registration Systems InctawnyonePas encore d'évaluation

- Answer and Affirmative Defenses by GINGO 2Document11 pagesAnswer and Affirmative Defenses by GINGO 2wicholacayoPas encore d'évaluation

- 2017-04-22 Margarita Mares - Complaint Effective Rescission Rev4Document11 pages2017-04-22 Margarita Mares - Complaint Effective Rescission Rev4api-360769610Pas encore d'évaluation

- (15-00293 241-2) Ex B - Proposed Fourth Amended ComplaintDocument89 pages(15-00293 241-2) Ex B - Proposed Fourth Amended Complaintlarry-612445Pas encore d'évaluation

- Celizena Julme Vilamar Julme in The Circuit Court of The 17Document5 pagesCelizena Julme Vilamar Julme in The Circuit Court of The 17Richarnellia-RichieRichBattiest-CollinsPas encore d'évaluation

- AStep 1 Answer and CounterclaimDocument16 pagesAStep 1 Answer and CounterclaimEl_NoblePas encore d'évaluation

- (15-00293 428-78) Appellate Brief and ExhibitsDocument20 pages(15-00293 428-78) Appellate Brief and ExhibitsJessie SmithPas encore d'évaluation

- Dickow Class WDocument33 pagesDickow Class WDinSFLAPas encore d'évaluation

- 01 - Capital Insurance and Surety Co Vs Del Monte WorksDocument24 pages01 - Capital Insurance and Surety Co Vs Del Monte WorksthelawanditscomplexitiesPas encore d'évaluation

- Kenneth Trent Draft Complaint V JPMC and TTC, Pierrevil Complaint 9Document17 pagesKenneth Trent Draft Complaint V JPMC and TTC, Pierrevil Complaint 9larry-612445Pas encore d'évaluation

- Quiet Title ActionDocument20 pagesQuiet Title ActionKeith Muhammad: BeyPas encore d'évaluation

- (15-00593 403-30) Ex 30 S&A & 1st Fidelity Supp. Resp. To Defs. 3rd Set of InterrogDocument16 pages(15-00593 403-30) Ex 30 S&A & 1st Fidelity Supp. Resp. To Defs. 3rd Set of InterrogJessie SmithPas encore d'évaluation

- Demolition Agenda: How Trump Tried to Dismantle American Government, and What Biden Needs to Do to Save ItD'EverandDemolition Agenda: How Trump Tried to Dismantle American Government, and What Biden Needs to Do to Save ItPas encore d'évaluation

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersD'EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersÉvaluation : 3 sur 5 étoiles3/5 (1)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsD'EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsÉvaluation : 5 sur 5 étoiles5/5 (1)

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)D'EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Pas encore d'évaluation

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsD'EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsÉvaluation : 5 sur 5 étoiles5/5 (12)

- Avoiding Workplace Discrimination: A Guide for Employers and EmployeesD'EverandAvoiding Workplace Discrimination: A Guide for Employers and EmployeesPas encore d'évaluation

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.D'EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.Pas encore d'évaluation

- Chapter 13 Bankruptcy in the Western District of TennesseeD'EverandChapter 13 Bankruptcy in the Western District of TennesseePas encore d'évaluation

- Northwest Trustee Services Class Action Law SuitDocument9 pagesNorthwest Trustee Services Class Action Law SuitSTOP RCO NOWPas encore d'évaluation

- Wells Fargo Affidavit Processing Training ManualDocument93 pagesWells Fargo Affidavit Processing Training ManualSP Biloxi100% (1)

- 8-20-2013 PHX Light SF LTD Et Al v. JPMCDocument503 pages8-20-2013 PHX Light SF LTD Et Al v. JPMCDiane SternPas encore d'évaluation

- CFPB Mortgage Complaint DatabaseDocument718 pagesCFPB Mortgage Complaint DatabaseSP BiloxiPas encore d'évaluation

- People of The State of California v. J.P. Morgan Chase, Chase Bank N.A., and Chase Bankcard ServicesDocument10 pagesPeople of The State of California v. J.P. Morgan Chase, Chase Bank N.A., and Chase Bankcard ServicesNicholas M. MocciaPas encore d'évaluation

- Chase Whistleblower FinalDocument8 pagesChase Whistleblower FinalSP BiloxiPas encore d'évaluation

- SEC SupplementalDocument15 pagesSEC SupplementalSP Biloxi100% (1)

- Sheker vs. ShekerDocument6 pagesSheker vs. ShekerPMVPas encore d'évaluation

- FLores V Sps LindoDocument10 pagesFLores V Sps LindoLynne Dela CruzPas encore d'évaluation

- Final Accounts of SoletradersDocument9 pagesFinal Accounts of SoletradersShanavaz AsokachalilPas encore d'évaluation

- Terms and Definitions in ObliconDocument3 pagesTerms and Definitions in Obliconmaccy adalidPas encore d'évaluation

- Management Accounting Jargons/ Key TerminologiesDocument11 pagesManagement Accounting Jargons/ Key Terminologiesnimbus2050Pas encore d'évaluation

- NCBA RA 7653 Summary v2.0Document18 pagesNCBA RA 7653 Summary v2.0Cha BL80% (5)

- In the Matter of Elwood Cluck, Debtor. Elwood Cluck Kristine A. Cluck First Capital Mortgage Company, Incorporated v. Randolph N. Osherow, Trustee Thomas William McKenzie, 101 F.3d 1081, 1st Cir. (1996)Document3 pagesIn the Matter of Elwood Cluck, Debtor. Elwood Cluck Kristine A. Cluck First Capital Mortgage Company, Incorporated v. Randolph N. Osherow, Trustee Thomas William McKenzie, 101 F.3d 1081, 1st Cir. (1996)Scribd Government DocsPas encore d'évaluation

- Ben Graham Net Current Asset Values A Performance UpdateDocument9 pagesBen Graham Net Current Asset Values A Performance UpdateB.C. MoonPas encore d'évaluation

- Paculdo v. RegaladoDocument3 pagesPaculdo v. RegaladoEmir Mendoza100% (1)

- Banker Customer RelationshipDocument7 pagesBanker Customer RelationshipJitendra VirahyasPas encore d'évaluation

- October 2018 RFBT New Topis MCQDocument43 pagesOctober 2018 RFBT New Topis MCQHafidz MusahariPas encore d'évaluation

- Convertible Note (Part of Note Purchase Agreement W Cap)Document4 pagesConvertible Note (Part of Note Purchase Agreement W Cap)David Jay MorPas encore d'évaluation

- Obligations and ContractsDocument6 pagesObligations and Contractssean denzel omliPas encore d'évaluation

- Insolvency Master 06-05-19Document124 pagesInsolvency Master 06-05-19ganeshkumar0% (1)

- Barings Bank and Nick LeesonDocument76 pagesBarings Bank and Nick Leesonmnar2056481Pas encore d'évaluation

- Recitation 1 ObliconDocument7 pagesRecitation 1 ObliconmxviPas encore d'évaluation

- Quiz On Obligations and ContractsDocument9 pagesQuiz On Obligations and ContractsTracy Miranda BognotPas encore d'évaluation

- Thor Power Tool Co. v. Commissioner, 439 U.S. 522 (1979)Document25 pagesThor Power Tool Co. v. Commissioner, 439 U.S. 522 (1979)Scribd Government DocsPas encore d'évaluation

- Crowne Plaza - Website Contract PDFDocument19 pagesCrowne Plaza - Website Contract PDFAnonymous 7f0h8lkDuPas encore d'évaluation

- Guerrero Advanced Accounting 1 PDFDocument2 pagesGuerrero Advanced Accounting 1 PDFPritz Marc Bautista MorataPas encore d'évaluation

- Requests For Admissions by CitiMortageDocument53 pagesRequests For Admissions by CitiMortageJylly JakesPas encore d'évaluation

- Bestwall - 1-19-21 Order Authorizing Estimation of Current and Future Mesothelioma ClaimsDocument6 pagesBestwall - 1-19-21 Order Authorizing Estimation of Current and Future Mesothelioma ClaimsKirk HartleyPas encore d'évaluation

- Incomplete Records ExampleDocument12 pagesIncomplete Records ExampleCindy Fry100% (2)

- Campillo vs. CA DIGESTDocument2 pagesCampillo vs. CA DIGESTStephanie Reyes GoPas encore d'évaluation

- Extinguishment of ObligationDocument17 pagesExtinguishment of ObligationRachel Rondina CasiñoPas encore d'évaluation

- Rose v. Rose, 481 U.S. 619 (1987)Document23 pagesRose v. Rose, 481 U.S. 619 (1987)Scribd Government DocsPas encore d'évaluation

- NG Chio Cio v. NG DiongDocument10 pagesNG Chio Cio v. NG Diongbenjo2001Pas encore d'évaluation

- Legal Framework On Protection of CreditorsDocument7 pagesLegal Framework On Protection of CreditorsERICK MLINGWAPas encore d'évaluation

- Required Exercises Solutions Chapter 13Document4 pagesRequired Exercises Solutions Chapter 13Le TanPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument9 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation