Académique Documents

Professionnel Documents

Culture Documents

Icici Ipo1

Transféré par

GreatAkxTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Icici Ipo1

Transféré par

GreatAkxDroits d'auteur :

Formats disponibles

About The Company

Established in 1994 Subsidiary of Industrial Credit and Investment Corporation of India. India's largest private sector bank.

On 31st March 2013: Total assets: US$ 99 billion. Profit after tax: US$ 1,533 million. The Bank has its presence in 19 countries, including India.

Subsidiaries, Braches & Representative offices

Subsidiaries: United Kingdom, Russia and Canada. Branches : United States, Singapore, Bahrain, Hong Kong, Sri Lanka, Qatar and Dubai International Finance Centre Representative offices: United Arab Emirates, China, South Africa, Bangladesh, Thailand, Malaysia and Indonesia.

Listing Information

Face Value Of Equity Shares : 10

Market Lot Of Equity Shares : 1 BSE Code NSE Code BSE Group : 532174 : ICICIBANK : A

Indices Sensex

Nifty BSE-100 BSE-200 S&P CNX 500

Products & Services (Personal Banking)

Funds & Investment : Mutual Fund , Deposits Portfolio Management Services Insurance & Risk Protection : Life Insurance & General Insurance Banking Products :

Saving A/C , Demat A/C , Family Wealth A/C , Home Loans , Car Loans , Foreign Exchange , Mobile Service , Lockers & b2 A/C

Banking Products (Business Banking)

Business Banking : Current A/C Trade Services Business Loan : Term Loan Cash Credit Business Insurance

What is Initial Public Offering ?

An initial public offering, or IPO, is the first sale of stock by a company to the public. A company can raise money by issuing either debt or equity. If the company has never issued equity to the public, It's known as an IPO. An IPO is the first time that a companys shares are traded on a public market.

Why Go Public?

Going public raises cash and usually a lot of it. Being publicly traded also opens many financial doors: As long as there is market demand, a public company can always issue more stock. Thus, mergers and acquisitions are easier to do because stock can be issued as part of the deal. Trading in the open markets means liquidity. Shares are offered to the public for various reasons including to: Help raise money for the company and to finance growth opportunities. Provide liquidity when it comes to trading shares in the company Generate publicity for the company.

ICICI Bank Initial Public Offer (IPO) The biggest in India by any bank. Issue opened on 02/04/2004. Was fully subscribed on the National Stock Exchange. Subscribed two times, with the maximum number of bids coming from foreign institutional investors.

Book Running Lead Manger

DSP Merrill Lynch Ltd. JM Morgan Stanley Pvt. Ltd. Kotak Mahindra Capital Company Ltd

The issue aimed to raise Rs 30.5 billion with a Green shoe option" of Rs 4.5 billion. The issue was through the book-building route. Price band was set between 255 and 295 per equity share.

Bids

Over all the issue had received bids for 239.1 million shares as against the issue size of 119.6 million shares. The maximum number of bids (80.9 million shares) were received at Rs 280, followed by 63.5 million shares at Rs 295. Bids for 22.6 million shares were received at Rs 255. . Green Shoe Option

After the IPO The bank's post-issue paid-up equity capital rose from 6.15billon to between 7.35 billion and 7.53 billion. depending on whether the bank used the green shoe option.

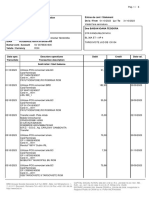

OFFER DETAILS of ICICI Bank Ltd

Issue Open Date : 02/04/2004 Issue Close Date 07/04/2004 Face Value (Rs) : 10.00 Offer Price/Range : Rs. 255 to Rs. 295 Issued at (Value) : Rs. 280.00 Issue Size(Retail) : 119.6 million Shares @280.00/share Issue Type : Public Issue (Book Building)

Vous aimerez peut-être aussi

- Comparative Performance of Merchant Bankers 2003Document32 pagesComparative Performance of Merchant Bankers 2003Yashkirti JainPas encore d'évaluation

- Main ReportDocument82 pagesMain ReportAparna MauryaPas encore d'évaluation

- Comparative Analysis of Mutual Fund of HDFC ICICIDocument33 pagesComparative Analysis of Mutual Fund of HDFC ICICIAniket Ramteke100% (1)

- IPO (Initial Public Offering)Document15 pagesIPO (Initial Public Offering)sudarshan1985Pas encore d'évaluation

- Angel CompanyDocument18 pagesAngel CompanyYuga NayakPas encore d'évaluation

- Investors Attitude Towards Primary MarketDocument62 pagesInvestors Attitude Towards Primary MarketRonak Singhal50% (2)

- Competito Analysis of Anand RathiDocument62 pagesCompetito Analysis of Anand RathiSaran Kutty67% (3)

- Mutual FundDocument48 pagesMutual FundSuresh P TryPas encore d'évaluation

- Problem Statement /titleDocument8 pagesProblem Statement /titleGaurav GargPas encore d'évaluation

- MARKETING STRATEGY OF - HDFC Mutual FundDocument114 pagesMARKETING STRATEGY OF - HDFC Mutual Fundsuryakantshrotriya100% (1)

- India BullsDocument26 pagesIndia BullsManjit Gogoi0% (1)

- Executive Summary: Performance Analysis and Risk ManagementDocument15 pagesExecutive Summary: Performance Analysis and Risk ManagementRajkumar VishwakarmaPas encore d'évaluation

- Brief Analysis of Some Merchant Banks in IndiaDocument6 pagesBrief Analysis of Some Merchant Banks in IndiaParul PrasadPas encore d'évaluation

- TASK DAY 1 MudrabizDocument5 pagesTASK DAY 1 MudrabizAnuja DekatePas encore d'évaluation

- Ipo DocumentDocument16 pagesIpo Documentalan ruzarioPas encore d'évaluation

- Investment Banks-Final With ChangesDocument14 pagesInvestment Banks-Final With Changesdaanishk87Pas encore d'évaluation

- Aditya Birla Mutual FundDocument66 pagesAditya Birla Mutual Fundpratim shindePas encore d'évaluation

- Project Report ON: Submitted By:-Saumya TripathiDocument36 pagesProject Report ON: Submitted By:-Saumya Tripathi000vaiPas encore d'évaluation

- Merchant Banking 6948Document12 pagesMerchant Banking 6948Ankit SinghPas encore d'évaluation

- Assignment Financial Market Regulations: Mdu-CpasDocument10 pagesAssignment Financial Market Regulations: Mdu-CpasTanuPas encore d'évaluation

- PARVEEN Final ProjectDocument64 pagesPARVEEN Final ProjectHarshil HundiaPas encore d'évaluation

- Finance SectorDocument18 pagesFinance SectorHemant ChaudharyPas encore d'évaluation

- Fundamental and Technical Analysis of Mutual FundsDocument52 pagesFundamental and Technical Analysis of Mutual FundsAnnu PariharPas encore d'évaluation

- Project On Derivative Market PDFDocument102 pagesProject On Derivative Market PDFprachijain2504Pas encore d'évaluation

- FortuneDocument27 pagesFortuneSatish PenumarthiPas encore d'évaluation

- Indiabuls Final PresentationDocument39 pagesIndiabuls Final PresentationVanraj PandeyPas encore d'évaluation

- FINAL REPORT HDFC LifeDocument53 pagesFINAL REPORT HDFC LifeDarshan ShahPas encore d'évaluation

- "Investment in Capital Market in Indiabulls" at Indiabulls Securities Ltd.Document94 pages"Investment in Capital Market in Indiabulls" at Indiabulls Securities Ltd.Sami ZamaPas encore d'évaluation

- HDFC Standard Life Insurance: Final ReportDocument29 pagesHDFC Standard Life Insurance: Final ReportKunal JalanPas encore d'évaluation

- Amit Bafna SIP ReportDocument34 pagesAmit Bafna SIP ReportAnupPas encore d'évaluation

- Summer Internship Project Report On Kotak Securities IndoreDocument34 pagesSummer Internship Project Report On Kotak Securities Indoredhruvisharma400Pas encore d'évaluation

- IciciDocument19 pagesIciciChetan AnsodariyaPas encore d'évaluation

- IIFL ProjectDocument82 pagesIIFL ProjectSubha Pawan ChPas encore d'évaluation

- Comparative Study of Capital MarketDocument80 pagesComparative Study of Capital MarketHassan Ali KhanPas encore d'évaluation

- Icici Securities Internship ReportDocument33 pagesIcici Securities Internship ReportDhanush.RPas encore d'évaluation

- Corporate AccountingDocument12 pagesCorporate AccountingStutiPas encore d'évaluation

- "A Study of Investment Avenue Offered by Reliance Money": A Project Report ONDocument76 pages"A Study of Investment Avenue Offered by Reliance Money": A Project Report ONRibhanshu RajPas encore d'évaluation

- Chapter-1: Submitted By: Bipin SahooDocument48 pagesChapter-1: Submitted By: Bipin SahooAshis Sahoo100% (1)

- Os Project 1Document66 pagesOs Project 1maheshmvijayanPas encore d'évaluation

- Executive Summary:-: 1.1 About The CompanyDocument19 pagesExecutive Summary:-: 1.1 About The CompanySameer Babu MPas encore d'évaluation

- Executive Summary:-: 1.1 About The CompanyDocument19 pagesExecutive Summary:-: 1.1 About The CompanySameer Babu MPas encore d'évaluation

- HDFC Asset ManagementDocument21 pagesHDFC Asset Managementritik bumbakPas encore d'évaluation

- Angel Broking - Wikipedia Hsushsb Jsis Enthi SunDocument20 pagesAngel Broking - Wikipedia Hsushsb Jsis Enthi SunYuga NayakPas encore d'évaluation

- Final Project India BullsDocument61 pagesFinal Project India BullsRanadip PaulPas encore d'évaluation

- Direct Equity Investing and Mutual Fund InvestingDocument116 pagesDirect Equity Investing and Mutual Fund Investingmoula nawazPas encore d'évaluation

- Wip BirlaDocument37 pagesWip BirlaSneha YadavPas encore d'évaluation

- IPO in IndiaDocument15 pagesIPO in IndiaSingh GurpreetPas encore d'évaluation

- A Report OnDocument63 pagesA Report OnPriya SharmaPas encore d'évaluation

- MayaaDocument48 pagesMayaaRICHA mehtaPas encore d'évaluation

- INTRODUCTION Muthoot FinaceDocument60 pagesINTRODUCTION Muthoot FinaceAnonymous V9E1ZJtwoEPas encore d'évaluation

- Name: Rahul Nambiar Roll No: 109 Project Topic: Initial Public Offer Faculty: Prof Akhil ShettyDocument47 pagesName: Rahul Nambiar Roll No: 109 Project Topic: Initial Public Offer Faculty: Prof Akhil ShettyRAHUL NAMBIARPas encore d'évaluation

- HDFC Mutual FundDocument24 pagesHDFC Mutual Fundsachin kumarPas encore d'évaluation

- Private PlacementDocument7 pagesPrivate PlacementRajeshwary CoolPas encore d'évaluation

- Comparative Analysis of Stock Brokers in CHANDIGARH Region - Manjit GogoiDocument100 pagesComparative Analysis of Stock Brokers in CHANDIGARH Region - Manjit GogoiManjit GogoiPas encore d'évaluation

- A Practical Approach to the Study of Indian Capital MarketsD'EverandA Practical Approach to the Study of Indian Capital MarketsPas encore d'évaluation

- Stock Market Investing: Pathway to Wealth CreationD'EverandStock Market Investing: Pathway to Wealth CreationÉvaluation : 4.5 sur 5 étoiles4.5/5 (4)

- Equity Investment for CFA level 1: CFA level 1, #2D'EverandEquity Investment for CFA level 1: CFA level 1, #2Évaluation : 5 sur 5 étoiles5/5 (1)

- Current Affairs Study PDF - May 2016 by AffairsCloud - FinalDocument190 pagesCurrent Affairs Study PDF - May 2016 by AffairsCloud - FinalAnonymous fCcCuoPAPas encore d'évaluation

- Challanges Indian EconomyDocument10 pagesChallanges Indian Economydayanand1984Pas encore d'évaluation

- Economics and Its Discontents - Jedrzej MalkoDocument374 pagesEconomics and Its Discontents - Jedrzej MalkoGreatAkx100% (2)

- Annd Rice MillDocument54 pagesAnnd Rice MillGreatAkx100% (1)

- Gramma Tik Be Griff eDocument7 pagesGramma Tik Be Griff eGreatAkxPas encore d'évaluation

- Working of Depositary System 110820104758 Phpapp02Document76 pagesWorking of Depositary System 110820104758 Phpapp02harsh royPas encore d'évaluation

- HedgingDocument19 pagesHedgingRupa H GowdaPas encore d'évaluation

- Financial Management-Ch01Document32 pagesFinancial Management-Ch01hasan jabrPas encore d'évaluation

- Bii Global Outlook 2023Document16 pagesBii Global Outlook 2023Zerohedge Janitor89% (9)

- Running Head: Case Study: Pan-Europa Foods 1Document6 pagesRunning Head: Case Study: Pan-Europa Foods 1Prathibha VemulapalliPas encore d'évaluation

- Forwards FuturesDocument29 pagesForwards FuturesAmeen ShaikhPas encore d'évaluation

- Needles POA 12e - P 12-07Document4 pagesNeedles POA 12e - P 12-07SamerPas encore d'évaluation

- The Balance SheetDocument39 pagesThe Balance SheetJUAN ANTONIO CERON CRUZPas encore d'évaluation

- Negotiable Instruments Act 1881Document47 pagesNegotiable Instruments Act 1881SupriyamathewPas encore d'évaluation

- Account Summary - 7382041247: ChecksDocument4 pagesAccount Summary - 7382041247: ChecksJack SheldenPas encore d'évaluation

- Cash Management - Overview Slide For TTT - 15.0 - PTJ Ao (Cmsi v1.0)Document63 pagesCash Management - Overview Slide For TTT - 15.0 - PTJ Ao (Cmsi v1.0)Siti Habsah Abdullah100% (1)

- PSSSB Patwari Fee 2023Document1 pagePSSSB Patwari Fee 2023Sahil AroraPas encore d'évaluation

- Individual Facility AgreementDocument66 pagesIndividual Facility AgreementDY KIM (INKO)Pas encore d'évaluation

- GBP Statement: Beatriz Manchado FloresDocument2 pagesGBP Statement: Beatriz Manchado Floresmr.laravelPas encore d'évaluation

- Tax Invoice: Account For Professional FeesDocument1 pageTax Invoice: Account For Professional FeesVinh DuongPas encore d'évaluation

- Solutions Ch04Document4 pagesSolutions Ch04jessicalaurent1999Pas encore d'évaluation

- AntichresisDocument2 pagesAntichresiscrisypilPas encore d'évaluation

- Assignment of Banking Company 22-23Document6 pagesAssignment of Banking Company 22-23DARK KING GamersPas encore d'évaluation

- Ch20 Guan CM Aise TBDocument35 pagesCh20 Guan CM Aise TBHero CoursePas encore d'évaluation

- SV39786361600 2023 10Document6 pagesSV39786361600 2023 10ioanateodorabaisanPas encore d'évaluation

- FAR Assignment 5 Adjusting EntriesDocument2 pagesFAR Assignment 5 Adjusting EntriesPaula BautistaPas encore d'évaluation

- Goat Project - 500+25Document11 pagesGoat Project - 500+25karannehra82Pas encore d'évaluation

- NISMDocument167 pagesNISMprashant_agharkar9257Pas encore d'évaluation

- ReviewerDocument3 pagesReviewergirlPas encore d'évaluation

- Long Lived Assets L1Document37 pagesLong Lived Assets L1heisenbergPas encore d'évaluation

- Internship Report On Zarai Traqiati Bank Limited Main Branch Mansehra (30901)Document67 pagesInternship Report On Zarai Traqiati Bank Limited Main Branch Mansehra (30901)Faisal AwanPas encore d'évaluation

- Trade and Other ReceivablesDocument21 pagesTrade and Other ReceivablesNoella Marie BaronPas encore d'évaluation

- Simple Interest Compounded Interest Population Growth Half LifeDocument32 pagesSimple Interest Compounded Interest Population Growth Half LifeCarmen GoguPas encore d'évaluation

- 2014 Ass Cash Budgeting Personal ComputersDocument6 pages2014 Ass Cash Budgeting Personal ComputersP Karan Jain0% (1)

- Why Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabreraDocument2 pagesWhy Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabrerathecenseireportPas encore d'évaluation