Académique Documents

Professionnel Documents

Culture Documents

Introductio 1

Transféré par

Anil ShelarDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Introductio 1

Transféré par

Anil ShelarDroits d'auteur :

Formats disponibles

Introduction:SEBI is managed by six members one chairman (nominated by CentralGovernment), two members (officers of central ministries), one member

r (fromRBI) and remaining two members nominated by Central Government. About SEBIESTABLISHMENT OF SEBI The Securities and Exchange Board of India was established on April 12,1992 in accordance with the provisions of the Securities and ExchangeBoard of India Act, 1992. PREAMBLE The Preamble of the Securities and Exchange Board of India describes thebasic functions of the Securities and Exchange Board of India as"...to protect the interests of investors in securities and to promote thedevelopment of, and to regulate the securities market and for mattersconnected therewith or incidental thereto" SEBI These Guidelines have been issued by the Securities and Exchange Board of India under Section 11 of the Securities and Exchange Board of India Act,1992.(a) These Guidelines may be called the Securities and Exchange Board of India (Disclosure and Investor Protection) Guidelines, 2000.(b) These Guidelines shall come into force from the date specified by theBoard Functions & ResponsibilitiesSEBI has to be responsive to the needs of three groups, which constitute themarket: The issuers of securities The investors The market intermediaries.SEBI has three functions rolled into one body:quasi-legislative,quasi- judicial and quasi-executive. It drafts regulations in its legislative capacity, itconducts investigation and enforcement action in its executive function andit passes rulings and orders in its judicial capacity. Though this makes itvery powerful, there is an appeals process to create accountability. There isa Securities Appellate Tribunal which is a threemember tribunal and ispresently headed by a former Chief Justice of a High court -Mr. JusticeN.K.Sodhi. A second appeal lies directly to theSupreme Court.SEBI hasenjoyed success as a regulator by pushing systemic reforms aggressively and successively. SEBI has been active in setting up the regulations asrequired under law.SEBI has also been instrumental in taking quick andeffective steps in light of the global meltdown and the Satyam fiasco. Ithad increased the extent and quantity of disclosures to be made by

Indiancorporate promoters. More recently, in light of the global melt down, itliberalised the takeover code to facilitate investments by removing regulatory structures. In one such move, SEBI has increased the application limit forretail investors to Rs 2 lakh, from Rs 1 lakh at present

Vous aimerez peut-être aussi

- SEBIDocument2 pagesSEBIAkash ShrivastavaPas encore d'évaluation

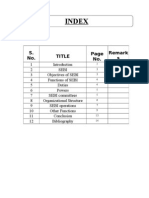

- Index: S. No. Title No. Remark SDocument17 pagesIndex: S. No. Title No. Remark SSiddhi PatwaPas encore d'évaluation

- Sebi PresentatationDocument21 pagesSebi PresentatationDeepikaPas encore d'évaluation

- Investment Law PresentationDocument11 pagesInvestment Law PresentationNanda SurajPas encore d'évaluation

- Upendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesDocument4 pagesUpendra Kumar Sinha C. B. Bhave: Was Appointed Chairman On 18 February 2011 Replacing - TH e Board ComprisesAbhishek ShuklaPas encore d'évaluation

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalPas encore d'évaluation

- Investment and Securities AssignmentDocument16 pagesInvestment and Securities Assignmentkhusboo kharbandaPas encore d'évaluation

- Functional Report of SEBIDocument9 pagesFunctional Report of SEBIAMIT K SINGH100% (1)

- SEBIDocument1 pageSEBIApurva DipnaikPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument6 pagesSecurities and Exchange Board of IndiaSiddhi PatwaPas encore d'évaluation

- Topic: Sebi As A Regulatory Authority On Companies: Company LawDocument21 pagesTopic: Sebi As A Regulatory Authority On Companies: Company LawsrivarshiniPas encore d'évaluation

- SSRN Id2293378 PDFDocument17 pagesSSRN Id2293378 PDFAlisha BhatnagarPas encore d'évaluation

- Role of SEBI in Primary MarketDocument19 pagesRole of SEBI in Primary MarketTwinkle RajpalPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument73 pagesSecurities and Exchange Board of IndiaSurya ParkashPas encore d'évaluation

- SEBIDocument25 pagesSEBIsumant singhPas encore d'évaluation

- Sebi'S Background: Securities and Exchange Board of IndiaDocument15 pagesSebi'S Background: Securities and Exchange Board of IndiaAnjaliPas encore d'évaluation

- Assignment On SebiDocument17 pagesAssignment On SebiSUFIYAN SIDDIQUIPas encore d'évaluation

- Securities and Exchange Board of India (SEBI) : AboutDocument3 pagesSecurities and Exchange Board of India (SEBI) : AboutLamhePas encore d'évaluation

- C C CM: MMMMMMDocument4 pagesC C CM: MMMMMMGaurav RauthanPas encore d'évaluation

- Financial Management Regulation PROJECTDocument25 pagesFinancial Management Regulation PROJECTraj vardhan agarwalPas encore d'évaluation

- Formation and Powers of SEBIDocument20 pagesFormation and Powers of SEBIMohd YasinPas encore d'évaluation

- Securities and Exchange Board of India: Navigation SearchDocument7 pagesSecurities and Exchange Board of India: Navigation SearchAshish ThengariPas encore d'évaluation

- Corporate Social ResponsibilityDocument9 pagesCorporate Social Responsibilityperumbhuduru manoharPas encore d'évaluation

- Name-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)Document6 pagesName-Meyechila Luho Reg. No. - 19019100017 Bba 5 Sem Investment Management (U18BBA52)MechiluhoPas encore d'évaluation

- SP ProjectDocument14 pagesSP ProjectVyankatesh KarnewarPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument21 pagesSecurities and Exchange Board of IndiaDeepa A PoojaryPas encore d'évaluation

- INTRODUCTIONDocument48 pagesINTRODUCTIONtanisq10100% (2)

- Corporate LawDocument20 pagesCorporate LawNaimish TripathiPas encore d'évaluation

- Ifm AssignmentDocument15 pagesIfm AssignmentRockstar KshitijPas encore d'évaluation

- Role of SEBI in Capital MarketDocument6 pagesRole of SEBI in Capital MarketShashank HatlePas encore d'évaluation

- National Law Institute University Bhopal: Project - Administrative Law SebiDocument20 pagesNational Law Institute University Bhopal: Project - Administrative Law SebiSurbhi LaddhaPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument13 pagesSecurities and Exchange Board of Indiasonal jainPas encore d'évaluation

- SEBIDocument3 pagesSEBIHasrat AliPas encore d'évaluation

- SEBI - The Securities and Exchange Board of IndiaDocument35 pagesSEBI - The Securities and Exchange Board of IndiaRohan FodnaikPas encore d'évaluation

- Co Law IiDocument15 pagesCo Law IiRitik SharmaPas encore d'évaluation

- Ministry of Corporate AffairsDocument10 pagesMinistry of Corporate AffairsAzim SamnaniPas encore d'évaluation

- Sebi Functional ReportDocument7 pagesSebi Functional ReportRohan Pawar61% (18)

- Securities and Exchange Board of India: Regulator Securities SEBI Act, 1992Document6 pagesSecurities and Exchange Board of India: Regulator Securities SEBI Act, 1992Pawan LohanaPas encore d'évaluation

- Securities and Exchange Board of IndiaDocument11 pagesSecurities and Exchange Board of IndiaRanesh Raveendran RPas encore d'évaluation

- CLASS - 1 Introduction of SEBIDocument7 pagesCLASS - 1 Introduction of SEBIPawas SinghPas encore d'évaluation

- History: The Securities and Exchange Board of India Act, 1992Document4 pagesHistory: The Securities and Exchange Board of India Act, 1992Arulmani MurugesanPas encore d'évaluation

- Group10 LABDocument10 pagesGroup10 LABRADHIKA MUKATIPas encore d'évaluation

- Project On Investment Law Sebi SecuritieDocument14 pagesProject On Investment Law Sebi Securitielalit 08Pas encore d'évaluation

- Project: Sebi (Securities and Exchange Board of India) Role, Powers and Functions Submitted ToDocument14 pagesProject: Sebi (Securities and Exchange Board of India) Role, Powers and Functions Submitted ToDHANANJAY MIRLEKARPas encore d'évaluation

- SebiDocument26 pagesSebiHitesh MendirattaPas encore d'évaluation

- SebiDocument18 pagesSebiSandeep Galipelli50% (2)

- Group10 LABDocument15 pagesGroup10 LABRADHIKA MUKATIPas encore d'évaluation

- Group10 LABDocument10 pagesGroup10 LABRADHIKA MUKATIPas encore d'évaluation

- Index SR No. Topic PG No.: K.E.S Shroff CollegeDocument55 pagesIndex SR No. Topic PG No.: K.E.S Shroff CollegeSaurabh sarojPas encore d'évaluation

- Anurag ProjectDocument6 pagesAnurag ProjectAnurag LahanePas encore d'évaluation

- Project On SebiDocument15 pagesProject On SebiVrushti Parmar86% (14)

- Debt Market SEBIDocument7 pagesDebt Market SEBIvidhipatadia3013Pas encore d'évaluation

- Arnav 245 (Sebi)Document14 pagesArnav 245 (Sebi)ArnavPas encore d'évaluation

- FR NotesDocument17 pagesFR NotesNitu YadavPas encore d'évaluation

- Sebi Power and FunctionDocument13 pagesSebi Power and Functionaman kadriPas encore d'évaluation

- Capital Market and SEBIDocument4 pagesCapital Market and SEBINishant GoyalPas encore d'évaluation

- Corporate Governance: A practical guide for accountantsD'EverandCorporate Governance: A practical guide for accountantsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10D'EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10Pas encore d'évaluation

- People vs. Salve Gonzales y TornoDocument1 pagePeople vs. Salve Gonzales y TornoAlecesse Vim Casinabe100% (1)

- CONSTI 1 SyllabusDocument12 pagesCONSTI 1 SyllabusLyannaSmith100% (2)

- Ppointments: Avid Ingh RewalDocument10 pagesPpointments: Avid Ingh Rewalprasanth rajuPas encore d'évaluation

- CA 101 Lecture 13Document40 pagesCA 101 Lecture 13Johnpatrick DejesusPas encore d'évaluation

- Prokofiev As Modernist, 1907-1915Document24 pagesProkofiev As Modernist, 1907-1915BurakPas encore d'évaluation

- Client Proposal TemplateDocument13 pagesClient Proposal TemplateMamatha SinghPas encore d'évaluation

- Philippines Decentralisation RRLDocument13 pagesPhilippines Decentralisation RRLDaniel Paulo MangampatPas encore d'évaluation

- IGNOU Political Science Material - Political Ideas and Ideologies WWW Prep4civils ComDocument379 pagesIGNOU Political Science Material - Political Ideas and Ideologies WWW Prep4civils ComPrep4Civils86% (7)

- Module 3 - Integration of BADAC Plan To BPOPS - NBOODocument15 pagesModule 3 - Integration of BADAC Plan To BPOPS - NBOOSharamae DalogdogPas encore d'évaluation

- MKTG3512 Brand Management 2022 23 Sem 2 Week 7 Notes PDFDocument60 pagesMKTG3512 Brand Management 2022 23 Sem 2 Week 7 Notes PDFLittlep LittlepPas encore d'évaluation

- People Vs MamaliasDocument2 pagesPeople Vs MamaliasPrudencio Ruiz AgacitaPas encore d'évaluation

- Art 12. People Vs MadaliDocument3 pagesArt 12. People Vs MadaliDonna Joyce de BelenPas encore d'évaluation

- Soriano Vs ListaDocument1 pageSoriano Vs ListaCarlota Nicolas Villaroman100% (1)

- United States of America Merit Systems Protection Board 2010 MSPB 105Document18 pagesUnited States of America Merit Systems Protection Board 2010 MSPB 105FedSmith Inc.Pas encore d'évaluation

- Pat Boone/60 Plus Endorses Senator Alex X. MooneyDocument1 pagePat Boone/60 Plus Endorses Senator Alex X. MooneySenator Alex X. MooneyPas encore d'évaluation

- Buckley's Pinochet ConnectionDocument2 pagesBuckley's Pinochet ConnectionJonathan MarshallPas encore d'évaluation

- Blo Umpar Adiong vs. Commission On Elections FactsDocument5 pagesBlo Umpar Adiong vs. Commission On Elections FactsJem OducayenPas encore d'évaluation

- FY2011 Schedule C FinalDocument356 pagesFY2011 Schedule C FinalAzi PaybarahPas encore d'évaluation

- Abelita V DoriaDocument2 pagesAbelita V DoriaMay Angelica TenezaPas encore d'évaluation

- In Re - Sabio 504 Scra 704 (2006)Document1 pageIn Re - Sabio 504 Scra 704 (2006)Shen TupasPas encore d'évaluation

- Competence and Compellability of JuvenilDocument46 pagesCompetence and Compellability of JuvenilBenedict AnicetPas encore d'évaluation

- Petitioner Vs Vs Respondent: Second DivisionDocument7 pagesPetitioner Vs Vs Respondent: Second DivisionAndrew NacitaPas encore d'évaluation

- Building LawsDocument18 pagesBuilding LawsMARK DANIEL DAGALEPas encore d'évaluation

- Tax 1 (Local Tax)Document40 pagesTax 1 (Local Tax)Atty AnnaPas encore d'évaluation

- Administrative HandbookDocument11 pagesAdministrative Handbookapi-246792700Pas encore d'évaluation

- Implied PoliciesDocument8 pagesImplied PoliciesTanushree HingoraniPas encore d'évaluation

- Resume KNM12Document1 pageResume KNM12Kikora Naila MasonPas encore d'évaluation

- Business Model CanvasDocument1 pageBusiness Model Canvasbrajesh singhPas encore d'évaluation

- Griswold v. Connecticut, 381 U.S. 479 (1965)Document41 pagesGriswold v. Connecticut, 381 U.S. 479 (1965)Scribd Government DocsPas encore d'évaluation

- Paradigms and Paradoxes of Victimology PDFDocument26 pagesParadigms and Paradoxes of Victimology PDFatjoerossPas encore d'évaluation