Académique Documents

Professionnel Documents

Culture Documents

Tan vs. Lagrama

Transféré par

scartoneros_1Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tan vs. Lagrama

Transféré par

scartoneros_1Droits d'auteur :

Formats disponibles

Tan vs.

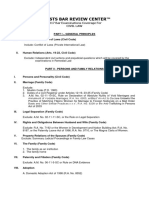

Lagrama 387 SCRA 393 Facts: Lagrama works for Tan as painter of billboards and murals for the motion pictures shown at the theaters managed by Tan for more than 10years. Lagrama was dismissed for having urinated in his working area. Lagrama filed a complaint for illegal dismissal and non payment of benefits. Tan asserted that Lagrama was an independent contractor as he was paid in piece-work basis Issue: W/N Lagrama is an independent contractor or an employee of Tan. Ruling: Lagrama is an employee, not an independent contractor. Applying Four Fold Test A. Power of Control - Evidence shows that the Lagrama performed his work as painter and under the supervision and control of Tan. Lagrama worked in a designated work area inside the theater of Tan for the use of which petitioner prescribed rules, which rules included the observance of cleanliness and hygeine and prohibition against urinating in the work area and any other place other than rest rooms and Tan's control over Lagrama's work extended not only the use of work area but also the result of Lagrama;s work and the manner and means by which the work was to be accomplished Lagrama is not an independent contractor because he did not enjoy independence and freedom from the control and supervision of Tan and he was subjected to Tan's control over the means and methods by which his work is to be performed and accomplished B. Payment of Wages Lagrama worked for Tan on a fixed piece work basis is of no moment. Payment by result is a method of compensation and does not define the essence of the relation. Tat Lagrama was not reported as an employee to the SSS is not conclusive, on the question whether he was an employee, otherwise Tan would be rewarded for his failure or even neglect to perform his obligation. C. Power of Dismissal by Tan stating that he had the right to fire Lagrama, Tan in effect acknowledged Lagrama to be his employee D. Power of Selection and Engagement of Employees Tan engaged the services of Lagrama without the intervention of third party Compared to an employee, an independent contractor is one who carries on a distinct and independent business and undertakes to perform the job, work, or service on its own account and under its own responsibility according to its own manner and method, free from the control and direction of the principal in all matters connected with the performance of the work except as to the results thereof. [8] Hence, while an independent contractor enjoys independence and freedom from the control and supervision of his principal, an employee is subject to the employers power to control the means and methods by which the employees work is to be performed and accomplished.

1.

2. 3.

1. 2.

Vous aimerez peut-être aussi

- 1.) Tan V. LagramaDocument2 pages1.) Tan V. LagramaJake PeraltaPas encore d'évaluation

- 1 of 25 MGVD - Wages Case Digest Compilation - Labor Law B - Atty. Chan-GonzagaDocument25 pages1 of 25 MGVD - Wages Case Digest Compilation - Labor Law B - Atty. Chan-GonzagaJefferson Maynard RiveraPas encore d'évaluation

- Tan v. LagramaDocument3 pagesTan v. LagramaJustinePas encore d'évaluation

- 339 Manila Electric Company v. BenamiraDocument2 pages339 Manila Electric Company v. BenamiraRem Serrano0% (1)

- Tan v. LagramaDocument3 pagesTan v. LagramaVica Dela CruzPas encore d'évaluation

- 214 Temic v. TemicDocument3 pages214 Temic v. TemicRabelais MedinaPas encore d'évaluation

- Exodus v. BiscochoDocument2 pagesExodus v. BiscochoKaren Ryl Lozada Brito100% (1)

- Penaranda vs. Baganga Plywood CorpDocument2 pagesPenaranda vs. Baganga Plywood CorpZaira Gem GonzalesPas encore d'évaluation

- Caltex Regular Employees at Manila Office v. Caltex, Inc. (Diegst)Document1 pageCaltex Regular Employees at Manila Office v. Caltex, Inc. (Diegst)Tini GuanioPas encore d'évaluation

- Maria Carmela P. Umali vs. Hobbywing Solutions, IncDocument7 pagesMaria Carmela P. Umali vs. Hobbywing Solutions, IncErole John AtienzaPas encore d'évaluation

- Temic Automotive Phils. vs. Temic Automotive Phils. Inc. Employee Union-FFWDocument2 pagesTemic Automotive Phils. vs. Temic Automotive Phils. Inc. Employee Union-FFWtalla aldover100% (4)

- Peñaranda v. Baganga Plywood Corp.Document2 pagesPeñaranda v. Baganga Plywood Corp.RNicolo BallesterosPas encore d'évaluation

- Universal Corn Products v NLRC | Christmas Bonus Dispute ResolvedDocument2 pagesUniversal Corn Products v NLRC | Christmas Bonus Dispute ResolvedglainarvacanPas encore d'évaluation

- Serrano v. Severino Santos Transit, August 9, 2010 (MARIANO)Document4 pagesSerrano v. Severino Santos Transit, August 9, 2010 (MARIANO)Miguel Joshua Gange AguirrePas encore d'évaluation

- Babas Vs Lorenzo Shipping DigestDocument2 pagesBabas Vs Lorenzo Shipping DigestKathleen Kay de GuzmanPas encore d'évaluation

- PAL v. LiganDocument4 pagesPAL v. Liganmarie melanie BuenaventuraPas encore d'évaluation

- Quintanar V Coca ColaDocument2 pagesQuintanar V Coca ColaSocPas encore d'évaluation

- Labor Law 1: Independent Contractors vs. Labor-Only ContractorsDocument2 pagesLabor Law 1: Independent Contractors vs. Labor-Only ContractorsJay-ar Rivera Badulis100% (2)

- Manila Electric Company V BenamiraDocument2 pagesManila Electric Company V BenamiraRea Nina OcfemiaPas encore d'évaluation

- PAL labor-only contractor ruling (2008Document1 pagePAL labor-only contractor ruling (2008ajyu100% (2)

- Orozco vs. Fifth Division of The Court of Appeals 562 SCRA 36, August 13, 2008 Case DigestDocument3 pagesOrozco vs. Fifth Division of The Court of Appeals 562 SCRA 36, August 13, 2008 Case DigestAnna Bea Datu Geronga100% (2)

- Caltex Union v. CaltexDocument2 pagesCaltex Union v. CaltexKim Michael de JesusPas encore d'évaluation

- 13 Month Pay - Central Azucarera Vs Central Azucarera UnionDocument2 pages13 Month Pay - Central Azucarera Vs Central Azucarera UnionJolet Paulo Dela CruzPas encore d'évaluation

- Philippine Spring Water v CA Ruling on Regular Employment StatusDocument3 pagesPhilippine Spring Water v CA Ruling on Regular Employment StatusEdeline CosicolPas encore d'évaluation

- Rada Vs NLRCDocument1 pageRada Vs NLRCJohnde MartinezPas encore d'évaluation

- Shell Company night shift pay disputeDocument2 pagesShell Company night shift pay disputetalla aldoverPas encore d'évaluation

- NAWASA V NAWASA Consolidated UnionDocument2 pagesNAWASA V NAWASA Consolidated UnionIan AuroPas encore d'évaluation

- Manila Electric Company Vs BenamiraDocument2 pagesManila Electric Company Vs BenamiraFrancis PunoPas encore d'évaluation

- Leyte Geothermal Power Progressive Vs PNOC 2011 DigestDocument2 pagesLeyte Geothermal Power Progressive Vs PNOC 2011 DigestEmmanuel OrtegaPas encore d'évaluation

- Allan Bazar Vs RuizolDocument3 pagesAllan Bazar Vs Ruizolopep77Pas encore d'évaluation

- 13 (10) Manila Memorial Park Cemetery v. LuizDocument3 pages13 (10) Manila Memorial Park Cemetery v. LuizJoe RealPas encore d'évaluation

- Dasco vs. PhiltrancoDocument2 pagesDasco vs. PhiltrancoChristine Gel MadrilejoPas encore d'évaluation

- Antonio W. Iran v. NLRC: (G.R. No. 121927 April 22, 1998)Document3 pagesAntonio W. Iran v. NLRC: (G.R. No. 121927 April 22, 1998)attyyang100% (1)

- Manila Electric Company vs. Rogelio Benamira, Et AlDocument4 pagesManila Electric Company vs. Rogelio Benamira, Et AlMacPas encore d'évaluation

- Villamaria JR Vs CADocument2 pagesVillamaria JR Vs CAClarissa SawaliPas encore d'évaluation

- (3.) Interphil Laboratories Employees Union (Digest)Document2 pages(3.) Interphil Laboratories Employees Union (Digest)Dom Robinson BaggayanPas encore d'évaluation

- 25.tan vs. Lagrama, G.R. No. 151228 Aug. 15, 2002Document11 pages25.tan vs. Lagrama, G.R. No. 151228 Aug. 15, 2002MykaPas encore d'évaluation

- Interphil Laboratories Employees Union DisputeDocument3 pagesInterphil Laboratories Employees Union DisputelorenbeatulalianPas encore d'évaluation

- Teng V Pahagac. Nov. 17, 2010Document3 pagesTeng V Pahagac. Nov. 17, 2010JM PabustanPas encore d'évaluation

- 203 National Semiconductor Distribution v. NLRCDocument1 page203 National Semiconductor Distribution v. NLRCNN DDLPas encore d'évaluation

- Abbott Lab V Alcaraz Case DigestDocument3 pagesAbbott Lab V Alcaraz Case Digestyasuren20% (1)

- Project Employees Not Regular Under Fixed Term ContractsDocument1 pageProject Employees Not Regular Under Fixed Term ContractsMark Oliver EvangelistaPas encore d'évaluation

- Digest Interphil Laboratories Employees Union v. Interphil Laboratories IncDocument6 pagesDigest Interphil Laboratories Employees Union v. Interphil Laboratories IncLoi VillarinPas encore d'évaluation

- Atlanta Industries Inc v. Sebolino (Digest)Document2 pagesAtlanta Industries Inc v. Sebolino (Digest)Christian Paul ChungtuycoPas encore d'évaluation

- SMC VS. ABALLADocument2 pagesSMC VS. ABALLAheinnahPas encore d'évaluation

- Manila Terminal Co. Inc. v. CIRDocument3 pagesManila Terminal Co. Inc. v. CIRrebellefleurme100% (1)

- Nitto Vs NLRC DigestDocument4 pagesNitto Vs NLRC DigestRal CaldiPas encore d'évaluation

- Far East Agricultural Supply Inc V LabatiqueDocument7 pagesFar East Agricultural Supply Inc V LabatiqueAdrian Olaguer AguasPas encore d'évaluation

- Apex Mining Co. V NLRC PDFDocument2 pagesApex Mining Co. V NLRC PDFPaulo TapallaPas encore d'évaluation

- Abasolo Vs NLRCDocument1 pageAbasolo Vs NLRCcarlos codizalPas encore d'évaluation

- Ebro III Vs NLRCDocument6 pagesEbro III Vs NLRCJim ReyPas encore d'évaluation

- Auto Bus Transport Systems V BautistaDocument1 pageAuto Bus Transport Systems V BautistaDanika S. SantosPas encore d'évaluation

- Twelve-Hour Shift Overtime DisputeDocument1 pageTwelve-Hour Shift Overtime DisputeMichael RentozaPas encore d'évaluation

- Trans-Asia Phil Employees Association (TAPEA) v. NLRCDocument3 pagesTrans-Asia Phil Employees Association (TAPEA) v. NLRCslumbaPas encore d'évaluation

- Congson V NLRCDocument2 pagesCongson V NLRCNeapolle FleurPas encore d'évaluation

- Cebu Marine Beach Resort Vs NLRC, YAMBAODocument3 pagesCebu Marine Beach Resort Vs NLRC, YAMBAOMaCai YambaoPas encore d'évaluation

- Villamaria v. Court of AppealsDocument2 pagesVillamaria v. Court of Appealsapbuera100% (1)

- Asserted That Lagrama Was An Independent Contractor As He Was Paid in Piece-Work Basis. Issue Is WON Lagrama Is An Independent Contractor or AnDocument2 pagesAsserted That Lagrama Was An Independent Contractor As He Was Paid in Piece-Work Basis. Issue Is WON Lagrama Is An Independent Contractor or AnGia DimayugaPas encore d'évaluation

- 1 Wages Case DigestDocument26 pages1 Wages Case DigestReino CabitacPas encore d'évaluation

- Tan vs Lagrama employer-employee relationshipDocument2 pagesTan vs Lagrama employer-employee relationshipSteph ParadisePas encore d'évaluation

- 2017 Bar Examinations Coverage For Civil LawDocument7 pages2017 Bar Examinations Coverage For Civil Lawscartoneros_1Pas encore d'évaluation

- Associated Insurance Vs Iya (103 Phil 972)Document1 pageAssociated Insurance Vs Iya (103 Phil 972)scartoneros_1Pas encore d'évaluation

- Consorcia Rollon vs. Atty. Camilo NaravalDocument1 pageConsorcia Rollon vs. Atty. Camilo Naravalscartoneros_1Pas encore d'évaluation

- Home Insurance v. EasternDocument8 pagesHome Insurance v. EasternJerome Dela Cruz DayloPas encore d'évaluation

- Carlos Alonzo vs. IAC and Tecla Padua (G.R. No. 72873Document1 pageCarlos Alonzo vs. IAC and Tecla Padua (G.R. No. 72873scartoneros_1Pas encore d'évaluation

- MTRCB V Abs-Cbn (GR 155282)Document1 pageMTRCB V Abs-Cbn (GR 155282)scartoneros_1Pas encore d'évaluation

- Bangalisan v. Court of AppealsDocument2 pagesBangalisan v. Court of Appealsscartoneros_1100% (1)

- People Vs Wong - FulltextDocument2 pagesPeople Vs Wong - Fulltextscartoneros_1Pas encore d'évaluation

- Consorcia Rollon vs. Atty. Camilo NaravalDocument1 pageConsorcia Rollon vs. Atty. Camilo Naravalscartoneros_1100% (1)

- Soriano v. Dizon (AC 6792)Document2 pagesSoriano v. Dizon (AC 6792)scartoneros_1100% (6)

- Financial Rehabilitation and Insolvency Act of 2010Document6 pagesFinancial Rehabilitation and Insolvency Act of 2010scartoneros_1Pas encore d'évaluation

- CIR Vs Anglo California National Bank - FulltextDocument1 pageCIR Vs Anglo California National Bank - Fulltextscartoneros_1Pas encore d'évaluation

- Bayani Vs PeopleDocument3 pagesBayani Vs Peoplescartoneros_1Pas encore d'évaluation

- Bayani Vs PeopleDocument3 pagesBayani Vs Peoplescartoneros_1Pas encore d'évaluation

- Foreign Corp Capacity to SueDocument2 pagesForeign Corp Capacity to Suescartoneros_1Pas encore d'évaluation

- Boudard Vs Tait - FulltextDocument2 pagesBoudard Vs Tait - Fulltextscartoneros_1Pas encore d'évaluation

- BPI Vs CADocument5 pagesBPI Vs CAscartoneros_1Pas encore d'évaluation

- Ang Tek Lian Vs CADocument2 pagesAng Tek Lian Vs CAscartoneros_1Pas encore d'évaluation

- Roehr Vs Rodriguez - FulltextDocument3 pagesRoehr Vs Rodriguez - Fulltextscartoneros_1Pas encore d'évaluation

- Yang Vs CADocument4 pagesYang Vs CAscartoneros_1Pas encore d'évaluation

- Ang Tek Lian Vs CADocument2 pagesAng Tek Lian Vs CAscartoneros_1Pas encore d'évaluation

- Structure of Legal Interview - Q &Document2 pagesStructure of Legal Interview - Q &scartoneros_1Pas encore d'évaluation

- Bayani Vs PeopleDocument3 pagesBayani Vs Peoplescartoneros_1Pas encore d'évaluation

- Wong Woo Yu Vs Vivo - FulltextDocument1 pageWong Woo Yu Vs Vivo - Fulltextscartoneros_1Pas encore d'évaluation

- Ang Tek Lian Vs CADocument2 pagesAng Tek Lian Vs CAscartoneros_1Pas encore d'évaluation

- Time Inc. Vs Reyes - FulltextDocument4 pagesTime Inc. Vs Reyes - Fulltextscartoneros_1Pas encore d'évaluation

- Ang Tek Lian Vs CADocument2 pagesAng Tek Lian Vs CAscartoneros_1Pas encore d'évaluation

- Ra 9285Document17 pagesRa 9285Jacinto Jr JameroPas encore d'évaluation

- Filipinas Compania Vs Christern - FulltextDocument2 pagesFilipinas Compania Vs Christern - Fulltextscartoneros_1Pas encore d'évaluation

- State Investment House Inc. Vs Citibank - FulltextDocument4 pagesState Investment House Inc. Vs Citibank - Fulltextscartoneros_1Pas encore d'évaluation

- The Employees' State Insurance Act - 1948Document2 pagesThe Employees' State Insurance Act - 1948Prem Shankar GuptaPas encore d'évaluation

- Funeral bpn-103 PDFDocument2 pagesFuneral bpn-103 PDFHazel SabadlabPas encore d'évaluation

- HR 03Document3 pagesHR 03Sudhan R0% (1)

- Employee Engagement - ActivitiesDocument3 pagesEmployee Engagement - ActivitiesVikashini VivekPas encore d'évaluation

- Position Paper LaborDocument5 pagesPosition Paper LaborKim Andaya-YapPas encore d'évaluation

- Employee Relations TescoDocument2 pagesEmployee Relations TescoJosephine Benjamin100% (1)

- Study of Talent Acquisition Practices A PDFDocument6 pagesStudy of Talent Acquisition Practices A PDFRiya PaliwalPas encore d'évaluation

- Getting Employment Based Green CardDocument4 pagesGetting Employment Based Green CardRahulPas encore d'évaluation

- Questionnaire On Employee MotivationDocument3 pagesQuestionnaire On Employee MotivationKharim Beine0% (1)

- University of Pangasinan Faculty Union Vs University of PangasinanDocument2 pagesUniversity of Pangasinan Faculty Union Vs University of PangasinanDeriq DavidPas encore d'évaluation

- SSSForm Funeral ClaimDocument2 pagesSSSForm Funeral ClaimRenmar John Abagat0% (1)

- 04 - Industrial Safety and Legislative ActsDocument40 pages04 - Industrial Safety and Legislative ActsKishor Patil100% (1)

- Models of Organizational BehaviorDocument27 pagesModels of Organizational BehaviorMenandro Calangian Oba Jr.Pas encore d'évaluation

- Effective Employee Communication MethodsDocument2 pagesEffective Employee Communication Methodskannan KPas encore d'évaluation

- Personal Learning PaperDocument5 pagesPersonal Learning PaperRavi Hariharan100% (1)

- KU Undergraduate Application FormDocument4 pagesKU Undergraduate Application FormDenley Kim50% (2)

- Lorenzo Shipping Corporation Ordered to Reinstate WorkersDocument2 pagesLorenzo Shipping Corporation Ordered to Reinstate Workersfrank zappaPas encore d'évaluation

- China Visa FormDocument4 pagesChina Visa FormAhmed GhoneimPas encore d'évaluation

- Mas 21226 SolutionDocument14 pagesMas 21226 SolutionAditiPas encore d'évaluation

- Declaration of Employment TerminationDocument3 pagesDeclaration of Employment TerminationManu IvanPas encore d'évaluation

- PAYE Modernisation Submission: Intelligo Software LimitedDocument13 pagesPAYE Modernisation Submission: Intelligo Software LimitedJasperMelPas encore d'évaluation

- Worksafe Rights Responsibilities ChartDocument1 pageWorksafe Rights Responsibilities Chartapi-405286554Pas encore d'évaluation

- Objectives of The StudyDocument4 pagesObjectives of The Studygiraeles100% (3)

- ENTERPRENEURSHIP - CH 16 - Building A New Venture TeamDocument10 pagesENTERPRENEURSHIP - CH 16 - Building A New Venture TeamFelicia MonikaPas encore d'évaluation

- Performance Appraisal CycleDocument11 pagesPerformance Appraisal CycleMunroe BuckPas encore d'évaluation

- Chavez Vs NLRC Et Al Digest: Chavez Vs NLRC, Supreme Packaging Inc, and Alvin Lee GR No. 146530 January 17, 2005 FactsDocument2 pagesChavez Vs NLRC Et Al Digest: Chavez Vs NLRC, Supreme Packaging Inc, and Alvin Lee GR No. 146530 January 17, 2005 FactsfendyPas encore d'évaluation

- Hundred5's Recruiting Metrics TemplateDocument5 pagesHundred5's Recruiting Metrics TemplateViet HoangPas encore d'évaluation

- Case 1 - Group SDM 2Document4 pagesCase 1 - Group SDM 2Hilmi AuliaPas encore d'évaluation

- LEGAL - Employment Contract UK - TemplateDocument3 pagesLEGAL - Employment Contract UK - TemplatemailguzmanPas encore d'évaluation

- SQL ProjectDocument4 pagesSQL ProjectDesis Pran100% (1)