Académique Documents

Professionnel Documents

Culture Documents

Fernando Gonzales - ECB

Transféré par

Machaca Alvaro MamaniDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fernando Gonzales - ECB

Transféré par

Machaca Alvaro MamaniDroits d'auteur :

Formats disponibles

Rubric Growth

of public and private debt ratios to GDP Public Sector Debt Ratio Private Sector Debt (% of GDP) Ratio (Variation in %)

1999 Euro Area Greece Italy Spain

Portugal

2007 66.4

-07 In % -7.4 13.0 -8.6 -41.8 33.0 -46.8

1

-07 In % 26.8% 217.5% 71.2% 75.2% 48.9% 101.0%

71.7

94.9 107.2 113.0 103.3 62.4 51.4 47.0 36.3 68.4 25.0

Ireland

Rubric

Cumulative growth of total exposure of banks from non-stressed to stressed countries (1999=100)

600 500 400 300 200 100 0 99 00 01 02 03 04 05 06 07 08 09 10 12

Total 1999=100

Total exposure of banks from nonstressed to stressed countries in % of respective GDP levels

60.0 50.0 40.0 30.0 20.0 10.0 99 00 01 02 03 04 05 06 07 08 09 10 12

% GDP S % GDP DC Countries GDP non-S %% GDP non-DC Countries

Rubric

Total exposure of banks from non-stressed to stressed countries in % of their GDP

200 180 160 140 120 100 80 60 40 20 0

99 00 01 02 03 04 05

3

CY IT

ES&PT

GR

06 07 08 09 10 12

Rubric

Cumulative growth of bank credit to the private sector in stressed countries 900

800 700 600 500 400 300 200 100 0 98 99 00 01 02 03 04 05 06

4

IE GR ES IT PT

07

08

09

10

12

12

Rubric

Rebalancing in the euro area Adjustment in the periphery: public finance

Total Primary government Change in Change in government nominal nominal structural nominal budget primary primary balance 2012 balance 2012 balance balance (as a % of (as a % of 2009-2012 (%) 2009-2012 (%) GDP) GDP) Greece Spain Ireland Portugal Italy Euro area -10.0 -10.6 -7.6 -6.4 -3.0 -3.7 -5.0 -7.7 -3.9 -2.0 2.6 -0.6 5.5 1.7 7.9 5.3 3.3 2.9 10.6 2.0 6.6 5.7 3.1 2.2

Source: European Economic Forecast, Spring 2013, European Commission

5

Rubric

Projected 2010 to 2060 changes in age-related expenditure (as a % of GDP)

Projected total changes 20102060 (pensions, health care, education, unemployment): Small < 2% IT, EE, PT 2< Medium < 6% GR, FR, ES, AT, DE, IE, NL Large > 6% FI, SK, MT, CY, BE, SI, LU

Source: Fiscal Sustainability Report 2012, European Commission

6

Rubric

Rebalancing in the euro area ULC deflated real effective exchange rates across countries

Percentage changes 1999Q4 to 2012Q3 Percentage changes 2008Q4 to 2012Q3

Source: ECB harmonised competitiveness indicators Increases (decreases) in the real effective exchange rate signal a worsening (improvement) in competitiveness

7

Rubric

Rebalancing in the euro area Evolution of external borrowing (-) / lending (+) since 1999

(in % of GDP)

Source: European Commission (February 2013)

Rubric

Rebalancing in the euro area

External borrowing / lending requirements in selected euro area countries

Exports of goods and External borrowing External borrowing Change from 2009 services (vol) (-) /lending (+) in (-) /lending (+) in to 2012 (% of GDP) cumulative growth 2013 (% of GDP) 2012 (% of GDP) 2009-2012 (in %) (forecast)

Country

Italy Spain Greece Ireland Portugal Slovenia Euro area

-0.6 -1.5 -5.5 2.1 -1.2 2.0 1.5

1.4 2.8 7.7 5.2 8.4 2.4 1.4

20.6 23.5 3.0 15.0 22.0 18.2 21.4

1.1 2.2 -1.1 1.8 1.8 4.8 2.6

Source: European Economic Forecast, Spring 2013, European Commission

9

Rubric

Rebalancing costs in the euro area Youth unemployment rates across countries

Euro area youth unemployment stressed vs non-stressed countries

(% of labour force of the relevant age group)

Youth unemployment rates across countries

(% of labour force of the relevant age group)

Feb. 2008 2009 2010 2011 2012 2013* Greece Portugal Ireland Spain Italy Cyprus Slovenia 22.1 20.2 13.3 24.6 21.3 9.0 10.4 25.8 24.8 24.0 37.8 25.4 13.8 13.6 11.2 20.3 32.9 27.7 27.6 41.6 27.8 16.6 14.7 9.9 20.9 44.4 30.1 29.1 46.4 29.1 22.4 15.7 8.6 20.8 55.4 37.7 30.4 53.2 35.3 27.8 20.6 8.1 23.1 58.4 38.2 30.8 55.7 37.8 31.8 23.2 7.7 23.9

Germany 10.6 Euro area 16.0

Source: Eurostat * December 2012 for Greece and Cyprus

Source: Eurostat Note: Stressed countries: GR, PT, IE, ES, IT, CY and SI

10

Vous aimerez peut-être aussi

- The Eurozone CrisisDocument39 pagesThe Eurozone CrisisPetros NikolaouPas encore d'évaluation

- Euro Area Economic Situation and The Foundations For GrowthDocument15 pagesEuro Area Economic Situation and The Foundations For GrowthXavier StraussPas encore d'évaluation

- What Is The Economic Outlook For OECD Countries?: Angel GurríaDocument22 pagesWhat Is The Economic Outlook For OECD Countries?: Angel GurríaJohn RothePas encore d'évaluation

- The Greek Economy Under Reform: Turning The TideDocument16 pagesThe Greek Economy Under Reform: Turning The TideNicholas VentourisPas encore d'évaluation

- PIGS Countries' New Challenges Under Europe 2020 Strategy: Danubius University of Galati, Faculty of EconomicsDocument10 pagesPIGS Countries' New Challenges Under Europe 2020 Strategy: Danubius University of Galati, Faculty of EconomicsЕлизавета МиняйленкоPas encore d'évaluation

- Fiscal Sustainability Report: European Economy 8 - 2012Document212 pagesFiscal Sustainability Report: European Economy 8 - 2012AdolfoSehnertPas encore d'évaluation

- 2012-03-19 Greece Is Changing Updated Mar 2012Document64 pages2012-03-19 Greece Is Changing Updated Mar 2012guiguichardPas encore d'évaluation

- En Presentation Merrill Lynch Oct2011 Presentation Banco SabadellDocument35 pagesEn Presentation Merrill Lynch Oct2011 Presentation Banco SabadellseyviarPas encore d'évaluation

- Labour Costs Highest in The Financial and Insurance SectorDocument7 pagesLabour Costs Highest in The Financial and Insurance SectorTurcan Ciprian SebastianPas encore d'évaluation

- National Economic Accounts Prov2012 170513Document30 pagesNational Economic Accounts Prov2012 170513Vassos KoutsioundasPas encore d'évaluation

- Η ΑΠΑΤΗ ΤΟΥ ΠΡΩΤΟΓΕΝΟΥΣ ΠΛΕΟΝΑΣΜΑΤΟΣDocument3 pagesΗ ΑΠΑΤΗ ΤΟΥ ΠΡΩΤΟΓΕΝΟΥΣ ΠΛΕΟΝΑΣΜΑΤΟΣMarios MarinakosPas encore d'évaluation

- The EU's Fiscal Crisis and Policy Response: Reforming Economic Governance in The EUDocument39 pagesThe EU's Fiscal Crisis and Policy Response: Reforming Economic Governance in The EUAlexandra Maria CiorsacPas encore d'évaluation

- Laboratory Work Nr. 3: Time Series and ForecastingDocument10 pagesLaboratory Work Nr. 3: Time Series and ForecastingNataliaPas encore d'évaluation

- Kwartaalupdate Kwetsbaarheidsindicator Publieke Financiën (SVI)Document9 pagesKwartaalupdate Kwetsbaarheidsindicator Publieke Financiën (SVI)KBC EconomicsPas encore d'évaluation

- 149/2009 - 22 October 2009Document12 pages149/2009 - 22 October 2009edo-peiraias.blogspot.comPas encore d'évaluation

- Economic Overview of GreeceDocument5 pagesEconomic Overview of GreeceRavi PandyaPas encore d'évaluation

- Unele Aspecte Ale Ajustarii Macroeconomice Din RomaniaDocument32 pagesUnele Aspecte Ale Ajustarii Macroeconomice Din RomaniaIulia FlorescuPas encore d'évaluation

- ESSQR Sep-2014 Sup BeyondGDP Format Rev5Document20 pagesESSQR Sep-2014 Sup BeyondGDP Format Rev5EduardIancuPas encore d'évaluation

- The Greek Economy & Its Stability Programme: Written byDocument44 pagesThe Greek Economy & Its Stability Programme: Written bypapaki2Pas encore d'évaluation

- France's Economic Background: InflationDocument5 pagesFrance's Economic Background: InflationMis Alina DenisaPas encore d'évaluation

- United Kingdom EconomyDocument4 pagesUnited Kingdom EconomyGobinath MannPas encore d'évaluation

- 9708 - s12 - QP - 41 - Case Study ResponseDocument7 pages9708 - s12 - QP - 41 - Case Study ResponseZainab SiddiquePas encore d'évaluation

- Economic Fact Book Greece: Key FactsDocument8 pagesEconomic Fact Book Greece: Key Factslevel3assetsPas encore d'évaluation

- p130309 Brazil World CrisisDocument24 pagesp130309 Brazil World CrisisHassaan QaziPas encore d'évaluation

- Euro Area and EU27 Government Deficit at 6.2% and 6.6% of GDP RespectivelyDocument14 pagesEuro Area and EU27 Government Deficit at 6.2% and 6.6% of GDP Respectivelyanakatiuska81Pas encore d'évaluation

- Individual Problem SET 1Document6 pagesIndividual Problem SET 1Bùi Hoài NhânPas encore d'évaluation

- Government Debt Down To 86.1% of GDP in Euro Area: Third Quarter of 2018 Compared With Second Quarter of 2018Document4 pagesGovernment Debt Down To 86.1% of GDP in Euro Area: Third Quarter of 2018 Compared With Second Quarter of 2018nermin3807Pas encore d'évaluation

- Government Debt Fell To 86.7% of GDP in Euro Area: Fourth Quarter of 2017 Compared With Third Quarter of 2017Document4 pagesGovernment Debt Fell To 86.7% of GDP in Euro Area: Fourth Quarter of 2017 Compared With Third Quarter of 2017Alyss AlysikPas encore d'évaluation

- Deuda Pública en UEDocument4 pagesDeuda Pública en UEelenaPas encore d'évaluation

- Country Strategy 2011-2014 GreeceDocument19 pagesCountry Strategy 2011-2014 GreeceBeeHoofPas encore d'évaluation

- FinlandDocument2 pagesFinlandabhikmehta2Pas encore d'évaluation

- France 2019 OECD Economic Survey OverviewDocument66 pagesFrance 2019 OECD Economic Survey OverviewAntónio J. CorreiaPas encore d'évaluation

- Root Cause of Greek Debt CrisisDocument28 pagesRoot Cause of Greek Debt CrisisKrishna KanthPas encore d'évaluation

- Market OverviewDocument14 pagesMarket OverviewAyo TundePas encore d'évaluation

- Spain Kingdom ofDocument23 pagesSpain Kingdom ofplangintzaestrategikoaPas encore d'évaluation

- Euro Area Government Deficit at 0.5% and EU28 at 0.6% of GDPDocument9 pagesEuro Area Government Deficit at 0.5% and EU28 at 0.6% of GDPEconomy 365Pas encore d'évaluation

- European Austerity SocGenDocument29 pagesEuropean Austerity SocGenHonza MynarPas encore d'évaluation

- Analyzing The Real GDP of European Countries Per Capita From 2000 To 2022 - Seyed Hossein Khademalsharieh 904017Document5 pagesAnalyzing The Real GDP of European Countries Per Capita From 2000 To 2022 - Seyed Hossein Khademalsharieh 904017sehokhadem03Pas encore d'évaluation

- Euro Area and EU27 Government Deficit at 4.1% and 4.5% of GDP RespectivelyDocument16 pagesEuro Area and EU27 Government Deficit at 4.1% and 4.5% of GDP RespectivelyRaluca MarciucPas encore d'évaluation

- FranceDocument12 pagesFranceMusfequr Rahman (191051015)Pas encore d'évaluation

- Industrial Production Down by 0.6% in Euro AreaDocument6 pagesIndustrial Production Down by 0.6% in Euro AreaeconomicdelusionPas encore d'évaluation

- Europe 2020 Targets: (Public Sector Only)Document3 pagesEurope 2020 Targets: (Public Sector Only)Lenna ZabaPas encore d'évaluation

- Euro Area Unemployment at 7.0%: December 2021Document6 pagesEuro Area Unemployment at 7.0%: December 2021Hristina ZarevaPas encore d'évaluation

- The Global Debt ProblemDocument3 pagesThe Global Debt Problemrichardck61Pas encore d'évaluation

- Week 5 Slides SLDocument57 pagesWeek 5 Slides SLSimraann 24Pas encore d'évaluation

- Sovereign Risk and The Euro: Lorenzo Bini Smaghi Member of The Executive Board European Central BankDocument66 pagesSovereign Risk and The Euro: Lorenzo Bini Smaghi Member of The Executive Board European Central BankVivian Vy LêPas encore d'évaluation

- GDP Down by 12.1% and Employment Down by 2.8% in The Euro AreaDocument4 pagesGDP Down by 12.1% and Employment Down by 2.8% in The Euro AreaOrestis VelmachosPas encore d'évaluation

- Euro Area Government Debt Down To 92.7% of GDP, EU28 Up To 86.8% of GDPDocument4 pagesEuro Area Government Debt Down To 92.7% of GDP, EU28 Up To 86.8% of GDPDonfp ProdPas encore d'évaluation

- Cr2015 Belgium enDocument89 pagesCr2015 Belgium enIlias MansouriPas encore d'évaluation

- Comparison of UAE and French EconomyDocument16 pagesComparison of UAE and French EconomyuowdubaiPas encore d'évaluation

- Public Debt/Sovereign Debt/Government Debt: The Euro-Zone PerspectiveDocument5 pagesPublic Debt/Sovereign Debt/Government Debt: The Euro-Zone PerspectiveNehaPas encore d'évaluation

- Hourly Labour Costs Ranged From 5.4 To 43.5 Across The EU Member States in 2018Document4 pagesHourly Labour Costs Ranged From 5.4 To 43.5 Across The EU Member States in 2018vengadeshPas encore d'évaluation

- The Packaging Sector in Croatia 2014Document80 pagesThe Packaging Sector in Croatia 2014manojPas encore d'évaluation

- An Phríomh-Oifig StaidrimhDocument98 pagesAn Phríomh-Oifig StaidrimhPolitico_iePas encore d'évaluation

- MACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhDocument14 pagesMACRO ASSIGNMENT ABAS HASSAN ALI Mid Ka Saxda AhCabaas XasanPas encore d'évaluation

- Current Economic Indicators - Euro ZoneDocument2 pagesCurrent Economic Indicators - Euro ZoneShiva DuttaPas encore d'évaluation

- 2 08062023 Ap enDocument10 pages2 08062023 Ap enrehanpinjara32Pas encore d'évaluation

- EIB Investment Survey 2022 - European Union overviewD'EverandEIB Investment Survey 2022 - European Union overviewPas encore d'évaluation

- Investment Report 2022/2023 - Key Findings: Resilience and renewal in EuropeD'EverandInvestment Report 2022/2023 - Key Findings: Resilience and renewal in EuropePas encore d'évaluation

- EIB Investment Survey 2023 - European Union overviewD'EverandEIB Investment Survey 2023 - European Union overviewPas encore d'évaluation

- Syllabusfall 11 Econ 310 Section 101Document5 pagesSyllabusfall 11 Econ 310 Section 101Machaca Alvaro MamaniPas encore d'évaluation

- Organigrama MHDocument1 pageOrganigrama MHMachaca Alvaro MamaniPas encore d'évaluation

- 3equation Book ChapterDocument26 pages3equation Book Chaptereco_alvaroPas encore d'évaluation

- Econ 201 Fall 01 SyllabusDocument2 pagesEcon 201 Fall 01 SyllabusMachaca Alvaro MamaniPas encore d'évaluation

- Syl 09Document2 pagesSyl 09Machaca Alvaro MamaniPas encore d'évaluation

- Asset Pricing Solutions: 1 Problem 1Document19 pagesAsset Pricing Solutions: 1 Problem 1Machaca Alvaro MamaniPas encore d'évaluation

- 741 ps1, 2010Document3 pages741 ps1, 2010Machaca Alvaro MamaniPas encore d'évaluation

- SyllabusDocument3 pagesSyllabusMachaca Alvaro MamaniPas encore d'évaluation

- Lecture 11Document20 pagesLecture 11Machaca Alvaro MamaniPas encore d'évaluation

- Lecture 10Document15 pagesLecture 10Machaca Alvaro MamaniPas encore d'évaluation

- ChileDocument14 pagesChilepankajmishra802002Pas encore d'évaluation

- Lecture 10Document15 pagesLecture 10Machaca Alvaro MamaniPas encore d'évaluation

- Lecture 12Document26 pagesLecture 12Machaca Alvaro MamaniPas encore d'évaluation

- Advanced International Economics Advanced International EconomicsDocument13 pagesAdvanced International Economics Advanced International EconomicsMachaca Alvaro MamaniPas encore d'évaluation

- Lecture 12Document26 pagesLecture 12Machaca Alvaro MamaniPas encore d'évaluation

- Advanced International Economics Advanced International EconomicsDocument13 pagesAdvanced International Economics Advanced International EconomicsMachaca Alvaro MamaniPas encore d'évaluation

- Lecture 4Document12 pagesLecture 4Machaca Alvaro MamaniPas encore d'évaluation

- Ad Dit Ti Le I Ad Dit Ti Le I Advanced International Economics Advanced International EconomicsDocument14 pagesAd Dit Ti Le I Ad Dit Ti Le I Advanced International Economics Advanced International EconomicsMachaca Alvaro MamaniPas encore d'évaluation

- Lecture 10Document15 pagesLecture 10Machaca Alvaro MamaniPas encore d'évaluation

- Advanced International Economics Advanced International EconomicsDocument14 pagesAdvanced International Economics Advanced International EconomicsMachaca Alvaro MamaniPas encore d'évaluation

- Ad Dit Ti Le I Ad Dit Ti Le I Advanced International Economics Advanced International EconomicsDocument14 pagesAd Dit Ti Le I Ad Dit Ti Le I Advanced International Economics Advanced International EconomicsMachaca Alvaro MamaniPas encore d'évaluation

- Advanced International Economics Advanced International EconomicsDocument14 pagesAdvanced International Economics Advanced International EconomicsMachaca Alvaro MamaniPas encore d'évaluation

- Ad Dit Ti Le I Ad Dit Ti Le I Advanced International Economics Advanced International EconomicsDocument11 pagesAd Dit Ti Le I Ad Dit Ti Le I Advanced International Economics Advanced International EconomicsMachaca Alvaro MamaniPas encore d'évaluation

- Advanced International Economics Advanced International EconomicsDocument14 pagesAdvanced International Economics Advanced International EconomicsMachaca Alvaro MamaniPas encore d'évaluation

- Adv Macro Lec 1Document29 pagesAdv Macro Lec 1Machaca Alvaro MamaniPas encore d'évaluation

- FHC Carne Asada TortasDocument1 pageFHC Carne Asada TortasMachaca Alvaro MamaniPas encore d'évaluation

- 1 Why Are We Interested in Economic Growth?: Advanced Macroeconomics, ECON 402Document11 pages1 Why Are We Interested in Economic Growth?: Advanced Macroeconomics, ECON 402Machaca Alvaro MamaniPas encore d'évaluation

- Adv Macro Lec 4Document17 pagesAdv Macro Lec 4Machaca Alvaro MamaniPas encore d'évaluation

- Adv Macro Lec 5Document14 pagesAdv Macro Lec 5Machaca Alvaro MamaniPas encore d'évaluation

- Sopas & Ensaladas: CombinacionesDocument1 pageSopas & Ensaladas: CombinacionesMachaca Alvaro MamaniPas encore d'évaluation

- Note 6 Situs (Sources) of IncomeDocument3 pagesNote 6 Situs (Sources) of IncomeJason Robert MendozaPas encore d'évaluation

- 2015-16 1st Semester Last Update Jan 2016Document3 pages2015-16 1st Semester Last Update Jan 2016Scott SanettPas encore d'évaluation

- Remedial Law Q and ADocument17 pagesRemedial Law Q and Akonvan100% (2)

- HSE Policy Statement, SchlumbergerDocument1 pageHSE Policy Statement, SchlumbergerProf C.S.PurushothamanPas encore d'évaluation

- GM 4Q W4Document24 pagesGM 4Q W4Charmaine GatchalianPas encore d'évaluation

- Revision Guide For AMD Athlon 64 and AMD Opteron Processors: Publication # Revision: Issue DateDocument85 pagesRevision Guide For AMD Athlon 64 and AMD Opteron Processors: Publication # Revision: Issue DateSajith Ranjeewa SenevirathnePas encore d'évaluation

- महारा दुकाने व आ थापना (नोकर चे व सेवाशत चे व नयमन) नयम, २०१८ Form - ‘F'Document3 pagesमहारा दुकाने व आ थापना (नोकर चे व सेवाशत चे व नयमन) नयम, २०१८ Form - ‘F'First EnterprisesPas encore d'évaluation

- Week 13 - Local Government (Ra 7160) and DecentralizationDocument4 pagesWeek 13 - Local Government (Ra 7160) and DecentralizationElaina JoyPas encore d'évaluation

- SullivanDocument7 pagesSullivanHtaed TnawiPas encore d'évaluation

- As 3789.6-1996 Textiles For Health Care Facilities and Institutions Fabric SpecificationsDocument7 pagesAs 3789.6-1996 Textiles For Health Care Facilities and Institutions Fabric SpecificationsSAI Global - APACPas encore d'évaluation

- Unit 15Document4 pagesUnit 15Oktawia TwardziakPas encore d'évaluation

- Fuji v. Espiritu - CaseDocument21 pagesFuji v. Espiritu - CaseRobeh AtudPas encore d'évaluation

- Solved Consider The Apple Computer Trade Example Given in Section 19 5 NowDocument1 pageSolved Consider The Apple Computer Trade Example Given in Section 19 5 NowM Bilal SaleemPas encore d'évaluation

- BMSICL - PPE TenderDocument55 pagesBMSICL - PPE TenderRafikul RahemanPas encore d'évaluation

- 16+ Zip Oyster Photocard Terms and ConditionsDocument9 pages16+ Zip Oyster Photocard Terms and ConditionsTTMo1Pas encore d'évaluation

- A Theoretical Study of The Constitutional Amendment Process of BangladeshDocument58 pagesA Theoretical Study of The Constitutional Amendment Process of BangladeshMohammad Safirul HasanPas encore d'évaluation

- Statutory InterpretationDocument6 pagesStatutory InterpretationYehaniSesaraPas encore d'évaluation

- 2022 - RCK 2.3Document49 pages2022 - RCK 2.3Udayakumar Subramani Adithya (Stgss)Pas encore d'évaluation

- DoPT Guidelines On Treatment - Regularization of Hospitalization - Quarantine Period During COVID 19 PandemicDocument2 pagesDoPT Guidelines On Treatment - Regularization of Hospitalization - Quarantine Period During COVID 19 PandemictapansPas encore d'évaluation

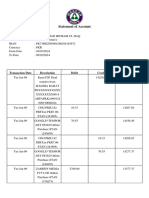

- FullStmt 1706022124583 3310248148699 Ibtisam922Document3 pagesFullStmt 1706022124583 3310248148699 Ibtisam922محمدابتسام الحقPas encore d'évaluation

- London International Model United Nations: A Guide To MUN ResearchDocument6 pagesLondon International Model United Nations: A Guide To MUN ResearchAldhani PutryPas encore d'évaluation

- Albany Authoritative InterpretationDocument26 pagesAlbany Authoritative InterpretationoperationsmlpPas encore d'évaluation

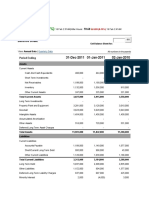

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaPas encore d'évaluation

- Business Associations - Template 3 (Australia)Document26 pagesBusiness Associations - Template 3 (Australia)Marten NguyenPas encore d'évaluation

- Salonga Vs Cruz PanoDocument1 pageSalonga Vs Cruz PanoGeorge Demegillo Rocero100% (3)

- Commercial Cards Add A Cardholder FormDocument3 pagesCommercial Cards Add A Cardholder FormsurePas encore d'évaluation

- CHAP - 02 - Financial Statements of BankDocument72 pagesCHAP - 02 - Financial Statements of BankTran Thanh NganPas encore d'évaluation

- S ThirdlyDocument7 pagesS Thirdlyparveez meerPas encore d'évaluation

- Three Generations By: Nick JoaquinDocument4 pagesThree Generations By: Nick JoaquinSean AbarelesPas encore d'évaluation

- 2 PNOC v. Court of Appeals, 457 SCRA 32Document37 pages2 PNOC v. Court of Appeals, 457 SCRA 32Aivy Christine ManigosPas encore d'évaluation