Académique Documents

Professionnel Documents

Culture Documents

Regional

Transféré par

Witness Wii MujoroCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Regional

Transféré par

Witness Wii MujoroDroits d'auteur :

Formats disponibles

The current issue and full text archive of this journal is available at www.emeraldinsight.com/1753-8394.

htm

Trade and regional integration: analysis of the effectiveness in the GCC

Amzad Hossain and Kamal Naser

College of Business Administration, Al Ain University of Science & Technology, Al Ain, UAE

Abstract

Purpose The purpose of this paper is to analyze the effectiveness of the GCC integration. Design/methodology/approach Both descriptive and comparative analyses are used. In order to measure the effectiveness, indicators like trends of trade, FDI inows, joint venture project activities and technology diffusion are considered. Findings The analyses revealed that the Gulf Cooperation Council (GCC) regularly reviews the collective process of all the proposals to be executed. It also conducts an in-depth analysis of all issues concerning the GCC states and their societies. The analyses also showed increasing trends in exports and imports, and high-tech manufacturing after implementing customs union. In the same fashion, the number of joint venture projects, total capital investment and capital investment per project increase dramatically after executing customs union. The analysis further shows that the investment in large-scale joint venture projects increases during the same period. The paper nds a sharp increase in FDI during the period between 2001 and 2004; within this period, the customs union has been implemented. This increased FDI is mainly due to the fact that the GCC attains enlarged domestic market size and stable economic growth after the GCC integration. The GCC integration also contributes to improve the push and pull factors of FDI that have further attracted increased FDI. The paper shows that the GCC countries have adapted and deployed new technology considerably quickly during the period 1999 to 2005 compared with the 1990s. Practical implications The study noticed improvements in all indicators as well as the push and pull factors that enhance effectiveness of the GCC integration. To attain more effective regional integration, a periodic review of all the issues concerning the GCC states and their societies in light of the advancement taking place in the Arab world and international arenas is vital. Originality/value The study nds that the effectiveness of the GCC integration is progressive. The integrators that measure effectiveness such as trends of trade, FDI inows, joint venture project activities and technology diffusion show increasing trends. Keywords International investment, Integration, Arabian Peninsula, Regional development Paper type Research paper

Trade and regional integration 95

Introduction As a result of the revolution in information technology and globalization, the world market is getting increasingly competitive and complex. Globalization contributes signicantly to the homogenization of consumers tastes, preferences and attitudes as well as the production process. It also eliminates political, economic, and technological barriers contributing to innovation and renovation. With the aim of attaining comparative advantages in ever changing competitive world market, several strategies, policies and initiatives have been implemented around the globe. Regional economic integration is viewed as one of the effective approaches that can be employed to achieve advantages over globalization. Under regional economic integration, economic unity

International Journal of Islamic and Middle Eastern Finance and Management Vol. 1 No. 2, 2008 pp. 95-112 q Emerald Group Publishing Limited 1753-8394 DOI 10.1108/17538390810880964

IMEFM 1,2

96

and cooperation are formed to achieve economic benets. Regional economic integration can also increase the inuence of the member countries in their own areas as well as outside it (Mosad, 1998). Furthermore, economic integration can substantially enlarge domestic markets by attracting foreign direct investment. Thus, the revival of interest in economic integration and cooperation is a worldwide phenomenon (Lavergne, 1997). Currently almost 170 regional integration and trading agreements are in force around the world, with a signicant number of these arrangements mainly involving less developed countries (Crawford and Fiorentino, 2005, quoted by Angeles M. Villarreal, 2005). However, many regional economic integration groups are not in progress or only have occasional meeting or are name oriented. The failure of such regional integration lays on the lack of planning at the governments doorstep, cost-benets of the integration, and the politically motivated allocation of investment (UNCTAD, 1973; quoted by Mytelka, 1997). Contrary to the above, the European Union (EU) and the North American Free Trade Agreement (NAFTA) among Canada, Mexico, and the USA are the most prominent and successful regional integration arrangements (IMF, 1994). The GCC and ASEAN or AFTA are in progress of a successful regional economic cooperation. The Gulf Cooperation Council (GCC) countries predominantly have a small domestic market with huge amounts of petroleum reserve. Such a situation, on the one hand, attracts investment in the petroleum sector from developed countries, and on the other hand, it discourages them to invest in non-oil-based manufacturing or other related sectors. The GCC historic manpower shortage is one of the most important reasons of expatriates involvement in the workforce of these countries. According to Ugo and Zubair (2003), expatriates account for almost three-fourths of the total workforce of the GCC countries. In 1981, GCC integration came into force with the aim of enlarging domestic market, diversifying the oil-based production to the horizons of service and manufacturing-based production, increasing competitiveness of domestic resources, developing intra and extra trade, and attracting foreign direct investment (FDI) in non-oil-based production. It has long been recognized that economic integration is a key to long-run trade development, and economic development at large. However, the effectiveness of the economic integration is measured by the improvements of intra and extra trade, inow of FDI, joint venture project activities and technology diffusion. The improvement of such indicators, in turn, brings their long-term development of trade and the economy as a whole. Thus, it is of paramount importance to analyze indicators like trends of trade, FDI inows, multilateral project activities and technology diffusion. This paper assesses the current GCC integration status, development of trade, FDI inows, joint venture project activities, and diffusion of technology. Some policies and issues related to continuous improvements of GCC ties for attaining their goals are also explored. Literature review It is very difcult to come up with a single straight denition of economic integration. Wikipedia (2006), however, viewed economic integration as a term used to describe how different aspects between economies are integrated. The basics of this theory were written by the Hungarian Economist Bela in the 1960s. As economic integration increases, the barriers of trade between markets diminish. Steven (1997-2004) demonstrated that any

type of arrangement in which countries agree to coordinate their trade, scal, and/or monetary policies is referred to as economic integration. While many others explain that economic integration is a process whereby boundaries between nation-states become less discontinuous (Viner, 1950; Marchal, 1965; Bourenane, 1997; Haile, 2000), thus leading to the formation of more comprehensive systems. In this respect, Viner (1950) pointed out that regional economic integration could lead to either trade creation or trade diversion by reducing trade barriers between neighboring countries to the gradual strengthening of international trade. According to Marchal (1965), integration as a result of development is distinct from integration as an instrument or precondition of development. Economic integration can be perceived as the historical product of evolving technical, economic, and social structures; or it can be the product of conscious efforts on the part of human societies, acting collectively to improve their economic condition as a matter of policy choice (quoted by Bourenane, 1997). Bourenane (1997) believes that regional integration is often perceived as a prelude to unication, understood to represent the existence of homogeneous rules and principles governing behavior in a given spatial area. Haile (2000) noted regional integration as a process involves the merging of industrial structures, economic, and administrative policies of member countries. Such a process is motivated by the recognition that national economic welfare could be enhanced in a more efcient way through such partnership than by adopting unilateral policy at each country level. Economic integration can be, therefore, dened as the association of two or more countries to enhance their mutual economic ties, leading to the growth of economy by coordinating scal policies and resource allocation, spanning regional boundaries to achieve mutual benets. It also enhances cost-effectiveness and overall trade. The World Trade Organizations (WTO) efforts towards globalization tolerate custom unions and free trade agreements in regional integration because they are seen to represent movements towards free trade, as one of the fundamental goals of the WTO. However, there is a disagreement among economists on this ground (Steven, 1997-2004). Ousmane (1997) showed that trade policy has gured prominently in the development and industrialization strategies of developing countries. Trade policy has also conditioned the macroeconomic and sector policies adopted in those countries. The choice of overall development strategy has shaped trading relations between domestic economies and the rest of the world, while having a specic bearing on these countries propensity to trade on regional markets. A signicant amount of empirical work has demonstrated close relationships between country-level macroeconomic and trade policies, as well as the effect of those policies on the overall trade and growth performance (Oyejide, 1986; Avillez et al., 1988; Krueger et al., 1988; Mundlak et al., 1989; Stryker, 1990; Dollar, 1992, quoted by Ousmane, 1997). The pursuit of regional integration implies recognition of the importance of international trade in the development process (Ousmane, 1997). However, much of the conventional literature lays the failure of traditional regional integration schemes squarely at a governments doorstep (UNCTAD, 1973; Robson, 1983; Berg, 1988; quoted by Mytelka, 1997). Two variants of this approach can be found. The rst emphasizes conicts over the costs and benets of integration that bedevil these organizations and the lack of political will to resolve them. The second stresses the economic inefciencies generated by government policy, particularly those associated with attempts at regional industrial planning and the politically motivated allocation of investment (quoted by Mytelka, 1997). There are also some other adverse effects which impede regional integration and trade such as culture, economic dimension and stage of development of the member states.

Trade and regional integration 97

IMEFM 1,2

98

Steven (1997-2004) referred to different degrees of integration (Figure 1). Obviously, the degree of integration relationship depends on mutual trust, respect, shared interest, and responsibility. As such, Mosad (1998) made the point that a strategic economic integration relationship is a relation between people. They are ideally based on shared interest, mutual trustworthiness, and commitment to continue the relationship. Figure 1 illustrates that there are six stages (types) of economic integration: Preferential Trade Agreement (PTA), Free Trade Area (FTA), Customs Union, Common Market, Economic Union, and Monetary Union. The rst three types of integration (PTA, FTA, and Customs Union) are the tariff agreement among the member countries that only promotes trade. The other three types of integration are the agreement that endorses trade along with other responsibilities to further enhance trade. For example, Common Market allows for free mobility of capital and labor across member countries to ensure efcient use of resources and capital for attaining cost effectiveness. This, in turn, upholds trade enhancement of the member countries. In addition to the free mobility of capital and labor across countries and tariff agreement, an Economic Union pays special attention for the protection and/or development of selected sectors. The European Unions Common Agriculture Policy (CAP) is an example of this type of scal coordination. Monetary Union establishes a common currency among the member countries in order to reduce the risk involved in currency exchange. It also facilitates achieving comparative and absolute advantages in trading goods and services among member countries and the rest of the world. The common currency (EURO) of the EU is an example of effective Monetary Union. Thus, it can be argued that all types of economic integration are formed mainly for the development of trade along with other activities that also further enhance trade. It can also be observed from Figure 1 that economic integration is a gradual process that continuously increases ties and coordination among the member states. Under this process, the member countries successfully complete one stage in achieving the next stage of the integration. During the on going stage of integration, an economic integration group continuously rethinks, and evaluates the progress taking into consideration their related factors. It is indispensable as the world business environment, terms of trade, rules, and overall societys needs change rapidly. However, their main goal is to enhance trade along with other related issues in order to reach the nal stage of integration, which is Monetary Union. Economic integration substantially requires the appropriate macro and microeconomic policies: government policies, the liberalization of trade, FDI rules, behavioral, and rm level aspects. It also needs the deregulation of nancial markets, the promotion of domestic competition, a well-matched developmental stage as well as the developments of infrastructure, remarkably transportation and communications. In order to achieve the effectiveness of economic integration all these requirements must be fullled. However, for measuring the effectiveness of the economic integration, intra and extra trade, FDI inows, joint venture project activities and technology diffusion might be considered. The OECD considers international trade, FDI, the activity of multinational rms, and international diffusion of technology as economic globalization indicators (OECD, 2005). Methodology Drawing from the OECDs globalization performance indicators, this study employs four variables as measurement indicators of the effectiveness of the regional economic integration:

Level of Integration

PTA

FTA

CU CM EU MU

Feature & aim Free trade in goods and services, sets common external tariffs among members Free trade in goods and services, sets common external tariffs among members

Tariffs rules Allows free mobility of capital and labor across members

Tariffs reductions, not eliminations for selected products categories; nondiscriminatory tariffs remain in all remainingproducts Allows free mobility of capital and labor across members

Eliminate tariffs between themselves; own external tariffs on imports from the rest of the world. Between members tariffs may zero

Eliminate tariffs between themselves; common external tariffs on imports from the rest of the world

Free trade in goods and services, sets common external tariffs among members

Mobility of resources & capital Null Null Null

Allows free mobility of capital and labor across members

Special attention Own monetary policy; not affected by PTA Own monetary policy; not affected by FTA Own monetary policy; not affected by CU Own monetary policy; not affected by CM

Null Null

Null

Null

Fiscal spending responsibilities to a supra-national agency

Fiscal spending responsibilities to a supra-national agency

Monetary policy

Own monetarypolicy; not affected by EU

Establishes a common central bank & currency

Policy coordination

Easy

"Rules of origin" makes fairly difficult

Problem of policy coordination

Difficult in policy coordination

Difficult in policy coordination

Complicated policy coordination

Degree of integration

Weakest

Weak

Strong

Fairly strong

Very strong

Highest

Aim

Enhances current trade & more future coordination to form FTA

Enhances current trade & more future coordination to form CU

Enhances current trade & more future coordination to form CM

Enhances current trade & more future coordination to form EU

Enhances current trade & sectoral protection & more future coordination to form MU

Maintain status with high efficiency and expansion ofmembers

Notes: PTA Preferential Trade Agreement; FTA Free Trade Area; CU Customs Union; CM Common Market; EU Economic Union; MU Monetary Union Source: The Idea of European Union and Steven (1997-2004)

Trade and regional integration

Figure 1. Levels/stages of economic integration, its feature and aim

99

IMEFM 1,2

(1) (2) (3) (4)

trade (intra and extra); FDI inows; joint venture project activities, and technology diffusion.

100

In a study of regional integration, Haile (2000) employed intra and extra trade, FDI and capital intensive project cooperation together with many other performance indicators. While the trade related indicators identify the ow of goods and services across a dened economic space, the FDI indicator measures the extent to which the GCC economies are integrated at inter-country and inter-region levels, and with the rest of the world. On the other hand, the capital investment in joint projects indicator explains the resource exploration and/or utilization in a collective manner across integrated countries. The development of ICT as indicator measures the extent to which the GCC economies communicate and share information at inter-country and inter-region levels, and with the rest of the world. All these indicators contribute to attain the goals of regional integration. However, irrespective of the type of the established economic integration (as noted in Figure 1), they all have common ultimate objectives such as: seeking to benet from trade creation, economies of scale, product differentiation, and efciency gains through policy coordination that follow implementation of regional integration agreements (Haile, 2000). To get statistical data on the above mentioned measurement indicators of the effectiveness of the regional economic integration employed in the current study, secondary data were gathered from publications, existing reports and web sites on related areas. This includes annual and technical reports from government agencies, data provided by the GCC secretariat, international organizations, published, unpublished articles as well as any other relevant information to this area of study. The obtained data have been reviewed and analyzed by using comparative and descriptive analysis to assess the effectiveness of the GCC integration. The Gulf Cooperation Council (GCC) Saudi Arabia was a prime mover in setting up the GCC in 1981. As such, on 25th May 1981, the leaders of the six states reached a cooperative framework joining the six states to effect coordination, integration, and inter-connection among the member states in all elds in order to achieve unity (Article 4, GCC Charter)[1]. Such unity enhances their deeper ties as the six member countries historically having common religious, social, and cultural identities. The GCC also is a political and economic policy-coordinating forum for its member countries. An efcient work is underway to form a free trade area between the GCC and the European Union. The United States favors strengthening regional integration efforts among GCC members, as well as enhancing USA-GCC economic and commercial ties. The USA Government engages in high-level economic policy talks with GCC members through the USA-GCC economic dialogue. At the 23rd session in 2002, the Supreme Council of the GCC states endorsed the establishment of the customs union in order to enhance economic cooperation with effect from 1st January 2003. The session also highlighted the difculties and obstacles that might arise from the implementation of the customs union. The goals of implementing customs union are: the facilitation of the ow of movement of goods; increasing inter-trade; and removal of customs and non-customs barriers that limit trade.

The council takes measures to meet the prerequisites of the Common Gulf Market as soon as possible, not exceeding the year 2007. This meeting also discussed the possibility of forming a monetary union. GCC states are also trying to formulate a homogenous petroleum policy, and taking common stands on developments in energy and related matters (GCC-SG, 2002). Several studies have pointed to a number of reasons behind the failure of regional integration: (1) lack of planning at governments doorstep; (2) cost-benets of the integration; and (3) the politically motivated allocation of investment (UNCTAD, 1973; quoted by Mytelka, 1997). Contrary to these ndings, GCC states regularly monitor the progress of the GCC integration. For instance, the 24th council meeting in 2003 reviewed the collective process of the proposals endorsed in the Councils 23rd meeting in 2002. An in-depth analysis of all the issues concerning the GCC States and its peoples in light of the developments taking place in the Arab and international arenas (GCC-SG, 2003). Effectiveness of the GCC integration Development Measures of the GCC Integration Generally speaking, the impact of integration policies in economic theory is dependent on the circumstances surrounding individual integration arrangements and the member countries. In addition, integration policies can be affected by the member countries needs and developmental stage for a potential cooperation (DeRosa, 1998). Thus, the development status of the member states is an important factor in determining the success of a regional integration. Based on the UNDPs development measures, Tables I-III depict that all GCC countries are passing through almost the same development stage. For example, Table I illustrates that, in the period between 1990 and 2002, the adult literacy rate, tertiary education, and public education expenditure together with research and development expenditures and number of researchers in research and development are almost the same. The table also showed that no one lives under poverty in any of the member states of the GCC. Table II demonstrates that the real GDP growth rate has increased substantially in 2005 compared to 2000 and shows almost the same status of growth as reected by the reported standard deviations of 2.3 and 0.8, respectively. The shares of industry and services sectors in the GDP also appeared to be identical among the member states as mirrored in the reported standard deviations of 16.7 and 16.8, respectively. In the same token, Table III shows that all the GCC member countries are experiencing smooth exchange rates. This implies that there was no vulnerability in exchange rates during 2000-2005 contributing to attract FDI and increase trade as well. Ination rate was stable or smooth falls and raises can be observed during 2000-2004, however, there was sharp increase in ination in 2005 only in the UAE and Qatar[2]. The stable or smooth growth of all the aforesaid indicators results in astounding human development index (HDI) values ranging from 0.772 to 0.849 as measured by the UNDP in the year 2005. The HDI values of all the GCC also appeared to be almost identical across the countries with 0.03 standard deviation. The results also show that

Trade and regional integration 101

102

IMEFM 1,2

GCC countries 77.3 82.9 89.2 87.7 79.4 74.4 NA NA 0.699 17 NA 0.708 5.8 3.1 NA NA 16 21 NA NA NA NA 0.812 NA NA 0.809 0.849 0.844 0.849 0.846 1.8 4.8 3.5 4.1 1.6 NA NA NA NA 4.6

UAE Kuwait Qatar Bahrain Saudi Arabia 0.772 0.781 (0.03)

Oman

Notes: Parenthesis shows standard deviation; ALR15 Adult literacy rate (per cent age 15 and above), 2003; TSSME Tertiary students in science, math, and engineering (per cent of all tertiary students), 1998-2003; Population below poverty line (per cent), 2005; 1 2001, 2 1998, 3 2004; HDI Human development index; PEE Public expenditure on educations as per cent of GDP (1990-2000/2002); RNE R&D expenditure as per cent of GDP (1997-2002); NR Number of researchers in R&D (per million population) Sources: CIA world fact book, 2005 for d and i; United Nations Human Development Report, 2005 for a, b, c, e, f, g, h

Table I. Socio-economic indicators of the GCC ALR15 Population below poverty HDIe b c d (per cent) TSSME line (per cent) 1990 2003 PEEf Participation in 1990 2002 RNEg NRh international organizationsi NA 0.2 NA NA NA NA NA 73 NA NA NA NA 42 49 40 41 46 38

Population (millions) 2003a

4.0 2.5 0.7 0.7

23.3

2.5

(e)

Country and standard deviation 29,100 22,100 26,000 20,500 12,900 13,400 6553.9 4.0 6.0 4.0 5.0 4.0 4.6 0.8 6.7 4.5 8.8 5.9 6.4 1.9 2.3 4 0.5 0.2 0.6 3.3 2.8 1.6 58.5 52.1 81 42.5 74.7 40 16.7 37.5 (2002) 47.4 18.8 56.9 21.9 57.1 16.8 46.0 6.0 16.0 9.0 7.0 5.0 15.7 4.0 7.0 10.0 9.0 10.0 14.0 3.3 NA 3.0 NA NA NA 2.0

GDP per capita (PPP), US$a 2000 2005

Real GDP growth rate (per cent)b 2000 2005 Share of GDP by sector (per cent), 2005c Agriculture Industry Services Manufactured exports (1)d 1990 2003

THE (2)e 1990 2003 2.0 1.0 NA NA NA 2.0

UR (3)g 2005 2.4 (2001) 2.2 (2004) 2.7 (2001) 15.0 (1998) 13.0 (2004) 15.0 (2004)

UAE Kuwait Qatar Bahrain Saudi Arabia Oman Standard deviation

22,800 15,000 20,000 15,900 10,500 7,700 5649.5

Notes: (1) Manufactured export as per cent of merchandise export; (2) High-technology export as per cent of merchandise export; (3) Unemployment rate, 2005 other wise mentioned in the parenthesis Sources: CIA World fact book, 2001 and 2005 for a, b, c, f, g; United Nations Human Development Report, 2005 for d and e

Trade and regional integration 103

Table II. Economic indicators of the GCC countries

104

IMEFM 1,2

Country 4.5 1.5 2.5 2.0 0.98 0.8 4.56 0.38 4.61 0.47 4.75 0.48 4.5 2.5 2.0 1.5 1.9 1.0 4.84 0.39 4.80 0.49 4.94 0.5 2.8 2.0 1.9 0.5 1.0 -0.5 5.32 0.42 5.28 0.54 5.44 0.55 3.2 1.2 2.0 0.4 1.0 0.3

UAE Kuwait Qatar Bahrain Saudi Arabia Oman

Notes: Exchange rate is calculated by currency unit per SDR (Special Drawing Rights; 1 SDR 1.46 USD). This rate is not used in fund transaction, is a reciprocal of SDR per currency. ExR Exchange rate; IR Ination rate Sources: Exchange rate archives, IMF, 2006a; World Fact book, 2001-2006b

Table III. Exchange rate and ination rate (consumer prices) in 2000-2005 5.64 0.45 5.59 0.57 5.76 0.57 3.2 2.3 3.0 2.1 0.8 0.2 5.22 0.41 5.18 0.53 5.33 0.54 10.5 4.1 8.8 2.7 0.4 1.2

ExRa

Year 2000 2001 2002 2003 2004 2005 IR (per cent)b ExRa IR (per cent)b ExRa IR (per cent)b ExRa IR (per cent)b ExRa IR (per cent)b ExRa IR (per cent)b

4.71 0.39 4.67 0.48 4.80 0.49

the HDI has increased in 2003 compared to 1990. The outcome of the analysis indicates that the GCC countries are beneting from the regional integration as reected in the upholding development measures. Trade and joint venture projects in the GCC The regional integration substantially eliminates tariff and non-tariff barriers and results in liberalizing trade restrictions. Trade liberalizations have positive impact on trade, output and unemployment (Dabee and Milner, 1995). In addition, operating joint venture projects between or among countries impact the macroeconomic factors (trade, outputs, and unemployment) in the participating countries. Thus, one of the vital objectives of regional integration is the improvements in extra and intra trade, and enhancing joint venture projects among member countries. Table IV shows that intra exports and imports in the GCC were not smooth during the period between 1990 and 2000. However, from the year 2001 it shows increasing trends and dramatic increase in the period between 2002 and 2004. The amounts of manufacturing and high technology exports also demonstrate increasing trends during the period of 1990-2003. One of the underlying causes of such increasing exports might be the implementation of the custom union in the year 2003. Joint venture project activities integrate capital, resources and expertise from the member states. This, in turn, enhances mobility of factors of production, products and sharing of ideas and knowledge. Such a unique phenomenon contributes to the innovation and renovation of production techniques and products as well. All such factors have positive impact on the trade development. Table IV demonstrates that there was high number of joint venture projects with high capital investment in large projects as capital investment per project reached 13.77 million USD in 1999. However, the number of projects, total capital investment and investment per project showed decline in the period between 2000 and 2002. During the same period, the capital investment was limited to small scale projects and investment has not been increased as capital investment per project was 3.19, 1.08, and 0.72 million USD, respectively. The underlying cause of this lower investment in joint venture projects might be the fact that the 11th Septembers incident in the USA has changed the world business environment especially in the Middle East. However, number of projects and total capital investment started to increase from the year 2002, and became dramatically high in terms of number, total capital investment, and capital investment per project in 2004. The capital investment mostly was in large-scale projects as the capital investment per project reached 7.76 million USD in 2004. The increase in the joint venture project activities might be the outcome of the implementation of custom union in the GCC in 2003. In addition, the 24th supreme council meeting has conducted an in-depth analysis of all the issues concerning the GCC States and its peoples in light of the developments taking place in the Arab and internationals arenas (GCC-SG, 2003). Thus, it can be argued that the implementation of custom union and the initiatives of the 24th supreme council meeting have increased motivations of the investors and reduced the risks associated with joint venture projects that boost this sector. Foreign direct investment (FDI) in the GCC The increase in the size of the market combined with regional integration initiatives attract more FDI. However, only the countries in the regional integration agreement that offers

Trade and regional integration 105

106

IMEFM 1,2

Years 4928.6 3735.6 5557.1 3478.8 6210.6 3891.7 5343.6 4036.7 6255.0 4457.2 7553.0 4709.9 8110.6 5158.5 6603.5 5612.0 7982.2 5531.7 150 2066.2 13.77

Exports Imports JVP Number Capital Capital per project

Note: JVP Joint venture project Source: GCC Achievements (2004)

Table IV. Intra-GCC trade (exports and imports) and joint venture projects during 1990-2004 ($US millions) 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 7776.9 5700.7 91 290.79 3.19 2001 6394.7 3651.6 206 222.96 1.08 2002 7734.4 7402.7 1013 737.45 0.72 2003 9649.9 8025.6 2004 11934.9 11760.0 583 4529.25 7.76

1990

4834.5 2703.8

a more attractive overall environment for FDI are likely to be winners in this game (Levy Yeyati et al., 2003). FDI promotes economic development by helping to improve productivity, growth, and exports in the multinationals host countries (Blomstrom and Kokko, 1997). In this section, the impact of the GCC integration on the FDI inows is considered. Table IV illustrates that FDI inow has increased remarkably in almost all the GCC member countries during 1980-2000. A sharp increase in FDI can be observed from the year 2001-2004 except Kuwait and Oman in 2004. The result of the analysis points to the fact that after GCC integration, the GCC region becomes one of the large market sizes in the middle east (population 33.7 million; Table I). This attracts an increased FDI from the high-tech developed and developing countries. In addition, this provides two signicant opportunities for GCC in the areas of labor-intensive and high-tech production process, respectively. Such sustained well-documented phenomenon results in stable economic growth in the GCC countries (Tables II and III). In addition, the enlarged domestic consumer market of the GCC enables it to be self-sufcient in economic activities contributing to a continuous economic progress and further attracts high FDI as it was the case during the period between 1980 and 2004. In addition, the sustained push and pull factors of FDI that was improved under the GCC integration has played an active role in increasing FDI during the same period. Push factors such as investors condence, which determines the willingness to invest, and the pull factors are objective and subjective determinants that are coordinated at the government level Table V. Technology diffusion in the GCC So as to obtain the competitive advantages of the regional integration, it is crucial to receive and share quality information. There are various mediums that transmit information at a very high speed and create a bridge to share information for maintaining a sustained development within the integrated countries. ICT is the medium that transmits information at a very high speed and establish a network of information sharing. ICT creates value, which originates from the sharing of information to enhance the speed of transmitting and sharing of quality information. Sharing information improves ties among integrated member countries contributing to enhance mobility of resources, products as well as joint venture projects activities. However, large amounts of valued information are exchanged and shared worldwide via ICT services. A countrys or a group of countries ICT services mostly depend on the availability of telephone lines, cellular phone, and internet facilities.

Trade and regional integration 107

Country Bahrain Kuwait Oman Qatar Saudi Arabia UAE World

1980 2 418 1 98 11 2 3192 98 55108

1990 2 183 6 125 5 312 2 116 207878

2000 364 16 83 252 183 2 515 13396539

Year 2001 80 2 147 390 296 504 1184 825925

2002 217 7 26 624 453 1307 716128

2003 517 2 67 528 625 778 30 632599

2004 865 2 20 2 18 679 1867 840 648146

Source: UNCTAD (2006)

Table V. FDI inows in the GCC countries (1980-2004)

IMEFM 1,2

108

According to Table VI, the number of telephone main line users and cellular subscribers in the GCC countries has increased during the period between 1990 and 2003. However, the ratio increase in cellular subscribers is much higher than telephone main line users. This indicates that the usage of cellular phone is more popular than that of telephone main line usage. The user friendly features of cellular phone may explain its fast growing popularity. Table VI also illustrates that the number of PC users are increasing rapidly during the period of 1999-2005. However, Saudi Arabia shows remarkably higher number of PC users compared to other GCC countries. There is hardly any internet user in the GCC in 1990 as the technology was not really available in the developing world at the same year. The history of computers explains that the internet was initially developed in 1969 by the USA Department of Defense, with the intention of creating a computer network that could withstand any type of disaster. The rst commercial internet dial-up access provider came online in 1990 (computerhope.com, 2006). Therefore, in the 1980s and in 1990s, this new technology was in the initial stage of development. A small number of users was available only in the industrialized countries. For instance, the USA and UK has only 8 and 1 internet users per thousand people, respectively, in 1990 (Table V). Thus, it can be argued that hardly any IT facilities were developed in the GCC countries in 1990. However, the data in Table V illustrates that the number of internet users are increasing rapidly in the GCC countries in the years 1999, 2004, and 2005. The number of internet hosts per 10,000 people has increased in the year 2004 or 2005 compared to 1999 in Bahrain, Saudi Arabia, and Oman. At the same period it shows decreasing rate in the UAE, Qatar, and Kuwait. This might be due to the respective countrys internal policy for internet host usage. However, the result shows that there is no impact of number of host on internet users as the internet users remarkably increase during the period 1999 to 2005 in the UAE, Qatar and Kuwait including all other GCC countries. The cellular subscribers, internet users or PC users in the GCC shows that they have adapted the new technology much faster in 1999-2005 compared to the 1990 s. This might be the outcome of the GCC countrys programs for ICT development that was launched at an earlier stage. The GCC countries also have launched unied industrial development strategies where R&D in applied science has been given priority. However, the results of this technology diffusion section clearly indicate that the continuous improvement in ICT in the GCC countries enhancing information sharing among the members strengthening GCC ties. Inversely, it also can be argued that the continuous upgrading GCC ties contributing to the improvement of ICT. Conclusion Continuous reviewing and analyzing the progress of the regional integration process at the states level is the key element of a successful integration. This study nds out that the GCC council reviews regularly the collective process of all the proposals to be executed. It also conducts an in-depth analysis of all the issues concerning the GCC states and their societies. The outcome of the analysis indicates that all six members of the GCC have almost identical development. This provides them with a strong position to achieve successful regional economic integration. The ndings of this study suggests that the intra exports and imports, and high-tech manufacturing exports shows increasing trends after implementing customs union. In the same fashion, the number of joint venture projects, total capital investment and capital investment per project increases dramatically after executing

Number of PCs per 1000 people d 1999 90.89 100.9 130.8 140.1 50.74 20.71 2004 119.9 176.3 177.3 163.7 340.1 40.6 2005 190.8 220.3 170.8 160.9 350.3 40.66

GCC Country 19 12 9 10 1 2 21 19 7 546 912 679 26 48 97 1905.6 292.2 208.1 6645.1 697.9 1286.8 6645.1 697.9 1286.8 8 1 NA 365.5 210.1 213.7

d

Telephone main lines per 1000 people a Ratio of 1990 2003 increase Internet c Hosts per 10,000 people Internet users per 1000 people 1999 2004 2005 1990c1 1999 2004 2005 78.64 19.31 18.51 17.0 1.99 2.82 555.8 628.8 502.0 and

1

Cellular subscribers per 1000 people b Ratio of 1990 2003 increase 736 572 533 638 321 228 38.74 47.66 59.22 63.8 321.0 114.0 61.11 10.93 4.20 25.03 6.69 5.94 62.02 10.93 4.23 25.84 6.96 5.94 0 0 0 0 0 0 150.1 47.75 40.16 140.1 4.80 20.08 280.9 235.0 220.0 210.8 60.62 90.67 310.08 260.05 280.16 210.34 60.62 90.67 630.0 628.8 502.0

UAE 224 281 1.25 Kuwait 188 196 1.04 Qatar 220 261 1.18 Bahrain 191 268 1.40 Saudi Arabia 77 155 2.01 Oman 60 88 1.46 Selected industrialized countries USA 547 624 1.15 UK 441 563.9 1.28 Japan 441 472 1.07

505.0 302.5 286.6

762.2 600.2 541.5

762.2 600.2 541.5 adapted and calculated from World

Source: a, b and c1 adapted and calculated from united nations Human Development Report (2005) c, Telecommunication Development Report (2005) (ITU)

Trade and regional integration 109

Table VI. Technology diffusion indicators in the GCC countries

IMEFM 1,2

110

customs union. The result also shows that the investment in large-scale joint venture projects increases at the same period. Another point observed in this study is the sharp increase in FDI during the period between 2001 and 2004; within this period, the customs union has been implemented. This increased FDI mainly due to the fact that the GCC attains enlarged domestic market size and stable economic growth after the GCC integration. The GCC integration also contributes to improve push and pull factors of FDI that has further attracted increased FDI. The cellular subscribers, internet users or PC users in the GCC shows that they have adapted and deployed new technology much faster during the period 1999-2005 compared to 1990 s. This might be the outcome of the GCC countrys launched programs for ICT development. The GCC countries also have launched unied industrial development strategy where R&D in applied science has been given priority. The results clearly indicate that the continuous improvement in ICT in the GCC countries enhancing information sharing among the members and strengthening the ties among the GCC countries. Inversely, it also can be argued that the continuous upgrading GCC ties contributing to the improvement of ICT. In sum, this study noticed improvements in all the indicators as well as the push and pull factors that enhance effectiveness of the GCC integration. To attain more effective regional integration, a periodic review of the all the issues concerning the GCC states and their societies in light of the advancement taking place in the Arab world and international arena is vital.

Notes 1. The member countries include Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and United Arab Emirates (UAE). 2. This is due to sharp increase in accommodation rent in Qatar, Abu Dhabi and Dubai. Governments in the Qatar and the UAE are taking measures to stop the dramatic increase in accommodation rent and to curb ination. References Angeles, M. V. (2005), Trade integration in the Americas, Foreign Affairs, Defense and Trade Division, Congressional Research Service for Congress, November. Avillez, F., Finan, T.J. and Josling, T. (1988), Trade, exchange rates, and agricultural pricing policy in Portugal, The Political Economy of Agricultural Pricing Policy, World Bank, Washington, DC. Berg, E. (1988), Applied Development Economics, Regionalism and Economic Development in sub-Saharan Africa. Vol. 1: Regional Co-Operation in Africa, United States Agency for International Development, Washington, DC. m, M. and Kokko, A. (1997), Regional integration and foreign direct investment, Blomstro Stockholm School of Economics, Working Paper Series in Economics and Finance 172 Sweden. Bourenane, N. (1997), Theoretical and strategic approaches, Regional Integration and Cooperation in West Africa, International Development Research Centre, Ottawa. Computer Hope.com (2006), Computer History for 1990-2000, Computer Hope.com Crawford, J-A. and Fiorentino, R.V. (2005), The changing landscape of the regional trading agreements, Discussion Paper No. 8, May, World Trade Organization, Geneva.

Debeen, B. and Milner (1995), Evaluating Trade Liberalization in Mauritius Mimeo, AERC, Nairobi, available at: www.idrc.ca/livres DeRosa, D.A. (1998), Regional Integration Arrangements: Static Economic Theory, Quantitative Findings, and Policy Guidelines, ADR International Ltd, Falls Church, VA. Dollar, D. (1992), Outward-oriented developing economies really do grow more rapidly: evidence from 95 LDCs, 1976-1985, Economic Development and Cultural Change, University of Chicago Press, Chicago, IL. GCC Achievements (2004), Cooperation Council for the Arab State of the Gulf Secretariat General, Riyadh, Saudi Arabia, available at: www.gcc-sg.org/statistics.html GCC-SG (2002), The Closing Statement of the 23rd Session of the GCC Supreme Council, Cooperation Council for the Arab State of the Gulf Secretariat General, Doha, Qatar, available at: www.gcc-sg.org/closingsessions.html GCC-SG (2003), The Closing Statement of the 24th Session of the GCC Supreme Council, Cooperation Council for the Arab State of the Gulf Secretariat General Kuwait City, Kuwait, available at: www.gcc-sg.org/closingsessions.html Haile, K.T. (2000), Regional integration in Africa: a review of the outstanding issues and mechanisms to monitor future progress a draft issues, paper presented at The African Knowledge Networks Forum Preparatory Workshop, Addis Ababa, Ethiopia, 17-18 August 2000. Human Development Report (2005), United Nations Development Program, New York, NY. IMF (1994), Background papers, International Trade Policies: The Uruguay Round and Beyond, Volume II, World Economic and Financial Survey, IMF, Washington DC. IMF (2006), Exchange Rate Archives, IMF, Washington, DC. Krueger, A.O., Schiff, M. and Valdes, A. (1988), Agricultural incentives in developing countries: measuring the effects of sectoral and economy wide policies, World Bank Economic Review, Vol. 3 No. 2, pp. 225-71. Lavergne, R. (1997), Introduction: reections on an agenda for regional integration and cooperation in West Africa, Regional Integration and Cooperation in West Africa, International Development Research Centre, Ottawa. Levy Yeyati, E., Stein, E. and Daude, C. (2003), Regional integration and the location of FDI, IDB Working Paper No. 492, Washington DC. gration Territoriale, Presses Universitaires Franc Marchal, A. (1965), Inte aises, Paris. Mosad, Z. (1998), Globalization and economic integration among Arab countries, paper presented at The 4th Nordic Conference on Middle Eastern Studies: The Middle East in Globalizing World, Oslo, 13-16 August. Mundlak, Y., Cavallo, D. and Domenech, R. (1989), Agriculture and Economic Growth in Argentina, 1913-84, Research report 76, International Food Policy Research Institute, Washington, DC. Mytelka, L. (1997), Building partnerships for innovation: a new role for south-south cooperation, Regional Integration and Cooperation in West Africa, International Development Research Centre, Ottawa. OECD (2005), Economic globalization indicators, The OECD Handbook on Economic Globalization Indicators, Organization for Economic Co-operation and Development, Paris. Ousmane, B. (1997), National policies as impediments to regional economic integration, Regional Integration and Cooperation in West Africa, International Development Research Centre, Ottawa.

Trade and regional integration 111

IMEFM 1,2

112

Oyejide, T.A. (1986), The Effects of Trade and Exchange Rate Policies on Agriculture in Nigeria, Research report 55, International Food Policy Research Institute, Washington, DC. Robson, P. (1983), Integration, Development and Equity: Economic Integration in West Africa, Routledge, New York, NY. Steven, S. (1997-2004), Economic integration: overview, International Trade Theory & Policy Analysis, The International Economic Study Centre, Washington, DC, available at: http:// internationalecon.com/v1.0/ch110/110c020.html Stryker, J.D. (1990), Trade, exchange rate, and agricultural pricing policies in Ghana, The Political Economy of Agricultural Pricing Policy, World Bank, Washington, DC. Ugo, F. and Zubair, I. (2003), GCC Countries: From Oil Dependence to Diversication, IMF External Relations Department, Washington, DC. UNCTAD (1973), The distribution of benets and costs in integration among developing countries, in Lizano, E. (Ed.), Current Problems of Economic Integration, Doc. TD/B/394, United Nations Conference of Trade and Development, New York, NY. UNCTAD (2006), Major FDI indicators, United Nations Conference on Trade and Development (UNCTAD), Geneva, available at: http://stats.unctad.org/FDI/TableViewer Viner, J. (1950), The Customs Union Issue, Carnegie Endowment for International Peace, New York, NY, Stevens & Sons, London. Wikipedia (2006), Economic Integration, Wikimedia Foundation, In., available at: http://en. wikipedia.org/wiki/Economic_integration World Telecommunication Development Report (2005), International Telecommunication Union (ITU), Geneva. Further reading Beala, B. (1961), The Theory of Economic Integration, R.D. Irwin, Homewood, IL. World Factbook (2001), CIA, Washington, DC. Corresponding author Amzad Hossain can be contacted at: amzad4@yahoo.com

To purchase reprints of this article please e-mail: reprints@emeraldinsight.com Or visit our web site for further details: www.emeraldinsight.com/reprints

Vous aimerez peut-être aussi

- Research Supervision Workshop 2009 Introduction 090925Document4 pagesResearch Supervision Workshop 2009 Introduction 090925Witness Wii MujoroPas encore d'évaluation

- Unpf 0063Document142 pagesUnpf 0063Witness Wii MujoroPas encore d'évaluation

- CH 10Document7 pagesCH 10Witness Wii MujoroPas encore d'évaluation

- What Is A Good Argument 120727Document10 pagesWhat Is A Good Argument 120727Witness Wii MujoroPas encore d'évaluation

- Research Project RecordDocument2 pagesResearch Project RecordWitness Wii MujoroPas encore d'évaluation

- Programme Timetable - 21bbads2, Bachelor of Business Administration S2Document3 pagesProgramme Timetable - 21bbads2, Bachelor of Business Administration S2Witness Wii MujoroPas encore d'évaluation

- Chapter 2Document39 pagesChapter 2Witness Wii MujoroPas encore d'évaluation

- The Hofstede Centre: Get CertifiedDocument3 pagesThe Hofstede Centre: Get CertifiedWitness Wii MujoroPas encore d'évaluation

- 2002 Southern African Customs UnionDocument11 pages2002 Southern African Customs UnionWitness Wii MujoroPas encore d'évaluation

- Journal Guidelines: How To Summarize and Write A Critical Response For JournalsDocument2 pagesJournal Guidelines: How To Summarize and Write A Critical Response For JournalsWitness Wii MujoroPas encore d'évaluation

- Bruno AndyDocument332 pagesBruno AndyWitness Wii MujoroPas encore d'évaluation

- Critical Success Factors Weight Rating Score Weight Rating Score Weight Rating ScoreDocument1 pageCritical Success Factors Weight Rating Score Weight Rating Score Weight Rating ScoreWitness Wii MujoroPas encore d'évaluation

- Key External Factors Weight Rating Weighted Score: OpportunitiesDocument1 pageKey External Factors Weight Rating Weighted Score: OpportunitiesWitness Wii MujoroPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- DB Enclosures SubmittalDocument90 pagesDB Enclosures Submittala wasayPas encore d'évaluation

- List 2Document18 pagesList 2saravananPas encore d'évaluation

- Minors Travelling Abroad Consent To Travel2Document1 pageMinors Travelling Abroad Consent To Travel2marian fae vergaraPas encore d'évaluation

- Middle East and North AfricaDocument59 pagesMiddle East and North AfricaAlban DukaPas encore d'évaluation

- Final Internship ReportDocument60 pagesFinal Internship ReportVidyashreePas encore d'évaluation

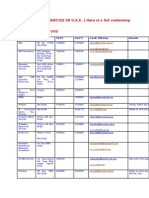

- 100+ Names) : RECRUITMENT AGENCIES IN U.A.E. (Here Is A List ContainingDocument8 pages100+ Names) : RECRUITMENT AGENCIES IN U.A.E. (Here Is A List Containingitssajjidali5826Pas encore d'évaluation

- Illumination UAEDocument324 pagesIllumination UAEPradeep KumarPas encore d'évaluation

- Etihad AirwaysDocument27 pagesEtihad Airwaysaduasinement100% (8)

- Awazel Uae: Material SubmittalDocument99 pagesAwazel Uae: Material SubmittalBachir BanboukPas encore d'évaluation

- ShurooqDocument36 pagesShurooqDavid100% (1)

- Mysticals Workbook U.A.E. - High ResolutionDocument30 pagesMysticals Workbook U.A.E. - High ResolutionDinesh Shukla100% (1)

- AnutoneDocument16 pagesAnutoneShivansh Singh GautamPas encore d'évaluation

- Sandhya Mehta & James Onley, "The Hindu Community in Muscat: Creating Homes in The Diaspora" (2015)Document28 pagesSandhya Mehta & James Onley, "The Hindu Community in Muscat: Creating Homes in The Diaspora" (2015)j.onley1684Pas encore d'évaluation

- UAE ManufacturerDocument48 pagesUAE ManufacturerGaneshMaliPas encore d'évaluation

- L KaramaDocument3 pagesL KaramaMostafa MohmmedPas encore d'évaluation

- Acoustic Louvers: ..... A Perfect Partner in Performance ..... A Perfect Partner in PerformanceDocument20 pagesAcoustic Louvers: ..... A Perfect Partner in Performance ..... A Perfect Partner in PerformanceAhmed MontashPas encore d'évaluation

- The World of Work Amal HessaDocument12 pagesThe World of Work Amal HessadreamsaroPas encore d'évaluation

- Global Warming Awareness Among The University of Bahrain Science StudentsDocument2 pagesGlobal Warming Awareness Among The University of Bahrain Science Studentssandra7generoso-2Pas encore d'évaluation

- Agency List-Oil &gas NewDocument11 pagesAgency List-Oil &gas NewjairomarcanoPas encore d'évaluation

- CA Compilation AprilDocument104 pagesCA Compilation Aprilshravan kumar ankemPas encore d'évaluation

- A Food FranchiseDocument26 pagesA Food FranchiseccptripoliPas encore d'évaluation

- Top 27 Online MBA Programs in Dubai UAEDocument5 pagesTop 27 Online MBA Programs in Dubai UAESuccesspoint CollegePas encore d'évaluation

- Job CV FarrukhDocument2 pagesJob CV FarrukhFarrukh MehmoodPas encore d'évaluation

- DubaiDocument404 pagesDubaiAbdulaziz AbdullahPas encore d'évaluation

- Likpin Job Offer Contract - Appointment Letter SoftDocument5 pagesLikpin Job Offer Contract - Appointment Letter SoftYasirIqbalPas encore d'évaluation

- Cover LetterDocument3 pagesCover LetterMuhammad Abubakar QureshiPas encore d'évaluation

- MEPE January 2019Document108 pagesMEPE January 2019Khaled Al Nuaimi100% (1)

- M04MKT-Etihad V6Document53 pagesM04MKT-Etihad V6ytudak100% (1)

- Company Profile - DCI Building ConstructionDocument29 pagesCompany Profile - DCI Building ConstructionRey MichaelPas encore d'évaluation

- UAE Consultants ListDocument20 pagesUAE Consultants Listcdmaa100% (1)