Académique Documents

Professionnel Documents

Culture Documents

Accounting Test Prep 2

Transféré par

penusilaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting Test Prep 2

Transféré par

penusilaDroits d'auteur :

Formats disponibles

ACCOUNTING TEST PREP 2

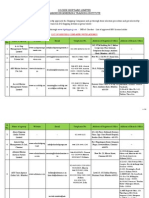

True/False Indicate whether the statement is true or false. ____ ____ ____ ____ ____ ____ ____ ____ ____ 1. A fiscal period may be one month, three months, six months, or even one year, but usually it is one year. 2. An accounting period that begins on July 1 and ends on June 30 is a calendar-year accounting period. 3. To record transactions in chronological order means to record them according to the date on which they occurred. 4. A journal is like a diary of a business because it is the only place where complete details of a transaction are recorded. 5. For every transaction recorded in the general journal, these items are always written: date, account titles, amounts, and source document or brief explanation. 6. If an error is discovered immediately after journalizing, a single ruling should be placed through the incorrect data and the correct information should be written above it. 7. Recording transactions is the second step in the accounting cycle. 8. To verify a source document means to check the accuracy of the information on it. 9. Since the debit and credit amounts in a business transaction are the same, the order in which the account titles are recorded in the general journal does not matter.

____ 10. Dollar signs, commas, and decimals are not used when entering amounts in the journal. ____ 11. The title of the account to be credited is indented from the left edge of the Description column so it can be easily distinguished from the debit part of the transaction. ____ 12. Never erase an error in a journal entry because an erasure looks suspicious. ____ 13. In order to help an owner/manager know the financial condition of a business, accounting records are kept and reported for a certain period of time called an accounting period. ____ 14. The type of source document prepared depends upon the nature of the transaction. ____ 15. The purpose of posting is to show the changes that take place in the business's accounts as a result of financial transactions. ____ 16. The ledger account form used by Roadrunner Delivery Service is a three-column account form. ____ 17. Opening an account in a ledger involves writing the account title and the account number on the account form. ____ 18. Opening an account in a computerized accounting system is entirely different from opening an account in a manual system. ____ 19. How often posting occurs depends on the size of the business, the number of transactions, and whether posting is done manually or electronically. ____ 20. The easiest way to post is from left to right in a ledger account because there is less chance of omitting data. ____ 21. Every posting requires the year, month, and day to be entered in the Date column of the ledger account for every transaction.

____ 22. Every amount posted will either increase or decrease the balance of a ledger account. ____ 23. The notation "G3" in the Posting Reference column of a ledger account indicates the data was posted from general journal page 3. ____ 24. Every journal entry requires a posting to at least two ledger accounts. ____ 25. A credit posting to the Office Equipment account will result in an increase to that account. ____ 26. In the preparation of a trial balance, all accounts are listed in the order in which they appear on the chart of accounts, including those accounts with a zero balance. ____ 27. An error discovered before posting is usually corrected with a journal entry. ____ 28. To locate a trial balance error, the first step is to check the postings from the journal to the individual ledger accounts. ____ 29. When posting a correcting entry, the phrase "correcting entry" is usually written in the Explanation column of the ledger account. ____ 30. If a transaction is journalized on the 8th and is posted on the 10th, the date entered in the Date column of the ledger account is the 10th. ____ 31. A trial balance is prepared after posting is completed. ____ 32. A work sheet is prepared at the end of each fiscal period. ____ 33. The work sheet is a working paper and is prepared in pen. ____ 34. Account titles are listed on the work sheet in alphabetical order. ____ 35. A double rule under a column of figures means that the figures are to be added or subtracted. ____ 36. A net income for the period is the amount left after the expenses for the period have been subtracted from revenue. ____ 37. All asset accounts are extended to the Balance Sheet section. ____ 38. Preparing the work sheet is the sixth step in the accounting cycle. ____ 39. Amounts from the Trial Balance section are extended first to the Income Statement section. ____ 40. A single rule across both amount columns of the Trial Balance section means that no more entries will be made. ____ 41. A net loss decreases the balance in the owner's capital account. ____ 42. After the net loss is calculated, it should be reflected in the debit column of the Income Statement section and the credit column of the Balance Sheet section. ____ 43. Total expenses for the period are reflected in the total of the credit column of the Income Statement section. ____ 44. The Trial Balance section contains entries for all accounts in the general ledger including those with zero balances. ____ 45. A work sheet always covers a period of one month. ____ 46. All liability accounts are listed in the credit column of the Income Statement section. ____ 47. The balance sheet reports the final balances of the permanent accounts at the end of the fiscal period. ____ 48. The balance sheet is prepared before the statement of changes in owner's equity.

____ 49. Financial reports are often prepared in pencil. ____ 50. The income statement represents the basic accounting equation. ____ 51. A net income will increase the owner's capital account. ____ 52. The heading is the same on all three financial statements. ____ 53. The revenue, expense, and the Income Summary accounts are included on the statement of changes in owner's equity. ____ 54. The information on the statement of changes in owner's equity is used in preparing the income statement. ____ 55. Net income or net loss is the difference between total revenue and total expenses over a specific period of time. ____ 56. The statement of changes in owner's equity summarizes the effects on the capital account of the various business transactions that occurred during the period. ____ 57. Return on sales is calculated by dividing net sales by net income. ____ 58. The primary financial statements prepared for a sole proprietorship are the income statement and the balance sheet. ____ 59. Current assets are those used up or converted to cash during the normal operating cycle of a business. ____ 60. The Trial Balance section of the work sheet provides the information used in preparing the income statement. ____ 61. The net income or net loss reported on the income statement must be the same as the net income or net loss calculated on the work sheet. ____ 62. The changes in the Cash in Bank account are reported in the statement of changes in owner's equity. ____ 63. Revenue and expense accounts must be closed out because their balances apply to only one accounting period. ____ 64. Closing entries transfer the net income or net loss to the withdrawals account. ____ 65. To close a revenue account, debit it for the amount of its credit balance. ____ 66. When expense accounts are closed, the Income Summary account is credited. ____ 67. Before closing entries are journalized and posted, the Income Summary account in the general ledger has a normal credit balance. ____ 68. The Income Summary account is a simple income statement in the ledger. ____ 69. After the closing entries have been posted, the balance in the capital account reflects the net income or net loss and the withdrawals for the period. ____ 70. The Income Summary account is located in the owner's equity section of the general ledger. ____ 71. Closing the revenue account is the second closing entry. ____ 72. If a business reports a net loss for the period, the journal entry to close the Income Summary account would be a debit to capital and a credit to Income Summary. ____ 73. The last step in the accounting cycle is the preparation of the post-closing trial balance. ____ 74. To close the withdrawals account, the amount of its balance is debited to the capital account and credited to the withdrawals account.

Multiple Choice Identify the choice that best completes the statement or answers the question. ____ 75. Which of the following accounts is not closed at the end of the accounting period? a. Fees c. Maintenance Expense b. Income Summary d. Klaus Braun, Capital ____ 76. Transferring the expense account balances to the Income Summary account is the ____. a. first closing entry c. third closing entry b. second closing entry d. fourth closing entry ____ 77. Accounts that start each new accounting period with zero balances are ____. a. permanent accounts c. liability accounts b. asset accounts d. temporary accounts ____ 78. Which of the following statements is true? a. The Income Summary account is located in the owner's equity section of the general ledger. b. The Income Summary account has a normal debit balance. c. The Income Summary account is a permanent account. d. The Income Summary account is used throughout the accounting period. ____ 79. The balance of the revenue account is transferred to the ____. a. debit side of the Cash in Bank account b. credit side of the owner's capital account c. credit side of the Income Summary account d. debit side of the owner's withdrawals account ____ 80. If a business has a net income for the period, the journal entry to close the balance of the Income Summary account is ____. a. a debit to owner's capital, a credit to Income Summary b. a debit to Fees, a credit to owner's capital c. a debit to Income Summary, a credit to owner's capital d. a debit to owner's capital, a credit to Fees. ____ 81. Closing entries are used to transfer the net income or net loss for the accounting period to the ____. a. Cash in Bank account c. revenue account b. expense accounts d. capital account Matching Match each item with the correct statement below. a. accounting cycle g. b. calendar year h. c. check stub i. d. fiscal year j. e. general journal k. f. invoice journal journalizing memorandum receipt source document

____ 82. A(n) ____ is an accounting period of twelve months ending on the last day of any month except December. ____ 83. A(n) ____ is often called a book of original entry. ____ 84. The ____ is an all-purpose journal used for recording business transactions.

____ 85. The various activities a business completes to organize its accounting records in an orderly fashion is called the ____. ____ 86. A(n) ____ is any type of business paper that verifies that a transaction occurred. ____ 87. Another term used for "recording" a business transaction is ____. ____ 88. A(n) ____ accounting period begins on January 1 and ends on December 31. Match each item with the correct statement below. a. correcting entry f. b. general ledger g. c. ledger h. d. ledger account form i. e. posting ____ ____ ____ ____ 89. 90. 91. 92. proving the ledger slide transposition error trial balance

____ 93. ____ 94. ____ 95. ____ 96. ____ 97.

If you were to write $190 as either $19 or $1,900, this mistake would be called a(n) ____. Errors discovered after posting has taken place require a(n) ____. Transferring data from the journal to the ledger is called ____. A periodic report prepared by a business to test the equality of total debits and total credits in the ledger is called a(n) ____. If you meant to write $27 but wrote $72, this mistake is called a(n) ____. The accounts used by a business can be kept on pages or cards, which are kept together in a book or file called a(n) ____. Adding all the debit balances and all the credit balances and then comparing the two totals to see whether they are equal is called ____. The accounting stationery used to record financial information about specific accounts is a(n) ____. Whether accounts are kept manually in a special file or electronically on magnetic disks or tapes, the ledger is often called a(n) ____. Match each item with the correct statement below. a. Balance Sheet section h. b. capital i. c. credit j. d. debit k. e. extending l. f. heading m. g. Income Statement section matching principle net income net loss ruling trial balance work sheet

____ ____ ____ ____ ____ ____ ____ ____ ____

98. 99. 100. 101. 102. 103. 104. 105. 106.

____ 107.

A(n) ____ results when revenue is larger than expenses. The asset, liability, and owner's equity accounts are extended to the ____ of the work sheet. ____ means drawing a line under a column of amounts. A net loss is entered in the ____ column of the Income Statement section of the work sheet. Revenue and expense accounts are listed in the Trial Balance section of the work sheet and in the ____ of the work sheet. The ____ allows a business to match revenue against expenses as a means of measuring profit for the period. A(n) ____ is a paper used to collect information from the general ledger accounts. The first two columns on the work sheet are used to enter the ____. If there is a net loss for the period, it is entered in the ____ column of the Balance Sheet section of the work sheet. ____ is transferring balances from the Trial Balance section of the work sheet to either the Balance Sheet section or the Income Statement section.

____ 108. If the total of the credit column of the Income Statement section is less than the debit column, there is a(n) ____ for the period. ____ 109. The amount of net income for the period is added to the Balance Sheet credit total because it increases the balance in the ____ account. ____ 110. The ____ of the work sheet answers the questions "who?", "what?", and "when?". Match each item with the correct statement below. a. balance sheet b. Balance Sheet section of the work sheet c. current assets d. current liabilities e. current ratio f. financial statements g. income statement h. Income Statement section of the work sheet i. liquidity ratio j. net income or net loss k. on a specific date l. profitability ratio m. quick ratio n. ratio analysis o. report form p. return on sales q. statement of changes in owner's equity ____ 111. The balance sheet reports financial information ____. ____ 112. The information needed to prepare the income statement comes from the____. ____ 113. ____ summarize the changes resulting from business transactions that have occurred during an accounting period. ____ 114. ____ is a comparison of two items on a financial statement, resulting in a percentage that is used to evaluate the relationship between the two items. ____ 115. ____ is reported on the income statement. ____ 116. A(n) ____ is the financial statement that reports the final balances in all asset, liability, and owner's equity accounts at the end of the accounting period. ____ 117. In the ____, the classifications of balance sheet accounts are shown one under the other. ____ 118. One source of information for completing the balance sheet is the ____. ____ 119. The ____ is completed as a support document for the balance sheet. ____ 120. ____ are debts of the business that must be paid within the next accounting period.. ____ 121. ____ indicates what percentage of net sales represents profit. Match each item with the correct statement below. a. closing entries d. permanent accounts b. compound entry e. post-closing trial balance c. Income Summary account f. temporary capital accounts ____ 122. Accounts that start an accounting period with zero balances are called ____. ____ 123. A(n) ____ is a journal entry with two or more debits or two or more credits. ____ 124. The ____ is a general ledger account used to accumulate and summarize the revenue and expenses for a period. ____ 125. Only ____ and their balances are listed on the post-closing trial balance.

____ 126. A(n) ____ is prepared to prove that debits in the ledger accounts are equal to the credits after the closing entries have been posted. ____ 127. ____ are made to close out or reduce to zero the balance of certain general ledger accounts.

ACCOUNTING TEST PREP 2 Answer Section

TRUE/FALSE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34. 35. 36. 37. 38. 39. 40. 41. ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: T F T T F T F T F T T T T T T F T F T T F T T T F T F F T F T T F F F T T T F F T PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A.

NAT: NBEA I.A.

NAT: NBEA I.A.

42. 43. 44. 45. 46. 47. 48. 49. 50. 51. 52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68. 69. 70. 71. 72. 73. 74.

ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS:

F F T F F T F F F T F F F T T F T T F T F T F T F F T T T F T T T

PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS:

1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

NAT: NBEA I.A.

NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT:

NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA III.B. NBEA I.A. NBEA III.A. NBEA I.A. NBEA I.A. | NBEA II.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A.

MULTIPLE CHOICE 75. 76. 77. 78. 79. 80. 81. ANS: ANS: ANS: ANS: ANS: ANS: ANS: D B D A C C D PTS: PTS: PTS: PTS: PTS: PTS: PTS: 1 1 1 1 1 1 1 NAT: NAT: NAT: NAT: NAT: NAT: NAT: NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A.

MATCHING

82. 83. 84. 85. 86. 87. 88. 89. 90. 91. 92. 93. 94. 95. 96. 97. 98. 99. 100. 101. 102. 103. 104. 105. 106. 107. 108. 109. 110. 111. 112. 113. 114. 115. 116. 117. 118. 119. 120. 121.

ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS: ANS:

D G E A K H B G A E I H C F D B I A K C G H M L D E J B F K H F N J A O B Q D P

PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS: PTS:

1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1

NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT: NAT:

NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. | NBEA III.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. NBEA I.A. | NBEA II.B. NBEA I.A. | NBEA III.A.

122. ANS: F 123. ANS: B 124. ANS: C

PTS: 1 PTS: 1 PTS: 1

NAT: NBEA I.A. NAT: NBEA I.A. NAT: NBEA I.A.

125. ANS: D 126. ANS: E 127. ANS: A

PTS: 1 PTS: 1 PTS: 1

NAT: NBEA I.A. NAT: NBEA I.A. NAT: NBEA I.A.

Vous aimerez peut-être aussi

- SOP For Quality Risk Management - Pharmaceutical GuidelinesDocument3 pagesSOP For Quality Risk Management - Pharmaceutical GuidelinesTarique KhanPas encore d'évaluation

- Beginners Guide To Arabic PDFDocument30 pagesBeginners Guide To Arabic PDFamitPas encore d'évaluation

- Confirmation Letter MarathiDocument1 pageConfirmation Letter MarathiTarique Khan50% (2)

- Circ26 2017csDocument11 pagesCirc26 2017csTarique KhanPas encore d'évaluation

- GST Rate Schedule For Certain Goods 3 June 17Document26 pagesGST Rate Schedule For Certain Goods 3 June 17CharteredAdda.comPas encore d'évaluation

- Notfctn 15 Central Tax EnglishDocument73 pagesNotfctn 15 Central Tax EnglishTarique KhanPas encore d'évaluation

- DisinfectantDocument17 pagesDisinfectantTarique KhanPas encore d'évaluation

- Newsflash - Highlights of The 15th GST Council MeetingDocument3 pagesNewsflash - Highlights of The 15th GST Council MeetingTarique KhanPas encore d'évaluation

- Understand Speak Arabic in 12 Coloured TablesDocument50 pagesUnderstand Speak Arabic in 12 Coloured Tablesabdussamad65Pas encore d'évaluation

- DrugsDocument1 608 pagesDrugsVacstuds GuestPas encore d'évaluation

- GST in India Vol1 PDFDocument233 pagesGST in India Vol1 PDFSrinivas YakkalaPas encore d'évaluation

- Diet Plan With RecipeDocument943 pagesDiet Plan With RecipeTarique KhanPas encore d'évaluation

- Arabic Book Key PDFDocument61 pagesArabic Book Key PDFTarique KhanPas encore d'évaluation

- Payroll Solution in Single SheetDocument818 pagesPayroll Solution in Single SheetTarique KhanPas encore d'évaluation

- CBSE Class 11 Accountancy Study MaterialDocument148 pagesCBSE Class 11 Accountancy Study MaterialTarique Khan100% (9)

- DrugsDocument1 608 pagesDrugsVacstuds GuestPas encore d'évaluation

- Islamic Activity 2Document120 pagesIslamic Activity 2Tarique KhanPas encore d'évaluation

- 24 letsStudyUrduAnIntroductoryCourseDocument519 pages24 letsStudyUrduAnIntroductoryCourseTarique Khan100% (1)

- Shipping Companies NewDocument30 pagesShipping Companies NewAks Gupta57% (7)

- Islam For Younger ChildrenDocument64 pagesIslam For Younger ChildrenEbtessam100% (6)

- Microwave ReciepeDocument53 pagesMicrowave Recieperukmanbgh12Pas encore d'évaluation

- DORMA Glass Cut-Out Details - 02 02 2012Document15 pagesDORMA Glass Cut-Out Details - 02 02 2012Tarique Khan100% (1)

- Indian BreadDocument25 pagesIndian Breadmarisepim9110Pas encore d'évaluation

- CV Sample UkdocDocument4 pagesCV Sample UkdocTarique KhanPas encore d'évaluation

- Shipping Companies NewDocument30 pagesShipping Companies NewAks Gupta57% (7)

- Berg 4Document5 pagesBerg 4Tarique KhanPas encore d'évaluation

- Leadership Is Action, Not PositionDocument59 pagesLeadership Is Action, Not Positionrgcsm88Pas encore d'évaluation

- Tally EasyDocument137 pagesTally EasyTarique KhanPas encore d'évaluation

- Shipping Companies NewDocument30 pagesShipping Companies NewAks Gupta57% (7)

- Berger 2Document20 pagesBerger 2Tarique KhanPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)