Académique Documents

Professionnel Documents

Culture Documents

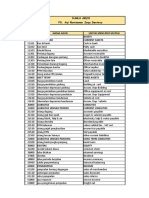

FA Vol.3 Operating Segments

Transféré par

Ryan SanitaDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FA Vol.3 Operating Segments

Transféré par

Ryan SanitaDroits d'auteur :

Formats disponibles

Rodel Francis G.

Sanita Financial Accounting Volume 3: Operating Segments End of the Chapter Questions

1.

What is the core principle of PFRS 8? An entity shall disclose information to enable users of its financial statements to evaluate the nature and financial effects of the business activities in which it engages and the economic environments in which it operates.

2.

Explain briefly segment reporting. Segment reporting is the disclosure of certain financial information about the products and services an entity produces and the geographical areas in which an entity operates.

3.

Why is segment reporting required? The purpose of such disclosure is to enable investors and users make better assessment of each business activity leading to the understanding of the performance of the entity as a whole.

4.

What is the scope of PFRS 8? PFRS 8 shall apply to the separate or individual financial statements of the entity, and to the consolidated financial statements of a group with a parent: Whose debt or equity instruments are traded in a public market That files or is in the process of filing the consolidated financial statements with a securities commission or other regulatory organization for the purpose of issuing any class of instruments in a public market

However, if a financial report contains both the consolidated financial statements of a parent and the parents separate financial statements, segment information is required only in the consolidated financial statements. 5. Define an operating segment. An operating segment is component of an entity: That engages in business activities from which it may earn revenue and incur expenses, including revenue and expenses relating to transactions with other components of the same entity. Whose operating results are regularly reviewed by the entitys chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance. And for which discrete financial information is available.

Accordingly, an operating segment can generally be thought of as a distinguishable component of an entity that is engaged in business activities which generate revenue and incur expenses. Moreover, to be classified as an operating segment, separate financial information must be available about the segment and its operating results shall be regularly reviewed by a chief operating decision maker.

6.

May the following be considered an operating segment? A. Start-up operations B. Corporate Headquarters C. Postemployment benefit plan An operating segment may engage in business activities for which it has yet to earn revenue. Start-up operations may be operating segments before earning revenue. Corporate headquarters or some functional departments that may not earn revenue that is incidental only to the activities of the entity would not be operating segments. An entitys postemployment benefit plan is not also an operating segment.

7.

Define a chief operating decision maker. The term chief operating decision maker identifies a function and not necessarily a manager with a specific title. The chief operating decision maker may be the entitys chief executive officer, chief operating officer or a group of executive directors depending on whom within the organization is responsible for the allocation of resources and the assessing the performance of operating segments.

8.

Explain the Management Approach of identifying operating segments. The management approach means that the operating segments are identified on the basis of internal reports about components of an entity that are regularly reviewed by the chief operating decision maker in order to allocate to the segments and to assess its performance. In other words, operating segments are identified based on the components of the entity that are considered to be important for internal management reporting purposes.

9.

What are the quantitative thresholds in identifying reportable segments? An entity shall report information about an operating segment that meets any of the following quantitative thresholds: The segment revenue, including both sales to external customers and the intersegment sales or transfers, 10% or more of the combined revenue, internal and external, of all operating segments. The absolute amount of the profit or loss of the segment is 10% or more of the greater in absolute amount of: o Combined profit of all operating segments that reported a profit o Combined loss of all operating segments that reported a loss The assets of the segment are 10% or more of the combined assets of all operating segments.

Operating segments that do not meet any of the quantitative thresholds may be considered reportable and separately disclosed on a voluntary basis if management believes that information about the segment would be useful to the users of the financial statements.

10.

Explain the 75% threshold in identifying reportable segments. If the total external revenue of the reportable operating segments constitutes less than 75% of the entity external revenue, additional operating segments shall be identified as reportable segments even if they do not meet the 10% quantitative thresholds until at least 75% of the entity external revenue is included in reportable segments.

11.

What are the criteria for aggregating two or more segments into one reportable segment? Two or more operating segments may be aggregated into a single operating segment if the segments have similar economic characteristics and the segments share a majority of the following five aggregation criteria: a. Nature of product or service b. Nature of production process c. Type or class of customers d. Marketing method or the method used to distribute the product e. Nature of the regulatory environment, for example, banking and insurance

12.

Is there a limit to the number of reportable segments? There may be a practical limit to the number of reportable segments to be disclosed separately by an entity beyond which segment information may become too detailed. Although no precise limit has been determined, as the number increases above ten, the entity shall consider whether a practical limit has been reached. In other words, if the number of reportable segments exceeds ten, it is likely that the information may become too detailed and consequently lose its usefulness.

13.

Explain the treatment of the following: 1. Segment that is no longer reportable in the current period but is reportable in the immediately preceding period. 2. Segment that becomes reportable in the current period but not reportable in the immediately preceding period. If the management judges that an operating segment identified as a reportable segment in the immediately preceding period is of continuing significance, information about the segment shall continue to be reported separately in the current period even if it no longer meets any of the 10% quantitative thresholds for reportability.] However, if an operating segment is identified as a reportable segment in the current period in accordance with the 10% quantitative thresholds, segment data for a prior presented for comparative purposes shall be restated to reflect the newly reportable segment even if that segment did not satisfy any of the quantitative thresholds in the prior period.

14.

Enumerate the information to be disclosed for each reportable segment. An entity shall disclose the following for each reportable operating segment: 1. General Information about the operating segment

2. Information about the profit or loss, including specified revenue and expenses included in the measure of profit or loss, segment assets, segment liabilities, and the basis of measurement. 3. Reconciliations of the totals of segment revenue, profit or loss, segment assets, segment liabilities, and other material segment items to corresponding items in the entitys financial statements. 15. Explain the disclosure about general information. An entity shall disclose the following general information about an operating segment: 1. Factors used to identify the reportable segments, including the basis of organization 2. Type of products and services from which each reportable segment derives its revenue 16. Explain the disclosure about profit or loss for each reportable segment. An entity shall disclose for each reportable segment a measure or profit or loss, total assets and total liabilities. An entity shall disclose a measure of profit or loss under all circumstances but shall disclose a measure of total assets and total liabilities for each reportable segment if such an amount is regularly provided to the chief operating decision maker. 17. What are the specified amounts included in the measure of profit or loss that are required to be disclosed? 1. Revenue from external customers 2. Revenue from transactions with other operations segments of the same entity 3. Interest revenue 4. Interest expense 5. Depreciation and amortization 6. Material items of income and expense as required by paragraph 97 of PAS 1 7. The entitys interest in the profit or loss of associate and joint venture accounted for by the equity method. 8. Income tax expense 9. Material noncash items other than depreciation and amortization Note that interest revenue and interest expense must be reported separately, unless a majority of the segment revenue is from interest. However, the chief operating decision maker relies primarily on net interest revenue in assessing the performance of the segment and in making decisions about resources to be allocated to the segment. Note also that the specified amounts are disclosed because they are included in the measure of profit or loss reviewed by the chief operating decision maker or otherwise regularly provided to the chief operating decision maker even if not included in the measure of profit or loss.

18.

Define Segment Revenue. Segment revenue is revenue that is directly attributable to a segment and the relevant portion of the entity revenue that can be allocated on a reasonable basis to the segment. It includes sales to external customers and intersegment sales.

19.

Define Segment Expense. Segment expense is expense resulting from the operating activities of the segment that is directly attributable to the segment and the portion of an expense that can be allocated on a reasonable basis to the segment.

20.

Define Segment Assets. Segment assets are those operating assets that are employed by a segment in its operating activities that are either directly attributable to the segment or can be allocated to the segment on a reasonable basis.

21.

What are the segment assets that are specifically required to be disclosed? An entity shall disclose for each reportable segment the following if the specified amounts are included in the measure of total assets or if not included, are regularly provided to the chief operating decision maker: 1. The amount of investment in associate and joint venture accounted for by the equity method. 2. The amount of addition to noncurrent assets, other than financial assets, deferred tax assets, postemployment benefit assets, and rights arising under insurance contracts.

22.

Define Segment Liabilities. Segment liabilities are those liabilities that result from the operating activities of a segment of a segment and that are either directly attributable to the segment or can be allocated to the segment on a reasonable basis.

23.

What reconciliations are required between segment information and amounts shown in the entitys financial statements? 1. The total revenue of all reportable segments to the entity revenue 2. The total profit or loss of all reportable segments to the entity profit or loss before income tax expense and discontinued operations 3. The total assets of all reportable segments to the entity total assets. 4. The total liabilities of all reportable segments to the entity total liabilities 5. The total for every other material item of information disclosed by the reportable segments to the corresponding amount for the entity.

24.

What is the treatment of change in internal organization? If an entity changes structure of its internal organization in a manner that causes the composition of its reportable segments to change, the corresponding information for earlier periods, including interim periods, shall be restated. However, no restatement is made if the corresponding information for earlier periods is not available and the cost to develop it would be excessive

25.

What are entity-wide disclosures? Entity-wide disclosures are additional information that is required to be disclosed by all entities if such information is not provided as part of the reportable segment information. An entity shall disclose information about the following: 1. Information about products and services 2. Information about geographical areas 3. Information about major customers

26.

What is the entity-wide disclosure about products and services? An entity shall disclose the revenue from external customers for each product and service, or each group of similar products and services, unless the necessary information is not available and the cost to develop it would be excessive.

27.

What is the entity-wide disclosure about geographical areas? An entity shall disclose the following geographical information: 1. 2. 3. 4. Revenue from external customers in the entitys country of domicile, and in all foreign operations in total. Separate disclosure of material revenue from external customers in an individual foreign country The basis for attributing revenue from external customers to individual countries. Noncurrent assets, other than financial instruments, deferred tax assets, postemployment benefit assets and rights under insurance contracts, located in the entitys country of domicile and in all foreign countries in total.

28.

What is a major customer? A major customer is defined as a single external customer providing revenue which amounts to 10% or more of an entitys external revenue. The following shall be considered a single customer: 1. A group of entities under a common control 2. A government and entities under the control of such government

29.

Explain the major customer disclosures. The major customer disclosure means that an entity shall provide information about the extent of its reliance on its major customers. The entity shall disclose such fact of reliance on major customers, the total amount of revenue from major customers and the identity of the segment or segments reporting the revenue. The entity is not required to disclose the identity of the major customer or the amount of revenue that each segment reports from that customer.

Vous aimerez peut-être aussi

- 9 - Segment ReportingDocument4 pages9 - Segment ReportingCathPas encore d'évaluation

- Cfas ReviewerDocument6 pagesCfas ReviewerMaycacayan, Charlene M.Pas encore d'évaluation

- PAS 34 Interim Financial Reporting: Learning ObjectivesDocument5 pagesPAS 34 Interim Financial Reporting: Learning ObjectivesFhrince Carl CalaquianPas encore d'évaluation

- Ias 24 Related Party DisclosuresDocument3 pagesIas 24 Related Party DisclosurescaarunjiPas encore d'évaluation

- FAR - DerivativesDocument1 pageFAR - DerivativesralphalonzoPas encore d'évaluation

- Group 8 - Group Discussion 1 PDFDocument3 pagesGroup 8 - Group Discussion 1 PDFMj GalangPas encore d'évaluation

- Accounting ReviewerDocument22 pagesAccounting ReviewerAira TantoyPas encore d'évaluation

- Interim Financial ReportingDocument4 pagesInterim Financial ReportingMia CruzPas encore d'évaluation

- Accntg4 Non-Current Assets Held For Sale and Discontinued Operations NewDocument32 pagesAccntg4 Non-Current Assets Held For Sale and Discontinued Operations NewALYSSA MAE ABAAGPas encore d'évaluation

- 05 Comprehensive Income PDFDocument2 pages05 Comprehensive Income PDFMimi YayaPas encore d'évaluation

- Ias 24 Related Party Disclosure PDFDocument5 pagesIas 24 Related Party Disclosure PDFsimply PrettyPas encore d'évaluation

- Evaluating Financial Performance PDFDocument66 pagesEvaluating Financial Performance PDFJeasmine Andrea Diane PayumoPas encore d'évaluation

- Cfas Notes Salisid: Chapter 03: Presentation of Financial StatementsDocument11 pagesCfas Notes Salisid: Chapter 03: Presentation of Financial StatementsBerdel PascoPas encore d'évaluation

- BH Ffm13 TB Ch01Document30 pagesBH Ffm13 TB Ch01Umer Ali KhanPas encore d'évaluation

- Afn 2 PDFDocument5 pagesAfn 2 PDFLovely Ann ReyesPas encore d'évaluation

- Accounting For Labor 3Document13 pagesAccounting For Labor 3Charles Reginald K. HwangPas encore d'évaluation

- Audit of CashDocument19 pagesAudit of CashAiden PatsPas encore d'évaluation

- Financial Statements Analysis, Part 1 - ExercisesDocument4 pagesFinancial Statements Analysis, Part 1 - ExercisesMark Angelo BustosPas encore d'évaluation

- Topic No. 2 Treasury Shares Rights Issue and Share SplitDocument47 pagesTopic No. 2 Treasury Shares Rights Issue and Share SplitGale KnowsPas encore d'évaluation

- Book Value Per Share Basic Earnings PerDocument61 pagesBook Value Per Share Basic Earnings Perayagomez100% (1)

- Module1 - Foreign Currency Transaction and TranslationDocument3 pagesModule1 - Foreign Currency Transaction and TranslationGerome Echano0% (1)

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document6 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)verycooling100% (1)

- Auditing Theory - Solution ManualDocument21 pagesAuditing Theory - Solution ManualAj de CastroPas encore d'évaluation

- 41 DepletionDocument5 pages41 DepletionjsemlpzPas encore d'évaluation

- Pas 20, 23Document32 pagesPas 20, 23Angela WaganPas encore d'évaluation

- IAS 1 Presentations of Financial StatementsDocument3 pagesIAS 1 Presentations of Financial StatementsPradyut KumarPas encore d'évaluation

- Topic 6 MFRS 110 3 Event - After - Reporting PeriodDocument14 pagesTopic 6 MFRS 110 3 Event - After - Reporting Perioddini sofia100% (1)

- Problems & SolutionsDocument436 pagesProblems & Solutionsmelissa100% (1)

- Full Pfrs Vs Pfrs For Smes PDFDocument21 pagesFull Pfrs Vs Pfrs For Smes PDFPaula Merriles100% (2)

- PFRS For SEsDocument2 pagesPFRS For SEsRisalyn BiongPas encore d'évaluation

- Borrowing Cost PDFDocument2 pagesBorrowing Cost PDFVillaruz Shereen MaePas encore d'évaluation

- Chapter 2 Budgeting Maf420Document28 pagesChapter 2 Budgeting Maf420FeeZzy Fq100% (1)

- PAS 01 Presentation of FSDocument12 pagesPAS 01 Presentation of FSRia GaylePas encore d'évaluation

- 1 The Basis of Strategy: StructureDocument17 pages1 The Basis of Strategy: StructureAlliah Gianne JacelaPas encore d'évaluation

- Conso Sale of PpeDocument6 pagesConso Sale of PpeMitch Delgado EmataPas encore d'évaluation

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document6 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)Mary Jo Lariz OcliasoPas encore d'évaluation

- Cash Cash Equivalents: Philippine Accounting Standards 7 Statement of Cash FlowsDocument2 pagesCash Cash Equivalents: Philippine Accounting Standards 7 Statement of Cash FlowsTrisha AlaPas encore d'évaluation

- Er and Ir Verbs Notes and PracticeDocument3 pagesEr and Ir Verbs Notes and Practiceapi-263078422Pas encore d'évaluation

- Quiz 5 - Chapter 12 & 13Document6 pagesQuiz 5 - Chapter 12 & 13マーチンMartinPas encore d'évaluation

- Cfas Pas 41 AgricultureDocument4 pagesCfas Pas 41 AgricultureMeg sharkPas encore d'évaluation

- Cost Concepts and ClassificationDocument5 pagesCost Concepts and ClassificationSaski AqmarPas encore d'évaluation

- AC2401 Assurance and Auditing BibleDocument57 pagesAC2401 Assurance and Auditing BibleStreak CalmPas encore d'évaluation

- Chapter 3 Summary of Bussiness Valuation Approaches PDFDocument4 pagesChapter 3 Summary of Bussiness Valuation Approaches PDFAliux CuhzPas encore d'évaluation

- Toa Interim ReportingDocument17 pagesToa Interim ReportingEmmanuel SarmientoPas encore d'évaluation

- Book Value and Earnings Per ShareDocument3 pagesBook Value and Earnings Per ShareAlejandrea LalataPas encore d'évaluation

- Investments in Debt SecuritiesDocument19 pagesInvestments in Debt SecuritiesdfsdfdsfPas encore d'évaluation

- The 2001 Balance Sheet and Income Statement For The LewisDocument1 pageThe 2001 Balance Sheet and Income Statement For The LewisMuhammad ShahidPas encore d'évaluation

- Week 1 Conceptual Framework For Financial ReportingDocument17 pagesWeek 1 Conceptual Framework For Financial ReportingSHANE NAVARROPas encore d'évaluation

- Module 1 - FA at FVDocument5 pagesModule 1 - FA at FVNorfaidah Didato GogoPas encore d'évaluation

- Cost of Capital Capital BudgetingDocument19 pagesCost of Capital Capital BudgetingFahad AliPas encore d'évaluation

- Business TaxesDocument47 pagesBusiness TaxesJoyce MorganPas encore d'évaluation

- Afar NotesDocument20 pagesAfar NotesChristian James Umali BrionesPas encore d'évaluation

- Fa 3 Chapter 15 Error CorrectionDocument5 pagesFa 3 Chapter 15 Error CorrectionKristine Florence Tolentino100% (1)

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoPas encore d'évaluation

- Gross Profit and Retail MethodDocument2 pagesGross Profit and Retail MethodMary Dale Joie BocalaPas encore d'évaluation

- GoodwillDocument16 pagesGoodwillapoorva100% (1)

- THEORY26PROBLEMSDocument10 pagesTHEORY26PROBLEMSIryne Kim PalatanPas encore d'évaluation

- #6 PFRS 8Document2 pages#6 PFRS 8Shara Joy B. ParaynoPas encore d'évaluation

- Operating SegmentsDocument3 pagesOperating SegmentsPaula De RuedaPas encore d'évaluation

- Operating Segment: Intermediate Accounting 3Document51 pagesOperating Segment: Intermediate Accounting 3Trisha Mae AlburoPas encore d'évaluation

- Dependency and Economic DevelopmentDocument12 pagesDependency and Economic DevelopmentRyan SanitaPas encore d'évaluation

- Demand Deposits - : ChequeDocument1 pageDemand Deposits - : ChequeRyan SanitaPas encore d'évaluation

- How Does The Internet Work?: FromDocument7 pagesHow Does The Internet Work?: FromRyan SanitaPas encore d'évaluation

- 1.1.a-Science and Technology in The Iron AgeDocument16 pages1.1.a-Science and Technology in The Iron Agetwinkledreampoppies100% (1)

- Syllabus Ba114.12012syllabusDocument9 pagesSyllabus Ba114.12012syllabusRyan SanitaPas encore d'évaluation

- 2.1 Summary Microelectronics and PhotonicsDocument4 pages2.1 Summary Microelectronics and PhotonicsRyan Sanita100% (1)

- Fabm 2-6Document39 pagesFabm 2-6Janine Balcueva82% (11)

- Finsas: Financial Statement Analysis SpreadsheetDocument25 pagesFinsas: Financial Statement Analysis SpreadsheetMashaal FPas encore d'évaluation

- Eg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Document15 pagesEg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Peyti PeytPas encore d'évaluation

- Multi-Step Income Statement - CRDocument16 pagesMulti-Step Income Statement - CRVivian BastoPas encore d'évaluation

- 3.theory Base of Accounting NotesDocument4 pages3.theory Base of Accounting Notesjency.ijaPas encore d'évaluation

- Entrepreneurship Quarter 2 - Module 10 Bookkeeping Pre - TestDocument6 pagesEntrepreneurship Quarter 2 - Module 10 Bookkeeping Pre - TestDinahrae Vallente50% (2)

- Course PresentationDocument40 pagesCourse PresentationShakkhor HaquePas encore d'évaluation

- BIR Issuances From March 27 To April 14, 2023 - Final PresentationDocument33 pagesBIR Issuances From March 27 To April 14, 2023 - Final PresentationPaulPas encore d'évaluation

- Ch-3 Cost BehaviorDocument25 pagesCh-3 Cost BehaviorNeelesh MishraPas encore d'évaluation

- Enterpreneurship Finance Exercises 4-6Document6 pagesEnterpreneurship Finance Exercises 4-6Trang TranPas encore d'évaluation

- STAADocument17 pagesSTAABlack Stork Research60% (5)

- Incremental Operating Cash Flow CalculationDocument11 pagesIncremental Operating Cash Flow Calculationmehrab1807100% (1)

- 25 - Vvimp Interview QuestionsDocument14 pages25 - Vvimp Interview QuestionsBala RanganathPas encore d'évaluation

- BFIN 1quareter ExamDocument29 pagesBFIN 1quareter ExamMark Louie Suarez100% (1)

- Chap 002Document73 pagesChap 002Farah ThabitPas encore d'évaluation

- Instance VRB 2021-22.xmlDocument147 pagesInstance VRB 2021-22.xmlSarah AlicePas encore d'évaluation

- Daftar Akun Pt. BerkahDocument4 pagesDaftar Akun Pt. BerkahRaeynindha DzulfiaPas encore d'évaluation

- Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Merchandising Business (Part I)Document10 pagesBusiness Transactions and Their Analysis As Applied To The Accounting Cycle of A Merchandising Business (Part I)Tumamudtamud, JenaPas encore d'évaluation

- 5.1 Multiple Choice Questions: Chapter 5 Intercompany Profit Transactions - InventoriesDocument36 pages5.1 Multiple Choice Questions: Chapter 5 Intercompany Profit Transactions - InventoriesGaith1 AldaajahPas encore d'évaluation

- CH 23Document92 pagesCH 23Erin Heizyk100% (1)

- Boynton SM CH 14Document52 pagesBoynton SM CH 14jeankopler50% (2)

- 139 Governmental Accounting HO PDFDocument6 pages139 Governmental Accounting HO PDFSankalp Singh100% (1)

- Kochi Municipal Corporation 3feb2020Document5 pagesKochi Municipal Corporation 3feb2020Shaji JkPas encore d'évaluation

- CPChap 2Document79 pagesCPChap 2K59 Hoang Gia HuyPas encore d'évaluation

- Accounting Activation AssignmentDocument19 pagesAccounting Activation AssignmentKen WuPas encore d'évaluation

- Intermediate Accountig AkuntansiDocument46 pagesIntermediate Accountig AkuntansiRika LerianiPas encore d'évaluation

- Baskin Horror Decision TreeDocument9 pagesBaskin Horror Decision Treespectrum_480% (2)

- Lanjutan KOMPUTER AKUTANSIDocument26 pagesLanjutan KOMPUTER AKUTANSIRedho AzmiPas encore d'évaluation

- Wharton Consulting Club Case Book 2019Document201 pagesWharton Consulting Club Case Book 2019guilhermetrinco64% (14)

- VCF - Day 4 ReportDocument10 pagesVCF - Day 4 ReportSoon seng ChuPas encore d'évaluation