Académique Documents

Professionnel Documents

Culture Documents

Chair: Vice Chair: Denis Anderson Tim Johnson Members: Rick Fagerlie Audrey Nelsen

Transféré par

West Central Tribune0 évaluation0% ont trouvé ce document utile (0 vote)

304 vues14 pagesAgenda and attachments from the Aug. 26 Finance Committee meeting, summarizing budget cuts.

Titre original

Aug. 26 Finance Committee agenda

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentAgenda and attachments from the Aug. 26 Finance Committee meeting, summarizing budget cuts.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

304 vues14 pagesChair: Vice Chair: Denis Anderson Tim Johnson Members: Rick Fagerlie Audrey Nelsen

Transféré par

West Central TribuneAgenda and attachments from the Aug. 26 Finance Committee meeting, summarizing budget cuts.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 14

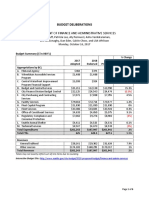

CITY OF WILLMAR

FINANCE COMMITTEE MEETING

4:45PM, MONDAY, AUGUST 26, 2013

CITY OFFICE BUILDING CONFERENCE ROOM NO. 1

Chair:

Vice Chair:

Denis Anderson

Tim Johnson

Members: Rick Fagerlie

Audrey Nelsen

AGENDA

1) Call Meeting to Order

2) Public Comment

3) Leisure Service Budget Amendment (Resolution)

4) 2014 Budget Information (Preliminary Levy Resolution)

A) Memos - Budget Cut Impacts

B) Preliminary Levy Resolution

5) Reports

A) 2nct Quarter Community Foundation

b) July Rice Trust

6) Old Business

A

B.

7) New Business

A

B.

8) Adjourn

CITY COUNCIL ACTION

CITY OF WILLMAR, MINNESOTA

REQUEST FOR COMMITTEE ACTION Date:

Agenda Item Number:

Meeting Date:

Attachments: Yes No

Originating Department: leisure Service

Agenda Item: Adjust the leisure Service Budget-Disc Golf Donation

D Approved

D Amended

D Other

D Denied

D Tabled

Recommended Action: I am requesting a budget amendment to the leisure Service Budget reflecting

the donation from the local Disc Golfers. I would like to amend the leisure Service Revenue Budget to

reflect this $1,224.35 donation. In addition I would like to increase the leisure Service Supplies Budget

101.45432.0229 $1,224.35 to reflect the expense of 10 new cages for our Disc Golf Course.

Background/Summary: Our department had conversations this summer about the needs of the disc

golfers and we agreed that putting in 9 more holes and a practice hole could be accomplished this

summer with the clubs assistance. The club will continue to raise money to assist with future

enhancements.

Alternatives:

Financial Considerations: $1,224.35 of revenue to assist with the $2,859.89 expended

Preparer: Steve Brisendine

Signature:

Comments:

CITY OF WILLMAR, MINNESOTA

REQUEST FOR COMMITTEE ACTION

Agenda Item Number:

Meeting Date: August 26, 2013

Attachments: Yes No

Originating Department: Finance

Agenda Item: Set the Preliminary 2014 Tax Levy by resolution.

CITY COUNCIL ACTION

Date: September 3, 2013

D Approved

D Amended

D Other

D Denied

D Tabled

Recommended Action: To set the Preliminary Tax Levy at $4,139,734

Background/Summary:

Action required by the City to set a preliminary tax levy to comply with the Truth in Taxation Statute.

Due to the levy limit law being reinstituted in 2013 for the 2014 tax year, the levy cannot be raised over

the 2013 tax levy. The levy proposed of $4,139,734 can be lowered, but not be raised after certification

to the County Auditor's office.

Alternatives: To set the amount at a lower amount and not take advantage of the ability to lower at a

later time.

Financial Considerations: Total fiscal impact would be to tax the citizens of Willmar and provide the

second largest funding source for the General Fund. Tax impact would stay relatively the same due to

increased construction and lowering of residential values.

Preparer: Steven B. Okins

Signature:

Comments:

MEMORANDUM

To: Finance Committee

Charlene Stevens, City <:

v--c ....... .->

From:

Dated: August 23, 2013

CITY ADMINISTRATOR

City Office Building

Box 755

Willmar. Minnesota 56201

320-235-4913

FAX: 320-235-4917

www.ci.willmar.mn.us

Re: Mayor's 2014 Budget Reductions and Impacts- Dues, Subscriptions and Memberships

City staff have been asked to provide some additional information on how services and

programs would be impacted by the Mayor's proposed reductions of Memberships and Dues.

The total dollars budgeted City wide for 2013 were $72,317 for the General Fund or .48% and

$4,100 in the Wastewater Treatment Fund. For 2014, the Mayor has proposed reducing all

departments by 35%. The dues for the League of Minnesota Cities, National League of Cities and

Coalition of Greater Minnesota Cities represented approximately $48,000 in 2013 or 66% of the overall

budget for Dues and Subscriptions.

The remaining departments would be impacted as follows:

City Administrator: The City Administrator is a member of ICMA and MCMA, as well as the Willmar

Rotary Club.

Mayor and Council: League of Minnesota Cities, National League of Cities, Coalition of Greater

Minnesota Cities. Willmar has been a charter member of the LMC and CGMC. Reducing the LMC

membership would cost the City significant dollars by raising the City's costs of insurance. The loss of

the CGMC membership will affect the City by its loss of legislative information and legislative influence.

The CGMC staff made a full presentation to the City Council on Monday, August 19, 2013.

Planning and Development Services : Both the Director and Planner are members of the State Planning

Association.

City Clerk: The City Clerk is a member of the Municipal Clerks and Finance Officers Association.

Assessing: Assessors are members of their State professional association.

Willmar

Finance Department: Finance staff are members of the Minnesota Finance Officers Association.

Information Technology: Staff are members of their State professional associations.

leisure Services: Staff are members of the Minnesota Parks and Recreation Association. Staff also

participate in local service clubs. Fees for our on-line bracketing and league scheduling software are also

part of this line item.

Civic Center: The manager is a member of the Minnesota Arena Managers Association.

Fire Department: The Chief is a member of the Kandiyohi County Fire Chiefs, State Fire Chiefs and

International Fire Chief Association, as well as the Association of MN Emergency Responders. Dollars

are also used to purchase NPFA Codes and Standards which are critical for the Fire Marshall.

Public Works: Personnel in WWTP, Public Works and Engineering also participate in their professional

associations. CADD subscription is also included.

Police Department: The Chief participates in the Minnesota and National Police Associations.

Summary: The City of Willmar does not offer regular training to our staff on customer service,

supervision, harassment, employment law or any of the basics of management. We rely on our staff

getting most of their training from their professional associations. If the ability to participate in

professional associations is limited along with the limits in travel and training, we will not be providing

our staff with adequate training.

The reductions could also have an impact on our ability to recruit and retain staff in the future.

MEMORANDUM

To:

Finance Committee

_,

Charlene Stevens, City

'-/'

From:

Dated: August 23, 2013

Re: Mayor's 2014 Budget Reductions and Impacts- Travel and Training

CITY ADMINISTRATOR

City Office Building

Box 755

Willmar, Minnesota 56201

320-235-4913

FAX: 320-235-4917

www.ci.willmor.mn.us

City staff has been asked to provide some additional information on how services and programs

would be impacted by the Mayor's proposed reductions of 50% in funding for Travel and Training.

The total dollars budgeted City wide for travel and training for 2013 were $74,090 for the

General Fund or .48% and $9,400 in the Wastewater Treatment Fund. For 2014, the Mayor has

proposed reducing all departments except the Police Department by 50%, leaving only $57,308 for

travel and training or .36% of the General Fund. The Police Department represents $30,000 of the

overall training budget.

The remaining departments would be impacted as follows:

City Administrator: The funds have been used for the Administrator to attend MCMA, ICMA, LMC or

CGMC Conferences and events. Funding is also used for training for the Administrative Assistant.

Mayor and Council: Attendance at League of Minnesota Cities seminars, meetings and the like would

be curtailed and limited to a select few on Council or Council members would be responsible for their

own costs.

Planning and Development Services: Annual certification of staff. Building Inspectors require certain

state certifications or they will not be qualified to perform inspections. Both planners have Continuing

Education (CEU) requirements as well.

City Clerk: The City Clerk typically attends the Municipal Clerks and Finance Officers Association. Also

charged to this line item are the costs for the CVB noon board meetings. The Clerk would not attend the

MCFOA conference.

Willmar

Assessing: Assessors must be licensed and certified; additionally a new assessor must be trained. The

reduction in dollars would not allow us to properly train a new appraiser and maintain existing licenses.

Without certified appraisers, we would not be able to continue to assess properties. Funds are also

used to pay mileage for personal vehicles used for City business due to a reduction in fleet.

Finance Department: In the past, funding has been used for the Finance Director to attend the

legislative action days for the CGMC, LMC conference and Springsted Symposiums, as well as training for

the other staff.

Information Technology: Training funds are used for IT and WRAC 8 staff to maintain certifications and

training on current and new technologies. Funds are also used for mileage in personal vehicles while on

City business.

Leisure Services: With the reduction in fleet, mileage for employees' use of personal vehicles is now

charged to this account. Three employees attend the Minnesota Parks and Recreation Conference. The

reduction would impact the number of employees able to attend the Minnesota Parks and Recreation

Conference. Dollars are also spent to keep the pool operators' certificate up to date.

Civic Center: The budget is for attendance of the Arena Manager to attend the Minnesota Arena

Managers events. The Manager would no longer be able to attend.

Fire Department: Training is required for firefighters to maintain a minimum certification for the

National Firefighters Protection Agency (NFPA) standards, as well as hazardous materials and Emergency

Medical Services Board. Firefighters also require recertification. Funding also anticipated an increase

in firefighters and the required training costs. Without completion of trainings and certifications, the

Department will not be in compliance with State regulations.

Public Works: Personnel in WWTP, Public Works and Engineering all require training and certification.

They also are provided with skills training in their fields. If certifications cannot be maintained, then we

will not be able to perform tasks in accordance with State regulations, such as MPCA.

Summary: The reductions in travel and training would severely limit an already limited training budget.

We would struggle to maintain minimum certifications and certainly would not be developing our staff

for future opportunities or equipping them with new skills for new tasks. We do not offer regular

training to our staff on customer service, supervision, harassment, employment law or any of the basic

of management. We rely on our staff getting that training from their professional associations.

I have been working with Kandiyohi County and the Willmar Municipal Utilities on developing basic

management training, but without funds, we would not be able to continue that collaboration.

Memo

To: Finance Committee

From: Staff

Re: Mayor's 2014 Budget Reductions and Impacts.

City staff have been asked to provide some additional information on how services and programs would

be impacted by the Mayor's proposed reductions of 50% in funding for Travel and Training; 35%

reduction for Memberships and Dues and 35% for Professional Services:

Professional Services: The total dollars spent City wide for Professional Serivces for 2013 was$ 412,010

for the General Fund or 2.7%, $ 44,041 for the Airport and$ 107,000 in the Wastewater Treatment

Fund. For 2014, after reclassifications for Janitorial services and proposed reductions by the City

Administrator, the Mayor has proposed reducing all departments by 35%, leaving only$ 246,415 for

Professional Services or 1.59% of the General Fund. The Legal Services represents$ 140,400 of the

overall Professional Service budget.

The remaining departments would be impacted as follows:

Mayor and Council: The recording of Council documents, downtown gateway redesign work, pay

equity updating and retreat facilitators.

City Clerk: Municipal Code Updating.

Finance Department: Due to the increase in Grant activity and the large projects the City has been

doing, there would be a negative impact, and possible a shortage to cover the independent auditing

costs.

Legal Fees: The ability to have legal review of required Council and staff actions would be negatively

impacted.

Information Technology: Funds are used for outside services for some of the specialty programs.

Leisure Services: Referee and Umpiring services would be impacted.

Police: Costs for interpretive services, Willmar Pet Hospital for impounding and automated pawn

registration, and Rice Hospital services are all charged and accounted in this area.

Fire Department: The professional services budget is paramount to the safety of each firefighter.

Numerous agencies such as the NFPA, Minnesota Occupational Safety and Health Administration

(MNOSHA) along with the Underwriters Laboratory (UL) require the fire department to hire a 3rd party

contractor to test and measure various pieces of equipment used by firefighters to ensure they are

operating correctly, thus assuring their safety when operating at the scene of an emergency of training.

Airport: Without an onsite City employee the contract for management services is would not be able to

be covered and have to be renegotiated.

Waste Treatment: All outside required testing by Minnesota Testing Lab. would be impacted.

Summary: The reductions in Professional Services would severely impact the ability to cover legal,

auditing, interpretive and required testing and inspection services by independent 3rd parties.

August 1, 2013

Steve Okins

Willmar City Offices

PO Box 755

Willmar, MN 56201

WAFU -12

Beginning Balance

Contributions

Other Income

Investment Activity

Capital Gains/Losses

Unrealized Gains/Losses

Interest & Dividends

Disbursements

Grants and Distributions

Other Expenses

Other Adjustments

Inter-fund Gifts

Grants Returned

Inter-fund Grants

Ending Balance

Grants Payable

Willmar Arts Fund

For Quarter Ending June 30, 2013

Quarter to Date Fiscal Yr to Date

04/01113-06/30/13 07/01/12-06/30/13

106,639.99 99,982.72

60.00 260.00

0.00 0.00

461.69 2,055.67

-2,109.46 6,115.80

611.24 2,532.27

0.00 -5,283.00

0.00 0.00

0.00 0.00

0.00 0.00

0.00 0.00

105,663.46 105,663.46

0.00

If you have any questions, please contact Patty Kennedy, Director of Finance and Investments,

320.257.9733 or pkennedy@communitygiving.org.

Alexandria Area

Fm.mdation

AFFILIATES

Brainerd Lakes Area

'--'V"'-''u.u.uc

5

Foundation

Willmar Area

Foundation

101 South 7th Avenue, Suite 100, St. Cloud, Minnesota 56301

phone (320) 253-4380 toll free (877) 253-4380 + fax (320) 240-9215 CommunityGiving.org

El/tjajt't1j reu?(e-, 73Ut!c/t't1j e()'/1tltUf.Vtti!J

W AFU Gift and Grant Detail

Donor Date Amount Contribution

Nancy Lee Johnson 07/06/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 07/20/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 08/03/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 08/17/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 08/31/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 09/14/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 09/28/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 10/12/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 10/26/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 11/09/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 11/23/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 12/07/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 12/21/2012 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 01/04/2013 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 01/18/2013 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 02/01/2013 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 02/15/2013 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 03/01/2013 10.00 Payroll

and Jeff Johnson

Nancy Lee Johnson 03/15/2013 10.00 Payroll

AFFILIATES

Alexandria Area Brainerd Area Willmar Area

Foundation Foundation Foundation

101 South 7th Avenue, Suite 100, St. Cloud, Minnesota 56301

phone (320) 253-4380 + toll free (877) 253-4380 + fax (320) 240-9215 + CommunityGiving.org

tJwf(e,, e()'l1tfi1.WU't!J

and Jeff Johnson

Nancy Lee Johnson 03/29/2013

and Jeff Johnson

Nancy Lee Johnson 04/12/2013

and Jeff Johnson

Nancy Lee Johnson 04/26/2013

and Jeff Johnson

Nancy Lee Johnson 05/10/2013

and Jeff Johnson

Nancy Lee Johnson 05/24/2013

and Jeff Johnson

Nancy Lee Johnson 06/07/2013

and Jeff Johnson

Nancy Lee Johnson 06/2112013

and Jeff Johnson

*** Total Gifts:

Grantee Date

Willmar Area 11/02/2012

Symphonic Orchestra

Willmar Area Arts 11102/2012

Council

Willmar Area Arts 11/02/2012

Council

*** Total Grants:

Alexandria Area

Cm1ununity Foundation

AFFILIATES

Brainerd Lakes Area

Foundation

10.00 Payroll

10.00 Payroll

10.00 Payroll

10.00 Payroll

10.00 Payroll

10.00 Payroll

10.00 Payroll

260.00

Amount Descr

1,283.00 Young Artists Concert

of the Willmar Area

Symphonic Orchestra

2,000.00 Willmar Area Arts

Council--General

Operating Support

2,000.00 Willmar Area Arts

Council--Studio Hop

and Celebrate Art!

Celebrate Coffee!

5,283.00

Willmar Area

C011nnmlit) Fm.mdation

101 South 7th Avenue, Suite 100, St. Cloud, Minnesota 56301

phone (320) 253-4380 toll free (877) 253-4380 '> fax (320) 240-9215 '> CommunityGiving.org

Bren1er

Investment Management

& Trust

Beginning Market Value

Disbursements

Withdrawals

Expenses

Fees

Total Disbursements

Income

Investment Income

Total Income

Value on lui 31, 2013

Total Change in Portfolio Value

Since 07/01/2013 Year to Date

($) ($)

2,726,478.18 2,616,990.01

-11,000.00 -42,002.36

0.00 -498.75

-1,750.35 -12,127.97

-12,750.35 -54,629.08

3,619.64 25,780.07

3,619.64 25,780.07

2,807,121.61 2,807,121.61

89,774.13 218,980.61

Activity Summary as of 7/31/2013

RICE CUSHMAN A CHAR TR

Asset Category

II Cash & Money

Markets

II Fixed Income

D Alternative

Equity

.Other

Total

Taxable Income

Total Income Summary

Short-term

Long-term

Total Gain/loss Summary

Market Value % T o ~ l

68,548.68 2.44

812,535.66 28.95

190,724.51 6.79

1,688,680.42 60.16

46,632.33 1.66

$2,807,121.61 100.00%

This Period ($)

3,619.64

3,619.64

This Period($)

0.00

3,245.82

3,245.82

Account 180205

Year to Date ($)

25,780.07

25,780.07

Year to Date($)

138.65

16,482.45

16,621.10

While the information and statistics oiwm are believed to he r:omnlete and accurate. we cannot auarantP.P. their comnlehmess or accurar.v. Past nerformance is no auarantee of future results.

Bremer

Investment Management

& Trust

RICE CUSHMAN A CHAR TR

Account 180205

Period Ending: 07/3112013

Sector Market Value 1 Month

Total Fund 2,768,295 3.48

Total Fd Net Fee 2,768,295 3.42

Fixed Income 818,832 .35

BarCap lnt Aggregate Bd .18

Domestic Equity 1,363,683 5.79

S&P 500 Index 5.09

Russell2000 Index 7.00

Inti. Equity 326,506 5.70

MSCI EAFE (US$ & Net) Index 5.28

Short Term Cash 68,220 .00

Citigroup 1 Month Treas Bill .00

Alternative Investments 190,725 -.89

Citigroup 3 Month Treas Bill .00

Uninvested Cash 329 .00

While the information and statistics given are believed to be complete and accurate, we cannot guarantee their completeness or accuracy. Past performance is no guarantee of future results.

Year

to Date

(7 Months)

9.62

9.13

-.64

-1.47

20.32

19.63

23.97

5.47

9.60

.01

.01

1.08

.04

.00

Vous aimerez peut-être aussi

- Joseph Olson Death CertificateDocument1 pageJoseph Olson Death CertificateWest Central TribunePas encore d'évaluation

- Meku Parameshwari Durga Nagalakshmi Reliance JioDocument7 pagesMeku Parameshwari Durga Nagalakshmi Reliance Jiompd nagalakshmiPas encore d'évaluation

- Willmar Design - 2024 Branding GuideDocument87 pagesWillmar Design - 2024 Branding GuideWest Central TribunePas encore d'évaluation

- Willmar Design - 2024 Branding GuideDocument87 pagesWillmar Design - 2024 Branding GuideWest Central TribunePas encore d'évaluation

- Willmar Design - 2024 Branding GuideDocument87 pagesWillmar Design - 2024 Branding GuideWest Central TribunePas encore d'évaluation

- Tool Kit for Tax Administration Management Information SystemD'EverandTool Kit for Tax Administration Management Information SystemÉvaluation : 1 sur 5 étoiles1/5 (1)

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionPas encore d'évaluation

- The Great Hack and data privacy in the PhilippinesDocument2 pagesThe Great Hack and data privacy in the PhilippinesVINCENT ANGELO ANTEPas encore d'évaluation

- Banez vs. ValdevillaDocument2 pagesBanez vs. Valdevillahmn_scribdPas encore d'évaluation

- 2019 Code of Ethics of The Medical Profession With AudioDocument13 pages2019 Code of Ethics of The Medical Profession With AudioManci Bito-onPas encore d'évaluation

- ISO 9001 Audit ProcedureDocument2 pagesISO 9001 Audit ProcedureKs ServicesPas encore d'évaluation

- Betty Jane Johnson Trust Fund RecipientsDocument3 pagesBetty Jane Johnson Trust Fund RecipientsWest Central TribunePas encore d'évaluation

- StatConDigest - Amadora vs. CA, GR L-47745 (15 April 1988)Document1 pageStatConDigest - Amadora vs. CA, GR L-47745 (15 April 1988)Lu CasPas encore d'évaluation

- P290037 TAHSIN M A Osmani UWEBIC Offer Letter PDFDocument5 pagesP290037 TAHSIN M A Osmani UWEBIC Offer Letter PDFM A Osmani TahsinPas encore d'évaluation

- Cincy Southern Railway Sale Spending PlanDocument13 pagesCincy Southern Railway Sale Spending PlanWVXU NewsPas encore d'évaluation

- La Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlDocument6 pagesLa Bugal-b'Laan Tribal Association Et - Al Vs Ramos Et - AlMarlouis U. PlanasPas encore d'évaluation

- Council Memo - 14.08.25 - CM Griggs' $3.84m Budget AmendmentDocument5 pagesCouncil Memo - 14.08.25 - CM Griggs' $3.84m Budget AmendmentcityhallblogPas encore d'évaluation

- 8.B Allocation of Marketing and Economic Development Budget 8-04-15Document7 pages8.B Allocation of Marketing and Economic Development Budget 8-04-15L. A. PatersonPas encore d'évaluation

- Web Pearland 2016 Annualreport CalendarDocument32 pagesWeb Pearland 2016 Annualreport Calendarapi-306549584Pas encore d'évaluation

- Sioux City 2013 Operating BudgetDocument378 pagesSioux City 2013 Operating BudgetSioux City JournalPas encore d'évaluation

- 2015 Mid Year ReportDocument36 pages2015 Mid Year ReportPennLivePas encore d'évaluation

- Event Fee Waivers 07-01-14Document8 pagesEvent Fee Waivers 07-01-14L. A. PatersonPas encore d'évaluation

- 10-0094 Report 3Document7 pages10-0094 Report 3RecordTrac - City of OaklandPas encore d'évaluation

- City of Wooster: Message From The MayorDocument8 pagesCity of Wooster: Message From The MayorCityofWoosterPas encore d'évaluation

- Council Amendment RequestsDocument32 pagesCouncil Amendment RequestsIvan HerreraPas encore d'évaluation

- City Council Resolution MPRWADocument3 pagesCity Council Resolution MPRWAL. A. PatersonPas encore d'évaluation

- Nov 2013 NewsletterDocument2 pagesNov 2013 NewsletterWoodbridge WichitaPas encore d'évaluation

- Cbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011Document20 pagesCbac Presentation: Citizens Budget Advisory Committee Recommendations For Fiscal Year 2011jeanettecriscione762Pas encore d'évaluation

- 2012Document3 pages2012maustermuhlePas encore d'évaluation

- Certain Fiscal and Time Limits With Respect To Special Event Fee Waivers 06-03-14Document5 pagesCertain Fiscal and Time Limits With Respect To Special Event Fee Waivers 06-03-14L. A. PatersonPas encore d'évaluation

- Wrrbfy14 BudgetDocument18 pagesWrrbfy14 BudgetMass LivePas encore d'évaluation

- City of Gahanna 2013 Proposed AppropriationsDocument303 pagesCity of Gahanna 2013 Proposed AppropriationsbjhoytPas encore d'évaluation

- City of Bloomington, Minnesota Annual Budget - Fiscal Year 2014Document285 pagesCity of Bloomington, Minnesota Annual Budget - Fiscal Year 2014MetalAnonPas encore d'évaluation

- City of Cincinnati Park Board AuditReport and Attachments 7-26-16Document21 pagesCity of Cincinnati Park Board AuditReport and Attachments 7-26-16James PilcherPas encore d'évaluation

- TRC News and Notes 1-19-12Document2 pagesTRC News and Notes 1-19-12James Van BruggenPas encore d'évaluation

- CMS Report PDFDocument8 pagesCMS Report PDFRecordTrac - City of OaklandPas encore d'évaluation

- Press Release 04-14-14 - Sarartoga Springs 2013 Year End Finances PDFDocument2 pagesPress Release 04-14-14 - Sarartoga Springs 2013 Year End Finances PDFDeanna BarberPas encore d'évaluation

- CEO: Bank To Be Part of Solution': Final HurdleDocument16 pagesCEO: Bank To Be Part of Solution': Final HurdleelauwitPas encore d'évaluation

- 2013 14 d156 Budget State Form 091013Document29 pages2013 14 d156 Budget State Form 091013api-233183949Pas encore d'évaluation

- City Youth Services Cys Is A Not For Profit Organization Established ToDocument2 pagesCity Youth Services Cys Is A Not For Profit Organization Established Tohassan taimourPas encore d'évaluation

- LMUDA 2012 Annual Report To The City of OaklandDocument7 pagesLMUDA 2012 Annual Report To The City of OaklandOaklandCBDsPas encore d'évaluation

- Saskatoon City Budget 2015Document3 pagesSaskatoon City Budget 2015David A. GilesPas encore d'évaluation

- C S D Councilmember Myrtle Cole, District Four Councilmember David Alvarez, District Eight Council President PRO TEM Marti Emerald, District NineDocument10 pagesC S D Councilmember Myrtle Cole, District Four Councilmember David Alvarez, District Eight Council President PRO TEM Marti Emerald, District Nineapi-238538932Pas encore d'évaluation

- Tourism Marketing District Renewal Background: Office of The Independent Budget Analyst ReportDocument5 pagesTourism Marketing District Renewal Background: Office of The Independent Budget Analyst Reportapi-78283810Pas encore d'évaluation

- Long Beach Civic Center RFP Consultant Agenda Item (Dec. 3, 2013)Document4 pagesLong Beach Civic Center RFP Consultant Agenda Item (Dec. 3, 2013)Anonymous 3qqTNAAOQPas encore d'évaluation

- Liberty Community Authority (LCA) - 2017 Financial Information - ER1087218-ER850925-ER1251592Document3 pagesLiberty Community Authority (LCA) - 2017 Financial Information - ER1087218-ER850925-ER1251592Dan MonkPas encore d'évaluation

- Scott Walker Finance Reform FINAL3.24.09 - Employee Pay and Benefits ReformDocument7 pagesScott Walker Finance Reform FINAL3.24.09 - Employee Pay and Benefits ReformSarah LittleRedfeather KalmansonPas encore d'évaluation

- 2023 Vandalism ReviewDocument4 pages2023 Vandalism ReviewTom SummerPas encore d'évaluation

- Mad Budgets 2004-8 v6 - CedadminDocument8 pagesMad Budgets 2004-8 v6 - Cedadminres ipsa loquiturPas encore d'évaluation

- Mayor Kasim Reed's Proposed FY 2015 BudgetDocument585 pagesMayor Kasim Reed's Proposed FY 2015 BudgetmaxblauPas encore d'évaluation

- Department of Finance and Administrative Services: Budget DeliberationsDocument11 pagesDepartment of Finance and Administrative Services: Budget DeliberationsWestSeattleBlogPas encore d'évaluation

- Town of Stillwater: Internal Controls Over Selected Financial ActivitiesDocument25 pagesTown of Stillwater: Internal Controls Over Selected Financial ActivitiesdayuskoPas encore d'évaluation

- CM Fimbres Fiscal Year 2013 Recommended BudgetDocument2 pagesCM Fimbres Fiscal Year 2013 Recommended BudgetRichard G. FimbresPas encore d'évaluation

- Newark Cy2014 MouDocument39 pagesNewark Cy2014 Mounsnix100% (1)

- 2015 South Euclid, Ohio Budget (Final Council Draft)Document128 pages2015 South Euclid, Ohio Budget (Final Council Draft)seoversightPas encore d'évaluation

- Plans For Budget Deficit 1-26-17Document3 pagesPlans For Budget Deficit 1-26-17Kyle GibsonPas encore d'évaluation

- May 30th 2014 Executive Budget Testimony - FinalDocument4 pagesMay 30th 2014 Executive Budget Testimony - FinalCeleste KatzPas encore d'évaluation

- ORG Meeting February 25, 2014 Agenda PacketDocument35 pagesORG Meeting February 25, 2014 Agenda PacketOaklandCBDsPas encore d'évaluation

- Jackson Master Plan DraftDocument45 pagesJackson Master Plan DraftAnna WolfePas encore d'évaluation

- 10-0094 Report 1Document12 pages10-0094 Report 1RecordTrac - City of OaklandPas encore d'évaluation

- City of Vermilion-08-Erie MLDocument7 pagesCity of Vermilion-08-Erie MLThe Morning JournalPas encore d'évaluation

- Report of Investigation RichwoodDocument189 pagesReport of Investigation RichwoodAnna MoorePas encore d'évaluation

- To: From: CC: Date: ReDocument11 pagesTo: From: CC: Date: ReBrad TabkePas encore d'évaluation

- City MGM'T Memo On Restoring Certain Long Beach Fire Services (Nov. 5, 2013)Document5 pagesCity MGM'T Memo On Restoring Certain Long Beach Fire Services (Nov. 5, 2013)Anonymous 3qqTNAAOQPas encore d'évaluation

- Audit Finds Irregularities at Guilderland Golf CourseDocument20 pagesAudit Finds Irregularities at Guilderland Golf CoursecathleencrowleyPas encore d'évaluation

- Fee Changes ReportDocument18 pagesFee Changes ReportmelissacorkerPas encore d'évaluation

- 5.25.23 Mayor Aftab Budget Transmittal LetterDocument3 pages5.25.23 Mayor Aftab Budget Transmittal LetterWVXU NewsPas encore d'évaluation

- Worcester City Manager Michael V. O'Brien Self-Evaluation.Document24 pagesWorcester City Manager Michael V. O'Brien Self-Evaluation.MassLive.comPas encore d'évaluation

- 2014-2018 Jackson County Capital Improvement ProgramDocument59 pages2014-2018 Jackson County Capital Improvement ProgramLivewire Printing CompanyPas encore d'évaluation

- La Credit ReportDocument31 pagesLa Credit ReportSouthern California Public RadioPas encore d'évaluation

- Advance Gov't&nfp AssignmentDocument5 pagesAdvance Gov't&nfp AssignmentHabte Debele100% (3)

- MAD SD Self-ManagedMAD-CityFY2006BudgetDocument9 pagesMAD SD Self-ManagedMAD-CityFY2006Budgetres ipsa loquiturPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionPas encore d'évaluation

- Carlson McCain Memo RE SW Willmar WellfieldDocument4 pagesCarlson McCain Memo RE SW Willmar WellfieldWest Central TribunePas encore d'évaluation

- Willmar and Willmar Municipal Utilities Sharing Document (May 4 2012)Document1 pageWillmar and Willmar Municipal Utilities Sharing Document (May 4 2012)West Central TribunePas encore d'évaluation

- Willmar Municipal Utilities Memo March 6, 2024, To Planning CommissionDocument1 pageWillmar Municipal Utilities Memo March 6, 2024, To Planning CommissionWest Central TribunePas encore d'évaluation

- City of Willmar and Willmar Municipal Utilities Joint Use Agreement (Dec 22 1988)Document6 pagesCity of Willmar and Willmar Municipal Utilities Joint Use Agreement (Dec 22 1988)West Central TribunePas encore d'évaluation

- Willmar Design - Round 1Document317 pagesWillmar Design - Round 1West Central TribunePas encore d'évaluation

- Willmar Design - Round 1Document317 pagesWillmar Design - Round 1West Central TribunePas encore d'évaluation

- Willmar Design - Round 2Document94 pagesWillmar Design - Round 2West Central TribunePas encore d'évaluation

- Renville County Board Parks Discussion Feb. 20, 2024Document15 pagesRenville County Board Parks Discussion Feb. 20, 2024West Central TribunePas encore d'évaluation

- Willmar Design - Round 1Document317 pagesWillmar Design - Round 1West Central TribunePas encore d'évaluation

- Potential Willmar Rail Park On 145 Acres in The Willmar Industrial ParkDocument1 pagePotential Willmar Rail Park On 145 Acres in The Willmar Industrial ParkWest Central TribunePas encore d'évaluation

- Order of OpinionDocument19 pagesOrder of OpinionWest Central TribunePas encore d'évaluation

- Tepetonka MP April 2023Document1 pageTepetonka MP April 2023West Central Tribune100% (1)

- Updated Kandiyohi County Commissioner District MapDocument1 pageUpdated Kandiyohi County Commissioner District MapWest Central TribunePas encore d'évaluation

- Lac Qui Parle Final Draft EA Package RedactedDocument1 pageLac Qui Parle Final Draft EA Package RedactedWest Central TribunePas encore d'évaluation

- Minnesota Department of Transportation District 8 2023 ConstructionDocument1 pageMinnesota Department of Transportation District 8 2023 ConstructionWest Central TribunePas encore d'évaluation

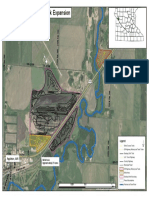

- Appleton Off-Highway Vehicle Park Expansion 2023 Overview MapDocument1 pageAppleton Off-Highway Vehicle Park Expansion 2023 Overview MapWest Central TribunePas encore d'évaluation

- SCS MN 20220110 v0Document1 pageSCS MN 20220110 v0inforumdocsPas encore d'évaluation

- Olivia Mayor Jon Hawkinson Statement March 25-2022Document1 pageOlivia Mayor Jon Hawkinson Statement March 25-2022West Central TribunePas encore d'évaluation

- HF2388 0Document1 pageHF2388 0West Central TribunePas encore d'évaluation

- Unique Opportunities Willmar Building Plan and Elevations.091922Document3 pagesUnique Opportunities Willmar Building Plan and Elevations.091922West Central TribunePas encore d'évaluation

- TH 7 & CR 15 Ice Report - FinalDocument286 pagesTH 7 & CR 15 Ice Report - FinalTom ChervenyPas encore d'évaluation

- Willmar Auditorium Condition Report - May 31, 2022Document127 pagesWillmar Auditorium Condition Report - May 31, 2022West Central TribunePas encore d'évaluation

- Carris Health Treating Acute Pain - HandoutDocument2 pagesCarris Health Treating Acute Pain - HandoutWest Central TribunePas encore d'évaluation

- 2022 Kandiyohi County Park Fees and PoliciesDocument9 pages2022 Kandiyohi County Park Fees and PoliciesWest Central TribunePas encore d'évaluation

- Kandiyohi County and City of Willmar Proposed Redistrict MapsDocument2 pagesKandiyohi County and City of Willmar Proposed Redistrict MapsWest Central TribunePas encore d'évaluation

- Family Races: Activity TypeDocument3 pagesFamily Races: Activity TypeHanhnguyen2020Pas encore d'évaluation

- Mini project analysis of top 50 companies in Nifty 50 indexDocument19 pagesMini project analysis of top 50 companies in Nifty 50 indexcharan tejaPas encore d'évaluation

- HBB94O3WDocument2 pagesHBB94O3WIndra Nath MishraPas encore d'évaluation

- 1495 6094 2 PBDocument8 pages1495 6094 2 PBAam Rachmat Mulyana.,SE.,MMPas encore d'évaluation

- E-Ticket: Travel InformationDocument2 pagesE-Ticket: Travel InformationAli BajwaPas encore d'évaluation

- FO-R23-001 - R2 Subcontractor Registration FormDocument6 pagesFO-R23-001 - R2 Subcontractor Registration FormKeneth Del CarmenPas encore d'évaluation

- Women Artists in Bologna PDFDocument426 pagesWomen Artists in Bologna PDFayeeta5099100% (1)

- ULAB Midterm Exam Business Communication CourseDocument5 pagesULAB Midterm Exam Business Communication CourseKh SwononPas encore d'évaluation

- Instant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full ChapterDocument32 pagesInstant Download Smith and Robersons Business Law 15th Edition Mann Solutions Manual PDF Full Chapterrappelpotherueo100% (7)

- NCLAT OrderDocument32 pagesNCLAT OrderShiva Rama Krishna BeharaPas encore d'évaluation

- Voyage-Account CompressDocument9 pagesVoyage-Account Compressmanisha GuptaPas encore d'évaluation

- Agreement-1st Essential Element of A ContractDocument15 pagesAgreement-1st Essential Element of A ContractSuptoPas encore d'évaluation

- Arriola vs. SandiganbayanDocument16 pagesArriola vs. SandiganbayanKKCDIALPas encore d'évaluation

- Bulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaDocument4 pagesBulk Sms Service Provider in India - Latest Updated System - Sending BULK SMS in IndiaSsd IndiaPas encore d'évaluation

- Acosta v. PlanDocument2 pagesAcosta v. PlanShayne SiguaPas encore d'évaluation

- Despieve A4VG045Document50 pagesDespieve A4VG045Zamuel Torres GarcíaPas encore d'évaluation

- Dayao Vs ComelecDocument2 pagesDayao Vs ComelecrmelizagaPas encore d'évaluation

- Factsheet Alcohol and Risk TakingDocument2 pagesFactsheet Alcohol and Risk TakingDanny EnvisionPas encore d'évaluation

- GASPI v. PACIS-TRINIDAD GR # 229010, NOVEMBER 23, 2020Document45 pagesGASPI v. PACIS-TRINIDAD GR # 229010, NOVEMBER 23, 2020Kristine TarPas encore d'évaluation

- ENTITYDocument4 pagesENTITYGejhin ZeeKiahPas encore d'évaluation

- KAPPA SIGMA BETA Fraternity: Checking and Auditing The Financial StatementsDocument3 pagesKAPPA SIGMA BETA Fraternity: Checking and Auditing The Financial StatementsZean TanPas encore d'évaluation

- By-Laws of Diatagon Business Sector Association (Dibusa) : Know All Men by These PresentsDocument18 pagesBy-Laws of Diatagon Business Sector Association (Dibusa) : Know All Men by These PresentsAllona Zyra CambroneroPas encore d'évaluation