Académique Documents

Professionnel Documents

Culture Documents

F6 Inheritance Tax Pt1

Transféré par

xxxfarahxxxCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

F6 Inheritance Tax Pt1

Transféré par

xxxfarahxxxDroits d'auteur :

Formats disponibles

RELEVANT TO ACCA QUALIFICATION PAPER F6 (UK)

Inheritance tax, part 1

The Paper F6 (UK) syllabus requires a basic understanding of inheritance tax (IHT), and this two-part article covers those aspects that you need to know. It is relevant to candidates taking Paper F6 (UK) in either June or December 2013, and is based on tax legislation as it applies to the tax year 201213 (Finance Act 2012). There will always be a minimum of five marks (but no more than 15 marks) on IHT, with these marks being included in either Questions 3, 4 or 5. The scope of inheritance tax IHT is paid on the value of a persons estate when they die, but it also applies to certain lifetime transfers of assets. If IHT did not apply to lifetime transfers it would be very easy for a person to avoid tax by giving away all of their assets just before they died. As far as Paper F6 (UK) is concerned the terms transfer and gift can be taken to mean the same thing. The person making a transfer is known as the donor, while the person receiving the transfer is known as the donee. Unlike capital gains tax where, for example, a principal private residence is exempt, all of a persons estate is generally chargeable to IHT. A person who is domiciled in the UK is liable to IHT in respect of their worldwide assets. As far as Paper F6 (UK) is concerned, people will always be domiciled in the UK. Transfers of value During a persons lifetime IHT can only arise if a transfer of value is made. A transfer of value is defined as any gratuitous disposition made by a person that results in a diminution in value of that persons estate. There are two important terms in this definition: Gratuitous: Poor business deals, for example, are not normally transfers of value because there is no gratuitous intent. Diminution in value: Normally there will be no difference between the diminution in value of the donors estate and the increase in value of the donees estate. However, in some cases it may be necessary to compare the value of the donors estate before the transfer, and the value after the transfer in order to compute the diminution in value. This will usually be the case where unquoted shares are concerned. Shares forming part of a controlling shareholding will be valued higher than shares forming part of a minority shareholding.

Example 1 On 4 May 2012 Daniel made a gift to his son of 15,000 1 ordinary shares in ABC Ltd, an unquoted investment company. Before the transfer Daniel owned 60,000

2013 ACCA

2 INHERITANCE TAX MARCH 2013 shares out of ABC Ltds issued share capital of 100,000 1 ordinary shares. ABC Ltds shares are worth 8 each for a holding of 15%, 10 each for a holding of 45%, and 18 each for a holding of 60%. Although Daniels son received a 15% shareholding valued at 120,000 (15,000 x 8), Daniels transfer of value is calculated as follows: Value of shares held before the transfer 60,000 x 18 1,080,000 Value of shares held after the transfer 45,000 x 10 450,000 Value transferred 630,000

By contrast, for capital gains tax purposes the valuation will be based on the market value of the shares gifted, which is 120,000. As far as Paper F6 (UK) is concerned, a transfer of value will always be a gift of assets. A gift made during a persons lifetime may be either potentially exempt or chargeable. Potentially exempt transfers Any transfer that is made to another individual is a potentially exempt transfer (PET). A PET only becomes chargeable if the donor dies within seven years of making the gift. If the donor survives for seven years then the PET becomes exempt and can be completely ignored. Hence, such a transfer has the potential to be exempt. If the donor dies within seven years of making a PET then it becomes chargeable. Tax will be charged according to the rates and allowances applicable to the tax year in which the donor dies. However, the value of a PET is fixed at the time that the gift is made. Example 2 Sophie died on 23 January 2013. She had made the following lifetime gifts: 8 November 2005 12 August 2010 A gift of 450,000 to her son. A gift of a house valued at 610,000 to her daughter. By 23 January 2013 the value of the house had increased to 655,000.

The gift to Sophies son on 8 November 2005 is a PET for 450,000. As it was made more than seven years before the date of Sophies death it is exempt from IHT. The gift to Sophies daughter on 12 August 2010 is a PET for 610,000 and is initially ignored. It becomes chargeable as a result of Sophie dying within seven years of making the gift, and the transfer of 610,000 will be charged to IHT based on the rates and allowances for 201213. Chargeable lifetime transfers Any transfer that is made to a trust is a chargeable lifetime transfer (CLT). 2013 ACCA

3 INHERITANCE TAX MARCH 2013 There is no legal definition of what a trust is, but essentially a trust arises where a person transfers assets to people (the trustees) to hold for the benefit of other people (the beneficiaries). For example, parents may not want to make an outright gift of assets to their young children. Instead, assets can be put into a trust with the trust being controlled by trustees until the children are older. Unlike a PET, a CLT is immediately charged to IHT based on the rates and allowances applicable to the tax year in which the CLT is made. An additional tax liability may then arise if the donor dies within seven years of making the gift. Just as for a PET, the value of a CLT is fixed at the time that the gift is made, but the additional tax liability is calculated using the rates and allowances applicable to the tax year in which the donor dies. Example 3 Lim died on 4 December 2012. She had made the following lifetime gifts: 2 November 2005 21 August 2010 A gift of 420,000 to a trust. A gift of a house valued at 615,000 to a trust. By 4 December 2012 the value of the house had increased to 650,000.

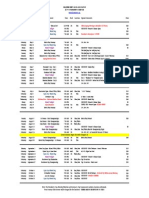

The gift to the trust on 2 November 2005 is a CLT for 420,000, and will be immediately charged to IHT based on the rates and allowances for 200506. There will be no additional tax liability as the gift was made more than seven years before the date of Lims death. The gift to the trust on 21 August 2010 is a CLT for 615,000, and will be immediately charged to IHT based on the rates and allowances for 201011. Lim has died within seven years of making the gift so an additional tax liability may arise based on the rates and allowances for 201213. Rates of tax IHT is payable once a persons cumulative chargeable transfers over a seven-year period exceed a nil rate band. For the tax year 201213 the nil rate band is 325,000, and for previous years it has been as follows: 200304 200405 200506 200607 200708 255,000 263,000 275,000 285,000 300,000 200809 200910 201011 201112 312,000 325,000 325,000 325,000

The rate of IHT payable as a result of a persons death is 40%. This is the rate that is charged on a persons estate at death, on PETs that become chargeable as a result of death within seven years, and is also the rate used to see if any additional tax is payable on CLTs made within seven years of death.

2013 ACCA

4 INHERITANCE TAX MARCH 2013 The rate of IHT payable on CLTs at the time they are made is 20% (half the death rate). This is the lifetime rate. The tax rates information that will be given in the tax rates and allowances section of the June and December 2013 exam papers is as follows: 1 325,000 Excess Death rate Lifetime rate Nil 40% 20%

Where nil rate bands are required for previous years then these will be given to you within the question. Example 4 Sophie died on 26 May 2012 leaving an estate valued at 600,000. The IHT liability is as follows: Death estate Chargeable estate IHT liability 325,000 at nil% 275,000 at 40% 600,000 110,000

Example 5 Ming died on 22 April 2012 leaving an estate valued at 300,000. On 30 April 2010 she had made a gift of 240,000 to her son. This figure is after deducting available exemptions. IHT liabilities are as follows: Lifetime transfer 30 April 2010 Potentially exempt transfer The PET is initially ignored. Additional liability arising on death 30 April 2010 Potentially exempt transfer 240,000 240,000

The PET utilises 240,000 of the nil rate band of 325,000 for 201213. No IHT is payable.

2013 ACCA

5 INHERITANCE TAX MARCH 2013 Death estate Chargeable estate IHT liability 85,000 at nil% 215,000 at 40% 300,000 86,000

Only 85,000 (325,000 240,000) of the nil rate band is available against the death estate.

Example 6 Joe died on 13 October 2012 leaving an estate valued at 750,000. On 12 November 2009 he had made a gift of 400,000 to a trust. This figure is after deducting available exemptions. The trust paid the IHT arising from the gift. The nil rate band for the tax year 200910 is 325,000. Lifetime transfer 12 November 2009 Chargeable transfer IHT liability 325,000 at nil% 75,000 at 20% 400,000 15,000

The gift to a trust is a CLT. The lifetime IHT liability is calculated using the nil rate band for 200910. 400,000 30,000 (15,000) 15,000

Additional liability arising on death 12 November 2009 Chargeable transfer IHT liability 325,000 at nil% 75,000 at 40% IHT already paid Additional liability

The additional liability arising on death is calculated using the nil rate band for 201213. 750,000 300,000

Death estate Chargeable estate IHT liability 750,000 at 40%

The CLT made on 12 November 2008 has fully utilised the nil rate band of 325,000.

2013 ACCA

6 INHERITANCE TAX MARCH 2013 Taper relief It would be somewhat unfair if a donor did not quite live for seven years after making a gift with the result that the gift was fully chargeable to IHT. Therefore taper relief reduces the amount of tax payable where a donor lives for more than three years, but less than seven years, after making a gift. The reduction is as follows: Years before death Over three but less than four years Over four but less than five years Over five but less than six years Over six but less than seven years Percentage reduction % 20 40 60 80

Although taper relief reduces the amount of tax payable, it does not reduce the value of a gift for cumulation purposes. The taper relief table will be given in the tax rates and allowances section of the exam. Example 7 Winnie died on 9 January 2013. She had made the following lifetime gifts: 2 November 2007 16 August 2009 A gift of 460,000 to a trust. The trust paid the IHT arising from this gift A gift of 320,000 to her son

These figures are after deducting available exemptions. The nil rate band for the tax year 200708 is 300,000, and for the tax year 200910 it is 325,000. IHT liabilities are as follows: Lifetime transfers 2 November 2007 Chargeable transfer IHT liability 300,000 at nil% 160,000 at 20% 460,000 32,000 320,000

16 August 2009 Potentially exempt transfer Additional liabilities arising on death 2 November 2007 Chargeable transfer IHT liability 325,000 at nil% 135,000 at 40%

460,000 54,000

2013 ACCA

7 INHERITANCE TAX MARCH 2013 Taper relief reduction 60% IHT already paid Additional liability (32,400) 21,600 (32,000) ______Nil

The taper relief reduction is 60% as the gift to the trust was made between five and six years of the date of Winnies death. Although the final IHT liability of 21,600 is lower than the amount of IHT already paid of 32,000, a refund is never made. 320,000 128,000 (25,600) 102,400

16 August 2009 Potentially exempt transfer IHT liability 320,000 at 40% Taper relief reduction 20%

The taper relief reduction is 20% as the gift to the son was made between three and four years of the date of Winnies death.

Transfer of a spouses unused nil rate band Any unused nil rate band on a persons death can be transferred to their surviving spouse (or registered civil partner). The nil rate band will often not be fully used on the death of the first spouse because any assets left to the surviving spouse are exempt from IHT (see the following section on transfers to spouses). A claim for the transfer of any unused nil rate band is made by the personal representatives who are looking after the estate of the second spouse to die. The amount that can be claimed is based on the proportion of the nil rate band not used when the first spouse died. Even though the first spouse may have died several years ago when the nil rate band was much lower, the amount that can be claimed on the death of the second spouse is calculated using the current limit of 325,000. Example 8 Nun died on 29 March 2013. None of her husbands nil rate band was used when he died on 5 May 2002. When calculating the IHT on Nuns estate a nil rate band of 650,000 (325,000 + 325,000) can be used, as a claim can be made to transfer 100% of her husbands nil rate band. Example 9 Win died on 24 February 2013 leaving an estate valued at 800,000. Only 60% of his wifes nil rate band was used when she died on 12 May 2003. 2013 ACCA

8 INHERITANCE TAX MARCH 2013 On 10 May 2010 Win had made a gift of 200,000 to his son. This figure is after deducting available exemptions. The nil rate band for the tax year 201011 is 325,000. IHT liabilities are as follows: Lifetime transfer 10 May 2010 Potentially exempt transfer Additional liability arising on death 10 May 2010 Potentially exempt transfer 200,000 200,000

No IHT is payable as the transfer is within the nil rate band. 800,000 218,000

Death estate Chargeable estate IHT liability 255,000 at nil% 545,000 at 40%

Wins personal representatives can claim the wifes unused nil rate band of 130,000 (325,000 x 40%). The amount of nil rate band is therefore 455,000 (325,000 + 130,000), of which 200,000 is utilised by the PET made on 10 May 2010.

Exemptions Transfers to spouses Gifts to spouses (and registered civil partners) are exempt from IHT. This exemption applies both to lifetime gifts and on death. Example 10 Sophie died on 25 June 2012. On 12 April 2008 she had made a gift of 400,000 to her husband. Her estate on 25 June 2012 was valued at 900,000. Under the terms of her will Sophie divided her estate equally between her husband and her daughter. The nil rate band for the tax year 200809 is 312,000. IHT liabilities are as follows:

2013 ACCA

9 INHERITANCE TAX MARCH 2013 Lifetime transfers The gift on 12 April 2008 is exempt as it to Sophies husband. 900,000 (450,000) 450,000 50,000

Death estate Value of estate Spouse exemption (900,000/2) Chargeable estate IHT liability 325,000 at nil% 125,000 at 40%

There are a number of other exemptions that only apply to lifetime gifts. Small gifts exemption Gifts up to 250 per person in any one tax year are exempt. If a gift is more than 250 then the small gifts exemption cannot be used, although it is possible to use the exemption any number of times by making gifts to different donees. Example 11 During the tax year 201213 Peter made the following gifts: On 18 May 2012 he made a gift of 240 to his son. On 5 October 2012 he made a gift of 400 to his daughter. On 20 March 2013 he made a gift of 100 to a friend. The gifts on 18 May 2012 and 20 March 2013 are both exempt as they do not exceed 250. The gift on 5 October 2012 for 400 does not qualify for the small gifts exemption as it is more than 250. It will instead be covered by Peters annual exemption for 201213 (see the next section). Annual exemption Each tax year a person has an annual exemption of 3,000. If the whole of the annual exemption is not used in any tax year then the balance is carried forward to the following year. However, the exemption for the current year must be used first, and any unused brought forward exemption cannot be carried forward a second time. Therefore the maximum amount of annual exemptions available in any tax year is 6,000 (3,000 x 2). Example 12 Simone made the following gifts: On 10 May 2011 she made a gift of 1,400 to her son.

2013 ACCA

10 INHERITANCE TAX MARCH 2013 On 25 October 2012 she made a gift of 4,000 to her daughter. The gift on 10 May 2011 utilises 1,400 of Simones annual exemption for 201112. The balance of 1,600 (3,000 1,400) is carried forward to 201213. The gift on 25 October 2012 utilises all of the 3,000 annual exemption for 201213 and 1,000 (4,000 3,000) of the balance brought forward of 1,600. As the annual exemption for 201213 must be used first, the unused balance brought forward of 600 (1,600 1,000) is lost. The annual exemption is applied on a strict chronological basis, and is therefore given against PETs even where they do not become chargeable. Example 13 Nigel made the following gifts: On 17 May 2011 he made a gift of 60,000 to his son. On 25 June 2012 he made a gift of 100,000 to a trust. The gift on 17 May 2011 utilises Nigels annual exemptions for 201112 and 201011. The value of the PET is 54,000 (60,000 3,000 3,000). The gift on 25 June 2012 utilises Nigels annual exemption for 201213. The value of the CLT is 97,000 (100,000 3,000). No lifetime IHT liability is payable as this is within the nil rate band for 201213. Normal expenditure out of income IHT is not intended to apply to gifts of income. Therefore a gift is exempt if it is made as part of a persons normal expenditure out of income, provided the gift does not affect that persons standard of living. To count as normal, gifts must be habitual. Therefore, regular annual gifts of 2,500 made by a person with an annual income of 100,000 would probably be exempt. A one-off gift of 70,000 made by the same person would probably not be, and would instead be a PET or a CLT. Gifts in consideration of marriage This exemption covers gifts made in consideration of a couple getting married or registering a civil partnership. The amount of exemption depends on the relationship of the donor to the donee (who must be one of the two persons getting married): 5,000 if the gift if made a by a parent. 2,500 if the gift is made by a grandparent or by one of the couple getting married to the other. 1,000 if the gift is made by anyone else. Example 14 On 19 September 2012 William made a gift of 20,000 to his daughter when she got married. He has not made any other gifts since 6 April 2011.

2013 ACCA

11 INHERITANCE TAX MARCH 2013 The gift is a PET, but 5,000 will be exempt as a gift in consideration of marriage and Williams annual exemptions for 201213 and 201112 are also available. The value of the PET is therefore 9,000 (20,000 5,000 3,000 3,000). The second part of the article will cover the more difficult aspects of lifetime transfers, the calculation of the value of a persons estate, and the payment of inheritance tax.

Written by a member of the Paper F6 examining team

2013 ACCA

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- AdverbsDocument4 pagesAdverbsxxxfarahxxxPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- A Guide To The Bach Flower Remedies Julian Barnard.10778 1contentsDocument3 pagesA Guide To The Bach Flower Remedies Julian Barnard.10778 1contentsxxxfarahxxx0% (2)

- Digest: BCDA V COADocument2 pagesDigest: BCDA V COAJoshua Pielago50% (2)

- Upcoming Events WebApril2013Document1 pageUpcoming Events WebApril2013xxxfarahxxxPas encore d'évaluation

- School Website: WWW - Salesbury.lancs - Sch.uk: Salesbury C.E. Primary School Worship Theme: Good To Be Me and TrustDocument1 pageSchool Website: WWW - Salesbury.lancs - Sch.uk: Salesbury C.E. Primary School Worship Theme: Good To Be Me and TrustxxxfarahxxxPas encore d'évaluation

- Rose Lane Sadliers Crossing Residential Buy Print Brochure 6836577Document2 pagesRose Lane Sadliers Crossing Residential Buy Print Brochure 6836577xxxfarahxxxPas encore d'évaluation

- SMGA Spring Meeting & Breakfast (10:00am) : Open Day - Mixed Bag Open Day - Mixed BagDocument1 pageSMGA Spring Meeting & Breakfast (10:00am) : Open Day - Mixed Bag Open Day - Mixed BagxxxfarahxxxPas encore d'évaluation

- BacteriaDocument1 pageBacteriaxxxfarahxxxPas encore d'évaluation

- Conferact SheetDocument2 pagesConferact SheetxxxfarahxxxPas encore d'évaluation

- Saltvedt 140116 Olje Og Natural Gas Green Tech NordeaDocument10 pagesSaltvedt 140116 Olje Og Natural Gas Green Tech NordeaxxxfarahxxxPas encore d'évaluation

- Chapter 4 of Mice and Men Vocabulary Vocabulary Dictionary Synonym Antonym Class 1. MauledDocument1 pageChapter 4 of Mice and Men Vocabulary Vocabulary Dictionary Synonym Antonym Class 1. MauledxxxfarahxxxPas encore d'évaluation

- Sun Life Financial PDFDocument4 pagesSun Life Financial PDFxxxfarahxxxPas encore d'évaluation

- Gypsy and Traveller Local Plan - Call For Sites FormDocument4 pagesGypsy and Traveller Local Plan - Call For Sites FormxxxfarahxxxPas encore d'évaluation

- Jain University Puts Indian Traditional Knowledge Into The SpotlightDocument2 pagesJain University Puts Indian Traditional Knowledge Into The SpotlightxxxfarahxxxPas encore d'évaluation

- Leave Three Types Hybrid Plants Flower SunDocument1 pageLeave Three Types Hybrid Plants Flower SunxxxfarahxxxPas encore d'évaluation

- Intel Xeon E3-1240 (BX80623E31240)Document2 pagesIntel Xeon E3-1240 (BX80623E31240)xxxfarahxxxPas encore d'évaluation

- Cow AdDocument1 pageCow AdABPas encore d'évaluation

- Terrace - New Year's Eve Menu 2013Document4 pagesTerrace - New Year's Eve Menu 2013xxxfarahxxxPas encore d'évaluation

- Whole Wheat Date SconesDocument2 pagesWhole Wheat Date SconesxxxfarahxxxPas encore d'évaluation

- Course Guide Internship at ENP November 2012Document6 pagesCourse Guide Internship at ENP November 2012xxxfarahxxxPas encore d'évaluation

- Keurbemerkingenbijlage UKDocument2 pagesKeurbemerkingenbijlage UKxxxfarahxxxPas encore d'évaluation

- JoomlaDocument3 pagesJoomlaxxxfarahxxxPas encore d'évaluation

- Course Guide Internship at ENP November 2012Document6 pagesCourse Guide Internship at ENP November 2012xxxfarahxxxPas encore d'évaluation

- Asus CP Cp6230-Bn005o (90pd78da41543k40gckz)Document3 pagesAsus CP Cp6230-Bn005o (90pd78da41543k40gckz)xxxfarahxxxPas encore d'évaluation

- Evidence Stefan Wolff Richard Whitman Conflict ResolutionDocument16 pagesEvidence Stefan Wolff Richard Whitman Conflict ResolutionxxxfarahxxxPas encore d'évaluation

- Neighbourhood Europeanization Through ENP. The Case of UkraineDocument28 pagesNeighbourhood Europeanization Through ENP. The Case of UkraineTransformEuropePas encore d'évaluation

- Enp Invitation enDocument2 pagesEnp Invitation enxxxfarahxxxPas encore d'évaluation

- EPC Issue Paper 54 - Reassessing The ENPDocument35 pagesEPC Issue Paper 54 - Reassessing The ENPxxxfarahxxxPas encore d'évaluation

- EPC Issue Paper 54 - Reassessing The ENPDocument35 pagesEPC Issue Paper 54 - Reassessing The ENPxxxfarahxxxPas encore d'évaluation

- Ra FellaDocument23 pagesRa FellaxxxfarahxxxPas encore d'évaluation

- Conjoint enDocument22 pagesConjoint enxxxfarahxxxPas encore d'évaluation

- Judaff Accused V2Document5 pagesJudaff Accused V2Rush YuviencoPas encore d'évaluation

- Family LawDocument7 pagesFamily LawHarsh SrivastavaPas encore d'évaluation

- Tax VitugDocument6 pagesTax VitugTrem GallentePas encore d'évaluation

- 2019 Bar LaborDocument8 pages2019 Bar LaborFraicess GonzalesPas encore d'évaluation

- Indian Contract Act-John.V.SugumaranDocument47 pagesIndian Contract Act-John.V.Sugumaranjv_suguPas encore d'évaluation

- Voluntary Winding Up Compulsory Winding UpDocument24 pagesVoluntary Winding Up Compulsory Winding UpDana AlHamadPas encore d'évaluation

- The Manager's Handbook For Corporate Security: Establishing and Managing A Successful Assets Protection ProgramDocument8 pagesThe Manager's Handbook For Corporate Security: Establishing and Managing A Successful Assets Protection ProgramJordan PopovskiPas encore d'évaluation

- Dumpit-Murillo V CA PDFDocument8 pagesDumpit-Murillo V CA PDFHenry BaltezaPas encore d'évaluation

- Abdul Karim vs. State of KarnatakaDocument21 pagesAbdul Karim vs. State of Karnatakaisha04tyagiPas encore d'évaluation

- Litonjua Vs LDocument2 pagesLitonjua Vs LKling KingPas encore d'évaluation

- PAL V CADocument4 pagesPAL V CAJeunaj LardizabalPas encore d'évaluation

- 184 Supreme Court Reports Annotated: Tambasen vs. PeopleDocument10 pages184 Supreme Court Reports Annotated: Tambasen vs. PeopleKevin AmantePas encore d'évaluation

- Sample Notice of Unavailability of Counsel For CaliforniaDocument3 pagesSample Notice of Unavailability of Counsel For CaliforniaStan Burman100% (1)

- Cancio JR Vs IsipDocument4 pagesCancio JR Vs IsipTjYambotPas encore d'évaluation

- A.M. No. 02-11-10-SC-LawPhilDocument7 pagesA.M. No. 02-11-10-SC-LawPhilAlbert BulawatPas encore d'évaluation

- Cohen Plea AgreementDocument9 pagesCohen Plea AgreementRoscoe B Davis50% (2)

- RP Vs CA and GacotDocument1 pageRP Vs CA and GacotWonder WomanPas encore d'évaluation

- Republic Vs Court of Appeals, 258 SCRA 639Document6 pagesRepublic Vs Court of Appeals, 258 SCRA 639Princess Loyola TapiaPas encore d'évaluation

- Republic Vs Phil ResourcesDocument6 pagesRepublic Vs Phil ResourcesNilsaPas encore d'évaluation

- Assignment of InsuranceDocument8 pagesAssignment of InsuranceMd. Ariful HaquePas encore d'évaluation

- Society and Living Standards 1Document4 pagesSociety and Living Standards 1Rita BrestovskaPas encore d'évaluation

- Alabang Country Club v. NLRCDocument1 pageAlabang Country Club v. NLRCtemporiariPas encore d'évaluation

- Petitioner Vs Vs Respondent Arsenio M. Cabrera For Petitioner. Antonio G. Nalapo For Private RespondentDocument10 pagesPetitioner Vs Vs Respondent Arsenio M. Cabrera For Petitioner. Antonio G. Nalapo For Private Respondentkumiko sakamotoPas encore d'évaluation

- Corpuz vs. Sto. TomasDocument3 pagesCorpuz vs. Sto. TomasSarah Monique Nicole Antoinette GolezPas encore d'évaluation

- REGISTRAR NEEDED Eugene Dupuch Law SchoolDocument2 pagesREGISTRAR NEEDED Eugene Dupuch Law SchoolJoette PennPas encore d'évaluation

- Mrunal Ethics (E1:P3) Human Values, Family, Society, Public Vs - PrivateDocument9 pagesMrunal Ethics (E1:P3) Human Values, Family, Society, Public Vs - PrivatePrateek BayalPas encore d'évaluation

- PubCorp ReviewerDocument24 pagesPubCorp ReviewerMike E Dm100% (1)

- ReferatDocument2 pagesReferatMarian ButuceaPas encore d'évaluation

- Duties of A Lawyer (F) To (G)Document9 pagesDuties of A Lawyer (F) To (G)Maria Recheille Banac KinazoPas encore d'évaluation