Académique Documents

Professionnel Documents

Culture Documents

Auto Monthy - August 2013

Transféré par

Angel BrokingTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Auto Monthy - August 2013

Transféré par

Angel BrokingDroits d'auteur :

Formats disponibles

Auto Monthly - August 2013

Ashok Leyland Ashok Leyland (AL) witnessed a steep decline of 18.3% mom in its total sales to 7,139 units led by the weak demand environment amidst slowdown in the economic activity. While medium and heavy commercial vehicle (MHCV) sales posted a decline of 21.1% mom; Dost sales too posted a decline of 11.3% mom during the month. On a yoy basis too, total sales declined by 24.3% with MHCV and Dost sales registering a decline of 25.1% and 22.4% yoy respectively. Bajaj Auto Bajaj Auto recorded an in-line volume growth of 11% mom to 312,188 units led by a 12.9% mom growth in the motorcycle sales primarily driven by the exports. Total exports surged sharply by 31% mom during the month. The threewheeler sales however declined 2.6% mom as the sales continue to be impacted due to the slowdown in Egypt. Domestic sales too declined by 1.9% mom due to the weak demand for motorcycles. On a yoy basis, total sales posted a decline of 9.5% yoy following a 21.2% decline in domestic volumes. Exports however, registered a growth of 9.6% yoy. The company has launched new three-wheelers in an attempt to progressively replace the entire portfolio over the next 3-4 months. Further, the company also intends to launch new variants of Discover around the festival season. Hero MotoCorp Hero MotoCorp (HMCL) registered lower-than-expected volumes in August 2013 as volumes continue to be impacted by the slowdown in motorcycle demand and higher competition from Honda. Overall sales declined 5.7% mom to 459,996 units. However, on a yoy basis, the sales grew by 3.6% primarily due to the base effect. Going ahead, the company expects better monsoons to revive growth during the festival season. Mahindra and Mahindra Mahindra and Mahindras (MM) tractor sales came in lower-than-expected at 14,158 units, down 23.3% mom as domestic sales declined by 23.8% mom during the month. However on a yoy basis, tractor sales grew by 7% yoy led by a 9.3% yoy growth in domestic sales driven by good monsoon and improved prospects for kharif crop. Meanwhile, the company has reached an agreement on the wage settlement issue with the workers at the Nashik plant after negotiating for almost a year. According to the media reports, the company will give an average wage hike of `9,300/ month to all its 2,950 permanent employees at the facility and the union has agreed to scale up production by 18% in a quid-pro-quo arrangement. The Nashik plant employs around ~4,000 workers, out of which ~1,000 are on contract basis, and produces models like Bolero, Scorpio, Xylo Quanto and Verito. Maruti Suzuki Maruti Suzuki (MSIL) registered a better-than-expected volume growth of 4.8% mom to 87,323 units driven by a strong 38.6% mom growth in exports. The domestic volumes though grew modestly by 1.2% mom and were led by a strong 25.4% mom growth in the compact segment. The utility vehicle sales of MSIL have slowed down considerably over the last few months due to the increasing competition from Renault and Ford and also due to the slowdown in demand for diesel vehicles post the recent hike in the fuel prices. On a yoy basis, total sales registered a growth of 61.2% yoy primarily due to the low base of last year. The companys sales in August 201 2 were impacted due to the labor problems at the Manesar plant which had led to temporary shutdown in production. Mr. Yaresh Kothari (Research Analyst - Automobile, Angel broking)

Vous aimerez peut-être aussi

- Automotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryD'EverandAutomotive Glass Replacement Shop Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryD'EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- Automobile Sales - September 2013: Car, CV Sales Stay Weak, But Improvement in Two-WheelersDocument3 pagesAutomobile Sales - September 2013: Car, CV Sales Stay Weak, But Improvement in Two-WheelersTariq HaquePas encore d'évaluation

- Auto Sales FiguresDocument5 pagesAuto Sales Figuressrishtiagarwal26Pas encore d'évaluation

- NewsDocument145 pagesNewsKAVVIKAPas encore d'évaluation

- AutomobileDocument5 pagesAutomobileRushin KothariPas encore d'évaluation

- MotoGaze - ICICI February 2013Document18 pagesMotoGaze - ICICI February 2013Vivek MehtaPas encore d'évaluation

- Auto Sector CrisisDocument4 pagesAuto Sector CrisisDawood SultanPas encore d'évaluation

- India's auto sector crisis deepens as sales plunge to lowest in nearly 8 yearsDocument4 pagesIndia's auto sector crisis deepens as sales plunge to lowest in nearly 8 yearsDawood SultanPas encore d'évaluation

- Decline in Automobile IndustryDocument4 pagesDecline in Automobile IndustryTushar SinghPas encore d'évaluation

- Initiating Coverage Maruti SuzukiDocument13 pagesInitiating Coverage Maruti SuzukiAditya Vikram JhaPas encore d'évaluation

- Industry Performance in 2012-13Document5 pagesIndustry Performance in 2012-13FarooqAnwarPas encore d'évaluation

- Indian Two Wheeler Industry Analysis Research Report - Fintapp BlogDocument10 pagesIndian Two Wheeler Industry Analysis Research Report - Fintapp BlogakshPas encore d'évaluation

- Auto Industry: Drastic Times Call For Drastic Measures: November 14, 2012Document3 pagesAuto Industry: Drastic Times Call For Drastic Measures: November 14, 2012Moiz HussainPas encore d'évaluation

- 1 AcknowledgmentDocument13 pages1 AcknowledgmentSachin UmbarajePas encore d'évaluation

- Hero MotorsDocument28 pagesHero MotorsNaveen KPas encore d'évaluation

- Retail sector of automobile industry sees 8% YoY decline in March 2019Document10 pagesRetail sector of automobile industry sees 8% YoY decline in March 2019Aadhavan ParthipanPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Tata Motors Unveils Upgraded Versions of Indica, Indigo, Sumo, Safari and NanoDocument5 pagesTata Motors Unveils Upgraded Versions of Indica, Indigo, Sumo, Safari and NanoDhiraj IppiliPas encore d'évaluation

- Hike in PricesDocument1 pageHike in PricesSaurabh GuptaPas encore d'évaluation

- Market Outlook Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Indian Automobile Market Growth and Major PlayersDocument7 pagesIndian Automobile Market Growth and Major PlayersBhupesh TalrejaPas encore d'évaluation

- August 2014 Auto Sales - Summary: Revival of The Auto SectorDocument2 pagesAugust 2014 Auto Sales - Summary: Revival of The Auto SectorVinuth RajPas encore d'évaluation

- Maruti SuzukiDocument4 pagesMaruti SuzukiDhaval MandaviyaPas encore d'évaluation

- Auto Sector Update, February 2013Document13 pagesAuto Sector Update, February 2013Angel BrokingPas encore d'évaluation

- (Automobile Industry Slowdown in India) : Arohi Sharma Sohail Parvez Prakhar MehrotraDocument8 pages(Automobile Industry Slowdown in India) : Arohi Sharma Sohail Parvez Prakhar MehrotraSaptashwa MukherjeePas encore d'évaluation

- Powerpoint of MahindraDocument17 pagesPowerpoint of MahindraCuteAngel06Pas encore d'évaluation

- Market Outlook Market Outlook: Dealer's DiaryDocument14 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Project On BA p1&2Document15 pagesProject On BA p1&2KAILAS S NATH MBA19-21Pas encore d'évaluation

- IMT Nagpur Group Report on Consumers, Firms and MarketsDocument6 pagesIMT Nagpur Group Report on Consumers, Firms and MarketsKaushal MajejiPas encore d'évaluation

- An Analysis of Car Dealers in IndiaDocument8 pagesAn Analysis of Car Dealers in IndiaTushar DagaPas encore d'évaluation

- Axis_Securities_Auto_Monthly_Volume_UpdateDocument7 pagesAxis_Securities_Auto_Monthly_Volume_UpdateAditya SoniPas encore d'évaluation

- Automobile Sector: Industry OverviewDocument2 pagesAutomobile Sector: Industry OverviewRaviAnandPas encore d'évaluation

- 4 Wheeler IndustryDocument21 pages4 Wheeler IndustryJaptej Singh100% (1)

- Market Outlook Market Outlook: Dealer's DiaryDocument9 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Recent Slump in Indian Automotive Industry: 150cc in The Next Six Years and All Three-Wheelers Within Four YearsDocument4 pagesRecent Slump in Indian Automotive Industry: 150cc in The Next Six Years and All Three-Wheelers Within Four YearsSomnath PaulPas encore d'évaluation

- Overview of Auto SectorDocument4 pagesOverview of Auto SectorNitin JainPas encore d'évaluation

- Bajaj Auto EICDocument4 pagesBajaj Auto EICankitaPas encore d'évaluation

- FEDERAL MOGUL GOETZE INDIA LIMITED - ReportDocument56 pagesFEDERAL MOGUL GOETZE INDIA LIMITED - Reportchaitra rPas encore d'évaluation

- Comparative Analysis of Auto Marketing Strategies in IndiaDocument21 pagesComparative Analysis of Auto Marketing Strategies in IndiaFaisal Mushir0% (1)

- Customer Satisfaction at Maruti SuzukiDocument55 pagesCustomer Satisfaction at Maruti SuzukirajPas encore d'évaluation

- Economics Assignment: (Decline in Sales in Automobile Sector)Document9 pagesEconomics Assignment: (Decline in Sales in Automobile Sector)AryanPas encore d'évaluation

- Project Report Two Wheeler IndustryDocument7 pagesProject Report Two Wheeler IndustrysouravPas encore d'évaluation

- Maruti Suzuki Sales Up 24Document5 pagesMaruti Suzuki Sales Up 24Prashant MishraPas encore d'évaluation

- Automobile Industry SlowdownDocument14 pagesAutomobile Industry SlowdownSaurav Pandab100% (1)

- M&M Motorcycle Report FinalDocument17 pagesM&M Motorcycle Report FinalSagar PanchalPas encore d'évaluation

- Market Share and Growth RatesDocument2 pagesMarket Share and Growth RatesHoney AliPas encore d'évaluation

- Mayank and Group EconomicsDocument15 pagesMayank and Group EconomicsMAYANK TANWANIPas encore d'évaluation

- Indian Automobile Industry Overview: Growth, Market Structure and Impact of COVID-19Document24 pagesIndian Automobile Industry Overview: Growth, Market Structure and Impact of COVID-19Vineetha Chowdary GudePas encore d'évaluation

- ICRA Report 2 WheelersDocument6 pagesICRA Report 2 WheelersMayank JainPas encore d'évaluation

- Snippet of Financial Results For Q1 FY 21Document9 pagesSnippet of Financial Results For Q1 FY 21shraddha anandPas encore d'évaluation

- Tyre Industry Performance AnalysisDocument15 pagesTyre Industry Performance AnalysisJubin RoyPas encore d'évaluation

- WORKING CAPITAL MANAGEMENT IN HERO HONDADocument15 pagesWORKING CAPITAL MANAGEMENT IN HERO HONDAAbhineet Kumar0% (2)

- IEA Report 12th JanuaryDocument37 pagesIEA Report 12th JanuarynarnoliaPas encore d'évaluation

- Visit Us atDocument3 pagesVisit Us atrooni889Pas encore d'évaluation

- AutomobileDocument2 pagesAutomobilePulkit JainPas encore d'évaluation

- Supply Chain Project-Maruti Suzuki India Limited: Operations ManagementDocument15 pagesSupply Chain Project-Maruti Suzuki India Limited: Operations Managementvijay singhPas encore d'évaluation

- TiniDocument3 pagesTiniBrijesh M JaradiPas encore d'évaluation

- BAJAJ Vs HERO HONDA Comparative Analysis in Automobile Industry Thesis 86p.Document88 pagesBAJAJ Vs HERO HONDA Comparative Analysis in Automobile Industry Thesis 86p.Chandani Thakur100% (1)

- Complete Engines, Part Engines & Engine Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryD'EverandComplete Engines, Part Engines & Engine Parts (Car OE & Aftermarket) World Summary: Market Values & Financials by CountryPas encore d'évaluation

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingPas encore d'évaluation

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingPas encore d'évaluation

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingPas encore d'évaluation

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingPas encore d'évaluation

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingPas encore d'évaluation

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingPas encore d'évaluation

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingPas encore d'évaluation

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingPas encore d'évaluation

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingPas encore d'évaluation

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingPas encore d'évaluation

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingPas encore d'évaluation

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingPas encore d'évaluation

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingPas encore d'évaluation

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingPas encore d'évaluation

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingPas encore d'évaluation

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingPas encore d'évaluation

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingPas encore d'évaluation

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingPas encore d'évaluation

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingPas encore d'évaluation

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingPas encore d'évaluation

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingPas encore d'évaluation

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingPas encore d'évaluation

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingPas encore d'évaluation

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingPas encore d'évaluation

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingPas encore d'évaluation

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingPas encore d'évaluation

- National HIghways Motorways Dimension of Goods Transport Vehicle Rules 2017 PDFDocument18 pagesNational HIghways Motorways Dimension of Goods Transport Vehicle Rules 2017 PDFWaqas Mustafa KunbherPas encore d'évaluation

- VelotaxiDocument18 pagesVelotaxisteambolt100% (1)

- Automatic Transaxle and Transfer Workshop Manual Aw6A-El Aw6Ax-ElDocument186 pagesAutomatic Transaxle and Transfer Workshop Manual Aw6A-El Aw6Ax-ElVIDAL ALEJANDRO GARCIAVARGAS100% (1)

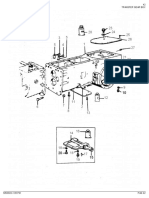

- MT 728 Série D-E3 MT 732 Série D-E3 MT 928 Série D-E3 MT 932 Série D-E3 MT 1030 S Série 4-E3 MT 1030 ST Série 4-E3Document156 pagesMT 728 Série D-E3 MT 732 Série D-E3 MT 928 Série D-E3 MT 932 Série D-E3 MT 1030 S Série 4-E3 MT 1030 ST Série 4-E3jacques PerronPas encore d'évaluation

- Engine Controls (Powertrain Management) - ALLDATA RepairDocument8 pagesEngine Controls (Powertrain Management) - ALLDATA RepairXavier AlvarezPas encore d'évaluation

- Engine Fire / Severe Damage / Separation On Takeoff: PF PM RemarksDocument5 pagesEngine Fire / Severe Damage / Separation On Takeoff: PF PM RemarksAbdel Hafid LahrechePas encore d'évaluation

- Mazda - SKYACTIV TechnologiesDocument25 pagesMazda - SKYACTIV TechnologiesPongchanok Paisitpatanapong100% (1)

- Marine transmission KMH50A specificationsDocument2 pagesMarine transmission KMH50A specificationsmike pappasPas encore d'évaluation

- Fiat Hitachi Wheel Loader W110 W130 130PL Service Manual en PDFDocument393 pagesFiat Hitachi Wheel Loader W110 W130 130PL Service Manual en PDFzdeniel2006Pas encore d'évaluation

- Accessory DrivesDocument2 pagesAccessory Drivesbassumudhol100% (1)

- Maruti Suzuki India LTD (MSIL) : Presented byDocument22 pagesMaruti Suzuki India LTD (MSIL) : Presented byAvnit kumarPas encore d'évaluation

- AMO certificate holder record keeping requirementsDocument6 pagesAMO certificate holder record keeping requirementsMunir DirgantaraPas encore d'évaluation

- Customer Details Pro-Forma Invoice (Revised)Document2 pagesCustomer Details Pro-Forma Invoice (Revised)Hugh O'Brien GwazePas encore d'évaluation

- Toyota PriusDocument7 pagesToyota PriusBhanuka SrikanthaPas encore d'évaluation

- Model S PDFDocument19 pagesModel S PDFffkefePas encore d'évaluation

- Vehicle DynamicsDocument33 pagesVehicle DynamicsDivyanshuPas encore d'évaluation

- Module 14 QuestionsDocument3 pagesModule 14 QuestionsKıvanc Terzioglu71% (7)

- 2019 Anhui Jicheng CatalogueDocument141 pages2019 Anhui Jicheng CatalogueSoe Pyae AungPas encore d'évaluation

- Vector General Presentation 0314Document8 pagesVector General Presentation 0314api-237465088Pas encore d'évaluation

- Motorcycle Maintenance Manual: BenelliDocument485 pagesMotorcycle Maintenance Manual: Benellicalvin tekPas encore d'évaluation

- 42Document3 pages42geovane silvaPas encore d'évaluation

- Ignition Key Number Stamped Position: Starter Motor Will Not OperateDocument1 pageIgnition Key Number Stamped Position: Starter Motor Will Not Operategreaternorthroad8820Pas encore d'évaluation

- MOTOR Selectline 10 PDFDocument1 pageMOTOR Selectline 10 PDFXavier Moreno100% (1)

- 2005 Chevrolet Spark engine sensor connector views and functionsDocument14 pages2005 Chevrolet Spark engine sensor connector views and functionsData TécnicaPas encore d'évaluation

- DMT 219004 AbDocument518 pagesDMT 219004 AbCiprian MariusPas encore d'évaluation

- Marketing Plan For Tesla Motors' Model SDocument21 pagesMarketing Plan For Tesla Motors' Model SPranav TripathiPas encore d'évaluation

- Saudi Arabia Road Sign Guide with Hairpin, Curve, Speed Limit SymbolsDocument7 pagesSaudi Arabia Road Sign Guide with Hairpin, Curve, Speed Limit Symbolsmoonstar_dme100% (1)

- Memo Gidley, Memo Gidley. Karting - Everything You Need To Know PDFDocument136 pagesMemo Gidley, Memo Gidley. Karting - Everything You Need To Know PDFTravellerPas encore d'évaluation

- 1937 Prototype W30 Chassis 26Document22 pages1937 Prototype W30 Chassis 26splett6493Pas encore d'évaluation

- X300 Extreme 300cc ATV Owners ManualDocument74 pagesX300 Extreme 300cc ATV Owners ManualLorraine du ToitPas encore d'évaluation