Académique Documents

Professionnel Documents

Culture Documents

Compliance S

Transféré par

Jaya JamdhadeDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Compliance S

Transféré par

Jaya JamdhadeDroits d'auteur :

Formats disponibles

India

Pvt. Ltd. Your gateway to business with India. Experience the difference we make. Entry, Investment & Trade Strategy Advisory and Business Development Services.

Bee Management Consultancy

SUMMARY OF REGULATORY REQUIREMENTS FOR INDIA ENTRY COMPLIANCE SERVICES FORMATION, REGISTRATION & ANNUAL IMPLICATIONS. (Provided by our partner compliance services firms and specialist Lawyers & Chartered Accountants). Under certain circumstances, depending on the intended nature of business operations in India, prior approval of the Foreign Investment Promotion Board (FIPB) would be necessary. If, on obtaining more details, it becomes apparent that such an approval is necessary, we would need anything from a few days to about two weeks to find out whether it is worth making an attempt at it in Delhi. It may be emphasized that, even if we do obtain positive feedback, approval would be at the discretion of the FIPB. In all cases, that is, where FIPB approval is required and obtained as well as in circumstances where such an approval is not required, a subsidiary company would need to be incorporated, shares issued to the Singapore holding company and relevant filings made with the Reserve Bank of India (RBI). The end results of these processes would be the registration and incorporation of an Indian company and a foreign collaboration registration number from the RBI. FORMATION AND REGISTRATION SERVICES FOR WHICHE FEES WOULD BE CHARGED Company incorporation including assistance with preparing formation documents Mandatory filing with the Reserve Bank of India on the issue of shares to a foreign investor Application to the FIPB*

* Regardless of whether FIPB approval is obtained or not. Whereas we will advise on the feasibility of making such an application on receiving further details, it may be noted that ultimately, this is a discretionary approval, which is sometimes not forthcoming. The Client / Indian Company would have to bear formation costs such as stamp duty and Registrar of Companies Fees. Out of pocket expenses will also be charged at actuals. Needless to say, these will be kept at the barest minimum. Service tax will be payable on our fees, at 10.2% of the gross fees. RECURRING ANNUAL COMPLIANCE SERVICES FOR WHICH ANNUAL FEES WOULD BE CHARGED Once the Company is formed, we shall be in a position to offer professional services, which cover the following functions:

Statutory Audit and Indian Tax Audit - The fees would be based on the volume of transactions per annum.

In addition to the statutory/Indian GAAP audit, the Company auditor will be required to furnish a Tax Audit Report under the Income Tax Act, if the turnover exceeds a specified amount. This Report mainly consists of certification of various tax allowances and certain expenditure, which is allowed as per the prescribed limits under the said Act. Indian GAAP Audit Indian Tax Audit Additional Indian GAAP audit, if required to complete Indian Tax Audit, on account of main Indian GAAP audit being for a year ending other than 31 March

participate in Indias opportunities with Bee Management 2nd floor, Kalpataru Heritage, 127, Mahatma Gandhi Road, Mumbai 400 023, India. Tel : 91-22-22670842, 22672561 Fax : 91-22-22672812 Email: bee@beemanagement.com Web : www.beemanagement.com (all Bee Management)

India

Pvt. Ltd. Your gateway to business with India. Experience the difference we make. Entry, Investment & Trade Strategy Advisory and Business Development Services.

Bee Management Consultancy

Company Law Compliance The Company may outsource the corporate secretarial function at an initial stage, but would need to employ a qualified Company Secretary within a few years of starting-up. This is usually done for a period of about a year from the incorporation of a new company. Corporate Taxation Advisorial services regarding planning opportunities for corporate taxation to minimise the burden of tax, appropriate commercial and accounting treatment to ensure that tax benefits are sustainable, assistance with related procedural paperwork up to the stage of filing the corporate return of income. Advice on the maintenance of the required documents and records, where applicable, as also advice and appropriate tax planning, as regards transfer pricing, where applicable

Fees for representing the Company at the assessment and appeal stages would be in addition to the above and would depend on the time involved. We are in a position to provide the Company with advice regarding the appropriate method for remunerating employees and the correct computation of withholding tax from their remuneration payments. The company is also required to file annual tax returns for such withholding tax and we will provide assistance in respect of those. We shall also provide assistance in matters connected with the Profession Tax Act, Shops & Establishment Act, Provident Fund Act, Payment of Gratuity Act and Payment of Bonus Act. These services are of an advisory capacity and would depend on the time involved. In any event, the fees for such services will not be material in nature, and these would be provided as part of our Corporate Taxation Services. Additionally, we can also advise corporate management on structuring the remuneration package for the employees of the Company, so as to make it both, tax efficient as also relevant, to the type of employees required. Our fees are based on the time expended and have regard to the level of experience of partners and staff concerned. An effort has been made to keep our fees at a level consistent with our commitment to maintain the highest professional standards. In addition to the fees quoted above, out of pocket expenses, such as stamp duty and travel and communication costs will be charged, at actuals. Needless to say, they will be kept at the barest minimum. Service tax will be payable on our fees, at 10.2% of the gross fees. Please brief us in detail to enable us to provide an estimate of fees and costs.

Our standard disclaimer applies here. www.beemanagement.com/disclaimer.asp

participate in Indias opportunities with Bee Management 2nd floor, Kalpataru Heritage, 127, Mahatma Gandhi Road, Mumbai 400 023, India. Tel : 91-22-22670842, 22672561 Fax : 91-22-22672812 Email: bee@beemanagement.com Web : www.beemanagement.com (all Bee Management)

Vous aimerez peut-être aussi

- Company Formation and Legal AspectsDocument3 pagesCompany Formation and Legal AspectsJayan PrajapatiPas encore d'évaluation

- DanOwa VAT & ERP Services Proposal 2019 KeepersDocument9 pagesDanOwa VAT & ERP Services Proposal 2019 KeepersMohamed EzzatPas encore d'évaluation

- Accounting Fees 2023Document12 pagesAccounting Fees 2023processingPas encore d'évaluation

- Ramesh Thumvar & Co.: Parmar & Palkar Is A Chartered Accountant (Indian CPA) Firm Based in Navi MumbaiDocument5 pagesRamesh Thumvar & Co.: Parmar & Palkar Is A Chartered Accountant (Indian CPA) Firm Based in Navi Mumbainafis20Pas encore d'évaluation

- Sip Report 1Document17 pagesSip Report 1nikhil KumarPas encore d'évaluation

- CA FIRM PROJECT ReportDocument50 pagesCA FIRM PROJECT ReportsaurabhPas encore d'évaluation

- Final ProjectDocument47 pagesFinal ProjectrakeshPas encore d'évaluation

- Business Case Studies For UK OutsourcingDocument14 pagesBusiness Case Studies For UK OutsourcingPavel DhakaPas encore d'évaluation

- Our Values & CommitmentDocument5 pagesOur Values & CommitmentVipul SharmaPas encore d'évaluation

- SKP Profile 04-02-2014 PDFDocument27 pagesSKP Profile 04-02-2014 PDFaishwarya123456Pas encore d'évaluation

- Remitting Money From India - Choosing The Right Repatriation StrategyDocument4 pagesRemitting Money From India - Choosing The Right Repatriation StrategypratikPas encore d'évaluation

- Interim ReportDocument19 pagesInterim ReportKunvar MattewalPas encore d'évaluation

- How To Register A Company in India A Complete GuideDocument9 pagesHow To Register A Company in India A Complete GuidesourabhonthewebPas encore d'évaluation

- Bashmakh ServicesDocument7 pagesBashmakh ServicesHeena BashmakhPas encore d'évaluation

- KamakshiDocument10 pagesKamakshiDRACOPas encore d'évaluation

- Indian ComplianceDocument29 pagesIndian Compliancekundhavai nambiPas encore d'évaluation

- S JaykishanDocument23 pagesS JaykishanKarthik PalaniPas encore d'évaluation

- Service Proposal - RUDKY TemplateDocument2 pagesService Proposal - RUDKY TemplateYuvraj Sharma PersandPas encore d'évaluation

- Rishabh DevDocument48 pagesRishabh DevRishabh DevPas encore d'évaluation

- Hopewell EngagementDocument4 pagesHopewell EngagementSamson OlubodePas encore d'évaluation

- BAT Credential EngDocument7 pagesBAT Credential EngAdi DariswanPas encore d'évaluation

- Business Process Outsourcing (BPO) Company Registration in IndiaDocument15 pagesBusiness Process Outsourcing (BPO) Company Registration in IndiavinothPas encore d'évaluation

- M Daga & Co ProfileDocument4 pagesM Daga & Co ProfileAbhijit NathPas encore d'évaluation

- CA Firm ServicesDocument7 pagesCA Firm ServicesHeena BashmakhPas encore d'évaluation

- D@G Consulting Business PlanDocument15 pagesD@G Consulting Business PlanGARUIS MELIPas encore d'évaluation

- Revised Schedule VIDocument81 pagesRevised Schedule VINIRAVDARJIPas encore d'évaluation

- Especia Associates Business ProfileDocument13 pagesEspecia Associates Business ProfileHarshil GoyalPas encore d'évaluation

- Doing Business in IndiaDocument19 pagesDoing Business in IndiaAparna SinghPas encore d'évaluation

- India Entry Strategy BrochureDocument30 pagesIndia Entry Strategy BrochureRahul BhanPas encore d'évaluation

- Sip ReportDocument5 pagesSip Reportanupriya mishraPas encore d'évaluation

- Kokamavic EngagementDocument4 pagesKokamavic EngagementSamson OlubodePas encore d'évaluation

- Implementationworks, IncDocument5 pagesImplementationworks, IncSeanKeithNeriPas encore d'évaluation

- Clemente Aquino CpasDocument4 pagesClemente Aquino CpasMariel TinolPas encore d'évaluation

- Summer Internship Report: Jagriti AwasthiDocument10 pagesSummer Internship Report: Jagriti AwasthiJAGRITI AWASTHIPas encore d'évaluation

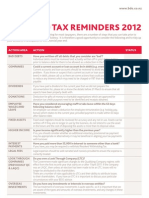

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783Pas encore d'évaluation

- One Stop Solution For Your Business: Website URL Android AppDocument8 pagesOne Stop Solution For Your Business: Website URL Android Appshashi_nspPas encore d'évaluation

- ICB Profile FinalDocument6 pagesICB Profile FinalVineethPas encore d'évaluation

- How To Register A Company in Pakistan (Copied)Document4 pagesHow To Register A Company in Pakistan (Copied)Tinna Devi ArmasamyPas encore d'évaluation

- Real Tax Service (RTS)Document19 pagesReal Tax Service (RTS)JayaPas encore d'évaluation

- Manage Finance 3Document6 pagesManage Finance 3Aileen KhorPas encore d'évaluation

- Engagement Letter For Accounting Services: TitleDocument1 pageEngagement Letter For Accounting Services: TitleFrancisquetePas encore d'évaluation

- Aamir AssociatesDocument5 pagesAamir AssociateshhaiderPas encore d'évaluation

- Accounting Policies BataDocument5 pagesAccounting Policies BataHarini SundarPas encore d'évaluation

- Mergers and Acquisitions - Financial Due Diligence - BDO AustraliaDocument2 pagesMergers and Acquisitions - Financial Due Diligence - BDO AustraliaPat LozanoPas encore d'évaluation

- Corporate Tax AdvisoryDocument2 pagesCorporate Tax AdvisoryParas MittalPas encore d'évaluation

- Assessment Task 1 - Prepare Budgets Case Study - Houzit: BSBFIM601 Manage FinancesDocument2 pagesAssessment Task 1 - Prepare Budgets Case Study - Houzit: BSBFIM601 Manage FinancesMemay MethaweePas encore d'évaluation

- Arqam-Tax-Audit-Finance CVDocument5 pagesArqam-Tax-Audit-Finance CVkhurramPas encore d'évaluation

- Audit ReportDocument34 pagesAudit Report張祐榮 ウヨンPas encore d'évaluation

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditD'EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditPas encore d'évaluation

- A To Z Group of Companies ProfileDocument29 pagesA To Z Group of Companies Profileroopesh_1986Pas encore d'évaluation

- Entrepreneur's World #2Document2 pagesEntrepreneur's World #2Lex ValoremPas encore d'évaluation

- 15 - 16 Accounting Concepts and PrinciplesDocument39 pages15 - 16 Accounting Concepts and PrinciplesKyeien100% (1)

- AFS Profile 27 Dec 2015Document5 pagesAFS Profile 27 Dec 2015pave.scgroupPas encore d'évaluation

- Startup India PDFDocument28 pagesStartup India PDFDrPinky ShrivastavaPas encore d'évaluation

- Internship ReportDocument36 pagesInternship Report570 BAF Drashti ShahPas encore d'évaluation

- Naukri ASHISHSINGH (13y 0m)Document3 pagesNaukri ASHISHSINGH (13y 0m)ashu.mahendruPas encore d'évaluation

- How To Set Up and Run Your Own BusinessDocument8 pagesHow To Set Up and Run Your Own BusinessDhiraj DixitPas encore d'évaluation

- CNK Firm ProfileDocument22 pagesCNK Firm ProfileSohail MavadiaPas encore d'évaluation

- Nidhi Company RegistrationDocument8 pagesNidhi Company RegistrationKamal DeenPas encore d'évaluation

- S S Singhvi Associates Firm ProfileDocument13 pagesS S Singhvi Associates Firm ProfileKirti ThakkarPas encore d'évaluation

- L-Arginine, L-Lysine, and L-OrnithineDocument1 pageL-Arginine, L-Lysine, and L-OrnithineJaya JamdhadePas encore d'évaluation

- FIDIC Code of Ethics: Sustainable DevelopmentDocument4 pagesFIDIC Code of Ethics: Sustainable DevelopmentJaya JamdhadePas encore d'évaluation

- World Bank Support For The Gas Market in South East EuropeDocument15 pagesWorld Bank Support For The Gas Market in South East EuropeJaya JamdhadePas encore d'évaluation

- Volume 6Document213 pagesVolume 6Jaya JamdhadePas encore d'évaluation

- Jeene Ki Usne Hume Nayi Ada Di HDocument1 pageJeene Ki Usne Hume Nayi Ada Di HJaya JamdhadePas encore d'évaluation

- 14:30 GMT - 20:00 LocalDocument6 pages14:30 GMT - 20:00 LocalJaya JamdhadePas encore d'évaluation

- Vat On ImportsDocument3 pagesVat On ImportsJaya JamdhadePas encore d'évaluation

- 87Document206 pages87Jaya JamdhadePas encore d'évaluation

- Sampled B 4 DownloadDocument10 pagesSampled B 4 DownloadJaya JamdhadePas encore d'évaluation

- CH 10Document8 pagesCH 10Jaya JamdhadePas encore d'évaluation

- Banking InterviewDocument30 pagesBanking InterviewJaya JamdhadePas encore d'évaluation

- General FrameworkDocument1 pageGeneral FrameworkJaya JamdhadePas encore d'évaluation

- Software Development Life CycleDocument110 pagesSoftware Development Life Cyclemuvvark100% (1)

- Home Remedies Cure: The ProcessDocument3 pagesHome Remedies Cure: The ProcessJaya JamdhadePas encore d'évaluation

- IndexDocument1 pageIndexJaya JamdhadePas encore d'évaluation

- History of NokiaDocument5 pagesHistory of NokiaJaya JamdhadePas encore d'évaluation

- Department of Labor: CIFENGWordDocument6 pagesDepartment of Labor: CIFENGWordUSA_DepartmentOfLaborPas encore d'évaluation

- Law of Torts - LLB - Study Notes PDFDocument126 pagesLaw of Torts - LLB - Study Notes PDFSwastik GroverPas encore d'évaluation

- 2021 SCMR PDF File1 by AAMIR KhanDocument66 pages2021 SCMR PDF File1 by AAMIR KhanSamerPas encore d'évaluation

- Settlement, OAG v. RattnerDocument35 pagesSettlement, OAG v. RattnerLaura NahmiasPas encore d'évaluation

- United States Court of Appeals, Third CircuitDocument26 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsPas encore d'évaluation

- Respuesta de La Comisión Europea A La Consulta de España Sobre El IVA de Las MascarillasDocument2 pagesRespuesta de La Comisión Europea A La Consulta de España Sobre El IVA de Las MascarillasMaldita.esPas encore d'évaluation

- MOTION FOR DISMISSAL (For POEA Cases)Document5 pagesMOTION FOR DISMISSAL (For POEA Cases)Allan SalvePas encore d'évaluation

- AnnexesDocument209 pagesAnnexesArceño AnnPas encore d'évaluation

- Appendix B Engagement LetterDocument3 pagesAppendix B Engagement LetterJoHn CarLoPas encore d'évaluation

- Abalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Document18 pagesAbalos v. Macatangay, JR., (G.R. No. 155043 September 30, 2004)Leizl A. VillapandoPas encore d'évaluation

- A Comparative Study of Positive and Negative Impacts of The 42nd and 44thconstitutional Amendments ActDocument16 pagesA Comparative Study of Positive and Negative Impacts of The 42nd and 44thconstitutional Amendments ActRishabh ladePas encore d'évaluation

- Candida Virata vs. Victorio OchoaDocument3 pagesCandida Virata vs. Victorio OchoaKristine KristineeePas encore d'évaluation

- Telesforo Alo vs. Clodoaldo RocamoraDocument3 pagesTelesforo Alo vs. Clodoaldo RocamoraMay RMPas encore d'évaluation

- G.R No. 173252 July 17, 2009 DIGESTDocument2 pagesG.R No. 173252 July 17, 2009 DIGESTChristine Jane Rodriguez100% (1)

- Local Self Government - Concept & ImportanceDocument14 pagesLocal Self Government - Concept & ImportanceAyan Nazir100% (5)

- Commercial Lien StrategyDocument8 pagesCommercial Lien Strategykinfromsa92% (12)

- Saratoga Springs City School District: Fund BalanceDocument13 pagesSaratoga Springs City School District: Fund BalanceBethany BumpPas encore d'évaluation

- Petitioner vs. vs. Respondent: en BancDocument14 pagesPetitioner vs. vs. Respondent: en BancRafie BonoanPas encore d'évaluation

- PCIB Vs BalmacedaDocument11 pagesPCIB Vs BalmacedaBeverlyn JamisonPas encore d'évaluation

- San Miguel Corporation V NLRC - Marc9Document5 pagesSan Miguel Corporation V NLRC - Marc9Anonymous oO1cYvPas encore d'évaluation

- Hon. Sto. Tomas v. Salac November 13 2012Document9 pagesHon. Sto. Tomas v. Salac November 13 2012bentley CobyPas encore d'évaluation

- Full Statement From Tony Bobulinski To The New York PostDocument2 pagesFull Statement From Tony Bobulinski To The New York PostMaureen Dowling100% (2)

- Chicago v. Sessions Opinion and OrderDocument41 pagesChicago v. Sessions Opinion and OrderDoug MataconisPas encore d'évaluation

- UPDATED Judicial Affidavit of King StefanDocument5 pagesUPDATED Judicial Affidavit of King StefanKristine Lara Virata EspirituPas encore d'évaluation

- Jurisdiction Over The PersonDocument37 pagesJurisdiction Over The PersonFelip MatPas encore d'évaluation

- Oci Fresh Application-Uploading ProcedureDocument3 pagesOci Fresh Application-Uploading ProceduresuretaPas encore d'évaluation

- Tamano v. OrtizDocument1 pageTamano v. OrtizRealKD30Pas encore d'évaluation

- The Killing Squads: Inside The Philippines' War On Drugs'Document5 pagesThe Killing Squads: Inside The Philippines' War On Drugs'Charmaine AlipayoPas encore d'évaluation

- Handbook of The Law of Real PropertyDocument1 065 pagesHandbook of The Law of Real PropertyDevaughn Immanuel Corrica-ElPas encore d'évaluation

- CBK POWER LTD Vs CIRDocument2 pagesCBK POWER LTD Vs CIRJM Ragaza67% (3)