Académique Documents

Professionnel Documents

Culture Documents

Technical and Fundamental Analysis

Transféré par

Rakesh Bhardwaj0 évaluation0% ont trouvé ce document utile (0 vote)

46 vues10 pagesThe document provides a technical and fundamental analysis of ACC Limited, a leading cement manufacturer in India. It analyzes ACC's financial performance, the cement industry environment, and technical indicators for ACC's stock price. Fundamentally, ACC has performed well despite economic challenges, with net sales and value increasing. Technically, moving averages show an upward trend over the long term, suggesting the stock is undervalued currently and investors should buy. However, the MACD and RSI indicators reveal potential short term downside risk, so stop losses are recommended. Overall, the analysis finds ACC stock to be a good long term investment.

Description originale:

technical and fundamental analysis of ACC

Copyright

© Attribution Non-Commercial (BY-NC)

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe document provides a technical and fundamental analysis of ACC Limited, a leading cement manufacturer in India. It analyzes ACC's financial performance, the cement industry environment, and technical indicators for ACC's stock price. Fundamentally, ACC has performed well despite economic challenges, with net sales and value increasing. Technically, moving averages show an upward trend over the long term, suggesting the stock is undervalued currently and investors should buy. However, the MACD and RSI indicators reveal potential short term downside risk, so stop losses are recommended. Overall, the analysis finds ACC stock to be a good long term investment.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

46 vues10 pagesTechnical and Fundamental Analysis

Transféré par

Rakesh BhardwajThe document provides a technical and fundamental analysis of ACC Limited, a leading cement manufacturer in India. It analyzes ACC's financial performance, the cement industry environment, and technical indicators for ACC's stock price. Fundamentally, ACC has performed well despite economic challenges, with net sales and value increasing. Technically, moving averages show an upward trend over the long term, suggesting the stock is undervalued currently and investors should buy. However, the MACD and RSI indicators reveal potential short term downside risk, so stop losses are recommended. Overall, the analysis finds ACC stock to be a good long term investment.

Droits d'auteur :

Attribution Non-Commercial (BY-NC)

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 10

ACC LIMITED Page 1

TECHNICAL AND FUNDAMENTAL

ANALYSIS

SUBMITTED BY

RAKESH BHARDWAJ

PGDM (MARKETING & FINANCE)

THAPAR UNIVERSITY

ACC LIMITED Page 2

FUNDAMENTAL ANALYSIS

Top to down valuation

ECONOMIC ANALYSIS

As current growth rate depicted by RBI come under 5% for first quarter 2013,

the growth in manufacturing sector become quite stagnant. Although

companies operations at ACC still shows 2% increase in Net sales and 11% in

net value of company. Company seems to do quite good even in most

turbulent market conditions and depreciating rupee. Current inflation rate of

first quarter is 5.79% which is within bearable levels of the company and

consumer. Gross GDP is around 10.79% as current economic conditions.

INDUSTRY ANALYSIS---

FIVE FORCE MODEL

Bargaining power of suppliers

As ACC and AMBUJA cement are companies of one parent company

HOLICIM international and these companies posses major stake in Indian

cement market.

Bargaining power of ACC being major player in market is more over its

suppliers.

Bargaining power could be strengthened if ACC and AMBUJA buy raw

material jointly.

Bargaining power of Buyers

As ACC is market leader in cement industry of India it dictates the price

of industry.

This factor is also in favour of Acc as it control market price of cement

industry.

ACC LIMITED Page 3

Threats of Substitution

Acc gets direct threat from Market challengers like BINANI, JAYPEE,

BIRLA cements etc.

ACC faces indirect threats from Substitutes like wooden houses etc.

Threats of New Entrants

As due to large initial cost threats for this industry are fewer than other

industries.

Major Indian players like TATA, RELIANCE are capable for entering this

market.

Government laws and licence norms are also Barriers to entry.

Rivalry among companies

Competition for market share is intense among top players.

As being characterised as commodity product lack major

differentiation.

Companies previously competed on price, but now more focus is

on creating differentiation to sustain completion.

ACC LIMITED Page 4

COMPANY ANALYSIS

ACC (ACC Limited) is India's foremost manufacturer of cement and concrete.

ACC's operations are spread throughout the country with 17 modern cement

factories, more than 40 Ready mix concrete plants, 21 sales offices, and several

zonal offices. It has a workforce of about 9,000 persons and a countrywide

distribution network of over 9,000 dealers.

Since inception in 1936, the company has been a trendsetter and important

benchmark for the cement industry in many areas of cement and concrete

technology. ACC has a unique track record of innovative research, product

development and specialized consultancy services. The company's various

manufacturing units are backed by a central technology support services

centre - the only one of its kind in the Indian cement industry.

ACC has rich experience in mining, being the largest user of limestone. As the

largest cement producer in India, it is one of the biggest customers of the

domestic coal industry, of Indian Railways, and a considerable user of the

countrys road transport network services for inward and outward movement

of materials and products.

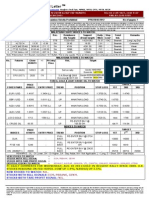

VALUATION

Market Based valuation

P/E ration= PRICE/EPS.

P/E ratio trend and EPS are forecasted till 2020.

Value of share = P/E*EPS.

Year value of share

2013 1374.46

2014 1466.26

2015 1558.06

2016 1649.87

2017 1741.7

2018 1833.53

2019 1925.38

2020 2017.24

ACC LIMITED Page 5

INFRENCE

ACC Ltd.

BSE: 500410 - 30 Aug 3:50pm IST

961.80+2.35 (0.24% )

As current market price of share is less than its value investor should go

for buying the stock.

Investor already having shares should hold until market Surges again.

Optimum time for going for bottom phishing.

TECHNICAL ANALYSIS

MOVING AVERAGES

Moving Average of ACC Ltd.

Current Share Price 964.10

Three Days 955.62

Five Days 962.33

Ten Days 1000.64

Fifteen Days 1056.36

Twenty Two Days 1092.13

Thirty Days 1130.00

Fifty Days 1166.57

Hundred Days 1189.89

ACC LIMITED Page 6

As trend is showing upward for long term investment, call buy for

long term investment.

BUY CALL at 955 per share.

Stop loss at 955 per share.

0

200

400

600

800

1000

1200

1400

1600

1

1

4

2

7

4

0

5

3

6

6

7

9

9

2

1

0

5

1

1

8

1

3

1

1

4

4

1

5

7

1

7

0

1

8

3

1

9

6

2

0

9

2

2

2

2

3

5

2

4

8

MA-10

MA-50

MA-100

0

200

400

600

800

1000

1200

1400

1600

1

1

2

2

3

3

4

4

5

5

6

6

7

7

8

8

9

1

0

0

1

1

1

1

2

2

1

3

3

1

4

4

1

5

5

1

6

6

1

7

7

1

8

8

1

9

9

2

1

0

2

2

1

2

3

2

2

4

3

MACD MA-12

MACD MA-26

ACC LIMITED Page 7

MACD

MACD is below zero that is 12 periods MA is below 26 period MA.

Sigh of bearish that is negative. Market can go further down, so stop loss

could be used.

-150

-100

-50

0

50

100

150

1

1

0

1

9

2

8

3

7

4

6

5

5

6

4

7

3

8

2

9

1

1

0

0

1

0

9

1

1

8

1

2

7

1

3

6

1

4

5

1

5

4

1

6

3

1

7

2

1

8

1

1

9

0

1

9

9

2

0

8

2

1

7

2

2

6

Signal

MACD

ACC LIMITED Page 8

CANDLE STICK CHART

Plot between dates, open, high, low, close stock price.

Stock is trending below its value.

0

200

400

600

800

1000

1200

1400

1600

1800

OPEN

HIGH

LOW

CLOSE

910

920

930

940

950

960

970

980

30-Aug-13

OPEN

HIGH

LOW

CLOSE

ACC LIMITED Page 9

RSI INDICATOR

Stock is overbought.

Market is showing low but RSI is rising which show divergence.

RSI above 50 is a Bullish sigh.

0

20

40

60

80

100

120

1

1

4

2

7

4

0

5

3

6

6

7

9

9

2

1

0

5

1

1

8

1

3

1

1

4

4

1

5

7

1

7

0

1

8

3

1

9

6

2

0

9

2

2

2

2

3

5

2

4

8

RSI

RSI

ACC LIMITED Page 10

Bibliography

ACC. (2013). ACC ANNUAL STATEMENT. ACC.

NSE. (2013). ACC CEMENT. NSE INDIA.

REASEARCH, T. S. (2013). ACC.

Vous aimerez peut-être aussi

- Security Analysis and Portfolio ManagementDocument36 pagesSecurity Analysis and Portfolio Managementthe_randomistPas encore d'évaluation

- Proper Trading Strategy v.1Document4 pagesProper Trading Strategy v.1Akash Biswal100% (1)

- Technical Analysis EnglishDocument30 pagesTechnical Analysis EnglishRAJESH KUMARPas encore d'évaluation

- How To Catch BlockbusterstocksDocument12 pagesHow To Catch Blockbusterstocksdr.kabirdev100% (1)

- Trading Systems IndicatorsDocument3 pagesTrading Systems IndicatorsKam MusPas encore d'évaluation

- IIFL Amey Kulkarni PDFDocument48 pagesIIFL Amey Kulkarni PDFPALLAVI KAMBLEPas encore d'évaluation

- Stock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Document7 pagesStock-Option-Trading-Tips-Provided-By-Theequicom-For Today-24-September-2014Riya VermaPas encore d'évaluation

- Intraday Buying Seen in The Past 15 Minutes, Technical Analysis ScannerDocument2 pagesIntraday Buying Seen in The Past 15 Minutes, Technical Analysis ScannerfixemiPas encore d'évaluation

- MBA 2nd Sem - 2.5 - MMDocument11 pagesMBA 2nd Sem - 2.5 - MMBaluKsPas encore d'évaluation

- Introduction To Fundamental Analysis: Presented by Sukhada DesaiDocument12 pagesIntroduction To Fundamental Analysis: Presented by Sukhada DesaiSukhada DesaiPas encore d'évaluation

- Upper Circuit Technical Indicator WarfareDocument16 pagesUpper Circuit Technical Indicator WarfareBiswambhar Ghosh100% (1)

- Edition 23 - Chartered 2nd February 2011Document8 pagesEdition 23 - Chartered 2nd February 2011Joel HewishPas encore d'évaluation

- Pse Trading RulesDocument3 pagesPse Trading RulesAriel Genilan Obja-anPas encore d'évaluation

- ARMSDocument4 pagesARMSWorld NewPas encore d'évaluation

- Bloomberg: C S L M - S G/BLP CDocument20 pagesBloomberg: C S L M - S G/BLP CvaibkalPas encore d'évaluation

- 10 Common Charting Patterns: and How To Trade Them Using Options and MinisDocument20 pages10 Common Charting Patterns: and How To Trade Them Using Options and MinisAnonymous xaFAVyPas encore d'évaluation

- Akshay Padman: Career ProfileDocument2 pagesAkshay Padman: Career ProfileakshayPas encore d'évaluation

- Technical Analysis ProgramDocument4 pagesTechnical Analysis ProgramKeshav KumarPas encore d'évaluation

- 44 Moving Average Swing, Technical Analysis ScannerDocument2 pages44 Moving Average Swing, Technical Analysis ScannerAniket Singh100% (1)

- A Stock Trading Algoritm PDFDocument6 pagesA Stock Trading Algoritm PDFki_tsuketePas encore d'évaluation

- Price Action Analysis Using The Wyckoff Trading MethodDocument2 pagesPrice Action Analysis Using The Wyckoff Trading MethodGuilherme OliveiraPas encore d'évaluation

- Technical InfosysDocument13 pagesTechnical InfosysPrakhar RatheePas encore d'évaluation

- 22 Rules of Trading - Mauldin EconomicsDocument5 pages22 Rules of Trading - Mauldin EconomicsJignesh71Pas encore d'évaluation

- SSRN Id3596245 PDFDocument64 pagesSSRN Id3596245 PDFAkil LawyerPas encore d'évaluation

- Risk and Portfolio Management Spring 2011: Statistical ArbitrageDocument66 pagesRisk and Portfolio Management Spring 2011: Statistical ArbitrageSwapan ChakrabortyPas encore d'évaluation

- Techncial Series IIDocument23 pagesTechncial Series IILal DhwojPas encore d'évaluation

- Nifty Dow JonesDocument6 pagesNifty Dow JonesAnand SachdevaPas encore d'évaluation

- Future Generali India InsuranceDocument52 pagesFuture Generali India InsuranceEinfach Sai100% (1)

- ForeignDocument5 pagesForeignkumar_eeePas encore d'évaluation

- Planning Your Trades: Risk Management RiskDocument2 pagesPlanning Your Trades: Risk Management RiskdoremonPas encore d'évaluation

- Share Market Courses BroucherDocument9 pagesShare Market Courses BroucherRaj DubeyPas encore d'évaluation

- Simple, Exponential, and Weighted Moving AveragesDocument10 pagesSimple, Exponential, and Weighted Moving Averagesaman jemalPas encore d'évaluation

- Candlestick Charts - ExplanationDocument15 pagesCandlestick Charts - Explanationpangm100% (1)

- Broadening Formations: A .The Orthodox Broadening TopDocument6 pagesBroadening Formations: A .The Orthodox Broadening TopKalfy WarspPas encore d'évaluation

- Elementary Mathematics: WwlchenandxtduongDocument15 pagesElementary Mathematics: WwlchenandxtduongAdri adriPas encore d'évaluation

- Techinical AnalysisDocument14 pagesTechinical AnalysisCamille BagadiongPas encore d'évaluation

- An Intelligent Short Term Stock Trading Fuzzy System For AssistingDocument55 pagesAn Intelligent Short Term Stock Trading Fuzzy System For AssistingDwight ThothPas encore d'évaluation

- ForexAlien Post Summary 2Document51 pagesForexAlien Post Summary 2Mamudu MarteyPas encore d'évaluation

- Accounting For Cryptocurrencies-Dec2016Document12 pagesAccounting For Cryptocurrencies-Dec2016Markie GrabilloPas encore d'évaluation

- Chart Technical AnalysisDocument56 pagesChart Technical Analysiscool_air1584956Pas encore d'évaluation

- 1 CA K.G.AcharyaDocument40 pages1 CA K.G.AcharyaMurthyPas encore d'évaluation

- Order Execution Policy PDFDocument20 pagesOrder Execution Policy PDFJennifer TimtimPas encore d'évaluation

- Falling WedgeDocument3 pagesFalling Wedgekarthick sudharsanPas encore d'évaluation

- Real Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksD'EverandReal Traders II: How One CFO Trader Used the Power of Leverage to make $110k in 9 WeeksPas encore d'évaluation

- My Trading StrategyDocument2 pagesMy Trading StrategyTakudzwaPas encore d'évaluation

- Fred Tam News LetterDocument7 pagesFred Tam News LetterTan Lip SeongPas encore d'évaluation

- Meta Stock User ManualDocument808 pagesMeta Stock User ManualAndre YosuaPas encore d'évaluation

- XM Philippines Forex Webinar Series: With Jonathan Lou ReyesDocument18 pagesXM Philippines Forex Webinar Series: With Jonathan Lou ReyesNd Reyes100% (1)

- Trading Rules "Randomness Is Unstructured Freedom Without Responsibility."Document1 pageTrading Rules "Randomness Is Unstructured Freedom Without Responsibility."getpaid2tradePas encore d'évaluation

- 10 Top Chart PDFDocument25 pages10 Top Chart PDFمحمد أميرل مكمعينين100% (2)

- Small Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming CompaniesD'EverandSmall Stocks for Big Profits: Generate Spectacular Returns by Investing in Up-and-Coming CompaniesPas encore d'évaluation

- Candlesticks Technical AnalysisDocument17 pagesCandlesticks Technical Analysiswhy_1234_5678Pas encore d'évaluation

- Polymedicure TIADocument28 pagesPolymedicure TIAProton CongoPas encore d'évaluation

- Option Trading With Elliott WaveDocument42 pagesOption Trading With Elliott WaveANIL1964100% (4)

- Range WS NR4 NR5 NR7: Toby Crabel's Day Trading Price PatternsDocument5 pagesRange WS NR4 NR5 NR7: Toby Crabel's Day Trading Price Patternsanon-98189100% (11)

- Nine ClassicDocument6 pagesNine ClassicTei YggdrasilPas encore d'évaluation

- 50 KWord EbookDocument247 pages50 KWord EbookLio PermanaPas encore d'évaluation

- Price Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)Document22 pagesPrice Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)kalpesh kathar100% (1)

- The Top Technical Indicators For Options TradingDocument5 pagesThe Top Technical Indicators For Options TradingSoumya Ranjan Basuri100% (1)

- Nix2b StratergyDocument38 pagesNix2b StratergyAneeshAntony100% (1)

- Market Never Ending Cycle: ChannelDocument1 pageMarket Never Ending Cycle: ChannelfizzPas encore d'évaluation

- 0-100 Pips Aday Trading SystemDocument3 pages0-100 Pips Aday Trading SystemmysticblissPas encore d'évaluation

- G4-T10 How To Trend Trade With Guppy Multiple Moving Average (GMMA)Document15 pagesG4-T10 How To Trend Trade With Guppy Multiple Moving Average (GMMA)The ShitPas encore d'évaluation

- Half Trend With SSL HybridDocument31 pagesHalf Trend With SSL Hybridkashinath09Pas encore d'évaluation

- FIN - NTS - Chart Patterns in Technical AnalysisDocument7 pagesFIN - NTS - Chart Patterns in Technical Analysis29_ramesh170Pas encore d'évaluation

- The Power62 System 4 Forex PDFDocument37 pagesThe Power62 System 4 Forex PDFBtrades Rise-up100% (1)

- Buzz CciDocument19 pagesBuzz CciProust TrentaPas encore d'évaluation

- FIN348 - Introduction To Technical Analysis L6Document10 pagesFIN348 - Introduction To Technical Analysis L6saraaqilPas encore d'évaluation

- FX101 - Introduction To ForexDocument43 pagesFX101 - Introduction To ForexHASSAN MRADPas encore d'évaluation

- SMART MONEY ORDE BLOC EditedDocument9 pagesSMART MONEY ORDE BLOC Editedtawhid anam86% (7)

- Strategy With MACD and ADX 21 5 2017Document3 pagesStrategy With MACD and ADX 21 5 2017Anant MalaviyaPas encore d'évaluation

- Market Technician No 55Document12 pagesMarket Technician No 55ppfahd100% (2)

- Gold Trading Guide by Ryan GPFXDocument40 pagesGold Trading Guide by Ryan GPFXPreeti Enterprises100% (2)

- Raghee Horner 34 EMA Wave and GRaB Candles PDFDocument3 pagesRaghee Horner 34 EMA Wave and GRaB Candles PDFjust.gopal100% (1)

- NIFTY Options Trading PDFDocument9 pagesNIFTY Options Trading PDFsantosh kumari100% (5)

- SMC Crypto FuturesDocument29 pagesSMC Crypto FuturesOlaniyi EmmanuelPas encore d'évaluation

- FXKeys Trading Systems & Examples V4.3 PDFDocument120 pagesFXKeys Trading Systems & Examples V4.3 PDFvictorPas encore d'évaluation

- Price Action (Strat's Stress Free Trading) - ActiverDocument11 pagesPrice Action (Strat's Stress Free Trading) - Activerrsousa1Pas encore d'évaluation

- 3 Best Technical Indicators On EarthDocument11 pages3 Best Technical Indicators On Earth009xx81% (26)

- Emea FPR Cee Big Box Logistics MV May 2011Document6 pagesEmea FPR Cee Big Box Logistics MV May 2011Smotco SmotcovPas encore d'évaluation

- q21 Cryptos Magazine February 2018 PDFDocument81 pagesq21 Cryptos Magazine February 2018 PDFNhan Phan100% (4)

- Ichimoku LearningDocument5 pagesIchimoku Learningecz1979100% (1)