Académique Documents

Professionnel Documents

Culture Documents

GST Exempt Car Parts

Transféré par

3CSRMuseumDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

GST Exempt Car Parts

Transféré par

3CSRMuseumDroits d'auteur :

Formats disponibles

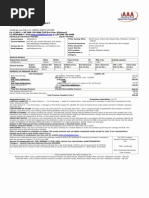

Declaration for an exemption of GST on a car or car parts disabled veterans

WHO SHOULD USE THIS DECLARATION?

If you are a disabled veteran who is eligible to buy or lease a car, or purchase car parts GST-free, you must present this declaration to your motor vehicle or car parts supplier. You do not need to send this declaration to the Tax Office. This declaration needs to be kept by your supplier as the authority for supplying the car, or car parts to you GST-free. You must sign and date the declaration before providing it to your supplier. We recommend you keep a copy of this declaration and any supporting documents for your records. To find out if you are an eligible disabled veteran: refer to GST and LCT on cars you buy for eligible people with disabilities (NAT 4325), or phone us on 13 28 66.

Section A: Your details

1 2

Title:

Your Veterans le number (VFN) Your name

Mr Mrs Miss Ms Other

Family name

Given name/s

Your postal address

Suburb/town

State/territory

Postcode

Business hours phone number

Section B: Vehicle details

5 6 7 8 9 Make of car Model of car Registration number

Day Month Year

Date of purchase or lease Description of the car parts (if applicable)

NAT 3418-04.2009

IN-CONFIDENCE when completed

Section C: Declaration to the Commissioner of Taxation

Before you sign this declaration

Check that you have answered all the applicable questions correctly. Penalties Please be aware that penalties may be imposed for giving false or misleading information. Privacy The Tax Office is authorised by the Taxation Administration Act 1953 to ask for the information on this form. We need this information to determine your eligibility for the GST-free supply of your car or car parts. Where authorised by law to do so, we may give this information to other government agencies. I declare that: I have served in the Defence Force or in any other armed force of Her Majesty I was not a cadet, an officer of cadets or an instructor of cadets and I am not a declared member, and As a result of that service at least one of the follow applies to me: I am a totally and permanently injured (TPI) veteran section 24 of the Veterans Entitlements Act 1986 applies and I receive a pension under Part II of that Act. I am a veteran receiving a Special Rate Disability Pension under Part 6 of, Chapter 4 of the Military Rehabilitation and Compensation Act 2004 or I satisfy the eligibility criteria in section 199 of that Act. I have lost a leg or both arms. I have had a leg or both arms rendered permanently and completely useless. My declaration relates to: Place

in the boxes that apply.

A car I intend to use the car described in Section B for my personal transportation for either: a period of up to two years, or until the car has travelled 40,000 kilometres after the date of purchase or lease. I request that the car be supplied to me GST-free under section 38505 of the A New Tax System (Goods and Services Tax) Act 1999. I understand that if the market value of the purchased car (GST inclusive) exceeds the car limit, GST is payable on the excess amount. Car parts The car parts described in Section B are for a car used by me, for my personal transportation. I request that these car parts be supplied to me GST-free under section 38505 of the A New Tax System (Goods and Services Tax) Act 1999. I certify that the information on this declaration is true and correct. Signature

Day

Month

Year

Date

IN-CONFIDENCE when completed

Vous aimerez peut-être aussi

- Motor Claim Form Reliance General InsuranceDocument4 pagesMotor Claim Form Reliance General InsurancePraveen VanamaliPas encore d'évaluation

- Motor Vehicle Rental Tax Exemption CertificateDocument2 pagesMotor Vehicle Rental Tax Exemption CertificateAbid M. SholihulPas encore d'évaluation

- Van Tax FormDocument2 pagesVan Tax FormtoptafPas encore d'évaluation

- Basic Own DamageDocument3 pagesBasic Own DamageHarsh PriyaPas encore d'évaluation

- Wisconsin DMV Registration FormDocument4 pagesWisconsin DMV Registration FormRhianonCatillazPas encore d'évaluation

- DL Vrode Kak Sosi LohDocument4 pagesDL Vrode Kak Sosi LohkvilvetoviyPas encore d'évaluation

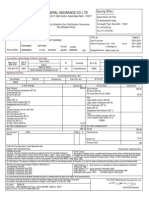

- Bike PolicyDocument2 pagesBike PolicyAdhwareshBharadwaj100% (2)

- AXA Commercial MotorDocument2 pagesAXA Commercial Motorcutiemocha1Pas encore d'évaluation

- Vsa17a PDFDocument2 pagesVsa17a PDFxerxeschuaPas encore d'évaluation

- Vsa 17 ADocument2 pagesVsa 17 AJustin WilliamsPas encore d'évaluation

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Document3 pagesIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017SureshPas encore d'évaluation

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing Officevijay_sudha50% (2)

- INSURANCEDocument3 pagesINSURANCEmurali9026100% (1)

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing OfficeAnonymous pKsr5vPas encore d'évaluation

- TWP 87187353Document2 pagesTWP 87187353Abilon Smith100% (2)

- Formvrtvpd1 PDFDocument1 pageFormvrtvpd1 PDFnirav16Pas encore d'évaluation

- Application For Motor Insurance: Particulars of Registered OwnerDocument2 pagesApplication For Motor Insurance: Particulars of Registered Ownercutiemocha1Pas encore d'évaluation

- F o R o Ffi C IDocument4 pagesF o R o Ffi C Iapi-26168972Pas encore d'évaluation

- Iffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017Document3 pagesIffco-Tokio General Insurance Co - LTD: Regd. Office: IFFCO Sadan C1 Distt. Centre, Saket, New Delhi - 110017ams20110% (1)

- Transfertaxform Apv9t Form (072010)Document2 pagesTransfertaxform Apv9t Form (072010)Karma Pema DorjePas encore d'évaluation

- XCD InsuranceDocument3 pagesXCD Insuranceabhiin4Pas encore d'évaluation

- Application For Transfer of RegistrationDocument6 pagesApplication For Transfer of RegistrationAqwPas encore d'évaluation

- R13 - Application For Classic Vehicle ConversionDocument2 pagesR13 - Application For Classic Vehicle Conversionclemen_angPas encore d'évaluation

- Motor Proposal ConfirmationDocument4 pagesMotor Proposal Confirmationwilliam.pangPas encore d'évaluation

- Two Insurance Copy ITDocument1 pageTwo Insurance Copy ITbaranimba5Pas encore d'évaluation

- 2312100095928100000Document2 pages2312100095928100000Kavin Prakash100% (2)

- Application To Repair A Written-Off VehicleDocument2 pagesApplication To Repair A Written-Off Vehicleharrypen77Pas encore d'évaluation

- Application For Transfer of RegistrationDocument6 pagesApplication For Transfer of RegistrationAnand KumarPas encore d'évaluation

- MV Dealer Manual Section06Document21 pagesMV Dealer Manual Section06AaronGuyPas encore d'évaluation

- Motorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleDocument3 pagesMotorised-Two Wheelers Package Policy - Zone A Motor Insurance Certificate Cum Policy ScheduleSelva KumarPas encore d'évaluation

- 2312100150128200000Document2 pages2312100150128200000sachinkulsh_1Pas encore d'évaluation

- GEORGIA MV Vehicles Titles ManualDocument144 pagesGEORGIA MV Vehicles Titles ManualDavid CarusoPas encore d'évaluation

- Bill of Sale Reg 3126Document2 pagesBill of Sale Reg 3126plmalan0% (1)

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransferYhr YhPas encore d'évaluation

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument2 pagesIffco-Tokio General Insurance Co - LTD: Servicing OfficeRANGITHPas encore d'évaluation

- UntitledDocument11 pagesUntitledapi-61200414Pas encore d'évaluation

- Form 28 - Application For RTO NOCDocument2 pagesForm 28 - Application For RTO NOCspirit3189Pas encore d'évaluation

- Cert TitleDocument2 pagesCert TitleDavid Valenzuela MendozaPas encore d'évaluation

- Motor Proposal ConfirmationDocument4 pagesMotor Proposal ConfirmationAlexandru SmarandaPas encore d'évaluation

- Dealer Management System v2.3.Xlsx - GetacoderDocument19 pagesDealer Management System v2.3.Xlsx - Getacoderapsantos_spPas encore d'évaluation

- Tax Disc Return FormDocument2 pagesTax Disc Return Formtaurus19Pas encore d'évaluation

- E0864V17 SDApplicationForMotorVehicleTitle&RegistrationDocument2 pagesE0864V17 SDApplicationForMotorVehicleTitle&RegistrationVladimir Olvera EstévezPas encore d'évaluation

- Icici LombardDocument1 pageIcici LombardTony Jacob33% (3)

- Motorised-Two Wheelers Liability Only Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleDocument3 pagesMotorised-Two Wheelers Liability Only Policy - Zone B Motor Insurance Certificate Cum Policy ScheduleJagateeswaran KanagarajPas encore d'évaluation

- Id CardDocument6 pagesId CardErin ZombiezPas encore d'évaluation

- LBU F VL MR9 VehicleTransferDocument6 pagesLBU F VL MR9 VehicleTransferChristopher RusliPas encore d'évaluation

- Yashvant Unicorn 150 BlackDocument4 pagesYashvant Unicorn 150 BlackAsif ShaikhPas encore d'évaluation

- 130 U 3Document2 pages130 U 3Juan Escobar JuncalPas encore d'évaluation

- S M Asloob.Document2 pagesS M Asloob.saikripa1210% (1)

- SatishDocument4 pagesSatishKambhampati SandilyaPas encore d'évaluation

- F3523 CFDDocument2 pagesF3523 CFDAdam Scott MillerPas encore d'évaluation

- Transfer Form 05Document3 pagesTransfer Form 05review20Pas encore d'évaluation

- Vic Roads Transfer FormDocument4 pagesVic Roads Transfer Formjikolji0% (1)

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsD'EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsPas encore d'évaluation

- Extended Warranty Insurance: Proposal & Policy ScheduleDocument26 pagesExtended Warranty Insurance: Proposal & Policy ScheduleFaizan FarasatPas encore d'évaluation

- Iffco TokioDocument2 pagesIffco Tokioneel55% (11)

- Harpriti PolicyDocument1 pageHarpriti PolicyIASkanhaPas encore d'évaluation

- Maryland Car Dealer License ApplicationDocument16 pagesMaryland Car Dealer License ApplicationBuySurety.comPas encore d'évaluation

- Thumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyD'EverandThumbs up Trucking llc E-book: Step by step e-book on how to start a trucking companyPas encore d'évaluation

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document9 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Madan ChaturvediPas encore d'évaluation

- 5th South Pacific ORL Forum Proposal UPDATEDocument10 pages5th South Pacific ORL Forum Proposal UPDATELexico InternationalPas encore d'évaluation

- Assessment and Returns of IncomeDocument13 pagesAssessment and Returns of IncomeMaster KihimbwaPas encore d'évaluation

- Payment Processing ProfessionalDocument6 pagesPayment Processing ProfessionalaPas encore d'évaluation

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryDocument2 pagesEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777Pas encore d'évaluation

- MZ Ex NTK 0 MZ UDocument2 pagesMZ Ex NTK 0 MZ UUsman AhmedPas encore d'évaluation

- PAYTIPPERY209Document1 pagePAYTIPPERY209puppygirl.ash13yPas encore d'évaluation

- Clause by Clause Analysis of Form 9C With Case Studies by CA. Swapnil MunotDocument51 pagesClause by Clause Analysis of Form 9C With Case Studies by CA. Swapnil MunotetgrgrfdPas encore d'évaluation

- Tutorial 1Document36 pagesTutorial 1yyyPas encore d'évaluation

- Annex C RR 11-2018Document1 pageAnnex C RR 11-2018KB WorldPas encore d'évaluation

- Liberty Tax School Homework AnswersDocument7 pagesLiberty Tax School Homework Answersafnaecvbnlblac100% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceTanuj KukretiPas encore d'évaluation

- ATAP 2022 ArtachoDocument1 pageATAP 2022 ArtachojomarPas encore d'évaluation

- J.B. Hunt Transport, Inc. 615 J B Hunt Corporate Drive Lowell, AR 72745 +1 (479) 820-0000Document1 pageJ.B. Hunt Transport, Inc. 615 J B Hunt Corporate Drive Lowell, AR 72745 +1 (479) 820-0000Anonymous w4gxCdLPas encore d'évaluation

- ICGAB New Tax Syllabus (Sep-19)Document9 pagesICGAB New Tax Syllabus (Sep-19)Aminul HaqPas encore d'évaluation

- Obligation Request and StatusDocument12 pagesObligation Request and Statusmichael ricafortPas encore d'évaluation

- PAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsDocument15 pagesPAN Deductee Name Section Code Employee Ref No (Optional) : Deductee Details Deduction DetailsSandeep ModhPas encore d'évaluation

- Chevron v. CIRDocument2 pagesChevron v. CIRannedefrancoPas encore d'évaluation

- Financial Management For Decision Makers 2nd Canadian Edition Test Bank AtrillDocument14 pagesFinancial Management For Decision Makers 2nd Canadian Edition Test Bank AtrillLiam Le67% (3)

- Invoice Print PDFDocument1 pageInvoice Print PDFKuladeep Naidu PatibandlaPas encore d'évaluation

- Andhra Bank ChallanDocument1 pageAndhra Bank ChallanSuneel_Kumar_2589Pas encore d'évaluation

- 1 CIR V MirantDocument13 pages1 CIR V MirantIsay YasonPas encore d'évaluation

- Closing Stock - GSTDocument8 pagesClosing Stock - GSTpuran1234567890Pas encore d'évaluation

- Account StatementDocument12 pagesAccount StatementBhabani Prasad DasPas encore d'évaluation

- CIR v. Manila Jockey ClubDocument2 pagesCIR v. Manila Jockey ClubKeila Garcia100% (2)

- BIR Ruling 456-2011 PDFDocument5 pagesBIR Ruling 456-2011 PDFLianne Carmeli B. FronterasPas encore d'évaluation

- Musafiri GabrielleDocument1 pageMusafiri GabriellemwakaPas encore d'évaluation

- Municipality of Tampilisan - ZN: Responsibily Center Accounts and Explanations Account Code PR Debit CreditDocument7 pagesMunicipality of Tampilisan - ZN: Responsibily Center Accounts and Explanations Account Code PR Debit CreditMary Jane Katipunan CalumbaPas encore d'évaluation

- Invoice SnehieserDocument1 pageInvoice SnehieserSiddhant A. KhankalPas encore d'évaluation

- Ridwan JanuariDocument22 pagesRidwan JanuariKaragePas encore d'évaluation