Académique Documents

Professionnel Documents

Culture Documents

Q5 Spring 2009 (ICAP-Module B)

Transféré par

mwaseeCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Q5 Spring 2009 (ICAP-Module B)

Transféré par

mwaseeDroits d'auteur :

Formats disponibles

Q5 Spring 2009

Sloution:

Mr.Abbasi

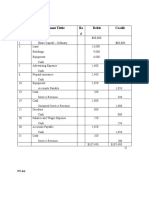

Trading and Profit and Loss Account

For the Year Ended December 31, 2008

Rs. Rs. Rs.

Sales (N3a) 1,600,000

Less:Cost of Goods Sold:

Opening Stock 0

Add: Purchases (N3b) 1,520,000

1,520,000

Less: Clossing Stock (N4c) 297,500

Goods Lost -N4b(i) 7,500

Goods Drawings -N4b(ii) 1,500

Goods gifted to coustomers -N4b(iii) 2,250 (308,750)

Cost of Goods Sold (1,211,250)

Gross Profit 388,750

Less: Operating Expenses:

Rent (150,000 X 12/15) 120,000

Petrol 40,000

Utilities 19,000

Others 6,000

Goods Lost -N4a(i) 7,500

Goods gifted to coustomers -N4a(ii) 2,250

Depreciation expense (N6) 65,200 (259,950)

Net Profit 128,800

Solved by Waseem Muhammad Hanif

Mr. Abbasi

Balance Sheet

As at December 31, 2008

Rs. Rs.

Non-Current Assets:

Furniture 60,000

Less: Provision for dep. (12,000) 48,000

Equipment 56,000

Less: Provision for dep. (11200) 44,800

Van 252,000

Less: Provision for dep. (42,000) 210,000

302,800

Current Assets:

Stocks:

Jeans 142,500

T-Shirts 5,000

Calculators 150,000

Debtors 50,000

Prepaid Rent (150,000 X 3/15) 30,000

Bank (N1) 292,000

Cash (N1) 135,000

804,500

1,107,300

Equity:

Capital 600,000

Add: Net Profit 128,800

Less:Drawings (N7) (225,500)

503,300

Current Liabilities:

Creditors:

Jeans (N2b) 400,000

Calculator 200,000

Equipment 4,000

604,000

1,107,300

Solved by Waseem Muhammad Hanif

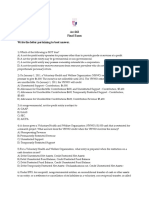

Working Notes

N1-Cash Book

Cash Book

Cash Bank Cash Bank

(i) Capital A/c 600,000 (i) Cash Deposited 550,000

Cash Deposited 550,000 (ii) Rent 150,000

(vi) Debtors-Jeans 1,400,000 Furniture 60,000

(vii) T-Shirts 150,000 (iii) Equipment Adv. 40,000

Creditor-Equip. 12,000

(iv) Van 252,000

(vi) Creditors-Jeans 800,000

(vii) T-shirts 120,000

(ix) Petrol 40,000

Utilities 19,000

Others 6,000

(x) Drawings-Tour 80,000

Drawings-P.M (12,000 X 12) 144,000

Balance c/f 135,000 292,000

750,000 1,950,000 750,000 1950000

N2a-Debtors-Jeans

Debtors-Jeans

1,400,000

Credit Sales 1,450,000

Balance c/f 50,000

1,450,000 1,450,000

N2b-Creditors-Jeans

Creditors-Jeans

(vi) Bank 800,000 (vi) Purchases 1,200,000

Balance c/f 400,000

1,200,000 1,200,000

N3a-Total Sales

Total Sales

Sales-Jeans (N2a) 1,450,000

Sales-T-Shirts 150,000

Total sales during the year 1,600,000

N3b-Total Purchases

Total Purchases

Jeans 8000 @ 150 1,200,000

T-Shrits 1600 @ 75 120,000

Calculators 1000 @ 200 200,000

Total purchases during the year 1,520,000

Solved by Waseem Muhammad Hanif

N4a-Closing Units

Closing Units

Jeans T-Shirts Calculators

Opening Units 0 0 0

Add: Units purchased 8000 1600 1000

Less: Units Sold (7000) (1400) 0

Remaining/Closing units 1000 200 1000

N4b-Closing Stock:

N4b(i) Jeans

Closing units 1000

Less: Physical stock taking revaled (950)

Goods lost 50

Closing Stock 950 @ 150 142,500

Goods lost 50 @ 150 7,500

N4b(ii) T-Shirts

Closing Units 200

Less: Goods Drawings (20)

Goods given free of cost to customers (30)

Remaining/Adjusted closing units 150

Closing stock 150 @ 75 11,250

Goods drawings 20 @ 75 1,500

Goods given free of cost to customers 30 @75 2,250

Cost of Closing stock 11,250

Net Realisible Value 5,000

Note:

Since NRV is lower of cost therefore closing stock will be valued at NRV i.e. 5,000

N4b(iii) Calculators

Cost 200,000

NRV= Estimated Selling Price-Estimated Selling Expense

Estimated Selling Price 250,000

Less: Estimated Selling Expense (100 X 1000) 100,000

NRV 150,000

Note:

Since NRV is lower of cost therefore closing stock will be valued at NRV i.e. 150,000

Solved by Waseem Muhammad Hanif

N4c- Value of Closing Stock

Value of Closing Stock

Jeans at cost- N4b(i) 142,500

T-shrits at cost- N4b(ii) 5,000

Calculators at cost- N4b(iii) 150,000

Value of Closing Stock 297,500

N5-Cost of Equipment

Remaining amount after payment of adv. Rs. 40,000 is (40,000/25%) 16,000

Add:Advance for equipment 40,000

Total cost of equipment 56,000

General Entries

(i) Equipment 56,000

Cash 40,000

Account Payable 16,000

(ii) Account Payable 12,000

Cash 12,000

Creditors-Equipment

Bank 12,000 Equipment 16,000

Balance c/f 4,000

16,000 16,000

N6-Depreciation Expense

Equipment (56,000-0) X 20% 11,200

Furnituture (60,000 -0) X 20% 12,000

Van (252,000/6) 42,000

Depreciation Expense during the year 65,200

N7-Stantement of Drawings

Drawings-Foreign tour 80,000

Drawings-p.m (12,000 X 12) 144,000

Drawings-Goods 1,500

Total Drawings during the year 225,500

Solved by Waseem Muhammad Hanif

Vous aimerez peut-être aussi

- Cash & Investment Management for Nonprofit OrganizationsD'EverandCash & Investment Management for Nonprofit OrganizationsPas encore d'évaluation

- AfarDocument128 pagesAfarlloyd77% (57)

- Senate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!Document666 pagesSenate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!DinSFLA100% (9)

- Cultivating Your Judgement SkillsDocument14 pagesCultivating Your Judgement SkillsmystearicaPas encore d'évaluation

- Asservation For NativityDocument27 pagesAsservation For Nativityjohnadams552266Pas encore d'évaluation

- Test Bank 2 - Ia 3Document31 pagesTest Bank 2 - Ia 3Xiena100% (6)

- Cash Flow StatementDocument3 pagesCash Flow StatementanupsuchakPas encore d'évaluation

- ANSWER KEY - MULTIPLE CHOICE - THEORIES & PROBLEMSDocument4 pagesANSWER KEY - MULTIPLE CHOICE - THEORIES & PROBLEMSstudentone100% (1)

- Shrimp FarmingDocument12 pagesShrimp FarmingGrowel Agrovet Private Limited.100% (2)

- Questions and AnswersDocument12 pagesQuestions and Answersaparajita rai100% (3)

- BUDGET Budget Theory in The Public SectorDocument314 pagesBUDGET Budget Theory in The Public SectorHenry So E DiarkoPas encore d'évaluation

- Enriquez v. de VeraDocument2 pagesEnriquez v. de Veralaurana amataPas encore d'évaluation

- Advacc 1 Millan 2019 Advac 1 Special Transactions 2019Document11 pagesAdvacc 1 Millan 2019 Advac 1 Special Transactions 2019Charlene BolandresPas encore d'évaluation

- CEO in United States Resume Valerie PerlowitzDocument10 pagesCEO in United States Resume Valerie PerlowitzValeriePerlowitzPas encore d'évaluation

- Afar PDFDocument128 pagesAfar PDFMelyn Bustamante100% (1)

- Equity Valuation: Models from Leading Investment BanksD'EverandEquity Valuation: Models from Leading Investment BanksJan ViebigPas encore d'évaluation

- Afar Partnership LiquidationDocument42 pagesAfar Partnership LiquidationKrizia Mae Uzielle PeneroPas encore d'évaluation

- PDF-Afar CompressDocument128 pagesPDF-Afar CompressCharisse VistePas encore d'évaluation

- FAR Problem Quiz 1 SolDocument3 pagesFAR Problem Quiz 1 SolEdnalyn CruzPas encore d'évaluation

- Assemble Smartphone Case SolutionDocument3 pagesAssemble Smartphone Case SolutionPravin Mandora50% (2)

- Bharat Chemicals Ltd. SolnDocument4 pagesBharat Chemicals Ltd. SolnJayash KaushalPas encore d'évaluation

- Business Finance Week 5Document5 pagesBusiness Finance Week 5cjPas encore d'évaluation

- A 1. FormationDocument3 pagesA 1. Formationmartinfaith958Pas encore d'évaluation

- Answer To Sample Question 2Document3 pagesAnswer To Sample Question 2Farid AbbasovPas encore d'évaluation

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75Pas encore d'évaluation

- Carrying Amount of Asset Sold 182,400Document4 pagesCarrying Amount of Asset Sold 182,400Serenity CarlyePas encore d'évaluation

- Semi Final AccountingDocument8 pagesSemi Final AccountingSherryl DumagpiPas encore d'évaluation

- Chapter 17 Answer Key-1Document4 pagesChapter 17 Answer Key-1NCTPas encore d'évaluation

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTOPas encore d'évaluation

- Multiple Choice ProblemsDocument5 pagesMultiple Choice ProblemsHannahbea LindoPas encore d'évaluation

- Statement of Cash Flows ADocument7 pagesStatement of Cash Flows ABabylyn NavarroPas encore d'évaluation

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManPas encore d'évaluation

- Poa Mock Exam 2020Document13 pagesPoa Mock Exam 2020DanPas encore d'évaluation

- Financial Accounting hw1Document5 pagesFinancial Accounting hw1Jermaine M. SantoyoPas encore d'évaluation

- 12 - Incomplete Record - With - AnswerDocument13 pages12 - Incomplete Record - With - AnswerAbid faisal AhmedPas encore d'évaluation

- Audit Problem Inventories AnswerDocument6 pagesAudit Problem Inventories AnswerJames PaulPas encore d'évaluation

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JPas encore d'évaluation

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngPas encore d'évaluation

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresPas encore d'évaluation

- AnswersDocument4 pagesAnswersamitmehta29Pas encore d'évaluation

- Asset Liability Expenses Income Owner's CapitalDocument4 pagesAsset Liability Expenses Income Owner's Capitalamitmehta29Pas encore d'évaluation

- Manatad - Accounting 14NDocument5 pagesManatad - Accounting 14NJullie Carmelle ChattoPas encore d'évaluation

- Answer Sheet Mock Test 23-2Document5 pagesAnswer Sheet Mock Test 23-2Nam Nguyễn HoàngPas encore d'évaluation

- GF) KFN Rf6 (8 (Psfpg6) G6/ +:yf: Chartered Accountancy Professional Cap-IDocument37 pagesGF) KFN Rf6 (8 (Psfpg6) G6/ +:yf: Chartered Accountancy Professional Cap-IsarojdawadiPas encore d'évaluation

- Chapter 1 - Teacher's Manual - Afar Part 1-1Document10 pagesChapter 1 - Teacher's Manual - Afar Part 1-1Mayeth BotinPas encore d'évaluation

- Tugas 4 Dasar AkuntansiDocument15 pagesTugas 4 Dasar AkuntansiSamuel PurbaPas encore d'évaluation

- Chapter 4 - Partnership Liquidation Practice ExercisesDocument3 pagesChapter 4 - Partnership Liquidation Practice ExercisessanjoePas encore d'évaluation

- AnswerDocument3 pagesAnswerRE GHAPas encore d'évaluation

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifPas encore d'évaluation

- Income StatementDocument13 pagesIncome StatementShakir IsmailPas encore d'évaluation

- Partnership LiquidationDocument14 pagesPartnership Liquidationjane toribioPas encore d'évaluation

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Document7 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-5Pramod VasudevPas encore d'évaluation

- 16 UNIT III LiquidationDocument20 pages16 UNIT III LiquidationLeslie Mae Vargas ZafePas encore d'évaluation

- Joseph LandscapeDocument20 pagesJoseph LandscapeJoshua KhoPas encore d'évaluation

- Answer Key - Unit TestDocument7 pagesAnswer Key - Unit TestJeanne Timoteo RaguroPas encore d'évaluation

- Joyk-Excel 2 3 1Document4 pagesJoyk-Excel 2 3 1api-664350584Pas encore d'évaluation

- Poa Mock Exam 2020Document13 pagesPoa Mock Exam 2020DanPas encore d'évaluation

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiPas encore d'évaluation

- Accn 101 Assignment Group WorkDocument8 pagesAccn 101 Assignment Group WorkkumbiraidavidPas encore d'évaluation

- SOLUTION FUNAC FINALEXAM2019 20 1Document21 pagesSOLUTION FUNAC FINALEXAM2019 20 1Rynette FloresPas encore d'évaluation

- ANS - 1 (A, B, C)Document5 pagesANS - 1 (A, B, C)Nazir AhmadPas encore d'évaluation

- Toy Factory Worksheet For The Year Ended Dec. 31, 20X4 Account Titles Trial Balance Adjustments Debit Credit DebitDocument12 pagesToy Factory Worksheet For The Year Ended Dec. 31, 20X4 Account Titles Trial Balance Adjustments Debit Credit DebitShiela EscobarPas encore d'évaluation

- Income Statement & Closing Entries ProblemDocument1 pageIncome Statement & Closing Entries ProblemLiwliwa BrunoPas encore d'évaluation

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoPas encore d'évaluation

- Accounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Document81 pagesAccounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Layla MainPas encore d'évaluation

- Andrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaDocument22 pagesAndrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaCamdenCanaryPas encore d'évaluation

- GBIDocument6 pagesGBIAnanth VybhavPas encore d'évaluation

- GOI Department and MinistriesDocument7 pagesGOI Department and MinistriesgaderameshPas encore d'évaluation

- Health Insurance IsDocument2 pagesHealth Insurance IsSaleh RehmanPas encore d'évaluation

- Answer: 215,000Document2 pagesAnswer: 215,000Winoah HubaldePas encore d'évaluation

- SPML Infra Debt To Reduce Substantially With Cabinet Decision On Arbitration Awards (Company Update)Document2 pagesSPML Infra Debt To Reduce Substantially With Cabinet Decision On Arbitration Awards (Company Update)Shyam SunderPas encore d'évaluation

- 407 - 1e LTN20170420808 PDFDocument196 pages407 - 1e LTN20170420808 PDFTony ZhangPas encore d'évaluation

- Fundamentals of ABM Week1-4 LessonsDocument9 pagesFundamentals of ABM Week1-4 LessonsYatogamiPas encore d'évaluation

- GCG MC 2017-02, Interim PES For The GOCC SectorDocument4 pagesGCG MC 2017-02, Interim PES For The GOCC SectorbongricoPas encore d'évaluation

- Fiinancial Analysis of Reckitt BenckiserDocument10 pagesFiinancial Analysis of Reckitt BenckiserKhaled Mahmud ArifPas encore d'évaluation

- DOJ: Buffett-Owned Mortgage Firm Guilty of Redlining in NCCoDocument50 pagesDOJ: Buffett-Owned Mortgage Firm Guilty of Redlining in NCCoCharlie MegginsonPas encore d'évaluation

- Chapter 18 22 Taxation 2Document67 pagesChapter 18 22 Taxation 2Zvioule Ma FuentesPas encore d'évaluation

- Assignment 1 BAN 100 Edwin CastilloDocument11 pagesAssignment 1 BAN 100 Edwin CastilloEdwin CastilloPas encore d'évaluation

- Acc162 Final Exam Write The Letter Pertaining To Best AnswerDocument3 pagesAcc162 Final Exam Write The Letter Pertaining To Best AnswerWilliam DC RiveraPas encore d'évaluation

- 09dinvestmentinequitysecuritiescostequitymethodpdfpdf PDF FreeDocument14 pages09dinvestmentinequitysecuritiescostequitymethodpdfpdf PDF FreeLouierose Joy CoprePas encore d'évaluation

- ACC 291 Week 4 ProblemsDocument8 pagesACC 291 Week 4 ProblemsGrace N Demara BoonePas encore d'évaluation

- Capital AdequacyDocument11 pagesCapital AdequacyTezan RajkumarPas encore d'évaluation

- Agr VisaNet РТ 200М 200424docx - 1Document14 pagesAgr VisaNet РТ 200М 200424docx - 1Ира КацPas encore d'évaluation

- Cumulative FD - Non-Cumulative Fixed DepositDocument10 pagesCumulative FD - Non-Cumulative Fixed Depositconfirm@Pas encore d'évaluation